Medicare Supplement Enrollment Period Explained

When you first turn age 65 and qualify for your Medicare benefits, you have a six-month window to enroll in the Medigap plan of your choice without the fear of being turned down or charged more due to a pre-existing condition. You must be enrolled in both Medicare Part A and Medicare Part B, but you have a guaranteed-issue right.

You Might Also Like:Do I Really Need Supplemental Insurance with Medicare?

Your Medicare supplement guaranteed-issue right, which starts on the effective date of your Part B coverage, means that insurance companies cant ask you any questions about your health. They can ask you your age, gender, where you live, and your use of tobacco, but they cant force you to ask intrusive health questions. And, so long as you can afford to pay the monthly premiumA premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ⦠for the policy, they cant turn you down.

Unless you live in one of the few states, like California, Oregon, and Washington State, that have enacted new guaranteed-issue legislation, your one-time open enrollment is the only time you are guaranteed to get the coverage you want. A few states have slightly different rules, which are covered below.

What Is Open Enrollment

- The free health insurance plan is a one-year period during which employees must choose coverage for the following year.

- Its important for employers to review it carefully before deciding which health insurance plans to offer to employees.

- The pandemic is making it difficult to register openly as many employees work from home.

Can I Be Dropped From My Medigap Policy

If you bought your policy after 1990, the policy is guaranteed renewable. This means your insurance company can drop you only if you stop paying your premium, you are not truthful about something under the policy or the insurance company goes bankrupt. Insurance companies in some states may be able to drop you if you bought your policy before 1990. If this happens, you have the right to buy another Medigap policy.

Also Check: Are Medical Alert Systems Covered By Medicare

How To Get Help During Your Medigap Open Enrollment Period

At MedicareFAQ, our agents are dedicated to helping you find the best Medicare coverage possible. They are able to educate you on all the different enrollment periods to make sure you don’t miss out. If you’re already outside your Medicare Supplement Open Enrollment Period, we’re still here to help you find a plan.Our agents are more than happy to answer all your questions and walk you through the health questions to see if you qualify. Once you enroll with our agents, you will have unlimited access to our Client Support Team.We’re ready to help! Contact us by calling the number above or use our rate comparison tool to see premiums near you now.

Buy A Policy When You’re First Eligible

The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first month you have

and you’re 65 or older. It can’t be changed or repeated. After this enrollment period, you may not be able to buy a Medigap policy. If you’re able to buy one, it may cost more due to past or present health problems.

Recommended Reading: Does Medicare Cover Bladder Control Pads

How Does Medicare Supplement Insurance Work With Medicare

Medicare Supplement Insurance works with Original Medicare Parts A and B. If you choose to buy a standalone Part D Prescription Drug plan, Medicare Supplement works with that, too.

Medicare Supplement Insurance is different from Medicare Advantage. You can have either a Medicare Advantage Plan or a Medicare Supplement Plan, but not both at the same time.

What Plan Changes Can I Make During The Medicare Open Enrollment Period

During the Medicare open enrollment period, you can:

- Switch from Original Medicare to Medicare Advantage .

- Switch from Medicare Advantage to Original Medicare .

- Switch from one Medicare Advantage plan to another.

- Switch from one Medicare Part D prescription drug plan to another.

- Enroll in a Medicare Part D plan if you didnt enroll when you were first eligible for Medicare. If you havent maintained other , a late-enrollment penalty may apply.

Don’t Miss: Does Aarp Medicare Supplement Plan Cover Silver Sneakers

It’s Important To Take Advantage Of Open Enrollment Here’s How

Many seniors end up finding that healthcare is their largest expense in retirement. Part of the reason has to do with the fact that many retirees manage to pay off their mortgages before ending their careers, and therefore don’t have to spend as much on housing. But part of it also has to do with the fact that health issues tend to arise as people age, leading to a need for more testing, more procedures, and more associated bills.

Meanwhile, many seniors end up on Medicare once they turn 65. And that alone can be a huge expense — especially for those who get the bulk of their retirement income from Social Security.

Image source: Getty Images.

It’s important to choose the right Medicare coverage so you can get the care you need as a senior without having to spend an unreasonable amount of money in the process. But the Medicare plan you choose initially is not necessarily the plan you’re stuck with for life.

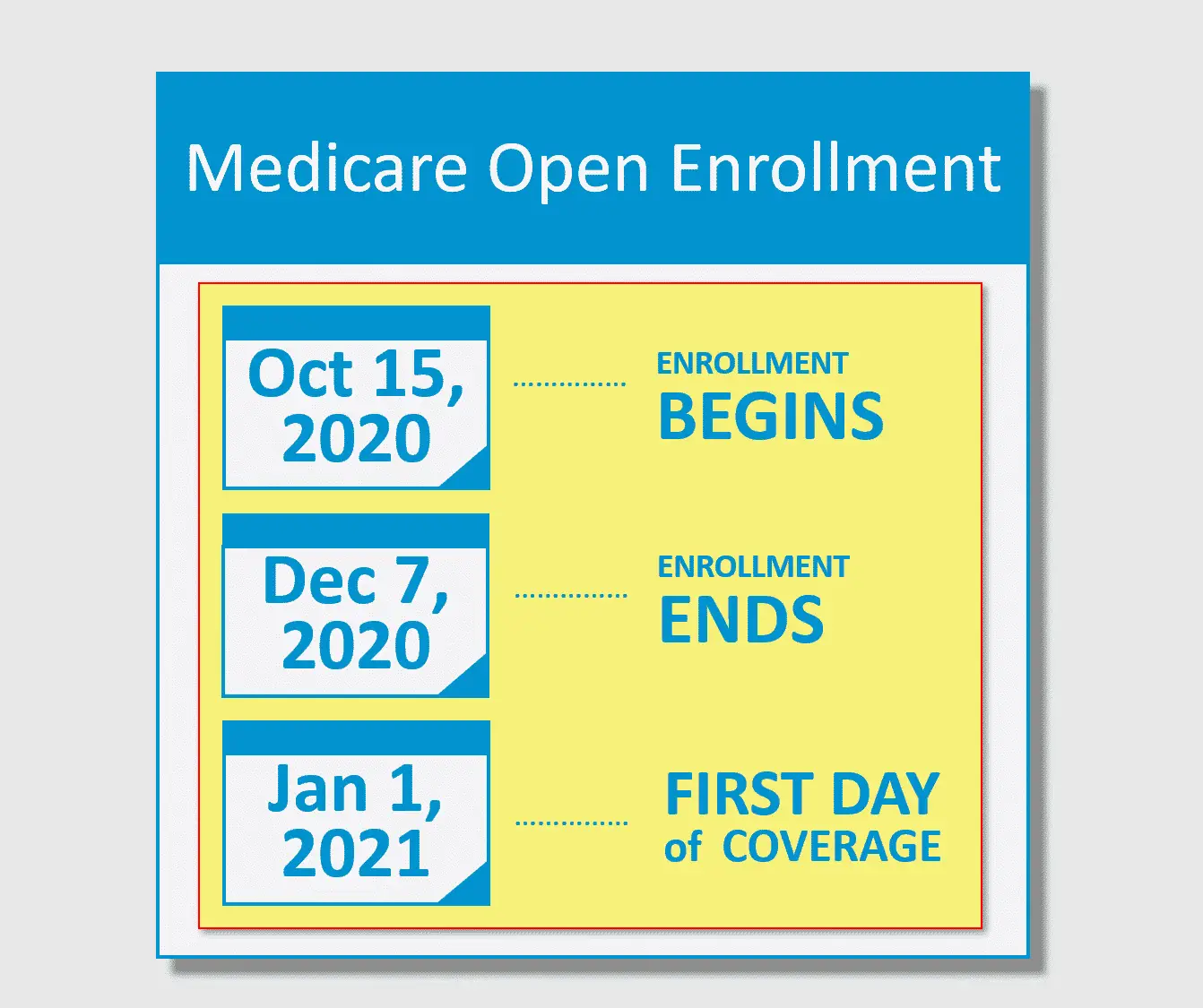

Each year, Medicare runs an open enrollment period, during which time existing enrollees can make changes to their health coverage. That period’s start date, Oct. 15, is coming up.

To be clear, open enrollment is not for people who are first becoming eligible to sign up for Medicare. Rather, it’s for those who are already on Medicare. But if you’re in the latter boat, it pays to gear up for open enrollment by doing these things.

What Is Medicare Supplement Insurance

The federal Medicare program pays most medical expenses for people 65 or older, or for individuals under 65 receiving Social Security disability benefits. However, Medicare does not pay all expenses. As a result, you may want to buy a Medicare Supplement policy that helps pay for certain expenses, including deductibles not covered by Medicare.

The Division of Insurance publishes annually a Medicare Supplement Insurance Premium Comparison Guide.

Read Also: How To Sign Up For Medicare Gov

Cancer Policies In Conjunction With A Medicare Supplement

Cancer policies can be sold in addition to a Medicare supplement policy, as long as the cancer policy pays regardless of whether Medicare pays.

If you are considering the purchase of a policy in addition to a Medicare supplement, you should review your insurance needs carefully to ensure you need additional coverage and how much additional coverage you may want or need.

A disclosure form describing the coverage must be provided to you to aid you in deciding whether the policy fits your needs.

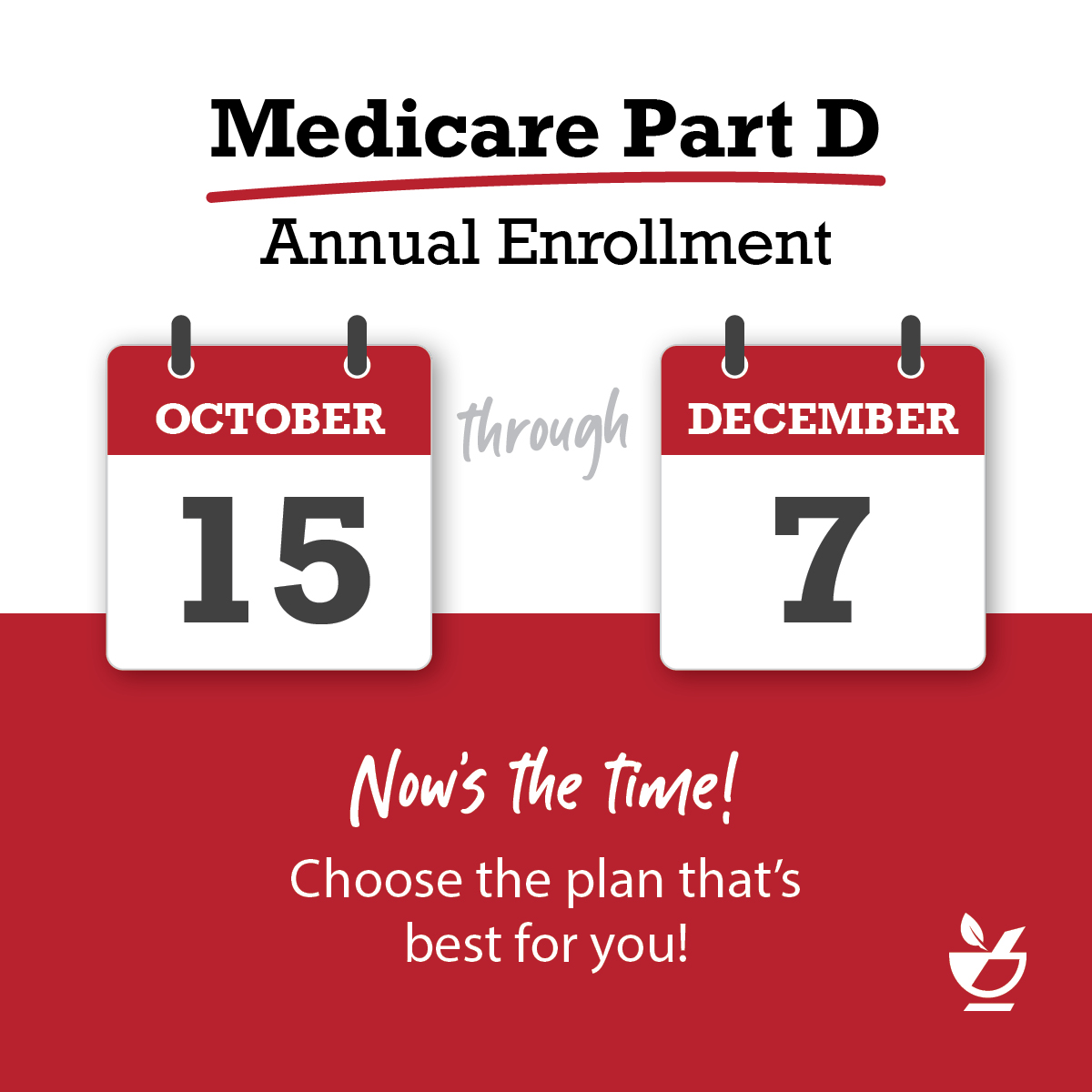

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes prescription drug coverage

- Enroll in a Medicare Part D standalone prescription drug plan

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent.

You can also enroll in a prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

You May Like: Are Diabetic Testing Supplies Covered By Medicare

How Long Is Open Enrollment For Medicare Supplement Policies

Open enrollment for Medicare Supplement spans six months, beginning on the first day of the month in which youre both at least 65 years old and enrolled in Medicare Part B. Some states have additional open enrollment periods, including ones for people under 65, so check with your local Medicare office for additional enrollment options that may be relevant for you.

Medicare Supplement Insurance Guaranteed Issue

Certain situations can occur that cause you to have whats known as a guaranteed issue right. These rights ensure that you can get the health care coverage you need.

When your guaranteed issue rights are in effect, providers have to:

- Sell you a Medigap plan

- Cover your pre-existing health issues, no matter what they are.

- Charge you the standard Medigap plan rate, even if you have pre-existing conditions.

Guaranteed issue rights apply to several situations. You can exercise your rights in the following scenarios:

- You have both Medicare and an employer-sponsored group health plan, and the latter is ending.

- You purchased a Medicare Advantage Plan thats leaving Medicare or stops covering your area.

- You stopped your Medigap policy to switch to a Medicare Advantage Plan. Less than a year has passed, and you want to switch back to Original Medicare and Medigap.

Your Medicare Supplement Insurance company goes bankrupt or otherwise stops your coverage at no fault of your own.

You May Like: How Much Is Medicare Cost For 2020

Medicare Supplement Insurance Open Enrollment Period

by Christian Worstell | Published December 22, 2020 | Reviewed by John Krahnert

Medicare Supplement Insurance has a six-month open enrollment period . Your open enrollment period begins when you are both:

- 65 years old and

- Enrolled in Medicare Part B

Unlike the Medicare OEP that happens once every year, you have only one Medigap OEP. If you get Medicare Part B before you turn 65, your Medigap OEP starts the first day of the month you turn 65. If you delay enrolling in Medicare Part B until after you turn 65, your Medigap OEP automatically starts the month you enroll in Medicare Part B.

Signing Up For Original Medicare

You can sign up for Medicare one of four ways:

For California residents, CA-Do Not Sell My Personal Info, .

1 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Recommended Reading: Does Medicare Cover Hospice Expenses

Medigap Is A Key Source Of Supplemental Coverage For People In Traditional Medicare

Medicare beneficiaries can choose to get their Medicare benefits through the traditional Medicare program or a Medicare Advantage plan, such as a Medicare HMO or PPO. Roughly two-thirds of Medicare beneficiaries are in traditional Medicare, and most have some form of supplemental health insurance coverage because Medicares benefit design includes substantial cost-sharing requirements, with no limit on out-of-pocket spending. Medicare requires a Part A deductible for hospitalizations , a separate deductible for most Part B services , 20 percent coinsurance for many Part B services, daily copayments for hospital stays that are longer than 60 days, and daily copays for extended stays in skilled nursing facilities.

To help with these expenses and limit their exposure to catastrophic out-of-pocket costs for Medicare-covered services, a quarter of beneficiaries in traditional Medicare had a private, supplemental insurance policy, known as Medigap in 2015 . Medigap serves as a key source of supplemental coverage for people in traditional Medicare who do not have supplemental employer- or union-sponsored retiree coverage or Medicaid, because their incomes and assets are too high to qualify. Medicare beneficiaries also purchase Medigap policies to make health care costs more predictable by spreading costs over the course of the year through monthly premium payments, and to reduce the paperwork burden associated with medical bills.1

Do I Need To Wait Until Im On Medicare To Select A Medigap Plan

Fortunately, you can often select the Medicare Supplementplan youd like up to six months before its intended start date. Reviewing youroptions early allows you to find the right coverage for your needs withoutpressure, and can give you peace of mind knowing that you have one less task tomanage when its time for you to transition to Medicare.

Shopping early can also help you save money, as somecarriers offer rate locks based on the date your application is submitted. Arate lock means that your premium wont change for a specific period, generallyabout 12 months once your policy is active. Rates tend to go up over time, soyou may be able to secure a lower rate by selecting your coverage early.

Also Check: Is Synvisc Covered By Medicare In Australia

What You Should Know About Medicare Open Enrollment

7 Facts About Medicare Open Enrollment You Should Know

What Is The Difference Between Open Enrollment And Annual Enrollment

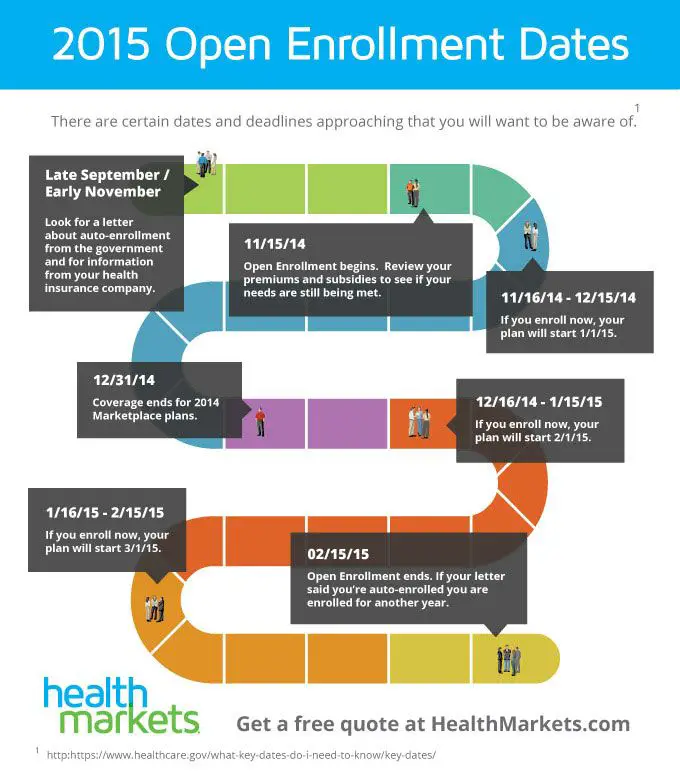

Open enrollment and annual enrollment are two types of insurance enrollment periods.

Annual enrollment is a term used in relation to employer-sponsored health insurance specifically. Its the period that often runs from the beginning of November to the middle of December in which an employee can make changes to their existing health insurance coverage. Such changes take effect on January 1 of the subsequent year.

Open enrollment, on the other hand, is a term that applies to everyone who doesnt have employer-sponsored health insurance, including Medicare beneficiaries. Similar to annual enrollment, open enrollment is a window of eligibility in which people can make changes to their insurance plans. The open enrollment period for Medicare beneficiaries runs from October 15 to December 7 each year.

Read Also: Is It Worth Getting Medicare Part D

Do Some People Get A Second Open Enrollment Period For Medigap

There are very few situations where a beneficiary will get a second Medigap Open Enrollment Period. Below is a list of a few.

- If you retire, enroll in Medicare Part B, then go back to work and join your employers group health care coverage, youll get a second Medicare Supplement Open Enrollment Period when you retire again and enroll back into Medicare Part B.

- If you get Medicare due to a disability when youre under 65, youll get two Medigap Open Enrollment Periods. The first will start with your Original Medicare Part B effective date before you turn 65. The second will begin when you turn 65.

One reason a beneficiary on Medicare due to disability would choose not to enroll during their first Medigap Open Enrollment Period is due to the minimal Medigap plan options available to them. Only certain states require Medicare Supplement carriers to offer Medigap plans to people under 65.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

In fact, most states only offer Plan A to those under 65. Because of this, someone qualifying due to disability may not have many options when first eligible. Allowing for a second Medicare Supplement Open Enrollment Period gives these beneficiaries access to all plans in their area.

What Is A Medigap Policy

A Medigap policy is health insurance sold by private insurance companies to fill the gaps in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan does not cover. If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay their share of covered health care costs.

Don’t Miss: Where Can I Go To Apply For Medicare

What Is Medicare Supplement Open Enrollment Period

Medicare Supplemental Open Enrollment is a 6-month period beginning on the first day of the month in which you are 65 years of age or older and enrolled in Medicare Part B. During this period, you may enroll in a Medicare Supplement Plan without existing medical conditions or acceptance restrictions.

Enrolling In Medigap Outside Open Enrollment

So, what happens if you decide to enroll in a Medigap plan outside of Medigaps open enrollment period? If you do not have guaranteed issue rights, the insurance company will likely require that you go through full medical underwriting. This means that you must answer questions about current and previous health conditions. The outcome of the underwriting process could mean that you pay higher premiums or that your coverage is completely denied. Remember that you can get guaranteed issue rights by meeting any of the criteria mentioned previously in this article.

Unlike some Medicare plans, you can sign up for Medigap at any time during the year. There is no need to wait until the annual enrollment period to sign up for Medigap. Plus, if you live in New York or Connecticut, you can sign up at any time without going through underwriting. Those states essentially have an unlimited open enrollment period. This means that you can sign up for Medigap at any time and not be subject to medical underwriting or health questioning.

Recommended Reading: What Documents Are Needed To Sign Up For Medicare