What To Do If Youre Wrongfully Billed For Medicare Costs

Know your rights as a Qualified Medicare Beneficiary.

If youre among the 7.5 million people in the Qualified Medicare Beneficiary Program, doctors, suppliers, and other providers should not bill you for services and items covered by Medicare, including deductibles, coinsurance, and copayments. If a provider asks you to pay, thats against the law.

The Centers for Medicare & Medicaid Services has heard from people with Medicare who report being billed for covered services, even though theyre in the QMB program. Older consumers have also submitted complaints to the CFPB, reporting that debt collectors tried to collect these types of bills, or sent this information to credit reporting companies.

How Do You Know If You Owe The Income

Using data from the Internal Revenue Service , the Social Security Administration determines who owes the Income-Related Monthly Adjustment Amount. SSA will notify you if you owe IRMAA. This notification will include information about appealing the IRMAA decision.

If you’re new to Medicare, you may be charged the standard Part B premium in the beginning, with the IRMAA determination coming once SSA receives your MAGI information from the IRS. Once you receive your Initial Determination Notice, you have 10 days to contact Social Security if you believe the determination was made in error.

You may appeal the IRMAA decision if you’ve experienced a permanent income reduction in the past 2 years. This is very common for Medicare beneficiaries who retired recently.

Visit SSA.gov for more information about IRMAA.

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Also Check: Will Medicare Help Pay For A Walk In Shower

Coverage And Claims Outside New Brunswick

If you require insured physician services anywhere in Canada, except Quebec, simply present your valid New Brunswick Medicare card to the physician. New Brunswick has agreements with all Canadian provinces and territories, except Quebec, which allow physicians to bill their own health plan for providing insured physician services to New Brunswickers.

However, physicians in other provinces or territories may bill a New Brunswick resident for services excluded from the agreements, such as genetic screening and procedures still in the experimental or developmental phase. These claims can be submitted to New Brunswick Medicare for consideration, but reimbursement is not guaranteed.

In the province of Quebec, the physician may bill the patient directly or choose to bill New Brunswick Medicare. If you receive a bill from a physician in Quebec, submit a claim to New Brunswick Medicare for consideration. If reimbursement applies, it will be calculated at the Quebec rate only, which could be less than the amount billed by the physician.

If you require insured hospital services elsewhere in Canada, New Brunswick Medicare will pay the standard rate. However, certain insured hospital services may be billed directly to you. These claims can be submitted to New Brunswick Medicare for consideration, but reimbursement is not guaranteed.

Travel and accommodation fees are not covered by New Brunswick Medicare for out-of-province services.

How Much Will Irmaa Add To My Part B Costs

In 2022, the standard monthly premium for Part B is $170.10. Depending on your yearly income, you may have an additional IRMAA surcharge.

This amount is calculated using your income tax information from 2 years ago. So, for 2022, your tax information from 2020 will be assessed.

Surcharge amounts vary based on your income bracket and how you filed your taxes. The table below can give you an idea of what costs to expect in 2022.

| Yearly income in 2020: individual | Yearly income in 2020: married, filing jointly | Yearly income in 2020: married, filing separately | Part B monthly premium for 2022 |

|---|---|---|---|

| $91,000 |

Also Check: What Is Medicare Part B Good For

Who Qualifies For Free Medicare

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What Is The Additional Medicare Tax For 2020

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 .

What is the 3.8 Medicare surtax?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayers income. The tax is paid on the lesser of the taxpayers net investment income, or the amount the taxpayers AGI exceeds the applicable AGI threshold .

What is the percentage of Medicare tax withheld for 2021?

1.45%FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax . A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

Don’t Miss: Does Medicare Cover Urgent Care Visits

The Truth About Your Medicare Part B Premium

You probably know that your Medicare Part B premium can change each year. Do you know why? Or how the amount is calculated? Or why it may increase?

Medicare costs, including Part B premiums, deductibles and copays, are adjusted based on the Social Security Act. And in recent years Part B costs have risen. Why? According to CMS.gov, The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.1

How Do You Pay Your Part D Irmaa

Generally, most people have their Part D IRMAA deducted from their Social Security benefits. However, if you arent a recipient of Social Security benefits or the amount of your benefit is not enough to pay for Part D IRMAA, the CMS will directly bill you.

Furthermore, if you are a recipient of the Railroad Retirement Board benefits, the board is responsible for billing you directly. Remember that Part D IRMAA is paid monthly and not quarterly like Part B.

You May Like: What Is The Best Supplemental Insurance For Medicare

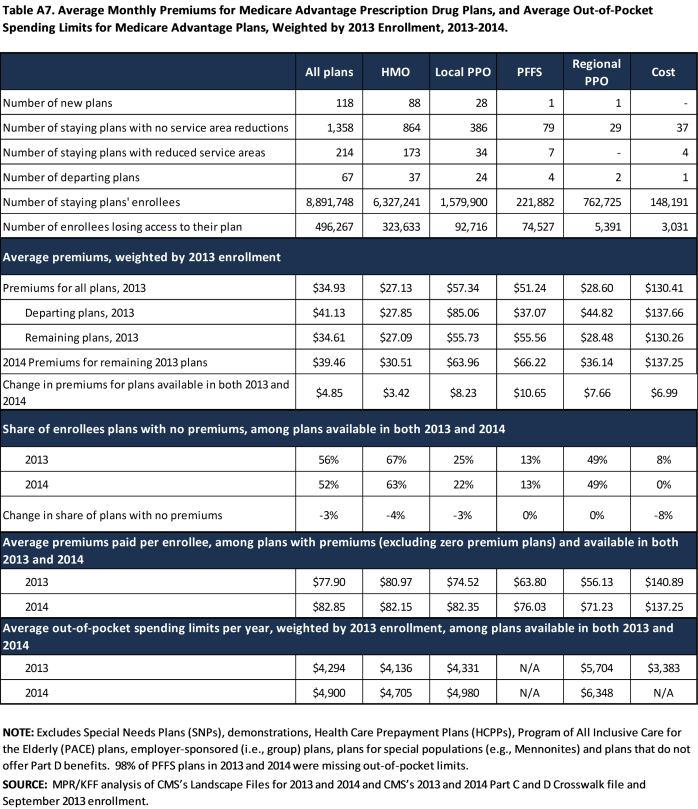

How Much Does Medicare Part D Cost

What it helps cover:

- helps cover prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by Part D plans, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

Social Security Tax / Medicare Tax And Self

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment. Your employer must deduct these taxes even if you do not expect to qualify for social security or Medicare benefits.

In general, U.S. social security and Medicare taxes apply to payments of wages for services performed as an employee in the United States, regardless of the citizenship or residence of either the employee or the employer. In limited situations, these taxes apply to wages for services performed outside the United States. Your employer should be able to tell you if social security and Medicare taxes apply to your wages. You cannot make voluntary social security payments if no taxes are due.

Also Check: How Much Does Medicare Pay For Hospice

What Is The Welcome To Medicare Visit

It is more commonly known as the Welcome to Medicare Visit, but the Centers for Medicare and Medicaid Services technically refers to it as an Initial Preventive Physical Examination . In reality, it is a misnomer. While there is a physical exam, the requirements are limited in scope to simple vital signs and a vision test with an eye chart.

The medical provider has the option to include “other factors deemed appropriate based on the beneficiarys medical and social history.” Without a clear consensus as to what that entails, some providers may or may not include a more extensive exam.

A head-to-toe examination is unlikely to be completed given time constraints on the IPPE visit.

The Welcome to Medicare Visit is a once-in-a-lifetime event and must be completed within 12 months of enrollment in Medicare Part B. It is intended to introduce you to preventive screenings offered by Medicare and is not intended to address acute illness.

Wages Rrta Compensation And Self

Will an individual owe Additional Medicare Tax on all wages, RRTA compensation and self-employment income or just the wages, RRTA compensation and self-employment income in excess of the threshold for the individuals filing status?

An individual will owe Additional Medicare Tax on wages, compensation and self-employment income that exceed the applicable threshold for the individuals filing status. Medicare wages and self-employment income are combined to determine if income exceeds the threshold. A self-employment loss is not considered for purposes of this tax. RRTA compensation is separately compared to the threshold.

Is remuneration not paid in cash, such as fringe benefits, subject to Additional Medicare Tax?

Yes. All wages not paid in cash, such as noncash fringe benefits, that are subject to Medicare tax are subject to Additional Medicare Tax, if, in combination with other wages subject to Medicare tax , they exceed the individual’s applicable threshold. Similarly, all RRTA compensation not paid in cash that is subject to Medicare tax is subject to Additional Medicare Tax, if, in combination with other RRTA compensation, it exceeds the individual’s applicable threshold . Noncash wages and RRTA compensation are subject to Additional Medicare Tax withholding, if, in combination with other wages, or with other compensation in the case of RRTA compensation, they exceed the $200,000 withholding threshold.

Are tips subject to Additional Medicare Tax?

You May Like: How Do I Qualify For Medicare Low Income Subsidy

Help Am I Being Charged Twice For Medicare

Editors Note: Journalist Philip Moeller is here to provide the answers you need on aging and retirement. His weekly column, Ask Phil, aims to help older Americans and their families by answering their health care and financial questions. Phil is the author of the new book, Get Whats Yours for Medicare, and co-author of Get Whats Yours: The Revised Secrets to Maxing Out Your Social Security. Send your questions to Phil.

Why do they take Medicare out of my payroll check and out of my Social Security check as well? Its like Im being charged twice!

Phil Moeller: The money taken from your payroll check is used to fund Part A of Medicare, which covers hospital and nursing home expenses. People who have worked long enough to qualify for Social Security benefits are entitled to Part A without having to pay a premium.

Once a person is on Medicare, the premiums for Part B of Medicare are deducted from their Social Security payments for people who already have claimed Social Security.

It may appear as if youre paying twice for the same thing, but youre really not. And while the Part B premiums may seem expensive, they actually cover only a fourth of Part B expenses. The rest come out of general federal revenues every year, to the tune of about $400 billion.

Phil Moeller: Sherry, I know that nothing I say can take away what must be a crushing sense that everything is stacked against you. But I can say that things may not be as bad as you think.

Customary Charges Relative To Prevailing Charges

Quantitative relationships between customary- and prevailing-charge pricing screens for office visits by established patients are presented in Figure 2 for participating solo-practice physicians and in Figure 3 for the physicians who did not have participation agreements. Data are displayed separately for physicians and services for the combined study States. Included are only those physicians who had at least one allowed service for office visits in FSY 1988.

Recommended Reading: How Medicare Works With Other Coverage

How Much Does Original Medicare Part B Cost

What it helps cover:

Other Part B costs for 2023:

- There is a $226 . After the deductible, youll pay a 20% copay for most doctor services while hospitalized, as well as for and .

- There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

- If you receive these services at a hospital outpatient department or clinic, additional copays or coinsurance amounts may apply.

Physicians Who Are Not Enroled

Services provided by a physician who is not enroled with MSP or whose enrolment has been cancelled by MSP are not insured and will not be reimbursed by MSP. However, unenroled physicians in B.C. may not charge for the provision of an insured service any amount that is more than the rate payable by MSP if they were enroled, so long as the service is provided in a hospital, a continuing care facility, publicly funded community care facility or assisted living residence, or a health authority as defined by legislation.

Also Check: Can You Be On Medicare And Medicaid

Special Rules Won’t Apply If You Live Abroad

For the purposes of this provision, there are no particular guidelines for nonresident aliens, U.S. citizens, or resident aliens who reside overseas.

If such people earn more than the corresponding threshold for their filing status, Additional Medicare Tax will also apply to their Medicare wages, railroad retirement compensation, and self-employment income.

Original Medicare And Part D Irmaa

If you receive a Medicare bill for Part B premium and Part D IRMAA costs, you may pay it in these ways:

- Medicares Easy Pay system lets you pay your Part A or Part B premium electronically. You can pay manually or set up automatic payments to be taken directly from a checking or savings account.

- You can pay with a debit card or credit card by writing your card number directly on your bill and mailing it in.

- You can pay with a check or money order.

You May Like: What Age Can A Woman Get Medicare

Understanding Fica Medicare And Social Security Tax

Do you ever wonder where exactly the money that is deducted from your gross pay goes? It can seem like a huge chunk when your gross pay and net pay are $100 or more off. So where is this money that is being taken from your paycheck really going? Read on to understand the basics of FICA, Medicare, and Social Security tax.

How Can I Claim For Medical Services

You can claim your Medicare benefit in a number of ways, for example:

- at your doctor’s office

- using the Express Plus mobile app

A patient account is when your doctor charges you a fee and you pay for the service. You can then claim your Medicare benefit. Medicare may not cover the entire cost you paid. The difference between the total account and your Medicare benefit is called an out of pocket cost.

Not all health professionals bulk bill, so before you see a doctor, ask if they bulk bill, and if there will be any out of pocket costs.

Recommended Reading: What Preventive Care Is Covered By Medicare

What Is The Cost Of Medicare Part B For 2021

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Premiums For Other Types Of Medicare Coverage

You may have to pay an additional premium if youâre enrolled in a Medicare Prescription Drug Plan, Medicare Supplement plan, or Medicare Advantage plan. In this case, your plan will send you a bill for your premium, and youâll send the payment to your plan, not the Medicare program. Some Medicare Advantage plans may offer premiums as low as $0. However, remember that regardless of whether you owe a premium for your Medicare plan, youâll need to keep paying your Medicare Part B premium.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Don’t Miss: Who Qualifies For Medicare Vs Medicaid