Other Ways To Sign Up

If you dont want to enroll online, print the form and mail it, fax it or bring it to your local Social Security office. Alternatively, you can fill out Form CMS-40B and have the employer who provides your health insurance complete Form CMS-L564. If the employer is unable to complete the form, you can submit the documents that show you had health insurance.

Most Social Security offices have been closed during the COVID-19 pandemic. Contact your local office to find out whether you can go in person or must mail your application.

To find your local office, use the Social Security field office locator. If you want to mail your application, use certified mail, which provides confirmation that your document was delivered. Another option is to fax the application to 833-914-2016.

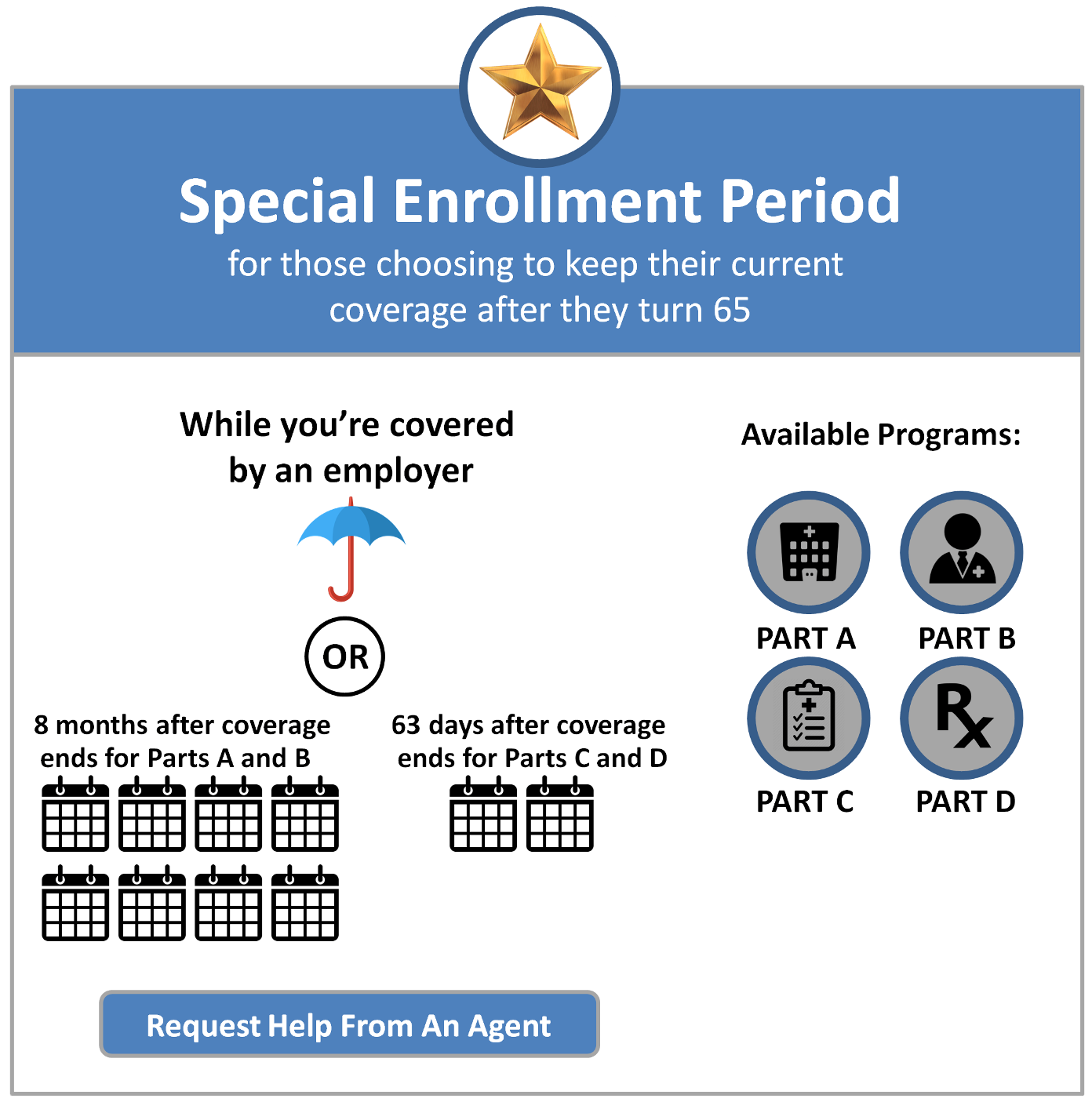

What Qualifies As A Special Enrollment Period For Original Medicare

Original Medicare refers to Medicare Part A and Part B . Most people enroll in Original Medicare during initial enrollment around the time they turn 65. If you do not enroll duringinitial enrollment, you can enroll later on either through general enrollment , or you may qualify for a special enrollment period.

You can qualify for an SEP for original Medicare when you would be leaving creditable coverage and coming into Medicare after age 65, says Keith Armbrecht, founder of MedicareOnVideo.com.

In fact, if youre over 65 and you or your spouse is still working and covered by a group health plan, you can get Original Medicare through a special enrollment period anytime you want. However, once that coverage ends, you have an eight-month window to sign up for Part A and/or Part B through special enrollment.

Note: If youre paying for COBRA, you will not qualify for a special enrollment period since thats not considered employer coverage.

Disenrollment From Your First Medicare Advantage Plan

If you enrolled in a Medicare Advantage plan when you first became eligible for Medicare, you have 12 months to disenroll from the plan and transition back to Original Medicare.

If you dropped a Medicare Supplement Insurance plan to enroll in a Medicare Advantage plan but wish to revert back again, you have 12 months to do so .

You May Like: Does Medicare Cover Inspire Sleep

Special Enrollment Periods: Other Qualifying Circumstances

Other reasons that you may be permitted to enroll during a Special Enrollment Period include if you have recently moved or if your Medicare plan changes to your disadvantage. A Special Enrollment Period allows you to make changes to your Medicare Plan, like adding Part D or switching from Medicare Advantage to an original Medicare Plan. Different rules and regulations depend on your reason for having a Special Enrollment Period. It is essential to check with your healthcare provider to be fully aware of what your Special Enrollment Period implies.

You may also use your Special Enrollment Period to sign up for Medicare Part A. If you have worked for ten years and have paid Medicare taxes, then you may already have Part A. Suppose you dont have enough work history and have delayed enrollment due to employer-sponsored coverage. In that case, you are eligible to enroll in Medicare Part A during the Special Enrollment Period. It is vital to be aware of this because you could be charged a late-enrollment premium if you dont enroll during the Special Enrollment Period.

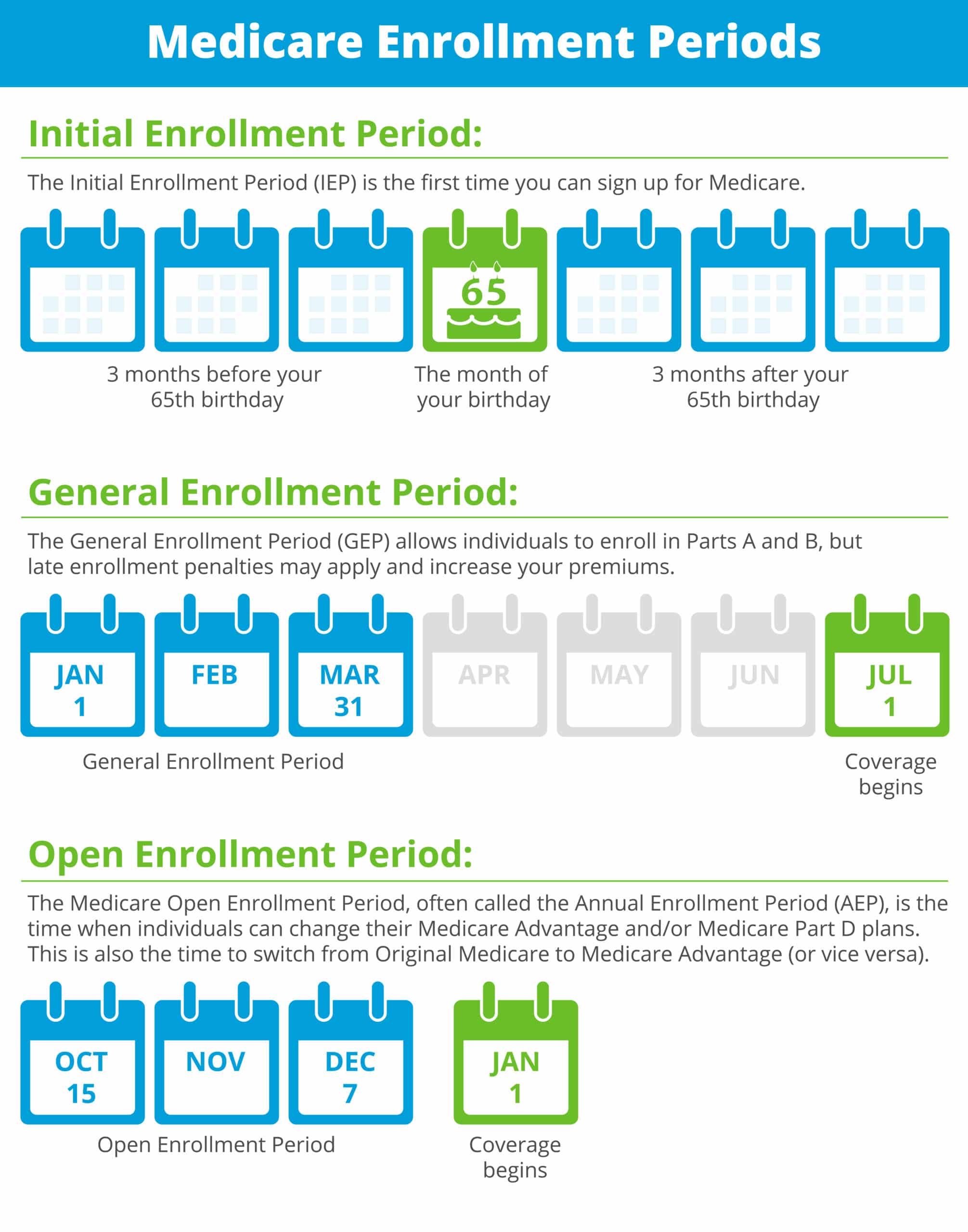

Medicare Enrollment Periods: When To Sign Up

When to join a Medicare Advantage Plan or Medicare Prescription Drug Plan

Its important for you to know when to sign up for Medicare or when to join a Medicare plan. Remember these times so you get the most out of your Medicare and avoid late enrollment penalties:

- Initial Medicare Enrollment Period: Most people get Medicare Part A and Part B during this period. It starts 3 months before you turn 65 and ends 3 months after you turn 65. If youre not already collecting Social Security benefits before your Initial Enrollment Period starts, youll need to sign up for Medicare online or contact Social Security.To get the most from your Medicare and avoid the Part B late enrollment penalty, complete your Medicare enrollment application during your Initial Enrollment Period. This lifetime penalty gets added to your monthly Part B premium, and it goes up the longer you wait to sign up. Find out if you should get Part B based on your situation.

- General Medicare Enrollment Period: If you miss your Initial Enrollment Period, you can sign up during Medicares General Enrollment Period , and your coverage will start July 1.

- Special Enrollment Period: Once your Initial Enrollment Period ends, you may have the chance to sign up for Medicare during a Special Enrollment Period . You can sign up for Part A and or Part B during an SEP if you have special circumstances.

When to join a Medicare Advantage Plan or Medicare Prescription Drug Plan

Read Also: How To Sign Up For Aetna Medicare Advantage

Medicare Special Enrollment Period For The Working Aged

If you are still working when you turn 65 and have group coverage through an employer or union, you can generally delay Part A and/or Part B. When that employment or your health coverage ends, you can typically enroll in Part A and Part B with a Medicare Special Enrollment Period. You have eight months to enroll, beginning the month that employment or employment-based coverage ends whichever happens first. You may not have to pay a late enrollment penalty for not enrolling when you were first eligible.

The health coverage must be based on current employment . You can either enroll in Part A and/or Part B while youre still covered through the group plan, or during the eight-month Medicare Special Enrollment Period . This SEP starts the month that your insurance ends, whichever happens first. This Special Enrollment Period occurs regardless of whether you decide to get COBRA coverage.

Keep in mind that COBRA and retiree health insurance dont count as coverage based on current employment and wont qualify you for a Medicare Special Enrollment Period when it ends. You also wont get a Medicare Special Enrollment Period if your group coverage or employment ends during your Medicare Initial Enrollment Period. In that case, youd join Part A and/or Part B during your Initial Enrollment Period.

What If An Employer Gives Me Money To Buy My Own Health Plan

A note about individual coverage: youll qualify for an SEP if you delayed Part B because you had employer-sponsored coverage through a group health plan . This is a specific type of insurance plan sponsored or run by your employer. It includes coverage your employer offers you through an insurer, and plans purchased from the Small Business Health Options Program marketplace.

Instead of offering GHP coverage, some employers provide you money to buy your own health insurance. They can reimburse you directly, in which case the money is taxed, or through a Qualified Small Employer Health Reimbursement Arrangement or an Individual Coverage Health Reimbursement Account . Coverage you buy on your own does not qualify you for the Part B SEP even if an employer paid for some or all of it. If you have individual coverage, you should sign up for Medicare when youre first eligible, and can enroll during your initial enrollment period or the general enrollment period.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare ombudsman contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals. In addition to advocacy work, Josh worked on federal and state health insurance exchanges at the technology firm hCentive.

Contributions to healthinsurance.org and medicareresources.org represent only his own views.

You May Like: How Do I Report A Lost Medicare Card

What Is A Medicare Special Enrollment Period

Certain life events and situations qualify you for a Medicare special enrollment period. There are more than 20 qualifying special circumstances listed by the U.S. Centers of Medicare & Medicaid Services.

Rules about when you can make changes to your Medicare plan and the type of changes you can make vary for each special enrollment situation.

If you miss your special enrollment period window, you may have to wait until the next Medicare open enrollment period, which takes place every year from Oct. 15 to Dec. 7.

A special enrollment period is different from your initial enrollment period, or the time when you first become eligible for Medicare.

For most people, this period starts three months before your 65th birthday and ends three months after your birth month.

During a special enrollment period, you may be able to:

- Enroll in Medicare Part A and/or Part B.

Don’t Leave Your Health to Chance

Top 5 Things You Need To Know About Medicare Enrollment

1. People are eligible for Medicare for different reasons.

Some are eligible when they turn 65. People under 65 are eligible if they have received Social Security Disability Insurance or certain Railroad Retirement Board disability benefits for at least 24 months. If they have amyotrophic lateral sclerosis , theres no waiting period for Medicare. Some people with End Stage Renal Disease may be eligible for Medicare. Its important to know the different ways that people qualify for Medicare so you can help current and former employees and their dependents anticipate their eligibility for Medicare so they can make timely and appropriate decisions about their enrollment.

2. Some people get Medicare Part A and Part B automatically and some people need to sign up for them.

People living in the United States and U.S. Territories who are already collecting Social Securityeither disability or retirementare automatically enrolled into Part A and Part B when theyre first eligible. These people will get a packet of information a few months before they turn 65 or receive their 25th month of Social Security Disability or Railroad Retirement Board benefits. At that time, they can choose to keep or decline Part B, but cant decline Part A unless they withdraw their original application for Social Security and pay back all Social Security cash benefits.

3. Enrolling in Medicare can only happen at certain times.

Read Also: How Much Is Medicare Plan B

How To Avoid Part D Late Enrollment Penalties When You Retire After 65

During this Special Enrollment Period, you can enroll in a Medicare Advantage or stand-alone Medicare Part D Prescription Drug Plan. However, the timing is slightly different.

You have 8-months to enroll in Medicare Parts A and B during this Special Enrollment Period. But you only have 60 days to enroll in a Medicare Advantage or Medicare Part D Prescription Drug Plan. If you dont enroll in those first two months, you may face late enrollment penalties for Part D coverage.

Changes Due To Other Circumstances

You may find yourself in a position where you face a different set of circumstances that qualify you for a SEP.

No Longer Qualify for Extra Help

Those no longer eligible for Extra Help in the upcoming year have several options. You can choose to join a new plan or switch your plan. Further, you can drop your Advantage plan and return to Medicare, or you can choose to decline your drug coverage. You can make changes to your policy for three months from the date in which youre no longer eligible, or the notification date.

Ineligible for Medicaid

Those no longer eligible for Medicaid coverage can enroll in a new plan, switch plans, drop advantage plan and return to Medicare, or even drop Part D. You can make these changes up to three months from the date that youre no longer eligible for Medicaid, or when you get a notification.

Read Also: How Does Medicare Plan G Work

What To Mark On The Application

At the time of applying, the prospective insurer needs to write down a specific election session. You can find a designated column/space to mark the reason for the special joining session election. You can observe the reason for the election as per the FEMA emergency or government weather disasters. If the application does not have a section to mark the cause, then you can score off the special joining session box, and in the remarks area, write FEMA disaster.

What Events Trigger A Special Enrollment Period For Medicare

Medicare is the federal health insurance program designed for people who are 65 years of age or older. It also provides coverage for some younger people with disabilities and people who have end-stage renal disease . When you become eligible for Medicare, you need to decide when to enroll.

You can enroll during the initial enrollment period, which begins near your 65th birthday and lasts for seven months. You can also enroll during the general enrollment period , but you may face late enrollment penalties. If youre already enrolled, you can make changes to your coverage during designated open enrollment periods each year, depending on the type of coverage you have.

But if you need to add or change your coverage outside of these times, you must qualify for a special enrollment period . Several different events can create these enrollment opportunities. Below, youll find which circumstances make you eligible for a special enrollment period, and what Medicare programs you can enroll in.

You May Like: Does Plan N Cover Medicare Deductible

A Medicare Advantage Plan That Surrenders Contracts With Providers

If your Medicare Advantage plan ceases contracts with many of its providers and these terminations are considered substantial, you will be granted a one-time opportunity to switch to a different Medicare Advantage plan.

The period given to make the change will begin the month you are notified of the opportunity and will continue for two months thereafter.

If your circumstances do not fit into any of the Special Enrollment Periods described above, you may ask the Centers for Medicare and Medicaid Services for your own Special Enrollment Period based on your situation.

What If The Marketplace Needs Documents To Confirm My Special Enrollment Period

Once you have submitted your application for new marketplace enrollment, you may be asked to send documents confirming events that qualify you for the Special Enrollment Period. You will find this request on your eligibility results screen, and you can download or get it in the mail.

It is suggested to choose a plan first, where Simpler Horizons experienced insurance agents can help you. Then, you have to upload your documents online or post copies to begin your coverage. Once you have selected a plan, you have 30 days to send the acceptable documents.

Your coverage start date depends on when you choose a plan.

However, you cannot use your coverage until your documents confirm your eligibility for a Special Enrollment Period, then make your first premium payment.

If your eligibility results do not ask you to provide documents, you are not required to do so. Instead, choose a plan and enroll. For more information, visit HealthCare.gov/coverage-outside-open-enrollment/confirmspecial-enrollment-period.

For choosing a suitable plan, you can always rely on experienced insurance agents who understand your medical needs and guide you towards the right option.

If you are eligible for SEP but havent yet decided what plan to replace with, give us a call, and our agents specialized in Medicare will help you.

Also Check: Does Medicare Have A Maximum Out Of Pocket

When Does A Special Enrollment Period Start

The beginning and end dates of your Special Enrollment Period will differ from one qualifying scenario to the next.

If you have a particular situation that prevented you from enrolling in any type of Medicare coverage for which you were eligible, you are encouraged to call 1-800-MEDICARE and request a Special Enrollment Period.

What Is The Special Enrollment Period For Medicare Advantage Plans

When it comes to Medicare Advantage Plans , there are a number of reasons that you can qualify for a special enrollment period, says Armbrecht. These may include:

- If you move and your plan is not available in the new location.

- If you move to a location with other plan options.

- If you return to the United States after living abroad.

- If you are released from prison.

- If you leave an employer that had coverage.

- If you get the chance to enroll in other coverage though employment or a spouse.

- If you enter or leave a nursing home or other care facility.

- If you had Medicaid, but are no longer eligible.

Another big one is if you develop a chronic condition, says Armbrecht. There are Medicare Advantage plans that specialize in certain chronic conditions like diabetes. So there is a special enrollment period to find the right plan for your needs, he says.

Recommended Reading: How To Qualify For Extra Help With Medicare Part D

How To Avoid Penalties

Keep in mind: If you delayed signing up for Medicare because you or your spouse were working, you need to enroll within eight months of losing your health insurance. Otherwise, you may have to pay a late-enrollment penalty.

This amounts to 10 percent of your Part B premium for each 12-month period you could have had Part B but didnt enroll. If you had job-based coverage during that time, those months wont count when the penalty is calculated.

To prove that you had health insurance, the employer who provided the insurance should fill out Form CMS-L564 and send it to the Social Security office along with your application.

Images: Social Security Administration Centers for Medicare & Medicaid Services

Kimberly Lankford is a contributing writer who covers personal finance and Medicare. She previously wrote for Kiplinger’s Personal Finance magazine, and her articles have also appeared in U.S. News & World Report, The Washington Post and the Boston Globe. She received the personal finance Best in Business award from the Society of American Business Editors and Writers.

More on Medicare