Adding Part B Benefits

When qualifying for benefits at the age of 65, a person will get the benefits of Part A, along with Part B. Part A and Part B combined are known as Original Medicare. Weve covered Part A, now well look at the two areas covered with Part B. Again, these are defined by Medicare.gov.

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventative services: Health care to prevent illness or detect it at an early stage, when treatment is most likely to work best.

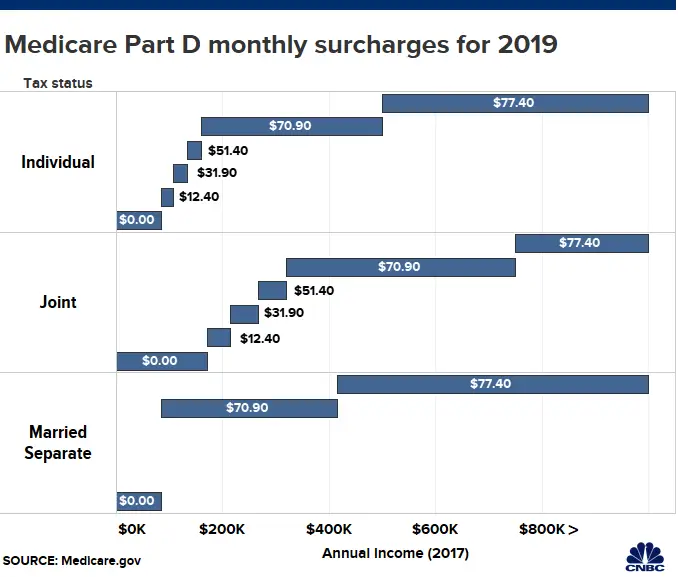

Unlike Part A, there is a Part B premium that most people will have to pay. However, the standard premium is minimal, currently $135.50. Those with an income below $85,000 will pay the standard Medicare premiums.

What Is Private Health Insurance

In Australia, private health insurance allows you to be treated in hospital as a private patient. It can also help pay for health care costs that Medicare doesnt cover, such as physiotherapy. How much and what it covers depends on your policy.

To get private health insurance you must:

- buy a policy from a registered health insurer

- pay regular premiums to stay covered.

Also Check: When Can Medicare Plans Be Changed

Medicare Before You Retire Maybe

Before you do anything about enrolling in Medicare, you need to talk with your employer benefits manager. You need to understand if your employer insurance qualifies as creditable coverage that could allow you to delay Medicare as well as find out how Medicare and your employer coverage may work together. In some cases your employer coverage will enable you to put off Medicare enrollment, and in other cases you may be required to take full Medicare benefits at age 65 even if you continue working. Quickly discover your options here.

Recommended Reading: Which Medicare Plans Cover Silver Sneakers

Don’t Miss: How Is Medicare Irmaa Calculated

When Does An Obamacare Plan Make Sense

While Obamacare can be costly for seniors who have to pay full price, for those who qualify for premium subsidies, it can be a very good choice.

All ACA plans cover people with preexisting conditions and include 10 essential health benefits, including preventive care, emergency services, hospitalization, lab services and more. So if you need more care, youre likely to save money in the end by choosing a plan that covers all the types of care and medication you need to get or stay well.

Can I Get Pet Insurance For An Older Cat

There are several types of cat insurance your senior pet may qualify for, the most popular being Accident & Illness coverage, which offers comprehensive coverage for new illnesses and injuries.

However, each pet insurance company has different policy terms and restrictions regarding aging felines.

In addition, many pet insurance companies offer pet wellness plans that you can add to the basic pet insurance policy for coverage of routine care costs. This includes expenses for things like flea and tick preventatives, annual heartworm testing, pet wellness exams, and more.

While some providers set a maximum age limit on enrollment, others have no upper age limits and will keep covering your cat regardless of their age. For instance, if you insure your feline companion when they are a kitten, they can be covered for the rest of their life as long as you keep paying your premiums.

Recommended Reading: What Is Medicare A Or B

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Signing Up For Medicare At Age 65

You can first sign up for Medicare during your7-month Initial Enrollment Period . Your IEP includes the month you turn 65, the three months before, and the three months after.

If you are receiving Social Security or Railroad Retirement Board benefits, youll be enrolled in Medicare automatically when you turn 65. Youll get your Medicare card in the mail.

If youre not enrolled automatically at age 65, then youll need to sign up for Medicare yourself when youre ready. You can sign up for Medicare Part A and Part B online at www.ssa.gov, in-person at your local Social Security office or via phone .

Recommended Reading: Does Medicare Cover Bariatric Surgery

Medicare Before Retirement Age

For some, benefits can start before the age of 65. This includes the categories of people above, including those who have a disability and those who have certain illnesses. At age 65, both those who are retired and those who are still working qualify for health insurance through Medicare enrollment.

Alternatively, Medicaid is a U.S. public assistance program for U.S. citizens of all ages.

Find out more about the differences between Medicare and Medicaid.

How Do You Qualify For Social Security Disability Benefits

Qualifying for SSDI is a complicated process and many people find the need to consult an attorney to expedite the process. SSA has instructions and offers an online application.

Qualification for SSDI has only two criteria, which are not entirely straightforward.

Also Check: Can You Have Medicare Before Age 65

Also Check: Is Healthfirst Medicaid Or Medicare

How Screening Guidelines Are Developed

Screening tests are examinations aimed at detecting disease before symptoms develop. They range from simple, noninvasive tests like blood pressure measurements to procedures such as colonoscopy, which requires preparation and sedation. By detecting disease before it becomes apparent, clinicians are usually able to treat it more effectively and often cure it.

Medical organizations want to be sure that screening tests are used appropriately in people for whom theyve proven most effective. Accordingly, they may conduct studies of death rates from a disease in which they compare people whove been screened for the disease with people in the same category who have not been screened. These studies help health officials to assess whether and for which groups of people the potential benefit of a test outweighs the risks. The studies can also be used to calculate statistically the number of people who would need to be tested in order to save a life.

Dont Miss: Does Medicare Pay Anything On Dental

Reaching Age 62 Can Affect Your Spouses Medicare Premiums

Although reaching age 62 does not qualify you for Medicare, it can carry some significance for your spouse if they receive Medicare benefits.

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they havent yet qualified based on their own work history.

- For example, Gerald is 65 years old, but he doesnt qualify for premium-free Part A because he did not work the minimum number of years required for eligibility. He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

- Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

In the above example, Jessica has not become eligible for Medicare by turning 62. Her husband Gerald, however, is now eligible to receive his Medicare Part A benefits without paying a monthly premium any longer.

Donât Miss: How To Get A Lift Chair From Medicare

You May Like: What Does Medicare Part E Cover

Here Is How Obamacare Works If You Are Over 65 But Dont Qualify For Medicare

Youre over 65 but not eligible for Medicare. You are eligible to get coverage on HealthCare.gov . If you meet the qualifications based on income and family size, you are eligible for cost-saving subsidies, too.

You have retiree health benefits. Youre considered covered under Obamacare and wont owe the fee. You can replace that coverage with coverage from HealthCare.gov. However, if your retirement coverage is considered affordable and meets certain minimum standards, or if you are eligible for Medicare but have chosen not to enroll, you wont qualify for Obamacares cost-saving subsidies.

You dont have any health coverage. If you are over 65 the fee for not having coverage still applies to you. Whether you get a Marketplace plan, get Medicare, or keep a retiree plan from a previous employer you are covered.

IMPORTANT: If you do have access to Medicare, its actually illegal for someone to sell you a non-Medicare health plan and you wont be able to shop on the Marketplace.

Learn more from LegalConsumer

Read Also: How To Get Medicare For Free

Get The Most Out Of Medicare With A Florida Medicare Advantage Plan From Simply Healthcare

Simply Healthcares Medicare Advantage Plans cover items that Part A and Part B do not, such as prescription drugs, dental, vision and hearing aids. Medicare Advantage plans also have other benefits, such as fitness program memberships, personal home helpers, transportation to doctor visits and more. We also have Medicare Special Needs Plans in Florida designed for people diagnosed with certain conditions or diseases.

Non-Discrimination Notice: The plan documents may be available in other languages. Or, if you have special needs, the documents may be available in other formats. Please call Customer Service for details. Please review the Notice of Non-Discrimination in Health Programs and Activities .

Benefits, premiums, copays and plans may vary by county. Medicare Advantage plans may not be available in all countries. This information is not a complete description of benefits. Contact the plan for more information.

Simply Healthcare Plans, Inc. is a Medicare-contracted coordinated care plan that has a Medicaid contract with the State of Florida Agency for Health Care Administration to provide benefits or arrange for benefits to be provided to enrollees. Enrollment in Simply Healthcare Plans, Inc. depends on contract renewal.

Also Check: How Much Is Medicare B Cost

How To Enroll For Medicare

If you meet the requirements for those 65 and older, you can receive Medicare Part A without paying any premiums. However, if you or your spouse did not pay Medicare taxes, you may have to pay for Part A. Medicare Part A covers hospital insurance. Medicare part B covers things like outpatient care, preventive services and medical equipment. It can also cover part-time home health services and physical therapy. Should you decide you also want Medicare Part B, you must pay a monthly premium.

If you have received Social Security disability benefits for 24 months, you will automatically be enrolled in Medicare at the start of the 25th month. If you have Lou Gehrigs disease, you are automatically enrolled the first month you begin receiving benefits. For these situations, enrollment includes both Medicare Part A and Part B. However, if you have end-stage renal disease, your Medicare benefits are determined on a case-by-case basis. In this case, you will need to manually apply.

Dont Miss: Does Medicare Medicaid Cover Dentures

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |

Recommended Reading: What Percentage Does Medicare Part A Cover

Eligibility Due To Specific Illness

Younger people may qualify if they have ESRD or ALS.

End stage renal diseaseIf a person is living with ESRD, they may also qualify for Medicare before they reach 65. They must:

- have received a diagnosis of kidney failure

- be getting dialysis or have had a kidney transplant

- be eligible to get SSDI benefits

Amyotrophic lateral sclerosisIf a person has ALS and gets SSDI, there is no waiting period. Medicare begins automatically in the first month that their SSDI benefits start.

If My Spouse Is 65 And Im 62 How Can That Affect My Spouses Medicare Costs

Traditional Medicare refers to Part A and Part B. Almost everyone has to pay a Part B monthly premium. But most people donât have to pay a Part A monthly premium.

For Medicare Part A, your monthly premium amount depends on how long you or your spouse worked and paid taxes.

If youâve worked at least 10 years while paying Medicare taxes, you donât pay a monthly premium for your Medicare Part A benefits. But if you havenât worked, or worked less than 10 years, you may pay a premium.

Hereâs where your spouse might benefit from your work history, or vice versa. Say youâre age 62 or older, and your spouse is 65. Your Medicare-eligible spouse has worked for less than 10 years. You, on the other hand, arenât eligible for Medicare yet at age 62, but youâve worked at least 10 years while paying taxes.

Well, tell your spouse he or she owes you a grand night out on the town. Because of your work history, your spouse will qualify for premium-free Part A.

So, to summarize with an example:

- Bob is 65 years old. Heâs on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

You May Like: Can You Apply For Medicare At 64

How Do Beneficiaries Out

Out-of-pocket spending

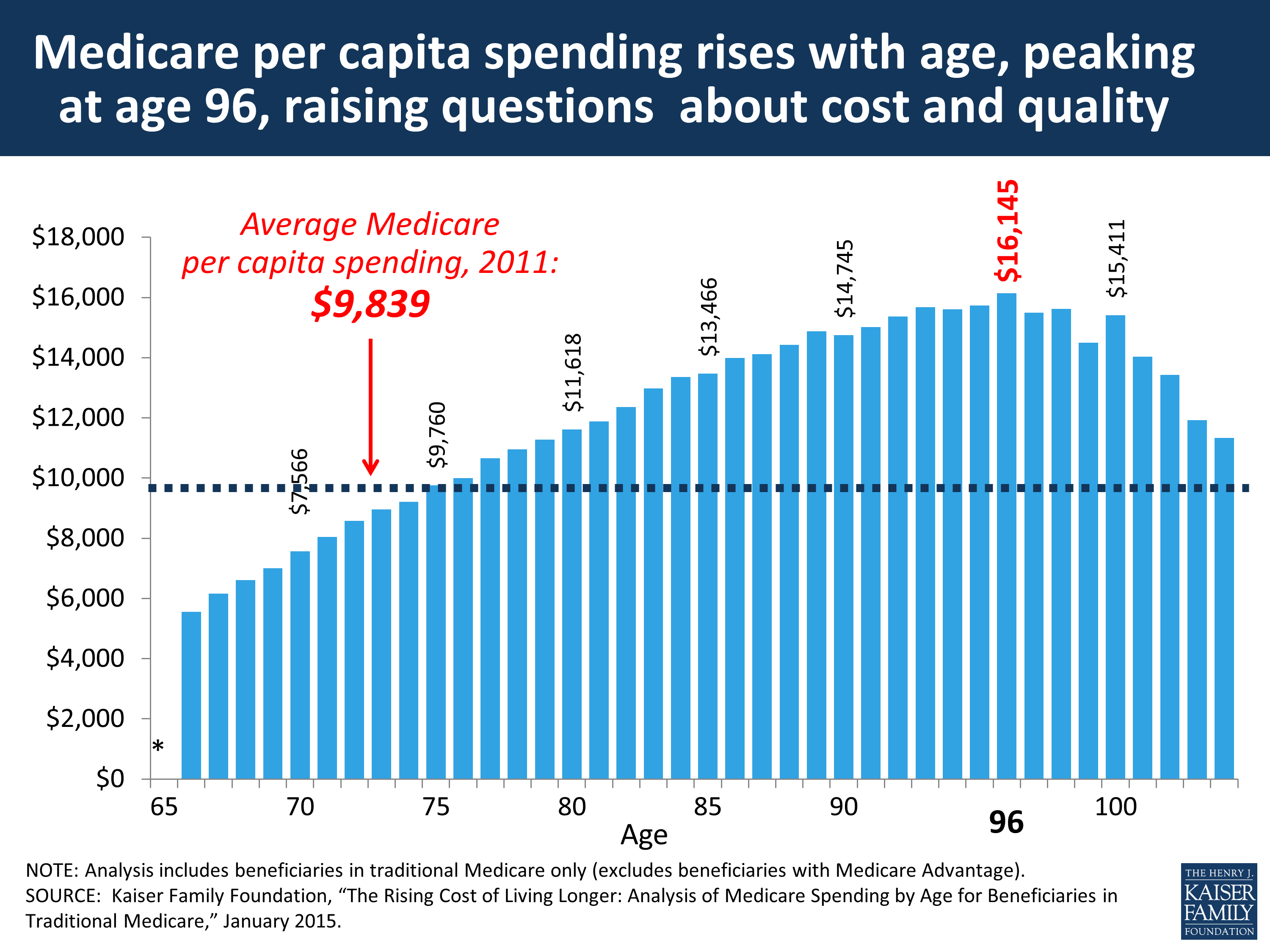

Although total Medicare per capita spending is higher for Medicare beneficiaries under age 65 with disabilities than for older beneficiaries, younger beneficiaries in traditional Medicare spend significantly less out of pocket, on average. This is likely due to the fact that a greater share of younger beneficiaries with disabilities than older beneficiaries have Medicaid coverage , as well as Part D Low-Income Subsidies , that help cover their premiums and cost sharing. Overall, out-of-pocket spending by younger beneficiaries with disabilities is 40% less than that of older beneficiaries . Younger beneficiaries have lower average out-of-pocket spending than older beneficiaries for insurance premiums and for medical and long-term care services combined .

On average, in 2012 beneficiaries in traditional Medicare with disabilities spent the largest share of their total non-premium out-of-pocket costs on medical providers , followed by prescription drugs and long-term care facility costs . These services also were the top three in terms of out-of-pocket costs for older beneficiaries, but in a different order: older beneficiaries spent the largest share of their out-of-pocket costs on facility costs , followed by medical providers and prescription drugs .

Access to care and cost-related problems

Figure 6: Selected Measures of Access to Health Care for Medicare Beneficiaries Under Age 65 Compared to Those Age 65 or Older

Reason #: Retire Early If You Are Ready To Simplify

Living more frugally is not a necessity in retirement, but if you think that you can simplify your spending, then you can probably retire at 62 or earlier if you really want to.

When you retire, you have the opportunity to prioritize what is important to you and let the rest slip away. Prioritization can help you reduce your spending levels. And, this can be incredibly freeing.

Read Also: What Medications Are Covered By Medicare Part D

Recommended Reading: What Is A Medicare Advantage Plan Ppo

If You Have Retiree Health Benefits

If you have retiree coverage and want to buy a Marketplace plan instead, you can. But:

-

You cant get premium tax credits and other savings based on your income. This is true only if youre actually enrolled in retiree coverage. If youre eligible for but not enrolled in retiree coverage, you may qualify for premium tax credits and lower out-of-pocket costs based on your household size and income.

-

If you voluntarily drop your retiree coverage, you wont qualify for a Special Enrollment Period to enroll in a new Marketplace plan. You wont be able to enroll in health coverage through the Marketplace until the next Open Enrollment period.