How To Apply For Medicare When You Have Cancer

Caroline Edlund, LCSW-R, is the Online Support Group Program Director at CancerCare. She provides supportive counseling and resources to people coping with cancer and people who have experienced the loss of a loved one.

Enrolling in Medicare can seem like a daunting process, especially if you have cancerso much so that you may be tempted to put off the application or even give up on it entirely. However, this can lead to serious long-term consequences that affect your cancer care coverage and finances.

With a little patience and preparation, you can successfully navigate the Medicare enrollment process. Here are 5 tips to keep in mind.

When Am I Eligible For Medicare Supplement Coverage

Because Medicare Supplement policies complement your Original Medicare coverage, you must be enrolled in Part A and Part B to be eligible for this type of policy. Youll also need to stay enrolled in Original Medicare for your hospital and medical coverage. Medicare Supplement plans arent meant to provide stand-alone health coverage these plans just help with certain out-of-pocket costs that Original Medicare doesnt cover.

If youre under 65 and have Medicare because of disability, end-stage renal disease, or amyotrophic lateral sclerosis, your eligibility for Medicare Supplement coverage may depend on the state that you live in. Not every state offers Medicare Supplement plans to beneficiaries under 65 .

In addition, keep in mind that Medicare Supplement plans dont include prescription drug benefits . In the past, some Medicare Supplement plans may have included this coverage, but plans sold today dont include prescription drug benefits. If you have an older Medicare Supplement policy with prescription drug coverage, make sure this coverage is creditable , or you could pay a late-enrollment penalty later on if you sign up for Part D later on.

Since Medigap plans dont include prescription drug benefits, if youre enrolled in Original Medicare and want help with prescription drug costs, you can get this coverage by enrolling in a stand-alone Medicare Prescription Drug Plan.

Example : You Are Contributing To Your Group Health Insurance Plan

In almost all cases, you can save money by switching to Medicare with a Medigap plan if youâre the one contributing to your group health insurance plan.

Health insurance premiums are sky-high, with some plans costing upwards of $800 per month. Medicareâs monthly premium is nowhere close to that, and you can even add on a Medicare Supplement with no chance of reaching that kind of premium.

In sum, you can have much better coverage for a fraction of the cost if youâre paying for your group health insurance and are over 65.

If youâd like a Medicare specialist to help you one-on-one, schedule a free Medicare planner with one of our licensed agents.

Recommended Reading: How Do I Cancel Medicare Part A

How Social Security Helps Pay For Medicare

In addition to automatically enrolling you in Medicare, if you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium will be automatically deducted from your monthly benefit payment.

If you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a Notice of Medicare Premium Payment Due . Bills can be paid for by check or money order, a credit or debit card, or through online bill pay services.

In conclusion, as youre starting to think about Medicare and retirement, do some research and make sure you understand how your Social Security benefits can or will play a role.

1

Sign Up: Within 8 Months After The Active Duty Service Member Retires

- Most people dont have to pay a premium for Part A . So, you might want to sign up for Part A when you turn 65, even if the active duty service member is still working.

- Youll pay a monthly premium for Part B , so you might want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

You May Like: What Does Medicare Part B Cover

What Are The Differences Between Medicare And Medicaid

Medicare is a federal health insurance program open to Americans aged 65 and older, and those with specific disabilities who are under the age of 65. Medicaid, a combined state and federal program, is a state-specific health insurance program for low-income individuals with limited financial means, regardless of their age.

Medicare, generally speaking, offers the same benefits to all eligible participants. However, coverage is divided into Medicare Part A, Part B, and Part D. Medicare Part A is for hospice care, skilled nursing facility care, and inpatient hospital care. Medicare Part B is for outpatient care, durable medical equipment, and home health care. Part D is for prescription coverage. Not all persons will elect to have coverage in all three areas. In addition, some persons choose to get their Medicare benefits via Medicare Advantage plans, also called Medicare Part C. These plans are available via private insurance companies and include the same benefits as Medicare Part A and Part B, as well as some additional ones, such as dental, vision, and hearing. Many Medicare Advantage plans also include Medicare Part D.

Medicaid is more comprehensive in its coverage, but the benefits are specific to the age group. Children have different eligibility requirements and receive different benefits from low-income adults and from elderly or disabled persons.

Helpful Resources

Medicare Part D Prescription Drug Coverage Eligibility

Like Medicare Advantage and Medicare Supplement, Part D prescription drug coverage is provided by Medicare-approved private insurance companies. These plans accompany Original Medicare. Generally, you cant have a standalone Part D plan if you have a Medicare Advantage plan.

To qualify for a Part D plan, you must meet the following requirements:

- You must have both Part A and B .

- You must live where plans are available.

- You must pay Part A, Part B, and Part D premiums, if applicable.

Don’t Miss: Will Medicare Pay For A Roho Cushion

Enrolling When Youre Indigenous

If youre Indigenous and have common identity documents, mail or email them with your Medicare enrolment form to Medicare Enrolment Services.

If you dont have standard identity documents, you can use a referee instead. You and your referee need to fill in the Aboriginal and Torres Strait Islander Medicare enrolment and amendment form. The form says who can be a referee.

You can take your form to your local agent, access point or service centre.

Call the Indigenous access line if you need help with the form.

How To Apply For Medicaid In Texas

You can apply online for benefits. You will need to be prepared to answer questions about the following for each family member:

- Social Security number and birth date

- Citizenship or immigration status

- Money from jobs and other sources

- The value of cars and other property

- Costs you pay for bills

You can also call 211 if you are in Texas. Alternatively, you can dial 1-877-541-7905 Monday to Friday, 8 a.m. to 6 p.m.

You can also visit a community partner in person. Printing and mailing a copy to HHS is also an option

Recommended Reading: What Is Medicare Premium Assistance

Read Also: What Is The Extra Help Program For Medicare

Review Your Medicare Choices Each Year

Whether you enroll in original Medicare or a Medicare Advantage plan, you generally do not need to renew coverage every year. That being said, plans are sometimes discontinued or their benefits and costs may change to the point that the plan no longer meets your needs. Its not unusual for pharmacy and provider networks to change, for costs to increase, or the list of covered prescription drugs to vary. Thats why its a good idea to review your plan each year and compare it against your current health care needs.

Your health insurer is required to send you an Annual Notice of Change by September 30 each year. The notice outlines any changes in coverage and costs expected to begin the following January. If you decide to change your health care plan after reviewing those updates, you can do so during Medicares open enrollment period. The period runs from October 15 to December 7. During this time, you can switch from original Medicare to Medicare Advantage or vice versa. You can switch from one Medicare Advantage plan to another or from one Medicare Part D plan to another. You can also enroll in Medicare Part D if you have not done so already, although late enrollment penalties may apply.

If you find that the new health care plan is not meeting your needs, you can reverse some plan decisions January 1 to March 31 of the following year. Guidance for the renewal process is offered through the U.S. governments phone line at 1-800-MEDICARE or through your local SHIP.

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Are you eligible for cost-saving Medicare subsidies?

Recommended Reading: What Nursing Homes Take Medicare

Person Who Is Aged Blind And/or Disabled

Apply if you are aged , blind, or disabled and have limited income and resources. Apply if you are terminally ill and want to get hospice services. Apply if you are aged, blind, or disabled live in a nursing home and have limited income and resources. Apply if you are aged, blind, or disabled and need nursing home care, but can stay at home with special community care services. Apply if you are eligible for Medicare and have limited income and resources.

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Read Also: Can You Sign Up For Medicare Part B Anytime

How Do Medicare Spending And Use Of Services Differ For Beneficiaries Under Age 65 With Disabilities And Older Beneficiaries

Medicare per capita spending

Average total Medicare spending is higher for traditional Medicare beneficiaries under age 65, mainly due to higher Part D prescription drug spending.13 Medicare per capita spending for beneficiaries younger than age 65 averaged $13,098 in 2014, nearly one third more than average per capita spending for beneficiaries over age 65 .14 Excluding Part D drug spending, the difference narrows considerably to $9,281 for beneficiaries under age 65 and $8,814 for those over age 65, on average. On average, beneficiaries under age 65 have higher per capita spending for drugs covered under Part D and for inpatient and outpatient services, but lower spending on post-acute and hospice care than beneficiaries over age 65 .

Figure 5: Average Medicare Per Capita Spending for Beneficiaries Under Age 65 With Disabilities and Over Age 65, by Type of Service, 2014

Use of medical services

When Can I Apply For Medicare

You may apply for Medicare 3 months before your 65th birthday. This marks the beginning of your Initial Enrollment Period. Your IEP:

- Starts 3 months before the month you turn 65

- Includes the month of your 65th birthday

- Ends 3 months after your birth month

For example, if you turn 65 on July 25, your IEP begins on April 1 and ends on October 31.

The exception to this timeframe is if your birthday falls on the first of the month. In that case, all dates move forward one month. So, if your birthday is July 1, your Initial Enrollment Period begins on March 1 and ends on September 30.

Don’t Miss: Does Medicare Cover Hepatitis A Vaccine

I Applied For Social Security Retirement Benefits Six Months Ago At Age 62 I Heard That Those Receiving Retirement Benefits Automatically Get Medicare How Come I Havent Received My Medicare Card

Part of this question is true. Those who are receiving Social Security retirement benefits are enrolled automatically in Medicare. However, one important fact is missing. They must be eligible for Medicare, which means they are 65 years or older. As detailed in the first question, only those who qualify for Medicare because of SSDI, ALS or ESRD can get Medicare coverage before age 65.

Do You Qualify For Medicare

Now that you know more about Medicare and can answer questions like how old do you have to be to get Medicare? and how old to get Medicare Part A with ease, what have you learned? Do you qualify for Medicare? Do you know what kind of plan youre going to choose if and when you do enroll?

Keep the information outlined above in mind moving forward and youll have no trouble navigating the waters of Medicare when the time comes.

Do you want to learn more about the healthcare world? If so, we have lots of other interesting resources available on our site, including this article on the latest medical device manufacturing trends. Check it out today!

Trevor Andersonwrote this article on behalf of FreeUp. FreeUp is the fastest-growing freelance marketplace in the US. FreeUp only accepts the top 1% of freelance applicants. to get access to the top freelancers in the world.

CTPost and Hearst partners may earn revenue when readers click affiliate links in this article.

You May Like: How Do You Pay Medicare

How Long Do People On Disability Have To Wait To Become Eligible For Medicare

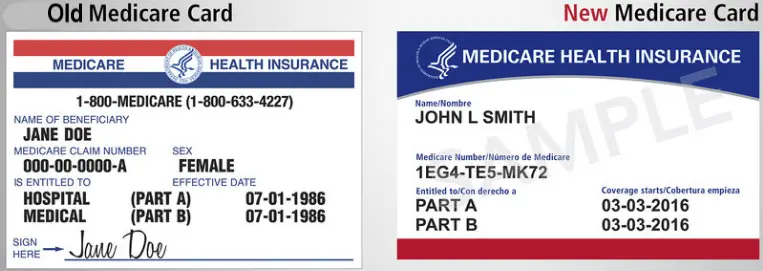

Once you have collected SSDI payments for two years, you will become eligible for Medicare. You wont even have to sign upMedicare will automatically enroll you in Part A and Part B and mail your Medicare card to you shortly before your coverage begins.

Thankfully, your 24-month waiting period doesnt have to be all at once. For example, if you qualify for SSDI, lose eligibility, then re-qualify for SSDI, each month you collect checks counts toward the total 24-month waiting period.

Similarly, if you apply for SSDI and are denied disability benefits, you can appeal the decision. If you appeal and the decision is reversed, your 24-month waiting period will be backdated to when your disability benefits should have started. The result: your wait for Medicare will be shorter than two years.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Recommended Reading: What Is Medicare Insurance Plans

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

What Can I Do Next

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Because the company has less than 20 employees, your job-based coverage might not pay for health services if you dont have both Part A and Part B.

You May Like: Where Do I Apply For Medicare Card

A Push To Lower The Eligibility Age And Expand Services Covered By Medicare

For a growing percentage of the population born after 1960, the retirement age has been increased to sixty-seven based on a law passed in the 1980s. To receive the maximum benefit for the number of years one has worked, they will have to wait until sixty-seven to retire. However, already many workers who must wait until sixty-five to receive the highest possible benefit chose to leave the workforce early.

This choice can create challenges when it comes to healthcare as they are no longer covered by the employer and often find that the plans on the healthcare market are far too expensive based on their retirement incomes. As the retirement age increases this will become a larger problem should more people choose to retire before sixty-five when their Medicare benefits would kick in.

8/ Lowering the Medicare eligibility age to 60.

Sean Casten

This period between retirement and when Medicare benefits kick in is known as the Medicare gap. The gap, like the cost of Part C and D plans, has a high health cost. When many fall into the Medicare gap, they forgo check-ups until they are eligible. Studies have shown that at age sixty-five more people are diagnosed with cancer, which can be fatal because they did not undergo preventative screenings when they were in the coverage gap.

The outstanding issues have become clear:- 4 weeks paid leave – Medicare vouchers for dental – Medicaid expansion