What To Do If You Think Your Medicaid Card Has Been Compromised

A lost or stolen Medicaid card that falls into the wrong hands can lead to fraud against the Medicaid program or even against you. Thats why its so important to report a lost or stolen card immediately.

Medicaid employs its own fraud investigators, and filing a report with this team can establish proof that you reported the missing card at a particular time and date, which can help protect you from identity theft.

Its important to not allow anyone else to use your Medicaid card. Not only could the person using the card encounter legal trouble for using the card, but you could be held liable for fraud as well.

If you are enrolled in a Medicaid-Medicare plan such as a Dual-eligible Special Needs Plan, you may have a separate card, and you may need to contact your insurance carrier directly to report a lost card and request a new one.

These plans are designed for people on both Medicare and Medicaid and feature a set of benefits that cater to those specific needs. Plan members do not pay a monthly premium and most plans include dental benefits that may include coverage for dentures.

If you are eligible for Medicare, speak to a licensed insurance agent to find out if Dual-eligible Special Needs Plans are available in your area.

For Insurance Quotes By Phonetty 711 Mon

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MedicareInsurance.com, DBA of Health Insurance Associates LLC, is privately owned and operated. MedicareInsurance.com is a non-government asset for people on Medicare, providing resources in easy to understand format. The government Medicare site is www.medicare.gov.

This website and its contents are for informational purposes only and should not be a substitute for experienced medical advice. We recommend consulting with your medical provider regarding diagnosis or treatment, including choices about changes to medication, treatments, diets, daily routines, or exercise.

This communications purpose is insurance solicitation. A licensed insurance agent/producer or insurance company will contact you. Medicare Supplement insurance plans are not linked with or sanctioned by the U.S. government or the federal Medicare program.

MULTIPLAN_GHHK5LLEN_2023

Recommended Reading: Will Medicare Pay Me For Taking Care Of My Mother

You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

You May Like: Why Does Medicare Cost So Much

You Can Do A Lot With Your My Medicare Account Including Printing And/or Ordering A New Medicare Card

Yes, you can. Your Medicare health insurance card is the way that you access your Medicare benefits, so understanding how this card functions is important to make sure that your coverage is always simple to receive. Well go through how to print your card online, as well as several other issues related to your Medicare card, so you can be prepared no matter what situation you find yourself in.

Protect Your Medicare Number Like A Credit Card

Only give personal information, like your Medicare Number, to health care providers, your insurance companies or health plans , or people you trust that work with Medicare, like your State Health Insurance Assistance Program .

Say no to scams

Medicare will never call you uninvited and ask you to give us personal or private information. Learn more about the limited situations in which Medicare can call you.

You May Like: How To Change Primary Doctor On Medicare

Can I Laminate My Medicare Card Yes But Why

While you can laminate your Medicare card, Medicare does not recommend it. Laminated cards tend to be more difficult for providers to make copies of. Still, Medicare does recommend that you make a copy of your Medicare card so that you can keep your original card in a safe place. The problem is that a paper copy is no better than the original Medicare card.

There is however, nothing stopping you from making a plastic copy of your Medicare card. A professionally printed plastic Medicare card allows your provider to make perfect copies for their records, and will last you forever!

How Do I Get My Card In The First Place

If you automatically enroll in Medicare, you will get your Medicare card in the mail three months before your 65th birthday. If you receive disability benefits, the card will come on the 25th month after you started receiving your benefits. You need your Medicare card to receive Medicare coverage.

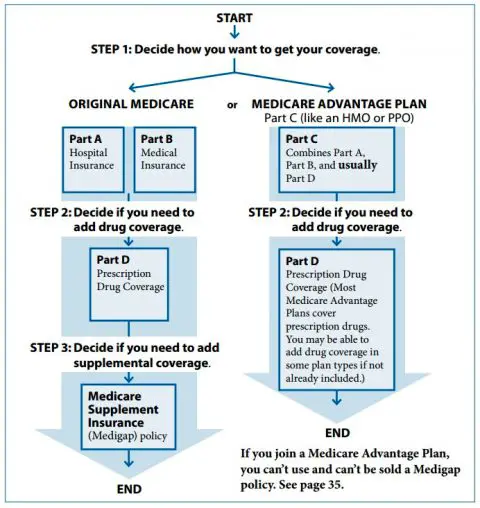

Your Medicare card contains all of the information that you need to receive coverage when you visit your health care provider. It functions as an ID card, as well as an explanation of what coverage you have. The terms used on the card are hospital for Medicare Part A and medical for Medicare Part B. These two parts together are referred to as Original Medicare.

If you have other forms of Medicare health insurance, like Part D prescription drug plan, a Medicare Advantage plan, or a Medicare Supplement Plan, this coverage wont be represented on your card. You will likely receive a separate card from the private insurance companies that you will use for this coverage.

All of the basic information about your Medicare card is available online at medicare.gov.

Read Also: Does Medicare Part B Cover Vision Exams

Read Also: When Can I Start Getting Medicare

You Have Health Insurance You Want To Keep

If you currently have a health insurance plan that you love either through a job, your spouse, a union, or other source you may wish to continue your current coverage.

Deferring Medicare may save you money on monthly premiums, especially if youre a high-wage earner. If your current insurance is provided through a large group insurer and covers everything that Medicare parts B and D cover, you wont be hit with a penalty if you defer for this reason.

Whats My Enrollment Status

See your current Medicare coverage at a glance.

- To see your Part A and Part B coverage start dates, look for the My Information summary box on the home page.

- To see details of your health and drug plans, Click My Plans and Coverage on the top menu bar.

Prescription Drug Plan Information

If you have Part D coverage, you can view your planâs details and drug costs under My Plans and Coverage. You can also print a temporary card to use at the pharmacy while waiting to receive your drug card in the mail.

You May Like: What Age Can A Woman Get Medicare

You May Like: When Do I Apply For Medicare Part B

Medicare Supplement Medigap Insurance

Medicare Supplement insurance is health insurance sold by private insurance companies to cover some of the “gaps” in expenses not covered by Medicare.

For policies sold before June 01, 2010, there are fourteen standardized plans A through L. For policies sold on or after June 01, 2010, there are 11 standardized plans A through N. Each standardized Medigap policy must provide the same basic core benefits such as covering the cost of some Medicare copayments and deductibles. Some of the standardized Medigap policies also provide additional benefits such as skilled nursing facility coinsurance and foreign travel emergency care. However, in order to be eligible for Medigap coverage, you must be enrolled in both Part A and Part B of Medicare.

As of June 1, 2010, changes to Medigap resulted in modifications to the previously standardized plans offered by insurers. Medigap plans H, I, and J, which contained prescription drug benefits prior to the Medicare Modernization Act, were eliminated. Plan E was also eliminated as it is identical to an already available plan. Two new plan options were added and are now available to beneficiaries, which have higher cost-sharing responsibility and lower estimated premiums:

- Plan M includes 50 percent coverage of the Medicare Part A deductible and does not cover the Part B deductible

- Plan N does not cover the Part B deductible and adds a new co-payment structure of $20 for each physician visit and $50 for each emergency room visit

Factors That Affect Original Medicare Out

- Whether you have Part A and/or Part B. Most people have both.

- Whether your doctor, other health care provider, or supplier accepts assignment.

- The type of health care you need and how often you need it.

- Whether you choose to get services or supplies Medicare doesn’t cover. If you do, you pay all the costs unless you have other insurance that covers it.

- Whether you have other health insurance that works with Medicare.

- Whether you have Medicaid or get state help paying your Medicare costs.

- Whether you have a Medicare Supplement Insurance policy.

- Whether you and your doctor or other health care provider sign a private contract.

Read Also: Can You Have More Than One Medicare Supplement Plan

How Medicare Works With Other Insurance

If you have

and other health insurance , each type of coverage is called a “payer.” When there’s more than one payer, “coordination of benefits” rules decide who pays first. The “primary payer” pays what it owes on your bills first, and then sends the rest to the “secondary payer” to pay. In some rare cases, there may also be a third payer.

When Your Information Changes

If any of your personal information changes, let us know as soon as possible. You can do so by calling Member Services. We need to be able to reach you about your healthcare needs.

The Department of Children and Families needs to know when your name, address, county or telephone number change, as well. Call DCF toll-free at 1-866-762-2237 Monday through Friday from 8 a.m. to 5:30 p.m. You can also go online and make the changes in your Automated Community Connection to Economic Self Sufficiency account. You may also contact the Social Security Administration to report changes. Call SSA toll-free at 1-800-772-1213 , Monday through Friday from 7 a.m. to 7 p.m. You may also contact your local Social Security office or go online and make changes in your Social Security account.

Also Check: What Is Medicare Part A And B

Also Check: Can You Be Dropped From Medicare

Does It Help Me In Any Way To Give Va My Health Insurance Information

Yes. Giving us your health insurance information helps you because:

- When your private health insurance provider pays us for your non-service-connected care, we may be able to use the funds to offset partor allof your VA copayment.

- Your private insurer may apply your VA health care charges toward your annual deductible .

How To Generate An Esignature For The Florida Medicaid Medicare Buy In Application Form On Android

In order to add an electronic signature to a florida medicaid application form, follow the step-by-step instructions below:

If you need to share the medicaid application florida with other parties, you can easily send it by e-mail. With signNow, you can eSign as many documents per day as you need at an affordable price. Start automating your eSignature workflows today.

Read Also: Does Mutual Of Omaha Offer Medicare Advantage Plans

You Want To Use Your Current Veterans Affairs Benefits

If youre a military veteran and have benefits through the Department of Veterans Affairs, youre covered only for services provided at VA facilities. VA benefits typically wont cover services you get at outside facilities, unless specifically authorized by the VA.

In this instance, it makes sense to enroll in Medicare Part A, so you can access services you may need at non-VA hospitals.

You might be better off getting Part B during initial enrollment as well, even though you have to pay a monthly Part B premium. If you defer enrollment, long-term penalties will raise your rates.

If you do enroll in Part B, your VA benefits will continue to pay for things that Medicare doesnt cover, such as hearing aids and over-the-counter medications. You may also qualify for help paying your premiums through a Medicare savings program.

For flexibility, you might also want to enroll in a Medicare Part D plan or a Medicare Advantage plan that covers medications.

VA benefits include prescription drug coverage thats considered to be at least as good as Medicare coverage. But it requires you to use a VA medical provider and pharmacy.

If you lose your VA benefits or decide you want a Part D plan, you may enroll without penalty, even after your initial enrollment period expires.

How Can You Tell If You’re Dealing With A Medicare Telemarketing Call

There are a few ways to tell if you’re dealing with a Medicare telemarketing call. One major hint is that the caller is from a company that doesn’t have your permission to contact you.The use of a recorded message is also a hint that you’re dealing with a telemarketer. The message may ask you to press 1 to be removed from the calling list or tell you that you have unpaid tax debt.

Read Also: Do I Qualify For Extra Help With Medicare

What Are My Medicare Part A Costs

Many people get Medicare Part A without a premium if theyve worked the required amount of time under Medicare-covered employment, generally 10 years or 40 quarters and paid Medicare taxes while working . However, your Part A coverage may still include other costs, even after Medicare has paid its share. This may include deductibles, copayments, and/or coinsurance, which can all change from year to year. Your costs may depend on the type of service youre getting and how often.

Medicare Part A cost-sharing amounts are listed below.

Inpatient hospital care:

- $0 coinsurance for the first 60 days of each benefit period

- $371 a day for the 61st to 90th days of each benefit period

- $742 a day for days 91 and beyond per each lifetime reserve day of each benefit period

- After lifetime reserve days are used up: You pay all costs

Skilled nursing facility care:

- $0 for days 1 to 20 for each benefit period

- $185.50 a day for the 21st to 100th days

- Days 101 and beyond: all costs

How To Use Medicaregov

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare.gov is the official website for Medicare, the U.S. government health care program for seniors and those living with certain disabilities. Medicare.gov is especially helpful for comparing plans, finding providers, getting claims paperwork and learning about costs and policies. Heres how you can use it.

If you want to enroll in Original Medicare, which includes Part A and Part B , you cant do it through Medicare.gov you have to go through Social Security.

Read Also: Who Does Not Have To Pay For Medicare Part B

Unitedhealthcare And Humana Account For Nearly Half Of All Medicare Advantage Enrollees Nationwide In 2022

Medicare Advantage enrollment is highly concentrated among a small number of firms. UnitedHealthcare and Humana together account for 46 percent of all Medicare Advantage enrollees nationwide. In nearly a third of counties , these two firms account for at least 75% of Medicare Advantage enrollment. account for 14 percent of enrollment, and four firms account for another 24 percent of enrollment in 2022.

How Do I Dispute A Part D Penalty

Part D Late Enrollment Penalty Reconsideration Request FormAn enrollee may use the form, Part D LEP Reconsideration Request Form C2C to request an appeal of a Late Enrollment Penalty decision. The enrollee must complete the form, sign it, and send it to the Independent Review Entity as instructed in the form.

Read Also: Can I Have Medicare Part B Without Part A

More Than 46 Million Medicare Beneficiaries Are Enrolled In Special Needs Plans In 2022

More than 4.6 million Medicare beneficiaries are enrolled in Special Needs Plans . SNPs restrict enrollment to specific types of beneficiaries with significant or relatively specialized care needs, or who qualify because they are eligible for both Medicare and Medicaid. The majority of SNP enrollees are in plans for beneficiaries dually enrolled in both Medicare and Medicaid . Another 9 percent of SNP enrollees are in plans for people with severe chronic or disabling conditions and 2 percent are in plans for beneficiaries requiring a nursing home or institutional level of care .

While D-SNPs are designed specifically for dually-eligible beneficiaries, 1.9 million Medicare beneficiaries with Medicaid were enrolled in non-SNP Medicare Advantage plans in 2020 .

Enrollment in SNPs increased from 3.8 million beneficiaries in 2021 to 4.6 million beneficiaries in 2022 , and accounts for about 16% of total Medicare Advantage enrollment in 2022, up from 11% in 2011, with some variation across states. In the District of Columbia and Puerto Rico, SNPs comprise about half of all Medicare Advantage enrollees . In 11 states, SNP enrollment accounts for about one-fifth of Medicare Advantage enrollment . More than 95% of C-SNP enrollees are in plans for people with diabetes or cardiovascular conditions in 2022. Enrollment in I-SNPs has been increasing slightly, but is still fewer than 100,000.