Medicare Supplement Plans In Virginia For People Under Age 65

Because premiums are significantly higher for Medicare recipients under the age of 65, Virginia requires Medigap insurers to offer them at least one Medigap plan. Who qualifies for Medicare under age 65? Social Security disability recipients , plus individuals diagnosed with End-stage Renal Disease and permanent kidney failure.

If youre disabled and receiving Social Security benefits, you automatically qualify for SSDI after 2 years. In Virginia, 13% of all Medicare recipients are under the age of 65. Virginia has recently enacted laws to make sure these individuals can take advantage of Medigap plans as well. Still, people under age 65 do pay more.

Medicare recipients in Virginia age 65 or older average monthly premiums anywhere from $100 to $160. Compare that to beneficiaries under the age of 65 who pay from $400 to $650 per month. Diasabled recipients do have access to lower rates when they turn 65.

Insurance companies in Virginia are not required to sell Medigap policies to recipients who are under age 65.

Aarp Medicare Supplement Plan L

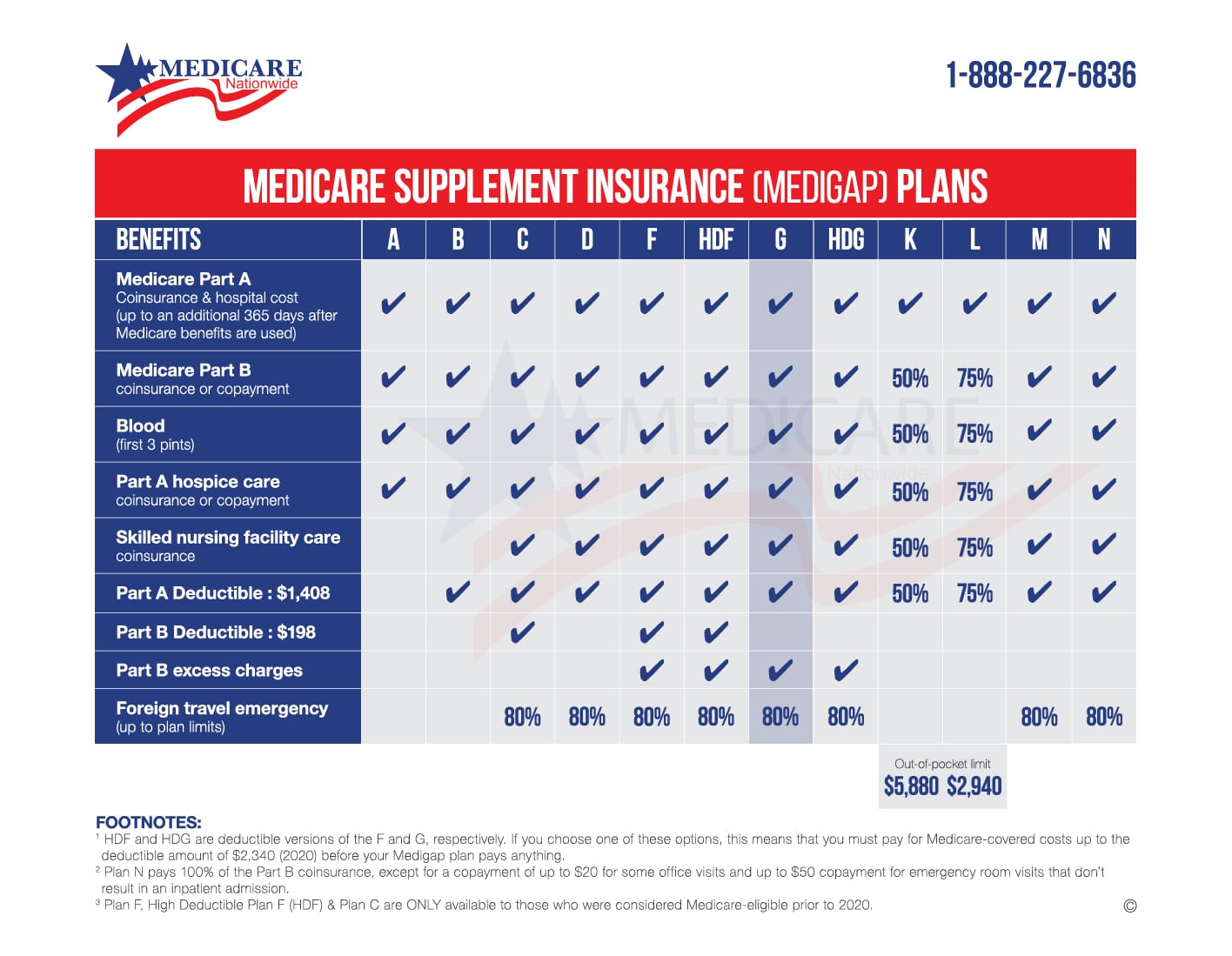

Similar to Plan K, Medicare Supplement Plan L offers less comprehensive coverage for a lower price. Plan L offers coverage for all basic benefits included with all Medicare Supplement plans. However, for some of these benefits, the coverage provided is partial rather than full.

Here are the benefits and coverage levels you can expect from Plan L:

- 100% of your coinsurance payments for inpatient hospital care

- 75% of your Medicare Part A hospice care coinsurance or copayment

- 75% of your Medicare Part A deductible

- 75% of your Medicare Part B coinsurance or copayment

- 75% of up to 3 pints of blood for use in a medical procedure

- 75% of your coinsurance for care provided in a skilled nursing facility

An Additional Benefit of Plan L

Plan L is one of two Medicare Supplement plans that includes an annual out-of-pocket maximum. In 2020, that limit is set to $2,940. Once youve spent this much, your plan will cover up to 100% of your Medicare costs for the remainder of the year.

What Is The Plan G Deductible In 2021

There are two version of Medigap Plan G: a standard version and a high-deductible version.

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 that must be met before the plan coverage kicks in.

The tradeoff for the high-deductible version of Plan G is that it typically comes at a lower monthly premium than the standard version of the plan.

Recommended Reading: What’s The Cost Of Medicare Part B

Mutual Of Omaha: Best For Trustworthiness

If youre looking for a company you can trust, look no further than Mutual of Omaha. Mutual of Omaha offers 3 separate Medigap plans in Virginia, running anywhere from $40 to $80 in monthly premiums. Mutual of Omaha Medigap plans help cover your share of the costs including hospital expenses, skilled nursing and hospice care.

- Does not offer any individual Medicare Supplemental coverage options itself

Reduced Premium Options For Plans With Medicare Select

Some Medicare Supplement Insurance Plans have a money saving option called Medicare Select. With this option, the Medicare Part A deductible is covered for non-emergency care at Medicare Select hospitals. If its an emergency, the Part A deductible is covered at any hospital.

Medicare Select is not an HMO. You can choose your own doctors and specialists. To avoid paying the Part A deductible, you must agree to use a Medicare Select hospital for non-emergency care.

Youre eligible if you live within 30 miles of any Medicare Select hospital. Find a list of Medicare Select hospitals. Plans F, G, K, L and N have Medicare Select options in Illinois.

Only certain hospitals are network providers under this policy. Check with your doctor to find out if he or she has admitting privileges at the network hospital. If he or she does not, you may be required to use another doctor at the time of hospitalization or, if you still use a non-network hospital, you must pay the Part A deductible and any non-covered charges.

Don’t Miss: Does Medicare Cover Hiv Medication

Medicare Supplement Plans In Wisconsin

Wisconsin standardizes its Medicare Supplement Insurance very differently. For one thing, there is only one major Medigap policy available, the Basic plan.

This plan covers basic benefits:

-

Part A coinsurance for inpatient hospital services

-

Part B coinsurance for outpatient medical services

-

First three pints of blood

-

Part A coinsurance or copayment for hospice care

It also covers coinsurance for stays in skilled nursing home facilities under Part A, as well as 175 days per lifetime in inpatient mental health care, and 40 visits/year for home health care .

Beneficiaries can add riders to their policy to make it fit their needs better. The riders available are:

-

100% Part A deductible

What Do Medicare Supplement Plans Not Cover

Most Medicare Supplement plans have limits and exclusions to what they cover. For example, Plans C, D, F, G, and N cover 80% of medically necessary emergency care outside the U.S., but each of those four plans has other areas that they dont cover. Medicare.gov offers a detailed explanation of benefits for each plan.

Most common things not covered by Medicare Supplement plans:

- Part B Deductible

- Part B Excess Charge

- Foreign Travel Exchange

You May Like: Is Joe Biden For Medicare For All

How We Chose The Best Medicare Supplement Plan F Companies

We selected the best Medicare Supplement Plan F companies based on several criteria. These included coverage size and if they offer a high-deductible option. The companies we chose typically offer their plans to 40 states or more. We also carefully evaluated each website, looking at how easy it was to find information on their plans, steps required to obtain a quote, the existence of apps that make it simple to see your claim, and the inclusion of easy-to-understand educational content. Finally, we evaluated the companies themselves, including their financial ratings, years in operation, and customer service reviews.

Best Plan For People With Chronic Health Conditions

Editor’s Choice: Plan G: When you have one or more chronic health issues that require you to see your doctor or specialist regularly, your out-of-pocket costs can be considerable. In this situation, Plan G really pays off.

Often times the monthly premium on a Medicare Plan G policy scares people into a Medicare Advantage plan. Then they start getting the co-pay bills from their doctor, ambulance operator, or emergency room.

If you get into a good healthcare system, a Medicare Advantage plan may help coordinate better care, but doctor choice is completely out of your hands. That’s a terrible trade-off if you’re not getting the quality care you need.

The best way to see if a Plan G policy is your best option is to do the math. How frequently do you see your doctor or specialists? How often do you need to use the emergency room or require transportation by ambulance? How often are you an inpatient? The co-pays with these services add up super fast. It’s not difficult to see how a $200, $250, or even a $300 premium on a Plan G policy can save you a lot of money.

Don’t Miss: Does Medicare Cover Chronic Pain Management

Ideal Medigap Plan If You Are Healthy

Editor’s Choice: Plan N.Medigap Plan N is a recent addition to the standardized plans and is rapidly turning into a crowd favorite. This is especially true with retiring baby boomers coming off of employer group health plans.

One of the reasons that Plan N is growing in popularity is because it goes straight to the core of the most costly gaps in original Medicare, but leaves the minor gaps for the beneficiary. This is why the premiums on this plan are typically much lower than Plan F and G, the two most popular policies.

What makes Plan N an excellent option for healthy seniors that what isn’t covered, which includes the Part B Deductible and Excess Charges, typically cost less than what you can save. Said differently, if you do need medical attention two or three times in a year, your out-of-pocket costs will be less than the monthly premiums on a plan that covers these benefits.

How Do I Apply For Medicare Supplement Plan G

You may enroll in a Medicare Supplement Insurance plan at any time by contacting a licensed insurance agent. However, the best time to do so is during your Medigap Open Enrollment Period. This period begins the month you are 65 years old and enrolled in both Medicare Part A and Part B. Your Medigap Open Enrollment Period lasts for six months.

During this enrollment period, you have what are called guaranteed issue rights. When you have guaranteed issue rights, insurance companies are not allowed to use medical underwriting to determine your plan rates or to deny you coverage. But if you apply for a plan during a time when you dont have guaranteed issue rights, a carrier may use medical underwriting to charge you a higher rate or deny you coverage based on your health.

Medigap prices may vary among insurance carriers in the same area, so contact a licensed insurance agent for help comparing all of your plan options.

Read Also: Is Labcorp Covered By Medicare

Find A Medicare Supplement Plan For You

A Medicare Supplement Insurance plan, also called a Medigap plan, is a separate policy that supplements your coverage from Original Medicare Part A and Part B. Medicare Supplement insurance helps protect you against high out-of-pocket costs by helping pay for eligible health care expenses that Medicare does not pay for.

Before you compare plans, you might find it helpful to review the basics of Medicare Supplement Insurance and eligibility and enrollment information.

What Insurance Company Offers The Best Medicare Supplement Plan G For 2021

Medicare Supplement Insurance benefits are standardized by the federal government. That means Medigap Plan G purchased through AARP will feature the same basic benefits as a Plan G purchased through a different carrier.

The only thing that differentiates one Plan G from another is the cost and any extra incentives the carrier may offer in exchange for your enrollment such as SilverSneakers membership or discounts for multiple policyholders form the same house which some insurance companies may offer.

Don’t Miss: How Much Does Medicare Cost Me

Here’s What A Medigap Plan Isn’t

Still unclear about what a Medigap policy is and what it covers? Maybe we can clear things up further by explaining what it’s not:

Is Medicare Supplement Plan G A Popular Plan

Medigap Plan G is soaring in popularity and is on track to become the top-selling Medicare Supplement Insurance plan.

Currently, Plan F is the most popular plan in terms of enrollment as it is the Medigap plan with the most coverage. However, Plan F is only available to beneficiaries who became eligible for Medicare prior to January 1, 2020. Anyone who became eligible for Medicare on or after that date may not purchase Plan F.

After Plan F, the plan with the most coverage is Plan G. So that leaves Plan G as the best Medicare Supplement Insurance plan for incoming Medicare beneficiaries.

Plan G saw a 33% enrollment increase from 2018 to 2019 alone, which was far higher than any other Medigap plan.

Recommended Reading: What Is New With Medicare

Transamerica Medicare Supplement Insurance Company

Transamerica Holding an A+ A.M. Best Rating, Transamerica has recently started to offer a variety of Medicare Supplement plan options, such as Plan G or Plan F. While the company has a rich history and excellent reputation for being a high-quality provider of financial products and life insurance policy options, its potential as a Medicare Supplement insurance provider has yet to reach its maximum but is still very promising.

Top 10 Supplemental Medicare Insurance Companies In 2022

The above are the top 10 most well-known companies offering Medicare Supplement policies. Every Medigap plan meets government standardization requirements. No matter which company you choose, the benefits are the same when the plan is identical. So, Plan G coverage with Mutual of Omaha is the same as Plan G with Medico.

Plan N coverage is also the same across the board, regardless of whether you go with Cigna, UnitedHealthcare, or any other company that offers the plan. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment which is the majority of doctors, coast-to-coast.

Thus, while comparing options, you may wonder why your premium rate quotes vary between carriers for the same letter plan. In the case of Medicare Supplement plans, many factors affect what youll pay each month. Demographic information such as age, location, and tobacco use affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board.

Don’t Miss: What Is Medicare For All

Where Geisinger Offers Medicare Supplements

As the name implies, Geisinger Medicare Supplement plans supplement Original Medicare coverage by helping with copayments, coinsurance, and deductibles. These are your shared costs that you pay when you use various health services.

A good way to understand your costs is to use the 80/20 rule. Medicare pays an estimated 80% of your major medical costs and you the remaining 20%. A Medicare Supplement from Geisinger will help you with the copayments, coinsurance, and deductibles, making your costs more manageable.

Geisinger offers 7 different lettered plans, each with its own pros and cons. The following Medicare Supplement Comparison Chart shows plan benefits side-by-side:

Comparing Medicare Supplement Insurance Companies

The list below includes some of the companies that sell Medicare Supplement Insurance plans in select states across the U.S.

Please note that our guide is meant to be informational and to help you as you start finding the right plan and plan carrier for your needs. Some of the companies listed below may not offer Medigap plans in your area, and you may find a Medicare Supplement carrier in your area that fits your need and isnt on this list.

This list identifies several of the top 10 insurance companies in no particular order.

- Humana

- Medico Insurance Company

- WellCare

Its important to keep in mind that although each companys plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

In other words, Medigap Plan A sold by one company will include the same essential benefits as Medigap Plan A sold by any other insurance company. Their costs and the availability of the types of plans, however, may vary.

Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state.

You can use the chart below to compare each type of 2022 standardized Medicare Supplement plan.

| 80% | 80% |

Don’t Miss: Will Medicare Help Pay For Hearing Aids

Do All Doctors Accept Medicare Supplement Plan Insurance

Although most physicians do accept Medicare payments, there are some that do not. You must ask your health care provider about accepting Medicare assignment this means that they will be willing to accept the amount Medicare pays for services. There are many reasons a doctor may refuse to take Medicare, including low reimbursement rates, administrative paperwork that must be done, and more.

What Are Medicare Coverages

Original Medicare is split into two parts, A and B.

- Part A covers hospital stays, skilled nursing care, hospice, and some home health care.

- Part B covers some doctors’ visits, medical supplies, preventative services, and outpatient care, such as rehabilitation.

The other parts of Medicare are parts C and D:

- Part C is an alternative way to receive Medicare Part A and Part B coverage and may include Part D.

- Part D is the Medicare Prescription Drug Plan.

If you are covered by original Medicare, there will be copayments, coinsurance and deductibles. You have supplemental insurance options that can help reduce the out-of-pocket expenses you will face during retirement. Private insurance companies offer these Medicare Supplement health insurance plans which supplement the health coverage provided by original Medicare. These plans may include payment for various out-of-pocket expenses not paid by Medicare such as copayments, coinsurance and deductibles that can change every year.

Read Also: Can I Sign Up For Medicare Part B Online

Best Set Pricing: Aarp

-

Must join AARP to enroll

-

Need birthday and current Medicare information for price details

-

No link to Medicare Supplement coverage from the main website

AARP is a nonprofit, nonpartisan membership organization that helps people who are ages 50-plus with a variety of services and information. One of the most trusted names for retirees and other seniors, the organization boasts 38 million members and is insured through UnitedHealthcare, which earns an A rating from AM Best for financial strength.

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesnt charge more as you grow older. This is especially helpful if you are still covered under your employer’s insurance and may require coverage after the age of 65.

AARP covers Parts A, B, C, F, G, K, L, and N, though its important to note that plans C and F are only available if you were enrolled in Medicare before January 2020. You can get pricing information easily by entering your ZIP code, and there’s a Spanish language website as well.