Medicare Part D: Prescription Drugs

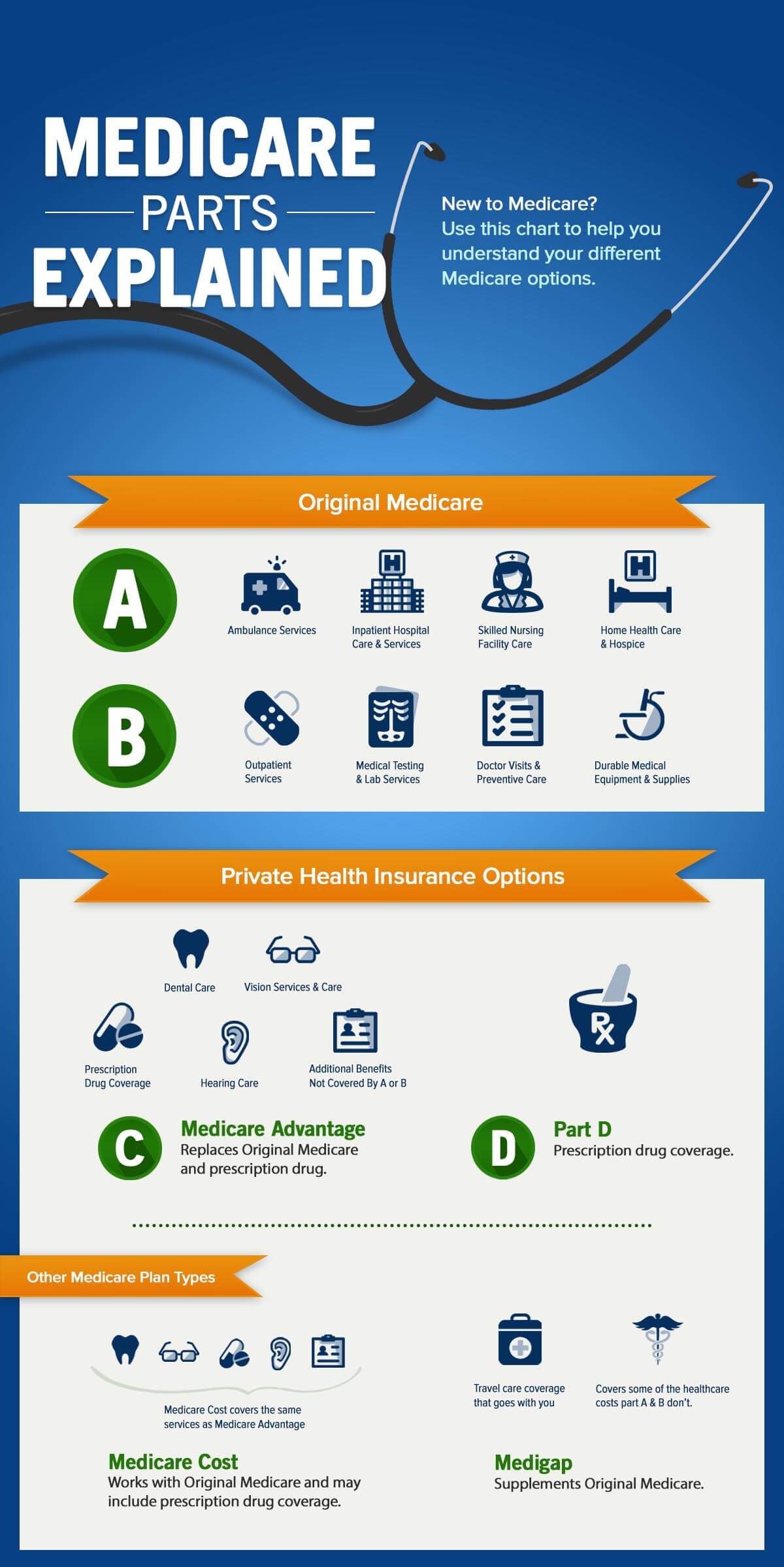

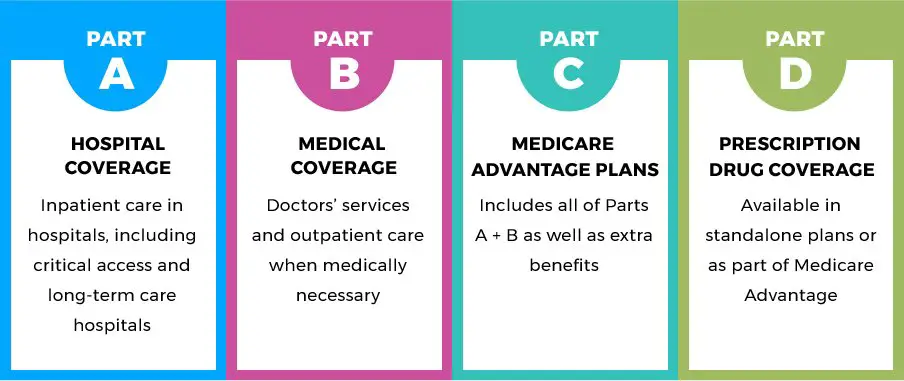

Prescription drug coverage, known as Part D, is also administered by private insurance companies. Part D is optional and is normally included in any Medicare Advantage plan. Depending on your plan, you may have to meet a yearly deductible before your plan begins covering your eligible drug costs. Some Part D plans have a co-pay.

Medicare prescription drug plans have a coverage gapa temporary limit on what the drug plan will cover. The coverage gap is often called the “doughnut hole,” and this gap kicks in after you and your plan have spent a certain amount in combined costs. For example, in 2022 the donut hole occurs once you and your insurer combined have spent $4,430 on prescriptions.

Once you have paid $7,050 in out-of-pocket costs for covered drugs, you have reached the level of “catastrophic coverage,” for 2022 in out-of-pocket costs for covered drugs. This means you are out of the prescription drug “donut hole” and your prescription drug coverage begins paying for most of your drug expenses again.

Many states have insurance options that will close the coverage gap, but these may require paying an additional premium.

Types Of Medicare Supplement Plans

Medicare supplement insurance, commonly known as Medigap, covers some out-of-pocket expenses for people with Medicare Parts A and B.

Medigap covers deductibles, co-payments, and coinsurance. A person must have Parts A and B to qualify for a Medicare supplement plan.

Those enrolled in Medicare Advantage should not have a Medigap plan. A person cannot use their Medigap policy to pay their Medicare Advantage Plan copayments, deductibles, and premiums.

Private insurers sell Medigap policies, so coverage varies according to the insurance company. These policies may cover services that are not available under Medicare.

Medigap is a single user policy, so spouses must buy their own coverage.

The costs and benefits of different Medigap policies depend on the insurance company. When it comes to pricing Medigap plans, insurance providers may use one of several methods. These include:

- Community pricing: Premiums are the same regardless of age.

- Issue age-related: When a person starts the policy, the insurance provider factors their age into the premium. That means buying the policy promptly after reaching 65 years of age is more cost-effective.

- Attain age-related: The insurer bases the original premium on the persons current age, but premiums rise as time passes.

The price of Medigap plans varies by state. As noted, prices are lower when the person buys a policy as soon as they reach the age of Medicare eligibility. Individual insurance companies may also offer discounts.

Enrollment Period For Medicare Part D

Like Medicare Part C, you are eligible to enroll in Medicare Part D during the seven-month period around your 65th birthdaybeginning three months before the month of your 65th birthday, including the month of your birthday, and up to three months after the end of your birthday month. You must enroll directly through an insurance company.

Recommended Reading: Does Medicare Come Out Of Your Paycheck

Original Medicare Vs Medicare Advantage

Its important to note that there is a difference between Original Medicare , sometimes called Traditional Medicare, and Medicare Advantage plans.

Medicare Advantage is an alternative to Original Medicarepeople cant enroll in both. Its provided by private insurance companies. Another perk of Medicare Advantage plans is that they usually cover extra benefits that Original Medicare does not cover, such as dental, vision, and hearing.

Original Medicare is made up of Medicare Parts A and B. If youd like your prescription drugs to be covered, you can also sign up for a standalone Medicare Part D drug plan. Since youll have out-of-pocket costs with Medicare, such as the 20% coinsurance, you can also obtain supplemental coverage insurance.

One benefit of Original Medicare is that it can be used anywhere within the United States. However, thats not necessarily the case with Medicare Advantage as many of these plans can only be used with in-network healthcare providers.

Out-of-pocket costs vary between Original Medicare and Medicare Advantage. In some instances, youll save more money with Original Medicare and in some instances Medicare Advantage will be cheaper.

Why Do I Need Medicare Part D

When you enroll in a Medicare Part D prescription drug plan, you pay a monthly premium. In exchange, your copays for your prescriptions will be lower.

If you have not taken any prescription medications recently, you might be wondering why you would need a prescription drug plan. Remember that it is essential to consider the future when selecting this coverage. If you need to pay for prescription drugs in the future, you will have coverage in place for fewer out-of-pocket costs.

Similar to Medicare Part B, if you are late signing up for Medicare Part D, you can be subject to a Medicare Part D late enrollment penalty. The penalty gets added to your monthly premium.

Even if you do not currently take any medications, you may notice greater savings in the long run by enrolling in a Medicare Part D plan as soon as you are eligible to avoid the Medicare Part D penalty. If you are assessed the late enrollment penalty, you will be required to pay it for life.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Read Also: What Is Medicare Advantage Premiums Part C

Common Services That Medicare Does And Doesnt Cover

Heres general info about what Medicare does or doesnt cover for common health care needs. Visit medicare.gov/coverage for more detail. Also, check a Medicare health plans Summary of Benefits to learn whats covered.

Medicare has some coverage for acupuncture and it is limited to treatment of chronic low back pain. Some Medicare Advantage plans have benefits that help pay for acupuncture services beyond Medicare such as treatment of chronic pain in other parts of the body, headaches and nausea.

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesnt cover costs to live in an assisted living facility or a nursing home.

Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

The federal Medicaid program can help pay costs for nursing homes or services to help with daily living activities.

Medicare Part B covers outpatient surgery to correct cataracts. It also pays for corrective lenses if an intraocular lens was implanted. Coverage is one pair of standard frame eyeglasses or contact lenses as needed after the surgery.

Medicare Part B covers a chiropractors manual alignment of the spine when one or more bones are out of position. Medicare doesnt cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

What Is Medicare Anyway

If you or a loved one is approaching 65 years of age or have been diagnosed with certain disabilities recently, you may be hearing a lot about Medicare, what it is, and exactly what it is designed to do. Unfortunately, there still exists some confusion surrounding Medicare and how it works. As part of our continued efforts to eliminate this confusion, lets discuss Medicare in more detail.

Basically, Medicare is a national health insurance program that is managed by the United States government. It is designed to assist millions of seniors and disabled individuals in paying for important healthcare appointments, procedures, and more.

An individual may be eligible for Medicare if they meet the following criteria:

- They are at least 65 years of age, or will become 65 within the next three months

- They have a long-term disability that qualifies them for Medicare

- They have been diagnosed with End Stage Renal Disease

While Medicare has been extremely helpful to millions of American citizens, many people are surprised to learn that Medicare is not one-size-fits-all health insurance coverage. In actuality, there are four different parts of Medicare, each of which may cover varying healthcare needs and scenarios.

Also Check: What Is The Donut Hole In Medicare Prescription Coverage

Do You Need Medicare Part B

The short answer is yes, especially if youll need the covered services mentioned above. However, if you have health insurance through a current job or are on your spouses active plan, you can delay your Medicare Part B enrollment without penalty. Once the spouse with employer coverage stops working whether its you or your partner you have eight months to sign up for Part B. Also, you need to be enrolled in Medicare Part B if you want to sign up for a Medicare Advantage plan.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Don’t Miss: Can You Cancel Medicare Part B

What Does Medicare Part D Cover

Part D covers prescription drugs. Only private insurance plans offer it. Its usually included in a Medicare Advantage plan or you can get a separate Part D plan.

Though Medicare Part B does cover certain vaccines and medications , Part D provides a much wider range of coverage of vaccines and outpatient prescription drugs.

Read more about the differences in Part B and Part D coverage in the article, Does Medicare cover all of my vaccines?

Medicare Part C: Medicare Advantage Plans

Many people opt for Medicare Part C, also known as a Medicare Advantage plan, rather than Original Medicare.

Unlike Original Medicare, which is covered by the federal government, Medicare Advantage plans are issued by private health insurance companies. Medicare Part C plans combine the coverages of Part A and Part B, and they often cover benefits Original Medicare doesnt, including hearing, dental, or vision services. Many plans even offer prescription drug coverage as well.

In some cases, your out-of-pocket costs with a Medicare Advantage plan will be lower than they would be with Original Medicare, making them an affordable alternative. In fact, the average premium is just $21 per month in 2021, in addition to your Medicare Part B premium.

Don’t Miss: What Is My Medicare Group Number

American Disabilities Act Notice

In accordance with the requirements of the federal Americans with Disabilities Act of 1990 and Section 504 of the Rehabilitation Act of 1973 , UnitedHealthcare Insurance Company provides full and equal access to covered services and does not discriminate against qualified individuals with disabilities on the basis of disability in its services, programs, or activities.

How Much Does Medicare Part A Cost1

If you or your spouse have worked at least 40 calendar quarters in any job where you paid Social Security taxes, you do not have to pay a premium for Part A.

- Premium: $0 per month

- 2022 Deductible: $1,556 for each benefit period

The 2022 Medicare Part A premium for those who do not qualify for $0 premiums is either $274 or $499 per month, depending on how long you worked and paid Medicare taxes.

Also Check: Does Medicare Cover Cataract Surgery And Lenses

Medicare Part A B C And D: What You Need To Know

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Medicare Parts A, B, C, and D are the four distinct types of coverage available to eligible individuals. Each Medicare part covers different healthcare-related costs. While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services , Medicare Part C and Medicare Part D are managed by private insurance companies.

Medicare is similar to the health insurance coverage youve probably had with an employer or an individual policy. It can cover doctor visits, inpatient and outpatient hospital care, prescription drugs, and lab tests. Depending on the plan you choose, your Medicare plan can also cover dental and vision, if you like.

Heres a brief overview of each of the parts of Medicare.

What Is Medicare Part A

Medicare Part A is part of Original Medicare and covers your inpatient and hospital service costs. Benefits of Medicare Part A include skilled nursing facility care, home health services, and hospice. When you have Medicare Part A, you are responsible for daily copayments depending on how long you have received care. For most who enroll in Medicare Part A, there is a $0 monthly premium. However, you are responsible for the per occurrence Part A deductible.

To be eligible for zero-premium Medicare Part A you must have worked at least 10 years in the United States paying Medicare taxes. This contribution to Medicare covers your Medicare Part A premiums as long as you are enrolled in the federal healthcare program.

Don’t Miss: Is Fidelis Medicaid Or Medicare

Medicare Part A + Medicare Part B = Original Medicare

Part B complements your Part A coverage to provide coverage both in and out of the hospital. In fact, Part A and Part B were the first parts of Medicare created by the government. This is why the two parts together are often referred to as Original Medicare. Additionally, most people who do not have additional coverage through a group plan generally sign up for Parts A and B at the same time.

To learn more about Original Medicare, go to “Unpacking Original Medicare: What Parts A and B cover and when to consider a Medicare Supplement plan.”

Explore Our Plans And Policies

Back to Knowledge Center

View State Disclosures, Exclusions, and Limitations

1Insured by Cigna Health and Life Insurance Company, American Retirement Life Insurance Company, Loyal American Life Insurance Company or Cigna National Health Insurance Company. In Kansas, insured by Cigna National Life Insurance Company, Cigna Health and Life Insurance Company and Loyal American Life Insurance Company. American Retirement Life Insurance Company is not available to residents of Kansas. In Pennsylvania, Maryland North Carolina and Utah, insured by Cigna National Health Insurance Company domiciled in Ohio. In New Mexico, Idaho and Ohio, insured by Cigna Health and Life Insurance Company.

2 Plans F and High Deductible F include the Part B Deductible and are only available if you first become eligible for Medicare before January 1, 2020 . Or you have qualified for Medicare due to disability before January 1, 2020.

3 You can sign up later if you have group plan coverage.

View Kansas disclosures, exclusions, and limitations

Notice for persons eligible for Medicare because of disability:

In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin.

Tennessee Medicare Supplement Policy Forms

Also Check: Can People On Medicare Use Good Rx

What Are My Costs

- Original Medicare

-

- For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance.

- You pay a premium for Part B. If you choose to join a Medicare drug plan, youll pay a separate premium for your Medicare drug coverage .

- There’s no yearly limit on what you pay out of pocket, unless you have supplemental coveragelike Medicare Supplement Insurance .

- Medicare Advantage

-

- Out-of-pocket costs varyplans may have different out-of-pocket costs for certain services.

- You pay the monthly Part B premium and may also have to pay the plan’s premium. Plans may have a $0 premium or may help pay all or part of your Part B premium. Most plans include Medicare drug coverage .

- Plans have a yearly limit on what you pay out of pocket for services Medicare Part A and Part B covers. Once you reach your plans limit, youll pay nothing for services Part A and Part B covers for the rest of the year.

What Is Medicare Part F And Part G

The four parts of Medicare we describe above are the only Parts to Medicare. However, you may also be wondering about additional lettered plans, such as Plan F, Plan G, or Plan N. These plans are known as Medicare Supplement Plans, not Medicare Parts.

Medicare Supplement plans are identified as Plans, identified as lettered plans, A through N. If you have ever heard of a Part F or Part G, this was a mistaken reference to one of the most popular Medigap plans.

Medicare Supplement plans provide extra coverage to fill in the gaps Original Medicare leaves uncovered. If you plan on traveling in retirement or would rather not worry about the 20% of expenses uncovered by Medicare, a Medicare Supplement plan could be the right choice for you.

Medicare Supplement Plan F and Plan G are two of the most popular Medicare Supplement plans available to you. When you enroll in Medicare Supplement Plan F, all the costs left over by Original Medicare are completely covered. This means, you pay $0 out-of-pocket for your healthcare services. Similarly, Medicare Supplement Plan G covers all your costs after you meet the Medicare Part B annual deductible. After you meet this deductible, you are covered at 100%.

Get A Free Quote

Find the most affordable Medicare Plan in your area

You May Like: Is Aquablation Covered By Medicare

What Parts A And B Don’t Cover

The largest and most important item that traditional Medicare doesn’t cover is long-term care if the only care you need is custodial. If you are diagnosed with a chronic condition that requires ongoing long-term personal care assistance, the kind that requires an assisted-living facility, Medicare will cover none of the cost. However, Medicare will cover the costs for acute-care hospital services, for patients who are transferred from an intensive care or critical care unit. Services covered could include head trauma treatment or respiratory therapy.