What Are The Medicare Income Limits For 2021

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000 for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

Recommended Reading: What Age Can You Get Medicare Part B

What Medicaid Covers For Medicare Enrollees

Medicare has four basic forms of coverage:

- Part A: Pays for hospitalization costs

- Part B: Pays for physician services, lab and x-ray services, durable medical equipment, and outpatient and other services

- Part C: Medicare Advantage Plan offered by private companies approved by Medicare

- Part D: Assists with the cost of prescription drugs

Medicare enrollees who have limited income and resources may get help paying for their premiums and out-of-pocket medical expenses from Medicaid . Medicaid also covers additional services beyond those provided under Medicare, including nursing facility care beyond the 100-day limit or skilled nursing facility care that Medicare covers, prescription drugs, eyeglasses, and hearing aids. Services covered by both programs are first paid by Medicare with Medicaid filling in the difference up to the states payment limit.

How Your Income May Affect Your Medicare Costs

The federal Medicare program has costs that come with it. There may be premiums, copayments, coinsurance, and deductibles associated with Medicare Part A, Part B, and the optional Part D . If your income is below certain limits, you might qualify for programs that reduce your Medicare costs. On the other hand, if your income is higher than a certain level, you might have to pay a higher Medicare Part B premium and a higher Medicare Part D premium .

Medicare Part A and Medicare Part B make up Original Medicare. If youre automatically enrolled in Medicare, as many Americans are when they turn 65, Original Medicare is the type of insurance you get. You can add to this insurance by enrolling in prescription drug coverage through Medicare Part D and/or buying a Medicare Supplement plan to help with Original Medicare costs or you can get your Medicare coverage through a Medicare Advantage plan.

Recommended Reading: How Do I Choose Medicare Part D Plan

How Many Credits Do You Need To Qualify For Medicare

40Before someone can qualify for Medicare or Social Security benefits, they must have 40 work credits. People earn credits, or qualifying quarters, as they work and pay Social Security taxes on their income. A person can earn up to four credits per year, so it will take 10 years to earn the required 40.

Do Medicare Premiums Change Yearly Based On Income

Yes, your Medicare Part B premium will change based on your MAGI.

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.

To find coverage for the things that Medicare does not cover, start shopping with eHealth.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

You May Like: Do You Have To Pay Medicare Part B

Medicare Part B Premiums

For Part B coverage, youll pay a premium each year. Most people will pay the standard premium amount. In 2022, the standard premium is $170.10. However, if you make more than the preset income limits, youll pay more for your premium.

The added premium amount is known as an income-related monthly adjustment amount . The Social Security Administration determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago.

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income.

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. Youll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Find Medicare Advantage Plans Where You Live

If you have any questions about the Medicare Advantage plans that are available near you and the network coverage they offer, you can call to speak with a licensed insurance agent.

A licensed agent can help you find out if your doctor is part of plan networks available near you, and they can also help you see if your prescriptions drugs are covered by any available plans.

Also Check: How To Enroll In Medicare Part B Special Enrollment

Help With Medicare Part D Costs

If you have a low income, you might qualify for help paying your Medicare Part D costs through Medicares Extra Help program. If you qualify, youll generally pay a maximum of $2.95 per generic drug prescription and $7.40 per brand-name drug prescription. These are 2016 amounts, and they apply only to medications that your Medicare Prescription Drug Plan covers.

If you qualify for certain Medicare Savings Plans described above , youre automatically eligible for Extra Help.

Medicare Part B Premium

Beneficiaries typically pay a monthly Medicare Part B premium, although if you have a low income, you may qualify for help paying it. This premium amount may vary, depending on your situation. Here are a few different scenarios:

- If you enrolled in Part B before 2016, your premium will generally be $104.90 per month.

- Youll generally pay $121.80 for your monthly premium if any of the following situations applies to you:

- You enroll in Part B for the first time in 2016.

- You arent receiving Social Security benefits yet.*

- You are billed directly for your Part B premium.

- You have both Medicare and Medicaid coverage , and Medicaid pays for your premiums.

*If you worked for a railroad, contact the Railroad Retirement Board to learn more about your Part B premium costs. You can contact the RRB at 1-877-772-5772, Monday through Friday, from 9AM to 3:30PM, to speak to an RRB representative. TTY users call 1-312-751-4701.

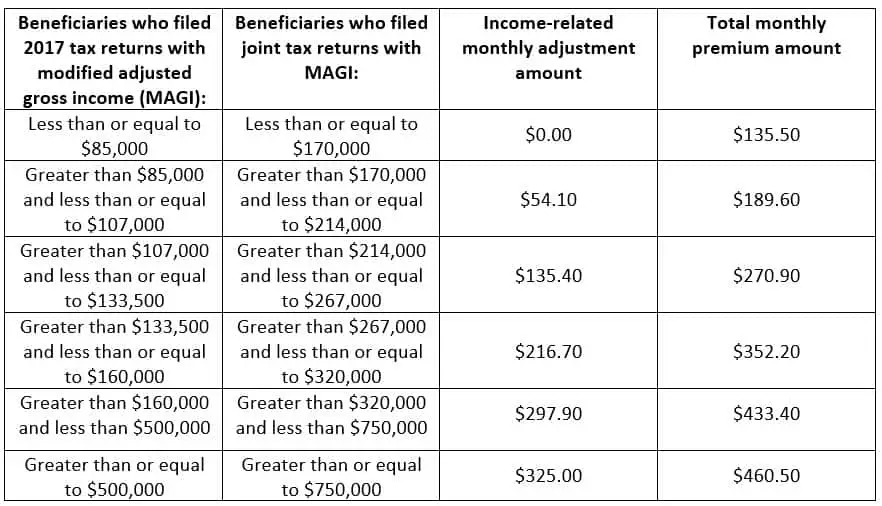

In some situations, your Part B premium may be higher than the above amounts. The government looks at your income as reported on your tax return from two years ago to set your Medicare Part B premium. This table refers to your 2014 income and your 2016 Medicare Part B monthly premium.

| More than $129,000 | $389.80 |

Your Medicare Part B premium payment is typically deducted from your monthly Social Security benefit. If you have to pay an income-related monthly adjustment amount, youll get a notice from Social Security.

Read Also: What Medicare Supplement Covers Dental

Am I Limited On Where I Can Use My Medicare Coverage

Original Medicare can be used anywhere in the U.S. and in certain U.S. territories, as long as you visit a provider who is enrolled in Medicare and who accepts new Medicare patients.

Some private Medicare plans such as Medicare Advantage plans and Part D plans may feature provider or pharmacy networks that limit the providers you can visit for covered services.

For more information on how your plan networks work and how to find a Medicare provider near you who accepts your plan, be sure to check with your plan carrier.

Does Medicare Part B Premium Change Every Year Based On Income

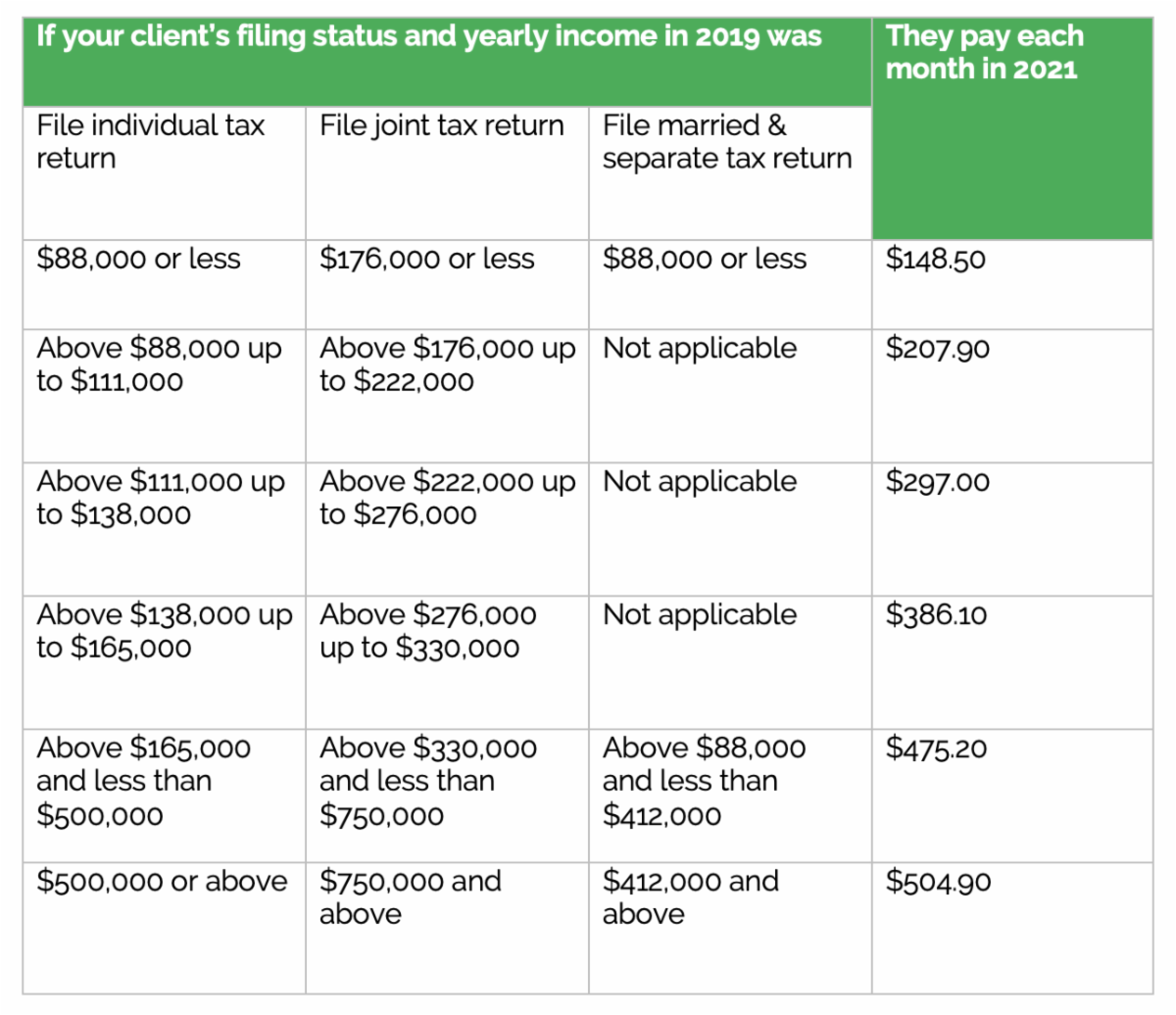

Medicare premiums are based on your modified adjusted gross income, or MAGI. If your MAGI for 2019 was less than or equal to the higher-income threshold $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly you pay the standard Medicare Part B rate for 2021, which is $148.50 a month.

Recommended Reading: What Is Part B Excess Charges In Medicare

How To Become Eligible For Medicare

You qualify for full Medicare benefits if: You are a U.S. You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them. You or your spouse is a government employee or retiree who has not paid into Social Security but has paid Medicare payroll taxes while working.

How Does Medicare Determine Your Income

Original Medicare is two-fold, comprised of Part A and Part B . They differ not only in the Medicare benefits covered but also in how the premiums are determined.

Part A premium based on credits earned

Most people eligible for Part A have premium-free coverage. The premium is based on credits earned by working and paying taxes. When you work in the U.S., a portion of the taxes automatically deducted are earmarked for the Medicare program. Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium. A sliding scale is used to determine premiums for those who work less than 40 quarters. In 2020, this equates to $252 per month for 30 to 39 quarters and $458 per month for less than 30 quarters.

Part B premium based on annual income

The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium. Once you exceed $87,000 yearly income if you file an individual tax return, or $174,000 if you file a joint tax return, the cost goes up to $202.40. As your income rises, so too does the premium amount until a certain level of income is exceeded based on tax return filing status. At that level, the monthly premium is set at $491.60. The amounts are reevaluated by Medicare annually and may change from year to year. Any amount charged above the standard premium is known as an income-related monthly adjustment amount .

Related articles:

Also Check: Who Is Eligible For Medicare In Georgia

Is There Help For Me If I Cant Afford Medicares Premiums

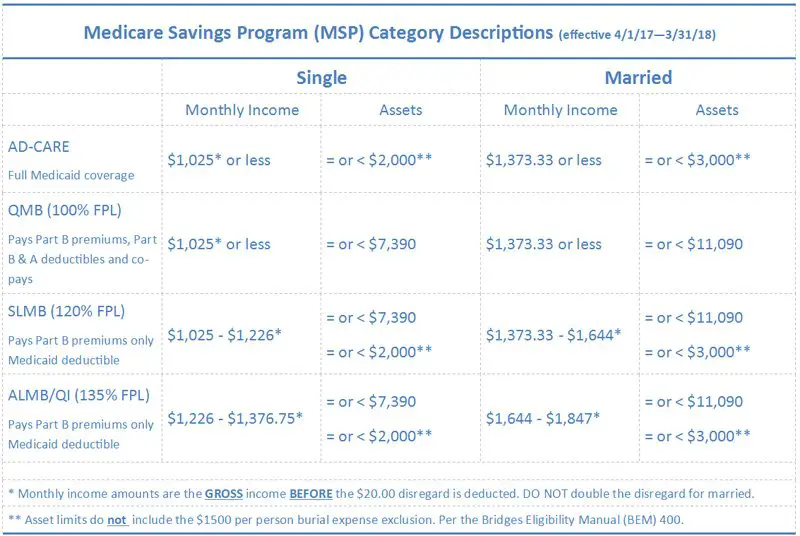

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

Reviewed by our health policy panel.

Q: Is there help for me if I cant afford Medicares premiums?

A: Yes. Medicare Savings Programs can help with premiums and out-of-pocket costs.

Income Limits For The Medicare Extra Help Program

The annual income limit to qualify for Medicare Extra Help is $19,140 or $25,860 . This number is based on the federal poverty level .

You may qualify for Extra Help even if your income falls outside these limits. For example, due to the higher cost of living, limits are slightly higher in Alaska and Hawaii. You may also be able to get Extra Help if part of your income is due to employment earnings or if you help support other family members who live with you.

Social Security does not count the following as income:

- Assistance from other individuals to help cover living expenses

- Disaster assistance

- Supplemental Nutrition Assistance Program benefits

- Victim compensation payments

This is not a complete list. For specific questions, please call SSA at 1-800-772-1213 or TTY 1-800-325-0778.

Don’t Miss: Does Medicare Pay For Ct Scans

What Are The Coverage Limits During The Medicare Part D Donut Hole

Medicare Part D prescription drug plans feature a temporary coverage gap, or donut hole. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs.

- Once you and your plan combine to spend $4,430 on covered drugs in 2022, you will enter the donut hole.

- Once you enter the donut hole in 2022, you will pay no more than 25 percent of the costs for brand name drugs and generic drugs until you reach the catastrophic coverage phase.

- After you spend $7,050 out-of-pocket on covered drugs in 2022, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

Who Is Affected By The 2021 Change Implemented At The Beginning Of The Year

Medicare beneficiaries earning more than $88,000 and couples earning more than $176,000 were affected by the 2021 change. Medicares 2021 income limits and corresponding surcharges apply to all beneficiaries with part B and/or part D coverage,Worstell tells Parade. To determine eligibility, Medicare will use 2019 tax data for the 2021 plan year.

That said, its important to notify Medicare of any life changes which can and/or do affect your income level, including but not limited to:

- Divorce, death, or marriage

Related: Medicare EnrollmentHow and When to Apply for Medicare

Read Also: Can I Submit A Claim Directly To Medicare

How Do You Qualify For Medicare

The majority of beneficiaries around 85 percent qualify for Medicare based on their age. All American citizens aged 65 or older can sign up for Medicare.

You may also be entitled to Medicare if you have a disability and qualify for either Railroad Retirement Board or Social Security benefits for 24 months. Finally, you may be eligible for Medicare if you have been diagnosed with either amyotrophic lateral sclerosis or end-stage renal disease .

Income has no bearing on Medicare eligibility.

Does Income Affect Medicare Part A Premiums

Medicare Part A, also known as hospital insurance, covers inpatient care. The vast majority of Medicare beneficiaries paid payroll taxes for the required 40 quarters to qualify for premium-free Part A. Even if you do have a Medicare Part A premium, though, you won’t pay more based on your income.

If you or your spouse did not work and pay Medicare taxes for the required 40 quarters, the standard Part A premium is $499 per month in 2022.

Don’t Miss: What Is Medical Vs Medicare

Medicare’s Extra Help Program Helps Pay Prescription Drug Costs If You Meet Income And Resource Requirements

Extra Help is a Medicare program that helps pay your Part D costs when you have limited income and resources. These guidelines are set by the federal government, although limits are slightly higher in Alaska and Hawaii.

Not all income counts toward the yearly threshold. The same is true for your personal resources. Some Medicare beneficiaries get Extra Help automatically while others have to apply. This page walks you through the guidelines to qualify for Extra Help and how to apply for assistance through the Social Security Administration .

More Resources For Low

If youre disabled or have a low income, you might qualify for financial help through Medicaid, an assistance program run jointly through the federal government and individual states. You might qualify for other financial assistance programs.

Some Medicare policies that are offered by Medicare-approved private insurance companies may save you money, depending on your situation. If you have questions about Medicare plan options, you can contact eHealth to speak with a licensed insurance agent and learn more about your coverage options.

To learn about Medicare plans you may be eligible for, you can:

- Contact the Medicare plan directly.

- Contact a licensed insurance agency such as Medicare Consumer Guides parent company, eHealth.

- Or enter your zip code where requested on this page to see quote.

Don’t Miss: How To Get A Medicare Number As A Provider

Helpful Tips For Members

- Use your formal, legal name. No nicknames or initials. Be consistent.

- If you change your name, make sure Social Security updates all three of their databases:

- Numident

- Title 2

- Title 16

If you have more questions about this program please contact our Customer Contact Center.

Program Contact: , 303-866-5402

Do Medicare Benefits Run Out

If you are admitted for inpatient care at a hospital or another inpatient facility, your MedicarePart A benefits will help pay for some of your hospital costs.

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs.

- For the first 60 days of a qualified inpatient hospital stay, you dont have to pay any Part A coinsurance. You are responsible for paying your Part A deductible, however. In 2022, the Medicare Part A deductible is $1,556 per benefit period.

- During days 61-90, you must pay a $389 per day coinsurance cost after you meet your Part A deductible.

- Beginning on day 91 of your stay, you will begin using your Medicare lifetime reserve days. Medicare limits you to only 60 of these days to use over the course of your lifetime, and they require a coinsurance payment of $778 per day in 2022.

You only get 60 lifetime reserve days, and they do not reset after a benefit period or a calendar year. If you have a hospital stay that lasts longer than 90 days after your lifetime reserve days are exhausted, you will be responsible for all costs beginning on day 91.

You May Like: Does Medicare Have Long Term Care Insurance

How Much Can You Expect To Pay For Medicare Coverage

Individuals making $88,000 or less and married couples who file a joint tax return and make $176,000 or less will pay the standard amount, i.e. their monthly payment will be $148.50. This is for Medicare part B. Individuals making between $88,000 and $111,000 and couples making between $176,000 to $222,000 will pay $207.90 a month, and the rates increase from there. A full breakdown of Medicares income limits and the corresponding IRMAA surcharges can be seen on pages 2 and 3 of this PDF, which is published by the official government website for Medicare.

Related: Do You Qualify For A Medicare Special Enrollment Period?

Part D prescription drug coverage is also affected by the aforementioned income limits. The additional amount you will pay for prescription coverage or Medicare part D ranges from $12.30 to $77.10, with the same income thresholds applied. Thats on top of any premium you pay, whether through a standalone plan or via the Advantage Plan, which typically includes drug coverage.

As for Medicare part A, most people do not pay for this coverage because they paid Medicare taxes while working. In order to receive free part A coverage you must have workedand paid Medicare taxesfor 10 years or more. If you dont get premium-free Part A, you may pay up to $471 each month.