How To Track The Part B Deductible For Plan G And Plan N

Please dont rely on your Medicare provider to tell you when youve met the Part B deductible. Otherwise, you may get overcharged and find yourself trying to get your money back.

This is especially important if you have Medicare Supplement Plan G or Medicare Supplement Plan Nbecause youll receive bills from medical providers. And, you want to make sure you only pay the amount youre responsible for.

Once you overpay, then you have to try and get your money back from the provider. Which can lead to stress and time wasted.

Medicare Supplement Insurance May Help Cover Deductibles

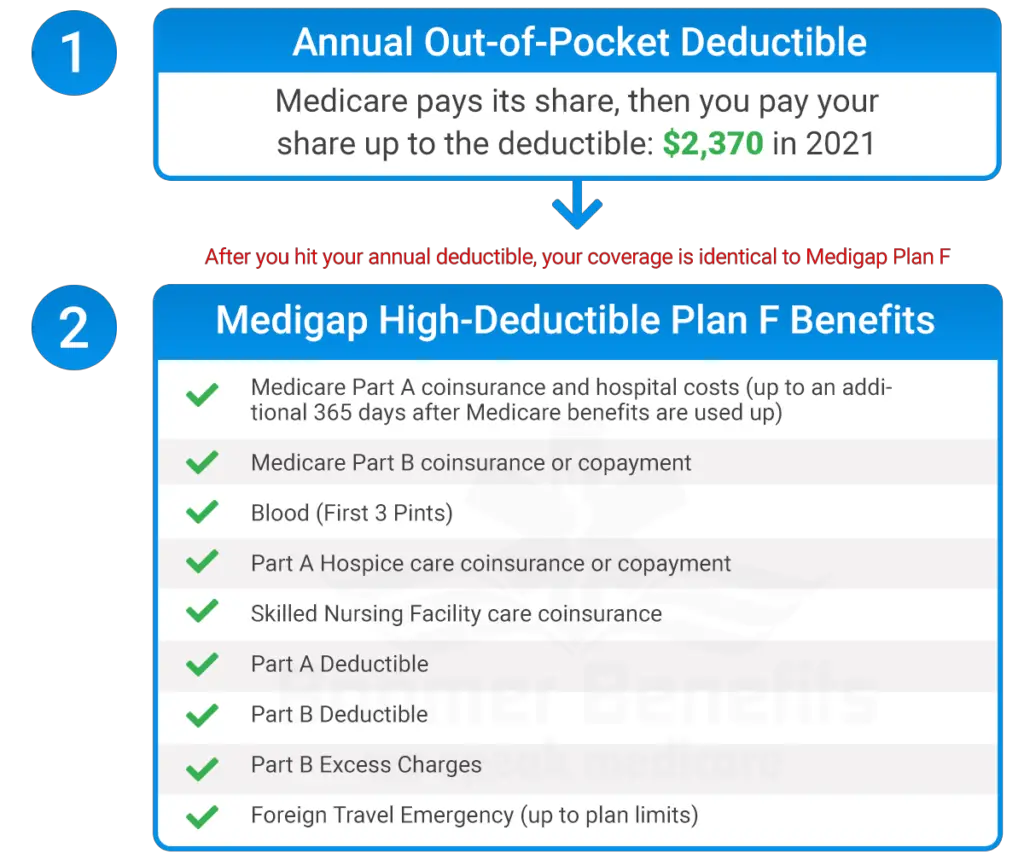

You can buy private Medicare Supplement insurance to cover Medicares out-of-pocket expenses, including the hospital deductible.

However, if you’re in a Medicare Advantage Plan, you can only purchase a Medicare Supplement plan if your Medicare Advantage plan coverage is ending.

Explore Medicare

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Humana is a Medicare Advantage HMO, PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract. Humana is also a Coordinated Care plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in any Humana plan depends on contract renewal.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN

Medicare Part D Premiums And Costs

Medicare Part D plans are sold by private insurance companies as an optional addition to Original Medicare. These plans provide their members with coverage for the prescription drugs they need to survive. Each Part D plan has a uniqueformulary, which is the list of drugs it covers.

It is important to ensure that the drugs you are currently taking or expect to take in the future are included in your plans formulary. Otherwise, you could end up paying for those drugs entirely out of pocket.

Don’t Miss: Does Medicare Pay For Chiropractic

Cms Announces Medicare Premiums Deductibles For 2022

The Medicare Part A deductible for inpatient hospital services will increase by $72 in calendar year 2022, to $1,556, the Centers for Medicare & Medicaid Services announced Friday. The Part A daily coinsurance amounts will be $389 for days 61-90 of hospitalization in a benefit period $778 for lifetime reserve days and $194.50 for days 21-100 of extended care services in a skilled nursing facility in a benefit period. The monthly Part A premium, paid by beneficiaries who have fewer than 40 quarters of Medicare-covered employment and certain people with disabilities, will increase by $28 in CY 2022 to $499, CMS announced . Certain voluntary enrollees eligible for a 45% reduction in the monthly premium will pay $274 in CY 2022.

The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced. CMS Administrator Chiquita Brooks-LaSure the increase in the Part B premium continued evidence that rising drug costs threaten the affordability and sustainability of the Medicare program.

How Long Does The Medicare Part A Deductible Cover Us For

As I said, for the calendar year 2020, Medicare beneficiaries will owe $1,408 for their Medicare Part A Deductible.

Generally, for the calendar year 2020, the patient will be on the hook for this first $1,408 of the inpatient hospital bill during the benefit period. This is the Medicare Part A deductible. The benefit period only lasts for 60 inpatient days. So once the Medicare beneficiary fills up their $1,408 bucket, Medicare covers them the rest of the way until they hit day 61.

If the hospital stay goes on beyond 60 days, things get a little more complicated. Since most hospital stays are less than 60 days, we are going to stay away from those longer periods of care for today. We will cover what happens if we are sick enough to go beyond the 60-day mark in another post.

The patient wont pay anything more than the $1,408 assuming all the days are medically necessary. They even cover self-administered drugs, a pain point for Medicare beneficiaries who receive outpatient services in the hospital setting.

There is one thing to note here though. When the hospitalist or physician does rounding on the units, those charges are filed to Medicare Part B. Since those are considered Medicare Part B services, the patient will get hit with a 20% coinsurance on those services. In other words, these services are not included in the Medicare Part A stay or deductible.

Also Check: What Medicare Supplement Covers Dental

Will Medicare Premiums Increase In 2022

According to the 2021 Medicare Trustees Report from the Centers for Medicare & Medicaid Services , the majority of the beneficiaries won’t be affected by the rate increase as they have paid Medicare taxes for 10 years of work .

However, for those who have done so for between 30 and 39 quarters, their Part A premium is expected to increase from the current rate of 259 dollars per month.

Meanwhile, for those who haven’t paid taxes for at least 30 quarters, the rate is estimated to rise from 471 dollars in 2021.

As for the Medicare Part B premium, it is also expected to see a jump from the 148.50 dollar fee set in 2021, going up to a 158.50 dollar fee per month next year, in 2022.

Medicare Part B : Out

Part B is your doctor’s office insurance under Original Medicare. It covers necessary medical treatments and preventive healthcare services. You pay a monthly premium for this coverage, which can be automatically taken out of your Social Security benefits.

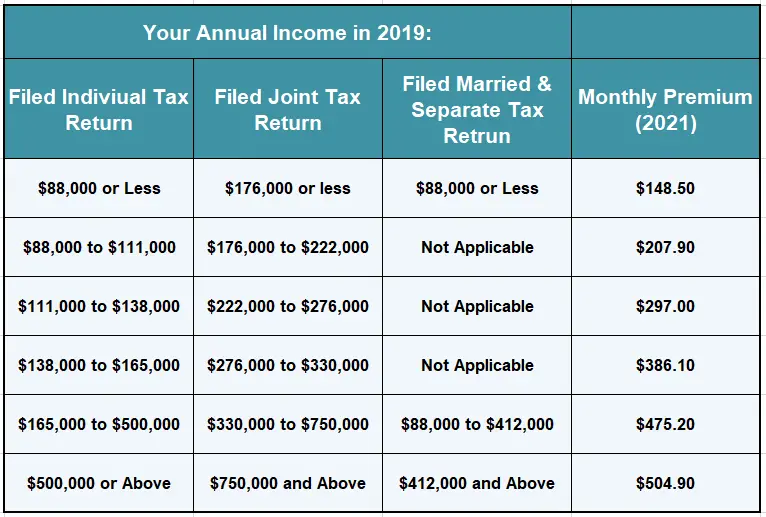

Most people pay a standard monthly premium, which is set each year. In 2022, the standard monthly Part B premium amount is $170.10 . If you earn over $88,000 a year, you will pay a higher premium. If the premium is deducted from your Social Security benefits, you will pay a lower premium.

Your total annual costs for Medicare Part B premium can be up to $6,939.60.

Don’t Miss: Can I Get Glasses With Medicare

How Can I Lower Medicare Costs

The Medicare Savings Program helps low-income beneficiaries pay Original Medicare premiums, copays, and deductibles. The Medicare Extra Help program assists low-income beneficiaries with prescription drug coverage.

Some Medicare beneficiaries are also eligible for Medicaid, the federal-and-state-funded health insurance program for low-income Americans. Eligibility varies by state â you can see our state-by-state guide to Medicaid here to find out if youâre eligible, and read more about Medicare vs Medicaid.

Beyond that, cost-saving comes down to finding the best plan and program structure for you. Some people may be looking for different Medicare benefits and more robust coverage than others. As weâve discussed, these elections and their costs will vary, depending on whatâs offered by your state and your income level.

B Coinsurance: Percentage Based

The Part B coinsurance is fairly simple to understand. Basically, Medicare will pay for 80 percent of your medically-necessary services, and you will pay the remaining 20 percent of the Medicare-approved cost after your deductible has been met. There may be some services that Medicare covers in full, but generally speaking, you should expect to pay this 20 percent cost.

Note that in addition to outpatient care, Part B covers durable medical equipment meaning the Part B coinsurance will apply.

Don’t Miss: Does Medicare Cover Mammograms After Age 70

What Is The Medicare Part D Deductible

Medicare Part D is prescription drug coverage. You dont get it automatically when you sign up for a Medicare prescription drug plan.

Medicare prescription drug plans are offered by private, Medicare-approved insurance companies that may charge premiums and deductibles for your coverage. Plans usually also charge coinsurance or copayment amounts for each covered medication.

There are two types of Medicare prescription drug plans. Each type might have a deductible.

- Medicare Advantage prescription drug plans include your Medicare Part A, Part B, and Part D coverage in a single plan. Not every Medicare Advantage plan includes prescription drug coverage.

- Stand-alone Medicare Part D prescription drug plans

How Much Is The Medicare Part A Coinsurance For 2022

The Part A deductible covers the enrollees first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage during that same benefit period, theres a daily coinsurance charge. For 2022, its $389 per day for the 61st through 90th day of inpatient care . The coinsurance for lifetime reserve days is $778 per day in 2022, up from $742 per day in 2021.

Recommended Reading: When Can You Start Collecting Medicare

So How Much Does Medicare Cost Per Month

As you can see, Medicare costs are built up out of many building blocks. Theres no way to tell exactly how much you will pay each month, but this should give you the resources to do those calculations based on your own plans, income level, and healthcare needs. For someone with a premium-free Part A plan or a $0 monthly premium Part C plan, monthly costs can vary quite a lot compared to someone who pays the full amount for Part A or has a low-deductible, high-premium plan.

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

You May Like: Does Medicare Part B Cover Prolia Shots

Chasing The Mdpp Money

Do it right and the MDPP can really pay off

When discussing Medicares Diabetes Prevention Program with health club managers, they eventually always ask me: How much money can we really get back from Medicare on this program? Here are some insights into how this program can be a lucrative offering to positively affect your bottom line.

Reimbursement Payments

Working with a Medicare reimbursement schedule is often new territory for fitness clubs. First, lets get a handle on what reimbursements are possible and then well talk more about the full revenue impact of the program.

| Performance Goal | ||

|---|---|---|

| Total Reimbursement for Entire Program | $670 | $195 |

Under the heading of making hay while the sun is shining, you can see that the potential to earn reimbursements from year one is the highest. Your initial time investments are higher but participant engagement is likely to be higher during that first year, too. Therefore, its crucial to capture early enthusiasm to help cement a new healthy lifestyle and keep them coming back for the program sessions. Participant retention is going to be a key marker to watch as your program ages and more people are moving through the phases.

Additional Revenue: Consider Offering a Fitness Program

So How Much Can I Expect?

Lets take a look at a simple model to see potential revenue for a 10-member cohort using some industry averages for membership fees and other charges:

| Expected Revenue |

|---|

B Late Penalties: Avoid At All Costs

The Part B late penalty is even more severe than the penalty for Part A because, for most people, it never goes away. For Part B, youll pay a 10 percent increase in your premiums for every 12-month period you could have had Part B but didnt. This means that if you dont have Part B for two years when you could have enrolled, your premiums will go up by 20 percent.

The worst part is that this 20 percent will stay with you the late enrollment premium addition doesnt go away. For this reason, its best to make sure you avoid the Part B late enrollment penalty. There are some situations that allow you to defer coverage without incurring this extra fee, for example, if you are covered by your employer. Make sure to check the details so you dont experience any unhappy surprises.

Recommended Reading: Should I Apply For Medicare If Still Working

Record Medicare Part B Deductible Payments

I know this seems obvious, but sometimes we get busy and forget to document important information. This leads to rummaging through cleared checks, scanning bank statements, or looking through check registers to find payments to providers.

So, here are a few ideas on how to track the Part B Deductible:

What Is The Maximum Out

Original Medicare does not have an out-of-pocket limit. You’ll keep paying co-pays and co-insurance regardless of how many services you receive or how much you spend in a plan year. However, Medicare Advantage plans are required by law to have an out-of-pocket maximum. A study by the Kaiser Family Foundation found that the average out-of-pocket limit for Medicare Advantage recipients in 2021 was $5,091 for in-network services and $9,208 for combined in-network and out-of-network services.

Read Also: Do You Have To Get Medicare When You Turn 65

Are There Resource Limits

The short answer is yes.

Your income and resources both need to fall below a certain amount in order for you to qualify for Extra Help. Resources are things like savings accounts, stocks, IRAs, bonds, and real estate thats not your primary home.

Your home, your car, and any valuables you own dont count as resources. Medicare also wont count large payments, such as the payout from a life insurance policy or a tax refund.

To qualify in 2021, your resources cant exceed $14,790 as an individual. If youre married, you need to have combined resources of less than $29,520 to qualify.

Dont Miss: Does Medicare Cover Bladder Control Pads

Explore Your Medicare Enrollment Options

If you have further questions about the Medicare Part B deductible or any other costs associated with Medicare, explore our guide to Medicare costs.

Learn more about your Medicare enrollment options. If you want to have Medicare health coverage without having to pay the Medicare Part B deductible, you may want to consider enrolling in a Medicare Advantage plan.

Don’t Miss: Does Medicare Cover New Patient Visit

Medicare Part D Costs In 2022

Medicare Part D may be worth considering if youre taking prescription medication on a regular basis when you reach retirement age.

You can choose from two options to get prescription medication coverage. You can either sign up with a private insurance company that you can compare on the Medicare website, or you can get prescription drug coverage through your Part C program.

Like Part C, each plan has different coverage, deductible, and copayment options. Part D is generally included in your plan premium, but unmarried individuals with reported incomes of more than $91,000 will pay an additional amount in 2022. This threshold increases to $182,000 for married filers of joint tax returns in 2022. The average Part D premium is expected to be $33 per month in 2022, up from $31.47 in 2021.

Make sure that it covers the drugs you take in one of the lower tiers before you sign up with a company. It will help keep your costs under control.

Other types of benefits, insurance, and social services can sometimes influence Part D benefits.

You must have Medicare Part A and/or Part B or Part C to enroll in Part D.

Is There Help For Me If I Cant Afford Medicares Premiums

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

Reviewed by our health policy panel.

Q: Is there help for me if I cant afford Medicares premiums?

A: Yes. Medicare Savings Programs can help with premiums and out-of-pocket costs.

You May Like: How Do I Find A Medicare Advocate

Are There Inflation Adjustments For Medicare Beneficiaries In High

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does high income mean? The high-income brackets were introduced in 2007 for Part B and in 2011 for Part D, and for several years they started at $85,000 . But the income brackets began to be adjusted for inflation as of 2020. For 2022, these thresholds have increased to $91,000 for a single person and $182,000 for a married couple .

For 2022, the Part B premium for high-income beneficiaries ranges from $238.10/month to $578.30/month, depending on income .

As part of the Medicare payment solution that Congress enacted in 2015 to solve the doc fix problem, new income brackets were created to determine Part B premiums for high-income Medicare enrollees. These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

And starting in 2019, a new income bracket was added on the high end, further increasing Part B premiums for enrollees with very high incomes. Rather than lumping everyone with income above $160,000 into one bracket at the top of the scale, theres now a bracket for enrollees with an income of $500,000 or more .

People in this category pay $578.30/month for Part B in 2022. The income level for that top bracket income of $500,000+ for a single individual or $750,000 for a couple has remained unchanged since 2020. But the thresholds for each of the other brackets increased slightly .