Senior Advantage Health Maintenance Organization Plans

People who select a Kaiser HMO plan must choose an in-network primary care physician .

The PCP is the first point of contact for a person who needs medical attention.

If an individual then needs specialist care, their PCP can refer them to an in-network consultant.

Individuals must use the network of doctors and other healthcare providers unless it is an emergency.

Kaiser provide limited out-of-network benefits. However, Kaiserâs Medicare Advantage HMO plans do include additional benefits, such as vision, hearing, and dental care.

Also included is a tailor-made gym membership. A person can take part in fitness programs at participating facilities.

The HMO plans provide prescription drug coverage. A person can order their prescription drugs through a mail-order pharmacy that delivers straight to their home.

Preferred Provider Organization Plans

Kaiser Medicare Preferred Provider Organization plans offer more freedom.

Individuals are not required to use in-network healthcare providers and can visit any provider without a referral. Specific procedures, such as surgery or radiology, may require preapproval.

If a person uses an in-network provider, the cost is generally lower.

Some PPO plans offer the member the choice of selecting a PCP, which will also save on costs.

As with the HMO plans, benefits include dental, vision, and hearing coverage and a mail-order prescription drug service.

People who are living in the following nine states can enroll in a Kaiser Medicare Advantage plan:

- routine eye exams

A fitness and wellness program is also offered, in which a person can attend a local gym for fitness classes.

A person may also be able to use the gym facilities and enjoy complimentary health benefits, such as massages.

How Much Is Kaiser Insurance Per Month

The average monthly cost of insurance from Kaiser Permanente will heavily depend on your state of residence. For example, Kaiser rates for health insurance range from $335 in Maryland to $474 in California. For those purchasing insurance on the marketplace, the amount you pay may be reduced because of health insurance subsidies.

Don’t Miss: Which Glucose Meters Are Covered By Medicare

Kaiser Special Needs Plans

Kaiser also offers plans for those with extra healthcare needs. These are called Special Needs Plans , and there are a few different types available, including:

- Chronic Condition Special Needs plans : for people with chronic health conditions

- Institutional Special Needs plans : for people who live in nursing homes or long-term care facilities

- Dual Eligible SNPs : for patients who are eligible for both Medicare and Medicaid coverage

These plans each offer comprehensive hospitalization, medical service, and prescription coverage, but have been separated based on the kinds of patients they serve.

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

Also Check: What Is A Medicare Advantage Plan Part C

Kaisers Medicare Advantage Plans Review

Comprehensive Medicare Advantage Coverage for Seniors in Certain States

SeniorLiving.org is compensated when you click on the provider links listed on this page. This compensation does not impact our ratings or reviews.

Thank you for your inquiry

Someone will be in touch shortly

Plans$0Part DHMO

Kaiser Permanente is a large consortium of medical services and facilities. While many of Kaiser’s services include direct doctor-to-patient care, they also offer private insurance to consumers in several locations across the country. For people who qualify for Medicare, Kaiser has a few Medicare Advantage plans available with competitive pricing and benefits. In this review, we will examine Kaiser’s Medicare Advantage plans and evaluate their pros and cons.

Medicaid And Programs For Those With Low Incomes

Kaiser Permanente also participates in Medicaid programs. For those who qualify for low-income health insurance, the plan issued by your government agency may be through Kaiser.

In addition, Kaiser also offers a Charitable Health Coverage program that provides coverage and access to care for those who are not eligible for public or private health coverage.

There’s also a Medical Financial Assistance program that provides free or reduced health care services for those who are low-income, uninsured and underserved.

Don’t Miss: Does Medicare Cover Out Of Country Medical Expenses

What Is A Kaiser Medicare Annual Wellness Visit

While the Medicare annual wellness visit thats covered by Kaiser Medicare plans is similar to a routine physical, its important to note that the annual wellness visit is not the same thing as a general routine physical. Your annual wellness visit does not actually include a physical examination or lab work.

The following services are some of the important health steps you can expect as part of your annual wellness visit covered by a Kaiser Medicare plan.

What Is Medicare Advantage

Medicare Advantage, or Medicare Part C, is an alternative to original Medicare where Medicare contracts with a private insurance company to provide services to Medicare members.

Medicare Advantage plans will provide Medicare Part A and Part B coverage as well as some additional services. These may include prescription drug coverage and vision, hearing, dental, or health and wellness programs.

HMOs and PPOs are two examples of common Medicare Advantage plans. Insurance companies like Kaiser contract with doctors and medical facilities to receive discounts in return for their members choosing their services.

You May Like: How Old To Get Medicare Benefits

Premiums Paid By Medicare Advantage Enrollees Have Declined Since 2015

In 2022, the average enrollment weighted MA-PD premium, including among those who do not pay a premium, is $18 per month. However, average MA-PD premiums vary by plan type, ranging from $16 per month for HMOs to $20 per month for local PPOs and $49 per month for regional PPOs. Nearly 6 in 10 Medicare Advantage enrollees are in HMOs , 38% are in local PPOs, and 3% are in regional PPOs in 2022. Regional PPOs were established to provide rural beneficiaries with greater access to Medicare Advantage plans.

Average MA-PD premiums have declined from $36 per month in 2015 to $18 per month in 2022. The reduction is driven in part by the decline in premiums for local PPOs and HMOs, that account for a rising share of enrollment over this time period. Since 2015, a rising share of plans are bidding below the benchmark, which enables them to offer coverage without charging an additional premium. More plans are bidding below the benchmark partly because Medicare Advantage benchmarks relative to traditional Medicare have increased over time, and when benchmarks increase, plans are able to keep more for Part A and B services as well as for extra benefits. Further, rebates paid to plans have increased over time, and plans are allocating some of those rebate dollars to lower the part D portion of the MA-PD premium. Together, these trends contribute to greater availability of zero-premium plans, which brings down average premiums.

Most Medicare Advantage Enrollees Have Access To Some Benefits Not Covered By Traditional Medicare In 2022 And Special Needs Plan Enrollees Have Greater Access To Certain Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $432 per enrollee annually for non-Medicare supplemental benefits, a 24% increase over 2021. The rise in rebate payments to plans is due in part to incentives for plans to document additional diagnoses that raise risk scores, which in turn, generate higher rebate amounts that make it possible for plans to provide extra benefits. Plans can also charge additional premiums for such benefits, but most do not do this. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered primarily health related but CMS expanded this definition, so more items and services are available as supplemental benefits.

Also Check: Can An Immigrant Get Medicare

Available Medicare Advantage Plans

Kaiser Permanente offers HMO Medicare Advantage plans. Many plans offer dental, vision and hearing benefits, and worldwide emergency care. Kaiser doesn’t offer any stand-alone Medicare prescription drug plans.

Plan availability may vary by county. Plan offerings may include the following types:

A health maintenance organization, or HMO, generally requires that you use a specific network of doctors and hospitals. You may need a referral from your primary doctor in order to see a specialist, and out-of-network benefits are usually very limited.

Special needs plans, or SNPs, restrict membership to people with certain diseases or characteristics. Hence, the benefits, network and drug formularies are tailored to the needs of those members. Kaiser Permanente offers one type of SNP:

-

Dual-Eligible SNP: For people who are entitled to Medicare and who also qualify for assistance from a state Medicaid program.

Nearly All Medicare Advantage Enrollees Are In Plans That Require Prior Authorization For Some Services

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly all Medicare Advantage enrollees are in plans that require prior authorization for some services in 2022. Prior authorization is most often required for relatively expensive services, such as Part B drugs , skilled nursing facility stays , and inpatient hospital stays , and is rarely required for preventive services . Prior authorization is also required for the majority of enrollees for some extra benefits , including comprehensive dental services, hearing and eye exams, and transportation. The number of enrollees in plans that require prior authorization for one or more services stayed the same from 2021 to 2022. In contrast to Medicare Advantage plans, traditional Medicare does not generally require prior authorization for services and does not require step therapy for Part B drugs.

Recommended Reading: Does Medicare Pay For Prep

How Do I Find A Kaiser Plan That Covers The Annual Wellness Visit

Every Medicare Advantage plan sold by Kaiser Permanente covers the annual wellness visit in full. These visits are covered by Medicare Part B, and Medicare Advantage plans are required by law to cover everything included under Medicare Part A and Part B.

Kaiser sells Medicare Advantage plans in the following states:

Individual And Family Plans

Kaiser health insurance plans can be purchased through the Health Insurance Marketplace set up by the Affordable Care Act or directly from the insurance company. However, buying insurance through the marketplace does give you access to health insurance tax credits, which can reduce how much you pay for insurance.

Kaiser Permanente plans include required standard coverages, such as access to free preventive care and screenings, as well as financial protections like an out-of-pocket maximum. Plans are divided into the metal tiers of Bronze, Silver, Gold and Platinum. Kaiser’s plans are also classified into the three insurance categories below, so you can choose a Bronze Deductible plan, a Gold Copayment plan or another combination.

Also Check: Does Medicare Pay For Cpap Machines And Supplies

How Satisfied Are Existing Customers

According to J.D. Power, Kaiser Permanente scored as the No. 1 insurance company for health insurance customer satisfaction in all of its locations where plans were ranked. In a separate J.D. Power study of Medicare Advantage customers, Kaiser also ranked as the top company for customer satisfaction.

The consistency of these ratings shows that consumers are happier overall with Kaiser Permanente than with other health insurers.

How Much Does Medicare Part B Cost In 2022

The premium for Medicare Part B in 2022 is $170.10 per month. You may pay less if youre receiving Social Security benefits. You also may pay more up to $578.30 depending on your income. The higher your income, the higher your premium.

The deductible for Medicare Part B is $233 per year.

The Medicare Part B coinsurance amount is 20% for covered supplies and services.

Learn more about Medicare Part B, including Part B premiums prices based on income level.

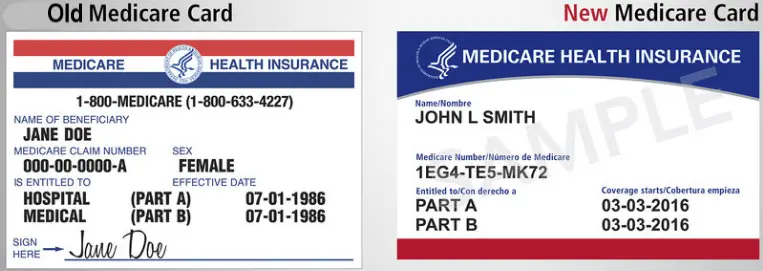

Read Also: When Can I Get My Medicare Card

Available Kaiser Medicare Advantage Plans

Kaiser is mostly limited to health maintenance organization plans. While you will have to get treatment within a network and choose a primary care physician, you can change your PCP at any time. You can also add riders to your plan via the Advantage Plus add-on. For a small monthly fee, Advantage Plus provides dental coverage and discounts on eyewear and hearing aids. Below, we’ll take a closer look at the two primary Part C plan types Kaiser Permanente offers.

Employer And Group Insurance

For group insurance, Kaiser may offer a wider variety of plan options than what’s available for individual purchasers. For example, some locations have preferred provider organization plans available, which provide broader medical coverage beyond Kaiser’s facilities and doctors.

Note that these PPO plans may not be as well-rated as Kaiser’s HMO plans. For example, we don’t recommend the Kaiser Options PPO plan in Washington state because of its poor customer satisfaction.

Read Also: Where Do You Sign Up For Medicare

Why Choose Medicare Advantage

Now that youve learned about the 4 parts of Medicare and when to enroll, its time to consider which plan best fits your needs Original Medicare or a Medicare Advantage plan.

Good health is essential, so finding a plan that supports your health, lifestyle, and budget is important. Consider your care needs and what your life may be like after you turn 65. You might want a plan that includes affordable prescription drug coverage and limits how much you spend out of pocket. From added benefits to more predictable costs, Medicare Advantage offers more than Original Medicare alone.

Medicare Advantage combines everything you get in Original Medicare with other benefits, like prescription drug coverage. Medicare Advantage plans also have predictable costs with set copays, which can make it easier to plan your expenses.

Youll need to enroll in Original Medicare with the federal government before you sign up for Medicare Advantage from a private health care provider. Then the private provider will become your primary insurer.

Get care designed to make your life easier choose a Kaiser Permanente Medicare Advantage plan

With Kaiser Permanente, your doctor, specialists, and health plan all work together to make it easier for you to get care. And when you move your coverage to a Kaiser Permanente Medicare Advantage plan, youll get comprehensive care at a great value.

You can count on:

Value and affordability

Ease and convenience

Quality and service

Get more information

How Much Do Kaiser Medicare Advantage Plans Cost

Medicare Advantage plan costs vary widely based on your location and health requirements, regardless of the insurance provider you choose. Many Kaiser plans have no monthly premium and offer $0 copays for most routine services. For those that do have a premium, the nationwide average is a little over $70 per month. However, this will inevitably vary based on where you live and the details of your plan.

Did You Know? Kaiser prides itself on offering plans with low or no annual deductibles, which could save you thousands of dollars per year on medical expenses!

Whether or not your plan has a premium, you will still have to pay your Part B premium, which averages about $170.10 per month. The following factors can also affect the overall cost of your insurance and healthcare:

Read Also: What Is The Monthly Premium For Medicare Part B

How Can I Show Medical Necessity For Breast Reduction

Before you can receive coverage for breast reduction surgery through Kaiser, you have to apply for authorization. Some documents the insurance company may require to prove medical necessity include:

- Medical records that detail your height, weight and breast size

- A letter from your healthcare provider explaining the symptoms that arise because of your breast size

- Notes about how your breast size affects your life, such as limiting your ability to engage in physical activity

Generally, you must have proof from a doctor that you have medical symptoms arising from your breast size. You also have to show that you have tried other treatments, such as diet and exercise, that have not been successful.

Average Monthly Cost Of Kaiser Permanente Insurance

| Tier |

|---|

| $555 |

Average monthly cost of a Silver plan for a 40-year-old in California.

The cost of Kaiser health insurance also changes by location. States are priced individually, but there are some regional trends on the West Coast. California, Washington and Oregon have similarly priced plans, with Oregon having the cheapest rates of the three. On the East Coast, costs change more between the neighboring states of Virginia and Maryland.

A 40-year-old could pay 41% more each month to get Kaiser insurance in Virginia than they would in Maryland. Some of this difference is due to overall pricing trends in the two states.

Read Also: Does Medicare Pay For Ensure