How Much Does Medicare Part B Cost

Q: How much does Medicare Part B cost the insured?A: In 2021, most people earning no more than $88,000 pay $148.50/month for Part B. And in most cases, Part B premiums are just deducted from beneficiaries Social Security checks.

The Part B premium increase from 2020 to 2021 was smaller than initially projected, thanks to a short-term government spending bill that was enacted in the fall of 2020, and that included a provision to cap the increase in the Part B premium for 2021.

Minimize Taxes Now Or Maximize Benefits Later

Should you skip some or all of the business tax deductions youre entitled to in order to increase your future Social Security benefit? Maybe. The answer is complicated because lower-earning business people stand to gain more in the future than their higher-earning counterparts due to the way Social Security retirement benefits are calculated.

Another important factor is where your Schedule C earnings fall compared to your previous years earnings. If you have a full 35-year career behind you and youre not earning nearly as much in your current self-employed pursuits, it makes sense to take all the deductions you can, as your Social Security benefits will be calculated based on your 35 highest-earning years. In this case, you want to minimize your Social Security taxes.

But if youre currently in the high-earning part of your career, a higher Schedule C income can help you get higher Social Security benefits later. Unless you enjoy complex math problems or have a top-notch accountant, its probably not worth the headache to figure out whether youll earn more in future Social Security benefits than youd save by claiming all the deductions you can today.

Of course, if youre on the cusp of not having enough Schedule C income to give you the work you need to qualify for Social Security, it may be worth foregoing some deductions to make sure youre entitled to any benefits at all.

Deductions Guarantee Payment And Coverage

The Social Security Administration offers Medicare deduction as a service to retirees.

Social Security income is vital to many older Americans. It can be a source of security for healthcare, too.

When Part A and Part B premiums deduct from Social Security payments, it alleviates the crucial issue of missed payments.

If preferable to pay from a savings or checking account, Medicare Easy Pay is a free service to help make payments easy and regular. When selected, Easy Pay can also deduct premiums for a Part D policy or Part C Medicare Advantage plan.

Comparison shopping is a great way to select a plan from the Medicare Advantage program in order to get a true picture of costs and benefits.

Stay covered no matter what life throws your way enter your zip below for free, affordable health insurance quotes!

Don’t Miss: Does Medicare Cover Transportation To Physical Therapy

How Social Security Determines You Have A Higher Premium

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

What Do Payroll Taxes Fund

In the United States, payroll taxes are social security and medicare taxes. This means federal payroll taxes are used to fund social security and medicare programs across the country. This is intended to ensure a basic level of medical care and social support in old age, disability and various other cases.

Note, in the United States payment of medicare and social security taxes does not negate the need for comprehensive health insurance.

Recommended Reading: What Is The Best Medicare Supplement Plan In Arizona

Medicare Part B Premiums To Rise 145% In 2022 With Premiums For Highest

Medicare Part B Premiums for the highest earners will top $14,000 a year in 2022.

getty

The Centers for Medicare & Medicaid Services has announced Medicare Part B premiums for 2022, and the base premium increases 14.5% from $148.50 a month in 2021 to $170.10 a month in 2022. That $21.60 monthly increase compares to a $3.90 monthly increase last year. Meanwhile income-related surcharges for high earners have been bumped up again too. The wealthiest senior couples will be paying nearly $14,000 a year in Medicare Part B premiums. Part B covers doctors and outpatient services.

The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. Last year, Congress kept the increases in the Part B premiums and the deductible in check with caps as part of a short-term budget bill. So far, no such luck this year.

The CMS announcement comes after last months Social Security Administrations COLA announcement: a 5.9% cost of living adjustment for 2022, compared to the 1.3% cost of living adjustment for 2021. The average Social Security benefit for a retired worker will rise in 2022 by $92 a month to $1,657 in 2022, while the average benefit for a retired couple will grow $154 a month to $2,753.

The income-related premium surcharges apply to Part D premiums for drug coverage too.

Medicare Part B Premium surcharges for high-income individuals

CMS

Further Reading:

What Is The Medicare Tax Rate For 2021

The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate.

Thus, the total FICA tax rate is 7.65%. The maximum Social Security tax amount for both employees and employers is $8,239.80. For self-employed people, the maximum Social Security tax is $16,479.60. Anyone who earns wages over $200,000 will need to pay an extra 0.9% Medicare tax.

Employers arent responsible for this additional fee. The charge is withheld from the employees wages only. The self-employment tax rate is slightly higher, at 15.3%. Both the Social Security tax rate of 12.4% and the 2.9% Medicare tax rate contribute to this figure.

Read Also: How To Get Social Security Money

Read Also: Does Medicare Pay For Eyeglasses For Diabetics

Do Medicare Advantage Premiums Come Out Of My Social Security Check

About half of Medicare Advantage plans have $0 premiums, but if you do have a premium, you can deduct it right from your Social Security check. This is your choice, as it is not required to come from the Social Security check.

Please note: If you choose a Medicare Advantage plan, you still must pay the Medicare Part B premium. So, you’d have two premiums coming out of your Social Security check.

Read More: 10 Things Medicare Advantage Plans May Cover That Original Medicare Doesnât

What About Part C And Part D

Youll pay your Part C or Part D bill directly to the insurance company. Each company has their own preferred methods, and not all companies accept all payment types.

Generally, you should be able to:

- pay online with a debit or credit card

- set up automatic payments

- mail a check

- use your banks automatic bill pay feature

You might also be able to set up a direct deduction for your retirement or disability payments.

You can contact your plan provider to find out what payment options are available. They can also let you know if theres anything you should be aware of with each payment type, such as added fees or time delays.

You May Like: Is Aetna Medicare Good Insurance

Social Security And Fica

Most employees and employers each pay Social Security and Medicare taxes on Social Security and Medicare covered wages. These taxes comprise FICA .

Social Security Portion of FICA

- The Social Security portion of FICA is 6.2% of the maximum taxable wages.

- If you reach the maximum payment, you do not pay any more Social Security tax until the next calendar year.

- The maximum taxable wage for Social Security is adjusted each year. Visit Social Security Administration site to learn more about your Social Security Contribution and Benefit Base.

Medicare Portion of FICA

- The Medicare portion of FICA is 1.45% for wages up to 200,000 and 2.35% for wages above $200,000.

- There is no cap on wages for the Medicare portion of FICA.

FICA Refunds

Find out about FICA Refunds as a result of the Doctors Council v. NYCERS court decision.

You Still Have To Pay Into The System

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

When you work for someone else, that employer takes Social Security taxes out of your paycheck and sends the money to the Internal Revenue Service . But things work a little differently for people who are self-employed. If you fall into this category, keep reading. This article will help you understand how to calculate the Social Security taxes you owe.

Recommended Reading: How To Sign Up For Medicare Online

Social Security Benefits And Medicare Part B Premiums From 2000 To 2018

Social Security benefits and Medicare Part B premium amounts are adjusted annually using different methods, which typically has resulted in a higher percentage increase in Medicare Part B premiums than in Social Security benefit increases. Specifically, Social Security benefits are adjusted for inflation annually by COLAs. The Social Security COLA is a measure of general inflation based on the CPI-W. By contrast, Medicare Part B premiums are adjusted annually to account for changes in Medicare program expenditures for covered medical services. Medicare Part B premiums represent a percentage of the actual costs of the program, and thus premiums rise as health care costs rise. The annual percentage increase in Social Security benefits and Medicare Part B premiums for years 2000 to 2018 is shown in Figure 1.

Since 2000, Social Security COLAs have ranged from 0.0% to 5.8% with an average Social Security COLA of 2.2%. There was no Social Security COLA increase in 2010, 2011, or 2016 and only a relatively small Social Security COLA in 2017.

Since 2000, the Social Security annual COLA has resulted in a cumulative benefit increase of approximately 50%, considerably less than the Medicare Part B premium growth of close to 195%.58

The Five Ways To Pay For Medicare

There are several ways to pay for Medicare premiums. They accommodate the preferences and user situations by offering several modes in addition to online bill pay.

- Automatic deductions from Social Security

- Automatic payment from a bank accounts online bill pay service

- Medicare Easy Pay is a free service from Medicare that deducts the payment from the members bank account on an agreed date of the month.

- Medicare offers the paper mail method for payments. The pre-addressed coupon directs the check to the Medicare Premium Collection Center.

Also Check: What Is A Medicare Advantage Medical Savings Account

Is There A Limit On Fica Tax

All employers & employees are charged FICA tax which consists of social security tax and medicare tax. There is a wage limit on the collection of social security tax from an employee, however, there is no wage limit for Medicare.

The aggregate FICA tax for an employee is capped at $142, 800 for the year 2021 . It means that the maximum social security tax that can be deducted during 2021 is $8,853.60.

If Youre In One Of These 5 Groups Heres What Youll Pay In :

2021 Medicare Part B IRMAA chart

Get more Medicare help on our Facebook community page.

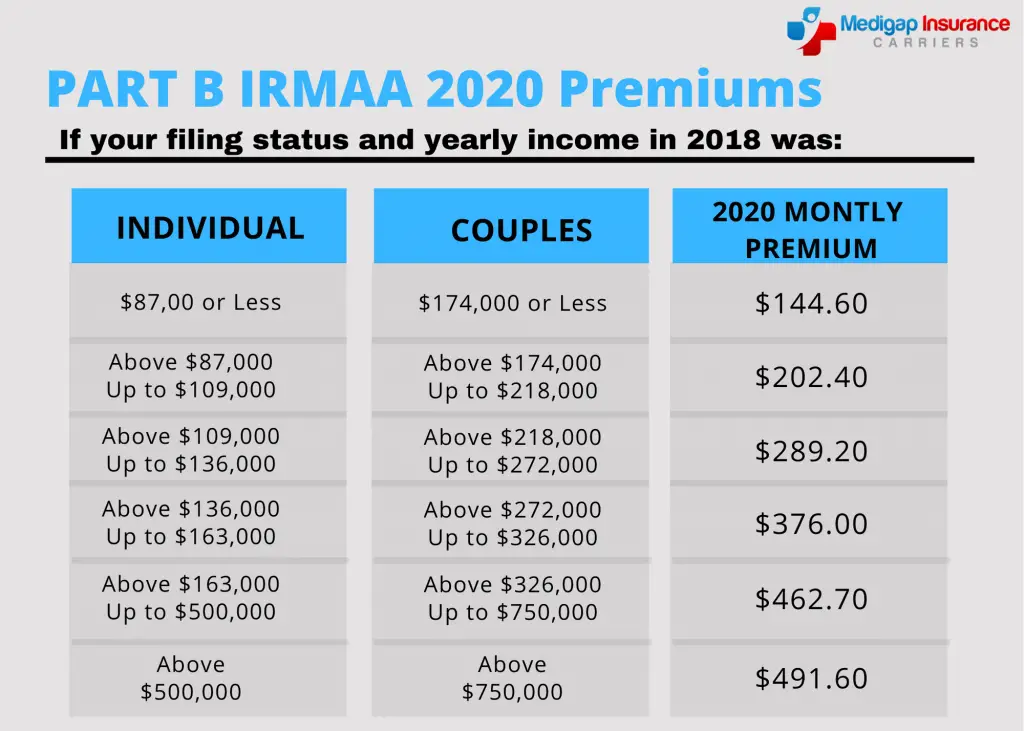

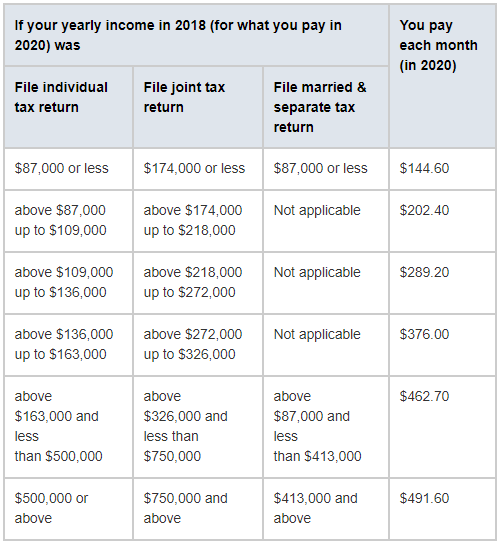

The Medicare Cost for some people in higher income brackets went up in 2018 and 2019 due to the MACRA legislation passed a few years ago. Its a good idea to keep an eye on these Medicare income limits in the future because they may be adjusted every few years.

Recommended Reading: How Does Medicare Plan G Work

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

How Much Is Medicare Tax 2016

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount . The Medicare portion is 1.45% on all earnings.

How much does Medicare an and B cost?

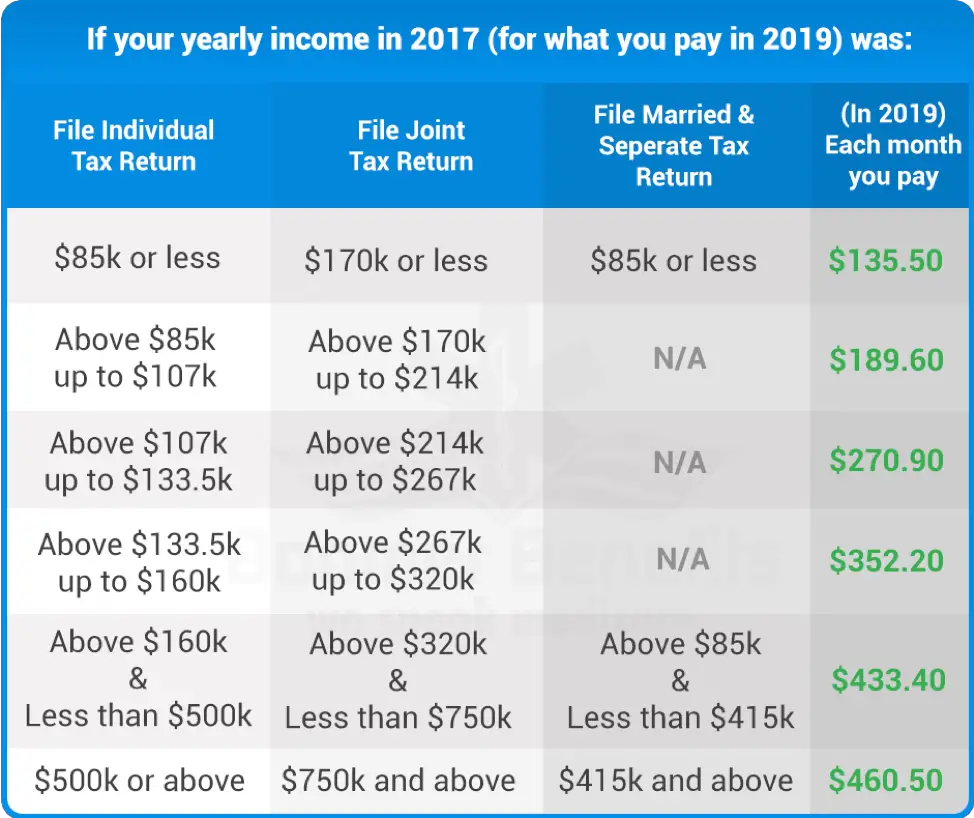

- For Medicare beneficiaries with incomes below $85K/single or $170K/couple, the Part B premium cost for 2019 will average $135.50 per month. For Medicare beneficiaries with higher incomes, the Part B premium cost will range from $189.60 to $460.50 per month, based on income level.

Read Also: Does Everyone Go On Medicare At 65

What Is The Monthly Premium For Medicare Part B

The standard Medicare Part B premium for medical insurance in 2021 is $148.50.Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits. Social Security will send a letter to all people who collect Social Security benefits that states each persons exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most. Depending on their income, these higher-income beneficiaries will pay premiums that amount to 35, 50, 65, or 80 percent of the total cost of coverage. You can get details at Medicare.gov or by calling 1-800-MEDICARE .

More Information

Some More Good Calculators That You May Find Useful

US Salary examples are useful for those who want to understand how income tax is calculated in the US or to get a quick idea of how payroll deductions are calculated in the United States. If you have time and prefer to produce a more detailed and accurate calculation, we suggest you use one of the following tools:

Read Also: Does Medicare Part C Cover Dentures

Medicare Part B Premiums For Those Held Harmless

Whether a beneficiary is held harmless or not depends on the amount of the standard Medicare Part B premium increase relative to the amount of his or her Social Security COLA in a given year.

The Medicare Part B premium an individual pays when held harmless may affect his or her future Medicare Part B premium amounts. For example, an individual held harmless in a year with no Social Security COLA may pay an increase in Medicare Part B premiums in a later year in which he or she is not held harmless, even if the standard Medicare Part B premium does not increase.

Table 2. Illustration of the Activation of the Hold-Harmless Provision for a Hypothetical Individual Over Time

|

Year |

|

0.35k |

CRS analysis based on data in 2018 Medicare Trustees Report and 2018 Social Security Trustees Report.

Notes: This chart assumes the individual is eligible for the hold-harmless provision .

a. COLA = Cost-of-living adjustment.

b. This amount is based on the average monthly Social Security benefit amount for a retired worker in 2008 , increased annually by the Social Security COLA.

c. Increase from the previous year.

d. The standard Medicare Part B premium is the premium amount paid by enrollees not held harmless and not subject to high-income-related premiums.

e. Increase from previous year. A negative value indicates a decreased premium.

Automatic Deduction For Part B

While most people pay for Part B, less frequently, people must pay Part A premiums as well.

For these applicants, Social Security can deduct for both Part A and Part B. Of course, this only occurs if a person receives Social Security income benefits.

Generally, if you join and have to pay for Part A then you must join and pay for Part B as well. If claiming no income benefits and choosing to get Part B only, Medicare either automatically deducts from Social Security income, or sends a quarterly bill.

Further, if a person wishes to get any prescription coverage or additional benefits beyond Original Medicare, this requires having Parts A and B.

Comparison shopping assesses whether to stick with Original Medicare or to join Medicare Advantage.

Read Also: When Can I Change My Medicare Coverage