Medicaid Expansion Also In Danger

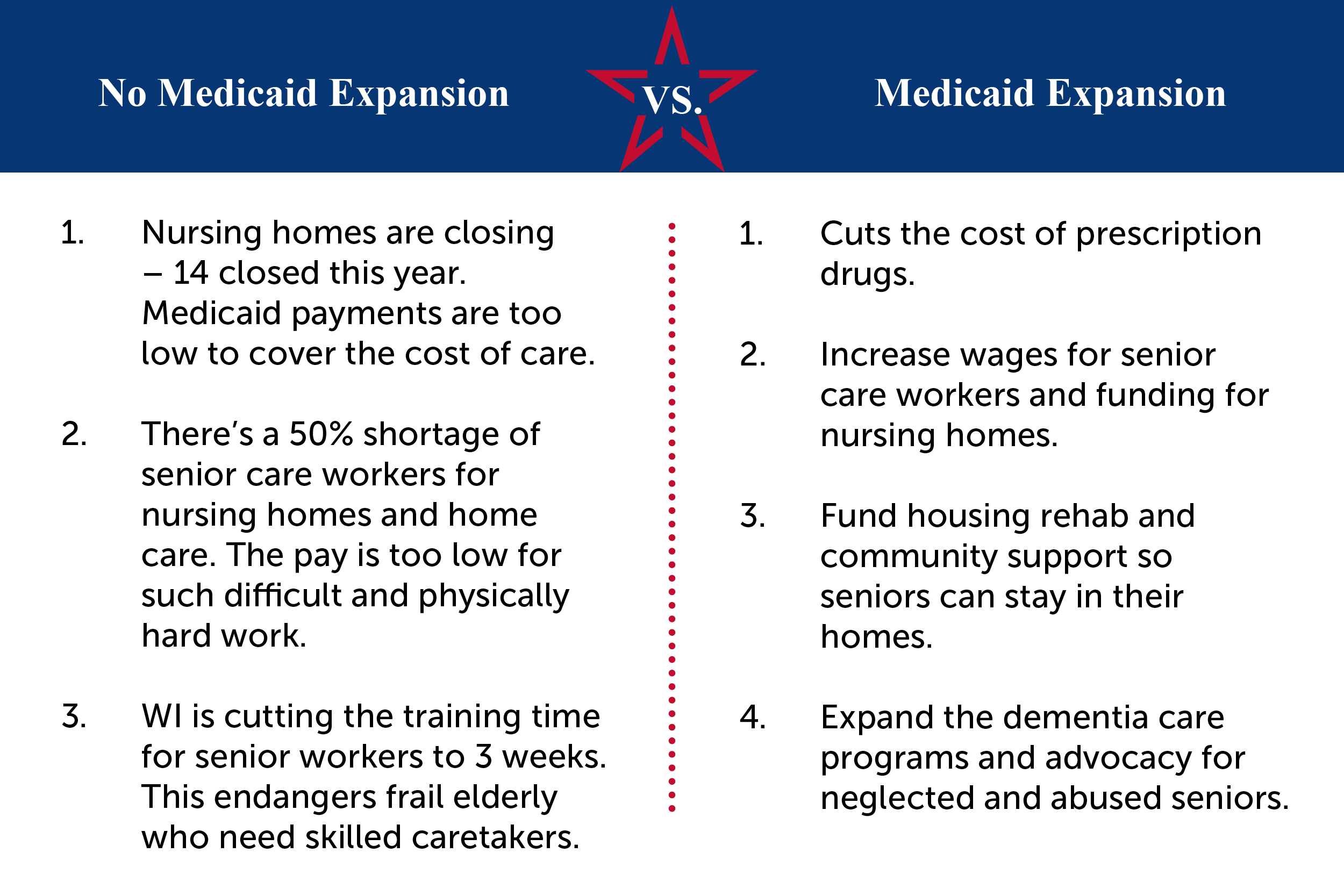

Other health-care costs are also on the chopping block. Plans to expand Medicaid to close a coverage gap for low-income Americans in states that did not expand the program under the Affordable Care Act may also be cut the proposal would cost roughly $300 billion over the next decade.

As of October, there are 12 states that have not adopted the Medicaid expansion, according to the Kaiser Family Foundation, limiting coverage for residents and especially those without children. Closing the coverage gap would mean more than 4 million adults would become eligible for Medicaid.

Of course, details of what is in and out of the reconciliation bill will likely change as negotiations continue. While Democrats had hoped to reach a deal this week, it’s still unclear that they’ll be able to stick to that timeline.

What Is Medicaid Expansion

A provision in the Affordable Care Act called for the expansion of Medicaid eligibility in order to cover more low-income Americans. Under the expansion, Medicaid eligibility would be extended to adults up to age 64 with incomes up to 138% of the federal poverty level .

Pre-ACA, Medicaid was generally never available to non-disabled adults under age 65 unless they had minor children. And even then, the income caps to qualify as a parent/caretaker were very low. By expanding Medicaid, the ACA created a viable pathway to coverage for millions of low-income adults.

Seniors’ Teeth Need Dental Care But Insurance Coverage Is Rare

Indeed, in the 1980s and ’90s, Medicare spending was more often restrained than expanded. A series of budget reconciliation bills trimmed millions of dollars out of Medicare usually at the expense of payment to doctors, hospitals and other health providers.

As the years wore on, Medicare has remained popular with recipients, though it has grown less generous than most private insurance policies. Many Medicare patients have beenable to find supplemental coverage to fill in what Medicare doesn’t cover, through private “Medigap” policies, through employer-provided retiree plans or, for those with low incomes,through Medicaid. Increasingly popular in recent years have been those Medicare managed-care plans, now known as Medicare Advantage, that were first authorized in 1982 and often provide extra benefits for members.

All of that “has taken some of the pressure off” lawmakers to expand the program, Oberlander says.

And a final reason that vision, hearing and dental care have not been added to standard Medicare plansis that they are far from the most critical gaps in Medicare’s benefit package.

Also, as previously mentioned, traditional Medicare includes no limits on patient cost sharing the percentage or amount of a medical bill that a beneficiary must pay. Its basic hospital benefit runs out after 90 days, and the 20% coinsurance on outpatient care runs indefinitely.

Recommended Reading: How To Apply For Medicare Card Replacement

Hundreds Of Billions In Savings

Adding dental, hearing, and vision benefits to traditional Medicare through the reconciliation bill could make Medicare Advantage plans less attractive to consumers, cutting into private insurers profits. Such an expansion of the national insurance program would likely cost the federal government more than $350 billion over the next ten years.

However, a proposal to include those benefits in Medicare without increasing the rate at which the government reimburses Medicare Advantage plans could cut that cost by 41 percent, according to a recent analysis by Matthew Fiedler, an economist at the USC-Brookings Schaeffer Initiative for Health Policy and former chief economist on President Barack Obamas Council of Economic Advisors. With corporate Democrats demanding a smaller reconciliation bill, such a drastic cost savings should, in theory, be a very attractive move.

Most of the federal savings from excluding the cost from the benchmark would be coming out of reduced plan profits, Fiedler told the Daily Poster.

More than 98 percent of Medicare Advantage plans already offer dental, vision, and hearing benefits. While some of those plans could be required to improve their dental, vision, and hearing benefits to meet the new proposed standards for traditional Medicare, and a few would be required to expand their coverage to include those benefits, the plans can afford to do so without the government increasing the benchmark, Fiedler explained.

Childrens Health Insurance Program And Medicaid Coverage Improvements

Federal CHIP funding would be made permanent. In addition, other CHIP-related provisions would be made permanent, such as the pediatric quality measures program and the contingency fund to provide states with assistance in the event their CHIP state allotment is insufficient. States would be provided an option to increase CHIP income eligibility levels above the existing statutory ceiling, which is currently tied to Medicaid income levels. The bill also creates a drug rebate program similar to the Medicaid rebate program in order to lower the cost of prescription drugs for CHIP. The new rebate program strictly prohibits duplicate discounts for any drug purchased through the 340B program. In addition, children under the age of 19 will be provided one-year continuous eligibility for Medicaid and CHIP coverage. There also is Medicaid coverage available to justice-involved individuals 30 days prior to their release.

Recommended Reading: Does Medicare Pay Anything On Dental

Worsening Medicares Financial Condition

Medicare, serving 61.2 million beneficiaries, is the nations largest payer for health care benefits and services. Beneficiaries premiums cover only 15 percent of the programs total cost taxpayers cover the rest.REF Based on Bidens budget submission for FY 2022, compared to last years spending of $884 billion, the total cost of the program is projected to reach $995 billion an increase of $111.7 billion in just one year.REF

Big New Costs. Beyond current taxpayer burdens, independent analyses indicate the cost increases generated by a Medicare expansion could be substantial. Writing in the Journal of the American Medical Association, Dr. Zirui Song, Professor of Health Policy at Harvard Medical School, estimates that the annual cost of the Biden proposal could range between $40 billion and $100 billion, depending on the details.REF

Whether new tax burdens are imposed through payroll taxes to resupply the depleting Medicare trust fund or bigger income tax increases are imposed to fund heftier general revenue transfers from the Treasury, the impact on the taxpayers pocketbook is the same. Taxpayers already face the prospect of bailing out an insolvent Medicare HI trust fund in 2026, possibly even earlier. Without an infusion of fresh taxpayer cash, the program will not be able to pay all its promised benefits. Rebalancing the trust fund, as the Medicare trustees warn, would require another payroll tax hike or a benefit reduction, or some ugly combination of both.REF

What Is In The Medicare Expansion

Medicare was first introduced in 1965 for people ages 65 and over, regardless of income, medical history, or health status. Over the years it has been expanded and now provides healthcare to over 60 million older people and younger people with disabilities. However, it is far from exhaustive and certain services are only covered through private healthcare insurance policies or Medicare Advantage plans.

Democrats after taking control of the White House and Senate and maintaining control of the House saw an opportunity to fill in some of the gaps in coverage. Earlier this year President Biden called on Congress to pass his Build Back Better plan which included expanding Medicare to cover dental, hearing and vision. These measures were as part of the original proposals for the $3.5 trillion resolution spending bill that Democrats plan to push through Congress without GOP support.

Medicare should cover your eyes, ears, and teeth. Its that simple.Its time to finally expand Medicare and guarantee seniors FULL coverage.

Rep. Pramila Jayapal

However, Senator Joe Manchin has been using the clout of his crucial vote in the Senate to force his colleagues to bring down the cost of the care economy and climate change combating bill. His latest focus is to remove the proposed expansions stating worries about the potential insolvency of Medicare by 2026.

You May Like: Can Medicare Take Your House

Missouri Medicaid Expansion Brings Quality Essential Health Coverage To More Than 275000 Missourians

Biden-Harris Administration Encourages Eligible Missourians to Apply for Coverage

The Centers for Medicare & Medicaid Services announced today that approximately 275,000 Missourians are now eligible for comprehensive health coverage, thanks to Medicaid expansion under the Affordable Care Act. Through the American Rescue Plan , Missouri will be eligible to receive an estimated $968 million in additional federal funding for its Medicaid program over the next two years.

Free or low cost health coverage is now available to Missourians in many cases for the first time. For example, a single adult making up to $17,774 a year, or a family of 4 making up to $36,750 a year, may qualify for Medicaid through MO HealthNet. This includes parents who have not qualified before, as well as adults without children.

Hundreds of thousands of Missourians can now gain the peace of mind of having health coverage through Medicaid, said Health and Human Services Secretary Xavier Becerra. This is a win for all Missourians who have fought long and hard to gain their rightful access to quality health insurance made possible through the Affordable Care Act. As we celebrate Missouris Medicaid expansion, the Biden-Harris Administration will double down on our outreach efforts to urge the remaining twelve states to join the rest of the nation in ensuring access to health care during this critical time.

Expanding Medicare Part Of The Sweeping Care Economy Bill Congressional Democrats Are Hammering Out Has Become A Sticking Point In Negotiations

Democrats are trying to reach a deal on reshaping Americas safety net, combating climate change and creating a fairer tax code. Expanding Medicare has become a point of contention in the intra-party negotiations and could be yet another measure that gets stripped from the final bill.

Centrist Democratic Senator Joe Manchin has stated that he wants to stabilize the program before there is any expansion. However, progressive members of the party are drawing a line in the sand demanding that the provisions set out in the bill must stay in order for there to be any deal.

You May Like: Can You Get Medicare At 60

Apply For Medicaid Coverage Even If Your State Hasnt Expanded

Even if your state hasn’t expanded Medicaid and it looks like your income is below the level to qualify for financial help with a Marketplace plan, you should fill out a Marketplace application.

Each state has coverage options that could work for you particularly if you have children, are pregnant, or have a disability. And when you provide more detailed income information you may fall into the range to save.

How Effective Is Medicaid

Medicaid is very effective in providing health insurance coverage to the most vulnerable. Since the ACAs major coverage expansions took effect in 2014, Medicaid has helped to reduce the number of uninsured from 45 million to 29 million. If Medicaid did not exist, most of the tens of millions of Medicaid enrollees would be uninsured. This is because private health insurance is generally not an option for Medicaid beneficiaries: many low-income workers do not have access to coverage for themselves and their families through their jobs and cannot afford to purchase coverage in the individual market. The creation of Medicaid, subsequent expansions of Medicaid coverage to children and pregnant women in the 1980s and 1990s, and the most recent expansion of Medicaid coverage to low-income adults under the ACA all have led to significant drops in the share of Americans without health insurance coverage.

Medicaid is also effective in improving access to care, in supporting financial stability among low-income families, and in improving health outcomes. Some of the clearest evidence comes from the ACA expansion of Medicaid coverage to low-income adults, which provides a recent natural experiment, letting researchers compare outcomes in states that did and did not adopt the expansion.

You May Like: Are Medicare Advantage Plans Hmos

Limiting The Cost Of Medicare Expansion

As Congress negotiates proposals for Medicare benefit expansions, it should consider ways to limit their costs by either dropping the expansions entirely or making sensible adjustments to the reforms that align them with the rest of the Medicare program. One of the more promising ways to do so would be to ensure the expansion does not further increase payments to Medicare Advantage private plans, which we’ve shown are already receiving overpayments.

The House Ways and Means Committees portion of the reconciliation package would expand Medicare to include vision, hearing, and dental benefits beginning in 2022, 2023, and 2028, respectively.

Though many seniors already have access to these types of benefits through Medicaid or Medicare Advantage plans, the Congressional Budget Office has estimated that expanding the benefits to everyone with no premium would cost over $80 billion per year when fully phased in more than the combined average annual cost of President Bidens proposals to extend Affordable Care Act premium subsidy enhancements from the American Rescue Plan, provide for universal pre-K, fund tuition-free community college, and support affordable child care.

Increasing Incentives To Drop Employer Coverage

If a Medicare expansion proposal were crafted to include persons enrolled in group coverage, of course employers would be strongly tempted to stop covering older workers. Ending group coverage would secure significant short-term financial benefits for businesses or corporations, especially with the elimination of coverage for older workers and their spouses. Health care utilization and spending climb as one progresses the age scale, particularly with the onset of chronic medical conditions that often accompany aging: The contrasts in costs and utilization between older and younger workers is thus dramatic.

The Health Care Cost Institute, an independent research organization, details these patterns in a comprehensive 2019 study on employment-sponsored insurance. According to the Institutes report, in 2017, 40.4 percent of persons ages 19 to 25, for example, experienced no insurance utilization, while only 15.8 percent of persons ages 55 to 64 were in that category.REF These patterns are reflected in dramatic differences in annual employer insurance spending. For persons covered under employer-based insurance, the average spending per person was $5,641, but for those ages 55 to 64, the per-person spending amounted to $10,476.REF

Don’t Miss: Does Medicare Part C Cover

How Does Medicaid Provide Financial Assistance To Medicare Beneficiaries In Arizona

Many Medicare beneficiaries receive help through Medicaid with paying for Medicares premiums, programs that lower prescription drug costs, and services Medicare doesnt cover such as long-term care.

Our guide to financial assistance for Arizona Medicare enrollees explains these benefits, including Medicare Savings Programs, long-term care benefits, Extra Help, and eligibility guidelines for assistance.

Other Related Health Insurance Marketplace Provisions

The legislation would establish a new health insurance affordability fund available to all states to provide assistance in reducing health care premiums and out-of-pocket costs through reinsurance programs, which would be funded at $10 billion annually from 2023 through 2025. The Centers for Medicare & Medicaid Services also is directed to implement a temporary reinsurance program in non-Medicaid expansion states. In addition, cost-sharing reductions would be extended through 2025 for individuals with income up to 150% of the federal poverty level receiving unemployment.

You May Like: Is Keystone 65 A Medicare Advantage Plan

What Is Medicare Expansion

Medicare expansion refers to broadening the benefits of the program, as the parts in which beneficiaries enroll through the government provide limited coverage. Throughout the years, extensions of the program have been uncommon, with one of the most notable instances being coverage of disabled individuals under 65.

Original Medicare consists of hospital insurance and outpatient insurance, including preventive care . These parts dont pay for dental, vision, or hearing services nor do they include prescription drugs that beneficiaries take at home.

To obtain these benefits, someone on Medicare would also need to purchase a Part D prescription drug plan, along with an ancillary policy for dental, vision, and hearing. Or, they could go with Part C if they find a suitable Medicare Advantage plan option in their area.

Additionally, Medigap plans are another type of supplemental insurance. These plans cover the coinsurance costs that come with Original Medicare.

Supplemental policies through private insurance companies, along with Medicaid for those eligible, help keep expansion on the backburner. Yet, the coverage gaps go beyond what the aforementioned policies include.

Chiefly, Medicare doesnt include long-term custodial care. Numerous Americans require these daily services late in life, and the costs can quickly add up even when they have additional policies.

Who Would Be Impacted

According to Avalere, a prominent Washington, DCbased health policy research firm, opening the Medicare program to persons between the ages of 60 and 64 could shift an estimated 24.5 million persons from existing health insurance coverage into the Medicare program.REF Of that number, 14.9 million are covered by employment-based health insurance. Of this number, 4.1 million people have coverage in the individual health insurance markets, and only 2 million of this target population are uninsured.REF

In short, depending on the dynamics of the target populations response to the proposal, including the response of their employers, the proposal would have minimal impact on reducing the number of the uninsuredbut would have an enormous impact on private and employer-based health insurance coverage.

Individual Coverage. In measuring the proposals impact, the Avalere analysts focus primarily on health plans in the health insurance exchanges created under the Affordable Care Act of 2010 . As these analysts note, there are several complicated trade-offs in moving from ACA coverage to Medicare. Persons would have to navigate differences in benefits, out-of-pocket and premium costs, and access to provider networks. There would inevitably be winners and losers in such a transition.

Also Check: Do You Have To Resign Up For Medicare Every Year

Medicaid Transformation Vs Expansion Whats The Difference

Blog | September 10, 2019

With Medicaid transformation on the horizon, and Medicaid expansion a major issue of debate in the North Carolina General Assembly , all things Medicaid have been hot topics among health care leaders, state policymakers, and affected consumers. With both happening at the same time, it is important to delineate their differences. Below is an overview of the debate concerning Medicaid expansion and a breakdown of what is going on with Medicaid transformation in North Carolina.

Medicaid Expansion

Since the passage of the Affordable Care Act in 2010, states have been given the option to expand coverage of Medicaid to low-income adults at or below 138% of the federal poverty level. So far, 36 states and the District of Columbia have expanded Medicaid coverage to low-income, working-age adults who would not have qualified for the program under previous Medicaid eligibility requirements.

Medicaid Transformation

Below are the changes coming to North Carolina Medicaid with the transition to managed care:

- Approximately 1.6 million of North Carolinas 2.2 million Medicaid and health Choice program beneficiaries will be enrolled in a standard plan.

- Those enrolled in the standard plan will be provided integrated physical health, mental health, and behavioral health care through PHPs.

- The following statewide entities will manage the PHPs: