What Are My Choices Of Medigap Policies

The federal government has standardized Medicare Supplement plans. You receive the same coverage no matter which insurance company sells you the Medigap plan. Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary.

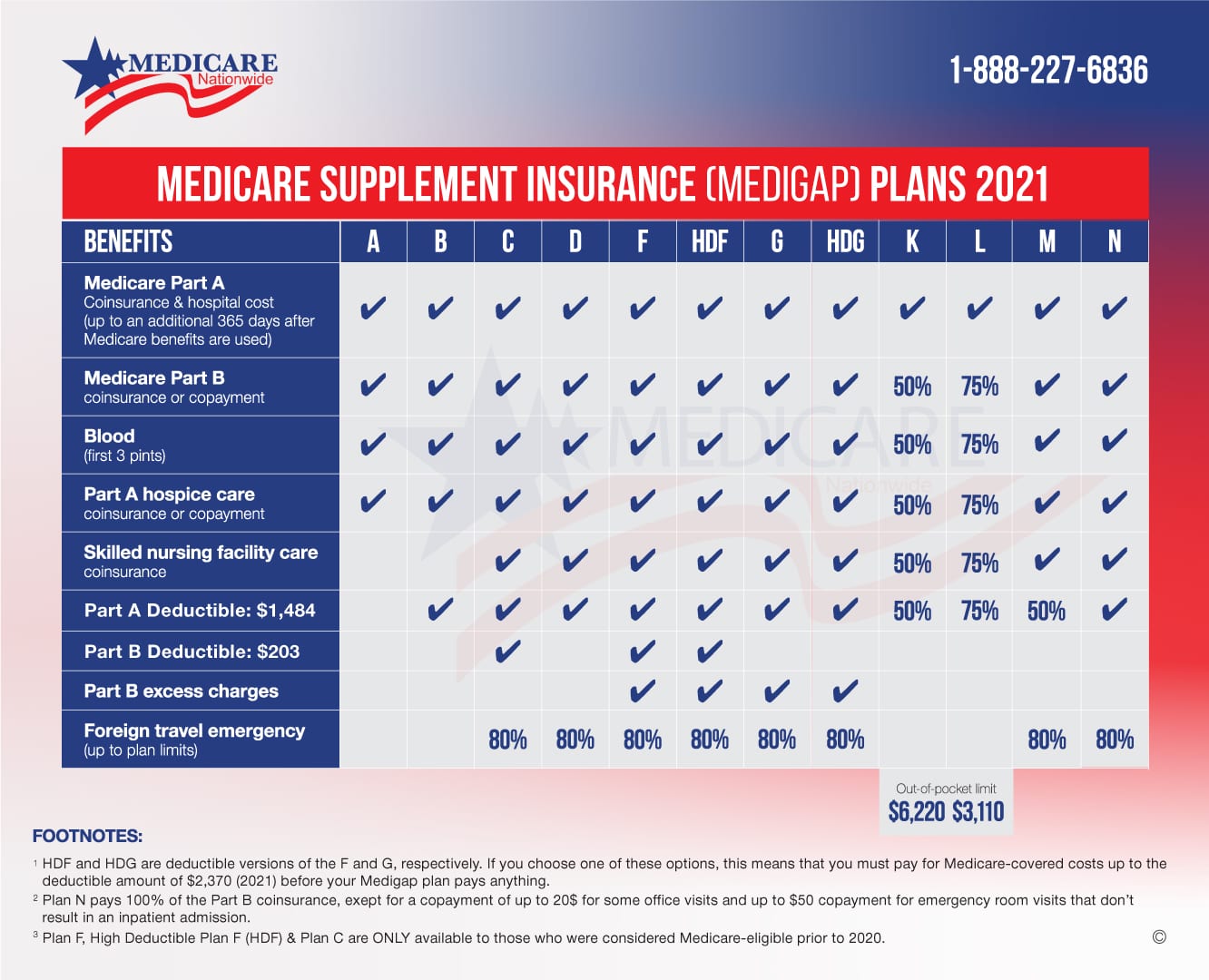

There are ten separate plans, labeled A through N. Two plans, C and F, are no longer offered to newly eligible beneficiaries. You can find the specific benefits that each plan covers in this comparative chart.

Once you decide how much coverage you want, you can check online or contact an insurance agent or broker for quotes.

What’s The Difference Between Creditable And Non

Unlike creditable coverage, non-creditable coverage has fewer benefits than Medicare.

People with creditable coverage are just as well covered and sometimes better off than if they had Medicare. Conversely, people with non-creditable coverage are worse off and, therefore, its beneficial for them to leave their current health plan and enroll in Medicare.

If you have non-creditable coverage for 63 days or more before enrolling in Medicare, you may pay more for your monthly premiums when you do register:

- Part B late enrollment penalty:10% more is added to your monthly Part B premiums for each 12-month period you had non-creditable coverage and were eligible for Medicare Part B but didnt enroll.

- Part D late enrollment penalty: 1% of the national base beneficiary premium multiplied by the number of months you had non-creditable coverage will be added to your monthly Part D premium.

You’ll pay these penalties every month for as long as you receive Medicare.

Do I Need A Certificate Of Creditable Coverage

A certificate of creditable coverage is a document that insurance companies can issue to indicate that someone has terminated their coverage. It shows the insured person’s name, the period they held insurance, and when they canceled their policy.

Certificates of creditable coverage are no longer necessary. However, if you’re enrolling in a Part D plan or a Medicare Advantage plan after holding creditable drug coverage, you may need to verify this with your Notices of Creditable Coverage.

Read Also: Are All Medicare Supplement Plan G The Same

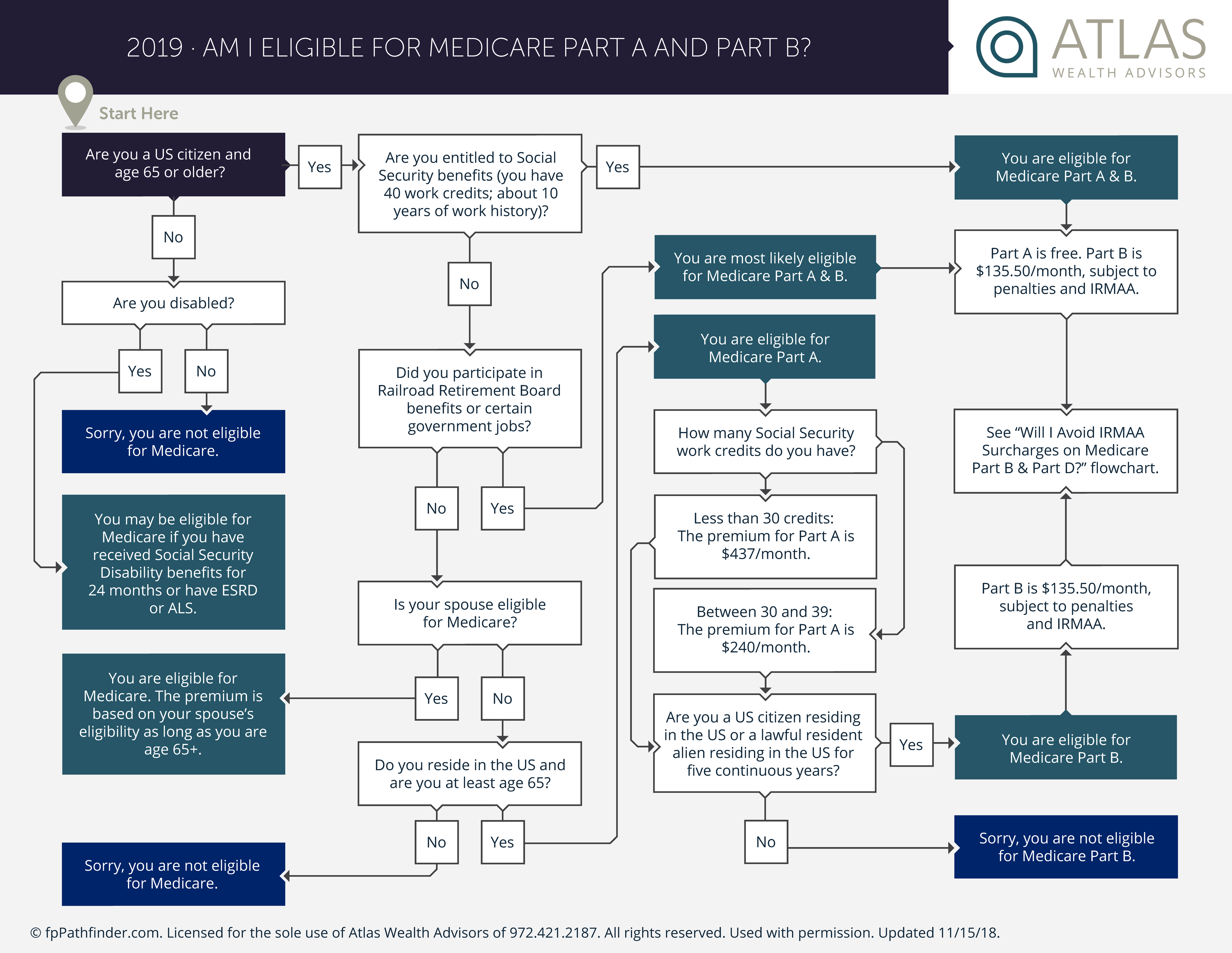

Medicare Eligibility If You Are Under 65

People younger than 65 may qualify for Medicare if they have certain costly medical conditions or disabilities.

If you are under 65, you qualify for full Medicare benefits if:

- You have been receiving Social Security disability benefits for at least 24 months. These do not need to be consecutive months.

- You have end-stage renal disease requiring dialysis or a kidney transplant. You qualify if you or your spouse has paid Social Security taxes for a specified period of time based on your age.

- You have amyotrophic lateral sclerosis, also known as Lou Gehrigs disease. You qualify for Medicare immediately upon diagnosis.

- You receive a disability pension from the Railroad Retirement Board and meet certain other criteria.

You Have Lou Gehrigs Disease

If you have amyotrophic lateral sclerosis , youll be eligible for Medicare and automatically enrolled in Medicare Part A and Part B on the first day of the month that you start receiving disability benefits. Unlike other disabilities, you dont have to wait 24 months to be eligible for Medicare benefits.

Read Also: Does Medicare Cover Laser Therapy

Medigap Eligibility In 2019

Eligibility for Medigap lasts for six months, starting from the month you turn 65 and have Medicare Part B in place. In other words, you must be 65 and enrolled in Medicare to sign up for a Medigap policy. Once youre 65 and enrolled in Part B, you have six months to enroll in Medigap without being subject to medical underwriting. During this initial eligibility window, you can:

- Buy any Medigap policy regardless of health history

- Buy a plan knowing that youll pay the same rate as someone without any medical problems

- Buy any Medigap plan available in your state as long as its sold by an approved Medigap seller

Once that 6-month window closes, you can still sign up for Medigap, but the conditions change. Outside of the initial signup window, youre no longer guaranteed coverage if you have medical problems. And if you find a plan at all, it will likely cost much more because itll be based on medical underwriting. The best time to sign up for supplemental coverage through a private Medigap policy is when you first become eligible i.e., when you turn 65 and enroll in Medicare Part B.

What If You Need Help With Other Medicare Costs, Like Prescription Drug Coverage?

Can You Enroll In Medicare Before You Turn 65

You may be eligible for Medicare before age 65 if:

- Youve received Social Security Disability Insurance for at least 24 months

- Youll get Medicare Part A and Part B automatically starting the first day of your 25th disability month. You should get your Medicare card in the mail three months before this date.

- You have Amyotrophic Lateral Sclerosis , or Lou Gehrigs disease

- Youll get Part A and Part B automatically in the month your SSDI benefits begin.

Note: Part B isnt automatic if you live in Puerto Rico.4 Youll have to contact Social Security to enroll.

- You have permanent kidney failure, or end-stage renal disease

- Youll need to sign up for Medicare yourself. Your coverage usually starts the first day of the fourth month of dialysis treatment or in the month youre admitted to a Medicare-certified hospital for a kidney transplant.5

A Word of Advice

If you dont have any other type of health insurance, you should enroll in Medicare Parts A and B when you turn 65.

Also Check: When Can I Change My Medicare Coverage

Eligibility Based On Age

Medicare was originally created for people over the age of 65, making age the most common factor for eligibility. Of the 63 million-plus people enrolled in Medicare in 2021, about 55 million qualify based on age.

Youre eligible for Medicare based on age if:

- Youre turning 65 soon.

- You live in the U.S. lawfully .

You likely also qualify for premium-free Part A if youve accumulated enough Social Security work credits during the course of your working life. Remember that Original Medicare is made up of two parts, A and B.

Nearly everyone pays a premium for Part B, but very few people pay a premium for Part A. Thats because payroll taxes help fund Part A. So if you or your spouse has accumulated 40 work credits by the time youre eligible for Medicare, you wont pay a premium for Part A.

- Note: You can check the status of your work credits with Social Security directly. Its actually a good idea to do this before youre eligible for Medicare, just to make sure your records are correct. Just head over to mySocialSecurity to learn more about creating an account and what you can do with it.

For those who dont have enough work credits, you can still enroll in Medicare when you turn 65. But youll probably have to pay a premium for Part A, which varies each year. How much you pay depends on your work credits.

Heres A Chart On How Medicare Enrollment Works Under Different Scenarios

| If you | Then you | And coverage will start |

| Dont have a disability and wont be receiving Social Security or Railroad Retirement Board benefits for at least four months before you turn 65 | Must sign up for Medicare benefits during your 7-month IEP | On the first day of your birthday month as long as you enroll before your birthday month otherwise, you may face a delay of up to three months |

| Will be receiving retirement benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65 | Will be enrolled automatically into Parts A and B | The first day of your birthday month |

| Are under 65 with a disability | Will be enrolled automatically into Parts A and B | On the 25th month that you receive Social Security disability benefits |

| Have ALS | Will be enrolled automatically into Parts A and B | The same month that you start receiving disability benefits |

| Have end-stage renal disease | Must sign up for Medicare benefits once you meet the qualifications for this condition | On the first day of the fourth month of dialysis treatments but situations can vary, so if you have ESRD, check with Social Security |

You May Like: Can You Get Medicare If You Live Outside The Us

How Does Pecos Support The Medicare Provider Enrollment Process

PECOS is the application that supports the Medicare provider and supplier enrollment process by capturing provider/supplier information from the 855A, 855B, 855I, 855O, 855R and 855S forms. For information pertaining to Medicare and to Medicare provider enrollment and certification, please access the following website:

What Is Medicare Part A When Can You Enroll

Medicare Part A is hospital insurance. It covers inpatient hospital, hospice, and skilled nursing facility care. Part A also covers home health care.

You can sign up for Part A:

- During your Initial Enrollment Period , if youre not automatically enrolled, or

- At any time after youre first eligible. If you qualify for premium-free Part A, you wont have a penalty if you enroll past your IEP.6

Recommended Reading: Does Medicare Coverage Work Overseas

Medicare Prescription Drug Coverage Eligibility Requirements

Medicare Part D prescription drug plans provide coverage for many retail prescription drugs that are available at pharmacies. Original Medicare doesn’t typically cover prescription drugs.

You may be eligible for a Part D plan if you are enrolled in Original Medicare and are not enrolled in a Medicare Advantage plan that includes Part D coverage.

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

Medicare Part D Prescription Drug Coverage Eligibility

Like Medicare Advantage and Medicare Supplement, Part D prescription drug coverage is provided by Medicare-approved private insurance companies. These plans accompany Original Medicare. Generally, you cant have a standalone Part D plan if you have a Medicare Advantage plan.

To qualify for a Part D plan, you must meet the following requirements:

- You must have both Part A and B .

- You must live where plans are available.

- You must pay Part A, Part B, and Part D premiums, if applicable.

Also Check: What Is The Difference Between Medicare Advantage And Regular Medicare

A Key To Compliance: Medicare’s Progress Note Requirements

Medicares requirements for documentation are often confusing to rehabilitation therapists and none more so than Progress Reports. In this guide, we are going to clarify what needs to be included in this document and why Medicare deems it necessary. We will also touch on what may happen if you dont comply.

What Does Medicare Consider Creditable Health Insurance Coverage

Medicare states that any health plan offering benefits equal to or greater than its own is creditable coverage. So if you have this level of coverage, you won’t get penalized for delaying Medicare enrollment.

Some of the most common types of creditable coverage include:

- Large employer group plans

- Retirement or pension plans

- Union-sponsored group health plans

If youre approaching Medicare eligibility, you may be able to delay enrolling in Medicare Part D prescription drug coverage and continue with your existing drug plan with creditable Part D coverage providing it:

- Pays for at least 60% of your prescription costs

- Covers brand name and generic drugs

- Allows you to fill your prescriptions at a range of pharmacies

- Does not have annual benefit caps or have low deductibles

If you’ve delayed joining Medicare because you have other creditable coverage, you may be able to sign up for Medicare during a special enrollment period once you are ready to leave that coverage.

In the case of workers who stay on their or their spouses employer-provided health insurance past the point when they first became eligible for Medicare, their special period typically lasts eight months after their creditable coverage ends. Each individual situation may be different, however, so you should speak with the benefits administrator of your current plan to make sure you enroll in Medicare at the correct time.

Don’t Miss: Can I Switch Medicare Supplement Plans

Medicare Advantage Plan Eligibility For 2019

Heres what you need to know about eligibility for Parts C and D:

| If you | |

| Qualify for Medicare because youre turning 65 | Sign up for Medicare Advantage or Part D during your 7-month initial enrollment period |

| Qualify for Medicare because of a disability but arent 65 | Sign up for Medicare Advantage or Part D during the 7-month period that starts 3 months before your 25th month of disability payments, includes that 25th month, and ends 3 months after the 25th month of disability payments |

| Qualify for Medicare because of a disability and youre 65 | Sign up for Medicare Advantage or Part D during the 7-month period that starts 3 months before the month you turn 65, includes your birthday month, and ends 3 months after your birthday month |

| Dont have Medicare Part A, and you enrolled in Part B during general enrollment | Sign up for Medicare Part D only, from April 1 to June 30 |

| Have Medicare Part A, and you enrolled in Part B during general enrollment | Sign up for Medicare Advantage only, from April 1 to June 30 |

You can also switch to Medicare Advantage or join a Part D drug plan during the Medicare annual open enrollment period, which runs from October 15 through December 7 each year. Eligibility for Medicare Advantage depends on enrollment in original Medicare. In other words, you must first be enrolled in Medicare Parts A and B to sign up for Medicare Advantage.

Now That Your Eligible For Medicare, What Should You Do?

Properly Completing Documentation Requirements For The Medicare Annual Wellness Visit

While it is important to understand the documentation requirements for the Medicare annual wellness visit , you must also follow the rules dictating who can “provide” and who can “perform” the AWV. These are two different concepts, as we discussed in this blog. Understanding these differences is important to further avoid improper billing, recovery audits, and even possible criminal liability.

Read Also: Does Medicare Cover Bed Rails

Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

How Does Medigap Work

In order to buy a Medigap policy, you must sign up for Medicare Part A and B.

Medicare coordinates the billing and claims between Original Medicare and your Medicare Supplement plan.

The provider bills Medicare first, then bills your Medigap plan. Depending on the plan, the provider then bills you for what remains, such as the Part B deductible, and your check goes to the provider.

You can renew your Medigap policy as long as you pay the premium. The insurer cannot use your health problems to cancel your policy or raise your premium.

State-by-state differences exist in some guarantees and limitations.

Also Check: When Do You Sign Up For Medicare

What If I Work Past Age 65

You still have a Medicare enrollment decision to make.

If you plan to keep working or you have employer health coverage through a spouse, you have some options to consider when signing up for Medicare. Depending on your situation, you may or may not be able to delay Medicare enrollment.

Your Initial Enrollment Period happens when you’re turning 65 whether you’re still going to work or not. Be sure to know your IEP dates and plan ahead.

Can I Apply For Medicare At Age 62 Or Do I Have To Be 65

Although you may be able to begin withdrawing Social Security benefits for retirement at age 62, Medicare isn’t available to most people until they turn 65. But if you are under the age of 65, you could be eligible for Medicare if you meet any of the following criteria.

- You have been receiving Social Security disability benefits for at least 24 months.

- You receive a disability pension from the Railroad Retirement Board and meet certain criteria.

- You have Lou Gehrigs disease .

- You have ESRD requiring regular dialysis or a kidney transplant, and you or your spouse has paid Social Security taxes for a length of time that depends on your age.

If none of these situations apply to you, you’ll have to wait until age 65 to begin receiving your Medicare benefits. However, you can begin the sign-up process three months before the month you turn 65 during your IEP .

You May Like: Does Medicare Cover The Cost Of A Shingles Shot

Medicare Eligibility Due To Specific Illnesses

In addition to the above ways to qualify for Medicare health insurance, you may also be eligible if you have one of the following diseases:

- End-stage renal disease. To qualify, you must need regular dialysis or a kidney transplant, and your coverage can begin shortly after your first dialysis treatment. If you receive a transplant and no longer require dialysis, youll lose Medicare eligibility.

- Amyotrophic lateral sclerosis. Also known as Lou Gehrigs Disease, patients diagnosed with this terminal disease gain immediate Medicare eligibility.