Can I Choose My Healthcare Provider

With Original Medicare, a primary care provider is not required. You can healthcare provider who accepts Medicare.

With a Medicare Advantage plan, your choice of doctor depends on whether you select a health maintenance organization or preferred provider organization plan.

With an HMO plan, you can choose your primary care doctor from any doctor in the plans network. If you opt for a PPO plan, generally, choosing a primary care doctor is optional. With both types of plans, youll usually save money by visiting an in-network provider.

Its important to note that Medicare Advantage plans must offer emergency coverage outside the plans service area, anywhere in the U.S.

Whats The Difference Between Medicare Part A And Part B When It Comes To Costs

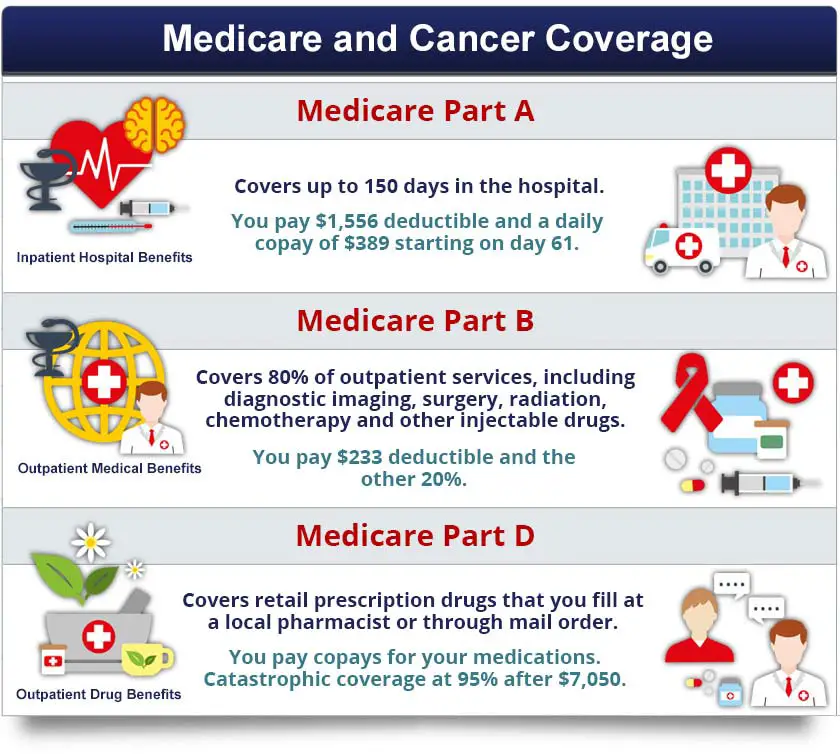

Medicare Part A and Part B have different premiums, deductibles, and coinsurance amounts.

| Part A | Part B | |

| Premiums | Most people get premium-free Part A. You generally qualify for premium-free Part A if youâre 65 and already get retirement benefits from Social Security or the Railroad Retirement Board. You can also get premium-free Part A if youâre under 65 and got Social Security or Railroad Retirement Board disability benefits for 24 months. | Most people pay a premium for Medicare Part B. The standard Part B premium is $170.10 in 2022, or higher depending on your income. |

| Deductibles | In 2022, the Medicare Part A deductible is $1,556 for each benefit period. | The Medicare Part B deductible is $233 a year in 2022. |

| Coinsurance | You pay a Part A coinsurance for certain days in the hospital beyond day 60. This amount is $389 per day for days 61-90, and $778 per day for days 91 and beyond, in 2022. However, if you use up all 60 of your âlifetime reserve days,â you could have to pay all costs. | You pay 20% of the Medicare-approved amount for most doctor services under Medicare Part B. You generally wonât know the actual dollar amount until you receive a bill. |

Medicare Part A B C And D: What You Need To Know

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

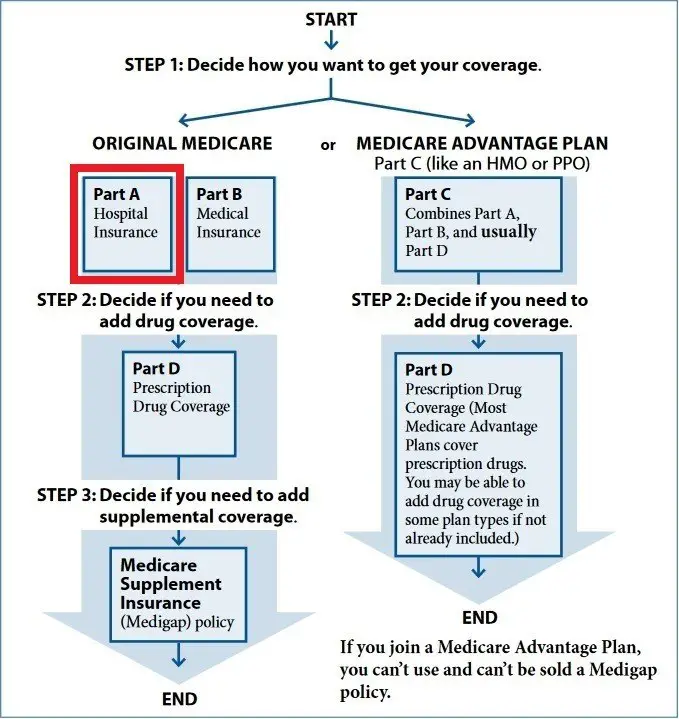

Medicare Parts A, B, C, and D are the four distinct types of coverage available to eligible individuals. Each Medicare part covers different healthcare-related costs. While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services , Medicare Part C and Medicare Part D are managed by private insurance companies.

Medicare is similar to the health insurance coverage youve probably had with an employer or an individual policy. It can cover doctor visits, inpatient and outpatient hospital care, prescription drugs, and lab tests. Depending on the plan you choose, your Medicare plan can also cover dental and vision, if you like.

Heres a brief overview of each of the parts of Medicare.

Read Also: Does Medicare Pay For 2nd Opinions

When Can I Enroll In Medicare Part B

Waiting for your 65th birthday to sign up? Good news! You have time to shop.

Your Initial Enrollment Period begins 3 months before the month of your 65th birthday, includes your birthday month, and continues through the 3 months after the month of your 65th birthday. That gives you 7 months to learn about Medicare and compare plans so you can make the right choice for you.

Already have a Medicare plan?

Its good to remember that choosing a Medicare plan is not a lifetime commitment. Generally, you can join, switch or drop an Original Medicare or Medicare Advantage plan during these times:

- Open Enrollment Period. From Oct. 15 Dec. 7 each year, you can join, switch or drop a plan. Your coverage will begin on Jan. 1 .

- Medicare Advantage Open Enrollment Period. From Jan. 1 March 31 each year, if youre enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or switch to Original Medicare.

- Special Enrollment Period. You can make changes to your Medicare Advantage and Medicare prescription drug coverage when certain events happen in your life, like if you move or you lose other insurance coverage.

Avoid a Medicare Part B late enrollment penalty. If you dont enroll in Medicare Part B as soon as youre eligibleand you dont have other you could be assessed a late enrollment penalty when you do enroll. The penalty could be as high as a 10% increase in your premium for each 12-month period that you were eligible but not enrolled.

Medicare Part B Eligibility

To enroll in Medicare Part B, you must meet specific criteria by the Center for Medicare and Medicaid Services .

If you receive Medicare Part A, you are eligible for Medicare Part B by enrolling and paying the monthly premium.

However, if you are new to Medicare, you must meet the following criteria:

- Must be a U.S. citizen for at least five years

AND one of the following

- Age 65 or older

- Under 65 and receiving Social Security disability benefits for at least 24 months

- Diagnosed with Amyotrophic Lateral Sclerosis

- Diagnosed with End-Stage Renal Disease

If you meet the above requirements, you are eligible to enroll in Medicare Part B.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Listen to this Podcast Episode Now!

Read Also: Why Does Medicare Not Cover Shingles Vaccine

Common Services That Medicare Does And Doesnt Cover

Heres general info about what Medicare does or doesnt cover for common health care needs. Visit medicare.gov/coverage for more detail. Also, check a Medicare health plans Summary of Benefits to learn whats covered.

Medicare has some coverage for acupuncture and it is limited to treatment of chronic low back pain. Some Medicare Advantage plans have benefits that help pay for acupuncture services beyond Medicare such as treatment of chronic pain in other parts of the body, headaches and nausea.

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesnt cover costs to live in an assisted living facility or a nursing home.

Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

The federal Medicaid program can help pay costs for nursing homes or services to help with daily living activities.

Medicare Part B covers outpatient surgery to correct cataracts. It also pays for corrective lenses if an intraocular lens was implanted. Coverage is one pair of standard frame eyeglasses or contact lenses as needed after the surgery.

Medicare Part B covers a chiropractors manual alignment of the spine when one or more bones are out of position. Medicare doesnt cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

You May Like: Do You Need Additional Insurance With Medicare

How Do You Enroll In Original Medicare

To enroll in Original Medicare , you must be 65 and dont necessarily have to be retired. Initial enrollment period packages are sent to people 3 months before they turn 65 or during their 25th month of disability benefits.

If youve received Social Security disability benefits for 24 months, you are automatically enrolled in Part A and Part B.

Medicare Part A Costs

Here are Part A costs for 2022:

Premium â Most people donât pay a monthly Part A premium. If you or your spouse has worked and paid taxes:

- For at least 10 years , you wonât pay a monthly Part A premium.

- For 30-39 quarters, you pay $274 in 2022.

- For less than 30 quarters, you pay $1,556 in 2022.

Deductible â $499

- Days 91 and beyond â $778

What doesnât Part A cover?

In most cases, Part A doesnât cover:

- Doctor visits in the hospital

- Private-duty nursing care

- TV or phone in your room if thereâs a separate charge for them

- Personal items like razors

Don’t Miss: Does Medicare Pay For Insulin Pumps

Medicare Has Multiple Enrollment Periods You Need To Know About

They include:

- Initial Enrollment. Initial enrollment begins three months before you turn 65 and lasts for 3 months after your birthday. If youre already taking Social Security benefits, you will automatically be enrolled in Medicare Parts A and B during this time. If you have not started Social Security, you will need to enroll yourself.

- General Enrollment. Medicares General Enrollment is for people who did not sign up for Part B during their initial enrollment period. It lasts from January 1st to March 31st of each year, with new coverage beginning on July 1st.

- Open Enrollment. The Medicare Open Enrollment period starts on October 15th and lasts until December 7th. This is when Medicare beneficiaries can add Part D, switch to Medicare Advantage, or switch back to Original Medicare.

- Special Enrollment. If you didnt sign up for Original Medicare because you were still working and covered by your employers group plan then you qualify for a Special Enrollment Period. Special Enrollment lasts for 8 months after you lose your group coverage.

Medicare Part B Costs

Here are Part B costs for 2022:

Premium$170.10

Coinsurance/copayment â 15% for most items and services.

What doesnât Part B cover?

Medicare Part B doesnât generally cover such items and services as:

- Routine dental care

This isnât a complete list.

Recommended Reading: What Is Basic Medicare Coverage

What Services Does Medicare Part B Cover

The following services are included:

- Doctor visits or appointments with other health care providers, including some doctor services when hospitalized

- Diabetes care, including education, certain equipment, prevention programs and screenings

- Diagnostic tests including CT scans, electrocardiograms, MRIs and X-rays

- Durable medical equipment, such as wheelchairs and walkers, that your doctor prescribes for use in your home

- Emergency department and outpatient surgery center services as well as other outpatient hospital services

- Some health programs, such as cardiac rehabilitation, obesity counseling and smoking cessation

- Laboratory services, such as blood and urine tests

- A limited number of prescription drugs that you usually dont administer yourself

- Outpatient mental health services

- Outpatient physical therapy, occupational therapy, and speech and language pathology services

- Preventive care, such as flu shots and mammograms, to help avert illness or detect it at an early stage. Many preventive services are covered without deductibles or copayments.

- A Welcome to Medicare checkup and the annual wellness visit, which are covered in full without deductibles or copayments, unless additional tests are ordered.

Whats The Difference Between Medicare Part A And Medicare Part B

Part A is the hospital services part of Medicare. This benefit covers inpatient care, hospital stays, skilled nursing facility care, hospice care, and medically needed home health care services.

Part B is the medical services part of Medicare. It covers many of the medically necessary services not covered in Part A, such as outpatient and preventive services. This involves things like x-rays, bloodwork, doctors visits, and outpatient care. It will also cover other medical items such as diabetic test strips, nebulizers, and wheelchairs.

You May Like: What Is The Requirement For Medicare

What Is Medicare Part B

As you age, picking the best healthcare planMedicare or notbecomes even more critical. But finding a health plan that meets your unique demands and falls within your budget can also be a) time-consuming and b) challenging to manage. To ensure that everyone who qualifies for Medicare can discover the best plan for their needs, the Healthpilot team cuts through all the cumbersome information and provides a recommendation thats tailored for your specific healthcare needs.Keep reading for an easy, comprehensive guide to Medicare Part B from some experts who actually love the subject.

Medicare, both Parts A & B, make up what is typically referred to as Original or Traditional Medicare. Where Part A covers inpatient expenses, Medicare Part B covers medical services like doctors costs, outpatient care, and some preventative services. While Part B is optional, it covers certain things that Medicare Part A doesnt, like lab tests and preventative screenings that help manage your health care.

The parts, otherwise known as the Medicare Alphabet, can be what makes Medicare confusing in the first place, but its the Parts of Medicare that make this government-run healthcare plan kind of genius. These various components, whether stand-alone or used in combination, provide you the freedom to create a coverage plan that best suits your needs and way of life.

Enrollment Period For Medicare Part A

Youre eligible to enroll in Medicare Part A during your Initial Enrollment Period , which is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes your birth month, and lasts up to three months after your birthday month.

When you apply for Social Security benefits, youre automatically enrolled in Medicare Part A.

Also Check: Does Medicare Cover Hospice Expenses

In 2019 Roughly 3 In 10 Part D Enrollees Receive Low

Figure 9: Medicare Part D Low-Income Subsidy Enrollment, by Plan Type, 2006-2019

In 2019, nearly 13 million Part D enrolleesroughly 3 in 10receive premium and cost-sharing assistance through the Part D Low-Income Subsidy program. These additional financial subsidies, also called Extra Help, pay Part D premiums for eligible beneficiaries, as long as they enroll in stand-alone PDPs designated as premium-free benchmark plans, and reduce cost sharing. Reflecting overall trends in Part D enrollment, the share of LIS enrollees in stand-alone PDPs has declined over time, from 87 percent in 2006 to 57 percent in 2019, while the share in MA-PDs has increased, from 13 percent in 2006 to 39 percent in 2019.

Overall, the share of Part D enrollees receiving low-income subsidies has declined over time, from 42 percent of Part D enrollees in 2006 to 28 percent in 2019. The rate of growth in LIS enrollment has not kept pace with the rate of growth in Part D enrollment overall or in total Medicare enrollment .

What Is Medicare Part C

Medicare Part C, also called Medicare Advantage, includes the coverage benefits of Medicare Parts A and B. Medicare Part C plans can also offer prescription drug benefits and other additional coverage . In total, Medicare Part C can cover things like:

- Medicare Part A

- Medicare Part B

- Medicare Part D

- Health and wellness programs

Also Check: Do Medicare Advantage Premiums Increase With Age

What You Need To Know About Medicare Supplement Plans:

- Coverage for medical care outside of the United States

- Help with copays, coinsurance and deductibles

- Limited Rx coverage

- Multiple plans to choose from, each offering different levels of coverage

- Plans are standardized, so the plan you select is the same no matter where you buy it

There are several Medicare Supplement plans offered by private insurance companies, each offering slightly different coverage with slightly different costs. Each Medicare Supplement plan is identified by a letter of the alphabet. For example, Medicare Supplement plan G offers emergency medical coverage abroad, while Medicare Supplement plan K has a lower cost than plan G, but does not include coverage abroad. Make sure not to confuse these plans for the different parts of Medicare, which are also identified by letters. By law, Medicare Supplement plans are regulated by Medicare. They vary only in cost and coverage.

Medicare Supplement plans even have a few welcome additions. For example, some plans will cover your health care while traveling abroad. If you have the appropriate Medicare Supplement plan and need to see a doctor in Rome, Paris or even Ouagadougou, your plan may help pay the costs.

Finding the coverage that fits you best is a key part of navigating Medicare.

How Much Does Medicare Part B Cost

In 2022, Medicare Part B has an out-of-pocket annual deductible of $233 which must be met before medically necessary services will be covered.

In addition to the annual deductible, youll pay a monthly premium. The standard monthly premium for Medicare Part B in 2022 is $170.10.

If youre still working and have an annual income of more than $91,000, your monthly premium may be higher. If youre married and you and your spouse have an annual income of more than $182,000, your monthly premium may be higher.

Don’t Miss: Does Medicare Pay For Mobility Scooters

More Parts Of Medicare

Medicare is a national health insurance program created and run by the United States federal government as a solution to increase the economic security of people that were traditionally underrepresented in the past. The Centers for Medicare and Medicaid Services are in charge of Medicare, and the services are divided up into four main parts A, B, C, and D.