Whats The Difference Between The Annual Enrollment Period And Medigap Open Enrollment Period

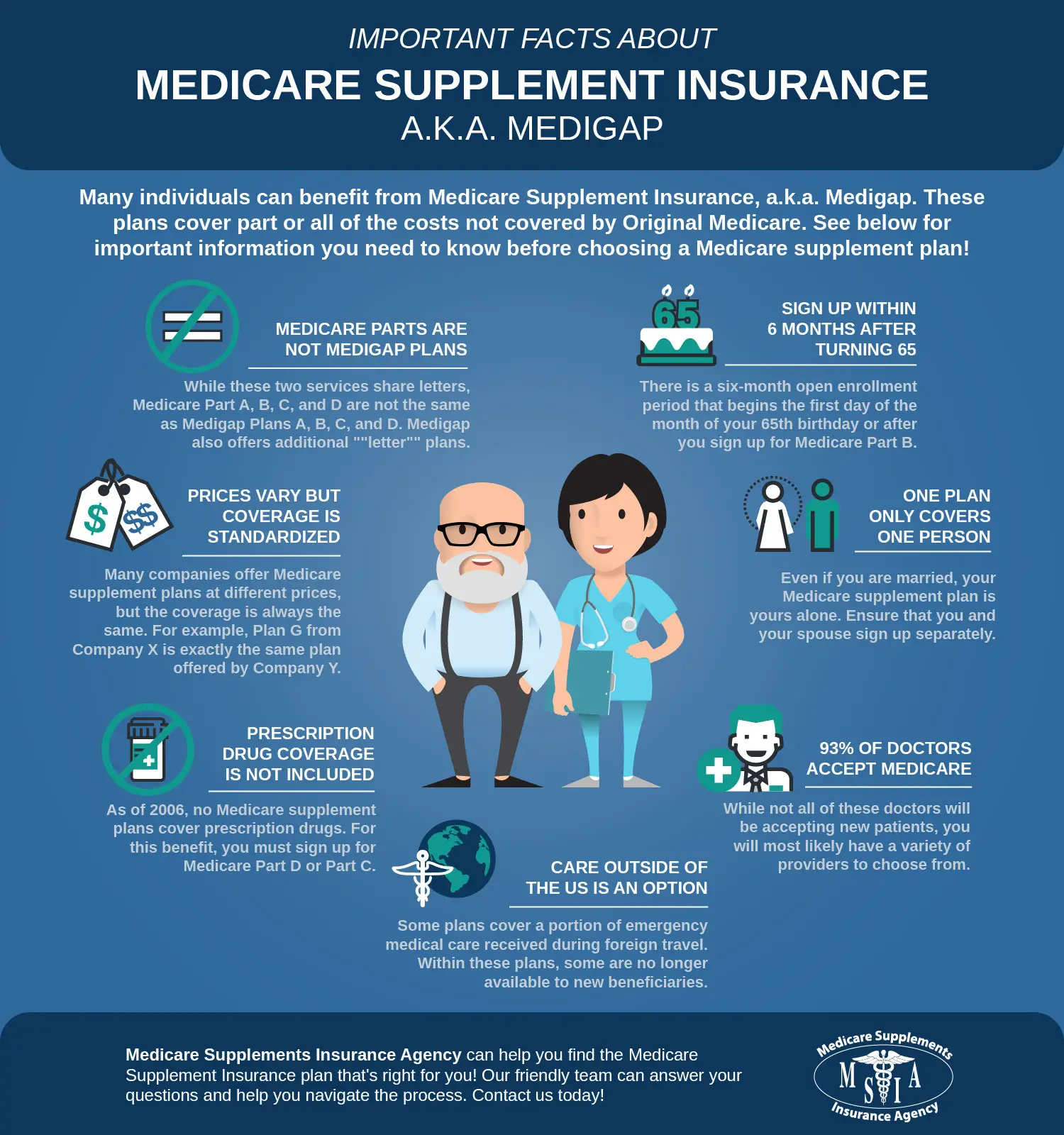

Your Medicare Supplement Open Enrollment Period is not the same as the Annual Election Period in the fall. The latter pertains to Medicare Advantage and Medicare Part D plans and the dates are the same every year. Your Medigap Open Enrollment Period is unique to you, only happens once in your lifetime, and only concerns Medicare Supplement selection.

Many new beneficiaries think they can enroll in a Medigap plan and bypass health questions during the Annual Enrollment Period. However, this isnt the case.

This is one of the biggest misconceptions and causes the most problems for beneficiaries. Its also why its so important to know about enrollment periods. One option during the Annual Enrollment Period is to disenroll from a Medicare Advantage plan and return to Original Medicare. This allows the beneficiary to enroll in prescription drug plan coverage and Medigap.

How Long Is Open Enrollment For Medicare Supplement Policies

Open enrollment for Medicare Supplement spans six months, beginning on the first day of the month in which youre both at least 65 years old and enrolled in Medicare Part B. Some states have additional open enrollment periods, including ones for people under 65, so check with your local Medicare office for additional enrollment options that may be relevant for you.

Coverage Complications For Preexisting Conditions

If none of the situations described above apply to you, then you fall outside the guaranteed issue rightsand could be on the hook for costs associated with your preexisting condition.

Medigap is one of areas of health care that insurers can underwrite, says Jacobson. This means if youre not in a guaranteed issue period, private insurance companies can charge you higher premiums based on your health status or preexisting condition and whether you smoke.

Medical underwriters attempt to determine a private insurance companys level of risk by granting you a Medigap policy, and they use your health history when determining whether to accept your application and how much to charge you. An analysis on medical underwriting in the long-term care insurance market, for example, estimates 40% of people in the general population would have their long-term care insurance application rejected for medical reasonsCornell PY, Grabowski DC, Cohen M, Shi X, Stevenson DG. Medical Underwriting In Long-Term Care Insurance: Market Conditions Limit Options For Higher-Risk Consumers. Health Aff . 2016 35:1494-1503. .

To avoid medical underwriting and improve your access to coverage, the best thing you can do is apply for a Medigap policy in the six-month window after you get Medicare Part B.

Also Check: What Is Medicare Part B Reimbursement

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Do You Need Medicare Supplement

Not everyone needs a Medicare supplement policy. If you have other health coverage, the gaps might already be covered. You probably dont need Medicare supplement insurance if:

- You have group health insurance through an employer or former employer, including government or military retiree plans.

- You have a Medicare Advantage plan.

- Medicaid or the Qualified Medicare Beneficiary Program pays your Medicare premiums and other out-of-pocket costs. QMB is a Medicare savings program that helps pay Medicare premiums, deductibles, copayments, and coinsurance.

If you have other health insurance, ask your insurance company or agent how it works with Medicare.

Also Check: What Is Medicare Advantage Premiums Part C

Apply For The Plan You Want

Now that you’ve picked your plan and understand what’s available in your area, there are a few ways to apply. If you already have a favorite insurance provider, you can go to their website or call them directly. Unfortunately, you cant compare prices from one provider to the next this waythe price the company quotes will be the price you pay.

If youd like to compare prices, you can also call one of our independent agents, who will be able to help you see prices from several insurance companies. Then once you’ve found the plan and price you like the best, they’ll walk you through the enrollment process, and you’ll be done!

Note: Interested in the most popular Medigap Plan, Plan F? Learn about changes to eligibility requirements for 2020 before going any further.

What Happens If You Need To Change Plans During A Period You Cannot Change Plans

The only way to change Medicare Advantage Plans outside of the standard annual enrollment periods is by qualifying for a Special Enrollment Period. include, but are not limited to:

- Moving outside of your current plans service area.

- Moving to a new address within your current plans service area but which has new plan options.

- Moving into or out of a skilled nursing facility or long-term hospital care.

- You are eligible for both Medicare and Medicaid.

- Becoming ineligible for Medicaid.

- If Medicare takes an official action because of a problem with your current plan that affects you.

- If Medicare terminates or does not renew your current plans contract.

- You joined a plan or chose not to join a plan due to an error by a federal employee.

You generally have 2 months to make a change to your Medicare Advantage Plan during a SEP.

For a complete list of special circumstances that qualify you for a SEP, click here: Special circumstances .

You May Like: What Type Of Insurance Is Medicare Part D

Also Check: What Dental Care Is Covered By Medicare

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Recommended Reading: Does Medicare Cover Chiropractic X Rays

What Can I Do Next

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Because the company has less than 20 employees, your job-based coverage might not pay for health services if you dont have both Part A and Part B.

Also Check: What Is United Healthcare Medicare Advantage Plan

Can I Get Medicare Supplement Plans Anytime

Generally, there is no type of Medicare plan that you can get âany time.â All Medicare coverage, including Medicare Supplement plans, is subject to enrollment periods. Other types of Medicare plans, like Medicare Advantage and Medicare Part D prescription drug plans, have open enrollment periods every year. However, Medicare Supplement open enrollment is more limited.

How Do I Purchase A Medicare Supplement Plan Or A Medicare Advantage Plan

- Speak to a licensed agent: local agents understand local plans and the healthcare landscape. They are best positioned to help you make the right decision. Local agents, like Connie Health, will also help you navigate your Medicare insurance after purchasing your coverage.

- Enroll online: If you feel you have everything you need to make a decision, you can enroll online on Connie Health, Medicare.gov, or other sites. If you purchase online through Connie Health, you will still be eligible for our services to help you with any Medicare-related questions after you purchase coverage.

- Enroll directly with the insurance company this is always an option, though it doesnt save you any money compared to enrolling online or with an agent. They also only sell their plans and not all insurance companys plans like the options above. Please keep in mind that if you choose this option you wont have an independent agent to consult with or who can advocate for you.

Recommended Reading: Will Medicare Pay For Palliative Care

When To Sign Up For Medicare

If youre not enrolled automatically, you should sign up in the three months before your 65th birthday. That way, coverage will start on the first day of your birthday month .

You technically have seven months around your 65th birthday to enroll: the three months before your birthday month, your birthday month and the three months after. This is called your initial enrollment period. If your birthday is the first of the month, your initial enrollment period includes the four months before your birthday month and two months after.

Your coverage could be delayed if you wait until your birthday month or the three months afterward to apply for Medicare. And if you miss your initial window, you may need to sign up during Medicare’s general enrollment period. However, you may be subject to a permanent penalty unless you have continuous coverage from a large employer group health insurance plan.

How And When To Apply For Medicare

Heres how and when you can sign up for Medicare:

When to Apply for Medicare

Generally, you should apply for Part A and Part B Medicare as soon as youre eligible. The enrollment period begins three months before your 65th birthday, including your birthday month, and extends three months after your birthday month, meaning you have seven months to apply for Medicare.

However, if you fail to sign up for Medicare during this seven-month window, youll have to wait to enroll and go months uncovered. You may also have to pay a monthly penalty for as long as you have Part B the penalty increases the longer you wait to enroll.

If youre still working and have health insurance via your employer, or if your spouses employer covers you, you might be able to delay enrolling in Medicare. However, youll need to follow the rules and sign up for Medicare within eight months of losing your coverage to dodge substantial penalties when you eventually enroll.

How to Apply for Medicare

Youll automatically be enrolled in Part A and Part B if you receive Social Security benefits at least four months before you become eligible for Medicare. However, if youre about to turn 65 or recently turned 65 and havent received Social Security benefits yet, heres what you can do according to the Medicare website:

After you apply for Medicare, theyll send you a welcome package with your Medicare card and program details about two weeks after signing up.

You May Like: Who Is The Medicare Coverage Helpline

Sign Up: Within 8 Months After You Or Your Spouse Stopped Working

Your current coverage might not pay for health services if you dont have both Part A and Part B .

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Recommended Reading: How To Become Medicare And Medicaid Certified

Do I Need Medicare If I Am Covered By My Spouse’s Insurance

If you have insurance through a spouse’s employer, you may also be able to delay Medicare past age 65. However, this depends on the rules the employer has for covered dependents of Medicare age. Some employers may require covered dependents to enroll in Medicare at age 65 in order to remain on the employer plan. In this case, you’ll need to talk directly with the employer’s benefits administrator to learn about what you can do about Medicare enrollment.

Medicare Late Enrollment Penalties

If you do not take the corresponding action above that reflects your situation, you may be faced with Medicare late enrollment penalties. These penalties are dual in nature you may receive a financial penalty as well as be restricted on when you can get into Medicare.

The financial penalty for late enrollment into Medicare Part B is 10% for each 12 month period that you were not enrolled but were eligible to do so.

The time period restriction is that there are certain times of year during which you can get into Medicare Part B. So, if you do not enroll on time, you may have to wait several months before your Medicare can start.

Note that there are also late enrollment penalties for Medicare Part D 1% of the national base beneficiary premium for every month that you were eligible but not enrolled.

Recommended Reading: Do Any Medicare Supplement Plans Cover Dental And Vision

Read Also: Is Trump Trying To Get Rid Of Medicare

Medicare Supplement Plans: When Can You Get One

Itâs easier to buy a Medicare Supplement plan during certain time periods. Usually, your best bet is to buy a plan during your Medicare Supplement Open Enrollment Period . This is the six-month period that starts the month youâre both at least 65 years old and enrolled in Medicare Part B.

Why is this OEP possibly the best time to buy a Medicare Supplement plan? Because if you apply for a plan during your OEP, the plan has to accept you in spite of any health problems you might have. It canât charge you more because of your health conditions. Once youâre signed up, if your health problems continue or you develop new ones, the plan canât drop you for that reason.

You can apply for a Medicare Supplement plan anytime, as long as you have Medicare Part A and Part B. But if itâs after your OEP, the insurance company can look at your medical history and ask you questions about your health conditions. The company can charge you more, or even reject you, if you have a health problem.

There may be other times when you have âguaranteed issue rightsâ to buy a Medicare Supplement plan.

Remember, you can click the Browse Plans button on this page anytime you want to start comparing plans. Of course, you can also contact us to reach a licensed eHealth insurance agent.

Medicare Supplement Plans: How To Apply

Medicare can cover a wide range of medical costs, but like anything else, its not perfect. We would all like a bit more coverage than Original Medicare can offer, especially when we know we’ll be in more need of the benefits later in life. Luckily, Medicare Supplement plans provide a solution, helping boost your Medicare coverage and potentially save you thousands.

This guide will cover how to apply for a plan and, most importantly, when to apply so you can ensure valuable federal protections.

Read Also: Do You Automatically Get Medicare When You Turn 65

If I Dont Like My Plan When Can I Change

Each year between October 15 and December 7, there is an annual enrollment period for Medicare beneficiaries. At this time, you can change your MAPD or PDP plans for a January 1 start date. There are other special enrollment periods that may allow you to change your plan during the rest of year. Read this article to find out more.

Also Check: What Is The Difference Between Medicare

When Is The Best Time To Buy Medigap

The best time to buy Medigap is when you are first eligible.

Everyone gets a six-month window after enrolling in Medicare Part B, during which they can apply for a Medicare Supplement, or Medigap, policy.

During this time, the medical underwriting process is waived. Medical underwriting allows private insurance companies to ask you questions about your health.

If youre in poor health or have preexisting conditions, an insurer can deny you coverage or force you to pay higher premiums for a policy.

Those rules dont apply when youre first eligible for a Medicare Supplement plan. During your Medigap open enrollment period, you can buy any policy for the same price as people in good health.

This six-month period cant be changed or repeated.

Medicare supplement plans help pay costs not covered by Original Medicare. This can include deductibles, copayments and coinsurance.

When You Can Buy Medigap Without Medical Underwriting

There are two other situations when you can buy a Medigap policy without undergoing medical underwriting.

Recommended Reading: How Much For Part B Medicare

When Can I Sign Up

- To qualify for enrolling in a Medigap plan, you must first be enrolled in Original Medicare Parts A and B.

- The best time to sign up for a Medigap plan is during the first six months in which you are age 65 or older and also enrolled in Part B. To sign up, contact the private insurance company directly. See Approved Medicare Supplement plans for contact information.

- If you’re under age 65, you might not be able to buy the Medigap plan you want – or any Medigap plan – until you turn 65.