How Much Flexibility Do You Want In Your Plan

When choosing an individual health plan, you want to consider the type of benefit design. Health maintenance organization plans are the most common plan design in the individual market. eHealth estimated that 49% of individuals plans are HMOs.

HMOs include restricted provider networks. HMO members can only see doctors and get care from facilities in those networks. Also, you need a primary care provider referral to see a specialist.

Exclusive provider organization plans make up one-third of individual market plans. These plans dont allow you to get care outside of the network, but you also dont need a referral to see a specialist.

Preferred provider organization plans are the most common type of plan in the employer-sponsored health insurance market. Forty-seven percent of employer-sponsored health plan members have a PPO. However, only 16% of individual health insurance plans are PPOs.

PPOs are more flexible. You can see doctors both in your network and outside the network. You dont have to get referrals to see specialists. However, PPOs have much higher premiums than HMOs, so you pay more for that flexibility.

Find out the differences between HMOs, PPOs and other types of health plans.

When To Buy An Individual Health Plan

You can purchase or make changes to individual health insurance during the open enrollment period. Open enrollment for most states is from . States with their own exchanges usually offer expanded open enrollment.

States with expanded open enrollment include California, Colorado, the District of Columbia, Massachusetts, Minnesota, Nevada, New Jersey and New York.

The only other time you can get individual health insurance coverage is if you have a qualifying event that launches a special enrollment period. These events may have caused you to lose your health insurance coverage. The special enrollment sign up period lasts 60 days.

Special enrollment qualifying events include:

- Getting married

- Having a baby, adopting a child or placing a child for adoption or foster care

- Moving

- Becoming a U.S. citizen

- Leaving incarceration

- Losing other health coverage due to job loss, divorce, COBRA expiration or aging off a parents plan

- Losing eligibility for Medicaid or the Childrens Health Insurance Program

- Change in income or household status that affects eligibility for premium tax credits or cost-sharing subsidies

- Gaining status as a member of an Indian tribe

When Can I Buy Medicare Supplemental Insurance

Remember, the best time to purchase a Medigap policy is during the 6-month open enrollment period, which begins the day you have Medicare Part B insurance if youre 65 or older. During open enrollment, you can purchase any Medigap policy in your state, regardless of health problems. If you wait until this period closes, you may not be able to buy a Medicare supplemental insurance plan. This makes it especially smart to start comparing your options and getting quotes from Benzingas recommended providers early so you dont miss your enrollment window.

You May Like: How Do I Check On My Medicare Part B Application

Where Can You Buy Medigap Coverage

Medigap policies are available in every state, from private health insurance carriers. Americas Health Insurance Plans reported in 2021 that total Medigap enrollment in late 2021 stood at 14.5 million people up from 11.6 million in 2014 .

All Medigap insurers must abide by strict state and federal laws. In most states, Medigap carriers must offer standardized policies that are identified by the letters A through N. There are a total of ten different plan designs: A, B, C, D, F, G, K, L, M, and N , and although the price varies from one carrier to another, the plan benefits are the same from one state to another and from one carrier to another, within each letter. So all plan Ks, for example, offer the same benefits regardless of where you live or what insurance carrier you use.

In some states, not all types of Medigap coverage will be available. In other states, you may be able to purchase Medicare SELECT a Medigap policy that requires plan holders to use specific hospitals and, in some cases, specific doctors. Any of the ten Medigap plan designs can be offered as a Medicare SELECT plan, and they tend to be less expensive than typical Medigap policies due to the restricted network. If you choose a Medicare SELECT plan and use a provider thats not in the network, your Medigap plan wont pick up your Medicare out-of-pocket costs unless its an emergency.

Will I Have To Wait For My Medigap Policy To Take Effect

An insurer cant make you wait for your coverage to start, but it can make you wait for coverage of a pre-existing condition and may also refuse to cover your out-of-pocket costs for that pre-existing condition for up to six months during a pre-existing conditionwaiting period. That said, if you recently had creditable coverage or if you have guaranteed issue Medigap protection you may be able to shorten or avoid entirely the waiting period.

For more information about Medigap, read Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Read Also: What Is A Medicare Special Needs Plan

Can You Be Denied Medicare Supplemental Insurance

You cannot be denied Medicare. It is available to all Americans over the age of 65. But you can be denied a supplement. If you purchase within the available window when you turn 65, you will not be denied. If you wait, there is the potential you will struggle to find coverage or at least affordable coverage.

During the Guaranteed Issue period, you will have limited time to enroll in a Medicare plan and supplement without needing an underwriting review. Guaranteed Issue periods also include moving out of the geographic area in which you are covered. Both of these conditions allow you to enroll in Medicare without the chance of denial.

Unless you are in these two circumstances, you will need to undergo an underwriting review that could lead to a denial. A denial by one company does not mean there are other insurance companies that will not offer coverage.

Our experienced team specializes in finding coverages for people that find themselves in this situation. Each company has different underwriting requirements and what may create a denial for one company will not be the same for another. If you are in that situation, you can still find help.

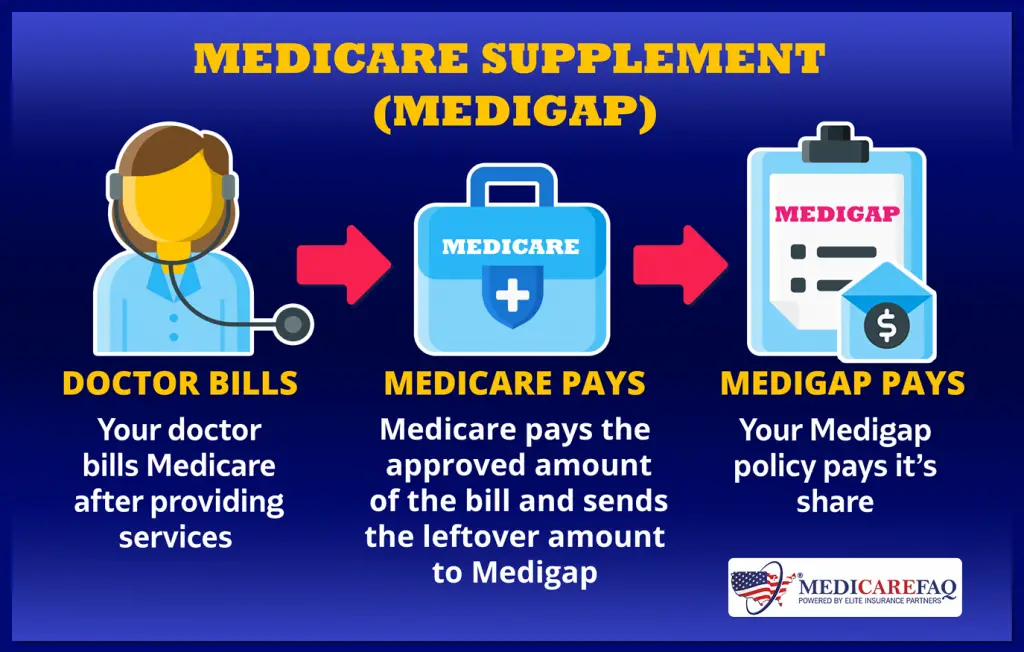

Whats A Medigap Policy

Medigap is the nickname for Medicare supplement insurance. This is private insurance that people can buy to help pay the bills that remain after Medicare Part A and Part B have paid their share. Having Medigap can help keep your out-of-pocket costs down.

However, people with Medicare Advantage plans cannotpurchaseMedigap insurance.

Medigap policies typically help pay for costs such as:

-

Copayments: fixed amounts, like $20, that you pay out of pocket for a medical service after meeting your deductible

-

Coinsurance: the percentage, such as 25%, of a medical cost that youre responsible for paying

-

Deductibles: the amount, like $200 or $1,000, that you must pay out of pocket for covered services before your health insurance plan starts to pay for them

Some Medigap plans offer additional coverage, such as emergency healthcare outside of the U.S.

Many well-known insurance companies, including UnitedHealthcare, Mutual of Omaha, and CVS Health , sell Medigap plans. Coverage specifics are regulated by the Centers for Medicare & Medicaid Services , and each insurance company chooses which plans to sell and what states to sell them in. There are 10 Medigap plans, known as Plans A, B, C, D, F, G, K, L, M, and N. Their rules and benefits are the same in all but three states: Massachusetts, Minnesota, and Wisconsin. These states have their own standards for coverage and provide a narrower selection of plans.

Read Also: Do I Need Health Insurance With Medicare

Denial Of Medigap Policy Renewal

In most cases your renewal is considered guaranteed and cannot be dropped, however there are certain circumstances when the insurance company can decide not to renew your Medigap policy:

- You stopped making premium payments

- You lied on your policy application

- Your insurance company went bankrupt

Medigap policies sold prior to 1992 are not guaranteed renewable, though the insurer needs the states permission to drop your coverage. Even then, you have the right to purchase another policy.

Medigap Guaranteed Issue Rights

You may qualify for guaranteed issue in specific situations outside the Medigap open enrollment period by federal law. For example, if:

- You no longer have coverage because your Medigap insurance company went bankrupt

- Your employer-sponsored supplemental/retiree coverage is ending

- Your Medicare Advantage Plan or PACE withdraws from your area, you moved to a new place not covered by your plan, or you chose to withdraw from a plan during the trial period.

- You choose to drop your Medicare Advantage plan within 12 months of enrolling.

- You choose to drop your Medigap or Medicare Advantage coverage because your insurance company broke rules or misled you.

Some states go beyond the federal requirements regarding Medigap guaranteed issue rights. For example, states such as New York and Connecticut require insurance companies to accept Medigap applications at any time throughout the year insurance companies are not allowed to charge more for a policy due to an applicants health.

Read Also: Can You Apply For Medicare After 65

Types Of Individual Health Plans

Individual health insurance plans dont differ in terms of benefits. However, plans vary on costs, how theyre structured, which doctors accept them and which prescription drugs they cover.

Health plans in the ACA marketplace are divided into four metal tiers to make comparing them easier. The tiers are based on the percentage of medical costs the plans pay and the portion you pay out of pocket. Out-of-pocket costs include deductibles, copayments and coinsurance. Find out more about copays and coinsurance.

The percentages are estimates based on the amount of medical care an average person would use in a year.

- Bronze — Plan pays 60% of your health care costs. You’re responsible for 40%.

- Silver — Plan pays 70% of your health care costs. You responsible for 30%.

- Gold — Plan pays 80% of your health care costs. You responsible for 20%.

- Platinum — Plan pays 90% of your health care costs. You responsible for 10%.

Buying Medigap During Your Open Enrollment Period

Your Medigap Open Enrollment Period is the timeframe in which you can first buy any Medigap plan available in your arearegardless of whether you have health problemsand for the same price as a healthy person. Your OEP lasts for 6 months. It starts on the first day of the month youre 65 or older and enrolled in Medicare Part B. For example, if you turn 65 and enroll in Medicare Part B in May, then May 1 through October 31 would be the best time to enroll.4

If you choose to delay enrollment in Medicare Part B and you dont buy a Medigap plan when youre first eligible, you might have to pay a Part B late enrollment penalty. But theres an exception if youre eligible for Medicare and have job-based insurance.4

Also Check: Does Medicare Pay For Air Evac

Who Should Purchase A Medicare Supplement Plan

Anyone concerned about the out-of-pocket costs of Medicare alone should consider the purchase of a Medicare Supplement plan, says Brandy Corujo, partner and co-owner of Cornerstone Insurance Group in Seattle. Medicare has cost-sharing in the form of deductibles and coinsurance. For example, there is a 20% coinsurance for all Medicare-approved services with no limit to out-of-pocket exposure.

Consider the following when purchasing a Medicare Supplement plan.

- You must enroll in Original Medicare, which includes Parts A and B, to qualify for a Medigap plan.

- A Medicare Supplement plan is not the same as a Medicare Advantage plan. Medicare Advantage plans offer Medicare benefits, follow Medicare rules and typically include drug coverage, while Medicare Supplemental plans are meant to fill the gaps in what your Medicare plan does not already cover.

- Each Medigap plan only covers one person, so spouses need to purchase separate policies.

- Premiums are paid to the private insurance company, which is in addition to your Part B premium paid to Medicare.

- Plan costs vary by state, but all plan benefits are the same nationally.

- Any standardized plan is guaranteed to be renewable even if your health conditions change.

- Medicare Supplement plans sold today dont include prescription drug coverage. If you need drug coverage, you may want to enroll in Medicare Part D . Part D is offered by some private insurance companies and may require separate payments.

Medicare Lift Chair Form

To purchase your lift chair from a Medicare supplier, you will probably pay for the chair up front and then fill out the paperwork for partial reimbursement. If you have used a Medicareapproved supplier, they may file the claim on your behalf. If you need to fill out the claim yourself, you can do so online.

In order to complete the claim, you will need some information. So, it’s a good idea to gather the following items together:

- the completed claim form

- a letter explaining why you are submitting the claim

- your doctors prescription

You have up to 12 months to file the claim or to ask your lift chair supplier to do so.

Read Also: What Age Am I Medicare Eligible

How To Compare Medicare Advantage Plans

Choosing a Medicare Advantage Plan can be a little intimidating because there are so many plans available. The average Medicare beneficiary has something like two dozen choices, Gordon says. That seems great, like, Oh, you have so many options, but it can be really overwhelming to consumers.

There are five different types of Medicare Advantage Plans:

-

Health Maintenance Organization, or HMO, plans: This kind of plan requires you to see an in-network provider unless its an emergency situation. Most require you to get a referral to see a specialist.

-

Preferred Provider Organization, or PPO, plans: This kind of plan allows you to see both in-network and out-of-network health care providers, although it typically is more expensive to go out of network.

-

Private Fee-for-Service, or PFFS, plans: This kind of plan allows you to see any Medicare-approved health care provider as long as they accept the plans payment terms and agree to see you, and you may also have access to a network of providers. You can see doctors that dont accept the plans payment terms, but you might pay more.

-

Special Needs Plans, or SNPs: This kind of plan provides benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. It also provides benefits to people with a limited income.

-

Medical Savings Account, or MSA, plans: These combine a high-deductible insurance plan with a medical savings account that can be used for health care costs.

Can I Be Dropped From My Medigap Policy

If you bought your policy after 1990, the policy is guaranteed renewable. This means your insurance company can drop you only if you stop paying your premium, you are not truthful about something under the policy or the insurance company goes bankrupt. Insurance companies in some states may be able to drop you if you bought your policy before 1990. If this happens, you have the right to buy another Medigap policy.

Also Check: How To Change Primary Doctor On Medicare

Supplement Plans A Wise Financial Decision

We never fully gave you a clear answer on whether a Medicare supplement is required or mandatory. Hopefully, seeing the differences between traditional Medicare and a supplement, the answer has become clear.

Supplement Plans are not required by law, but they are a wise financial decision that will protect you from high medical costs as you enter your senior years.

Youve worked hard and saved throughout your life, and seeing your savings melt away due to medical costs is a burden no one wants.

Now you have to decide on how to choose the best plan most appropriate to your situation. Depending on your financial situation as well as your current health status, plans can be adapted to help you make the best use of your resources.

Knowing the plan to choose is important, but also the company you choose is more than just premium dollars. We can help you find the most cost effective plan, but also help you find a company that will provide the added benefits and meet the needs you have.

That is why we started Medicare Nationwide. We saw the benefits that having adequate health coverage could have on peoples lives. We gathered the best Medicare Supplement companies in one place, so we can shop for you.

Let our experienced staff help you find the product that fits your needs and budgets. You wont be stuck in a company that fits our needs. We can examine what you need and find the best plan and the best company that works for you.

How To Find The Right Independent Medicare Insurance Broker

Now you know the first step in making certain the person you work with has your best interest in mind work with an independent insurance broker, not an agent working for an insurance company. In my opinion, throwing a dart and selecting any independent Medicare insurance broker will leave you better off than any agent employed by an insurance company. But, you can do better.

Not all independent Medicare insurance brokers are the same and it is in your best interest to find one that has the knowledge, wisdom, and experience to be your advisor. Here are a few bullet points I suggest to follow. Its not a difficult process, in fact, it can be completed in a moments time. These bullet points will you quickly sift out the below average and average insurance broker and find the ones that can add the most value and meet your needs. I might add that what you wont see is the old ask for referrals suggestion. Bernie Madoff built his Ponzi scheme business on referrals. Enough said.

Also Check: How To Apply For Medicare By Phone