To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

Sign Up: Within 8 Months After You Or Your Spouse Stopped Working

Your current coverage might not pay for health services if you dont have both Part A and Part B .

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

When Should I Enroll

There is a seven-month period when you can first enroll in Medicare. Its called the Initial Enrollment Period and it happens three months before the month you turn age 65, the month of your 65th birthday and the three months after. If your birthday is on the 1st of the month, your coverage can begin on the first day of the previous month.

If you are disabled and under age 65, there is a seven-month period surrounding the 25th month you begin receiving Social Security Disability payments. Enrollment time frames are different for people who become eligible because of end-stage renal disease or Lou Gehrigs Disease .

Don’t Miss: What Is Traditional Medicare Coverage

Who Is Automatically Enrolled In Medicare

If youre already receiving Social Security or Railroad Retirement Board benefits at least four months before your 65th birthday, youll be enrolled automatically in Medicare Part A and Part B. If you live in Puerto Rico and are receiving those benefits, only Part A will come to you automatically youll need to take extra steps to enroll in Part B.

Youll receive your Medicare card in the mail and can start using it the beginning of the month you turn 65. If your birthday is on the first day of a month, your coverage will start a month earlier.

Part A, which covers hospitalization, is free if you or your spouse has paid Medicare taxes for 40 quarters, the equivalent of 10 years. Part B, which covers doctor and outpatient services, has a monthly premium of $170.10 for most people in 2022, and the Social Security Administration will automatically deduct the premium from your monthly benefit.

But if you or your spouse is still working and you have health insurance from that employer, you may not have to enroll in Part B yet. You can send back the card and enroll in Part B later. Follow the instructions on the back of the card to delay enrolling in Part B if youre already receiving Social Security or Railroad Retirement benefits.

What Happens After I Register For Medicare Online

Once you have submitted your application, it will be reviewed by Medicare to ensure all the information is accurate and complete. You should double-check your contact information to make sure it is correct. This is important to ensure prompt delivery of your Identification Card, as well as in the event Medicare needs to contact you about your enrollment.

After your application is received and processed, a letter will be mailed to you with the decision. If you encounter any questions or problems during the process, you can always contact Social Security for assistance.

You May Like: Does Medicare Cover Respite Care Services

Signing Up For Medicare Supplement Plans

As long as you have Medicare Part A and Part B, you can sign up for a Medicare Supplement plan anytime. However, your Medicare Supplement Open Enrollment Period is the best time to enroll.

You can enroll in any Medicare Supplement plan when you become eligible, with no health underwriting questions during the Medicare Supplement Open Enrollment Period. Thus, you will not face denial due to pre-existing health conditions. Read more about Medicare Supplement Open Enrollment.

Applying For Medicare Supplement Insurance At Age 65

When you turn 65, you will be granted a Medigap Open Enrollment Period during which you can apply for a Medigap plan. This six-month period will begin once you turn 65 and are enrolled in Medicare Part B .

During this period, insurance companies cant use your medical history like your hearing loss as a reason to raise your premiums or deny your coverage completely. They must issue you a plan at the same rate as someone with no significant medical history.

You May Like: What Is A Medicare Special Needs Plan

You May Like: How Long Does Medicare Pay For Home Health Care

Youre Eligible For Medicare

Medicare eligibility begins at age 65, and you can even sign up for coverage beginning three months before the month of your 65th birthday. It pays to enroll in Medicare on time, because if you donât, you could end up subject to costly penalties that make your Part B premiums more expensive.

If youâll be signing up for original Medicare , youâll need a Part D plan for prescription drug coverage as well. Medicare Part A will cover your hospital care and Part B will cover outpatient care, but drug coverage is separate.

Image source: Getty Images.

Q: What Should You Do To Prepare For Medicare At Age 64

A: If you take Social Security at age 65, you automatically get put into Medicare. Unfortunately the retirement age is now 66 and if you wait until then to take Social Security, youll likely need to prepare for Medicare at age 64 on your own, and a lot of people dont realize that.

You enroll in Medicare through the Social Security Office. You can either enroll online, on the Social Security website it takes about 10 minutes or you can go to a Social Security office. They recommend calling first to make an appointment, so you wont be waiting there all day. Or, you can enroll over the phone, by calling Social Security. You usually wait on hold for a while, but its another option.

Corinne Lofchie, LICSW, is an Elder Care Advisor at Somerville-Cambridge Elder Services

You can start the process three months before your 65th birthday. That way, your coverage will start the month that you turn 65. Lets say your birthday is January 15. If you enroll in the three-month period before January, your Medicare coverage will begin on January 1. After your birthday month, you have 3 more months to enroll. If you wait, say until January, your coverage will begin on February 1. It always starts the next month, unless you enroll before your birthday month.

Read Also: Does Medicare Pay For Varicose Veins

Recommended Reading: Can I Cancel My Medicare Supplemental Plan Anytime

How To Enroll In Medicare Beyond The Initial Enrollment Period

Things to know about the Medicare General Enrollment Period:

- You might be charged a penalty fee for failing to enroll during your Initial Enrollment Period.

- If you did not enroll during the IEP when you were first eligible, you may enroll during the General Enrollment Period.

- The General Enrollment Period for Original Medicare occurs each year from January 1 through March 31.

Things to know about the Medicare Special Enrollment Period :

- When you turn 65, you may choose to forgo Medicare Part B when you become eligible. You will be able to enroll in Medicare when your group coverage ends.

- Your eight-month SEP for Medicare Part B begins either the month that your employment ends or immediately when your group health coverage ends.

- If you enroll in Medicare during an SEP, you do not have to pay a late-enrollment penalty.

Other Medicare enrollment options:

Read Also: Does Medicare Cover Whooping Cough Vaccine

Do I Qualify For A Medicare Special Enrollment Period

Perhaps, if you or your spouse is still working and you have health insurance from that employer. The special enrollment period allows you to sign up for Medicare Part B throughout the time you have coverage from your or your spouses employer and for up to eight months after the job or insurance ends, whichever occurs first.

If you enroll at any point during this time, your Medicare coverage will begin the first day of the following month. And you will not be liable for late penalties, no matter how old you are when you finally sign up.

Your decision also depends on the size of your employer and whether the employers plan is first in line to pay your medical bills or second.

Larger companies. If you or your spouse work for a company with 20 or more employees, you can delay signing up for Medicare until the employment ends or the coverage stops, whichever happens first. These large employers must offer you and your spouse the same benefits they offer younger employees and their spouses, which means that the employers coverage can continue to be your primary coverage and pay your medical bills first.

Many people enroll in Medicare Part A at 65 even though they have employer coverage, because its free if they or their spouse has paid 40 or more quarters of Medicare taxes. But they often delay signing up for Part B while theyre still working so they dont have to pay premiums for both Medicare and the employer coverage.

Keep in mind

Don’t Miss: How To Call Medicare Office

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

I Want To Sign Up For Only Part A Or Both Part A & Part B

Once youre eligible to sign up for Medicare , you have 2 options:

Once you sign up , youll get a welcome package with your Medicare card.

Read Also: What Are The Guidelines For Medicare

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

Im Turning 65 What Do I Need To Do For Medicare Enrollment

Summary:

At 65 you may be looking forward to different things: having grandchildren perhaps, possibly retiring from your career, or taking a trip that youâve dreamed of your whole life. Sixty-five may also be a significant year for you as it may be the first year that youâre eligible for Medicare coverage options. Medicare coverage is the government health insurance program that provides hospital and medical insurance to people 65 and older and some under 65 who qualify because of a disability. Medicare Part A and Part B are called Original Medicare.

Read Also: When Can A Person Born In 1957 Get Medicare

If I Keep My Work Insurance Do I Need To Enroll In Medicare

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

Part A: For most people, Part A does not charge a premium. Typically, Part A pays after your work insurance. Part A probably wont pay much of the bill, but doesnt cost anything to have. For that reason, most individuals enroll in Part A at age 65.

Part B: Everyone pays a monthly premium for Part B. Part B typically pays after your work coverage and may not pick up much of the bill. Enrolling in Part B will also start your one-time guarantee to purchase a Medicare Supplement. Once this 6-month time frame starts, it cannot be stopped. For these two reasons, most people wait until their work coverage ends to enroll in Part B.

Part D: Everyone pays a monthly premium for Part D. As long as you have other “creditable coverage,” you do not have to enroll in a Part D plan. Creditable coverage means the insurance is as good as, or better than, a standard Part D plan. Check with your HR department to verify if your policy is creditable coverage. Typically, prescription insurance through work offers better coverage than what you can get through Medicare. For this reason, most people wait until their work coverage ends to enroll in Part D.

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Read Also: What Medicare Part B Does Not Cover

Signing Up For Medicare

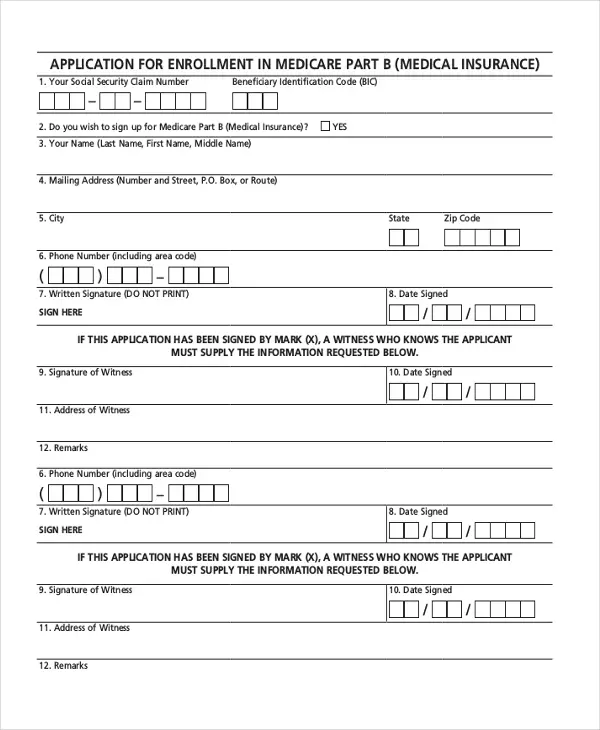

Follow the steps below if you need to actively enroll in Medicare.

If you decide to enroll in Medicare during your Initial Enrollment Period, you can sign up for Parts A and/or B by:

- Visiting your local Social Security office

- Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare

- Or, by applying online at www.ssa.gov

If you are eligible for Railroad Retirement benefits, enroll in Medicare by calling the Railroad Retirement Board or contacting your local RRB field office.

Keep proof of when you tried to enroll in Medicare, to protect yourself from incurring a Part B premium penalty if your application is lost.

- Take down the names of any representatives you speak to, along with the time and date of the conversation.

- If you enroll through the mail, use certified mail and request a return receipt.

- If you enroll at your local Social Security office, ask for a written receipt.

- If you apply online, print out and save your confirmation page.

Related Answers

Working While Receiving Benefits

You may work after you start receiving benefits, which could mean a higher benefit for you in the future. We may withhold some of your benefits if you earn more than the yearly earnings limit. Sometimes people who retire in mid-year already have earned more than the annual earnings limit. However:

- We have a special rule that applies to earnings for one year, usually the first year you begin receiving benefits. This means we cannot withhold benefits for any month we consider you retired, regardless of your yearly earnings.

- After you reach full retirement age, we will recalculate your benefit amount to take into account any months you did not receive benefits because your earnings were too high.

Read Also: What Are The Types Of Medicare Advantage Plans

How To Apply For Medicare Part A And Part B

Applying for Medicare Part A and Part B is easier than ever. Once you meet eligibility requirements, you are ready to choose from a variety of Medicare Part A and Part B plans in which to enroll. As we mentioned, some beneficiaries can receive automatic enrollment, and some must apply manually.

There are three ways to apply for Medicare Part A and Part B:

If you have previously been a railroad employee, you can enroll in Medicare by contacting the Railroad Retirement Board, Monday through Friday, from 9:00 AM 3:30 PM at 1-877-772-5772.

Medicare applications generally take between 30-60 days to obtain approval.

While You Can Start Collecting Benefits At Age 62 Should You Collect Early Or Delay

For many elderly people, Social Security benefits make up one of their primary sources of income in retirement. For half of seniors, Social Security comprises about half of their retirement income, according to the Center on Budget and Policy Priorities. Some studies estimate that without Social Security, between 30% and 40% of senior citizens would be considered below the poverty line.

The age at which you decide to collect your Social Security benefits has a big impact on how much youll earn from the program over time because the longer you wait, the higher your monthly payout will be.

Dont just call Social Security and apply at age 62. Everybody has options. A married couple could receive $1 to $1.5 million in benefits over their lifetime. And single people could maybe half of that, says Marc Kiner, a CPA at Premier Social Security Consulting. And do not assume that Social Security will review your options with you.

Select spoke to Kiner and Jim Blair, the lead consultant at Premier, about some of the factors you should consider when deciding when to apply for Social Security benefits.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

You May Like: What Is The Annual Deductible For Medicare Part A