The Average Cost Of Medicare In Every State

New to Medicare? Compare Medicare plan costs in your area.

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Original Medicare has standardized 2021 costs that are the same in every state.

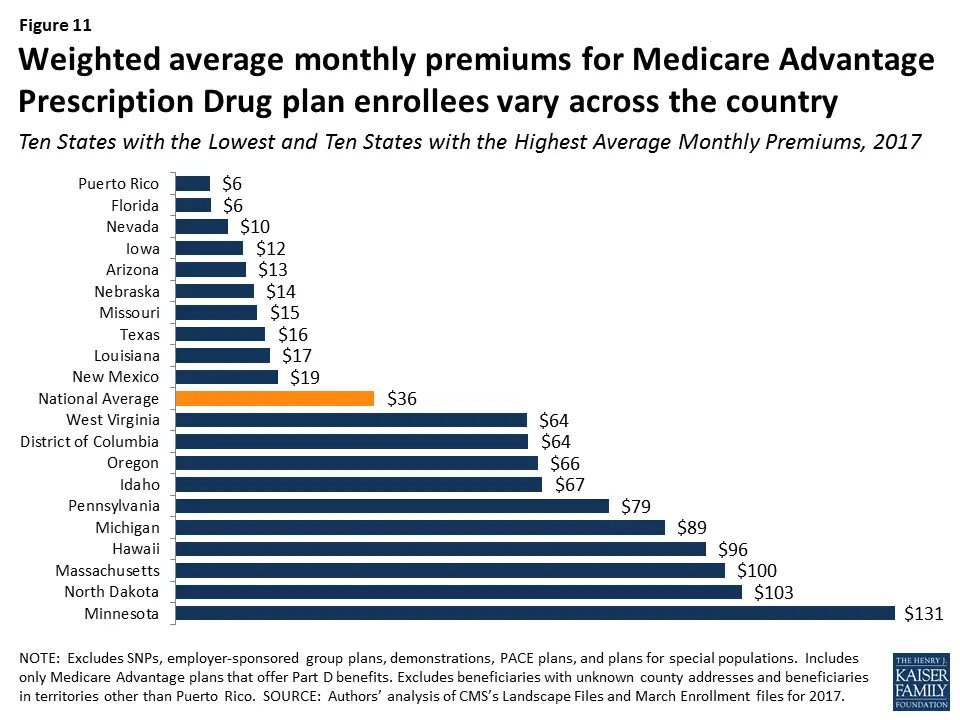

But the average cost of Medicare Advantage plans , Medicare prescription drug plans and Medicare Supplement Insurance plans can vary according to a number of factors, including where you live.

What Is A Zero

A zero-premium plan is a Medicare Advantage plan that has no monthly premium. In other words, you dont pay anything to the insurance company each month for your coverage. Thats in comparison with the average Medicare Advantage premium of $23/month in 2020. . If you have a zero-premium plan, you pay $0/month instead.

Other Medicare Advantage Plan Costs

The cost of your Medicare Advantage plan will depend on a variety of factors, including:

- How much you pay for each service or doctor visit .

- Whether the plan has a yearly deductible that you must meet before it provides coverage.

- What type of services you require and how often you require them.

- Whether you enroll in a plan with additional benefits such as routine vision, dental, or prescription drug coverage.

- Your out-of-pocket prescription drug costs

- How much the plans maximum out-of-pocket limit is for covered medical services.

- Whether you will be required to receive care from in-network health-care providers or whether you can use non-network providers .

Medicare Advantage plans determine cost-sharing requirements for covered services, and each plan sets its own coinsurance percentages and terms. So its a good idea to shop around and compare plan options to find coverage that fits your budget and offers the best value.

Keep in mind that Medicare Advantage plan costs may change from year to year, so its important to review your coverage annually to make sure its still meeting your needs. If you need help finding Medicare Advantage plan options that fit your budget, contact eHealth to speak with a licensed insurance agent today.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

You May Like: Is Unitedhealthcare A Medicare Advantage Plan

As The Popularity Of Private Health Insurance Coverage Grows A Broker Makes The Case For Original Medicare

CDPHP health plan in upstate New York is working with Mom’s Meals to offer home-delivered meals at no cost to Medicare Advantage members returning home from the hospital.

Consumers and insurers love Medicare Advantage plans. The federal government has also touted the benefits of the private health insurance coverage for those 65 and older.

Insurers are all-in on medical, supplemental and wellness offerings and are doing well financially in a market only expected to grow as baby boomers retire.

In a recent Morning Consult poll, beneficiaries reported near-universal satisfaction with Medicare Advantage’s coverage and provider networks, the latter being the often-cited drawback of the plans which have been compared to the narrow network HMO plans of the 1980s.

It’s hard to argue with MA’s lower, and sometimes zero-premium, supplemental benefits for vision, dental and wellness and now telehealth coverage.

But North Shore Insurance Brokers managing partner, Ina Goldberg, does take issue, making the argument for original Medicare over a Medicare Advantage plan.

WHY THIS MATTERS

Goldberg, whose business is in Chicago, specializes in selling Medicare supplemental plans, which cost beneficiaries money out of their Social Security payments.

Through a Medicare Advantage plan, premiums are lower, and sometimes free, and will also likely include benefits for vision and dental, something original Medicare doesn’t offer.

THE LARGER TREND

Premiums Paid By Medicare Advantage Enrollees Have Declined Slowly Since 2015

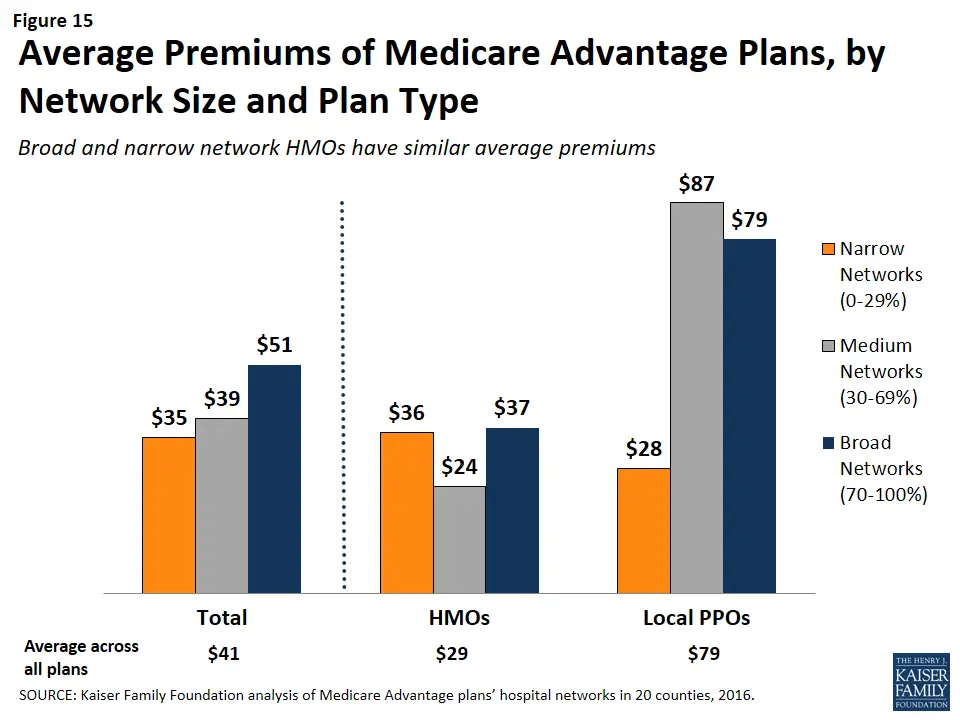

Average Medicare Advantage Prescription Drug premiums declined by $4 per month between 2020 and 2021, much of which was due to the relatively sharp decline in premiums for local PPOs, which fell by $7 per month. Since 2016, enrollment in local PPOs has increased rapidly as a share of all Medicare Advantage enrollment, corresponding to broader availability of these plans. Average premiums for HMOs declined $2 per month, while premiums for regional PPOs increased $1 per month between 2020 and 2021.

Average MA-PD premiums vary by plan type, ranging from $18 per month for HMOs to $25 per month for local PPOs and $48 per month for regional PPOs. For all MA-PDs, the monthly premium is $21 per month for both Part A and Part B benefits and Part D prescription drug coverage . Nearly two-thirds of Medicare Advantage enrollees are in HMOs, 35% are in local PPOs, and 4% are in regional PPOs in 2021.

You May Like: Does Medicare Cover Rides To The Doctor

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Until recently, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C and F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

What Is Medicare Advantage

Until 1997, the original Medicare program was the only game in town. Enrollees signed up and the government paid their health care expenses. That year, the government rolled out a second option that is now known as Medicare Advantage.

With Medicare Advantage plans, the government pays a flat fee per enrollee to a private insurance company, which then delivers the same core benefits as Medicare and is responsible for paying all care providers.

Recommended Reading: Are Cancer Drugs Covered By Medicare

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259. |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203. After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Disadvantages Of Medicare Part C

- Limited range of service providers: Depending on the insurance provider you use, you may be required to stay within the service providers network. If you choose to see a medical professional outside of the network, you may face higher fees and out-of-pocket costs. This can be detrimental if you already have a long-standing patient-provider relationship with an out-of-network medical professional.

- An overwhelming number of plan options: In most states, there are multiple health insurance companies offering a variety of Medicare Part C plans. If you live in an area with many plan providers, comparing all of these options can quickly become a headache.

- Coverage may be limited by state: Many health insurance providers are only licensed to offer plans in a limited number of states. This means that if you sign onto a Part C plan in 1 state and you decide to move, your coverage may not be valid in your new location. This is not a problem with original Medicare Part A and Part B, and the insurance is offered by the federal government and can be applied in any state.

Recommended Reading: What Does Medicare Cost Me

Medicare Advantage Rate Book For 2019

We all know that the Federal expenditures for Medicare are growing fast and its putting a real strain on our budget. $835 billion dollars was spent on Medicare and Medicaid in 2011. That big number doesnt translate well into an expense per Medicare beneficiary for me. What I wanted to know was, How much does the Federal government actually pay to the private insurance companies to administer either Medicare Advantage Plans or Part D Prescription Drug Plans on behalf of Medicare beneficiaries?

I was curious because I wanted to know how it compared to the individual market for health insurance and how large the subsidy was for each Medicare beneficiary. The answers are not easily found on either an Internet search or picking up the phone and calling someone. What I found out was that determining the actual numbers is complicated at best.

Here is the information that I was able to find. I am not claiming this information is perfect and I welcome additional input from folks that have more detailed expertise. From my perspective, until the American public can start to grasp the enormity of the individual expenditure per Medicare beneficiary, we wont be able to have a meaningful discussion on reform.

First: How does Medicare compare to the private health insurance market?

From: Medicare Part D Prescription Drug Benefit: A Primer

Payments to Plans

Direct Subsidies

Benefits Of A Medicare Advantage Plan

Many individuals beyond retirement age opt for Medicare Advantage Plans because they reduce annual out-of-pocket health care costs. They feel familiar, too, because theyre essentially the same as other health insurance plans. Seniors can choose plans with dental and vision coverage, and they can also pick from a wide range of deductible and coinsurance options.

Some Medicare Advantage plans pay for a persons Medicare Part B benefits automatically. While they seem more expensive at first glance, these plans make life easier because policyholders no longer have to remember to send a separate check to the government every month.

Also Check: Should I Enroll In Medicare If I Have Employer Insurance

Medicare Part C Provider Networks

There are three main types of Medicare Advantage Plan provider networks: Health Maintenance Organizations , local Preferred Provider Organizations and regional Preferred Provider Organizations. Some people opt for Private Fee-for-Service plans or Medicare Special Needs Plans , which provide a different range of benefits.

With an average $23 monthly premium, HMO plans were the cheapest option for seniors in 2019. Local PPOs were next, with an average $39 monthly premium, followed by regional PPOs, which had an average monthly premium of $44.

Eldercare Financial Assistance Locator

- Discover all of your options

- Search over 400 Programs

Are There Any Protections If I Enroll In A Plan And Do Not Like It

In order to enable beneficiaries to try a Medicare Advantage plan, but still have the option of returning to Original Medicare, a number of protections are in place. These protections will enable beneficiaries, in certain situations, to try a plan, but then return to Original Medicare and a Medicare Supplement policy if they want to do so.

Under these protections, beneficiaries will have guarantee issue of a Medicare Supplement policy as long as they meet one of the following criteria. For eligible beneficiaries, companies which sell supplement policies will not be able to deny coverage, charge more, or exclude benefits. However, to receive these protections, beneficiaries must apply for a supplement policy within 63 days of disenrolling from the health plan, or within 63 days of the termination of the health plan.

A beneficiary would be eligible for the Medicare Supplement protections if they meet one of the following criteria.

Case #1

You are enrolled in a Medicare Advantage plan and one of the following happens:

- The contract between Medicare and the plan ends.

- The plan service area no longer covers the county where you live.

- You move out of the plan service area.

- There are violations by the plan.

Protection: In this case, you would get a guaranteed issue of a Medicare Supplement Plan A, B, C, or F from any company .

Case #2

Case #3

Protection: You are guaranteed to get any Medicare Supplement plan with any company .

Case #4

You May Like: Is Silver Sneakers Part Of Medicare

Is A Plan With A Low Medicare Advantage Premium My Best Option

The Medicare Advantage premium is just one cost of the plan. Keep in mind that plans with lower premiums may also have more basic coverage and plans with higher premiums may have more extensive coverage.

When eHealth asked Medicare beneficiaries about their top health-care concerns, 42% said it was Medicare premiums. Copayments and deductibles were the top concern for 51% of those surveyed. eHealths survey respondents included over 1000 Medicare beneficiaries.

The premium isnt always the only factor affecting your Medicare costs. For example, suppose Medicare Advantage plan 1 has a $0 monthly premium and $0 coverage for routine dental services. If you get $2,000 of dental work, you could pay $2,000.

Suppose Medicare Advantage plan 2 has a $50 monthly premium and $1,000 coverage for routine dental services. You pay $600 in premiums for the year, but with the $1,000 dental coverage, your total spending is only $1,600 compared to $2,000.

*This report reviews costs and trends among people who purchased Medicare insurance products through eHealth from January 1 through March 31, 2018 and the same period in 2019.

Do you have more questions about Medicare Advantage plan premiums? Just enter your zip code on this page to begin searching for plans in your area.

The Real Disadvantage Of Medicare Advantage Plans

In Understanding Medicare in 4 Easy Steps, we outline how to determine if Medicare Advantage or Original Medicare and a Medigap plan is the best option for you. To paraphrase, we suggest that theres a single fundamental difference that helps most people make the right choice. In fact, the bulk of the pros and cons of Medicare Advantage plans take a back seat to this one issue.

The difference is this. With Original Medicare and supplemental Medicare insurance, you pay the bulk of your major medical costs upfront through monthly insurance premiums. Doing so lets you budget your health care costs.

When you have Medicare Advantage, you pay most of your health care costs when you use services. For this reason, it is very difficult to budget your health care costs. And this is the primary disadvantage of Medicare Advantage plans. If you fit into one of the five categories above, this wont be much of a disadvantage. If not, it could put you in a world of hurt.

Also Check: How Old To Be Covered By Medicare

What Is A Medicare Advantage Plan

A Medicare Advantage Plan, sometimes referred to as Medicare Part C, is an alternative to the original Medicare parts A and B. Medicare Advantage plans combine the benefits of original Medicare Part A and Part B to offer you health insurance with a single monthly payment. Medicare Part C plans are offered through private health insurance providers, but only providers that are authorized by the federal government may sell these plans.

Some Medicare Part C providers also include additional benefits not covered under original Medicare like eye exams and hearing aids. These benefits can vary depending on the insurance provider.

To qualify for a Medicare Advantage plan, all of the following must be true:

- You must already have Medicare Part A and Medicare Part B coverage.

- You must live in the area where your Advantage plan offers service at least 6 months of the year.

- You must be a citizen or legal resident of the U.S.

- You dont have end-stage renal disease .

Paying For A Medicare Advantage Special Needs Plan

Along with having a qualifying medical condition, you must have Original Medicare to be eligible for a Special Needs Plan . Some people who meet these requirements also have Medicaid. For those who have both Medicare and Medicaid, Medicaid helps pay for most of the costs in joining a plan. These costs include premiums, coinsurance, and copayments.

CMS requires that Medicaid pay for copayments and coinsurance for certain people enrolled in MSPs. However, Medicaid is not required to help pay for Medicare Part C insurance premiums. Federal Medicaid laws allow each state Medicaid agency to decide if they will pay Medicare Part C premiums for those enrolled in a MSP as a qualified Medicare beneficiary.

An insurance company can also decide to charge a premium for Part C SNP enrollees who have both Medicare and Medicaid as well as those who dont have both. In this case, you would pay the full Part C premium . According to Medicare.gov, SNPs typically have the same basic costs as other Part C plans. This means you could pay around the same average monthly premiums as shown in the table above or maybe even $0 in premiums.

Don’t Miss: How To Get New Medicare Card Without Social Security Number