How Do You Qualify For Medicare Advantage In Ohio

If you have Medicare Parts A and B, you qualify for Medicare Advantage in Ohio.

American citizens and permanent legal residents age 65 and older are eligible for Medicare. If you began collecting Social Security benefits at least 4 months before your 65th birthday, you will be automatically enrolled in Parts A and B. Everyone else must apply for Medicare.

You can qualify for Medicare before turning 65 if you collect disability benefits from either Social Security or the Railroad Retirement Board for 24 months. Anyone who qualifies for Medicare due to a disability is automatically enrolled in both Parts A and B during month 25.

Finally, you may also be eligible for Medicare before turning 65 if you have either amyotrophic lateral sclerosis or end-stage renal disease .

Understanding Medicare Advantage In Ohio

Regular Medicare is made up of three parts.Each different part of Medicare covers a separate service, covering the various needs of continuing medical care.

Part A- Medicare part A in OH covers hospital insurance. It covers inpatient hospital care, hospice care, skilled nursing facilities, and some health care. Most people dont pay a premium for this part of Medicare if they worked and contributed to funds for the required time frame.

Part B in OH – This covers a wider array of services such as preventative services, doctors fees, outpatient care, home health care, and medical equipment. Everyone pays a standard premium for part B, plus an adjusted cost for those who made above a certain amount.

Part D in OH – Part D is an optional addition that covers prescription drugs including some preventative and recommended vaccines. Part D must be enrolled through a private, Medicare-approved insurance company.

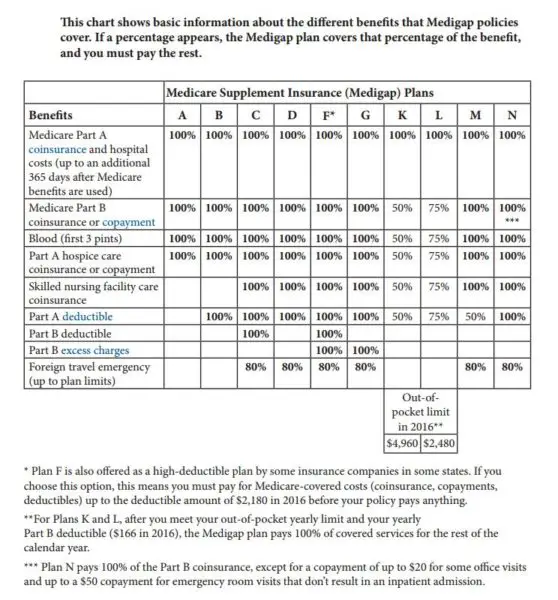

Medicare pays for a portion of the cost of covered medical services. Since it doesnt cover all of it, you have the option to buy Medicare Supplement Policy. This helps cover your part of the bills. Without the supplement, you are responsible for services as you receive them. You pay an out-of-pocket deductible at the beginning of the year and the 20% of costs for approved procedures.

How To Choose A Medicare Advantage Plan

Its crucial to ask a few questions while shopping for the right plan for you. Heres a quick checklist to help you consider your options:

-

How much are the plans costs? Do you understand what the plans premium, deductibles, copays and/or coinsurance will be? Can you afford them?

-

Is your doctor in-network? If you have a preferred doctor or hospital, make sure they participate in the plans network.

-

Are your prescriptions covered? If youre on medication, understand how the plan covers it. What tier are your prescription drugs on, and are there any coverage rules that apply to them?

-

Is there dental coverage? Does the plan offer routine coverage for vision, dental and hearing needs?

-

Are there extras? Does the plan offer any extra perks, such as fitness memberships, transportation benefits or meal delivery?

You can use Medicares plan finding tool to compare plans in your area.

Don’t Miss: Does Medicare Cover Dr Visits

Why Should I Choose Medicare Advantage

A Medicare Advantage plan covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patient’s situation worsens, it might be difficult or expensive to switch plans.

How Does Medicare Advantage Differ From Medicare Original

Original Medicare is also known as Part A and Part B. You can add Medigap and stand-alone:

Bear in mind that each plan comes with a stand-alone premium. These plans work together to give you comprehensive and affordable medical coverage. Just remember that youll pay individual premiums for each plan you add.

Medicare Advantage is an alternative to Medicare Original. You will still enroll in Part A and Part B and have to pay the Part B premium.

The majority of Medicare Advantage plans in Ohio include prescription drug plans, or the equivalent of Medicare Part D. Most plans will also include at least one additional benefit, such as:

If a plan doesnt include additional coverage, you can still add a stand-alone plan to cover care.

Medicare beneficiaries in Ohio who have end-stage renal disease and other chronic health conditions are not eligible for Medicare Advantage. Instead, they will enroll in Special Needs Plans tailored to their conditions.

You May Like: Can I Draw Medicare At Age 62

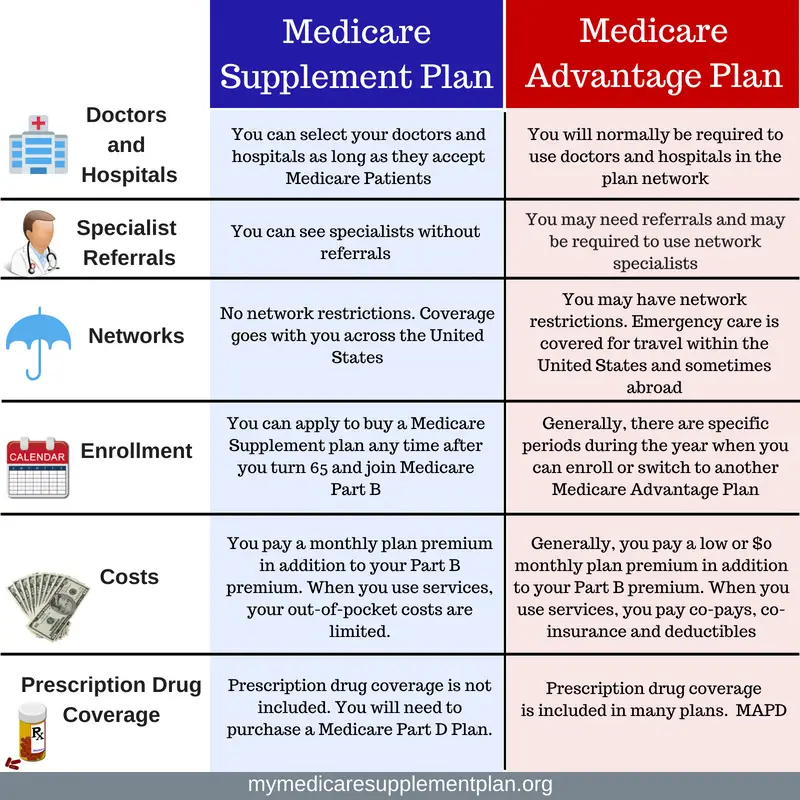

Can I Get My Health Care From Any Doctor Other Health Care Provider Or Hospital

- Original Medicare

-

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

In most cases, you don’t need a

referral

to see a specialist.

- Medicare Advantage

-

In many cases, youll need to only use doctors and other providers who are in the plans network . Some plans offer non-emergency coverage out of network, but typically at a higher cost.

You may need to get a

referral

-

You can join a separate Medicare drug plan to get Medicare drug coverage.

- Medicare Advantage

-

Medicare drug coverage is included in most plans. In most types of Medicare Advantage Plans, you cant join a separate Medicare drug plan. You can join a separate Medicare drug plan with certain types of plans that:

- Cant offer drug coverage

- Choose not to offer drug coverage

Youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply:

Local Health Insurance Resources In Ohio

- Ohios Senior Health Insurance Information Program provides free and objective information and assistance to the states beneficiaries of Medicare with the goal of helping Ohios seniors make the most of their insurance. The program may be reached at 800-686-1578.

- You can also explore more information about the insurance industry in Ohio by visiting the states Department of Insurance website.

- Ohio Prescription Drug Assistance ProgramsThe state of Ohio has a number of programs designed to help with the cost of prescription drugs. There are programs for both Medicare beneficiaries and non-Medicare beneficiaries alike that can cover the cost of premiums and cost-sharing or even lower the cost of the drugs themselves.

1 Freed M. et al. . Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. Retrieved from www.kff.org/issue-brief/medicare-advantage-2022-spotlight-first-look.

3 Medicare evaluates plans based on a 5-star rating system.

Compare plans today.

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Medicare has neither reviewed nor endorsed this information.

You May Like: What Age Can You Get Medicare Part B

What Are My Costs

- Original Medicare

-

- For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance.

- You pay a premium for Part B. If you choose to join a Medicare drug plan, youll pay a separate premium for your Medicare drug coverage .

- There’s no yearly limit on what you pay out of pocket, unless you have supplemental coveragelike Medicare Supplement Insurance .

- Medicare Advantage

-

- Out-of-pocket costs varyplans may have different out-of-pocket costs for certain services.

- You pay the monthly Part B premium and may also have to pay the plan’s premium. Plans may have a $0 premium or may help pay all or part of your Part B premium. Most plans include Medicare drug coverage .

- Plans have a yearly limit on what you pay out of pocket for services Medicare Part A and Part B covers. Once you reach your plans limit, youll pay nothing for services Part A and Part B covers for the rest of the year.

Medicare Advantage Plan In Ohio

In Ohio, 19 healthcare organizations offer Medicare Advantage plans. MoneyGeek provided statistics on the states plan types, $0 premium plans and commonly-offered benefits. This information can help you see which plan components are rare Vs. common.

Ohio Medicare Advantage Plans are a mix of HMO, PPO, PFFS and MSA plans with 81.9% of these offering drug coverage

In Ohio, 51.3% of its Medicare Advantage Plans are HMO while 44% are PPO plans. Additionally, 0.8% of the states plans are Private Fee-For-Service and 3.8% are Medical Savings Account plans. 81.9% of these plans offer drug coverage.

48% of Medicare Advantage Plans in Ohio have a $0 premium

Ohio has 60 unique plans with $0 premiums. Thats 48% of the available Medicare Advantage Plans in the state. For plans with a monthly premium, the average cost is $79.40.

Hearing, Vision and Dental benefits are common in Ohio, and most plans offer them

The most common benefits included in Medicare Advantage Plans in Ohio are hearing, vision and dental. On the other side of the spectrum, the rarest benefits included in plans are emergency response devices, in-home support and home safety devices & modifications.

You May Like: Does Medicare Pay For Scooters

Switching Back To Original Medicare

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur. If you decide that the Medicare Advantage Plan isn’t for you, you have the right under federal law to purchase any Medigap plan if you switch to Original Medicare within 12 months of the date that you joined a Medicare Advantage Plan for the first time.

You may also switch from your Medicare Advantage Plan to Original Medicare during the annual Open Enrollment Period or if you qualify for a Special Enrollment Period. However, you may not be able to purchase a Medigap policy . If you are able to do so, it may cost more than it would have when you first enrolled in Medicare.

Keep in mind that an employer only needs to provide Medigap insurance if you meet specific requirements regarding underwriting . The wait time for Medigap coverage can be avoided if you have what is called a “guaranteed issue right.”

A thorough breakdown of what is considered a “guaranteed issue right,” where an insurance company can’t refuse to sell you a Medigap policy, can be found on the Medicare website.

Most Medigap policies are issue-age rated policies or attained-age rated policies. This means that when you sign up later in life, you will pay more per month than if you had started with the Medigap policy at age 65. You may be able to find a policy that has no age rating, but those are rare.

Consider Your Other Costs

Out-of-pocket costs can quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. The best candidate for Medicare Advantage is someone who’s healthy,” says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. “We see trouble when someone gets sick.”

Also Check: How To Determine Medicare Eligibility

Does Medicare Cover Vision

This depends on the type of Medicare coverage that you have. Some types do cover vision entirely, while other types do not cover it at all. Before receiving vision care, you should find out what your plan covers.

Medicare Part A only covers vision care when the condition is considered a medical problem. Part A is hospital coverage, which means that your vision issue must qualify as a medical emergency that requires admission to the hospital. It does not cover routine vision exams or glasses and contacts.

Medicare Part B covers some vision care, but not routine vision exams, glasses, or contacts.

Medicare Part C may or may not include vision coverage, depending on your plan. Some plans include full coverage for vision care, while others may include vision benefits with higher premiums.

Read also> > Does Walmart Accept Medicare for Eyeglasses?

Medicare Part D is a plan which offers prescription drug coverage. This plan works alongside Medicare Part A and Part B.

So, while this plan may cover some vision-related products such as eye drops or other vision-related medications, it will not cover things like routine eye exams, glasses, or contacts.

If you are wanting standard vision coverage through Medicare, your best option is Medicare Part C or Medicare Advantage. This way, you can select a plan which does offer vision coverage.

Who Is Eligible For Medicare In Ohio

Medicare is a nationwide health insurance program for citizens or legal residents aged 65 and over. Exceptions to this eligibility rule include those who have end-stage renal disease or amyotrophic lateral sclerosis . Ohioans can begin enrolling in Medicare up to three months before or as late as three months after their 65th birthday.

Enrollment is automatic for those eligible for both Medicare and Medicaid and those who receive Social Security Disability before age 65. Registration can be done by going to your local Social Security office or calling 1 772-1213 TTY users can call 1 325-0778.

Once enrolled, you can search for and compare Medicare Advantage plans online. Insurify makes it easy to find the best plan without having to leave your home to meet with an insurance agent. With just your ZIP code, you can compare plans in your service area, including:

-

Medicare Advantage plans

-

Medicare Advantage plus Part D

-

Stand-alone Part D

You May Like: Who Pays The Premium For Medicare Advantage Plans

The Top 10 Medicare Advantage Plans In Ohio

More than 50 private insurers offer Medicare Advantage plans in Ohio, giving Medicare-eligible residents a variety of options. The following table lists the 10 most popular Medicare Advantage providers in the state by enrollment. Most of these companies offer multiple Medical Advantage plans, so we show cost information as a range rather than average prices. We also combined the enrollment numbers for each providers plan together to arrive at a providers total enrollment in the state. This plan information was last updated in April 2022, but you can check with Medicare.gov for more current information on available plans in your area.

|

Name |

Tips For Enrolling In Medicare In Ohio

If youre deciding between original Medicare and Medicare Advantage, or if youve already decided on Medicare Advantage, it can be hard to choose the right plan for your needs. As you shop around for a plan, you may want to keep the following considerations in mind:

- Costs. You may need to pay a higher monthly premium for plans that offer drug coverage or other extra benefits, such as dental and vision care. Dont forget to consider each plans annual out-of-pocket maximum.

- Types of coverage. Medicare Advantage plans in Ohio may offer dental, vision, and hearing coverage, and some plans may cover perks like fitness memberships. Determine what types of coverage you want or need before you choose a plan.

- Provider network. People with original Medicare can see any doctor who accepts Medicare, but Medicare Advantage plans usually have a provider network. Before you sign up for a plan, ask your doctor if theyre in the network.

- Ratings. The Centers for Medicare & Medicaid Services rates Medicare Advantage plans based on many factors, such as plan performance and customer service. The CMS Five-Star Rating System can help you find quality plans in Ohio.

- Other coverage. You may have other health coverage, such as from a union or former employer. If you leave your current plan, you may not be able to rejoin later. Contact your insurer to find out how your existing coverage is affected by Medicare.

Read Also: Is There A Monthly Premium For Medicare Part B

Cleveland Clinic Announces Medicare Partnership With Anthem Blue Cross And Blue Shield In Ohio

The Cleveland Clinic will offer a Medicare insurance plan with Anthem Blue Cross and Blue Shield in Ohio called Anthem MediBlue Prime Select .

CLEVELAND, Ohio The Cleveland Clinic continues its move into the insurance market with its newest partnership, a deal with Anthem Blue Cross and Blue Shield in Ohio.

Starting Sunday, Oct. 15, the Clinic will offer a Medicare insurance plan with Anthem called Anthem MediBlue Prime Select . Enrollment will be open until Dec. 7, and coverage will begin Jan. 1, 2018.

In collaboration with Anthem, we will be able to work with patients across the state of Ohio, providing high-quality, coordinated care to help improve their health and well-being, Kevin Sears, executive director of market and network services for the Clinic, said in a news release.

The deal with Anthem is the Clinics third integrated partnership with an insurance company and part of a nationwide trend among health systems and payers to collaborate on insurance.

Earlier this month, the Clinic announced it would offer two co-branded Medicare plans with Humana, a Louisville, Kentucky-based insurance provider. The Humana Cleveland Clinic Preferred Medicare Plans will include an HMO plan for those with Medicare and a plan for those eligible for both Medicare and Medicaid.

Read Also: When You Turn 65 Is Medicare Free

What Do The Different Parts Of Medicare Cover

Medicare has four parts: A, B, C, and D.

- Medicare Parts A and B are what is called Original Medicare.

- Medicare Part A is Hospital Insurance. So, this is probably the most important Medicare Part for you as an inpatient cancer patient at MD Anderson. This Part of Medicare covers hospital stays, skilled nursing facilities, hospice care, and some additional healthcare.

- Medicare Part B is Medical Insurance. So, this will cover visits to the doctor, preventative care and screenings, and some medical supplies. This Part is also very important to you as a cancer patient at MD Anderson, especially if you are attending a lot of outpatient visits and treatments.

Read Also: What Are Medicare Part D Drugs

Recommended Reading: Does Medicare Cover Dental Emergencies