Key Things To Remember

The main thing you need to keep in mind if you do not receive Social Security benefits but are eligible to enroll in Medicare is of your enrollment periods. Although you wont be enrolled automatically, you will still be able to sign up for any part of Medicare in the same way that Social Security beneficiaries can.

You should also remember that you can have your Medicare premiums deducted automatically from your monthly benefit checks, greatly simplifying your Medicare experience. If you do not collect Social Security benefits, you can also do automatic billing with Medicare Easy Pay.

Using Your Medicare Card

Youll need to have your Medicare card with you any time you have any medical-related visits or services. This is true even if you have Medicare Advantage, Medicare Part D prescription drug coverage or Medigap supplemental insurance.

Your regular doctor may make a copy of your card on your first visit so they will have it readily available on file. But pharmacies, testing labs, some doctors and other health care providers will require you to show it on each visit.

Be sure to let your doctor or other health care provider know if youve received a replacement or updated Medicare card. They will need the new information.

Recommended Reading: Are Motorized Wheelchairs Covered By Medicare

What Is A Calendar Quarter

The Social Security Administration divides a calendar year into 4 quarters. A calendar quarter refers to a 3-month period, which ends at one of the following calendar dates:

The SSA keeps track of each 3-month quarter a person works and pays their social security and Medicare taxes. Each quarter contributes to a persons eligibility for Medicare Part A.

Also Check: Do Most Doctors Accept Medicare

Why Renew Your Public Services Card

The Public Services Card assists you in accessing a range of public services in an easy and safe manner. If you are a Free Travel customer, an in date Public Services Card is required for you to use this service.

To ensure no interruption in services you are advised to renew your Public Services Card before it expires.

Medicare Special Enrollment Period

You may choose not to enroll in Medicare Part B when you are first eligible because you are already covered by group medical insurance through an employer or union. If you lose your group insurance, or if you decide you want to switch from your group coverage to Medicare, you can sign up at any time that you are still covered by the group plan or during a Special Enrollment Period.

Your eight-month special enrollment period begins either the month that your employment ends or when your group health coverage ends, whichever occurs first. If you enroll during an SEP, you generally do not have to pay a late enrollment penalty.

The Special Enrollment Period does not apply if youre eligible for Medicare because you have ESRD. Please also keep in mind that COBRA and retiree health coverage are not considered current employer coverage and would not qualify you for a special enrollment period.

Read Also: How Do I Check On My Medicare Part B Application

What Else Do I Need To Know About Medicare Easy Pay

- Once your Medicare Easy Pay starts, 2 things will happen each month:

- You’ll get a monthly statement that says “THIS IS NOT A BILL” letting you know that the premium will be deducted from your bank account. Get a sample of the new statement that will start mailing in early 2022.

- We’ll deduct your premium from your bank account on or around the 20th of the month. Your bank statement will show a payment to “CMS Medicare Premiums.”

- If your bank rejects or returns your premium deduction, we’ll send you a letter with instructions on how to send your payment to Medicare.

- If your premium amount changes, we’ll automatically deduct the new premium amount from your bank account.

A Note On The Railroad Retirement Board

The Railroad Retirement Board is a government agency that provides benefits to retired railroad workers. Although it is distinct from Social Security, the RRB can also play into many of the Medicareeligibility requirements.

In most cases, when a Medicare guideline is contingent on receiving Social Security benefits, it is more accurate to say that it depends on Social Security or Railroad Retirement Board benefits.

Also Check: When You Are On Medicare Do You Need Supplemental Insurance

Why Would I Opt Out Of Medicare

Part B comes with a premium in most cases. Some people delay enrollment in Medicare Part B to avoid paying the premium especially if they have other coverage. The same can be true of Part A, for people that must pay a premium for it.

If you delay enrollment in Part B or Part A, make sure you plan it well to avoid problems. For example:

- Group health plans may have different coverage rules if youre eligible for Medicare coverage. Check with your plan and ask how it would work with and without Medicare.

- You might face a late enrollment penalty if you delay Part B and/or Part A coverage. To avoid a penalty, make sure you enroll in Medicare promptly when your employment ends, or when the group health coverage ends. After the month coverage or employment ends , you might have an 8-month Special Enrollment Period to enroll in Medicare without a penalty. Ask your benefits administrator, or contact Medicare.

At What Age Do I Qualify For Social Security

You can begin collecting Social Security retirement benefits as early as age 62. Doing so, however, is often not advisable, since it means lowering your monthly benefits potentially for life.

To collect the full monthly benefit your earnings record entitles you to, you must wait until full retirement age to sign up for Social Security. Depending on your year of birth, that age will fall out somewhere between 66 and 67. For each month you file for Social Security ahead of full retirement age, youll face a reduction in your monthly benefits that will likely remain in effect indefinitely, unless you manage to go through the motions of withdrawing your application soon after filing it.

Also Check: Where Do You Apply For Medicare

Examine Atentamente Su Factura

El tipo de factura de Medicare que recibe muestra si está en riesgo de perder su cobertura Medicare por pagos atrasados:

Si el cuadro de la esquina superior derecha dice |

Significa |

Haga esto |

|---|---|---|

| Esto no es una factura | Usted se inscribió en el Pago Fácil de Medicare. El pago de su prima se debitará automáticamente de su cuenta bancaria alrededor del día 20 de cada mes. | No necesita hacer nada. |

| Primera factura | Esta es su primera factura o ya ha pagado el monto completo de su última factura. | Envíe un pago por el monto total adeudado. Medicare debe recibir su pago antes de la fecha de vencimiento de la factura o se considerará vencida. |

| Segunda factura | Medicare no recibió el pago antes de la fecha de vencimiento que se mostraba en la Primera factura. . | Envíe el pago por el total de la cantidad adeudada antes de la fecha de vencimiento de la factura. |

| Factura en mora | Medicare no recibió el pago antes de la fecha de vencimiento que se mostraba en la Segunda factura. . Si usted no paga la cantidad total adeudada, perderá su cobertura de Medicare. | Envíe un pago por el monto total adeudado antes de la fecha de vencimiento para no perder su cobertura de Medicare. Esta es la última factura que recibirá. |

Todas las facturas de Medicare vencen el día 25 del mes. En la mayoría de los casos, la prima se debe pagar el mismo mes en que se recibe la factura. Por ejemplo, Medicare ejecuta la factura de abril el 27 marzo. Recibirá la factura a principios de abril y vence el 25 abril.

When Other Insurance Plans Cost Less Than Medicare

You may find that other insurance options are less expensive for you than Medicare.

Obamacare plans are an appealing but you are not allowed to have any part of Medicare while on an Obamacare plan. You could sign up for health coverage through your spouse’s health plan if that option is available. Better still, you may be eligible for health care based on your military experience, whether through the VA or TRICARE.

In these cases, you may be tempted to decline Medicare in favor of another insurance. After all, no one wants to pay two premiums if they don’t have to. However, you need to understand that declining Medicare can have serious repercussions.

It is unclear at this time how an Obamacare repeal will affect insurance access. This will depend on what kind of replacement plan the Trump administration puts forward.

Don’t Miss: When Is Medicare Supplement Open Enrollment

Who Is Eligible For Ssi

You can qualify for SSI if you:

- are over 65

- are legally blind

- have a disability

As with all Social Security benefits, youll also need to be a United States citizen or legal resident and have limited income and resources. However, to apply for SSI, you dont need work credits.

You can receive SSI in addition to SSDI or retirement benefits, but it can also be a standalone payment. The amount you receive in SSI will depend on your income from other sources.

Social Security Disability Insurance is a type of Social Security benefit for those with disabilities or health conditions that prevent them from working.

Qu Pasa Si Se Atrasa El Pago De Mi Prima

Si se atrasa en el pago de su primera factura, recibirá una segunda factura. Su segunda factura incluirá tanto las cantidades anteriores como la prima del próximo mes. Si no paga el monto total adeudado antes del 25 del mes, recibirá una factura en mora. Si recibe una factura en mora y no paga su cantidad total antes del día 25, perderá su cobertura Medicare.

Don’t Miss: How Can I Sign Up For Medicare

Some Basics Of Medicare Supplemental Insurance Plans

Supplemental plans fill the gap in medical expenses that Original Medicare does not fully cover.

For example, if you need care for a medical condition, Medicare Part B only covers 80 percent of those costs, and you are on the hook for the remaining 20 percent.

Using a supplemental plan, you can significantly reduce the out-of-pocket costs that can add up from medical care, including copayments, deductibles and coinsurance.

Private insurance companies offer supplemental plans, also known as Medigap.

If you cannot afford the out-of-pocket expenses you incur from Part B, then a supplemental policy may help you curb those costs.

You must pay a monthly premium for a supplemental plan, so it is imperative that you shop by comparison when you are searching for one.

Just like traditional health care, you should never decide on the first insurance company that you see.

This is especially true here, because Medigap plans are standardized into types, and plans of the same type offer the exact same coverage, no matter the private carrier.

In other words, the only difference between Medicare supplements plans of the same type is the monthly premium charged by the carrier.

There are several Medicare-approved private insurance companies that offer quality supplemental plans.

The cost of your monthly premium and the portion of your medical expenses a supplemental plan will cover are at stake, so thoroughly comparison shop private insurance companies offering supplemental plans.

Should I Sign Up For Medicare Part B

If youre still working and have health insurance through your employer, you might not need to sign up for Medicare Part B right when you turn 65.

Thats because your health insurance plan probably provides coverage thats at least as good as what Medicare Part B would give you.

If thats the case, you qualify for a special enrollment period. That means you have eight months after your health insurance through work ends to sign up for Medicare Part B.

Tip: Always check with Social Security to make sure you’re eligible for a special enrollment period. You can find their phone number on our Contact Us page.

You May Like: How To Get A Lift Chair From Medicare

Signing Up For Medicare Part D At 65 If Youre Still Working

To make sure you have prescription medication coverage, you need either from work, Medicare Part D, or a Medicare Advantage plan with drug coverage. Your employer can tell you if your workplace coverage is creditable, meaning its as good as or better than Part D.

Once you , you could lose your workplace prescription coverage and you may not be able to get it back.

If you dont have either and you dont enroll in Part D on time, youll pay higher Part D premiums.

Keeping Your Medicare Card Safe

Keep your Medicare card in a safe place, and dont let anyone else use it. Always have your card handy when you call Medicare with questions.

You should take your Medicare card with you when you receive any health care services or supplies. Even if you havent reached your deductible, your doctor will need your card information to submit a claim. That claim will be applied to your deductible so you can use your benefits sooner. If you receive a new Medicare card, show it to your doctors office staff so they can make a copy of the updated information.

If you misplaced or lost your card, you can get a replacement Medicare card.

To learn about Medicare plans you may be eligible for, you can:

- Contact the Medicare plan directly.

- Contact a licensed insurance agency such as Medicare Consumer Guides parent company, eHealth.

- Or enter your zip code where requested on this page to see quote.

Recommended Reading: How Much Is Premium For Medicare

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the plan’s denial for a service to be provided.

The Right to Information About All Treatment Options

You have the right to know about all your health care treatment options from your health care provider. Medicare forbids its health plans from making any rules that would stop a doctor from telling you everything you need to know about your health care. If you think your Medicare health plan may have kept a provider from telling you everything you need to know about your health care options, then you have the right to appeal.

Protect Yourself Going Forward

Once youve followed all the steps to get your replacement Social Security card, its wise to take action to protect yourself. You may have received a new physical card, but your Social Security number will remain unchanged, and anyone who comes into possession of your old card can use it to commit fraud. This may mean staying diligent about whats on your credit report for years to come.

The good news is theres a lot you can do to prevent your Social Security card from being used nefariously. In addition to taking steps to protect your identity, make sure your new card is stored safely and securely and only leaves your home or safety deposit box when absolutely necessary. Losing possession of your Social Security card can be a nerve-wracking experience, but youve got tools at your disposal to make sure its replaced quickly and your identity is protected for years to come.

Dont Miss: Does Medicare Pay For Ensure

You May Like: Does Cigna Have A Medicare Supplement Plan

What Documents Do I Need To Enroll In Medicare

Youll need to prove that youre eligible for Medicare when you first enroll. In some cases, Medicare might already have this information.

If youre already receiving Social Security retirement benefits or Social Security Disability Insurance, you wont need to submit any additional documentation. Social Security and Medicare will already have all the information they need to process your enrollment.

If you dont receive any kind of Social Security benefits, youll need to provide documentation to enroll in Medicare.

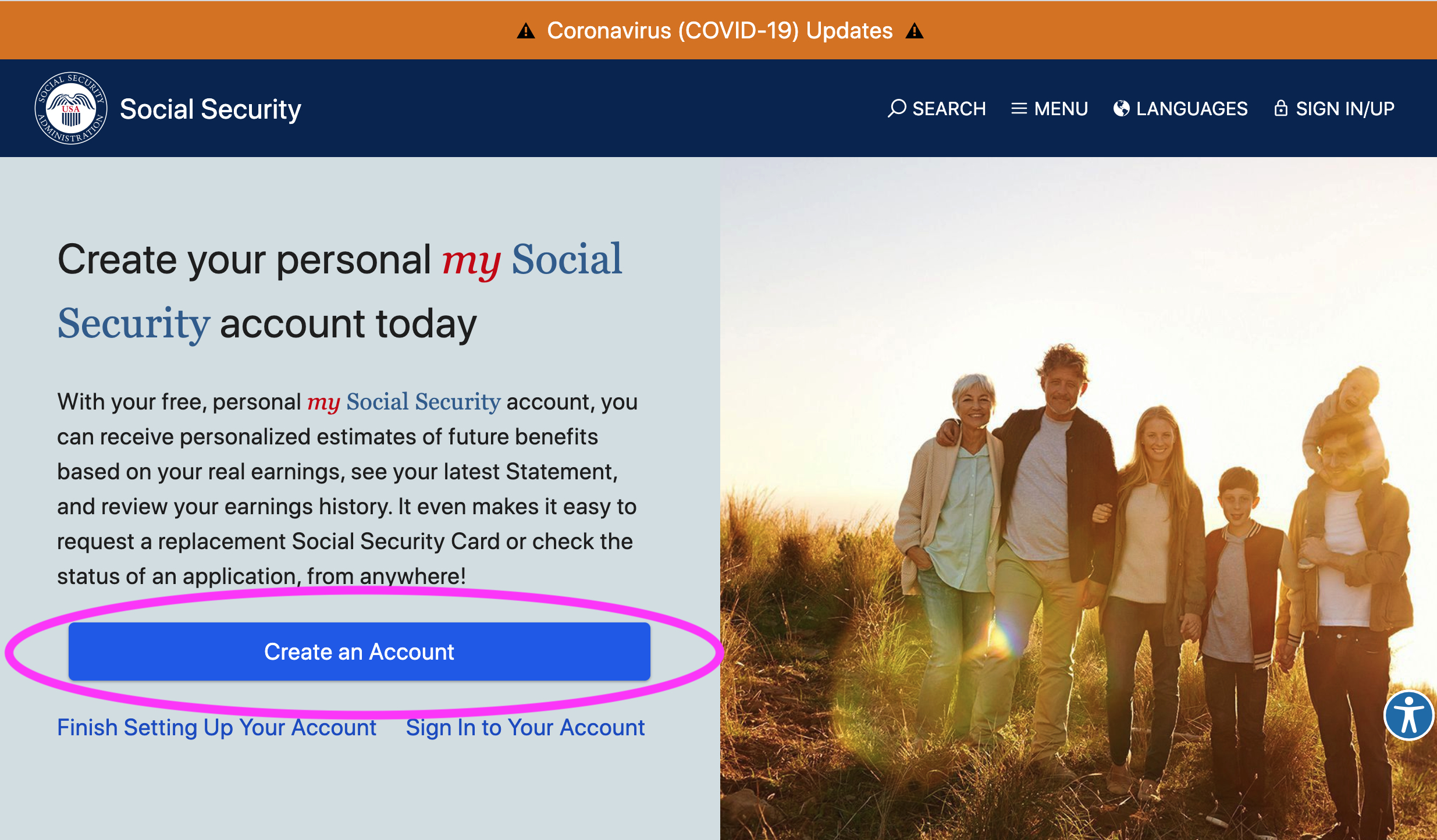

You can enroll online, over the phone, or in person at a Social Security office. No matter how you apply, youll need to provide certain information.

Generally, this includes:

Most of this information can be provided simply by filling out the application. Some details, though, will need extra documentation. These documents may include:

You might not need all these documents, but its a good idea to have as many of them ready as you can. Social Security will let you know whats needed.

Any documents you send should be originals. Social Security will accept copies of W-2s, tax documents, and medical records, but everything else needs to be an original document.

Social Security will send the documents back to you after theyre reviewed.

Medicare Requirements Impacting Your Calpers Health Coverage

If youre Medicare eligible and you lose your Part A and/or Part B, youll be disenrolled from the CalPERS Medicare health plan. Your disenrollment from Part A and/or Part B may result in cancellation of your CalPERS health coverage.

CMS requires members to live in the approved plan service area and list a residential address. Post Offices Boxes are not permitted. If CalPERS is unable to verify your permanent residential address, your enrollment may be subject to cancellation, or you may be administratively enrolled in a Medicare Supplement plan to continue your CalPERS health coverage.

CMS must approve your enrollment in a Medicare Advantage plan and Medicare Part D plan. CalPERS and/or your CalPERS Medicare health plan may contact you to obtain additional information required by CMS to complete your enrollment. If youre contacted for additional information, respond immediately to protect your health coverage.

You may be enrolled in only one Medicare Advantage plan at one time, as well as one Medicare Part D plan at one time. If youre enrolled in a CalPERS Medicare health plan and later enroll in another Medicare health plan, youll be disenrolled from the previous Medicare health plan.

Don’t Miss: How To Sign Up For Aetna Medicare Advantage