Did Medicare Part D Costs Go Up In 2021

Medicare Part D plans provide coverage exclusively for certain retail prescription drugs.

Medicare Part D plans are sold on the private market. Premiums for Part D plans have been on the decline in recent years.

The average Part D premium is $41.64 per month in 2021.2

Part D plans use an IRMAA surtax for beneficiaries who earn a higher income.

|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$77.10 + your plan premium |

Recent Articles And Updates

For older articles, please see our article archive.

References

The 2010 Medicare Part D $250 Donut Hole Rebate. Q1Group LLC, .

2020 Part D Income-Related Monthly Premium Adjustment. . .

2021 Medicare Part D Outlook. Q1Group LLC, .

2021 Part D Income-Related Monthly Premium Adjustment. . .

How Do Medicare Advantage Ppo Plans Work? Healthline Media, May 5, 2021, .

Analysis of Part D Beneficiary Access to Preferred Cost Sharing Pharmacies . . .

Announcement of Calendar Year 2021 Medicare Advantage Capitation Rates and Part C and Part D Payment Policies. . .

Assistance with Paying for Prescription Drugs. Center for Medicare Advocacy, November 30, 2015, .

How Medicare Part D Works. AARP, October 2016, .

Medicare Advantage Special Needs Plans . Healthline Media, May 3, 2021, .

Kirchhoff, Suzanne M. Medicare Coverage of End-Stage Renal Disease . . .

What About The Part D Late

Medicare imposes a late enrollment penalty if you dont purchase Part D coverage before the end of your Initial Enrollment Period the seven-month period starting three months before the month you turn 65 or if youve gone 63 consecutive days or more without prescription drug coverage. This penalty is in addition to your monthly premium cost and generally remains in effect for as long as your Medicare drug coverage continues.

Medicare determines the penalty amount by multiplying the number of full months you were eligible for but didnt have drug coverage by 1%, then multiplying that product by the national base beneficiary premium . The result is rounded to the nearest 10 cents. This means the longer you wait to purchase drug coverage, the higher your penalty will be. In addition, because the national base beneficiary premium can change every year, the monthly penalty amount you owe may also increase over time.

Suppose that after your Initial Enrollment Period ended, you waited another full two years without purchasing prescription drug coverage. Your penalty would be 0.24 x $33.06 for a total of $7.93, rounded to $7.90. You would owe this $7.90 each month in addition to your premium cost for as long as you had Medicare drug coverage. This may not seem like much, but it adds up to almost $95 over a year and could get more expensive over time if the national base beneficiary premium rises.

To avoid the Part D late enrollment penalty:

You May Like: Is Obamacare Medicaid Or Medicare

How Do I Compare Medicare Part D Prescription Drug Plans

You should look at all three out-of-pocket expenses when you compare plans: Your Medicare Part D premiums, deductible, and copayment or coinsurance amounts. A plan with a higher deductible may have lower monthly premiums. If you dont use a lot of prescription medications, that may be the most cost-effective option for you. On the other hand, if you take daily medications, a lower deductible may be more important so you get help with your medications with less out-of-pocket expense.

If you take daily medications, its very important to look at each plans formulary. A formulary is simply the list of covered medications and your costs for each. Check to make sure the plans covers all your daily medications. Also remember a Medicare Supplement Insurance Plan doesnt cover any costs associated with Medicare Part D coverage.

Finally, compare pharmacy networks and benefits such as mail-order pharmacies. If you have a preferred pharmacy and its not in a plans network, you may be happier with a different plan. With many plans, you can save on your copayments and out-of-pocket costs by using the plans mail order pharmacy for medications you take regularly. If a plan offers this option, you may actually come out ahead even if the plan has a higher deductible or monthly premium, depending on the medications you use.

Limitations, copayments, and restrictions may apply. Premiums and/or copayments/co-insurance may change on January 1 of each year.

New To Medicare?

Did Medicare Go Up In 2021

The cost of Medicare premiums and deductibles typically increase each year, though its hard to predict by how much.

It’s important to consider rate increases as you prepare to enroll in Medicare for the coming year .

When looking at Medicare rate increases for 2021, these are two of the main types of costs to consider.

- Medicare premiumsA premium is a monthly amount that you pay to belong to a Medicare plan.

- Medicare deductiblesThe deductible is the amount of money that you must pay out of your own pocket for covered services before your plan coverage begins.

Different parts of Medicare have different premiums and deductible amounts.

Some Medicare Advantage plans offer $0 premiums. To find out if any $0 premium Medicare Advantage plans are available where you live, call to speak with a licensed insurance agent at 1-800-557-6059TTY Users: 711 24/7.

Read Also: What Does Medicare Part B Include

Issues For The Future

The Medicare drug benefit has helped to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. But in the face of rising drug prices, more plans charging coinsurance rather than flat copayments for covered brand-name drugs, and annual increases in the out-of-pocket spending threshold, many Part D enrollees are likely to face higher out-of-pocket costs for their medications.

Policymakers are currently debating several proposals to control drug spending by Medicare and beneficiaries. Several of these proposals address concerns about the lack of a hard cap on out-of-pocket spending for Part D enrollees, the significant increase in Medicare spending for enrollees with high drug costs, prices for many drugs rising faster than the rate of inflation, and the relatively weak financial incentives faced by Part D plan sponsors to control high drug costs. Such proposals include allowing Medicare to negotiate the price of drugs, restructuring the Part D benefit to add a hard cap on out-of-pocket drug spending, requiring manufacturers to pay a rebate to the federal government if their drug prices increase faster than inflation, and shifting more of the responsibility for catastrophic coverage costs to Part D plans and drug manufacturers.

Topics

What Does Medicare Part D Cover

Medicare Parts A and B come directly from the federal government, but that’s not the case for prescription drug plans. Private insurers provide the coverage that Medicare Part D offers, and the specifics differ from plan to plan.

Because of these plan differences, there’s no way to say exactly what Part D will cost. In particular, the following things can distinguish one Part D plan from another:

- One plan might offer coverage for a particular drug that another plan omits from coverage.

- Some plans put drugs into categories, some of which have higher copayments than others.

- Plans can require using certain pharmacy benefit management companies to fill prescriptions.

However, there are limits on how much flexibility Part D plans have. They typically can only change drug coverage at the end of the year, which means you can count on a particular drug getting covered throughout the plan period.

Don’t Miss: Does Medicare Part B Cover Prolia Shots

Is Medicare Part D Right For Me

There are dozens of drug plans offered in most states. Fortunately, we can assist you with evaluating each plan based on your individual medications. Well help you determine which drug plans offer the specific medications you need at the lowest copays.

At Boomer Benefits, we will happily offer assistance with Part D when you choose to enroll in a Medigap plan through us. Give us a call at 732-9055 or to request for help, click below:

D Plan Premiums And Benefits In 2022

Premiums

The 2022 Part D base beneficiary premium â which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment â is $33.37, a modest increase from 2021. But actual premiums paid by Part D enrollees vary considerably. For 2022, PDP monthly premiums range from a low of $5.50 for a PDP in Colorado to a high of $207.20 for a PDP in South Carolina . Even within a state, PDP premiums can vary for example, in Florida, monthly premiums range from $7.70 to $174.30. In addition to the monthly premium, Part D enrollees with higher incomes pay an income-related premium surcharge, ranging from $12.30 to $77.10 per month in 2021 .

Benefits

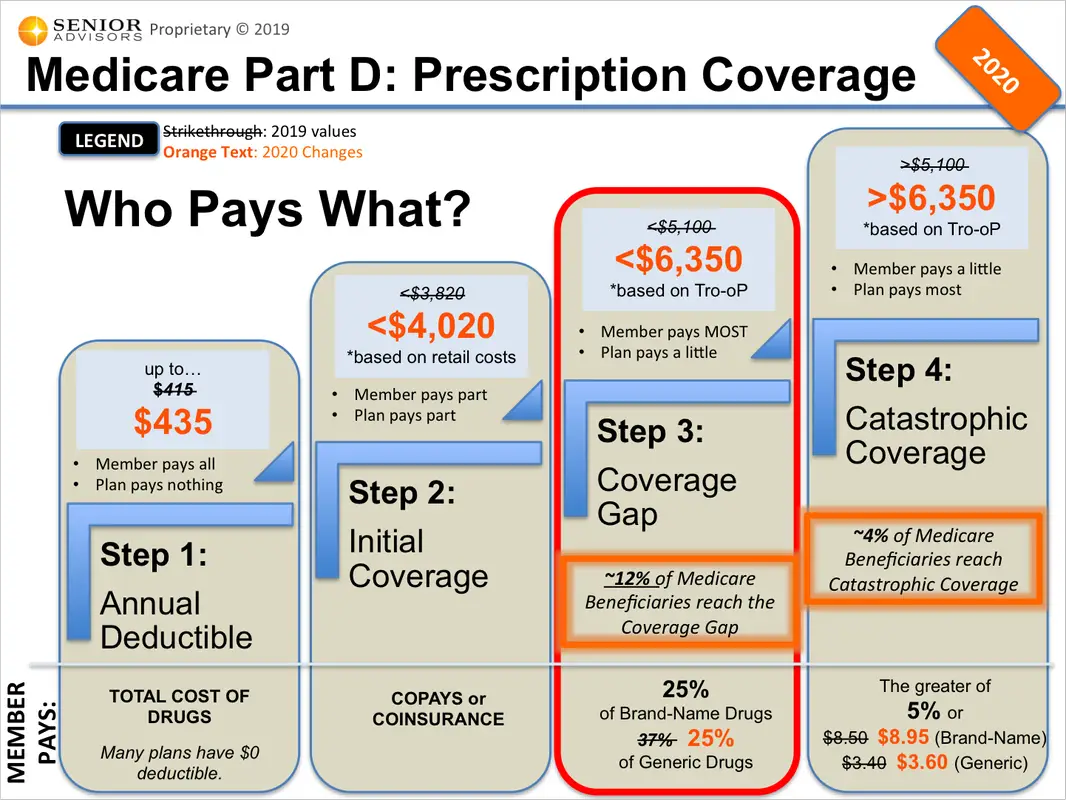

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage, although it does not have a hard cap on out-of-pocket spending. Between 2021 and 2022, the parameters of the standard benefit are rising, which means Part D enrollees will face higher out-of-pocket costs for the deductible and in the initial coverage phase, as they have in prior years, and will have to pay more out-of-pocket before qualifying for catastrophic coverage .

- The standard deductible is increasing from $445 in 2021 to $480 in 2022

- The initial coverage limit is increasing from $4,130 to $4,430, and

- The out-of-pocket spending threshold is increasing from $6,550 to $7,050 .

Figure 6: Medicare Part D Standard Benefit Parameters Will Increase in 2022â

You May Like: Can You Only Have Medicare Part B

Special Election Periods For Medicare Part D

Once enrolled in Medicare Part D, you are locked into the plan for the rest of the calendar year. You must wait for the next Annual Election Period to change or disenroll. However, Medicare recognizes that there might be certain circumstances in which you need to change mid-year. They have created Special Election Periods for this.

An example would be if you move out of state or lose your group medical coverage mid-year. These kinds of situations create a short Special Election Period during which you can make the necessary change. Your application for the new Part D plan must be coded properly to take advantage of that SEP. An incorrect code on the application can cause a rejection, so be sure to work with an agent who specializes in these plans.

Be aware that your insurance agent cannot solicit you for Part D, so if you wish to enroll, you must initiate that with your agent.

Are There Additional Costs For High

If your modified adjusted gross income is higher than a certain amount, you may have to pay an extra monthly premium. Medicare calls this an income-related monthly adjustment amount . Medicare calculates this amount based on your tax return from 2 years ago.

In 2021, if your income is $88,000 or less as an individual or $176,000 or less on a joint tax return, you wont have to pay an IRMAA. The highest IRMAA, an added $77.10 per month, is for an individual who makes $500,000 or more or a joint tax return amount of $750,000 or more.

Also Check: Does Medicare Cover You When Out Of The Country

What Does Medicare Part C Cost In 2021

Medicare Part C plans are sold by private insurance companies, so plan premiums, deductibles and other costs can vary.

Despite regular increases in Original Medicare costs, Medicare Advantage premiums have decreased in recent years.

The average 2021 Medicare Advantage plan premium is $33.57 per month for Medicare Advantage plans that include prescription drug coverage.2

Increasing competition may be contributing to falling premiums. The number of Medicare Advantage plans available in 2021 represents a 13 percent increase from 2020 and the highest number of plans ever available.3

Its possible that the competition within the Medicare Advantage market will keep Medicare Advantage plan premiums lower.

As mentioned above, many Medicare Advantage plans feature $0 premiums.

How Much Does Medicare Advantage Cost Per Month

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month.1

Depending on your location, $0 premium plans may be available in your area.

Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies. Medicare Advantage offer the same benefits that are covered by Original Medicare, and most Medicare Advantage plans include additional benefits that Original Medicare doesnt cover.

Because Medicare Advantage plans are sold by private insurance companies, plan costs can vary based on location, carrier, benefits offered and more.

Find out the average cost of Medicare Advantage plans in your state.

Don’t Miss: How Does Medicare Part D Deductible Work

D Medicare Advantage Drug Plans Must Install Cost

Medicare Advantage and standalone Part D prescription drug plans must implement a maximum monthly cap on patient cost-sharing payments by the start of 2025, according to the latest version of new drug price reform legislation.

House Democrats released the legislative text for a series of reforms aimed at lowering prescription drug costs, including language on how many drugs will be subject to negotiation under Medicare. But the legislation includes new key requirements for payers as Democrats aim to curb drug costs for seniors in Medicare Part D.

Consider Talking To A Broker Or Consultant

Why wade through overwhelming information if you dont have to? Engaging with a broker or a health insurance consultant is free. Brokers sometimes have access to more plans or better pricing and can use their connections with insurance companies to help find the best plan and coverage for you.

State Health Insurance Assistance Programs can be an excellent resource to help you find all the information you might need if you look for further help with insurance.

Don’t Miss: Where To Send Medicare Payments

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare in 2021 report. .

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

How Would Part D Redesign Differ From Current Policy

The current design of the program has three phases of coverage:

Initial coverage: Beneficiaries pay 25 percent of drug costs and the Part D plan pays 75 percent for brand-name and generic drugs.

Coverage gap: Beneficiaries enter the gap when they hit $4,130 in spending. They continue to pay 25 percent of costs, while drug manufacturers pay 70 percent of costs for brand-name and biosimilar drugs and the Part D plan pays the remaining 5 percent for brand-name and biosimilar drugs, or 75 percent for generics.

Catastrophic coverage: Once beneficiaries have paid $6,550 out of pocket, they enter the catastrophic phase, where they are on the hook for 5 percent of drug costs. The Part D plan pays 15 percent and Medicare pays 80 percent. Under current policy, Medicare beneficiaries have no hard cap on out-of-pocket drug costs.

The table below lays out the similarities and differences between the three congressional proposals for redesigning the Part D program. These bills, introduced during the last Congress , are the starting point for the policy debate in 2021.

Recommended Reading: Does Medicare Supplemental Insurance Cover Pre Existing Conditions

Medicare Prescription Drug Plans Costs

Medicare Part D is an optional RX drug help that works with Medicare. People cannot be denied coverage due to health reasons.

2020 Part D Deductible

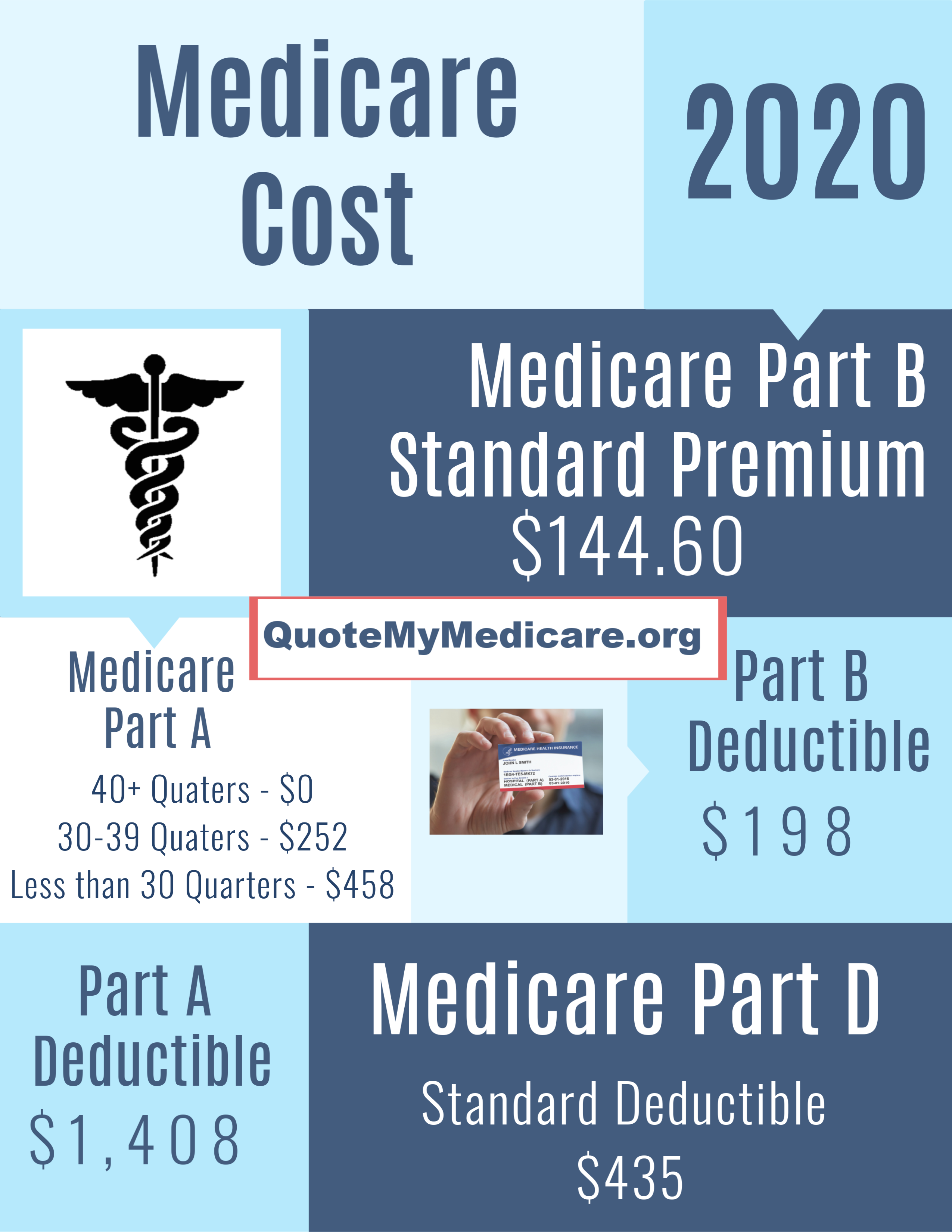

The annual deductible for Part D prescription drug coverage in a standalone Part D drug plan or a Medicare Advantage plan is $435.

2020 Part D Monthly Premium

Average Part D premiums areexpected to fall to $30 in 2020.3 The average Part D premium has been between $30 and $35 per month for over a decade.

The chart below shows your estimated prescription drug plan monthly adjustments If your income is above a certain limit, you will pay an income-related monthly adjustment amount in addition to your plan premium.

| If your yearly income in 2018 was: | You pay: |

What Is The Medicare Part D Deductible For 2020

A Medicare Part D deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to pay its share of your medications that are covered. This is for a calendar year and resets every January 1. The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible. Of those, 69% use the $435 maximum established by CMS. If you get your Medicare Part D coverage through a Medicare Advantage plan, you may not pay a deductible.

Once you reach your Medicare Part D deductible, your plan pays its share of your medications. Most plans use a tiered copayment system. Generic medications are in the lower tiers and generally have a copayment of between $0 and $10 each. Expensive brand-name and specialty medications may have a higher copayment or coinsurance amount.

Also Check: Does Medicare Part D Cover Shingrix