What Does Medicare Part B Cover Exactly

Medicare Part B generally covers the medical treatments you receive. But Part B wont cover everything your treatments or services must either be:

- Medically necessary: Your doctor must deem your treatment is required to improve or maintain your health.

- Preventive services: Medicare-approved screenings and other preventive services are covered and generally at no-cost

Part B can also cover wheelchairs and other medically necessary equipment. Items like these are known as durable medical equipment.

How Does Original Medicare Work

Original Medicare is a federal health care program made up of both Medicare Part A and Part B . Its a fee-for-service plan, which means you can go to any doctor, hospital, or other facility thats enrolled in and accepts Medicare, and is taking new patients.

Medicare was set up to help people 65 and older. In 1972, Medicare became available to people with disabilities and End-Stage Renal Disease/kidney failure.

What If I Cant Afford Part B

If youre at least 65 and cant afford your Medicare Part B premium or deductible, there may be help. Medicare Savings ProgramsMedicare Savings Programs help those with low incomes pay premiums and sometimes coinsurance for Medicare expenses. are designed for low-income individuals who have trouble affording healthcare. To help you get started, here are the four types of MSPs, and their most-recent eligibility requirements from 2020:

- Qualified Medicare Beneficiary Program : helps pay premiums, copays, deductibles and coinsurance for Parts A and B.

- Whos eligible: individuals with income up to $1,084 per month couples making up to $1,457

If you need help finding an affordable Medicare plan, contact GoHealth. Our licensed insurance agents can help you navigate the different options and see what makes the most sense for you.

You May Like: What Is Basic Medicare Coverage

Cost Of Medicare Supplement

For 2022, a Medicare Supplement plan costs an average of $163 per month. However, costs will depend on two factors: the policy you choose and the pricing structure in your state.

Firstly, different plan letters have different prices since each policy provides a different level of coverage. For example, Medigap Plan G, a more comprehensive plan, costs more than Plan K, a cheaper plan with less coverage. Below are the average monthly premiums of each Medigap plan for 2022. Notice that a range is given since costs can vary.

| Medigap plan |

|---|

| $102-$302 |

Monthly premium for a 65-year-old female nonsmoker

Secondly, Medigap prices will differ based on state regulations and whether the plan can set rates based on age or health status. There are three different ways in which Medigap policies can be priced:

- Community-rated

- Issue-age-rated

- Attained-age-rated

The simplest rating system is community-rated, which means the same monthly premium is charged to everyone who has the same Medigap policy. This means your premium will not be based on your age but could go up because of inflation.

Issue-age-rated has a premium structure in which your monthly premium is based on the age you are when you buy the Medicare Supplement plan. In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

What Does Medicare Part B Cover

Part B provides coverage for a mixture of outpatient medical services. This includes coverage for preventive vaccines, cancer screenings, annual lab work, and much more.

It will cover preventive services in addition to specialist services. Part B even covers services for mental healthcare, durable medical equipment that your doctor finds medically necessary.

Also, Part B will cover some services you receive while in the hospital. This includes surgeries, diagnostic imaging, chemotherapy, and dialysis if you obtain drugs while at the hospital, it will also provide coverage for those.

Don’t Miss: Are Medicare Supplement Plans Worth It

What Is The 2022 Medicare Part B Deductible

As mentioned above, the annual Medicare Part B deductible for 2022 is $233. So what exactly does that mean?

You are responsible for the first $233 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2022.

After you have paid $233 out of your own pocket, your Part B coverage will kick in.

Part B covers:

- Qualified medical care, such as doctor’s office visits and procedures

- Certain preventive care

- Some durable medical equipment

Medicare Supplement Insurance Plan F and Plan C both provide full coverage for the 2022 Part B deductible. However, both plans are not be available to Medicare beneficiaries who become eligible for Medicare on or after Jan. 1, 2020. If you already have Medicare, you may be able to enroll in Plan C or F if either is available in your area.

What Do Medicare Part A And Part B Premiums Cover

Medicare has different parts and plans, but the most common is Original Medicare . Parts A and B are available to all Americans 65 years of age and older and individuals under 65 with certain disabilitiesA disability is a restriction or lack of ability to perform an activity in the manner or within the range considered normal for a human being. The Social Security Administration judges disability and whether you qualify for financial assistance based on whether you can work..

Keep in mind, Parts A and B provide different coverage:

Also Check: Does Original Medicare Cover Silver Sneakers

Can You Ever Get Both Part A And Part B Coverage At The Same Time

When youâre an inpatient in a hospital, itâs possible to get Part A and Part B coverage at the same time. For example, while Part A generally covers medically necessary surgery and certain hospital costs, Part B may cover doctor visits while youâre an inpatient.

Did you know that thereâs another way to get your Part A and Part B coverage? A Medicare Advantage plan delivers these benefits, and often more. Most Medicare Advantage plans include prescription drug coverage. Learn more about Medicare Advantage plans. You must pay your Medicare Part B premium when you have a Medicare Advantage plan, as well as any premium the plan might charge.

This information is not a complete description of benefits. Contact the plan for more information. Limitations, copayments, and restrictions may apply. Benefits, premiums and/or copayments/co-insurance may change on January 1 of each year.

Medicare Part B Coverage & Enrollment

When it comes to Medicare, Part B is a big part of what comes to mind when older Americans think about their medical coverage. Medicare Part B covers the medical services you need and, along with Part A , provides the foundation of Original Medicare.

But Part B coverage isnt exclusive to Original Medicare youll receive at least the same benefits with Medicare Advantage . It replaces Original Medicare , but offers the same Part A and B benefits or coverage as Original Medicare. Along with receiving Part A and B benefits, Medicare Part C often bundles additional services like dental, hearing, vision and prescription drug coverage.

You May Like: When Will Medicare Cover Hearing Aids

The Cares Act Of 2020

On March 27, 2020, President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the CARES Act. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19ârelated hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19ârelated services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Medicare Coinsurance Or Copayment Requirements

Your Medicare Part B coinsurance or copayment is the amount that you have to pay for covered services after meeting your annual deductible. The standard Part B coinsurance for most services and items is 20 percent of the Medicare-approved amount.

Using the example from above, you would likely be required to pay 20 percent of the $67 that was left over after you met your Part B deductible. This 20 percent would equal around $13.

In this example, your total spending for your $300 bill would be $246 .

Don’t Miss: Who Is My Medicare Carrier

Watch A Video To Learn More About Medicare Costs

NOTE: Video does not contain audio

Video transcript

An animated white speech bubble appears over an animated character’s yellow and blue head.ON SCREEN TEXT: What are the costs you could pay with Medicare?

The speech bubble and character fall away. Blue text appears surrounded by animated dollar signs on a light blue background.

ON SCREEN TEXT: There are four kinds of costs you may pay with all Medicare plans.

The text and dollar signs fall away. Darker blue text appears surrounded by animated calendars on a light blue background.

ON SCREEN TEXT: 1 Premiums A fixed amount you pay to Medicare, a private insurance company, or both. Premiums are usually charged monthly and can change each year.

ON SCREEN TEXT: January June February April May

The text and calendars fall away. Darker blue text appears above an animated piggybank graphic on a light blue background.

ON SCREEN TEXT: 2 Deductibles A set amount you pay out of pocket for covered health services before your plan begins to pay.

The text and piggybank fall away. Darker blue text appears surrounded by animated green and white circles on a light blue background.

ON SCREEN TEXT: 3 Co-payments A fixed amount you pay when you receive a service covered by Medicare. Your plan pays the remaining amount.

The text and circles fall away. A white and green circle splits in two, the white half falling to the left and the green to the right. Darker blue text emerges in the center of the screen on a light blue background.

Costs: Part B And Part C

Original Medicare and Advantage plans have different costs.

Part B

In 2021, an individual with Part B must pay a standard monthly premium of $148.50 and the yearly deductible of $203. They must also pay 20% of the cost of Medicare-approved services after they have met the deductible.

A person with Plan B also has Plan A, but most people with original Medicare do not pay a Part A monthly premium. However, a $1,484 deductible is payable for Part A hospital inpatient services for each benefit period, together with coinsurance that varies from $0 to $742.

As Part A and Part B do not cover most medications, an individual may wish to purchase Part D, which is prescription drug coverage.

Part C

Every year, each Medicare plan sets out the amount it will charge for premiums, deductibles, and services. The amount varies among plans, and some plans offer zero premiums.

Also, because a person must have enrolled in Medicare Part A and Part B to qualify for Medicare Advantage, they must pay the Part B monthly premium. Some plans may pay the premium, either in part or in full.

Deductibles and other out-of-pocket costs vary among plans. However, Advantage plans have a maximum out-of-pocket spending limit, which the government sets. After a person reaches their plans annual cap, the plan generally pays their covered healthcare expenses.

You May Like: How To Check Medicare Payments

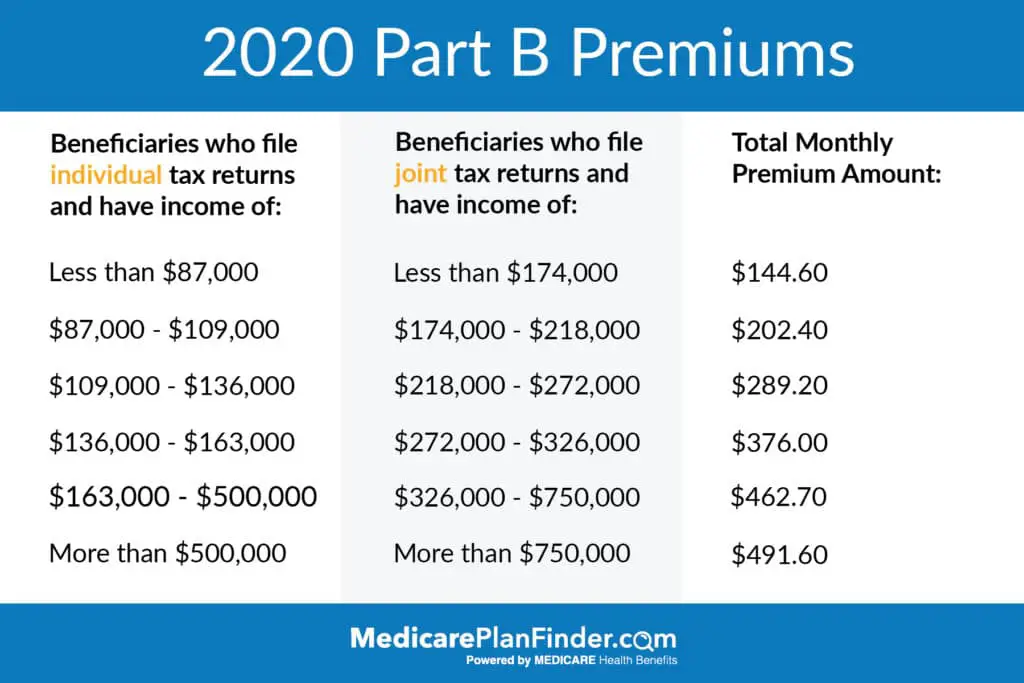

How Much Are The Premiums For Part B In 2022

Most people pay $170.10 a month for Medicare Part B in 2022. This premium is paid to the federal government whether youre participating in original Medicare or a Medicare Advantage plan from a private insurer.

If you are receiving Social Security benefits, the monthly premium will be deducted from your monthly benefit payments. If not, Medicare will bill you quarterly or you can set up an electronic payment.

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

Read Also: What Does Part C Cover In Medicare

How Do I Pay My Part B Premium

Your Medicare Part B premium is a monthly payment. It may be deducted automatically for you if you receive the following benefits:

- Social Security

- Railroad Retirement Board

- The Office of Personnel Management

If you dont receive any of these benefits, you may be responsible for paying your Part B premium each month.

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

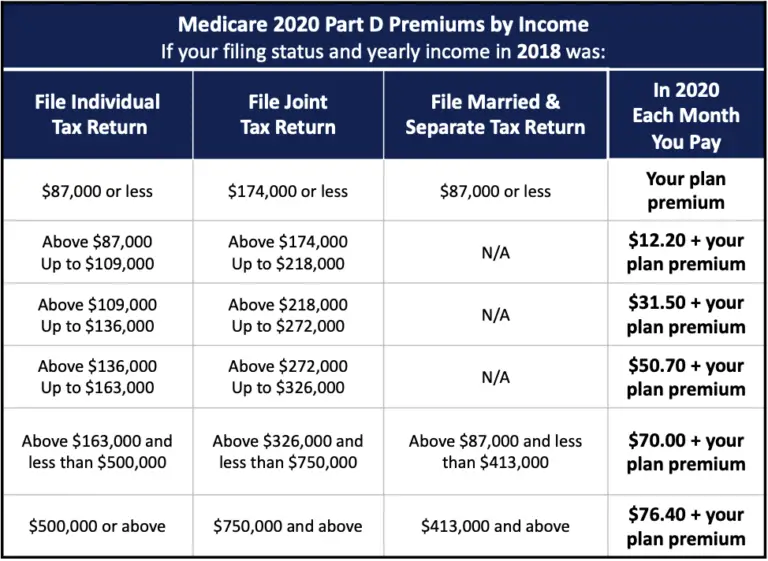

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

Read Also: Will Medicare Pay For An Upwalker

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

Medicare Part B Deductible In 2022

In 2022, the Medicare Part B deductible is $233.

So youll pay in full for the first $233 of your outpatient care before the cost-sharing begins. After you meet the deductible, youll typically pay 20% of the cost for doctor appointments, diagnostics and other outpatient care.

Like the Medicare Part A deductible, the Medicare Part B deductible increases slightly every year.

But unlike the Part A deductible, the Part B deductible is an annual deductible based on the calendar year. You only have to meet the Part B deductible once a year, and a new deductible takes effect on Jan. 1.

Dont Miss: Does Medicare Cover Toenail Removal

Recommended Reading: Does Medicare Cover Hospital Bills

The 2022 Medicare Part B Deductible: What It Is And How You Can Get Coverage

by Christian Worstell | Published January 21, 2022 | Reviewed by John Krahnert

The Medicare Part B deductible increased from 2021 to 2022. The 2022 Part B deductible is $233 per year .

This guide also explores the Part B deductible and some of the other 2022 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

Medicare Supplement Insurance Costs And Coverage

If youre enrolled in Original Medicare, enrolling in Medicare supplemental insurance also known as Medigap may help cover additional costs such as copayments and deductibles.

The average monthly premium for Medigap was $175 per month, according to a 2017 study published by Harvard University. But costs can vary widely for a Medigap plan.

Companies are free to set their own prices for each plan they offer, but the rates are filed and reviewed by the various state insurance departments.

Different insurers may charge different premiums for the exact same plan, so its important to compare prices between companies to find the best deal.

Long-term care, vision, dental, hearing aids and eyeglasses generally arent covered with Medigap. Medicare Advantage plans cannot be paired with Medigap.

Recommended Reading: How Much Is Medicare B

What Is Medicare Part C

Part C, or Medicare Advantage, is an alternative to original Medicare and is offered by private insurance companies.

A person enrolled in Part A and Part B can join a Medicare Advantage plan. In addition to hospital and medical coverage, most Advantage plans also cover:

- prescription drugs

- dental, vision, and hearing care

- additional perks, such as gym memberships

Medicare Advantage offers different benefits through several plan options, which a person can choose from to suit their medical situation.