Eligibility For Medicare Part A

In general, you are eligible for Medicare Part A if:

- You are age 65 or older and a U.S. citizen or permanent legal resident of at least five years in a row.

- You are already receiving retirement benefits.

- You are disabled and receiving disability benefits.

- You have end-stage renal disease .

- You have amyotrophic lateral sclerosis .

Most beneficiaries do not pay a premium for Medicare Part A if they have worked at least 10 years and paid Medicare taxes during that time. Individuals who arenât eligible for premium-free Medicare Part A can still enroll in Part A and pay a premium. Beneficiaries who delay enrollment after they first become eligible for Medicare Part A may be subject to a late enrollment penalty once they sign up.

What Medicare Supplement Insurance Plans Do Wisconsin Minnesota And Massachusetts Have

Wisconsin, Minnesota, and Massachusetts handle Medicare Supplement insurance plans differently than other states. Each of these states has a list of âbasic benefitsâ that every Medicare Supplement insurance plan in the state must cover at a minimum.

In Wisconsin, basic benefits include:

- Medicare Part A coinsurance for inpatient hospital care

- Medicare Part B coinsurance for medical costs

- The first 3 pints of blood each year

- Part A hospice coinsurance or copayment

In Minnesota, basic benefits include:

- Medicare Part A coinsurance for inpatient hospital care

- Medicare Part B coinsurance for medical costs

- The first 3 pints of blood each year

- Part A hospice and respite care copayments

- Part A and Part B home health services and supplies cost sharing

In Massachusetts, basic benefits include:

- Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Original Medicare benefits are exhausted

- Medicare Part B coinsurance for medical costs

- The first 3 pints of blood each year

- Part A hospice coinsurance or copayment

The product and service descriptions, if any, provided on these eHealth Insurance Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

What Does Medicare Supplement Insurance Cost

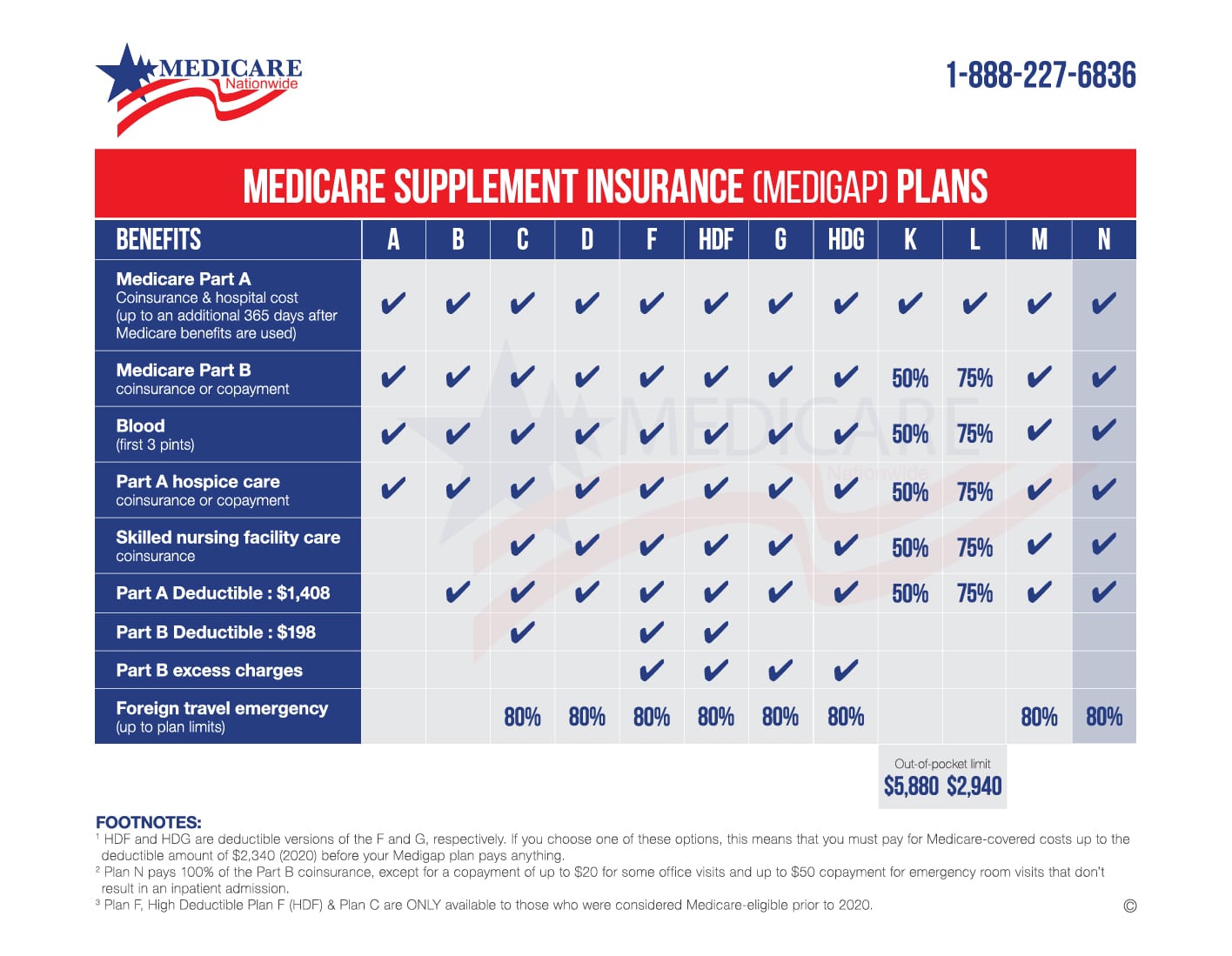

The primary goal of a Medicare Supplement insurance plan is to help cover some of the out-of-pocket costs of Original Medicare . As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary by insurance company, and premium amounts can change yearly.

Recommended Reading: Does Medicare Cover Whooping Cough Vaccine

Who Should Get A Medigap Plan

If you rely on Original Medicare for your health insurance coverage, you should consider supplement Medigap plans to offset the portion of health care costs that Medicare doesnt pay. Remember, if you have Medicare Advantage, then you cant also get Medigap. As with Original Medicare, you have freedom of choice of providers because you can see any Medicare provider in the United States. You can choose which supplement coverage plan best meets your needs. For instance, six of the standardized plans include coverage for emergency care which you may want if you travel abroad. Medigap Medicare supplement plans give you peace of mind if you anticipate the need for frequent health care now or in the future.

Medicare Part A Home Health Care Benefits

Medicare Part A benefits for home health care services are covered when deemed medically necessary and ordered by your doctor.

Home health care services may include:

- Part-time or intermittent skilled nursing care

- Physical therapy

- Part-time or intermittent home health aide services

- Durable medical equipment, when ordered by your doctor*

*If your doctor orders durable medical equipment as part of your care and the equipment meets eligibility requirements, this cost is covered separately under Medicare Part B. If youâre eligible for coverage, Medicare typically covers 80% of the Medicare-approved amount for the durable medical equipment.

Medicare Part A does not cover 24-hour home care, meals, or homemaker services if they are unrelated to your treatment. It also does not cover personal care services, such as help with bathing and dressing, if this is the only care that you need.

Medicare Part A covers the entire cost for covered home health care services. As mentioned, if you need durable medical equipment and itâs ordered by your doctor this is covered under Medicare Part B and you are responsible for 20% of the Medicare-approved amount.

The home health care must be provided by a Medicare-certified home health agency, and a doctor must certify that you are home-bound. According to Medicare, you are âhomeboundâ if both of the following are true:

Also Check: How To Get Medicare Without Social Security

Who Should Get A Medicare Supplement Insurance Plan

A Medicare Supplement Insurance plan may be a good choice for you if you:

- Turn 65 and want to cover as much of your health care costs as possible while on Original Medicare.

- Are already on Original Medicare but want help paying for your portion of costs for services received moving forward.

- Want peace of mind that your health insurance policies will pay for the majority of your Medicare-covered health care costs without constraints of networks or need for referrals.

- Dont mind purchasing a standalone Medicare Part D plan for prescription drug coverage.

Can You Change From A Medicare Advantage Plan To A Medicare Supplement Plan

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period.4

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage youre seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

Read Also: What Age Can You Start To Collect Medicare

Medicare Part A Hospice Coverage

If your doctor has certified that you have a terminal illness with an estimated six months or less to live, you may be eligible for hospice care coverage. In hospice care, the focus is on palliative care, not curing your disease. The goal is to relieve pain and make the patient as comfortable as possible.

To qualify for Medicare-covered hospice care, you must meet all of the following conditions:

- You must be enrolled in Medicare Part A.

- Your doctor or health provider must certify that you are terminally ill and have six months or less to live.

- You must agree to give up curative treatments for your terminal illness, although Medicare will still cover palliative treatment for your terminal illness, along with related symptoms or conditions.

- You must receive hospice care from a Medicare-approved hospice facility.

Medicare Part A hospice care is usually received in the patientâs home. It may include, but is not limited to:

- Doctor services

- Short-term inpatient care

- Short-term respite care

If a patient is under hospice care, Medicare Part A may also cover some costs that Medicare normally does not include, such as spiritual and grief counseling. Medicare Part A only pays for room and board in a hospital if the hospice medical team orders short-term inpatient stays for pain or other symptom management.

Which Of The Following Is True Of Medicare Supplement Insurance Plans

Asked by: Pablo Schmidt V

Which of the following is true about Medicare Supplement Insurance Plans? They are regulated by the Centers for Medicare & Medicaid Services . Plan benefit amounts automatically update when Medicare changes cost sharing amounts, such as deductibles, coinsurance and copayments.

Also Check: Does Kaiser Medicare Cover Dental

If Youre 65 Or Older:

If you apply for Medigap coverage after your open enrollment period, theres no guarantee an insurance company will sell you a policy. Insurers can:

- Request your medical history as part of the conditions of issuing you a plan

- Refuse to sell you a policy

- Make you wait for coverage to start

- Charge you more

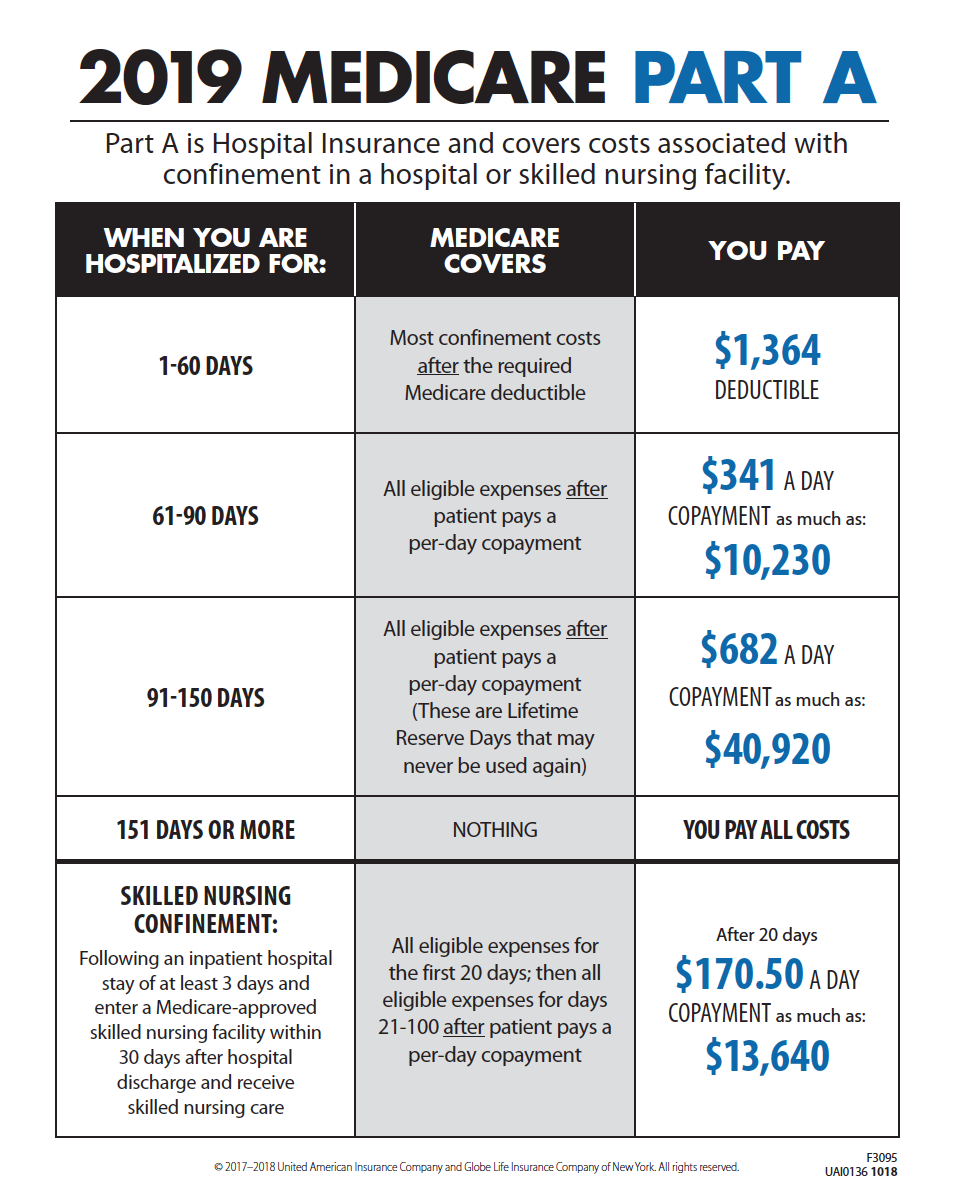

Which Of The Following Coverages Must Be Included In All Medicare Supplement Policies

All Medicare supplement policies must provide certain core benefits, including coverage for Medicare Part A-eligible hospital expenses not covered by Medicare from the 61st day through the 90th day in any Medicare benefit period, the coinsurance amount of Medicare Part B-eligible expenses, and coverage under Medicare …

Recommended Reading: What Does Bcbs Medicare Supplement Cover

About Our Analysis And Methodology

For this analysis we used data licensed from the National Association of Insurance Commissioners . Specifically, we used the Medicare Supplement Exhibits for years 20162020. Per NAIC, innovative benefits are defined as those not available as part of the standardized Medicare supplement benefit design. Examples of new or innovative benefits may include, but are not limited to, the following services not already covered by Medicare and excluding prescription drug coverage:

- hearing

Applying For A Medicare Supplement Insurance Plan

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you’re both age 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment periods and Guaranteed Issue requirements.

If you apply outside of Open Enrollment or Guaranteed Issue periods, you may be denied coverage or charged more based on your health history. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare supplement plans are guaranteed available.

Scroll for Important Disclosures

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP® Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

Recommended Reading: How To Find My Medicare Claim Number

Improvements To Medicare’s Preventative Care Coverage

Medicare beneficiaries pay nothing for most preventive services if the services are received from a doctor or other health care provider who participates with Medicare . For some preventive services, the Medicare beneficiary pays nothing for the service, but may have to pay coinsurance for the office visit to receive these services.

Medicare covers two types of physical exams one when you’re new to Medicare and one each year after that. The Welcome to Medicare physical exam is a one-time review of your health, education and counseling about preventive services, and referrals for other care if needed. Medicare will cover this exam if you get it within the first 12 months of enrolling in Part B. You will pay nothing for the exam if the doctor accepts assignment. When you make your appointment, let your doctor’s office know that you would like to schedule your Welcome to Medicare physical exam. Keep in mind, you don’t need to get the Welcome to Medicare physical exam before getting a yearly Wellness exam. If you have had Medicare Part B for longer than 12 months, you can get a yearly wellness visit to develop or update a personalized prevention plan based on your current health and risk factors. Again, you will pay nothing for this exam if the doctor accepts assignment. This exam is covered once every 12 months.

Many Plans Offer Additional Coverage

Medicare Advantage plans offer all the same basic benefits offered by Original Medicare .

But they may not stop there. Many Medicare Advantage plans may also offer additional benefits that are not covered by Medicare Part A or Part B, such as prescription drug coverage, dental, vision, hearing and more.

Some Medicare Advantage plans may offer even more additional benefits, such as transportation to doctors offices and grab bars for home bathrooms.

According to Medicare expert John Barkett, some Medicare Advantage plans started offering new benefits to beneficiaries with chronic illnesses in 2020. To hear more about these benefits, watch the video below.

Recommended Reading: Is Medicare Getting A Raise

When Is The Best Time To Buy A Plan

The Medicare Supplement Open Enrollment period starts on the 1st day of the 1st month in which youre age 65 or older and enrolled in Medicare Part B. In some states, you can buy a plan on the 1st day youre enrolled in Medicare Part B, even if youre not yet 65.

If you meet certain criteria, such as applying during your Medicare Supplement Open Enrollment Period, or if you qualify for guaranteed issue, a company cant use your medical history to determine your eligibility. Rules in some states may vary.

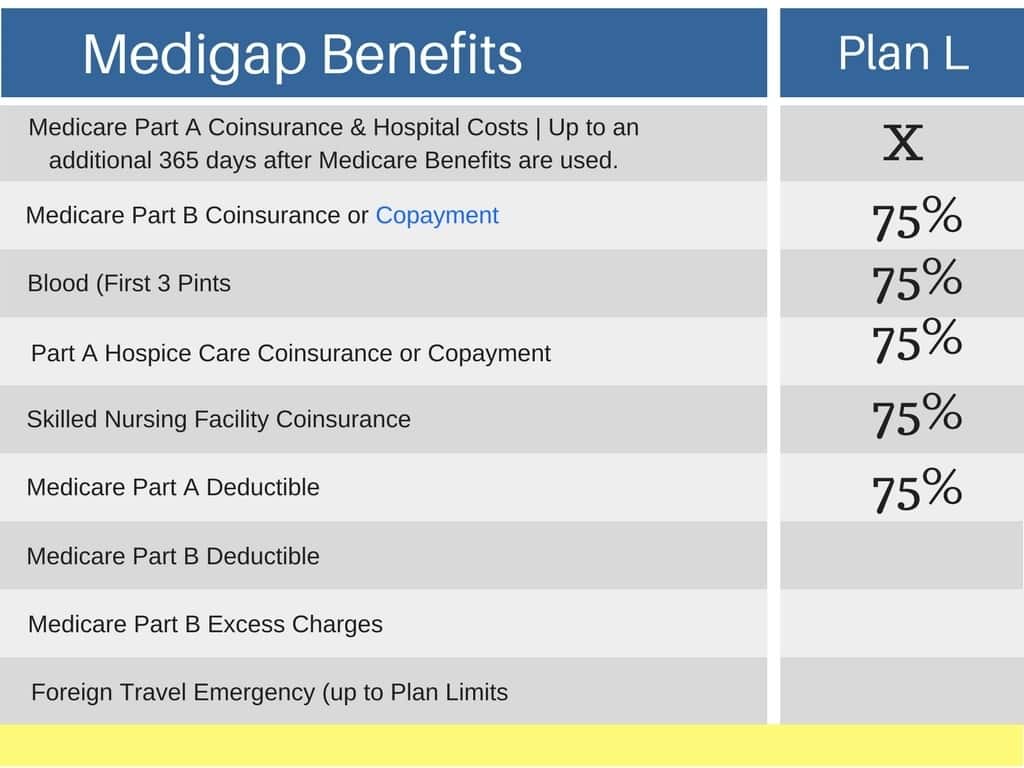

Which Of The Following Is A Basic Benefit Of Medicare Supplemental Insurance

Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up. Medicare Part B copayment or coinsurance expenses. The first 3 pints of blood used in a medical procedure.

Don’t Miss: Is Xiidra Covered By Medicare Part D

Some Extra Help With Costs

To protect people from the costs, the government worked with private insurers to come up with a set of plans that are designed to help with some of the costs associated with Original Medicare. By paying a monthly premium for a Medicare Supplement plan, you can get financial help with:

- Paying for your Part A deductible and the share of inpatient care costs not covered by Part A

- Paying for your doctor bills for Part B services

- Paying the costs of hospice care not handled by Original Medicare

These benefits mean that if you have a Medicare Supplement plan, you can:

- Pay a predictable up-front premium for your coverage

- Reduce the amount that you have to pay if you have a long inpatient hospital stay or repeat visits to a specialist.

Medicare Advantage Vs Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare, Part A and Part B, and may help pay for certain costs that Original Medicare doesnât cover. These plans donât provide stand-alone coverage you need to remain enrolled in Part A and Part B for your hospital and medical coverage. If you need prescription drug coverage, youâd need to enroll in a stand-alone Medicare Prescription Drug Plan.

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles. In addition, Medigap insurance plans may help with other costs that Original Medicare doesnât cover, such as Medicare Part B excess charges or emergency medical coverage when youâre traveling outside of the country. Keep in mind that Medicare Supplement insurance plans can only be used to pay for Original Medicare costs they canât be used with Medicare Advantage plans.

In contrast, Medicare Advantage plans are an alternative to Original Medicare. If you enroll in a Medicare Advantage plan, youâre still in the Medicare program. However, youâll get your Medicare benefits through your Medicare Advantage plan, instead of through the federally administered program, and the Medicare Advantage plan replaces your Original Medicare coverage.

Also Check: How Does Medicare D Work

Medigap & Medicare Advantage Plans

Medigap policies can’t work with Medicare Advantage Plans. If you have a Medigap policy and join a

, you may want to drop your Medigap policy. Your Medigap policy can’t be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

If you want to cancel your Medigap policy, contact your insurance company. If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a “trial right.“

If you have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to

. Contact your State Insurance Department if this happens to you.

If you want to switch to Original Medicare and buy a Medigap policy, contact your Medicare Advantage Plan to see if you’re able to disenroll.

If you join a Medicare Advantage Plan for the first time and you arent happy with the plan, you have a trial right under federal law to buy a Medigap policy and a separate Medicare drug plan if you return to Original Medicare within 12 months of joining the Medicare Advantage Plan.

A Majority Of Medicare Advantage Plans Provide Traditional Supplemental Benefits

Nearly all plans provided traditional medical supplemental benefits such as vision, dental, hearing, and fitness services in 2020 . In addition, a substantial and growing number of plans offer over-the-counter benefits, which cover the purchases of certain nonprescription items such as first aid supplies and sunscreen. As shown in Exhibit 4, these benefits were common before CMS expanded its definition of primarily health-related benefits. Supplemental benefits such as dental, vision, and hearing have long been popular with plans and enrollees.

You May Like: Does Medicare Pay For Custom Foot Orthotics

Dropping Your Entire Medigap Policy

You may want a completely different Medigap policy . Or, you might decide to switch to a Medicare Advantage Plan that offers prescription drug coverage.

If you decide to drop your entire Medigap policy, you need to be careful about the timing. When you join a new Medicare drug plan, you pay a late enrollment penalty if one of these applies:

- You drop your entire Medigap policy and the drug coverage wasn’t creditable prescription drug coverage

- You go 63 days or more in a row before your new Medicare drug coverage begins