How Do I Enroll In Medicare

Automatic Enrollment Period

A person receiving SSDI for the required time period is automatically enrolled in Medicare Part A and Medicare Part B . Beneficiaries should receive a Medicare card in the mail a few months before they become eligible. This will notify beneficiaries of their automatic enrollment in Medicare Part A and Medicare Part B. If you do not receive this card, you should contact the Social Security office as you approach Medicare eligibility. Medicare Part A is usually premium-free for everyone. If you have worked fewer than 40 quarters, the premium is based on the number of quarters worked. For Medicare Part B there is a monthly premium which is usually deducted from your Social Security check. The monthly Part B premium can change annually. A person has the option to turn down Medicare Part B. If you are a beneficiary or your spouse is actively working for an employer that is providing an employer group health plan , you may be able to continue the EGHP coverage if you or your spouses employer has 100 or more employees. In this situation you will be able to delay enrollment in Medicare Part B. If you are going to delay your enrollment in Medicare Part B, you should meet with a Social Security representative or call 1-800-772-1213 or 1-800-325-0778 .

Special Enrollment

For more details and further information, please call SHIIP at 1-855-408-1212 Monday through Friday from 8am to 5pm.

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

You Can Receive Medicare Without Taking Your Social Security Benefits

Medicare and Social Security aid older Americans and their spouses who paid into the programs through FICA taxes during their working years.

Medicare provides both free and cost-effective health insurance coverage for eligible older adults who are 65 years of age or older. Social Security retirement benefits act as a small pension, providing monthly income to those eligible as early as age 62.

Even if you are eligible to start receiving benefits, you do not have to start taking them. In some cases, it may be better to delay or to start taking benefits from one program but not the other.

Recommended Reading: When You Are On Medicare Do You Need Supplemental Insurance

Retirees And Those Still Working

If you paid into a retirement system that didnt withhold Social Security or Medicare premiums, youre probably still eligible for Medicareeither through your retirement system or through your spouse. To receive full Medicare coverage at 65, you must have earned enough credits to be eligible for Social Security.

Each $1,470 you earn annually equals one credit, but you can only earn a maximum of four credits each year. You will receive Social Security benefits at retirement if you have earned 40 credits10 years of work if you earned at least $5,880 in each of those years. If you continue to work beyond age 65, things get a bit more complicated. You will have to file for Medicare, but you may be able to keep your companys health insurance policy as your primary insurer. Or, your company-sponsored insurance plan might force you to make Medicare primary, or other conditions may apply to you.

Theres a lot to consider that makes it prudent to talk to a person knowledgeable in Medicare about your specific choices. This could be your Human Resources department or a Medicare representative.

If you continue to work beyond 65, theres a lot to consider that makes it prudent to talk to a Medicare expert about your choices.

Taking Medicare But Not Social Security

It is possible to enroll in Medicare coverage but delay taking your Social Security retirement benefits. For many workers, this strategy might be financially advantageous.

For most older people, it is a good idea to enroll in all parts of Medicare coverage they plan to use as soon as they are eligible at age 65. If you delay enrolling, Medicare Part D may become more expensive. If you delay signing up for Part B, you may also experience a gap in your coverage or have to pay a late enrollment penalty.

However, if you can afford to, it is often a smart financial decision to delay receiving Social Security benefits until at least your full retirement age in order to increase the benefit you receive. This may mean that there are several years during which you are enrolled and covered by Medicare but not yet receiving your monthly Social Security benefit.

Also Check: Does Stanford Hospital Accept Medicare

How Do I Apply For Traditional Medicare

If youre not automatically enrolled in Medicare Part A and Part B, you need to sign up. You should enroll during your IEP, or a Special Enrollment Period if you qualify for one. As mentioned above, one example of a Special Enrollment Period might be if you delayed enrollment in Medicare Part A and/or Part B because you had employer coverage.

You typically sign up for Medicare through the Social Security Administration . You can go to the website at ssa.gov. Or, go in person to a Social Security office. You can reach the SSA at 1-800-772-1213 . Representatives are available Monday through Friday, from 7AM to 7PM, in all U.S. time zones.

Can I Apply For Medicare At Age 62 Or Do I Have To Be 65

Although you may be able to begin withdrawing Social Security benefits for retirement at age 62, Medicare isn’t available to most people until they turn 65. But if you are under the age of 65, you could be eligible for Medicare if you meet any of the following criteria.

- You have been receiving Social Security disability benefits for at least 24 months.

- You receive a disability pension from the Railroad Retirement Board and meet certain criteria.

- You have Lou Gehrigs disease .

- You have ESRD requiring regular dialysis or a kidney transplant, and you or your spouse has paid Social Security taxes for a length of time that depends on your age.

If none of these situations apply to you, you’ll have to wait until age 65 to begin receiving your Medicare benefits. However, you can begin the sign-up process three months before the month you turn 65 during your IEP .

You May Like: Do People Pay For Medicare

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Also Check: Does Medicare Cover Out Of Country Medical Expenses

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Medicaid In The Interim

Those with low income and low assets may qualify for the Medicaid program during the two-year waiting period for Medicare. States set their own rules regarding Medicaid eligibility, but those granted SSI at the same time as SSDI automatically qualify for Medicaid.

While Medicare covers hospice for those who are expected to pass within six months, the waiting period prevents many with a terminal illness from using Medicare for hospice needs. However, all 50 states’ Medicaid programs cover hospice for those with low income and low assets. States may vary on the length of hospice coverage they provide and the amount of inpatient care that’s covered.

For more information on Medicaid eligibility, see the Medicaid section on Nolo.com.

Also Check: Do I Need To Sign Up For Medicare Part B

Contact Social Security To Sign Up For Medicare

You can either:

Know when to sign up for Part BYou can only sign up for Part B at certain times. If you dont sign up for Part B when you turn 65, you might have to wait to sign up and pay a monthly late enrollment penalty. Find out when you can sign up. How much is the Part B late enrollment penalty?

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Don’t Miss: Does Medicare Cover Chronic Pain Management

When You’re Eligible For Social Security

Today, older adults become eligible for full Social Security retirement benefits at age 66 or 67 depending on their birth year and whether they or their spouse have met the work credit requirement.

For anyone born in 1929 or later, the minimum work credit requirement for Social Security benefits is 40 credits or 10 years of work. The year you can start taking full Social Security benefits is known as your full retirement age or normal retirement age. If you were born on January 1 of any year, refer to the previous year when calculating your full retirement age.

| Age for Receiving Full Social Security Benefits | |

|---|---|

| Birth Year | |

| 1960 and later | 67 |

Unlike Medicare, older people can opt to start taking their benefits before their full retirement age. The earliest you can begin taking Social Security benefits is age 62. However, if you begin taking Social Security payments before your full retirement age, you will receive a reduced monthly benefit for the remainder of your life.

If you are a widow or widower, you can start claiming your spouse’s reduced Social Security benefits when you are age 60, or 50 if you are disabled. You can then switch to taking your own full benefit at your full retirement age.

You can also choose to delay your Social Security benefit past full retirement age until age 70. This will often make you eligible for delayed retirement credits, which increase your monthly benefit for the remainder of your life.

What Are Cases When Medicare Automatically Starts

Medicare will automatically start when you turn 65 if youve received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday.

Youll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks. According to the Social Security Administration, more than 30% of seniors claim Social Security benefits early.1 For those seniors, Medicare Part A and Part B will automatically start when they reach the age of 65.

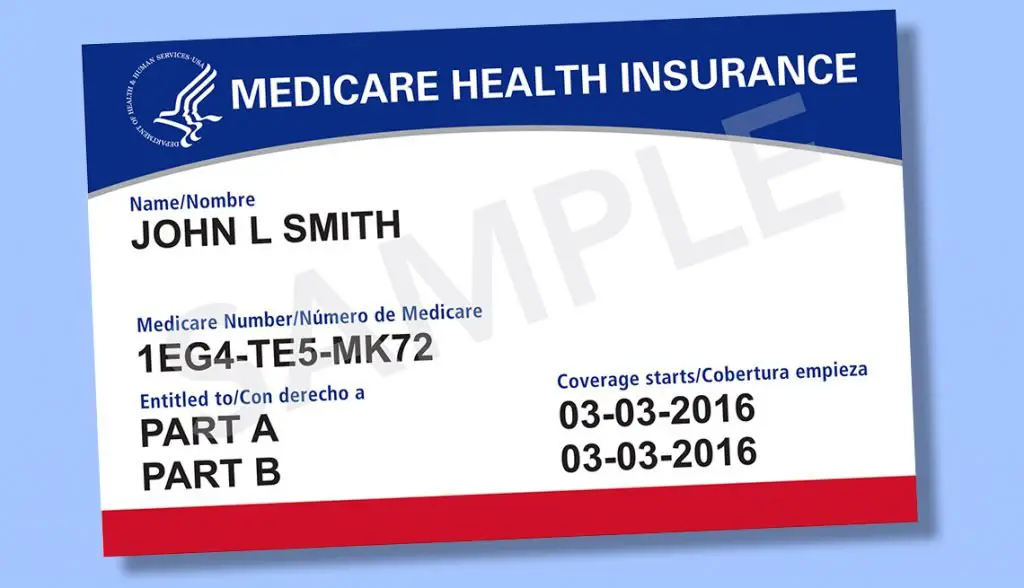

When do You Get Your Medicare Card?

You can expect to receive your Medicare card in the mail three months before your birthday. Your Medicare card will come with a complete enrollment package that includes basic information about your coverage. Your card wont be usable until you turn 65, even though youll receive the card before that time.

What Are Your Costs?

Keep in mind that youll still have to pay the usual costs of Medicare, even though youre automatically enrolled. Once your Medicare is active, the cost of your Part B premium will be deducted from your Social Security or RRB benefits.

What If You Already Enrolled in Medicare?

What about Medicare Supplement ?

What If I Switch to Medicare Advantage?

And if you want to switch to Medicare Advantage , youll have a one-time Initial Enrollment Period for Medicare Advantage that begins 3 months before the month you turn 65 and lasts for 7 months.

What I Have Part A?

You May Like: Does Medicare Advantage Plan Replace Part B

Using Your Medicare Card

You need to bring your original Medicare card with you the first time you visit your doctor or health care provider. They will typically make a photocopy of your card for their own files.

Remember these important rules for handling your Medicare card:

- Some doctors, labs, pharmacies, or other health care providers may require you to bring your Medicare card each time you receive a service. However for safety, you may wish to leave your Medicare card at home in a safe place at other times.

- If you recently received an updated Medicare card or replacement, make sure your doctor has the updated card on file.

- Never share your Medicare card or your Medicare ID number with anyone except your doctor or health care provider. If you are married, your spouse should have a separate Medicare card and number. Protect your Medicare card, and always keep it in a safe place.

- Have your Medicare card handy whenever you call Medicare with questions.

If you think someone has used your Medicare card without your knowledge, contact your local authorities or the Federal Trade Commissions ID Theft Hotline at 1-877-438-4338 .