Medigap Coverage Outside The Us

If you have Medigap Plan C, D, E, F, G, H, I, J, M or N, your plan:

-

Covers foreign travel emergency care if it begins during the first 60 days of your trip, and if Medicare doesn’t otherwise cover the care.

-

Pays 80% of the billed charges for certain

medically necessary

emergency care outside the U.S. after you meet a $250

deductible

Does Medicare Advantage Cover You While Abroad

Unlike Medigap coverage, Medicare Advantage plans are a government-approved alternative to Medicare offered by private health insurance companies. These plans differ in which added benefits they provide. Check with your Medicare Advantage provider to see if your plan includes health insurance for foreign travel .

If your Medicare Advantage plan does have travel insurance, make sure that it explicitly covers health issues such as preexisting conditions or medically necessary emergencies.Be mindful that Part C plans may not cover travel in every country or may even be limited in covering domestic travel emergencies. Part C plans operate in limited geographic areas. Your benefits will be equal to or better than Original Medicare, but they dont apply everywhere. If your Medicare Advantage plan becomes aware that youve lived away from your plans service area for 6 months or more, you may be automatically disenrolled.

What Is Travel Insurance

- Travel insurance primarily covers trip-related negatives, such as trip cancellation, trip interruption or lost baggage.

- Travel medical insurance is for people who are leaving the country and provides coverage while they are outside of the country. A travel medical policy focuses on emergency medical and dental. It also covers medical evacuation if its needed.

You May Like: Does Medicare Cover Nerve Blocks

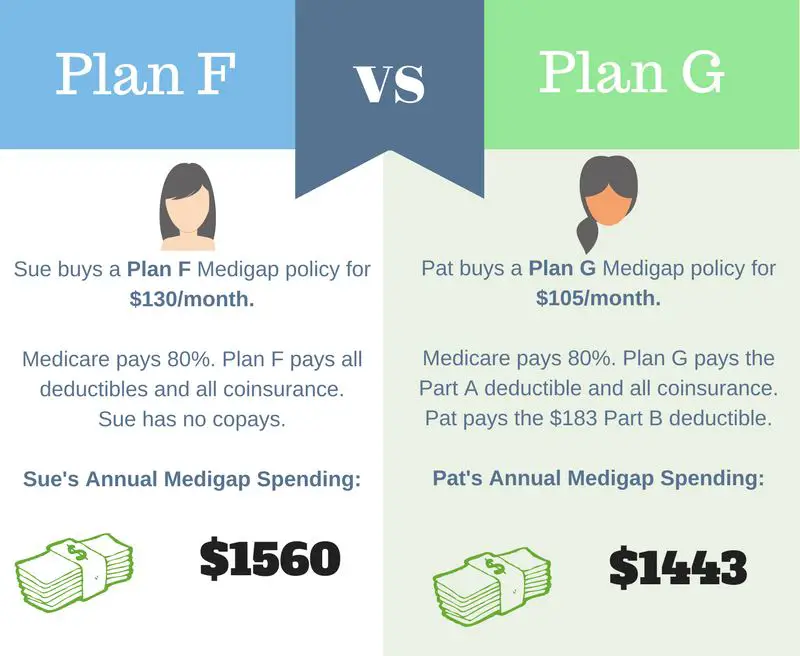

What Are The Differences Between Plan F And Plan G

In 2016, 55% of all Medicare Supplement Insurance beneficiaries were enrolled in Medigap Plan F, making it the most popular supplement plan in the market. Plan G was the second most popular, though it only was used by 10% of all Medigap enrollees.

There are three differences found in the Medicare Supplement Plan F vs. Plan G:

- The price of Medicare Supplement Plan F vs. Plan G

- Availability of Medicare Supplement Plan F vs. Plan G

- The coverage of the Medicare Part B deductible, only available with Medicare Supplement Plan F

What Are The Different Parts Of Medicare

- Medicare Part A covers hospital stays and expenses.

- Medicare Part B covers the coinsurance and testing associated with doctors visits.

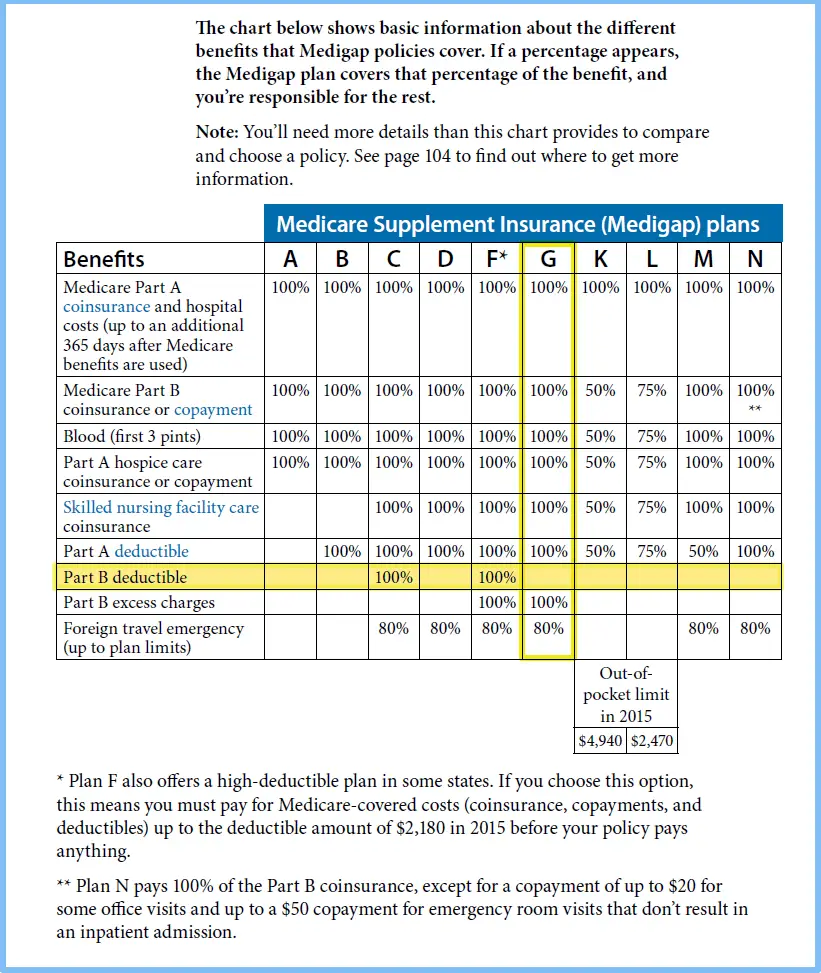

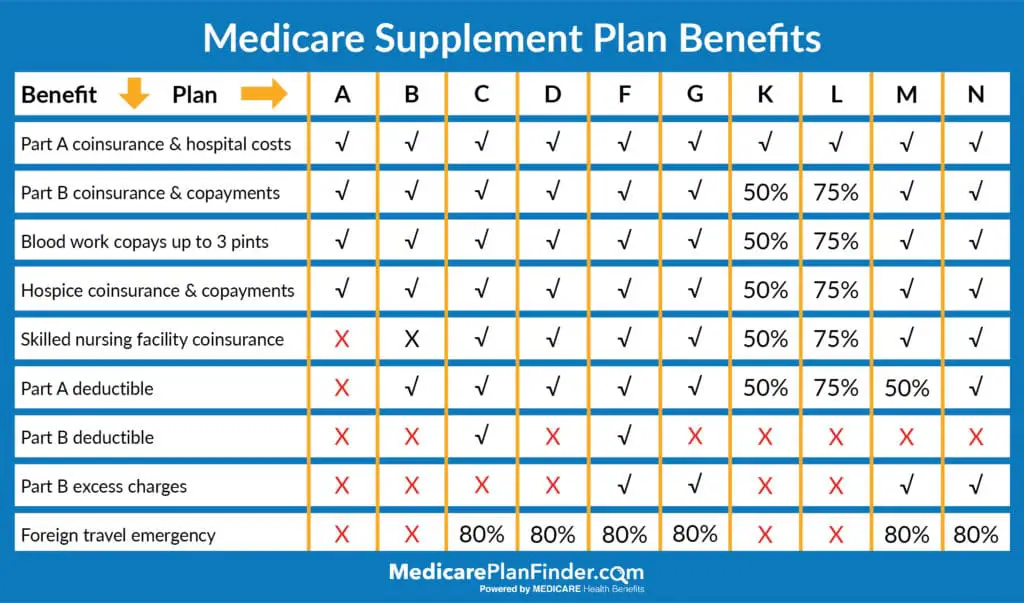

- Medigap plans are listed as A-N. Medigap Plan CMedicare Supplement Plan C, also called Medigap Plan C, is one of the most comprehensive of the 10 standardized supplemental Medicare plans available in most states. In fact, only Medicare Plan F offers more coverage…., E, F, H, I, and J are no longer available to new Medicare beneficiaries. As of 1 January 2020, if you have both Medicare Part A and B you can get a Medigap Plan AMedicare Supplement Plan A is often confused with Medicare Part A, which is the Medicare coverage that pays for your inpatient hospital care. Medicare Supplement Plan A, which is also known as Medigap Plan A,…, B, D, G, K, L, M, or N. The most popular plans are G and N.

- Medicare Part C is the Medicare Advantage plan program. These plans are not compatible with Medigap plans.

- Medicare Part D is a prescription drug coverage plan option that is compatible with all Medigap plans.

Read Also: Is It Better To Have Medicare Or Medicaid

Traveling Internationally With Medicare Advantage

Medicare Advantage is an optional plan that allows enrollees to receive their Medicare benefits in a way that’s more like employer-sponsored coverage. Advantage plans cover everything Original Medicare covers . But Medicare Advantage plans can also include extras such as prescription drugs, vision, dental, hearing, and fitness.

Some Medicare Advantage plans cover enrollees while traveling internationally in more situations than Original Medicare will. Each policy varies, so contact your insurance company to learn more. If your plan wont cover much travel or you dont have Medicare Advantage, speak with a licensed Medicare agent to go over your options.

How Does Medicare Cover Me If I’m Traveling Within The Us

For Medicare beneficiaries who see endless travel opportunities right here in the U.S., Original Medicare plus a Medigap plan will provide coverage border to border and coast to coast, including the U.S. territories.

Ninety-three percent of all U.S. doctors who provide Medicare-covered services are participating providers with Original Medicare. And only about 1% of all non-pediatric physicians in the U.S. have opted out of Medicare entirely.

Its also important to understand that Medicare Part D plans can require members to use in-network pharmacies, and some have localized networks rather than nationwide networks. Check with your Part D plan before traveling, and see if youll need to make arrangements to purchase medication in advance or use a mail-order pharmacy.

Medicare Advantage plans cover emergency care anywhere in the United States or its territories, but for routine care, plans typically require enrollees to use a local provider network. With most Medicare Advantage plans, if you travel outside of your plans service area for more than six months, youll be disenrolled from the Medicare Advantage plan and switched to Original Medicare instead.

Also Check: What Are The Qualifications For Medicare

Foreign Travel For People On Medicare

People with Original Medicare can travel anywhere in the United States and all of its territories and still have access to medical care from almost any doctor or hospital. This means that if you are travelling to the Virgin Islands, Guam, Puerto Rico or any other American territory, you are covered! But what about foreign travel for people on Medicare? Does Medicare cover international travel?

Medicare generally does not provide for care outside of the U.S. There are some limited exceptions, such as care on a cruise ship while in U.S. territorial waters or emergency care that occurs while you are en route to the U.S. and the closest hospital is in another country, such as Canada. However, its best to plan ahead and not assume any benefits from Medicare while you are outside of the country.

So how can you protect yourself if you have travel plans out of the country? Fortunately, both types of Medicare health insurance options offer some foreign travel emergency benefits.

Under What Circumstances Will I Be Covered By Original Medicare When I’m Outside Of The United States

Original Medicare coverage outside the United States and U.S. territories is limited to these circumstances:

- Youre in the U.S. when you have a medical emergency but youre close enough to its border that the nearest hospital is outside the United States, or you live near the border and the closest hospital that can treat you is outside the United States.

- Youre traveling between Alaska and another U.S. state via a direct route through Canada without unreasonable delay and a medical emergency occurs while youre in Canada .

- Youre on a cruise ship within six hours of a U.S. port.

Other than those situations, Medicare does not reimburse for care provided outside the United States. So if youre approaching Medicare enrollment and youve got a bit of wanderlust, its imperative that you seek out supplemental coverage that will protect you in case of a medical emergency outside the United States.

Recommended Reading: Does Medicare Cover In Home Caregivers

International Medicare And Medigap Coverage

by Christian Worstell | Published December 16, 2020 | Reviewed by John Krahnert

Clothing check. Passport check. Medical coverage?

If you are enrolled in Medicare and planning a vacation abroad, you should review what international medical services are covered under Medicare and Medigap.

Original Medicare health insurance provides limited international medical coverage. If you need health care coverage outside of the United States, you may want to consider a Medicare Supplement insurance plan . Some plans provide a foreign travel emergency care benefit.

Medicare Coverage For International Travel

Need Help? / /

- International travel Medicare coverage: Medicare may or may not cover medical expenses incurred while abroad. Medicare may cover the expense incurred if you live in the US and a foreign hospital is closer to you than a US hospital and you require medical treatment immediately.

- Medicare coverage overseas: Medicare may cover you for the health care services that you receive in a cruise by the concerned doctor while you are admitted to US or foreign hospital for Medicare covered emergency stay.

- Original Medicare Plan: Medicare only pays for the services covered under the Original Medicare Plan. The Original Medicare plan includes Part A and Part B

- Claims handling for Medicare International coverage: US hospitals are required to submit claims to Medicare but hospitals abroad are not required to do so. In that case where the hospital does not submit claim to Medicare, you can submit the bill that includes inpatient, doctor and outpatient services can be submitted to Medicare. Call 1-800-MEDICARE for more information

- Medicare Supplement Insurance or Medigap Policy is there to fill in the gaps in the Original Medicare Plan.

- Medigap plans C,D,E,F,G,H,I and J provide International Travel Emergency health care received outside the US.

- They pay 80% of the charges received for emergency care covered by Medicare in the US.

- Address:Crossborder Services, LLCFive Greentree Center, Suite 104, Route 73 Marlton, NJ 08053

Don’t Miss: Will Medicare Pay For Palliative Care

Does Medicare Cover Dialysis Abroad

No, Medicare cannot be used to get any medical treatment as youre travelling internationally, including dialysis. The only time when Medicare could potentially cover dialysis is if t is an emergency and:

- You are in the US, but the nearest hospital that could offer you dialysis is a foreign hospital or

- You are in Canada, on your way back from Alaska, and the nearest hospital that could offer you dialysis is in Canada

Does Medicare Advantage Have Limitations On Travel

If you get a Medicare Advantage plan, then your plan doesnt always cover medical services while traveling outside of the United States. It depends on what kind of plan you signed up and how long you travel for. It also depends on where you travel and the kind of care that you need while you are traveling.One thing is certain that if you travel outside of a Medicare Advantage plans service are for more than six months, you will likely be disenrolled. Medicare Advantage plans have service areas that are based on the region of where you originally signed up for Medicare. This means that even if you are traveling in the United States, you may be disenrolled from a Medicare Advantage plan unless you notify that you are changing geographic locations. This simply places you in Original Medicare if you are disenrolled from your plan. You also receive a Special Enrollment Period to join a new Medicare Advantage plan if you are disenrolled based on your new geographic location.Of course, not all plans have that policy to disenroll their members. You will receive notification if that is the case from your healthcare carrier. Some plans also include benefits to allow people to stay on a plan even if they are traveling long-term.

Also Check: Are Synvisc Injections Covered By Medicare

Does Medicare Advantage Cover Travel

Medicare Advantage plans must cover the same limited foreign emergency care expenses as Original Medicare.

Some Medicare Advantage plans may offer additional coverage as well. Certain rules and restrictions may apply.

For example, your Medicare Advantage plan may require you to pay your expenses upfront and get reimbursed by the insurance company later. Other plans might cap overseas travel benefits.

Its important to check the details of your specific plan for more information. Make sure to contact your plan provider to ask about costs and coverage rules.

Other Than Medicare What Coverage Should I Consider When I’m Traveling

For added peace of mind, many Medicare beneficiaries choose to purchase travel medical insurance prior to a trip. Travel medical plans are widely available, but be aware that in many cases, they restrict the amount of coverage available to seniors.

Although travel plans are frequently available with medical benefit maximums as high as seven figures, that limit is often reduced to $50,000 or less for applicants over 70 years old. Travel medical insurance can be used in conjunction with Medigap coverage or other health insurance.

Many travel medical insurance plans include separate medevac coverage, but it can also be purchased on a stand-alone basis from private carriers. Medevac return to the United States is not included in the foreign travel emergency coverage provided by Medigap plans. So beneficiaries with Original Medicare plus Medigap coverage might want to consider purchasing Medevac coverage prior to a trip abroad.

Recommended Reading: Does Medicare Pay For Mobility Scooters

What Countries Accept Us Medicare

Medicare will help cover you in some emergencies whileyoure abroad, but you shouldnt rely on it to work as it does in the U.S. Youcan only use your Medicare benefits as usual in the United States and itsterritories such as:

- Puerto Rico

Outside of the United States, your coverage under Medicarewill be limited to emergency situations.

What Does Medicare Supplement Plan F Cover

Medicare Supplement Plan F is one of the most popular Medicare Supplement Insurance plans because it offers the most comprehensive coverage of the currently available Medicare Supplement insurance plans.

Medicare Supplement Plan F covers the most amount of benefits compared to the other Medicare Gap plans. Plan F covers the gap in coverage associated with Parts A and B. This plan enables someone to be able to visit a doctors office or hospital to receive approved treatment and walk out without paying anything, virtually eliminating all out of pocket costs.

Plan F also includes coverage for other Medicare-approved expenses not associated with Parts A or B. This includes foreign travel emergencies and skilled nursing facility coinsurance. Importantly, Plan F is one of only two plans that include coverage for Medicare Part B excess charges.

Also Check: What Age Do You Apply For Medicare

Will Medicare Advantage Provide Coverage For Extended Travel Abroad

Some Medicare Advantage plans keep people on a plan if they are traveling abroad for extended periods, but seniors traveling outside of their Medicare Advantage plans service area for over six months could face disenrollment. Even seniors traveling within the United States or its territories may be disenrolled unless they notify the plan of changing geographic locations.

Seniors who are disenrolled under these circumstances can join a different Part C plan during a special enrollment period. If they dont choose a new plan, they will be automatically enrolled in Original Medicare.

A Home Away From Home

Does travel means spending an extended amount of time in your second home or with family or in a long-term vacation rental? During these longer stays, you may need to take an even closer look at your MA coverage.

Medicare Advantage is a national program, but MA plans are offered to individuals based on their ZIP codes. That means you are only eligible to remain in a particular MA plan if you are in a ZIP code where that plan is offered. In fact, the Centers for Medicare & Medicaid Services require that members be disenrolled from their MA plan if they live outside their plans service area for more than six months.

However, there are MA plans designed to allow you to stay on your plan even if you spend significant time outside the plans service area. Aetna offers MA plans with a visitor travel program. This program allows you to remain in your plan for an extra six months on top of what CMS rules allow when you live outside your plans service area.

How to make sure your Medicare Advantage HMO plan travels with you

Monique C. has a Medicare Advantage HMO plan from Aetna that includes the Travel Advantage feature. Travel Advantage allows Monique to remain in her plan for an extra six months when out of her plans service area. It also offers a multistate provider network. She lives in Florida but is planning to spend three months in New York to visit her grandchildren. Here are some steps she should take to enjoy her coverage away from home.

Don’t Miss: Is A Sleep Study Covered By Medicare

Do Medigap Plans Cover International Travel

Medigap plans are supplemental insurance policies designed to cover the out-of-pocket expenses associated with Medicare, such as copays, coinsurance and deductibles. These plans, which are sold through private insurers, may also provide coverage for medical services or supplies received while traveling outside of the United States if they’re not reimbursable through Medicare.

Medigap Plans C, D, E, F, G, H, I, J, M or N cover medically necessary services for individuals who seek emergency treatment for an accident or illness during the first 60 days of a trip. Before coverage begins, beneficiaries must meet a $250 annual deductible, after which theyll be responsible for 80% of billed charges. The program has a lifetime cap of $50,000 for international travel emergency coverage.

Common Questions About Foreign Travel:

Here are some common questions about traveling with Medicare.

Can I visit a doctor in a different state?

Original Medicare does not have network restrictions. Therefore, you can visit any doctor in the United States that accepts Medicare.

Will Medicare pay for healthcare services in a different country?

Medicare typically does not cover medical services outside the country and its territories unless in the midst of an emergency in certain situations.

Does my Medigap plan have foreign coverage?

Medigap Plans C, D, F, G, and N offer up to $50,000 in foreign travel emergency benefits.

What could happen to my Medicare Advantage plan if I travel abroad?

Since Medicare Advantage plans have network restrictions, you cannot travel outside your service area for more than six months. If you travel abroad for more than six months, you may get dis-enrolled from your Medicare Advantage plan and return to Original Medicare.

Can I use my Part D plan internationally?

No, Medicare Part D plans do not cover prescription medications you purchase outside the United States. If you visit an international pharmacy, prepare to pay for 100% of your drug costs.

Also Check: How Much Does Humira Cost With Medicare

Traveling Internationally With Rrb Medicare

If you were a railroad worker and qualified for Medicare through the Railroad Retirement Board, your benefits are slightly different from those most Medicare recipients have. In addition to the situations above, you could also receive some coverage while living in Canada with RRB Medicare.

This coverage is through Part A only, not Part Bwhich is to say youre covered for hospital stays, but not doctors appointments hospice, but not lab work. Learn more about Part A vs. Part B to better understand what your coverage limitations will be.