How Much Does Medicare Advantage Cost

Medicare Advantage plans are private, Medicare-approved health insurance plans that provide Part A and Part B coverage, and may also include other types of coverage, such as vision or dental. The costs of these plans varies, depending on the benefits provided. Each plan offers different coverage and associated premiums, deductibles, and copay. Participants must also pay their Part B premium, along with the adjustment for high earners, if applicable.

Average premiums for 2022 are expected to drop to $19 a month.9

Medicare Part A Costs Are Not Affected By Your Income Level

Your income level has no bearing on the amount you will pay for Medicare Part A . Part A premiums are based on how long you worked and paid Medicare taxes.

Medicare Part A premium costs in 2022 are as follows:

|

Number of quarters you paid Medicare taxes |

2022 Medicare Part A monthly premium |

|---|---|

|

40 or more |

|

|

$499 |

Most Part A beneficiaries qualify for premium-free Part A coverage.

Two of the Medicare Savings Programs that may help pay Part A premium costs for qualified individuals include:

- Qualified Medicare Beneficiary Program

- Qualified Disabled and Working Individuals Program

Medicare Advantage and Medigap costs by income level

Medicare Part C plans and Medicare Supplement Insurance plans are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Cost Of Medicare Part C 2020

Medicare Part C is also known as Medicare Advantage. A Medicare Advantage plan is an alternative way of getting your Medicare benefits. These are healthcare plans that are offered by Medicare-approved private companies, and they take the place of Medicare A and B if you choose to enroll in one of them.

Each Medicare Advantage plan cost will vary based on the plan you choose. To compare costs and find the right Medicare Advantage plan, speak to a licensed healthcare professional.

Each Medicare Advantage plan cost will vary based on the plan you choose.

Recommended Reading: How Does Geha Work With Medicare

For Medicare Premiums 2021 Look For Modest Increases In Premiums And Out

The New Year will usher in a host of adjustments to Medicare that both new enrollees and existing beneficiaries will need to navigate. In order to get the most from your plan, its important to understand your out-of-pocket costs, which will vary depending on your income and the type of plan you choose. Heres a rundown of what you can expect in 2021.

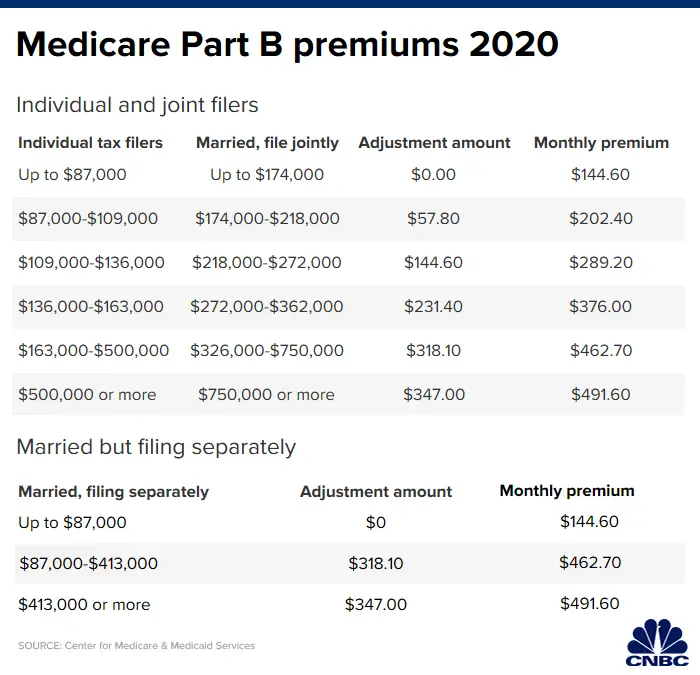

Medicare Part B Premium 2021. Although Part A, which pays for hospital care, is free for most beneficiaries, youll pay a monthly premium for Part B, which covers doctor visits and outpatient services. In 2021, the standard monthly premium will be $148.50, up from $144.60 in 2020.

But if youre a high earner, youll pay more. Surcharges for high earners are based on adjusted gross income from two years earlier. In 2020, beneficiaries with 2018 AGI of more than $87,000 paid $202.40 to $491.60 per month for Part B. Surcharges in 2021 for beneficiaries with 2019 AGIs of more than $88,000 range between $207.90 and $504.90.

Mind the gap. If youre new to Medicare, you may be surprised to discover what it doesnt cover. Part B pays for only 80% of doctors visits and other outpatient services. In addition, Medicare doesnt cover dental care, eye appointments or hearing aids.

Upgrades To The Medicare Finder Tool

If youve ever used the official Medicare website, especially over the past few years, youve probably noticed how dated everything looks. And when it comes to functionality, the website doesnt work as well as most websites in 2020 do.

The good news is, someone noticed this and decided to start making some major upgrades to the site itself. The most notable is an update to the Medicare finder tool, which has been improved and modernized.

The official Medicare website breaks down the upgrade in detail, but the overall gist is simple: it just works better. To break things down a bit further, a few notable improvements are:

- A faster prescription drug list builder

- More details on Medicare Advantage Plans

- The ability to learn more about Medicare coverage options before you see plans

These upgrades are especially helpful if youre applying for the first time, and thus, need to set everything up using this tool.

Don’t Miss: How Much Is A Colonoscopy With Medicare

Ask The Hammer: Can I Predict My 2023 Medicare Premiumsyour Browser Indicates If You’ve Visited This Link

Is it possible to predict your 2023 Medicarepremiumsbasedon your 2021 income? Jeffrey Levine answers.”I understand that the new Medicarepremiums have just been announced. Is it possible to tell what I will pay for my Medicarepremiums in 2023 basedon my 2021 income?

Retirement Daily on The Street on MSN.com

Find A Medicare Advantage Plan That Fits Your Income Level

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B ? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Some of these additional benefits such as prescription drug coverage or dental benefits can help you save some costs on your health care, no matter what your income level may be.

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Recommended Reading: Does Medicare Cover Dental Root Canals

Example Of A Medicare Tax Bill For A High Earner

The total tax bill for Medicare that could be paid by a high-income taxpayer could look something like this:

Jerry is single and has inherited several pieces of land that produce oil and gas income at the wellhead. He also works as a salesman for a local technology company and earned $225,000 of 1099 income this year. His oil and gas royalties for the year total $50,000, and he also realized capital gains of about $20,000 from the sale of stock.

Medicare Part D Premiums

Medicare Part D prescription drug coverage is optional. Some Medicare Advantage plans also incorporate prescription drug coverage. Monthly premiums vary from plan to plan.

Most people only pay their monthly premium for Medicare Part D coverage. But people with higher incomes also have to pay an additional fee based on their income reported to the Internal Revenue Service. For 2022, that would most likely be based on 2020 income.

2022 Medicare Part D Premiums

| Filed an Individual Tax Return | Filed a Joint Tax Return | Your Monthly Premium in 2022 |

|---|---|---|

| $91,000 or less |

The extra amount you pay is not part of your plan premium and you do not pay it to your Medicare Part D insurer.

In most cases, the extra amount will be held out of your Social Security check. If it isnt withheld, youll get a bill from either the Social Security Administration or the Railroad Retirement Board.

You also have to pay the extra fee if you are in a Medicare Advantage plan that includes prescription drug coverage.

If you dont pay the extra fee, you can lose your Medicare Part D coverage.

Recommended Reading: How Do You Pay Medicare

The Basic Medicare Cost Plan For 2020

Well, there you have it! Those are the basic price increases and changes for Medicare in 2020!

As you can see, everyones Medicare cost plan will increase in 2020. The reasons for those changes have also been explained, so you can be informed as to why your Medicare costs are going up. And now that you now know the numbers and can decide if Medicare is still the best option for you and your family.

On a positive note, if youre someone who has been flirting with the high income minimum, that going up a bit could be helpful. And if youre applying for Medicare for the first time, youll be able to do so using a brand new Medicare finder tool, which is good news.

Are you on Medicare? Considering signing up? Check out our blog for more information on it, as well as other health-related tips and tricks that you can use to live a happy and healthy lifestyle.

No Comments

Sorry, the comment form is closed at this time.

Search

Deductibles And Cost Sharing

You will pay full price for care until you reach the $1,484 deductible for each benefit period.

A benefit periodis the time that you are in a hospital or nursing facility, plus the 60 days that immediately follow your stay.

It is possible to have multiple benefit periods within a year, and you would be responsible for meeting the deductible in each of those periods.

Once you have reached that deductible, your costs are determined by the number of days that you remain in the hospital or facility. You will pay $0 per day for each hospital stay under 60 days, $371 per day for each hospital stay that lasts 61 to 90 days, and $742 per day for stays that exceed 90 days.

After 90 days, you will be using what are known as “lifetime reserve days. All Medicare recipients are granted 60 of these days in their lifetime. Once you have used all of them, you are responsible for all costs incurred during any subsequent hospital stays.

Don’t Miss: What Is The Requirement For Medicare

How Much Does Medicare Part A Cost

Medicare Part A is hospital insurance. Heres how much Medicare Part A costs in 2021.

- Monthly premium: You might be able to save on this Medicare cost if you dont have to pay the Part A premium. Most people dont. If youve worked at least 10 years while paying Medicare taxes, you dont have to pay a Part A premium. If you paid Medicare taxes for 30-39 quarters, your Part A premium is $259 in 2021. If you paid Medicare taxes for less than 30 quarters, your Part A premium is $471 in 2021.

- Deductible: $1,484 in 2021. Note that this cost isnt per year, but per benefit period. A new benefit period starts when you havent had inpatient hospital care or skilled nursing care for at least 60 days in a row, and youre newly admitted as an inpatient.

- Daily coinsurance or copayment: When youre an inpatient in the hospital, or if youre in a skilled nursing facility, Part A may cover some of the costs of your stay.

The first 60 days youre an inpatient, you generally dont pay coinsurance . Days 61 through 90, youll typically pay $371 per day in 2021. From Day 91 on, your coinsurance is $742 per day for each lifetime reserve day. You get a total of 60 lifetime reserve days in your lifetime. When theyre used up, you may have to pay all costs. A Medicare Supplement plan may help pay some of these costs.

What Are The Medicare Costs For 2020

Reviewed by Diane Omdahl

At HealthCare.com, we want to make health insurance content easy to understand so that it can help you make better decisions. We adhere to strict editorial standards. This post may contain links to lead generation forms, which is how we make money. However, this will not influence our writing. The content of this page is accurate as of the posting or update date.Read more

Read Also: Which One Is Better Medicare Or Medicaid

How About Medicare Parts C And D

If youâre interested in a Medicare Advantage or Part D plan, there arenât firm costs that can be given. This is because both of these parts of Medicare are offered by private companies that are approved by CMS. What we can give you is an estimate from CMS based on the averages of costs for 2020.

For Medicare Advantage, the average monthly premium is expected to fall to $23. This is the lowest average monthly premium in thirteen years. Medicare Part D is also predicted to see a lower monthly premium compared to recent years, dropping to $30 per month. This is the lowest average premium since 2013.

â â â

With AEP upon us, Medicare beneficiaries are given the opportunity to ensure that their plans match their needs. It can pay to explore what Medicare plans are available near you, making sure that what you have fits your medical and financial needs better than other options. To compare some of your coverage options, search the Medicareful Plan Finder and see plans in your area. If you need help or find a plan you like, Medicareful can connect you with a local, licensed sales agent who can help you through the enrollment process.

All numbers were drawn directly from the CMS 2020 Medicare Parts A & B Premiums and Deductibles Fact Sheet. Should you have any questions, please refer back to the fact sheet. For reference, prices and costs for 2019 are available here.

Each newsletter comes with articles, news, and a special sneak preview for the coming week!

Senior Health Care Struggles By The Numbers

According to the yearly Retirement Income Strategies and Expectations survey released by Franklin Templeton, Health issues are the No. 1 retirement-related concern for adults over 65 . Whats worse is that financing those health insurance costs throughout those golden years is the top expense concern amongst American adults, regardless of age . Investing in Medicare Supplement Plans that are right for you can relieve some of this stress.

To address the top retirement concerns so many Americans are facing, its imperative to incorporate healthcare expense planning as part of a holistic retirement savings strategy, said Kevin Murphy, head of strategic accounts for Franklin Templetons defined contribution division.

Health savings accounts are a great example of one of the most efficient vehicles to save for medical expenses in retirement that can complement a long-term retirement saving strategy.

You May Like: Who Is Eligible For Medicare In Georgia

Medicare Part B Costs By Income Level

Medicare Part B premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount .

The 2022 Medicare Part B premium costs by income level are as follows:

Medicare Part B IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$578.30 |

There are several Medicare Savings Programs in place for qualified individuals who may have difficulty paying their Part B premium.

Medicare Part B includes several other costs in addition to monthly premiums. The 2022 Part B deductible is $233 per year.

After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

How Medicaid Is Funded

Medicaid is funded by the federal government and each state. The federal government pays states for a share of program expenditures, called the Federal Medical Assistance Percentage . Each state has its own FMAP based on per capita income and other criteria. The average state FMAP is 57%, but FMAPs can range from 50% in wealthier states up to 75% for states with lower per capita incomes. FMAPs are adjusted for each state on a three-year cycle to account for fluctuations in the economy. The FMAP is published annually in the Federal Register.

As mentioned above, the CARES Act will provide additional funds to states for costs related to COVID-19.

Recommended Reading: Does Medicare Part D Cover Shingrix

What Will Medicare Part D Cost In 2020

As of January 1, 2020, changes to Medicares Part D Prescription Drug plan can impact how much Medicare recipients pay per month and how much they pay out of pocket. Significant changes may also impact the coverage gap.

Changes to the Part D Premium in 2020

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay the insurer requires for each prescription, the deductible recipients are obligated to pay and the list of drugs available on the carriers formulary.

In addition to a monthly premium, recipients with certain incomes may be required to pay extra for their Part D plan this is called the Part D income-related monthly adjust amount . For 2020, this amount is based on the recipients tax filing status for 2018.

The 2020 Part D IRMMA for individual tax filers for 2018:

- Below $87,000: None

The 2020 Part D IRMMA for joint tax filers for 2018:

- Below $174,000: None

- Between $174,000 and $218,000: $12.20

- Between $218,000 and $272,000: $31.50

- Between $272,000 and $326,000: $50.70

- Between $326,000 and $750,000: $70.00

- Above $750,000: $76.40

Changes to the Part D Annual Deductible in 2020

Changes to the Part D Coverage Gap in 2020

Related articles:

Premium Additions For Higher Incomes

Medicare Part D charges higher premiums for people with higher reported income. This means youll pay any premium that is mandated by your selected plan in addition to a flat fee based on your reported income.

Like Part B, the income used to determine your extra premium payment is based on the income you reported on your IRS tax return from two years prior. The table below breaks down what a 2021 Medicare Part D enrollee would have pay for a premium.1

| 2019 Reported Income | 2021 Medicare Part D premium cost |

| $88,000 or less | |

| Plan premium + $77.10 |

Recommended Reading: Is Wellcare The Same As Medicare