What Counts Toward Exiting The Coverage Gap

When you are in the gap and paying 25% of covered drugs, your spending counts toward exiting the gap. The manufacturers drug discount of 70% also counts and will help you exit the gap faster.

There are two things, though, that dont count toward closing the gap. These are:

- The amount that your drug plan pays toward the cost of the drug, which is 5% in the gap

- The amount that the drug plan pays toward the pharmacys dispensing fee, which is 75% of the fee in 2022

Keep in mind that there are other things that dont count toward reaching the catastrophic limit, which are your plan premium and also what you spend on any drugs that arent covered by your Part D plan.

Costs That Count Toward Getting Out Of The Coverage Gap Include:

- Your plans deductible.

- Copayments and coinsurance for your prescription drugs.

- Manufacturer discounts you may get from brand-name drugs during the donut hole period. To illustrate, if you have a manufacturer coupon for $50 off, this $50 will still be applied to your total paid costs.

- Whoever else who has paid on your behalf.

- Funds paid by state pharmaceutical assistance programs.

How Much Will You Pay For Prescription Drug Coverage

Premiums for Medicare Part D coverage vary by plan. And if you join a Medicare Advantage Plan or Medicare Cost Plan that includes Medicare prescription drug coverage, there may be an amount for drug coverage included in the plans monthly premium.

If you dont for Medicare Part D when youre first eligible, you may have to pay a late enrollment penalty. The amount of the penalty depends on how long you went without Part D or creditable prescription drug coverage. Youll generally pay this penalty for as long as you have a Medicare drug plan.10

Don’t Miss: When Does A Person Sign Up For Medicare

How Generic Drug Alternatives Are No Bargain For Many Patients During The Mandated Lapse In Coverage

hn A. Hovanesian, MD

The Patient Protection and Affordable Care Actof 2010 will eventually eliminate the Medicaredonut hole in 2020, but until this gap in benefitsis closed for good, it will continue to affectpatients. The prospect of falling into a coverage lapse isa daunting reality for patients, especially in the currenteconomic climate. In the interest of offering premiumcare to patients, it is important that cataract surgeonsknow and understand the ramifications of the donuthole, especially because many of their patients may not.

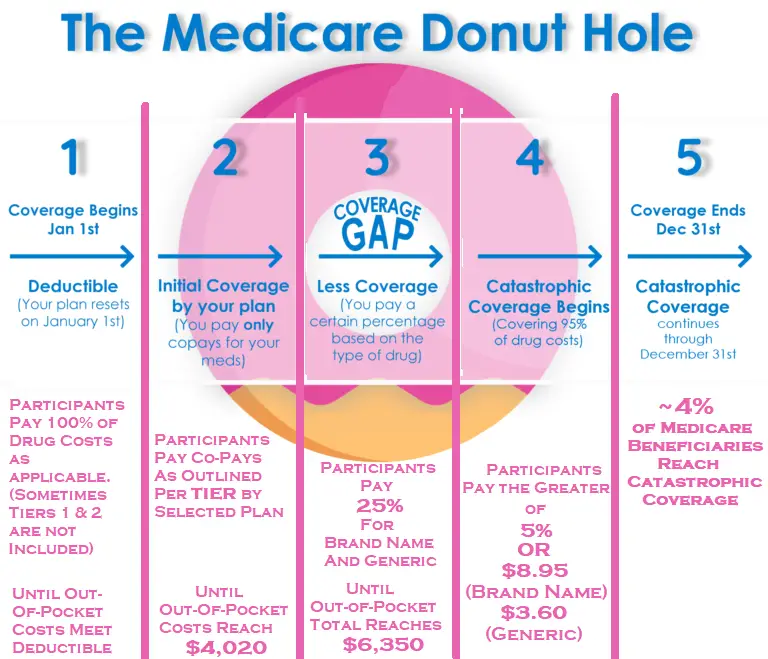

For the purpose of this article, the donut hole is definedas a gap in coverage where enrollees in Medicare Part Dmust pay out of pocket for all drug costs. This pause incoverage begins after the patient reaches a predefinedexpenditure for total retail drug costs in a calendar year.While in the donut hole, patients pay for all of their medicationsuntil they reach a predetermined total amountof out-of-pocket expenses. Once that total is reached,catastrophic coverage begins, and Medicare covers mostof the patient’s prescription drug-related expenses . For further information on thedonut hole and other aspects of Medicare coverage, physiciansshould consult the Centers for Medicare & MedicaidServices’ Web site .

DONUT HOLE PHASE OUT

IMPLICATIONS OF THE DONUT HOLE

Interestingly, generic medications cost about 30% to50% less than their branded equivalents, so this exampleis particularly generous to generic medicines.

GENERIC SUBSTITUTIONS

The Medicare Part D Drug Plan Donut Hole Is Closed What Does That Mean

The Medicare donut hole for drugs is closed. What does that mean for you?

Getty

Just about every Medicare beneficiary has heard about the donut hole in a Medicare Part D drug plan. Many will admit they dont understand it but they all know it means drugs will cost more.

Now, theyve heard that the donut hole closed on January 1, 2020. They are ecstatic because they believe their drugs will be free. And, once again, its likely they dont understand whats happening.

The donut hole is closed, but drugs wont be free!

In 2006, Medicare introduced Part D prescription drug coverage. The structure included four payment stages. There are different costs associated with each stage.

1. Deductible: The standard deductible in 2020 is $435. This is the amount you pay out-of-pocket before the plan starts paying. A plan can choose to charge no deductible or any amount up to $435. This year, there are only two national plans with no deductible and the monthly premiums for those plans are about $35 and $70.

You May Like: Does Medicare Cover Droopy Eyelid Surgery

What Is The Medicare ‘donut Hole’

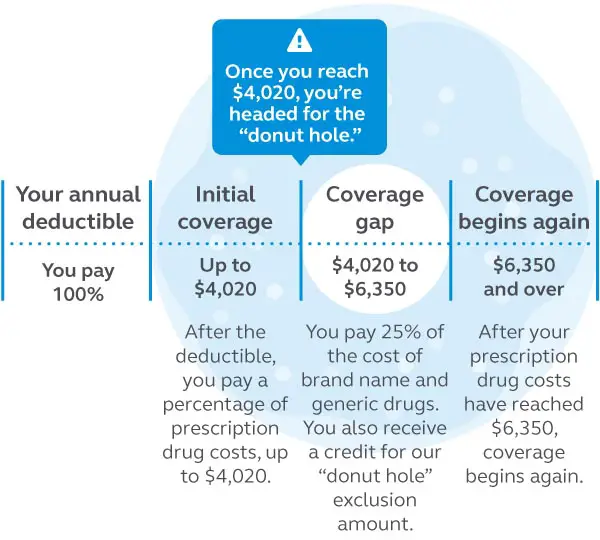

There are four phases of Medicare Part D coverage that correspond to how much youve spent out-of-pocket on covered prescription drugs for the year. The donut hole is the third of those four phases, and its the one thats likely to be the most expensive for you.

You might see these divisions of Medicare Part D coverage described as either phases or stages in documents from Medicare or your insurance company.

Here are the four phases, in order

Leaving The Donut Hole Phase

The good news is there is a way out of the donut hole phase once you enter. The bad news is it requires some hefty out of pocket spending. To leave the donut hole, your true out of pocket costs must reach $7,400 which is the limit for 2023. Once you have spent $7,400 you will enter the catastrophic coverage stage.

Itemsthat count toward leaving the coverage gap:

- The 25% you pay for each prescription drug

- The manufacturers drug discount of 70%

Items thatdontcount toward leaving the coverage gap:

- Monthly premium

- Costs for any prescription drugs you buy that your plan doesnt cover

- Pharmacy dispensing fees

You May Like: Does Medicare Pay For Dtap Shots

How To Get Out Of The Donut Hole

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement.

However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements. These include:

- Extra Help:Extra Help is a Medicare program that helps people pay for medications and other aspects of medical care. A person can qualify for Extra Help if their income is $18,735 or less when single or $25,365 or less as a couple. They must also have less than $14,390 as a single person or $28,720 as a married couple in resources. Resources include savings, stocks, or bonds.

- Medicaid: Medicaid is a federal program that helps low income individuals pay for healthcare. People who qualify for Medicaid are automatically enrolled in the program.

- State Health Insurance Assistance Program : These state-specific programs can provide additional assistance for people in funding healthcare costs, including medications.

Many pharmaceutical manufacturers also offer prescription assistance programs that can reduce costs. A doctor or pharmacist can often make suggestions for contacting the drug company.

Did The Medicare Donut Hole Go Away In 2020

No. The Medicare donut hole still exists. However, starting in 2020, instead of being responsible for 37% of the cost of generic prescription drugs and 25% of the cost of brand name prescription drugs while in the donut hole , Medicare beneficiaries only pay 25% for both brand name and generic drugs.

Previously, when Medicare Part D was first rolled out in 2007 and prior to the Affordable Care Act, beneficiaries paid 100% of drug costs while in the donut hole.

Also Check: When Do People Become Eligible For Medicare

What Happened To The Medicare Drug Donut Hole In 2020

No more changes to the Part D Donut Hole.

Medicare Part Ds Donut Hole is something many people talk about but nobody really understands. We will get into the details below but basically it is the percentage you may pay for certain drugs at certain times of the year. The good news is that it has been decreasing for the past few years now and there are no more planed changes after 2020.

Do Medicare Advantage Plans Cover The Donut Hole

Medicare Advantage plans often come with Part D prescription drug coverage. While all plans must cover at least the minimum coinsurance set by the federal government during the donut hole, they are free to extend additional coverage. So yes, some Medicare Advantage plans do offer extended gap coverage for enrollees in the donut hole.

If youre interested in finding a plan with extended coverage during the donut hole, call an agent and they can help.

Read Also: Does Medicare Pay For Ophthalmologist

Stage 2initial Coverage Stage

During this stage, your copayments and coinsurance come into play. You pay just your share of prescription costs and your Part D plan pays the rest for covered drugs. For example, if your plan has a 25% coinsurance for a $200 prescription, you would pay $50 and your plan would cover the $150 balance.

If the combined amount you and your drug plan pay for prescription drugs reaches a certain level during the yearthat limit is $4,430 in 2022you enter the Part D coverage gap.

How Does The Donut Hole Affect Beneficiaries

Lets say your Medicare drug plan has a coinsurance requirement of 10%. During the initial coverage phase, you will be responsible for 10% of the cost of your prescriptions.

But during the donut hole, you might be responsible for up to 25% of the cost of the same prescriptions. So if the cost of your drug was $100, you would only pay $10 during the initial coverage phase, but you would pay $25 during the donut hole phase.

Not everyone is affected by the donut hole. Some people never reach the donut hole limit in a plan year and therefore never exit the initial coverage phase. Some may never even exit the deductible phase of their plan.

Other people may be less affected by the donut hole or not affected at all. If your plans coinsurance is already 20%, then making the jump to 25% for the donut hole phase presents only a minimal impact. And if your plans coinsurance is 25% to begin with, your costs in the donut hole may remain unchanged.

Lets use a hypothetical scenario to show the donut hole at work.

Doug continues making these higher coinsurance payments for his refills until he and his plan have combined to spend $7,050 on his drugs. He then enters the catastrophic coverage phase where he will only be responsible for a very small coinsurance payment for his refills, typically just 5%.

Recommended Reading: When To Sign Up For Medicare Supplemental Insurance

The Medicare Donut Hole Is Closed: What Does That Mean

When first implemented in 2006, the Part D drug plan had a gap in coverage. Drug plans did not pay anything toward the cost of drugs in the donut hole so beneficiaries were stuck with the tab for the entire cost. Beginning in 2011, the Affordable Care Act took measures to close the donut hole, known as the Coverage Gap. Then, in 2012, the ACA implemented discounts for the Coverage Gap. In 2019, discounts meant that beneficiaries paid 25% of the cost for any brand-name medication, officially closing the donut hole, and 37% for generics. Then, in 2020, the donut hole for generic drugs is also closed.

So, the donut hole has closed for all medications. Many think that means they wont have to pay for medications once they get to this drug payment stage. But that is not the case. Going forward, drug plan members will pay 25% of the cost for any prescribed medication from the time they meet the deductible until reaching the out-of-pocket spending limit that leads to Catastrophic Coverage.

Even with these changes, some beneficiaries will experience sticker shock. Thats because their drug plans charge a copayment or coinsurance in Initial Coverage, instead of 25%. Here’s an example.

In the Initial Coverage payment stage, Laura’s medication has a $47 copayment. Once she lands in the donut hole, she is responsible for 25%. Because the full cost of the drug is $475, she will pay $118.75.

What Happens After I Exit The Donut Hole

After you exit the donut hole, youll receive whats called catastrophic coverage. This means that youll have to pay whatever is greater for the rest of the year: Five percent of a drugs cost or a small copay.

The minimum copay for 2022 has increased a little from 2021:

- Generic drugs: minimum copay is $3.95, which is up from $3.70 in 2021

- Brand-name drugs: minimum copay is $9.85, which is up from $9.20 in 2021

Choosing Medicare prescription drug coverage

Are you planning on enrolling in a Medicare prescription drug plan? Consider the following before choosing a plan:

- Use the Medicare website to search for a plan thats right for you.

- Compare a Medicare Part D with a Medicare Advantage plan. Medicare Advantage plans include health care and drug coverage on one plan and sometimes other benefits like dental and vision.

- Check that the plan covers your medications.

- If you take generic drugs, look for a plan that charges a low copayment.

- If youre concerned about expenses while in the donut hole, find a plan that provides additional coverage during this time.

- Make sure that additional coverage includes medications you take.

Don’t Miss: Will Medicare Pay For A Patient Lift

How Can I Get Out Of The Medicare Donut Hole Once Im In It

As the saying goes, the only way out sometimes is to go through. As your out-of-pocket spending adds up, youll eventually move out of the donut hole and into the catastrophic coverage phase.

However, it may make sense to switch to brand-name drugs while youre in the Medicare donut hole. Thats because the manufacturer discount you receive for brand-name drugs counts toward your out-of-pocket spending. As always, be sure to speak with your doctor or pharmacist before making any decisions about switching drugs.

How Can I Avoid The Donut Hole

There is no such thing as Medicare Part D plans with no donut hole, so you have to just do your best to stay under the threshold. The best way to avoid the donut hole is to take generic medications whenever possible. You can also work with your doctor on reducing your drug spending.

Show your doctor which drugs are costing you the most on your Part D plan and see if he/she can recommend any cheaper alternatives. Some medications may not have a generic equivalent on the market yet, but there may be other similar medications that are cheaper that achieve a like result.

You May Like: Is Medicare Getting A Raise

The Medicare Part D Donut Hole 2019

Donuts? Yum! But the Medicare Part D donut hole has nothing to do with the delicious, carb-laden treat we know and love. The donut hole is actually the term everyday people use to describe what is officially known as the coverage gap in Medicare Part D.

What is the Medicare Part D coverage gap?

Medicare Part D is the part of Medicare that deals with prescription drug coverage, which is not a benefit that original Medicare covers. Congress in fact designed Medicare Part D so that every calendar year, there would be a gap in the middle of your drug coverage. This gap, or donut hole, occurs once your prescription drug coverage costs reach a certain amount, which is set by Congress every year. In 2019, this amount was $3,820.

Image via Bankrate

Once your prescription drug coverage costs hit this threshold, you are responsible for a greater portion of the cost of your medications than you may have been beforehand. Rather than paying a copay per drug, you will pay a percentage of the total cost of the drug.

This is intended to encourage Medicare recipients to seek out cheaper alternatives to their prescription drugs and to keep the costs of the Medicare Part D program down. The people whose costs hit this level have reached higher-than-average costs to Medicare, so they are expected to share more in costs.

How much do I pay while in the Medicare Part D donut hole?

How do I cover the Medicare Part D donut hole?

The bad news is you dont.

Image via HomeHealthPulse

How Can You Get Help Paying For Prescription Drug Coverage

If you qualify, Medicare and Social Security offer a program called Extra Help that lowers your drug costs to $3.95 for each generic covered drug and $9.85 for each brand-name covered drug.5

You may also be able to get help through state pharmaceutical assistance programs, through assistance programs from pharmaceutical companies themselves, or by choosing a Medicare drug plan that offers additional coverage during the gap.6

A Reminder

If you dont sign up for Medicare Part D when youre first eligible, you may have to pay a late enrollment penalty.

Read Also: How Old To Collect Medicare

Did The Donut Hole Go Away In 2020

The donut hole did not exactly go away, but it is considered closed for the most part with the Affordable Care Act of 2010. This is because the out-of-pocket costs are now significantly reduced in the coverage gap. There is still a gap between the initial coverage limit threshold and the catastrophic-coverage threshold. However, within this gap, the law now states that you pay 25% of the total cost of your prescription drugs.

The Phases Of Part D Prescription Coverage

In addition to your premium, you likely will pay a fixed dollar amount, called a copayment, for each of your prescriptions after you meet any deductible. Or you may pay coinsurance, a percentage of the costs your plan charges for a medication. What you pay out of pocket can vary depending on how much youve already paid during a year.

| Annual deductible | |||

| You pay for your medicines until reaching your plans deductible. | You pay your plans copays or coinsurance for brand-name and generic drugs. | You pay no more than 25 percent of the cost of brand-name and generic drugs. | You pay a small copay amount or small insurance percentage. |

| If your plan has no deductible, initial coverage starts with your first prescription. | You stay in this stage until your total drug costs reach $4,430 in 2022. | You stay in this stage until your out-of-pocket costs reach $7,050 in 2022 | You stay in this stage for the rest of the year. |

Recommended Reading: Is Medicare Good Or Bad