How Can I Enroll In A Medicare Supplement Plan

To be eligible for a Medicare Supplement plan, you must enroll in Original Medicare . The Medicare supplement open enrollment period lasts six months. It begins the month you turn 65 and are enrolled in Part B. You can enroll through a private insurance company , or by connecting with a GoHealth licensed insurance agent. Learn more about Medicare Supplement enrollment.

Skilled Nursing Facility Care Coinsurance

More than 20 days of inpatient care within the same benefit period at a skilled nursing facility will incur a daily coinsurance payment of $185.50 per day in 2021. If more than 100 days of inpatient care are accumulated in the same benefit period, the beneficiary becomes responsible for all costs. If you have Plan F, however, these costs are covered in full.

Where Can I Buy Medicare Part F

Although most Americans get their Medicare Part A and Part B coverage through the federal government, thats not how you get Medicare Supplement coverage.

To get Part F or Plan F coverage, or any other kind of MedSup coverage, you have to go through an insurance company that is licensed in your state to sell these policies.

You May Like: What Age Can You Get Medicare Health Insurance

Will Medigap Plan F Cover Both Me And My Spouse

MedSup policies cover only one person, so you and your spouse each have to buy your own Part F plan.

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided “as is” and “as available” for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.

Also Trending

Applying For A Medicare Supplement Insurance Plan

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you’re both age 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment periods and Guaranteed Issue requirements.

If you apply outside of Open Enrollment or Guaranteed Issue periods, you may be denied coverage or charged more based on your health history. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare supplement plans are guaranteed available.

Scroll for Important Disclosures

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP® Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

WB27382ST

Recommended Reading: How To Check Medicare Status Online

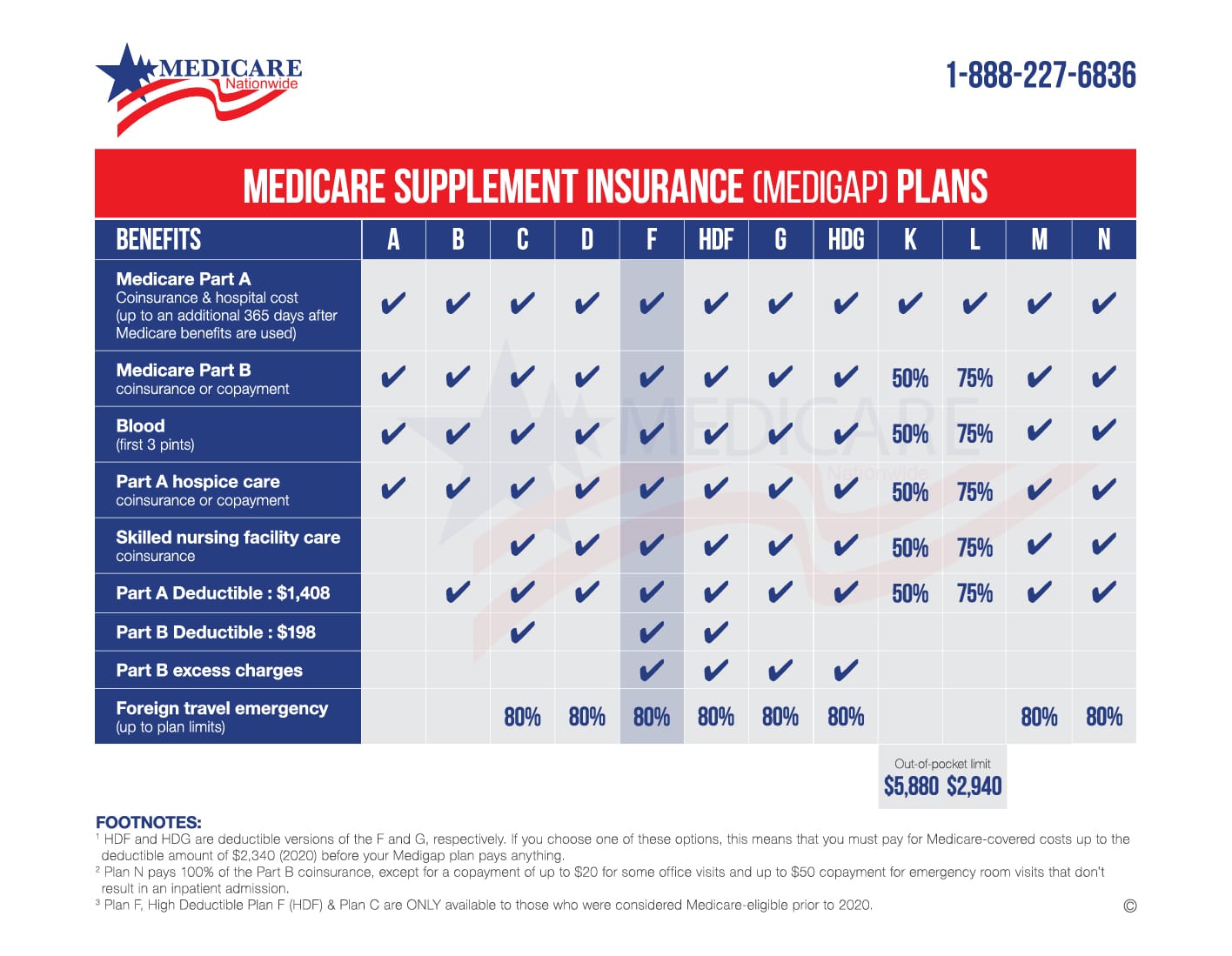

Medicare Supplement Plan F Vs Plan N

Medicare Supplement Plan F provides coverage for two areas that Plan N does not:

- Medicare Part B deductible

- Part B excess charges

Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide. These costs are called excess charges.

Even though Plan N doesn’t cover these excess charges, they are typically easy to avoid. Most doctors who accept Medicare patients also accept Medicare assignment, which means they accept the Medicare-approved amount as payment in full and won’t charge any excess amounts. Be sure to ask your doctor if they accept Medicare assignment before receiving any treatment services.

Plan N typically has lower premiums than Plan F. In exchange for the lower monthly premiums, Plan N beneficiaries have to pay a copay of up to $20 for some doctor’s office visits and a $50 copay for emergency room visits that don’t result in being admitted for inpatient care.

Plan N can therefore be a good fit for beneficiaries who are looking for a plan with low monthly costs and who still want most of their Medicare out-of-pocket costs covered.

Who Can Enroll In Plan F

Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

If your 6-month period has ended and you dont qualify for a Special Enrollment Period you can apply to enroll in Plan F by completing an application that asks about your health history. The insurance company can decline your application and/or request medical records to determine whether it will accept you.

Read Also: Do I Have To Pay For Medicare On Ssdi

What Is The Difference Between Medicare Plans F And G

There are two main differences between plans F and G: the premium and the amount of coverage you receive. Here’s a comparison of the coverage differences between the two Medigap plans:

| Benefit |

|---|

| Medicare Part B excess charges |

| Blood |

| Skilled nursing facility coinsurance |

As you can see, Medigap Plan G would not provide coverage for the Medicare Part B deductible. This means if you were to purchase Plan G, you would have to pay the deductible for Part B, which is $185 for 2019, as you receive health services.

Additionally, typical premiums for Medicare Plan F are slightly higher when compared to Plan G â $140 versus $110, respectively â and have a larger rate increase from year to year. The increased premiums are because of the more comprehensive coverage that you receive through Plan F.

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Why Should I Enroll In A High

High-deductible Plan F policies usually have lower premiums than standard Plan F policies. As a result, if you need or want to keep your monthly payments to a minimum, this might be your best option as far as Medicare Supplement policies are concerned.

Just know that youll have to deal with higher out-of-pocket costs if you get sick or otherwise need medical care. Given that, people who are fairly healthy are the best candidates for high-deductible Medigap Plan F coverage.

Also Check: Does Medicare Cover Dexcom G6 Cgm

Medicare Part A Coinsurance

Medicare beneficiaries do not owe any Part A coinsurance for the first 60 days of an inpatient hospital stay during a Part A benefit period. But beginning with day 61, Medicare Part A requires a daily coinsurance of $371per day in 2021. And beginning on day 91, that daily coinsurance goes up to $742 per day.

Medigap Plan F covers those daily coinsurance requirements at 100%.

In addition, Plan F covers Part A hospital benefits for another 365 days after your Medicare Part A benefits are exhausted.

How Much Does Medicare Plan F Cost

Costs vary from person to person. The price of a Medicare Plan F policy is determined based on your age, location, gender, and use of tobacco. National averages are around $300 per month, but in many areas, rates start as low as $125 per month. For the high deductible version, you may pay as little as $68. Health insurance companies will be able to help you determine eligibility and costs for the different Medigap policies.

IMPORTANT: Many people try to compare the cost of Medicare supplement insurance plans with a Medicare Advantage plan . The two types of insurance are as different as apples and oranges. With a Medigap plan, you pay for most of your medical services in advance through your monthly premiumsA premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. …. With a Part C plan, you pay most of your costs through copays and coinsurance when you use healthcare services. Both offer comprehensive coverage, but a Medicare supplement gives you peace of mind and helps you plan for your healthcare expenses. If you still have questions about how these plans differ, your insurance agent can walk you through the costs and covered services.

You May Like: What Does Regular Medicare Cover

Best In Educational Information: Cigna

Cigna

-

Easily understandable breakdown of costs

-

Plan information is explained in simple terms

-

Only additional benefit is a 24-hour health hotline staffed by nurses

-

Long process to get estimates, requiring contact information and agreement to be contacted by Cigna representatives

Cigna wants all of its customers to be knowledgeable about and comfortable with what exactly theyre signing up for with a Medicare Plan F plan, whether it’s a regular or a high-deductible option. The differences between two plansthe deductible costs and the difference in premiumsand what each of them covers are clearly laid out, so you can make an informed decision. However, the comparison aspect of the process is time-consuming, requiring not only your ZIP code, but your name, date of birth, the dates when you enrolled in Parts A and B, and your phone number and email address. In addition, you must consent to be contacted by Cigna before you can continue to get your estimate.

Who Will Not Be Able To Have Medicare Supplement Plan F

If you were eligible for Medicare on or after January 1, 2020, you will generally not have the option to buy a Medicare Supplement Plan F. In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible.

Read Also: Does Medicare Cover Bed Rails

Learn About Medicare Supplement Plans Available Where You Live

1 AHIP. . State of Medigap: Trends in Enrollment and Demographics. Retrieved from https://www.ahip.org/wp-content/uploads/AHIP_State_of_Medigap-2020.pdf.

2 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Best For Discounts: Blue Cross Blue Shield

Blue Cross Blue Shield

-

Household discounts

-

New to Medicare Discount

-

User-friendly website

-

Also offers dental, hearing, vision, and Part D plans

-

Few states with High-Deductible Plan F

-

Rates increase based on age

Founded in 1929, BCBS was the first insurance company to manage Medicare claims in 1966. Blue Cross Blue Shield is the umbrella company for Anthem, CareFirst, Highmark, and the Regence Group. Altogether, BCBS offers Plan F in 43 states, excluding Alabama, Arkansas, Hawaii, Massachusetts, Minnesota, North Carolina, and Wisconsin. High-Deductible Plan F is available in 14 states: Alaska, Delaware, Illinois, Maryland, Michigan, Montana, New Mexico, New York, North Dakota, Oklahoma, Pennsylvania, South Carolina, Texas, and West Virginia.

BCBS members have access to a 24/7 nursing hotline. Depending on your state, a wide variety of discount programs are also available. Blue California, for one, offers a New to Medicare discount , a household discount when two or more enrollees live together , an automatic bank payment discount , and discounts for enrolling in a dental plan at the same time . Be sure to ask about available discounts in your state.

Read Also: Will Medicare Pay For An Inversion Table

Can Anyone Enroll In Medicare Part F Or Who Is Eligible To Enroll In Part F Plans

You should be able to buy Medicare Supplement Plan F coverage if:

- Youre over 65.

- Youre enrolled in both Medicare Part A and Part B.

- Youre not enrolled in a Medicare Advantage plan.

- You live in the plans service area.

- You didnt become eligible for Medicare on or after Jan. 1, 2020.

If you go to buy Plan F or any other MedSup plan outside of a Medicare open enrollment period, you might have to jump through a few extra hoops. One is that you may have to pass a medical screening, which means answering a number of questions about your medical and health history. Another is that your doctor or physician may have to get involved in various ways.

Also, if youre under the age of 65 and you have Medicare coverage due to a disability or end-stage renal disease, you may not be able to buy any MedSup or Medigap policy. Or you may not be able to get the one you want.

Costs Associated With Medigap Plan F Coverage

There is an additional high deductible Medigap Plan F option that requires beneficiaries to pay out-of-pocket expenses for the first $2,370 in 2021 before the plan will begin paying for coverage. This plan is a cheaper alternative to the standard Medigap Plan F, since the beneficiary is responsible for higher out-of-pocket costs from the start.

Medigap Plan F is offered through most insurance companies, so you may want to shop around. Other plans may be available at lower cost but Plan F generally represents a great value for those facing increased copayments and deductibles because of regular medical attention.

Don’t Miss: How Do I Get Dental And Vision Coverage With Medicare

Other Medicare Supplement Plans

1 Insured by Cigna Health and Life Insurance Company, American Retirement Life Insurance Company, Loyal American Life Insurance Company or Cigna National Health Insurance Company. In Kansas and Pennsylvania, Medicare Supplement insurance policies are insured by Cigna National Life Insurance Company. American Retirement Life Insurance Company, Loyal American Life Insurance Company and Cigna Health and Life Insurance Company plans are not available to residents of Kansas or Pennsylvania.

2 A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out of the hospital and have not received skilled care in any other facility for 60 days in a row.

3 Notice: When your Medicare Part A hospital benefits are exhausted, the insurer stands in the place of Medicare and will pay whatever amount Medicare would have paid for up to an additional 365 days as provided in the policys Core Benefits. During this time, the hospital is prohibited from billing you for the balance based on any difference between its billed charges and the amount Medicare would have paid.

4 Once you have been billed $203 of Medicare-approved amounts for covered services, your Part B deductible will have been met for the calendar year.

5 State variations apply. The Household Discount is not available in HI, ID, MN, and VT. For residents of WA, the discount only applies to spouses .

- Customer Plan Links

What Is Medicare Plan F

Medicare Plan F is a supplemental Medigap health insurance plan that is offered to individuals who are disabled or over the age of 65. Known better as simply Plan F, the policy is the most comprehensive of the 10 Medigap plans offered in each state. Plan F is a supplemental policy to the standard Medicare parts A and B plans and can fill many of the gaps of standard Medicare policy and provide broader assistance with out-of-pocket costs. However, not all health insurance gaps will be covered by Plan F.

Also Check: Is Dexcom G6 Cgm Covered By Medicare

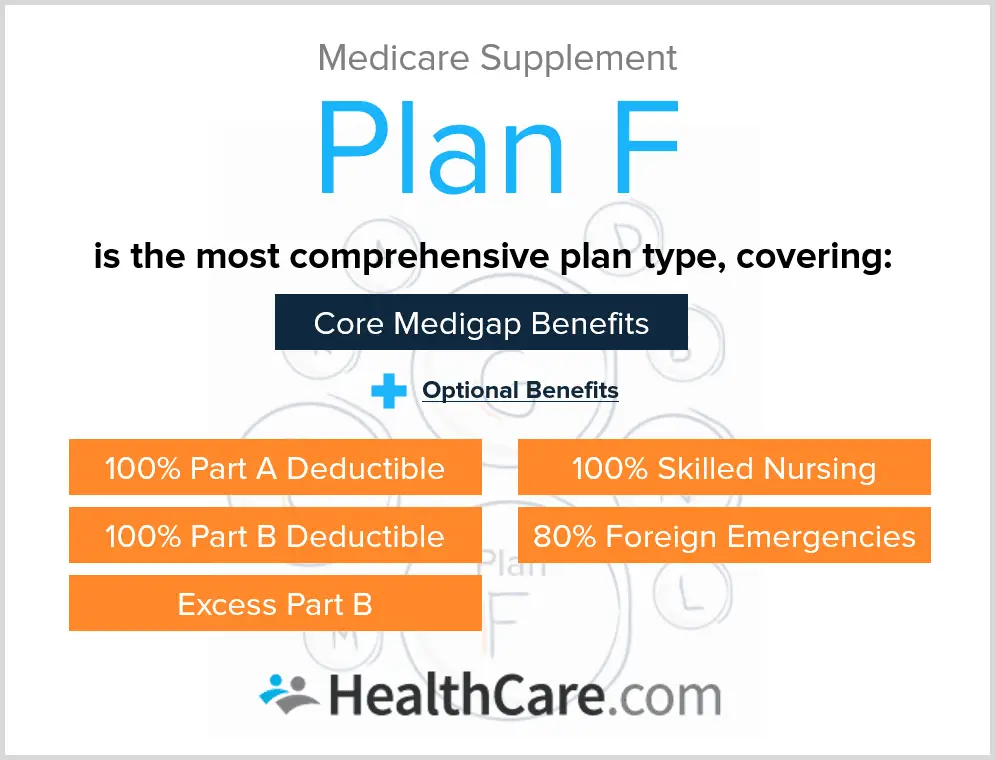

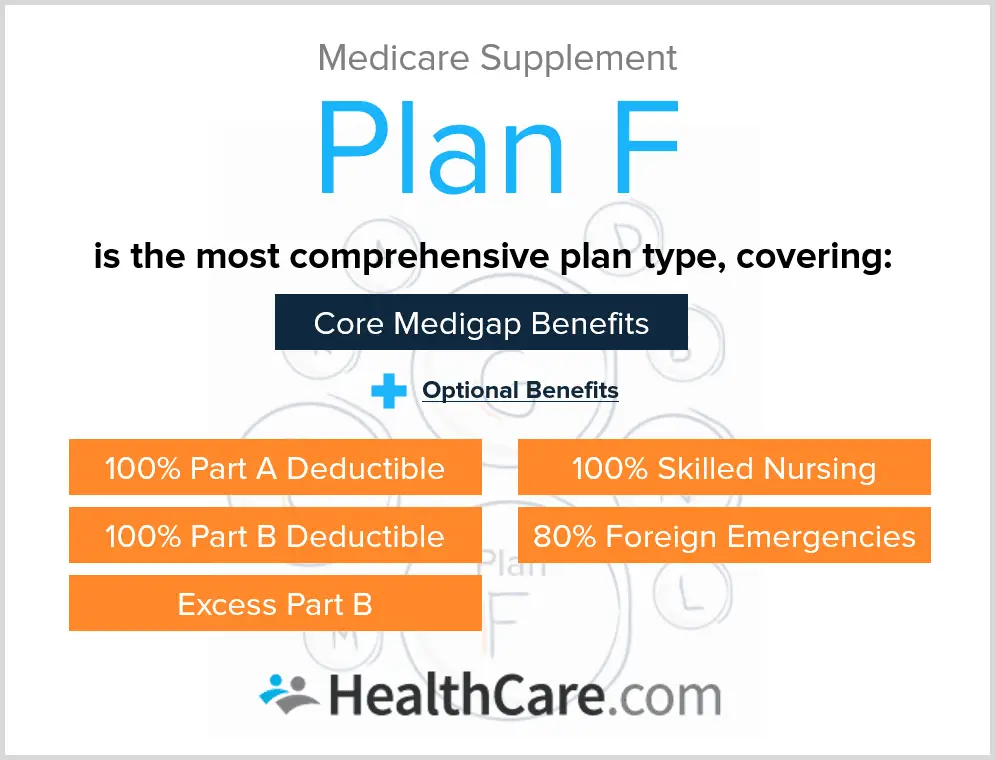

Medicare Supplement Plan F Benefits

As mentioned, Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings .

Medigap Plan F may cover:

- Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers

- Part A hospice care copayment or coinsurance costs

- Part A deductible

- First three pints of blood

- Skilled nursing facility care coinsurance costs

- Limited overseas emergency travel coverage, up to plan limits*

* May be covered if your foreign travel emergency care starts during the first 60 days after leaving the United States and Medicare doesnt otherwise cover the care.

Is There A Lower Premium Option For Plan F

Are you interested in enrolling in Plan F but find that the premium rates are more than you want to spend? High Deductible Plan F is a potential option for you to consider. If you are comfortable with reaching the higher deductible prior to receiving full coverage for this plan, the lower premium could be worth it.

You May Like: Can I Enroll In Medicare Online

Best For Cost And Overall Price Transparency: Aetna

Aetna

-

Highest household discounts

-

Also offers dental, vision, and Part D drug plans

-

Rates available online

-

Cannot enroll online

-

Rates increase based on age

Founded in 1853 as a life insurance company, Aetna entered the healthcare market in 1899. Now a subsidiary of CVS Health Corporation, these two reputable companies work together to bring you a well-rounded healthcare experience. Aetna offers Plan F in 35 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, New York, Washington, Washington DC and Wisconsin. High-Deductible Plan F is also available in 35 states: Alabama, Arizona, Arkansas, California, Delaware, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Montana, Nebraska, Nevada, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia and Wyoming.

Enrolling in Medicare Supplement Plan F is easy and if you also need to plan for the prescription drug plan, it offers many that rate 4 stars or higher on the Medicare Five-Star Rating System. To enroll, you must reach out to a representative by phone. Its rate for Plan F was the lowest we found, starting at $142 per month for a 66-year-old man. Rates may vary based on age, preexisting medical conditions, and where you live.