Biogen Complains About Narrow Criteria Of The Policy

Without Medicare coverage, Aduhelm’s future is uncertain. As such, Biogen has criticized the proposed policy, arguing that making coverage available only to clinical trial patients with early-stage symptoms leaves out the vast majority of people who suffer from the disease.

The company has argued that the policy would delay treatment for many patients who are Medicare beneficiaries, potentially to the point where treatment may no longer be an option for them.

But since the pharmaceutical firm halted its studies in 2019, the policy proposal appears to be a conservative step forward in light of uncertain results.

Biogen’s complaints may be largely driven by the fact that Aduhelm hasn’t received much traction since it was approved by the Food and Drug Administration in June 2021. Many physicians and hospitals have held off because the drug, which is administered via monthly intravenous infusions, must be paid for upfront.

With no support from the Medicare program up until now, healthcare providers have balked at the idea of purchasing a product where there’s no guarantee of getting reimbursement from insurance companies. Others have cited concerns about the drug’s safety and effectiveness.

The FDA has required Biogen to complete one more study to confirm its effectiveness. If that fails, the pharmaceutical company may choose to pull the drug from the market entirely.

What Are The Medicare Part B Changes For 2021

Medicare Part B covers physician fees, outpatient services, some home health services, medical equipment, and some medications.

The increase in premiums and deductibles is lower in 2021 than they were in 2020. These increases are primarily the result of increased costs for medications administered by physicians, according to CMS.

How To Choose A Home Care Provider

Once enrolled in a Medicare Advantage plan, you can then start looking for a licensed home care provider in your area that can deliver the services you need.

Heres how to narrow down your search list:

- What do others say about them?

- What accreditations and certifications do they have?

- Do they provide ongoing staff training?

- Do they thoroughly screen their caregivers?

- Whats their emergency backup plan?

Recommended Reading: Does Medicare Cover Chronic Pain Management

How Much Does Medicare Cost

As someone who is new to the Medicare program, you are probably wondering about the costs associated with Medicare plans. You might be relieved to know that most people do not pay for their Part A coverage. However, if you do not qualify for premium-free Part A, you can generally still sign up for this coverage . Like Part A, premiums for Part B are set by the federal government, and the standard Part B monthly premium in 2021 is $148.50. You may pay a higher monthly premium in some situations, such as if you have income above a certain level .

It may be more difficult to plan for Medicare Advantage and stand-alone Medicare Part D Prescription Drug plan premiums, because these rates are set by the individual insurance companies. You must continue to pay your Part B premium, but you may pay an additional premium depending on the plan you choose.

Stand-alone Medicare Part D Prescription Drug Plan premiums also vary by the plan you choose. Enrollment in Part D is optional. However, if you think you might need this coverage and as someone who is new to Medicare, its important to plan for Medicare Part D coverage as soon as you are eligible, because you may pay a late-enrollment penalty for as long as you are enrolled in Part D if you delay. Most people only pay the Part D premium set by their plan however, if your income is above a certain level, you may also pay an income-related monthly adjustment amount as well.

What Isnt Covered By Medicare

As broad as Medicare benefits can be, they dont pay for everything. Services not covered by Medicare include:

- Eye exams and most vision care, such as glasses and contact lenses.

- Dental exams and care, except what is necessary for medical reasons, such as reconstruction after an injury or oral surgery.

- Elective procedures, such as plastic surgery in most cases.

- Alternative therapy, such as homeopathy, acupuncture, and reflexology.

- Experimental procedures and some off-label drugs.

Coverage details can vary by area and by plan provisions. Always check with a plan representative to find out whether a service is covered.

Recommended Reading: How Much Does Medicare Cover For Home Health Care

New Market Entrants And Exits

Medicare Advantage continues to be an attractive market for insurers, with 20 firms entering the market for the first time in 2022, collectively accounting for about 19 percent of the growth in the number of plans available for general enrollment and about 6 percent of the growth in SNPs . Thirteen new entrants are offering HMOs available for individual enrollment. Nine of the new entrants are offering SNPs seven firms are offering D-SNPs for people dually eligible for Medicaid, one firm is offering a C-SNP for people with select chronic conditions, and one firm is offering an I-SNP.

Three of the new firm entrants are offering plans in Massachusetts, two are offering plans in California, Florida, North Carolina, South Carolina, and Utah, and the remainder are offering plans in at least one of thirteen other states .

Seven firms that previously participated in the Medicare Advantage market are not offering plans in 2022. Six of the firms had very low enrollment in 2021, while one firm had no enrollment in 2021. Two of the seven exiting firms offered plans in California.

What Is The 2022 Maximum Out Of Pocket

For Medicare Advantage, maximum out-of-pocket limits can reach up to $7,550 for in-network services. Now, out of network, you could have a MOOP of $11,300.

Those with Medicare Supplement Plan L have a $3,310 out-of-pocket maximum. Those with Medigap Plan K have a $6,620 Maximum Out of Pocket for the year.

Don’t Miss: How To Get Help Paying Your Medicare Premium

New To Medicare How To Plan For Medicare

August 7, 2021 / 6 min read / Written by Jill H.

If you or a loved one are new to Medicare or approaching Medicare eligibility, you may have questions about how the program works, whats covered, the costs involved, and your benefit options. Heres a look at how to plan for Medicare and your health-care needs.

Offer From The Motley Fool

The $16,728 Social Security bonus most retirees completely overlook: If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $16,728 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

You May Like: When Do Medicare Premiums Start

Medicare Advantage Premiums Are Lower

The average premium in 2022 for Medicare Advantage plans will be $19 per month, versus $21.22 in 2021.

More people are projected to enroll in Medicare Advantage in 2022 as well: The CMS estimates 29.5 million people will sign up, compared to 26.9 million in 2021.

There are 3,834 Medicare Advantage plans available in 2022, up 8% from 2021. Of the 2022 plans, 59% are health maintenance organization, or HMO, plans, and 37% are preferred provider organization, or PPO, plans.

Can I Still Buy Medigap Plans C And F

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 , Medigap plans C and F are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020. People who became Medicare-eligible prior to 2020 can keep Plan C or F if they already have it, or apply for those plans at a later date, including for 2022 coverage.

Medigap Plans C and F cover the Part B deductible in full. But other Medigap plans require enrollees to pay the Part B deductible themselves. The idea behind the change is to discourage overutilization of services by ensuring that enrollees have to pay at least something when they receive outpatient care, as opposed to having all costs covered by a combination of Medicare Part B and a Medigap plan.

Because the high-deductible Plan F was discontinued for newly-eligible enrollees as of 2020, there is a high-deductible Plan G available instead.

Don’t Miss: Is Medical Part Of Medicare

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Improvements To Medicare’s Preventative Care Coverage

Medicare beneficiaries pay nothing for most preventive services if the services are received from a doctor or other health care provider who participates with Medicare . For some preventive services, the Medicare beneficiary pays nothing for the service, but may have to pay coinsurance for the office visit to receive these services.

Medicare covers two types of physical exams one when you’re new to Medicare and one each year after that. The Welcome to Medicare physical exam is a one-time review of your health, education and counseling about preventive services, and referrals for other care if needed. Medicare will cover this exam if you get it within the first 12 months of enrolling in Part B. You will pay nothing for the exam if the doctor accepts assignment. When you make your appointment, let your doctor’s office know that you would like to schedule your Welcome to Medicare physical exam. Keep in mind, you don’t need to get the Welcome to Medicare physical exam before getting a yearly Wellness exam. If you have had Medicare Part B for longer than 12 months, you can get a yearly wellness visit to develop or update a personalized prevention plan based on your current health and risk factors. Again, you will pay nothing for this exam if the doctor accepts assignment. This exam is covered once every 12 months.

Read Also: Does Plan N Cover Medicare Deductible

Facts About The Medicare Give Back Benefit

If you’re looking to maximize your savings while on Medicare, you may be wondering, what is the Medicare give back benefit? This benefit is not an official Medicare program, but rather a colloquial name for a Medicare Part B premium reduction included in some Medicare Advantage plans. Whether you receive this reduction depends on the conditions of the plan that you choose and a few other factors. Read on for three facts about this benefit.

Cdc Shingles Vaccine Recommendations

The Centers for Disease Control and Prevention recommends Shingrix vaccination for anyone 50 years and older, even if you have already had shingles, if you had another type of shingles vaccine, and if you dont know whether or not youve had chickenpox in the past.

You should not get the vaccine if you are allergic to any of the components, are pregnant or breastfeeding, currently have shingles, or you have lab tests that definitively show that you do not have antibodies against the varicella-zoster virus. In that case, you may be better off getting the varicella vaccine instead.

Don’t Miss: Does Medicare Cover Office Visits

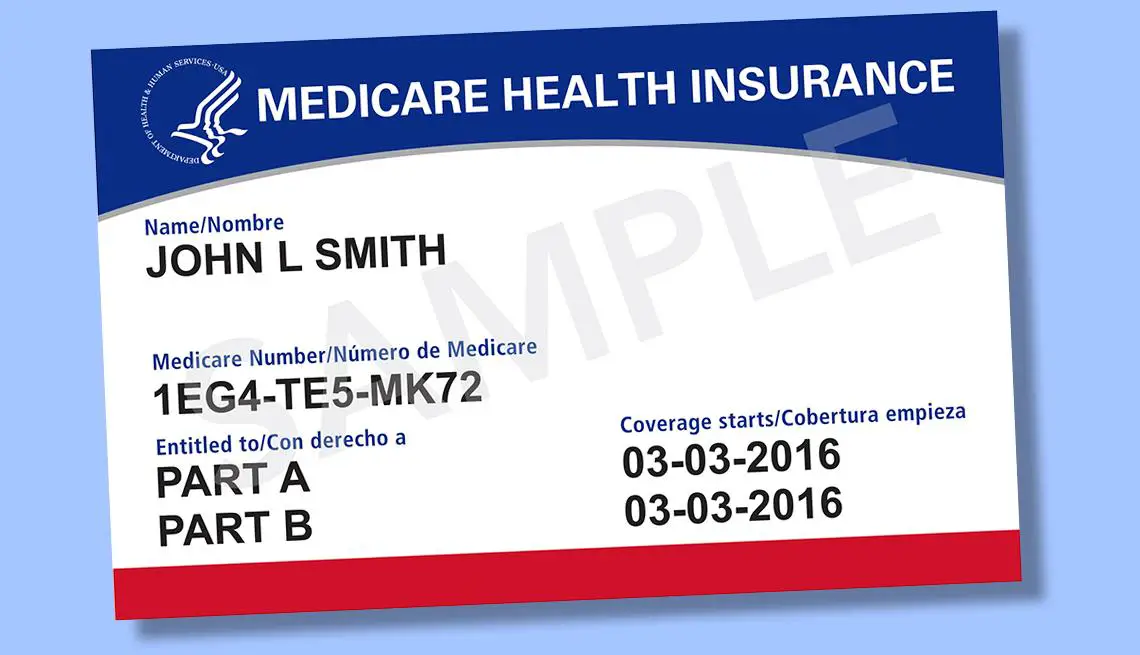

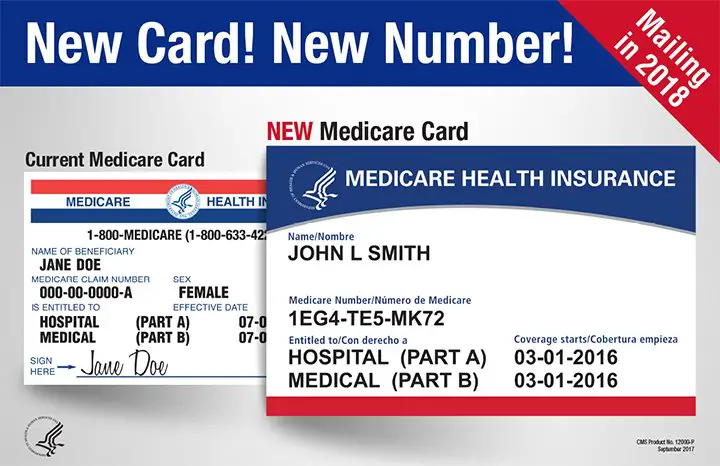

How Does Medicare Work

With Medicare, you have options in how you get your coverage. Once you enroll, youll need to decide how youll get your Medicare coverage. There are 2 main ways:

- Original Medicare

-

Original Medicare includes Medicare Part A and Medicare Part B . You pay for services as you get them. When you get services, youll pay a

deductible

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan .

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn’t cover, like emergency medical care when you travel outside the U.S.

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

You May Like: How To Avoid Medicare Part D Penalty

Beneficiaries Could See A Reduced Part B Premium After Biogen Announced It Would Slash The Price Of Its Expensive And Controversial New Alzheimer’s Treatment Aduhelm

Seniors could see a cut in their monthly Medicare Part B premiums for 2022 after a controversial new drugs price was slashed.

In November, Medicare set the monthly Part B premium at $170.10 for this year, a more than 14% increase from 2021. The agency said the increase was due in part to Medicare beneficiaries potentially being prescribed Aduhelm, an Alzheimers treatment manufactured by Biogen that was approved by the Food and Drug Administration last year. Since the drug must be administered by a physician, it is covered under Part B. Initially, the drug would cost $56,000 each year per patient, though Biogen later announced the price would be reduced to $28,200.

Health & Human Services Secretary Xavier Becerra said on Monday in a press release that he had asked Medicare to reassess the recommendation for the 2022 Medicare Part B premium, given the dramatic price change of the Alzheimers Drug, Aduhelm.

With the 50% price drop of Aduhelm on January 1, there is a compelling basis for CMS to reexamine the previous recommendation, he added.

The Kaiser Family Foundation estimated in June before the drugs price was cut that if just a quarter of the 2 million Medicare beneficiaries who were prescribed an Alzheimers treatment under Part D in 2017 took Aduhelm, it would cost Medicare $29 billion in one year. Overall, Medicare spent $37 billion on all Part B drugs in 2019, according to KFF.

Q: What Are The Changes To Medicare Benefits For 2022

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

But there are also changes to Original Medicare cost-sharing and premiums, the high-income brackets, and more.

The standard premium for Medicare Part B is $170.10/month in 2022. This is an increase of nearly $22/month over the standard 2021 premium, and is the largest dollar increase in the programs history. But the 5.9% Social Security cost-of-living adjustment is also historically large, and will more than cover the increase in Part B premiums for beneficiaries who receive Social Security retirement benefits.

CMS noted that the significant Part B premium increase is due to several factors, including costs associated with COVID, uncertainty around potential spending increases due to Aduhelm , and the fact that 2021 premiums were lower than they would otherwise have been, due to a short-term spending bill enacted in 2020 that limited the Part B premium increase for 2021. Under the terms of the spending bill, the increase for 2021 was limited to 25 percent of what it would otherwise have been.

Looking for Medicare coverage with lower costs? Talk with a licensed advisor now. Call .

Recommended Reading: How Do You Qualify For Medicare In Texas

New Era Life Insurance Company Background & History

New Era Life is an insurance company that offers Medicare supplement plans, annuities, and whole life insurance. The company was incorporated in 1924, and the current management has been in place since 1989. They are headquartered in Houston, Texas. New Era Life offers Medicare supplement plans through one of the following subsidiaries:

- New Era Life Insurance Company

- Philadelphia American Life Insurance Company

- New Era Life Insurance Company of the Midwest

New Era maintains an A.M. Best rating of B++ which shows they are a financially stable company. The difference between an A-rated carrier and B+ should NOT be a major factor in deciding what carrier to go with and I explain why here.

What are some of the benefits of signing up for New Era Life Medicare supplement insurance?

New Era provides great Medigap plans for Medicare-eligible folks. They have excellent customer service, fast underwriting, and claims support. New Era also has competitive Medicare supplement rates that vary per state, but they make sure to make it affordable for varying budgets.

What are the benefits of New Era Medicare Supplement Plan F?

New Era offers Medigap Plan F to folks that were Medicare-eligible before January 1st, 2020. With this plan, you can get coverage for the Part A deductible, Part B deductible, skilled nursing, and more. This plan is one of the more comprehensive Medicare plans in the market.