Other Medicare Charges Also Rising

The annual Part B deductible will rise $30 next year to $233, up from this year’s $203.

For Medicare Part A, which covers hospitalization and some nursing home and home health care services, the inpatient deductible that patients must pay for each hospital admission will increase by $72 in 2022 to $1,556, up from $1,484 this year. Almost all Medicare beneficiaries pay no Part A premium. Only people who have not worked long enough to pay their share of Medicare taxes are liable for Part A premiums.

Open enrollment for Medicare began Oct. 15 and continues through Dec. 7. During this period, beneficiaries can review their coverage and decide whether to make changes.

Dena Bunis covers Medicare, health care, health policy and Congress. She also writes the Medicare Made Easy column for the AARP Bulletin. An award-winning journalist, Bunis spent decades working for metropolitan daily newspapers, including as Washington bureau chief for the Orange County Register and as a health policy and workplace writer for Newsday.

Editor’s note: This story has been updated to include additional information.

More on Medicare

Medicare Premium Reimbursement Arrangement

The type of Section 105 plans employers offers will depend on the employers size and whether they provide a group health plan. A Health Reimbursement Arrangement is a system covered by Section 105. This arrangement allows your employer to reimburse you for your premiums.

Some HRAs at employers that provide group coverage require that your employers payment plan ties in with the group health plan. Contact a human resources representative at your organization if you have questions about the plan offered to you.

Well explain two common types of HRAs offered by employers that can help with your Medicare premiums.

Officials Say Substantial Social Security Cola Will More Than Offset The Monthly Hike

by Dena Bunis, AARP, Updated November 15, 2021

designer491 / Alamy Stock Photo

Medicare’s Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program’s history, the Centers for Medicare & Medicaid Services announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase:

CMS officials stressed that while the 14.5 percent Part B premium increase is a stiff one, the Social Security cost-of-living adjustment at 5.9 percent, the largest in 30 years – is estimated to average $92 per recipient. So even after the increase in the Medicare Part B premium, most Social Security recipients, whose Part B premiums are typically deducted from their Social Security benefits, will still see a net increase in their monthly check. The COLA goes into effect in January.

Join today and get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Don’t Miss: Does Medicare Cover Fall Alert Systems

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

Alternative Medicare Assistance Programs

Programs outside of Medicare that can help pay premiums are generally for Medicare Part D plans. Depending on the state you live in, you may be able to get help with paying your Part D premiums through State Pharmaceutical Assistance Programs . These programs provide assistance to adults with disabilities and low-income seniors. States that offer Medicare premium assistance for Part D insurance make their own rules on who can qualify.

Some drug manufacturers also offer help with prescription drug costs, but this is for the cost of medicines instead of the actual premium for your Part D plan. If youre a senior citizen, have limited income, or a disability, you may qualify for discounted or free prescribed medicines through Patient Assistance Programs .

48191-HM-1121

Also Check: Does Medicare Pay For Cancer Drugs

Does The Medicare Part B Premium Increase Each Year

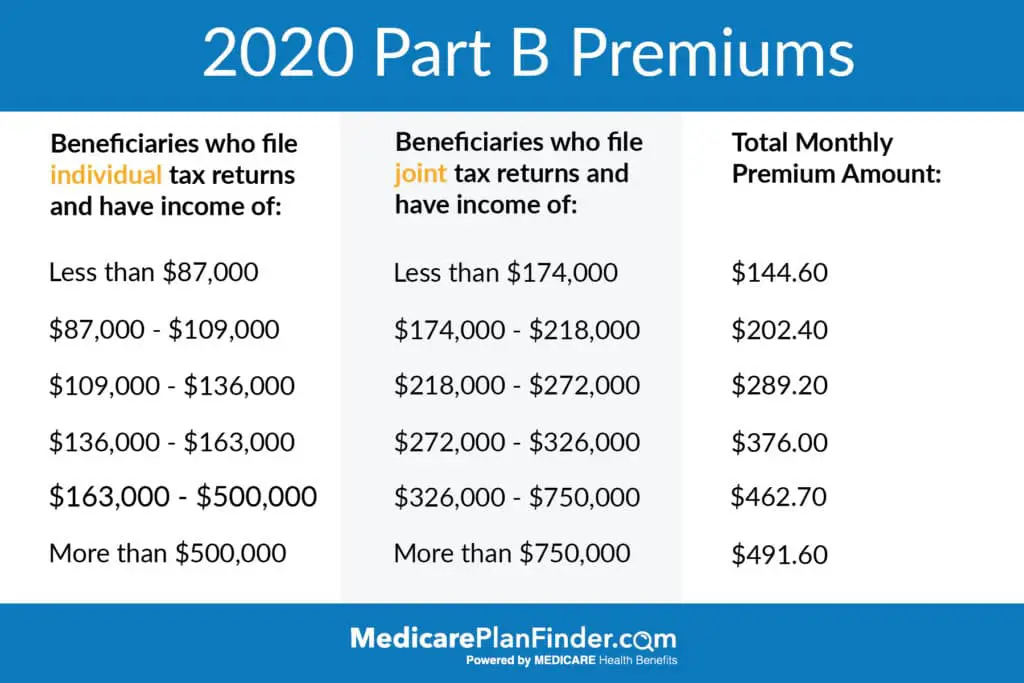

When Medicare debuted in 1966, the Part B premium was $3 per month. But the Part B premium is $144.60 per month as of 2020. Although there have been some stretches of time when the premium declined from one year to the next or remained steady 2013 through 2015, for example, when it was $104.90/month each year it has generally increased every year.

Help Paying Original Medicare Premiums

Most MSPs provide help for Medicare Part A or Part B only. All programs require eligibility for Medicare Part A, but the main difference between each is the income range that those seeking help must be within.

Parts A and B: The Qualified Medicare Beneficiary program is the only Medicare assistance program that pays premiums for both parts of Original Medicare. If youre approved as a QMB, youre the program will help pay for your Medicare costs .4

Part A Only: If you need help with just your Part A premiums, you may get assistance through the Qualified Disabled and Working Individual program. To get full or partial aid, you must:4

- Be employed

- Be disabled

- No longer be eligible for a premium waiver of your Part A benefits because youre working

Part B Only: Both the Specified Low-Income Medicare Beneficiary and Qualifying Individual programs will help pay for Medicare Part B premiums.4

- SLMB program: Must meet low-income limits to get aid.

- QI program: Aid is provided on a first-come-first-served basis, with preference given to previous year QI enrollees. You must apply for this program each year.

Also Check: How Old To Get Medicare And Medicaid

B Premiums And Social Security

You cannot be expected to pay more for Medicare if there is not also a proportionate rise in Social Security benefits. The holds harmless provision of the Social Security Act protects recipients from paying higher Medicare Part B premiums if those premiums will cause their Social Security benefits to be lower than they were the year before.

Simply put, increases in Part B premiums cannot exceed the annual cost-of-living adjustment for Social Security.

In those cases, the Medicare Part B premium will be decreased to maintain the same Social Security benefit amount. However, keep in mind that the holds harmless provision does not apply to Medicare Part D. If the Medicare Part D Income-Related Monthly Adjustment Amount increases, a beneficiary may still see a decrease in their overall Social Security benefits.

Not everyone is eligible for the holds harmless provision. Only people in the lowest income category who have already been on Medicare Part B and have had their premiums directly deducted from their Social Security checks for at least two months in the past year are considered. Beneficiaries new to Medicare and people on Medicaid will be subjected to the current premium rate.

The Social Security cost-of-living adjustment for 2022 is 5.9%. This is estimated to be an additional $92 per month for the average recipient. This amount would be able to cover the rise in Medicare premiums in the new year.

For those who are dual eligible, Medicaid will pay their Medicare premiums.

Does Medicare Part B Premium Change Every Year Based On Income

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you’re being charged and follow up with Medicare or the IRS if you have questions.

Read Also: Does Humana Offer A Medicare Supplement Plan

Can Employers Pay Medicare Premiums For Active Employees

Its a good question. Because of the Affordable Care Act , age is a huge rating factor for small-business employers, with health insurance carriers charging up to three times as much for older workers as they do for younger employees. While larger and self-insured companies are not subject to the ACAs modified adjusted community rating rules, age is a big rating factor for them as well.

So whats the answer? Can an employer pay for Medicare Part B and D, Medicare Advantage, and/or Medicare Supplement Insurance premiums for their employees, and either require or encourage them to drop off the group health plan? If so, it might be a good strategy for companies who have seen their premiums skyrocket in recent years, and it could be a great way for brokers to save their clients some money.

Is There Help For Me If I Cant Afford Medicares Premiums

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

Reviewed by our health policy panel.

Q: Is there help for me if I cant afford Medicares premiums?

A: Yes. Medicare Savings Programs can help with premiums and out-of-pocket costs.

Recommended Reading: Does Medicare Pay For Vitamins

V Waiver Of Proposed Rulemaking

The annual updated amounts for the Part B monthly actuarial rates for aged and disabled beneficiaries, the Part B premium, and Part B deductible set forth in this notice do not establish or change a substantive legal standard regarding the matters enumerated by the statute or constitute a substantive rule that would be subject to the notice requirements in section 553 of the APA. However, to the extent that an opportunity for public notice and comment could be construed as required for this notice, we find good cause to waive this requirement.

Can Employers Pay Their Employees Medicare Premiums

MEDICARE | August 23, 2018

Can Employers Pay Their Employees Medicare Premiums? At AHCP, were starting to get this question more and more frequently from brokers. We believe there are two reasons for this:

Read Also: Does Medicare Cover Outpatient Physical Therapy

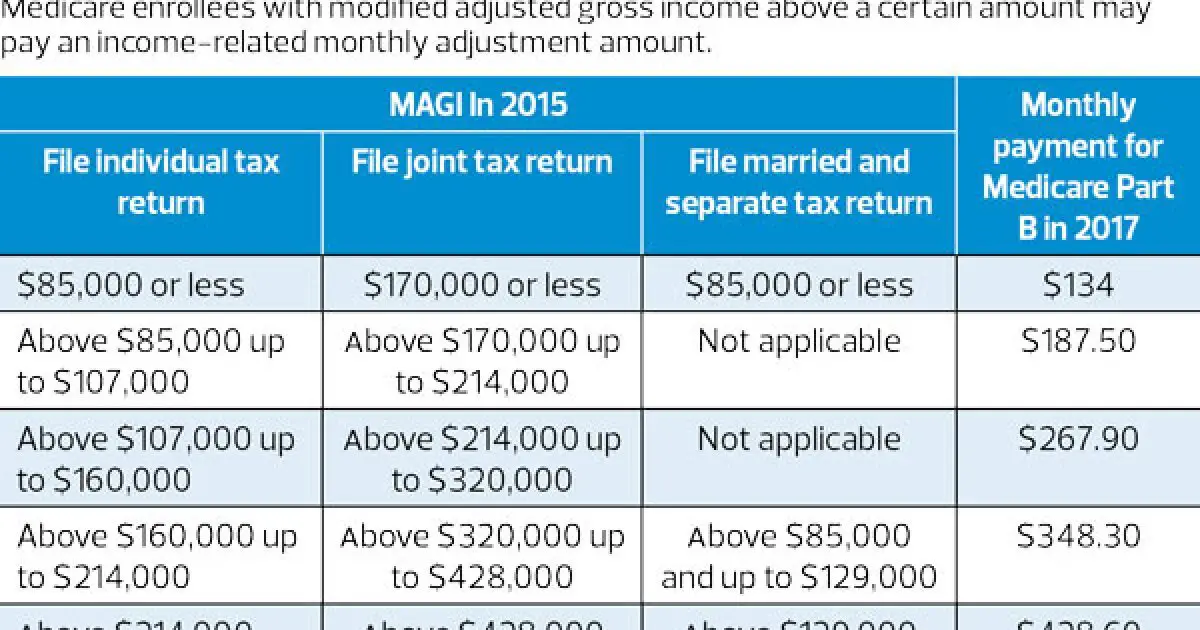

What Higher Earners Will Pay For Medicare In 2021

It’s easy to argue that being a higher earner in retirement is a good thing. But when it comes to paying for Medicare, it can come back to bite you. IRMAA surcharges for Medicare Part B are based on your modified adjusted gross income from two years prior, so for 2021, the amount you’ll pay is based on your 2019 tax return.

Here are the income brackets where IRMAAs apply and the subsequent Part B costs you’ll face if you’re a higher earner:

|

2019 Income: Individual Tax Return |

2019 Income: Joint Tax Return |

2019 Income: Married With Separate Tax Return |

Monthly Part B Premium for 2021 |

|---|---|---|---|

|

$88,000 or less |

Keep in mind that IRMAAs apply to Medicare Part D, too.

How Much Are Medicare Part A Premiums In 2020

If you do have to pay Part A premiums in 2020, youll pay either $252/month or $458/month . These premiums are adjusted annually.

Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year . For 2020, the threshold for having to pay higher premiums based on income increased. .

People who dont enroll in Medicare B when first eligible are charged a late enrollment penalty that amounts to a 10 percent increase in premium for each year they were eligible for Medicare B but not enrolled. So if you wait until three years after youre eligible to enroll, youll pay 30 percent more than the standard premium for Medicare B, for as long as you have the coverage. But this penalty does not apply if you delayed your Part B enrollment because you had employer-sponsored coverage from a current employer and used that coverage instead of Part B.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Also Check: How Do I Find Out What My Medicare Number Is

Medicare Part B Premiums For Those Not Held Harmless

As noted earlier, certain individuals receiving Social Security benefits and those not receiving Social Security benefits are not protected under the hold-harmless provision. However, by law, standard Medicare Part B premiums are calculated to cover 25% of the expected costs of Medicare Part B program costs. In years in which a large number of individuals are held harmless and pay reduced premiums, aggregate Part B premiums may not cover 25% of costs unless the entire share of a premium increase is shifted onto those not held harmless. Thus, in certain years, those not held harmless may bear the burden of meeting the 25% requirement disproportionately. For example, in 2010 there was no Social Security COLA and approximately 70% of Medicare Part B enrollees were held harmless from the Medicare Part B premium increase. Those who were held harmless, on average, paid a Medicare Part B premium of $96.40 whereas Medicare Part B beneficiaries not held harmless paid the 2010 standard Medicare Part B premium of $110.50 .65

Low-income beneficiaries who receive premium assistance from Medicare Savings Programs are not held harmless. However, because they do not pay the Medicare Part B premiumâMedicaid will typically pay low-income beneficiaries’ Medicare Part B premiumâthe costs of low-income beneficiaries’ rising Medicare Part B premiums generally would be borne by Medicaid rather than by the beneficiaries themselves.

How Much Does Medicare Cost For A Married Couple

Medicare has no family plans, meaning that you and your spouse must enroll for Medicare benefits separately. This also means husbands, wives, spouses and partners pay separate Medicare premiums.

You may need to enroll at different times, depending on your age and health. While Medicare considers you individually as beneficiaries, your marital status can influence some of your Medicare costs.

You May Like: What Income Is Used To Calculate Medicare Premiums

What Basic Benefits Do Medicare Supplement Insurance Plans Have

Certain Medicare Supplement insurance plans may help pay deductible and coinsurance costs for Medicare Part A and Part B. The Part A inpatient deductible is $1,484 in 2021 for each benefit period. Part A coinsurance for hospital stays ranges from $0 per day for the first 60 days, to $371 per day , to $742 per day in 2021. The Part B yearly deductible is $203 in 2021. Medicare Supplement insurance plans may help pay these costs. See below for changes in store for some Medicare Supplement insurance.

All the standardized Medicare Supplement insurance plans available in most states may pay 100% of Medicare Part A coinsurance and hospital costs up to an additional 365 days after Original Medicare benefits are exhausted. These standardized Medicare Supplement insurance plans also pay some portion of Medicare Part B coinsurance or copayment . Other Medicare Supplement insurance plan basic benefits may include :

- First three pints of blood needed for a medical procedure

- Skilled nursing facility coinsurance

- Medicare Part A hospice care coinsurance or copayment

Some, but not all, Medicare Supplement insurance plans may pay for the Part A deductible, the Part B deductible, Part B excess charges, and foreign travel emergencies .

Other Things To Know About The Qmb Program:

Medicare providers arent allowed to bill you for services and items Medicare covers, including deductibles, coinsurance, and copayments, except outpatient drugs. Pharmacists may charge you up to a limited amount for prescription drugs covered by Medicare Part D.

- If you get a bill for Medicare charges: Tell your provider or the debt collector that youre in the QMB Program and cant be charged for Medicare deductibles, coinsurance, and copayments.

- If you already made payments on a bill for services and items Medicare covers: You have the right to a refund.

- If you have a Medicare Advantage Plan: Contact the plan to ask them to stop the charges.

In some cases, you may be billed a small copayment through Medicaid, if one applies.

Make sure your provider knows you’re in the QMB program

The SLMB Program is a state program that helps pay Part B premiums for people who have Part A and limited income and resources.

Read Also: Are Medical Alert Systems Covered By Medicare