Will Part B Deduct From My Social Security Check

Yes, Social Security will deduct your Part B premiums from your check. No need to worry about paying your monthly Part B premium unless you dont collect Social Security. The Part B premium is deducted out of your Social Security check automatically. The amount that comes out will depend on your income. The standard Part B premium amount does change annually.

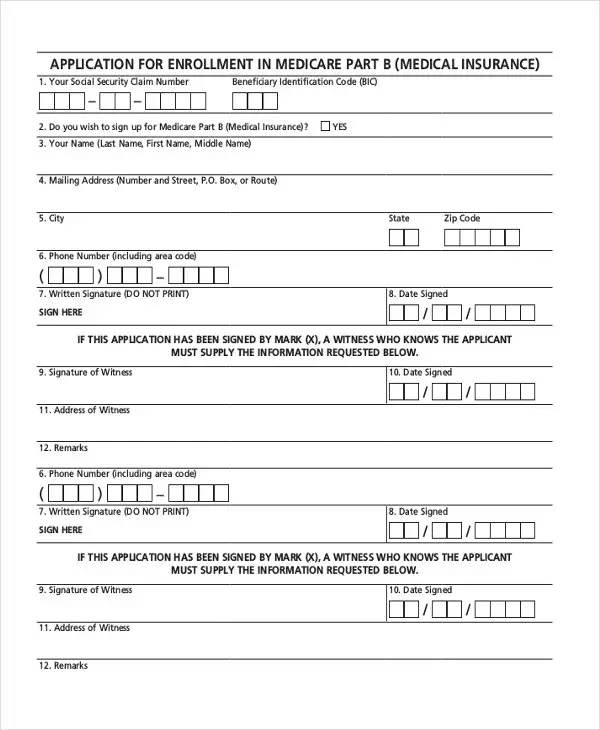

How Do I Apply For Medicare Benefits

If you are already receiving Social Security retirement or disability benefits or railroad retirement checks, Social Security will contact you a few months before you become eligible for Medicare and give you the information you need to register. You should sign up for Medicare even if you dont plan to retire at age 65, or you may be penalized a 10% premium surcharge for each year past age 65 that you do not have Medicare. However, if you are age 65 or older and are covered under a group health plan either from your own employment or you are covered from your spouses employment, you may delay enrolling in Medicare medical insurance without having to wait for a general enrollment period or pay the 10% premium surcharge for late employment. The rules allow you to:

- Enroll in Part B any time you are covered under the group health plan, or

- Enroll in Part B during an eight-month special enrollment period that begins with the month your group health coverage ends or the month your employment ends, whichever comes first

I disagree with the SSAs decision on my claim. How can I appeal? Please visit www.ssa.gov/pubs/10041.html or call 1-800-772-1213 to file an appeal. All appeals should be sent to your local office to find your local office, please visit www.ssa.gov/locator.

Different Ages For Different Benefits

One of the complexities involved in signing up for Social Security and Medicare is that people become eligible for the two programs at different times. Social Security retirement benefits are available as early as age 62, but most people don’t become eligible to receive Medicare benefits until age 65.

If you happen to want to retire right at age 65 and therefore want to start getting Social Security and Medicare benefits at the same time, then it’s easy to coordinate those benefits. The Social Security Administration handles the sign-up process for both Social Security and Medicare, and you can use a single application to file for both benefits if you’re within three months of your 65th birthday. The SSA’s online retirement application website is the easiest way to start.

However, if you have other plans for when to retire, then you’ll need to think carefully. There are two possible scenarios.

You May Like: Does Medicare Cover Bed Rails

How Do I Get A Medicare Premium Refund

Still cant get a straight answer on this! And very frustrated. Millions of people take Medicare benefits and delay SS benefits. This is not some kind of personal dilemma. I paid Medicare quarterly in advance. My SS benefits started mid-quarter. How do I get a refund? Particularly since SS benefits started mid month and not on the cycle of Medicare coverage on the 1st thru 30th e.g. quarter paid for Aug 1 Oct 31st. Do they refund? Is it prorated the Bday . Please respond!!!!!!

Hi. When Social Security withholds Medicare premiums for months that have already been paid out of pocket they normally refund the duplicate premiums within 60 days. However, many people have reported not receiving timely refunds, so I assume the refunds are currently taking longer possibly due to COVID related backlogs. In any case, such refunds are supposed to be automatic, so you shouldn’t need to do anything to get your refund. If your duplicate premiums aren’t refunded in what you consider to be a reasonable amount of time you’ll need to call Social Security to try to resolve the issue.

Medicare monthly premiums are not prorated because Medicare coverage isn’t prorated. If a person reaches age 65 in August and if they apply for Medicare timely, their Medicare coverage starts on August 1st even if they don’t turn 65 until August 31st. As a result, they must pay a full month’s premium for their coverage.

Best, Jerry

Who Qualifies For Medicare And Social Security

If you have a physical or mental illness that keeps you from working, you might be able to receive Social Security disability benefits.

Although Medicare, a United States health insurance program, is marked for adults 65 or older, you might qualify if you are younger than 65. This qualification would apply to you if you have disabilities and/or permanent kidney failure. If you have a physical or mental illness that keeps you from working, you might be able to receive Social Security disability benefits. Some qualifying ailments include:

- Musculoskeletal issues

- Cardiovascular issues

- Speech and sense issues

- Respiratory issues

- Neurological issues

- Mental disorders

- Immune system disorders

- Various other disorders

- Skin disorders

- Hematological disorders

- Endocrine disorders

Find out if your disability qualifies for coverage.Wounded or injured military personnel may apply for disability benefits through the Social Security benefit program. This might apply even if they are performing limited work, on active duty status, or receiving limited pay. Social Security staff will evaluate your work ability and decide whether or not you may receive Social Security disability benefits. Find out how much your wounded warrior Social Security benefit will be, whether your family will also receive benefits, and other questions.

MORE ADVICE

Don’t Miss: How Much Does Medicare Cover For Hospital Stay

You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Documents Needed If You Sign Up In Person

- An original or certified copy of your birth certificate or other proof of birth

- Proof of United States citizenship or legal residency if not born in the U.S.

- Your Social Security card if you are already receiving benefits

- A copy of your most recent W-2 form and/or self-employment tax return

- U.S. military discharge papers if you served before 1968

- Health insurance information

Read Also: How To Sign Up For Medicare And Tricare For Life

Calculate The Best Time To Start Social Security

If you are confused about when to start, you can use the Social Security Explorer part of the NewRetirement Retirement Planner to compare your monthly income and maximum lifetime payout at different ages.

Or, you might consider the following rules of thumb:

- Take Early: The only people who should consider taking their Social Security early are those who absolutely need the money immediately, or those who do not expect to live for very long, due to illness

- Take at Full Retirement Age: Should you have reason to believe that you will not live past the age of 80, then generally speaking you will maximize your social security benefits if you take them when you reach your Full Retirement Age.

- Wait as Long as Possible: On the other hand, if you are confident that you will live past the age of 80 or 85, then most experts recommend that you defer your social security for as long as you can , so as to maximize the benefits you receive from it.

- Other: If you have dependent children, the additional benefits you receive for them might make filing when you are younger worthwhile.

It can also be a very good idea to have an overall retirement plan before you decide when to start your Social Security benefits. The NewRetirement Retirement Planner can help you assess all of your sources of retirement income and whether or not you will have enough to cover your expenses. This tool was recently named a best retirement calculator by the American Association of Individual Investors .

How To Apply For Medicare In Person

Some people prefer to apply for Medicare in person at a local Social Security office. This can be a convenient option if you are very close to turning 65 and need to get your application processed quickly.

Visit the social security website to search for the office nearest you. When you meet with a representative, ask for a printout which shows that you have applied for Medicare Part A & B. This form will give you all the information you need to move forward with your Medicare supplement application and/or Part D drug plan.

Recommended Reading: Who Pays For Part A Medicare

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Also Check: What Is Needed To Replace Lost Social Security Card

How Do I Enroll In Medicare If I Am Receiving Social Security

If you are getting Social Security benefits at least four months before you turn 65, you generally do not need to enroll in Medicare. You will automatically get Medicare Part A and Part B starting the first day of the month you turn 65. If your birthday is the first of the month, your Medicare benefits will start the first day of the prior month. If you decided you want Medicare Advantage, Medicare Supplement, or Medicare Part D prescription drug coverage, you must enroll separately.

If you are getting Social Security because you have a disability, you will automatically get Medicare Part A and Part B after you have been getting disability benefits from Social Security for 24 months. However, owever, Medicare treats some conditions differently from others. If you have ALS you automatically get Medicare Part A and Part B the month your Social Security disability benefits begin. If you enroll in Medicare because you have ESRD and youre on dialysis, Medicare coverage generally starts on the first day of the fourth month of your dialysis treatments. Like with ALS, there is no two-year waiting period to enroll in Medicare.

You also can apply for Social Security and Medicare at the same time through the Social Security Official Website.

Read Also: Does Aspen Dental Accept Medicare

How Do I Get Social Security

Social Security gives monthly payments to retirees, disabled persons, and families of retired, disabled, or deceased workers, according to the National Academy of Social Insurance. The Social Security Administration states that almost all of American workers are covered under Social Security. Your age at retirement and your lifetime earnings affect your Social Security benefit amount. Higher earnings will result in higher Social Security benefits. The earliest you can start receiving Social Security retirement benefits is age 62, but you may receive more if you wait longer to retire.

If you are younger than 62 and have a disability, you may qualify for Social Security disability or Supplement Security Income after supplying information about your medical condition and work and education history. You can find the Social Security adult disability report here. Types of disabilities that may qualify you for Social Security benefits include:

- Musculoskeletal system disorders

- Congenital disorders that affect multiple body systems

- Neurological disorders

- Mental disorders

While families of retired and disabled workers are eligible for Social Security, families are generally not eligible for Medicare.

Concerning Medicare Part C And Medicare Part D

There are also Medicare Part C and D plans. Medicare C, now known as the Medicare Advantage Plan, includes all benefits and services covered under Part A and Part B bundled together in one plan. The average monthly cost for this plan is around $25, however, you are often subject to copay fees and must continue to pay your Medicare Part B premium. The perceived advantages of a Medicare Advantage plan are a known, fixed out-of-pocket maximum fee, as well as oftentimes access to vision, hearing, dental and prescription drug coverage.

-

If you’re thinking about relocating to somewhere cheaper in retirement, you’re not alone. Find out which states have the lowest cost of living for seniors.

- GOBankingRates

If you’ve ever answered the phone or received a voicemail threatening you with legal action for overpayments of Social Security or requesting you pay them in an unusual way, you’ve already had a brush…

- GOBankingRates

The holidays have a funny way of sneaking up on you when you’re living a busy life or surviving a pandemic. It seems like we just survived Thanksgiving and now Christmas is bearing down on us. Lots of…

- GOBankingRates

Recommended Reading: What Is The Monthly Charge For Medicare

If You Already Receive Benefits From Social Security:

If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A and Part B starting the first day of the month you turn age 65. You will not need to do anything to enroll. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If your 65th birthday is February 20, 2010, your Medicare effective date would be February 1, 2010.

How Social Security Determines You Have A Higher Premium

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Read Also: Is Ssi Social Security Disability

Read Also: Do Husband And Wife Pay Separate Medicare Premiums

Can You Immediately Receive Medicare With Social Security

For those on Social Security Disability, Medicare enrollment will begin after 24 months of collecting benefits. The exception is when you have End-Stage Renal Disease or Amyotrophic Lateral Sclerosis those conditions allow you to qualify immediately. If you dont collect Social Security, youll need to apply for Medicare yourself.

At What Age Do I Qualify For Social Security

You can begin collecting Social Security retirement benefits as early as age 62. Doing so, however, is often not advisable, since it means lowering your monthly benefits potentially for life.

To collect the full monthly benefit your earnings record entitles you to, you must wait until full retirement age to sign up for Social Security. Depending on your year of birth, that age will fall out somewhere between 66 and 67. For each month you file for Social Security ahead of full retirement age, youll face a reduction in your monthly benefits that will likely remain in effect indefinitely, unless you manage to go through the motions of withdrawing your application soon after filing it.

Recommended Reading: How To Apply For Medicare Through Spouse

How To Apply For Medicare Part C

Medicare Part C plans, more commonly known as Medicare Advantage plans, are offered by federally approved private insurers as alternatives to Original Medicare .

In order to get a Part C plan, you must first enroll â and stay enrolled â in Original Medicare. You can compare Medicare Advantage plans on the Medicare website and then purchase one directly from the insurer. You can do this during your initial enrollment, special enrollment, and open enrollment period in the fall.

If you decide you want to return to Original Medicare coverage, you can drop Part C during Medicare Advantage disenrollment, which runs January 1 to February 14 ever year.

Learn more about Medicare Part C.

When To Start Your Social Security

Here in America, you are eligible to begin taking Social Security benefits as early as age 62 if you have earned enough credits. The latest that you can start your benefits is at age 70.

If you begin your Social Security benefits at age 62, your benefits will be reduced based on the number of months that you receive your benefits before you have reached your full retirement age.

Your full retirement age in terms of Social Security is generally considered to be at age 66 and a half. However, this varies based on the year that you were born. Visit this page on the Social Security website for more specifics.

In very simple terms, taking income benefits earlier than your full retirement ages means that your monthly benefit amount will be lower. Waiting and taking those benefits later, up to age 70, means you will have a larger monthly benefit check.

Delaying your Social Security income benefits does not affect your eligibility for Medicare at age 65 either.

Read Also: Who To Talk To About Medicare