Medicare Part A Coverage

Medicare.gov explains that Medicare Part A is often referred to as Hospital Insurance. Rightfully so, as this is the part of Medicare that covers expenses related to hospital, nursing facility care, hospice, and home health care.

Inpatient Hospital Care

One of the most basic coverages provided under Medicare Part A is inpatient care in a hospital or rehabilitation facility. It also provides coverages related to inpatient mental health care, if this type of treatment is needed.A few of the inpatient expenses covered by Medicare Part A include:

- General nursing staff

- Medications used while in care

- Various other medical services and supplies used while in the hospital

- A semi-private room

- Meals

However, there are some hospital-related expenses that Medicare Part A does not provide coverage toward. These include certain non-medical expenses, such as costs associated with having a telephone or television in your room. It also does not cover charges assessed for personal care items such as a razor or set of slippers.Skilled Nursing Facility Care

If skilled nursing facility care is required, Medicare Part A will cover some of these expenses as well. However, theyre only covered if:

- Skilled nursing care

- Meals and dietary counseling

Hospice Care

Home Health Care

MORE ADVICE

Medical Coverage Outside The United States

Original Medicare generally does not cover treatment outside the United States, except under very limited circumstances, such as on a cruise ship within six hours of a U.S. port.

However, some Medicare supplement insurance policies also known as Medigap cover overseas health care costs.

Medigap plans C, D, F, G, M, and N provide foreign travel emergency health care coverage outside the United States.

These Medigap Plans Will Cover

- Foreign travel emergency care if it begins during the first 60 days of your trip

- Eighty percent of billed charges for certain medically necessary emergency care after a $250 yearly deductible is met

A lifetime coverage limit of $50,000 applies.

In 2020, the average premium for a Medigap policy was roughly $150 per month, or $1,800 per year, according to full-service insurance organization Senior Market Sales.

Medicare Doesn’t Cover Routine Vision Care

Medicare generally doesnt cover routine eye exams or glasses . But some Medicare Advantage plans provide vision coverage, or you may be able to buy a separate supplemental policy that provides vision care alone or includes both dental and vision care. If you set aside money in a health savings account before you enroll in Medicare, you can use the money tax-free at any age for glasses, contact lenses, prescription sunglasses and other out-of-pocket costs for vision care.

Read Also: Can Medicare Take My Settlement

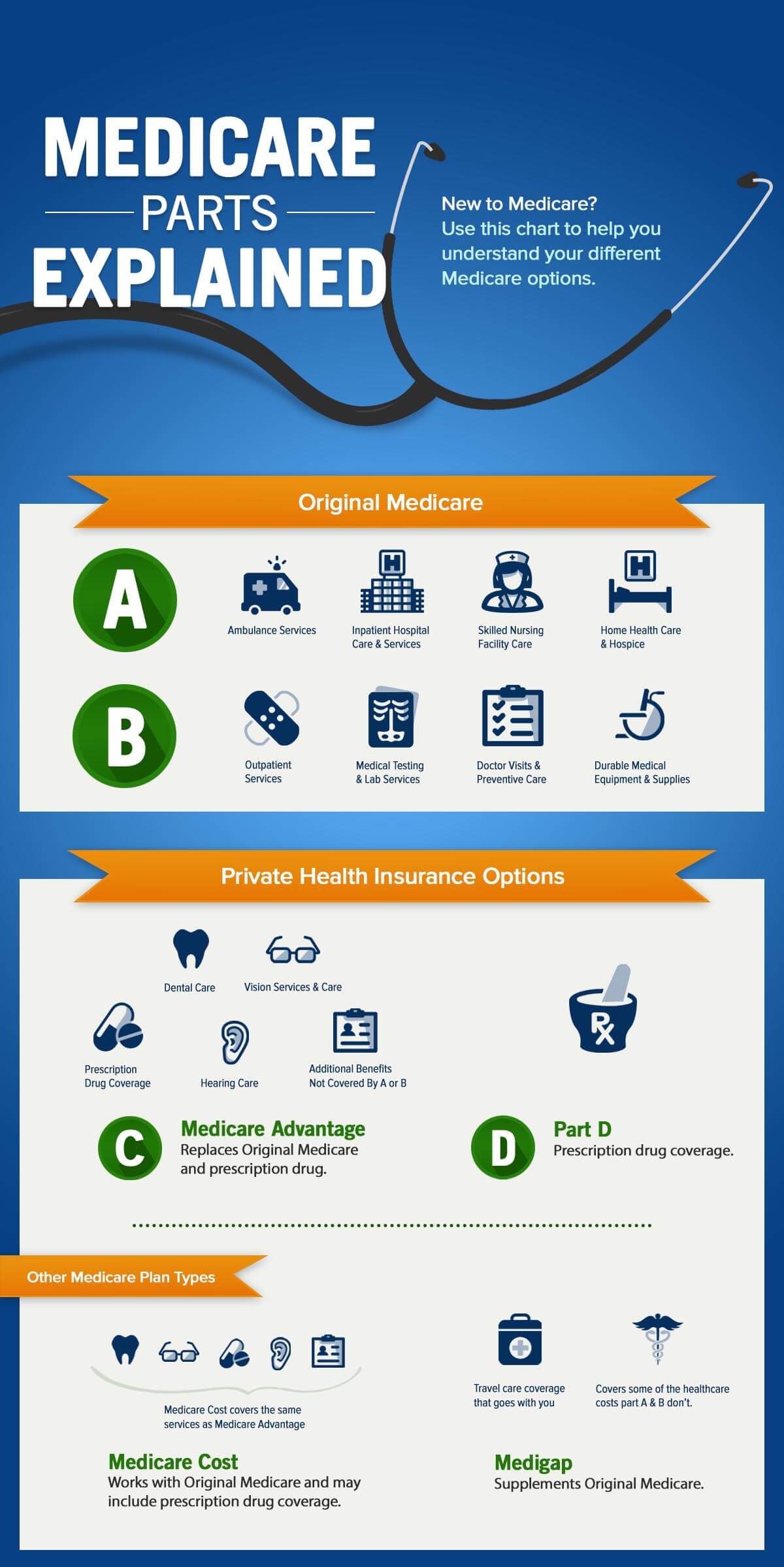

What Are My Medicare Coverage Options

In a nutshell, here are your basic choices for Medicare coverage.

- Stay with Original Medicare and do nothing else. A few things to be aware of:

- You get Medicare Part A premium-free if youve worked at least 10 years, or 40 quarters, while paying Medicare taxes.

- Most people pay a monthly premium for Medicare Part B. You can decide not to enroll in this part of Original Medicare. Some people opt out of Part B coverage if they have group health coverage through an employer, for example. You can sign up for Part B later when you stop working or your group coverage ends. But you must be enrolled in Part B if you want to sign up for a Medicare Advantage plan or a Medicare Supplement plan. If you delay enrollment in Part B, you might face a late-enrollment penalty for as long as you have the coverage, unless you qualify for a Special Enrollment Period.

- Outside of certain specific situations, Original Medicare doesnt cover prescription drugs. Medicare plan options to cover prescription drugs are discussed below.

- Original Medicare does come with certain out-of-pocket costs. Medicare Part A and Part B have deductibles and sometimes coinsurance, copayments, and certain coverage limits.

Medicare Part A And Part B Leave Some Pretty Significant Gaps In Your Health

Medicare Part A and Part B, also known as Original Medicare or Traditional Medicare, cover a large portion of your medical expenses after you turn age 65. Part A helps pay for inpatient hospital stays, stays in skilled nursing facilities, surgery, hospice care and even some home health care. Part B helps pay for doctors’ visits, outpatient care, some preventive services, and some medical equipment and supplies. Most folks can start signing up for Medicare three months before the month they turn 65.

It’s important to understand that Medicare Part A and Part B leave some pretty significant gaps in your health-care coverage. Here’s a closer look at what isn’t covered by Medicare, plus information about supplemental insurance policies and strategies that can help cover the additional costs, so you don’t end up with unexpected medical bills in retirement.

Don’t Miss: How Often Does Medicare Pay For A1c Blood Test

Enhanced Plans Can Offer Coverage In Donut

Enhanced plans can offer coverage in the donut-hole, but basic drug plans cannot do so. While gap coverage may be your deciding factor in choosing an enhanced plan you must remember that most donut-hole gap coverage is limited to a small group of generic drugs and an enhanced plan that offers this type of coverage will charge a much higher premium. Therefore a higher premium enhanced plan with gap coverage may not be worth its extra costs.

What Exactly Is Basic Health Insurance

The Affordable Care Act guarantees basic health insurance by making sure plans provide minimum essential coverage, sometimes called qualifying health coverage. This is any insurance plan that meets the Affordable Care Act requirement for health coverage. Obamacare plans are designed to help protect you and your family from the cost of routine and unexpected medical expenses. Under this law, all Obamacare plans include coverage for 10 essential health benefits youd expect including emergency services, doctor visits, rehabilitation, maternity, and more.

Many plans encompass this basic health coverage including private insurance, job-based plans, and Medicare but you are not automatically enrolled in any of these. You need to find the plan that works best for you and your family and take the steps to enroll.

It should be noted, however, that not all healthcare plans provide the minimum essential coverage outlined in Obamacare. Short-term health insurance and supplemental insurance plans do not offer the same benefits.

Also Check: How To Get Medicare Insurance License

Medicare Part B Dental Benefits

On the other hand, if the physician conducts the examination needed prior to kidney transplant or heart valve replacement, the CMS states that Part B benefits will apply.

However, when it comes to Medicare Part B, there are two specific sets of services that it will not cover.

The first involves services used to care, treat, remove, or replace teeth to structures supporting the teeth. For example, this can include pulling teeth prior to getting dentures.

The second set of services Medicare Part B wont cover also include those related to the teeth and their supporting structures, unless those services are needed to effectively treat a non-dental condition.

In this type of situation, the dental service must be performed at the same time as the covered service in order for Medicare to pay its portion. It must also be performed by the same healthcare professional who performed the covered service, whether that person is a physician or dentist.

MORE ADVICE

MORE ADVICE Discover more tips for comfortably aging in place

Many Medicare Advantage plans do offer dental coverage, according to Medicare.gov, though the exact benefits provided varies based on the plan chosen.

Original Medicare Vs Medicare Advantage

You have two options when you sign up for Medicare. You can opt for Original Medicare or Medicare Advantage. Original Medicare is Parts A and B, and it’s managed by the federal government. You can see any doctor or go to any hospital in the U.S. that accepts Medicare when you have this coverage. You can also add a separate Medicare drug plan and supplemental coverage, such as Medigap, to help limit your out-of-pocket costs.

Medicare Advantage plans are Medicare-approved policies offered by private insurance companies. You receive most of your Parts A and B benefits through an MA policy if you elect one, except for hospice care, which is provided through Original Medicare. MA plans frequently require that you see doctors in the planâs network, but some offer advantages such as lower out-of-pocket costs and extra coverage. You must have both Parts A and B to get an MA plan.

You canât get a Medigap policy if you have a Medicare Advantage plan. You often can’t have a Part D plan, either, if you have an MA plan with prescription drug coverage.

About 37.8 million people enrolled in Original Medicare in 2020, while 24.4 million enrolled in Medicare Advantage.

Read Also: How To Sign Up For Medicare Advantage

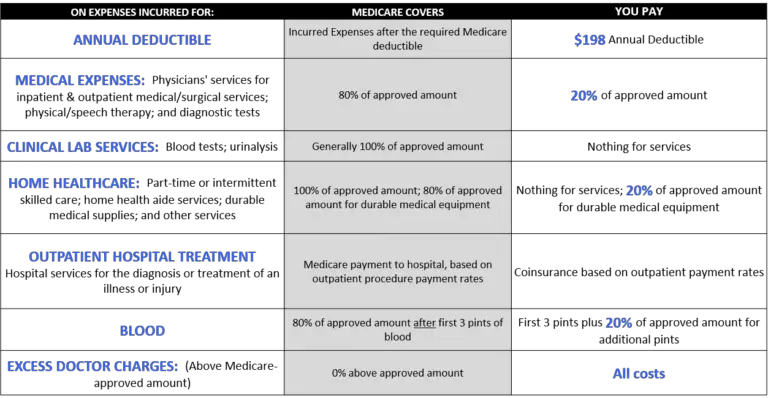

What Does Medicare Part B Cost

Some of your Part B cost is a monthly premium of $148.50 however, your premium could be less or more or less depending on your income.

Some services are covered under Medicare Part B at no additional cost to you if you see a doctor that accepts Medicare. If you need a service outside of what is covered by Medicare, you will have to pay for that service yourself.

Medicare Supplement Insurance Or Medigap Policy

Medicare Supplement Insurance, also known as Medigap, helps to cover the out-of-pocket healthcare costs you incur with traditional Medicare Part A and Part B. There are 10 standardized plans and premiums are regulated by the states. Massachusetts, Minnesota and Wisconsin have their own version of Medigap. What you pay in monthly premiums can depend on where you live, what coverage you get and how old you are.12

You May Like: Does Medicare Pay For Blood Pressure Cuffs

How Much Does Medicare Part B Coverage Cost

Medicare Part B generally pays 80% of approved costs of covered services, and you pay the other 20%. Some services, like flu shots, may cost you nothing.

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount.

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021.

After you pay your deductible, you generally pay a 20% coinsurance for most covered services.

What Is The Difference Between Medicaid And Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare.

Heres how Medicaid works for people who are age 65 and older:

Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article, Can I get help paying my Medicare costs?

You May Like: What Are The Qualifications For Medicare

Original Medicares Part A Dental Coverage

Under Original Medicare Part A, participants may be covered for certain dental services received while in the hospital. These include any emergency or complicated dental procedures deemed necessary at the time, according to Medicare.gov.

The Centers for Medicare and Medicaid Services explains that while blanket dental exclusions for Part A coverage are made under Section 1862 of the Social Security Actan act that hasnt been amended since 1980, according to the CMSone example of an emergency or complicated procedure that is often at least partially covered is jaw reconstruction needed as a result of an accidental injury.

Another instance in which Medicare Part A would pick up a portion of a typical dental care cost is if an extraction is needed to prepare a patient for radiation treatments as a result of jaw-related neoplastic diseases. Healthline says that this category of conditions are diseases involving the growth of tumors, both cancerous and noncancerous in nature.

According to the CMS, Medicare will also contribute toward oral examinations needed before kidney transplants or heart valve replacements in certain situations. Specifically, this type of expense would likely be covered under Medicare Part A if the hospitals dental staff performs the exam.

What Are The Parts Of Medicare

The different parts of Medicare help cover specific services:

- Medicare Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Medicare Part B Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Medicare Part D Helps cover the cost of prescription drugs .

Read Also: What Is Original Medicare Mean

D Prescription Drug Benefit

If you have Medicare, you can join a private health plan that pays for prescription drugs. This coverage is called Part D, or the Medicare prescription drug benefit. Each insurance company that offers a Part D plan decides which drugs it will cover and what they will cost. Look carefully at the details of each plan before you choose one.

You pay a monthly fee, called the premium, to get prescription drug coverage. This is addition to the monthly fees you pay for Part B if you have it.

You can also get perscription drugs benefits by joining one of these plans:

- A Medicare Advantage plan that has a prescription benefit

- A Medicare Cost Plan with prescription medicine benefits

The premium you pay for one of these plans includes prescription drug coverage.

You need to decide whether to get Part D coverage as soon as you’re eligible. If you wait, you may have to pay a penalty for joining late. You can change your Part D plan each year during open enrollment.

If you can’t afford a prescription drug plan, financial help may be available.

For more information or to get help, you can visit your local State Health Insurance Assistance Program . Each SHIP has people trained to help you understand your Medicare benefits and answer questions you have about your Medicare coverage. To find your local SHIP go to the

What Makes A Plan Enhanced

Enhanced plans are required to have a higher actuarial value than basic plans. Actuarial value is just fancy language for plan the percentage of cost covered. Enhanced plans cover more, but it is important to remember that how an insurance provider covers these costs can vary from deductibles to lower costs on certain drugs -see below, because enhanced plans generally have higher cost-sharing.

Don’t Miss: Do I Have To Have Medicare When I Turn 65

The Solvency Of The Medicare Hi Trust Fund

This measure involves only Part A. The trust fund is considered insolvent when available revenue plus any existing balances will not cover 100 percent of annual projected costs. According to the latest estimate by the Medicare trustees , the trust fund is expected to become insolvent in 8 years , at which time available revenue will cover around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years. This and other projections in Medicare Trustees reports are based on what its actuaries call intermediate scenario but the reports also include worst-case and best-case projections that are quite different .

Medicare Doesn’t Cover Deductibles And Co

Medicare Part A covers hospital stays, and Part B covers doctors services and outpatient care. But youre responsible for deductibles and co-payments. In 2022, youll have to pay a Part A deductible of $1,556 before coverage kicks in, and youll also have to pay a portion of the cost of long hospital stays — $389 per day for days 61-90 in the hospital and $778 per day after that. Be aware: Over your lifetime, Medicare will only help pay for a total of 60 days beyond the 90-day limit, called lifetime reserve days, and thereafter youll pay the full hospital cost.

Part B typically covers 80% of doctors services, lab tests and x-rays, but youll have to pay 20% of the costs after a $233 deductible in 2022. A medigap policy or Medicare Advantage plan can fill in the gaps if you dont have the supplemental coverage from a retiree health insurance policy. Medigap policies are sold by private insurers and come in 10 standardized versions that pick up where Medicare leaves off. If you buy a medigap policy within six months of signing up for Medicare Part B, then insurers cant reject you or charge more because of preexisting conditions. See Choosing a Medigap Policy at Medicare.gov for more information. Medicare Advantage plans provide both medical and drug coverage through a private insurer, and they may also provide additional coverage, such as vision and dental care. You can switch Medicare Advantage plans every year during open enrollment season.

Read Also: How To Reorder Medicare Card

Coverage And Open Enrollment

Medicare is the program of the United States federal government that provides payment coverage support for health and medical care. It was first enacted in 1965 to help those who could not afford health or medical care in their retirement years, or who were totally disabled from certain diseases like end-stage renal disease. Today, millions of American citizens who are age 65 and older, and millions of younger people who suffer from those specific diseases receive Medicare assistance.