How Does Medicare Work And What Are The Different Parts

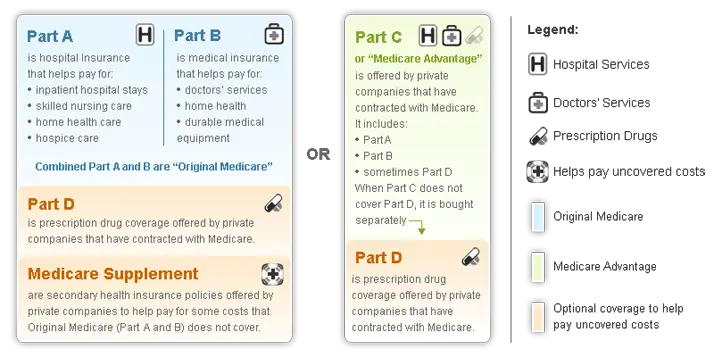

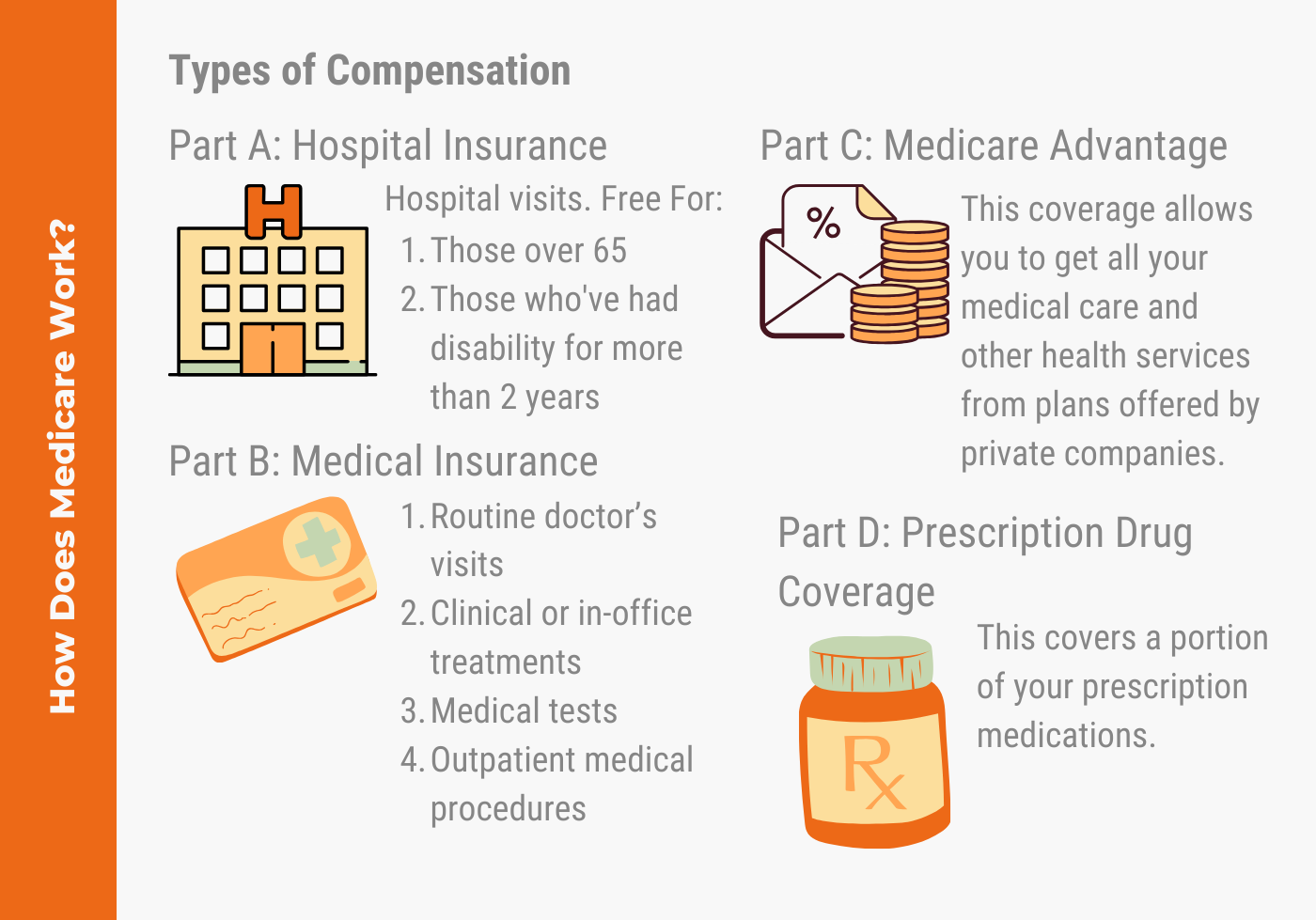

Original Medicare, also known as traditional Medicare, includes Part A and Part B. Original Medicare covers hospital stays, doctor visits, durable medical equipment, home health care and other medical services. However, it doesnt cover vision, dental or hearing.

Medicare Part D is optional prescription drug coverage, and serves as a supplement to Original Medicare.

Medicare Part C, better known as Medicare Advantage, is an alternative to Original Medicare. Its provided by federally approved private insurance companies and bundles features of Part A, Part B and usually Part D drug coverage into a single plan.

You can have other insurance, such as employer coverage, and Medicare at the same time. In this situation, Medicare pays first and your other insurance is the secondary payer.

Part A: Hospital Coverage

Medicare Part A is basically hospital insurance. Its premium-free for most Medicare beneficiaries because you paid into it during your working years via those Medicare taxes.

However, Part A isnt completely free. Youll still have Part A deductibles and coinsurance costs.

Medicare Part A covers:

2021 Medicare Part A costs include:

All the costs above are per benefit period. The clock for a benefit period begins when youre admitted to the hospital or a skilled nursing facility as an in-patient. It ends once you havent had any in-patient care for 60 days.

So if you had a 75-day hospitalization, youd pay a $1,484 deductible, plus coinsurance of $5,565 .

Medigap

How Does Medicare Part D Work With Other Insurance

October 1, 2021 / 5 min read / Written by

- What is Medicare Part D coordination of benefits? Jump to

- When does Medicare Part D pay first?Jump to

- When is Medicare Part D not the primary payer? Jump to

- Do you have Medicare Part D and Medicaid? Jump to

View More

Summary:

Some prescription drugs can cost hundreds of dollars for a single pill, according to CNBC. And if you take five prescription pills a day at just $15 a piece, youre still facing $75 a day in medication costs. If thats the case for you, you probably want the best prescription drug coverage you can get, even if it means combining different types of insurance.

Medicare Part D prescription drug coverage is offered by private insurers contracted with the Centers for Medicare & Medicaid Services . If you currently have prescription drug coverage through another plan its important to understand how Medicare Part D coverage works with other insurance.

How Do Medicare Part D Plans Work

A typical Part D plan has 3 phases and works like this:

- Deductible and Initial Coverage: The typical plan has an annual deductible. After you have paid costs equal to the deductible amount, then you have Initial Coverage. In this phase, you will only pay a copay or coinsurance on covered prescription drugs until you reach the Initial Coverage Limit, which starts the Coverage Gap.

- Coverage Gap: Also known as the donut hole. Here you pay a discounted amount for brand and generic drugs. Once your combined drug costs reach the upper level of the Coverage Gap, you move to Catastrophic Coverage.

- Catastrophic Coverage: You will pay a small amount for medications, typically not more than 5% of the cost. The plan pays most of the cost.

Also Check: When Do My Medicare Benefits Start

D Appeals And Grievances

Coverage Determinations and Exceptions

All Part D plans must have an appeal process through which members can challenge a denial of drug coverage. The Part D appeals process is based on and similar to the Part C appeals process.

Denials of drug coverage by a PDP or MA-PD are called coverage determinations. For example, a coverage determination may be issued by the plan if the drug is not considered medically necessary or if the drug was obtained from a non-network pharmacy. It is necessary to have a coverage determination in order to initiate an appeal. A doctors supporting statement is not required for this type of appeal, but it may be helpful to submit one. If the request for coverage is denied, the member may proceed to further levels of appeal, including redetermination by the plan, reconsideration by an Independent Review Entity , Administrative Law Judge review, the Medicare Appeals Council , or federal district court.

One type of coverage determination is called an exception request. An exception request is a coverage determination that requires a medical statement of support in order to proceed to appeal. There are two types of exceptions that may be requested:

Formulary Exceptions This type of exception is requested because the member:

- needs a drug that is not on the plans formulary,

- requests to have a utilization management requirement waived for a formulary drug).

What to do When a Drug is Denied at the Pharmacy

The Medical Statement

Grievances

What Is Donut Hole Prescription Assistance

Ask your doctor if any other medicine on your plans formulary would be as effective for your condition as the ones youre currently using. Using lower-cost drugs, like generics or similar drugs, will substantially lower your costs.

It pays to have donut hole assistance like Extra Help or a state pharmacy assistance plan that can pay a portion or all your costs while in the gap.

If you dont have extra coverage, you can consider:

- Lower-cost drugs from countries like Canada

- Free or low-cost medicines supplied by charities, patients organizations, or local medical clinics

- Low-cost or free medicines from the assistance programs, managed by pharmaceutical manufacturers

Recommended Reading: What Month Does Medicare Coverage Begin

Is There Financial Help For Part D

Medicare provides assistance, known as Extra Help, in paying for prescription drug costs for those with limited income and resources.

If you qualify, you will receive help paying for any Medicare drug plan’s monthly premium, annual deductible , and prescription copays or coinsurance. This Extra Help will count towards your out-of-pocket expenses.

How Do I Compare Medicare Part D Prescription Drug Plans

You should look at all three out-of-pocket expenses when you compare plans: Your Medicare Part D premiums, deductible, and copayment or coinsurance amounts. A plan with a higher deductible may have lower monthly premiums. If you dont use a lot of prescription medications, that may be the most cost-effective option for you. On the other hand, if you take daily medications, a lower deductible may be more important so you get help with your medications with less out-of-pocket expense.

If you take daily medications, its very important to look at each plans formulary. A formulary is simply the list of covered medications and your costs for each. Check to make sure the plans covers all your daily medications. Also remember a Medicare Supplement Insurance Plan doesnt cover any costs associated with Medicare Part D coverage.

Finally, compare pharmacy networks and benefits such as mail-order pharmacies. If you have a preferred pharmacy and its not in a plans network, you may be happier with a different plan. With many plans, you can save on your copayments and out-of-pocket costs by using the plans mail order pharmacy for medications you take regularly. If a plan offers this option, you may actually come out ahead even if the plan has a higher deductible or monthly premium, depending on the medications you use.

Limitations, copayments, and restrictions may apply. Premiums and/or copayments/co-insurance may change on January 1 of each year.

New To Medicare?

Also Check: What Is The Out Of Pocket Maximum For Medicare

Enroll In Medicare In Phoenix Today

Learn more about which Medicare programs may be right for you and get enrolled by calling Phoenix Health and Life Insurance. We serve thousands of clients across the valley and are ready to help you, too! to schedule an appointment with one of our experienced agents.

20823 N Cave Creek RD, Building B Suite 101Phoenix, AZ 85024https://www.phxhealthinsurance.com/?p=4565& fb-edit=1

When Am I Eligible For Medicare Part D And When Can I Enroll

The sooner you apply for Part D, the better. Ideally, this is done during your initial enrollment period. If you decide to wait to enroll in Medicare Part D and you don’t have “creditable coverage” for instance from an employer or union you could end up paying a late enrollment penalty. This late enrollment fee will be added to your monthly premium once you do enroll and will continue for as long as you have Medicare. You’ll pay a fee based on the following calculation: 1% of the national base premium for that year for every month you were eligible but not enrolled.

Don’t Miss: Is Inogen One Covered By Medicare

Faqs About Medicare And Open Enrollment

Medicare is the largest health insurance program in the United States, covering more than 60 million Americans.

Its also one of the most confusing and complex programs.

Contrary to popular belief, Medicare isnt free and it doesnt cover all your health care costs either.

Heres what you need to know to get the most out of your Medicare coverage.

What If Youre Already Taking Prescription Medications

If the medications you are taking are all generic then you might be better off purchasing them without using insurance. By using the website GoodRx.com, you might find that the cash price of your medication is less than the insurance copay for many of the medications youre taking. If you add the cost of insurance premiums to that of your copays, then youre almost certainly saving money by going without insurance and buying your generic medications directly.

If the medication youve been prescribed is rather expensive, you can also check if an alternative medication is available that does the same thing but costs less. Most of the time there will be several alternative medications that have the exact same effect as the one youre taking and prices can vary significantly for different medications in the same class that do the same thing. Whats more, doctors are quite used to substituting medications for patients since insurance formularies change all of the time. If a doctor is willing to change a patients medication simply because an insurance company asks, he should also be willing to change your medication when you ask.

You May Like: Is Medicare Accepted In Puerto Rico

When Is Medicare Part D Not The Primary Payer

In some cases, Medicare Part D will pay second to your other insurance plan. For instance:

- Are you currently working and covered by your employers or unions Group Health Plan and have Medicare Part D coverage? Generally if you are currently working, your employers Group Health Plan pays before Medicare Part D coverage. However, if you work for a small firm of 20 or fewer employees, usually your Medicare Part D Plan pays first and the Group Health Plan pays second.

- Are you currently working and covered under workers compensation insurance and have Medicare Part D coverage? Workers compensation insurance is primary to the Medicare Part D Plan for all prescriptions related to the workers compensation injury or illness. If the prescription drug is not related to the workers compensation injury or illness, only the Medicare Part D Plan will be billed.

- Have you been injured and have no-fault or liability insurance and Medicare Part D coverage? Usually the no-fault or liability insurance is primary and would be billed first. If the prescription drug is not related to accident, only the Medicare Part D Plan will be billed.

What Is Part D

Medicare Part D is a federal program administered through private insurance companies. These companies offer retail prescription drug coverage to Medicare beneficiaries. Prior to 2006, when Medicare Part D began, tens of thousands of Medicare beneficiaries in America had little help with retail drug costs. They would often spend thousands of dollars each year paying for their medications out of pocket.

Fortunately, todays Medicare beneficiaries have better coverage with Part D. Beneficiaries can enroll in a standalone Part D drug plan that goes alongside their Original Medicare benefits, or they can choose a Part D drug plan that is built-in to a Part C Medicare Advantage plan.

Don’t Miss: What Age Do You Draw Medicare

How To Enroll In Medicare Part D

First, you need to enroll in Original Medicare . If you arenât automatically signed up â meaning youâre 65 but not yet receiving federal retirement benefits â you can enroll in Medicare by visiting your local Social Security office, calling 1-800-772-1213, or completing an online application at the Social Security Administration website.

Then you can find Medicare Part D plans in your area through the Medicare website. When you choose a plan, the site will direct you to the insurerâs website because you have to purchase plans directly from insurers.

However, you can only get a Medicare Part D plan during certain times of the year. New Medicare beneficiaries have a seven-month period that starts three months before their 65th birthday. This is your initial enrollment period. Outside of that, there are three other times you can enroll:

-

Medicare open enrollment runs from October 15 to December 7 each year. Itâs also called the annual election period .

-

Special enrollment occurs after a major life event, like a move or loss of coverage. Itâs also known as a special election period .

-

If you have Medicare Advantage , the Medicare Advantage disenrollment period allows you to drop Medicare Advantage, and revert to Original Medicare. Then you can enroll in a Medicare Part D plan. The MADP is January 1 to February 14.

Learn more on how and when to apply for Medicare.

Should You Drop A Part D Plan

When asked about the consequences of quitting a Part D plan, Patricia Barry, a senior editor at the AARP Bulletin, and the author of Medicare for Dummies, has a warning for those who dont currently need prescription drug coverage in a recent Ask Ms. Medicare Q& A.

Even a person with the healthiest lifestyle suddenly can be struck by an unforeseen disease or an accidental injury that requires expensive drugs to treat, she writes. Some drugs, especially for cancer, can cost thousands of dollars a month. You are not allowed to enroll or re-enroll in Part D outside the annual open enrollment period, just because you suddenly develop an urgent medical need for prescription drugs and cannot afford to pay the full price out of pocket.

Recommended Reading: When Does My Medicare Coverage Start

Medicare Part D Overview

Medicare Part D provides prescription drug coverage to Medicare recipients. You pay a monthly premium so that when you need to get prescription medication, your insurance will cover some of the cost. Part D plans are called Medicare prescription drug plans, or PDPs, and theyâre administered through private health insurance companies. All of the insurance companies offering Part D plans are approved by Medicare to do so.

Getting a Medicare prescription drug plan is optional, but prescription drugs are expensive and most people would benefit from getting a PDP. Even if you donât use any prescriptions right now, itâs best to get a plan soon after you enroll in the regular Medicare program because you will need to pay a late enrollment penalty if youâre eligible to enroll, donât enroll, and then try to enroll later on.

Get your finances right, one money move at a time. Sign up for our free ebook.

An ebook to e-read while youâre e-procrastinating everything else. Download âFinance Your Futureâ today.

Get your copy

The Part D Deductible

Medicare Part D is optional coverage you can buy to help pay for prescription drugs. Like the Part B deductible, this one resets annually too. Part D deductibles vary by plan, but by law must be $435 or lower .3

After you meet this deductible, you’ll pay a portion of the cost of your covered medications. How much you pay depends on which tiers your drugs fall into, as well as which phase of coverage youre in.

Learn more about Part D drug tiers and coverage phases.

Don’t Miss: How Much Does Medicare Cover For Nursing Home Care

How Do You Choose A Medicare Part D Plan

The following factors may affect how you choose a Part D plan:

- Consider the medications you takehow many medications do you take, are they available as generics, do you have a chronic condition that requires specialty medications like insulin, nebulizers, etc.?

- If you want prescription drug coverage as part of a Medicare Advantage Plan, make sure you review the details of that drug coverageis it enough to cover your prescription needs?

- Standalone plans can differ among private insurers and offer various levels of drug coverage and different pharmacy networks.

- Review Part D plan options, considering monthly premium and other costs.

Dual Residency And Medicare Advantage

Medicare Advantage is another way to get your Medicare benefits. Suppose you travel for extended periods or live in two different states. In that case, you may want to look at a PPO or PFFS Medicare Advantage plan.

Some PPO plans have a suitcase program that allows you to see providers in other states as in-network providers. A PPO Medicare Advantage will also provide coverage if you need out-of-network services or providers.

Recommended Reading: How To Bill Medicare For Home Health Services

What Are The Costs Of Medicare Part D Prescription Drug Coverage

Q: What are the costs of Medicare Part D prescription drug coverage?

A: When you enroll in Medicare Part D coverage, you will depending on your plan likely pay a monthly premium, an annual deductible, and coinsurance or copays.

Premiums vary by plan and by geographic region but the average monthly cost of a stand-alone prescription drug plan with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Premiums vary tremendously however, depending on location and the plan selected. In 2021, actual monthly premiums for stand-alone PDPs vary from under $6/month to over $200/month.

Want to make changes to your Part D coverage? Discuss your options with a licensed Medicare advisor at .

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020. But not all plans have deductibles, and some have deductibles that are lower than the maximum allowed .

After the deductible is met, PDP policyholders pay copays or coinsurance during their initial coverage period until the total of their prescription drug costs reaches $4,130 in 2021 . The deductible is included in the portion that the beneficiary pays, so if your deductible is $445, that counts towards the $4,130 initial coverage threshold.

Dont Miss: How Much Is Premium For Medicare