Am I Eligible For Medicare Part B

Anyone who is eligible for premium-free Medicare Part A is eligible for Medicare Part B by enrolling and paying a monthly premium. If you are not eligible for premium-free Medicare Part A, you can qualify for Medicare Part B by meeting the following requirements:

- You must be 65 years or older.

- You must be a U.S. citizen, or a permanent resident lawfully residing in the U.S for at least five continuous years.

You may also qualify for automatic Medicare Part B enrollment through disability. If you are under 65 and receiving Social Security or Railroad Retirement Board disability benefits, you will automatically be enrolled in Medicare Part A and Part B after 24 months of disability benefits. You may also be eligible for Medicare Part B enrollment before 65 if you have end-stage renal disease or amyotrophic lateral sclerosis .

NEW TO MEDICARE?

Do I Have To Enroll In Medicare Part B

What if you have other medical coverage, like an employers plan? Do you still have to sign up for Part B?

You can choose to delay Part B enrollment, as some people do when theyre covered under an employers or union-based health insurance plan. However, when that coverage ends, be aware that if you dont sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty.

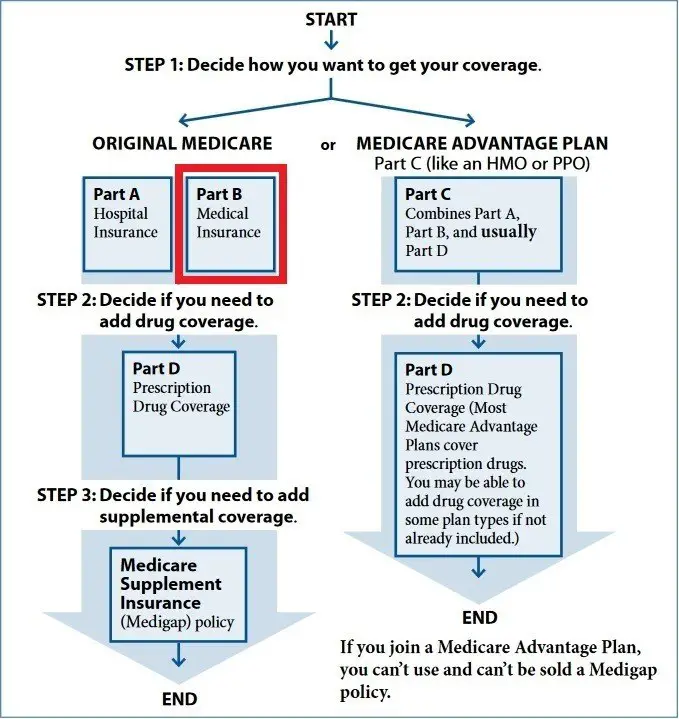

Heres one reason you might want to sign up for Medicare Part B. Suppose you decide youd like to buy a Medicare Supplement insurance plan. Or, you want to enroll in a Medicare Advantage plan. Both of these types of coverage require you to be enrolled in both Medicare Part A and Part B.

If you stay with Original Medicare and decide to sign up for a stand-alone Medicare Part D prescription drug plan, you need to be enrolled in Medicare Part A and/or Part B.

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, youll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

Do you want to learn more about those Medicare coverage options we mentioned? Start comparing plans right away by typing your zip code where indicated on this page and clicking the button.

New To Medicare?

How Much Does Medicare Cost Per Month

The amount that you will pay for Medicare each month will vary based upon your income and the kind of supplemental coverage you choose.

An example would be the base Part B premium of $148.50/month plus a Medigap Plan G monthly premium of $125/month plus a Part D premium of $27/month your total would be $300.50/month in premiums.

With this example you can be sure your additional out-of-pocket spending would be minimal as Plan G would pick up the majority of your out-of-pocket costs.

There are many different Medicare plan options to choose from so that you can have a monthly premium within your budget.

Also Check: Does Medicare Cover Outpatient Mental Health Services

Should I Enroll In Medicare Part D If I Have Fehb Coverage

You generally dont have to sign up for a Part D plan if you are covered through FEHB. The prescription coverage through your FEHB plan may have fewer restrictions than the Part D plans in your area. FEHB plans limit what youll have to pay each year in covered medical and prescription drug costs, but Part D plans do not. If you do sign up for Part D, it will usually be your primary insurer.

If youre eligible for Extra Help, you probably do want to use Medicare Part D, because the co-pays for people with Extra Help pay are typically lower than the costs in FEHB plans. People with the most generous level of Extra Help pay only $3.60 for generics and $8.95 for brand medications in 2020.

Because FEHB is considered creditable coverage, you wont have to pay a late enrollment penalty if you dont take Part D now and decide to enroll in the future.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare ombudsman contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals.

In addition to advocacy work, Josh helped implement federal and state health insurance exchanges at the technology firm hCentive. He also has held consulting roles, including as an associate at Sachs Policy Group, where he worked with insurer, hospital and technology clients on Medicare and Medicaid issues.

How To Sign Up For Medicare Part B

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically be enrolled. Youll receive your Medicare card the month before your birthday. If youre not collecting Social Security benefits, youll need to enroll yourself. You can apply online, over the phone, or in-person.

All beneficiaries will have an Initial Enrollment Period for both Part A & Part B. This period begins three months before the month you turn 65th birthday and ends three months after. If you dont enroll during your Initial Enrollment Period and dont have , you could be subject to a penalty.

You wont pay the penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period. An example would be if you continued working past 65 and had creditable coverage through an employer group health insurance.

Don’t Miss: How Much Can I Make On Medicare

How To Apply For Medicare Part B

If you are already receiving Social Security benefits when you turn 65, you will automatically be signed up for Medicare Part A and Medicare Part B by the Social Security program. Your Part B premium will be deducted from your retirement benefit each month.

If you are not yet collecting Social Security at age 65, you can apply for Medicare coverage online at the Social Security website. You will be billed for your Medicare Part B premium quarterly. You can pay for this with a credit card, debit card or a bank transfer.

To avoid any potential missed payments, you might want to consider enrolling in Medicare Easy Pay, which will automatically deduct your premiums from a bank checking or savings accounts.

If you are still working at age 65 and continue to have coverage through your workplace plan, you may want to delay starting your Medicare Part B coverage. Joanne Giardini-Russell, whose insurance firm specializes in helping people navigate Medicare choices, notes that even if you automatically signed up at 65 because you were already receiving Social Security benefits, you could then opt out, if that made sense.

I often see people who just accept enrollment and start paying the premium, even though they dont need to just yet, says Giardini-Russell.

Before making that choice, be sure to consult a Medicare insurance pro to make sure you are in fact eligible to delay, or you could be slapped with a permanent penalty premium when you do eventually sign up for Part B.

Medicare Premiums Deducted From Social Security Payments

If you have low income and receive Social Security assistance, you may receive premium-free Medicare.

Depending on your income, some people with Social Security benefits may still have to pay for Medicare. However, you can have your Medicare payments automatically deducted from your Social Security benefits.

You will receive a bill in the mail for your Medicare payments, unless one of the following applies to you:

- If you receive Social Security benefits, your payments may be automatically deducted from your benefits.

- If you receive Railroad Retirement benefits, your payments may be automatically deducted from your benefits.

- If you retire from civil services, your payments may be automatically deducted from your annuities

Once you receive your bill, there are a few ways you can pay it. You can pay directly through your bank , you can send in a check or money order, you can pay by debit or credit card by filling in the card information on your bill slip and mailing it back in, or you can sign up for Medicare Easy Pay, a free service which will automatically deduct the premium from your bank account.

Keep in mind that aside from your premiums, you may still have to pay copayments when you visit a doctor or other provider.

Also Check: Can I Get Medicare At Age 62

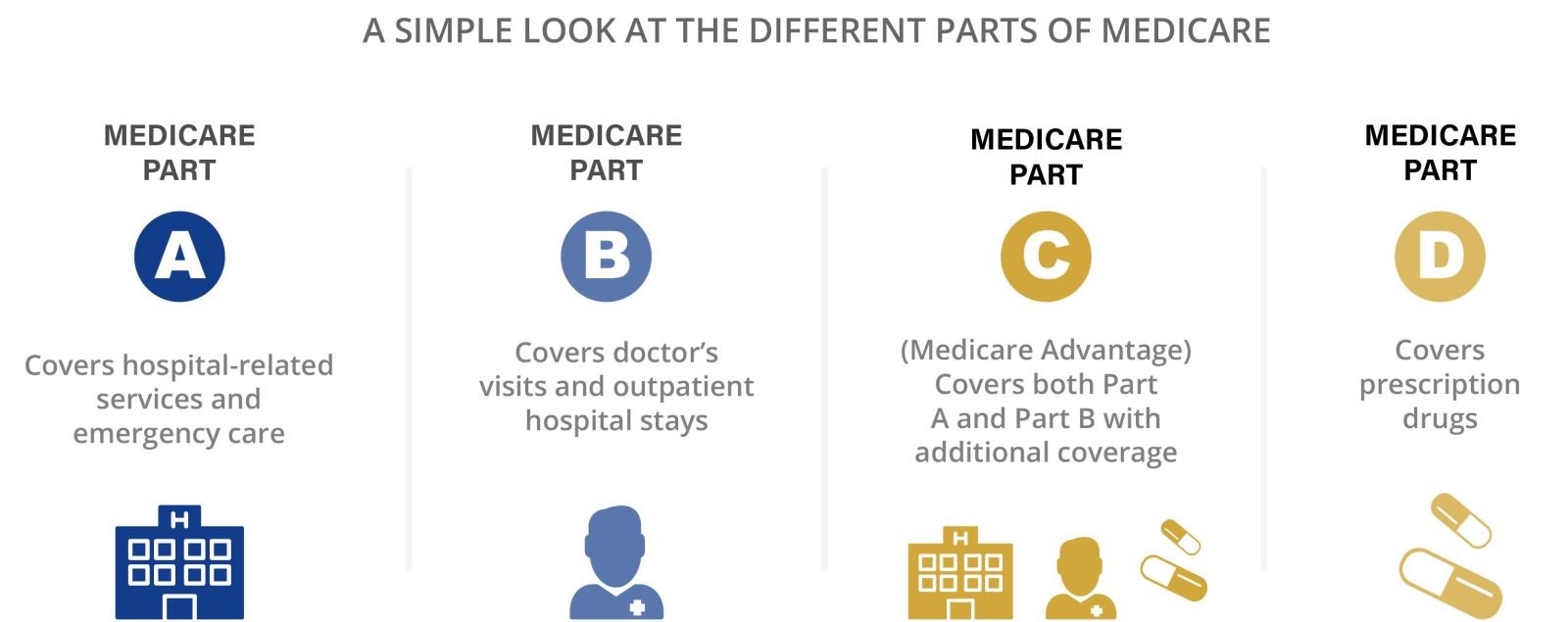

How Does Original Medicare Work

Original Medicare is a federal health care program made up of both Medicare Part A and Part B . Its a fee-for-service plan, which means you can go to any doctor, hospital, or other facility thats enrolled in and accepts Medicare, and is taking new patients.

Medicare was set up to help people 65 and older. In 1972, Medicare became available to people with disabilities and End-Stage Renal Disease/kidney failure.

How Do I Qualify For The Part B Premium Giveback Benefit

You may qualify for a premium reduction if you:

- Are enrolled in Medicare Part A and Part B

- Do not already receive government or other assistance for your Part B premium

- Live in the zip code service area of a plan that offers this program

- Enroll in an MA plan that provides a giveback benefit

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

Don’t Miss: Are Cancer Drugs Covered By Medicare

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Do You Need Medicare If You Have Va Benefits

Are you a veteran with medical coverage through the U.S. Department of Veterans Affairs who is eligible, or nearing eligibility for Medicare coverage? If you already have medical coverage through the VA health program, you may be wondering if you also need to enroll in Medicare. The answer is that you could probably benefit from having both VA benefits and Medicare. The VA encourages you to consider enrolling in Medicare as soon as youre eligible because Medicare and VA benefits dont work together and you may have to pay a penalty if you end up enrolling in Medicare later.

VA health care benefits typically only cover services received at a VA facility, and for Medicare to cover your care, you must visit a non-VA facility that accepts your Medicare coverage. Having coverage through both the VA health program and Medicare gives you wider coverage and more choices of where you can be treated. Therefore, Medicare coverage may be particularly important if, say, you dont live near a VA facility or your local facility has long wait times. With Medicare, youre not limited to being treated at VA facilities you can visit one of the many doctors, hospitals, and facilities that accept Medicare. Follow along to learn more about Medicare and VA benefits.

Recommended Reading: Is Prolia Covered By Medicare Part B Or Part D

Do You Need Medicare Part B

Ever wonder if you really need Medicare Part B? For most people over 65 the answer is: Yes, you need to enroll in Part B and you should do so when first eligible. If you miss your Part B deadline, you could be subject to penalties. Check out our Medicare deadline Calculator here

When to enroll in Medicare Part B largely depends on whether you has qualifying job-based or retirement insurance that can act in place of Part B. If so you may be able to waive Part B due since you have credible coverage through work. If you dont have access to credible coverage from a work or spouse, it is usually recommended that you enroll in Medicare Part B when first eligible .

Even if you have retirement insurance, you may still have to enroll in Part B. Most retirement programs require it. Check with your HR team and confirm your situation. Make sure that if you waive Medicare Part B due to retirement insurance, that you are not subject to Part B penalties if you enroll later.

For those who have retirement coverage, You have 8 months to enroll in Medicare once you stop working OR your employer coverage ends . If you do not enroll in Part B within 8 months of losing your coverage based on current employment, you may have to pay a lifetime late enrollment penalty and have a gap in coverage.

Medicare Part B Deductible

Medicare Part B comes with an annual deductible amount that must be met before coinsurance or copay benefits kick in. In 2021, the deductible amount is $203, meaning after you pay out of pocket for expenses that total $203, cost sharing will begin.

Typically, after you have reached the deductible for the year, you will be required to pay 20% of Medicare Part B approved expenses out of pocket.

For example, say you went to the doctor for a screening that cost you $150 and then also had a therapy visit that cost you $53. The total cost of these medical expenses would add up to $203, meaning you would have met your Medicare Part B deductible. Then, later in the year you had another screening that cost $150. Since this is a qualified Medicare expense, you would pay 20%, or $30 , while Medicare would pay the remaining $120.

Read Also: What Is The Annual Deductible For Medicare Part A

Which Companies Offer Part B Premium Reduction

Humana Medicare Advantage options include the give-back feature on some plans. In some areas, Cigna may also have a Part B premium reduction plan. Even Aetna has a Part B give back in some areas. Further, there are likely more companies offering this type of policy than just the ones weve mentioned. Also, consider the plan ratings before you enroll.

What Is Medicare Part B Buy Back/give Back

Are Medicare Buy Back plans too good to be true?

Can they really put money back into your social security check?

Yes, its offered through SOME Medicare Advantage plans but not all.

Here is how it works.

Some Medicare Advantage plans out there that can buy back your monthly Part B premiums, ultimately putting money back into your pocket. Youve likely seen this on TV, but unfortunately its misleading as this specific benefit is narrowly used by a few plans across the country.

These plans are effectively paying you instead of the other way around! Let me explain.

Recommended Reading: When Can You Apply For Part B Medicare

What Doesnt Medicare Part B Cover

Medicare Part B doesnt cover every possible medical expense. Heres a partial list of what Part B doesnt generally cover.

- Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B.

- Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services.

- Routine dental care

- Routine vision care

- Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting.

- Hearing aids

- 24-hour home health care

- Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesnt generally cover it.

Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

If I’m In The Fehb Should I Enroll In Part A

Most people dont have to pay a premium for Part A. When combined with FEHB coverage, having Part A would limit your out-of-pocket costs for the expenses it covers . Having Part A means you cant contribute to a Health Savings Account , so youd want to delay enrolling in Part A if your FEHB coverage is HSA-qualified and you want to continue making contributions to your HSA.

You can only delay Part A until you begin collecting Social Security at which point your Part A coverage will start automatically. The Office of Personnel Management , which administers the FEHB, recommends taking Part A if you dont have to pay a premium.

Read Also: Does Medicare Part D Cover Shingrix

Will I Pay Less For Fehb Premiums If I Enroll In Medicare

FEHB premiums are not reduced if you enroll in Medicare, but having Medicare Part A and B can allow you to switch to a less expensive version of your current FEHB plan, because some FEHB insurers waive cost sharing when you have Medicare Parts A and B. Contact your FEHB insurer if youre wondering whether your plan waives cost sharing for people enrolled in Medicare.

The decision whether to enroll in Part B often hinges on whether you have to pay more for it because of your income. You pay more for Part B in 2020 if you earn over $87,000 , according to your tax return from two years ago. These higher premiums can range from $202.40/month to $491.60/month. Youll have to gauge how much you are willing to pay in Part B premiums in exchange for lower cost sharing when you visit the doctor.