Paying For A Medicare Advantage Special Needs Plan

Along with having a qualifying medical condition, you must have Original Medicare to be eligible for a Special Needs Plan . Some people who meet these requirements also have Medicaid. For those who have both Medicare and Medicaid, Medicaid helps pay for most of the costs in joining a plan. These costs include premiums, coinsurance, and copayments.

CMS requires that Medicaid pay for copayments and coinsurance for certain people enrolled in MSPs. However, Medicaid is not required to help pay for Medicare Part C insurance premiums. Federal Medicaid laws allow each state Medicaid agency to decide if they will pay Medicare Part C premiums for those enrolled in a MSP as a qualified Medicare beneficiary.

An insurance company can also decide to charge a premium for Part C SNP enrollees who have both Medicare and Medicaid as well as those who dont have both. In this case, you would pay the full Part C premium . SNPs typically have the same basic costs as other Part C plans. This means you could pay around the same average monthly premiums as shown in the table above or maybe even $0 in premiums.

46585-HM-1121

If I Have Part A And Part B Do I Need A Medicare Supplement Plan

If you have Medicare Part A and Part B, you might also consider a Medicare Supplement Insurance plan.

Medigap plans can help cover some of the out-of-pocket costs that Medicare does not cover, such as deductibles, coinsurance and copayments.

Remember that Original Medicare does not have an out-of-pocket spending limit. This means that in the case of a serious illness, Medicare copayments and deductibles can add up quickly.

Do I Need Medicare Part B If Im A Veteran

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of Medicare are one group. The most common situation though is with Veterans.

Not all veterans qualify for VA coverage. Your length of military service and your discharge characterization affect your eligibility. If you plan to use VA healthcare coverage as your only coverage, be sure that you apply for VA coverage before your initial enrollment window for Medicare expires. That window runs 3 months before and after your birth month.

Once enrolled in VA coverage, you can choose to skip Medicare and get all of your care at VA clinics and hospitals only. However, I do not advise this. The VA system has been the subject of considerably negative press for years over long waiting times. I have seen many people personally experience this.

Enrolling in Medicare Parts A and B gives you a civilian option. Medicare will pay for Medicare-covered services or items, and Veterans Affairs will pay for VA-authorized services or items.

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. Youll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active.

In my opinion, most Veterans should sign up for Part B. You can read more about VA coverage and Medicare here.

You May Like: What Is The Best Medicare Supplement Plan In Arizona

How Can My Medicare Part C Plan Have A $0 Premium

Medicare Advantage plans with $0 premiums are not uncommon. In fact, it was predicted that 96% of Medicare enrollees would have at least one choice for a zero-premium plan in 2021, according to the Kaiser Family Foundation.4 You may be wondering, how can an insurance company have $0 premiums? Thats a great question. And its easy to explain. This is how the process works:

Its important to remember that, although you may pay $0 in premiums for Medicare Advantage, this does not mean that the plan is free. You still have to pay your Part B premium, annual deductible, copayments, and coinsurance for your Part C plan.

Is Medicare Mandatory When Youre First Eligible

If youre still working when you turn 65, or you become eligible through disability, you may be covered under your employers group plan. Or maybe your spouse has an employment-based or union-based group health plan that covers you. You usually dont have to enroll in Medicare right away if you have a group health plan.

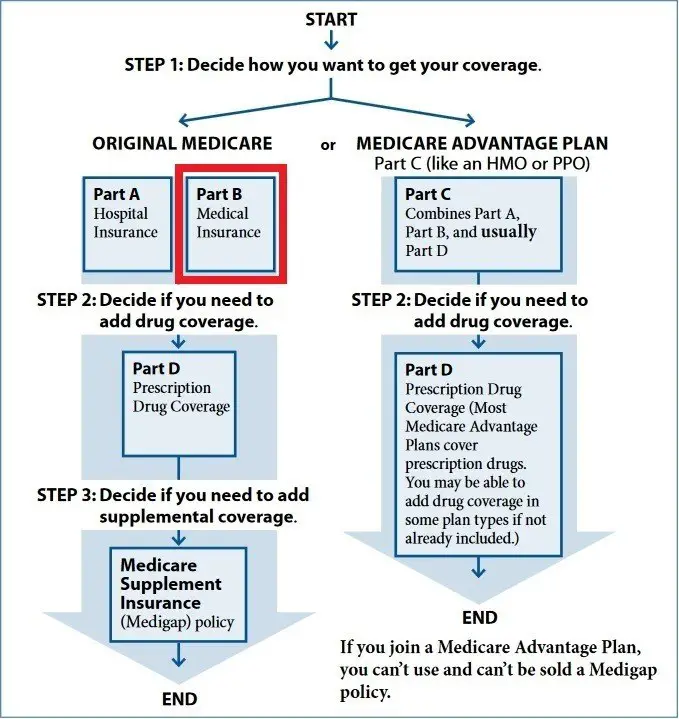

Traditional Medicare refers to Medicare Part A, which is hospital insurance, and Part B, which is medical insurance. Part A can be premium-free if youve worked and paid taxes long enough. If you qualify for premium-free Medicare Part A, theres little reason not to take it.

In fact, if you dont pay a premium for Part A, you cannot refuse or opt out of this coverage unless you also give up your Social Security or Railroad Retirement Board benefits. Youd also have to pay back your previous benefits to the government.

Don’t Miss: Is Medicare Enrollment Required At Age 65

Medicaid Part B Reimbursement Options

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.

Medicare Part A: Hospital Insurance

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,556 deductible in 2022.

Services covered under Part A may include surgeries, inpatient care in hospitals, skilled nursing facilities, hospice care, home healthcare services, and inpatient care in a religious non-medical healthcare institution.

This sounds straightforward, but it’s not. For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility.

Additionally, if you’re hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day’s expenses. If you’re admitted to the hospital multiple times during the year, you may need to pay a deductible each time.

Read Also: How Long Does It Take For Medicare To Become Effective

Should I Enroll In Medicare Part D If I Have Fehb Coverage

You generally dont have to sign up for a Part D plan if you are covered through FEHB. The prescription coverage through your FEHB plan may have fewer restrictions than the Part D plans in your area. FEHB plans limit what youll have to pay each year in covered medical and prescription drug costs, but Part D plans do not. If you do sign up for Part D, it will usually be your primary insurer.

If youre eligible for Extra Help, you probably do want to use Medicare Part D, because the co-pays for people with Extra Help pay are typically lower than the costs in FEHB plans. People with the most generous level of Extra Help pay only $3.60 for generics and $8.95 for brand medications in 2020.

Because FEHB is considered creditable coverage, you wont have to pay a late enrollment penalty if you dont take Part D now and decide to enroll in the future.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare ombudsman contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals.

In addition to advocacy work, Josh helped implement federal and state health insurance exchanges at the technology firm hCentive. He also has held consulting roles, including as an associate at Sachs Policy Group, where he worked with insurer, hospital and technology clients on Medicare and Medicaid issues.

How Do I Qualify For The Part B Premium Giveback Benefit

You may qualify for a premium reduction if you:

- Are enrolled in Medicare Part A and Part B

- Do not already receive government or other assistance for your Part B premium

- Live in the zip code service area of a plan that offers this program

- Enroll in an MA plan that provides a giveback benefit

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

Recommended Reading: Does Medicare Cover Full Body Scans

Medicare Advantage Vs Medigap

People who only have Medicare Parts A, B, and D may incur sizable bills not covered by Medicare. To close these gaps, recipients can enroll in some form of Medigap insurance or in a Medicare Advantage plan .

One important thing to know about Medigap: It only supplements Medicare and is not a stand-alone policy. If your doctor doesn’t take Medicare, Medigap insurance will not pay for the procedure.

Insurance agents are not allowed to sell Medigap to participants of Part C, Medicare Advantage.

Medigap coverage is standardized by Medicare but offered by private insurance companies. According to, Patrick Traverse, founder of MoneyCoach, Mt. Pleasant, S.C.,

“I recommend that my clients purchase Medigap policies to cover their needs. Even though the premiums are higher, it is much easier to plan for them than what could be a large out-of-pocket outlay they might have to face if they had lesser coverage.”

Medicare Part C: Medicare Advantage

Also known as Medicare Advantage, Part C is an alternative to traditional Medicare coverage. Coverage normally includes all of Parts A and B, a prescription drug plan , and, depending on your choice of a Medicare Advantage plan, other possible benefits.

Part C is administered by Medicare-approved private insurance companies that collect your Medicare payment from the federal government.

Depending on the plan, you may or may not need to pay an additional premium for Part C. You still need to pay your Medicare Part B premium. You don’t have to enroll in a Medicare Advantage plan, but for many people, these plans can be a better deal than paying separately for Parts A, B, and D. Beneficiaries will still pay separate premiums if they don’t choose to have the Part “C/D” premium taken out of their Social Security check.

If you’ve been pleased by the coverage of a Health Maintenance Organization , you might find similar services using a Medicare Advantage plan.

Read Also: What Does Part B Cover Under Medicare

How Much Are Medicare Part A Premiums In 2020

If you do have to pay Part A premiums in 2020, youll pay either $252/month or $458/month . These premiums are adjusted annually.

Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year . For 2020, the threshold for having to pay higher premiums based on income increased. .

People who dont enroll in Medicare B when first eligible are charged a late enrollment penalty that amounts to a 10 percent increase in premium for each year they were eligible for Medicare B but not enrolled. So if you wait until three years after youre eligible to enroll, youll pay 30 percent more than the standard premium for Medicare B, for as long as you have the coverage. But this penalty does not apply if you delayed your Part B enrollment because you had employer-sponsored coverage from a current employer and used that coverage instead of Part B.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

How Much Medicare Part B Pays

When all medical bills are added up, on average Medicare pays for only about half the total. There are three reasons for this. First, Medicare does not cover all major medical expenses for example, it doesn’t cover routine physical examinations, some medication, glasses, hearing aids, dentures, and some other costly medical services.

Second, Medicare pays only a portion of what it decides is the proper amountcalled the approved chargesfor medical services. In addition, when Medicare decides that a particular service is covered and determines the approved charges for it, Part B medical insurance usually pays only 80% of those approved charges you are responsible for the remaining 20%.

Third, the approved amount may seem reasonable to Medicare, but it is often considerably less than what the doctor actually charges. If your doctor or other medical provider does not accept assignment of the Medicare charges, you are personally responsible for the difference.

Read Also: Does Plan N Cover Medicare Deductible

What Is Medicare Supplement

A Medicare Supplement insurance plan, sold by private companies, can help pay some of the out-of-pocket health-care costs that Medicare Part A and Part B dont pay, such as coinsurance, copayments, and deductibles. Some Medicare Supplement insurance plans may also help with costs of emergency medical care outside of the U.S. However, a Medicare Supplement insurance plan cannot be used to pay another plans premium, or to pay your Medicare Part A or Part B premium.

Similarly, Medicare doesnt pay for a Medicare Supplement insurance plan. If you have a Medicare Supplement insurance plan, you will need to pay the private insurance company for your Medicare Supplement premium as well as pay Medicare for your monthly Part B premium. If you receive Social Security benefits, in most cases your Part B premium is automatically deducted from your benefit payment.

Will I Pay Less For Fehb Premiums If I Enroll In Medicare

FEHB premiums are not reduced if you enroll in Medicare, but having Medicare Part A and B can allow you to switch to a less expensive version of your current FEHB plan, because some FEHB insurers waive cost sharing when you have Medicare Parts A and B. Contact your FEHB insurer if youre wondering whether your plan waives cost sharing for people enrolled in Medicare.

The decision whether to enroll in Part B often hinges on whether you have to pay more for it because of your income. You pay more for Part B in 2020 if you earn over $87,000 , according to your tax return from two years ago. These higher premiums can range from $202.40/month to $491.60/month. Youll have to gauge how much you are willing to pay in Part B premiums in exchange for lower cost sharing when you visit the doctor.

Also Check: Will Medicare Pay For Liposuction

You Need Part B To Be Eligible For Supplemental Coverage

Medigap plans do not replace Part B. They pay secondary to Part B.

Part B works together with your Medigap plan to provide you full coverage. This means you must be enrolled in Part B before you are even eligible to apply for a Medicare supplement. Your healthcare providers will bill Medicare, and Part B will then pay 80% of your outpatient expenses after your small deductible. Medicare then sends the remainder of that bill to your Medigap plan to pay the other 20%.

The same goes for Medicare Advantage plans. You are not eligible for a Medicare Advantage plan unless you are enrolled in both Medicare Parts A and B and live in the plans service area.

On the flip side, having ONLY Parts A and B with no secondary coverage is also very risky. It leaves you exposed to paying 20%, unending, or some very expensive items. For example, if you needed a knee replacement and had only Medicare, you would pay 20%. A surgery like that might cost in excess of $100,000. Dont be left holding a bill for 20% of that.

My advice: You should enroll in both Part B and either a Medigap plan or Medicare Advantage plan.

How Much Medicare Part B Will Pay

In addition to the monthly Part B premium, you may have to pay other costs for the services described above. Medicare has rules about how much it will pay for each of the Part B services.

Medicare will pay the entire costs of some services, like flu shots.

For other services, like mental health, Medicare will pay for 80% of the cost.

For most services, Medicare will pay for 80% while you pay the remaining 20% . This is called coinsurance.

For most Part B services, Medicare will help pay only after youve spent a certain amount of money for the year on medical services. This is the yearly deductible, and its $233 in 2022.

Medicare may help pay for occupational therapy to help you return to daily living activities.

Lets say that you havent received any medical services for the year and your doctor prescribes occupational therapy at a cost of $333 .

Since you havent paid your deductible yet, you would have to pay the first $233.

After that, theres still $100 left to pay . And since coinsurance applies, Medicare would pay for 80% of the remaining $100. So Medicare would pay $80 and youd pay another $20.

Lets say later in that same year, you are having balance problems and your doctor decides you need a balance exam. This is also covered by Medicare. But since you have already paid your $233 deductible for the year, you would only need to pay coinsurance for this exam.

Don’t Miss: Is Medicare Solutions A Legitimate Company