North Dakota Medicaid Eligibility

The North Dakota Department of Human Services provides assistance with Medicaid enrollment. You must be a North Dakota resident and U.S. citizen. While the state requires you to meet certain financial guidelines, assets such as your home or vehicle will not be counted against your application.

Which Medicaid plan is best in North Dakota?

North Dakota provides a range of Medicaid-related services that you may qualify for based on your health or financial needs. In some cases, you may be required to pay a co-payment for any medical services you receive, though there are exceptions .

You can apply for benefits online, through the mail, or in person.

North Dakota Medicaid Application:

South Dakota Medicaid Eligibility

South Dakotas Medicaid eligibility is based on your income, just like most other states. In some cases, your health situation can also be a factor in the decision.

Which Medicaid plan is best in South Dakota?

South Dakotas Medicaid plans and programs vary greatly depending upon your financial situation and the amount of care you require. In most cases, it is difficult to pre-determine what programs are your best fit prior to submitting an application, though it is important to know that specific programs are available for some health conditions, such as pregnancy, cancer, and disability.

South Dakota Medicaid Application:

Effective Date Of Coverage

Once an individual is determined eligible for Medicaid, coverage is effective either on the date of application or the first day of the month of application. Benefits also may be covered retroactively for up to three months prior to the month of application, if the individual would have been eligible during that period had he or she applied. Coverage generally stops at the end of the month in which a person no longer meets the requirements for eligibility.

Don’t Miss: How Much Does Medicare Deduct From Social Security

Other Ways To Get Medicare Coverage At Age 65

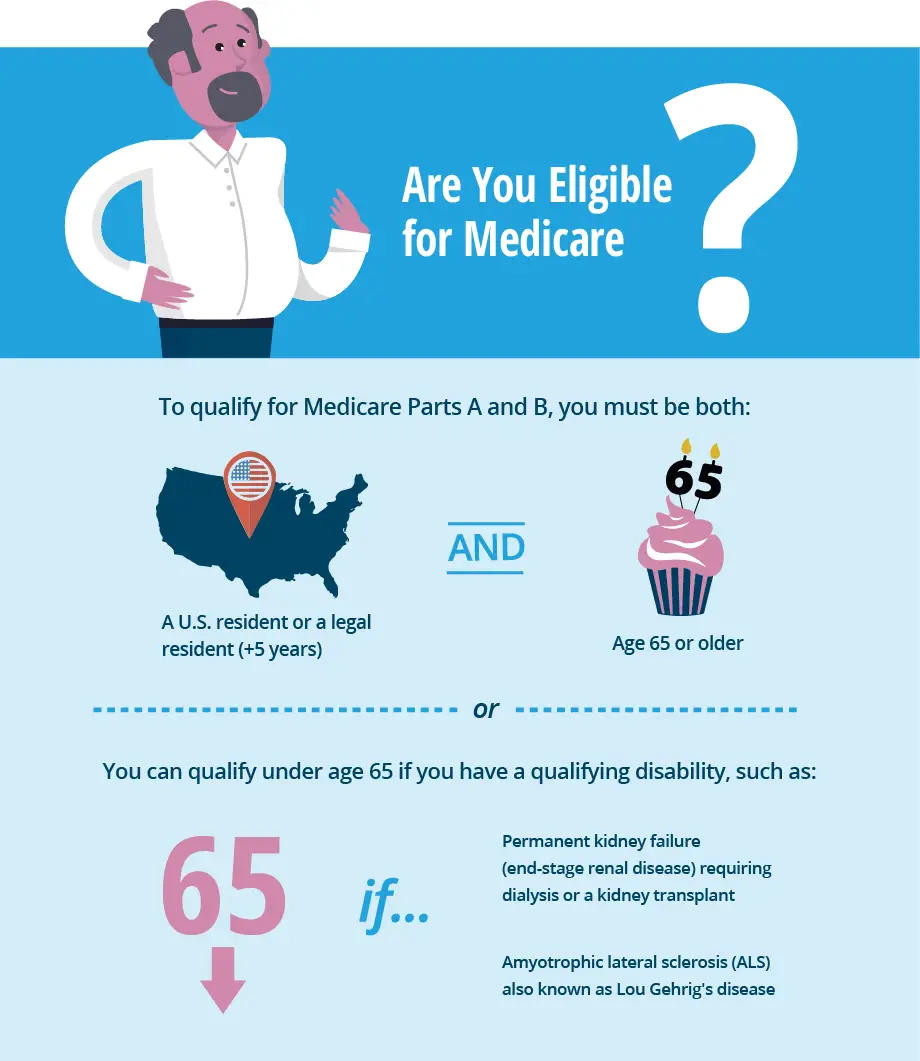

If you dont qualify for premium-free Medicare Part A coverage, you may still be eligible to buy coverage.

You still have to be a U.S. citizen or a permanent resident for at least five years.

Other Medicare Eligibility Options

- You can pay premiums for Medicare Part A hospital insurance. These vary on how long you have worked and paid into Medicare. If you continue working until youve totaled 10 years of paying into the system, you wont have to pay premiums anymore.

- You can pay monthly premiums for Medicare Part B medical services insurance. Youll pay the same premiums as anyone else enrolled in Part B.

- You can pay monthly premiums for Medicare Part D prescription drug coverage. This is the same as anyone else would pay depending on the plan you choose.

You will not be able to purchase a Medicare Advantage plan or Medigap supplemental insurance unless you are enrolled in Original Medicare Medicare Parts A and B.

Choosing The Right Medicare Coverage

Individuals who are eligible for Medicare have several options, including traditional Medicare with or without Part D or Medigap coverage or Medicare Advantage plans. There is no single solution that is right for everyone. A number of factors, including age, budget and underlying medical conditions determine which Medicare choice is the right one.

Read Also: Does Medicare Cover 24 Hour Care

Getting Help From A Medicaid Planning Lawyer

A Medicaid planning lawyer can provide assistance in making certain that you are able to qualify for benefits coverage when you need it. You dont want to endanger all of the assets that you have worked so hard to acquire over the course of your life. You need to make sure you can get Medicaid coverage so you are able to pay for nursing home care without spending down your assets- and you need to act long before you need Medicaid to pay your bills.

Miller will advise you on whether Medicaid planning is something that you need to do, and can help you to understand the asset protection tools that can allow you to make a Medicaid plan. You can download a free estate planning worksheet to learn more about what is involved in Medicaid planning and why it is so important. You can also give us a call at 508-799-8885 or contact us online to to speak with a member of our legal team who can assist you with your personalized plan.

Medicare Advantage Eligibility Requirements

While regular Medicare Advantage does not cover ESRD, you may qualify for a Medicare Special Needs Plan. SNPs are special types of Advantage plans specifically designed for a particular condition or financial situation.

You can keep your Medicare Advantage plan if you purchased it before developing ESRD. And you can buy an Advantage plan after being medically determined to no longer have ESRD usually from a successful kidney transplant.

Don’t Miss: When Can You Apply For Part B Medicare

Who’s Eligible For Medigap

If youre enrolled in both Medicare Part A and Part B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy. These plans are standardized, and are designed to cover some or all of the out-of-pocket costs that are incurred when you have a Medicare-covered claim .

You have a federal right to buy a Medigap plan during the six months beginning when youre at least 65 years old and have enrolled in Part B. This is known as your Medigap open enrollment period. After this time runs out, you will have only limited chances to purchase one down the road.

Some states allow people of any age or health status to purchase Medigap coverage at any time without medical underwriting, but most dont. In many states, Medigap plans may not be available for people who have Medicare before age 65. There are 33 states that require Medigap plans to be guaranteed issue in at least some circumstances when an applicant is under age 65, but the rules vary from one state to another you can click on a state on this map to see details about state-based Medigap rules.

If youre enrolling in Medicare due to your age, the primary factor that will affect your ability to purchase a Medigap policy regardless of your health will be whether you enroll during your Medigap Open Enrollment Period.

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the plan’s denial for a service to be provided.

The Right to Information About All Treatment Options

You have the right to know about all your health care treatment options from your health care provider. Medicare forbids its health plans from making any rules that would stop a doctor from telling you everything you need to know about your health care. If you think your Medicare health plan may have kept a provider from telling you everything you need to know about your health care options, then you have the right to appeal.

Read Also: Why Is My First Medicare Bill So High

Am I Eligible For Medicare Part A

Generally, youre eligible for Medicare Part A if youre 65 years old and have been a legal resident of the U.S. for at least five years. In fact, the government will automatically enroll you in Medicare Part A at no cost when you reach 65 as long as youre already collecting Social Security or Railroad Retirement benefits.

If youre already receiving Social Security or Railroad Retirement benefits, all you need to do is check your mail for your Medicare card, which should automatically arrive in the mail about three months prior to your 65th birthday . The card will arrive with the option to opt-out of Part B , but opting out of Part B is only a good idea if youre still working and have employer-sponsored coverage that provides the same or better coverage, or if your spouse is still working and you have coverage under their plan.

If youre not already receiving Social Security or Railroad Retirement benefits, youll need to enroll in Medicare during a seven-month open enrollment window that includes the three months before the month you turn 65, the month you turn 65, and the three following months. If you enroll before the month you turn 65, your benefits will start the month you turn 65 . If you enroll in the three months after you turn 65, your coverage could have a delayed effective date.

In addition to turning 65, people can become eligible for Medicare due to a disability , or due to end-stage renal disease or amyotrophic lateral sclerosis .

Do I Automatically Get Medicare When I Turn 65

If youre receiving Social Security benefits, you automatically enroll in Part A and Part B when you turn 65. Otherwise, Social Security will notify you when its time for you to enroll at the beginning of your Initial Enrollment Period.

Medicare Eligibility Verification

When you go to the doctor, the billing department will verify your Medicare eligibility. The billing department will need your full name, Medicare number, gender, and date of birth.

So, when you arrive at the doctors office and they request identification, be ready!

Recommended Reading: Why Have I Not Received My Medicare Card

How To Determine Medicare Awv Eligibility

Medicares Annual Wellness Visit is a way for your practice to keep patients as healthy as possible. As health care moves from volume- to value-based models, the AWV addresses gaps in care and enhances the quality of care you deliver. A personalized prevention plan created for the Medicare beneficiary is a way to improve patient engagement and promote preventive health care.

About Erin Zielinski: Erin is a former practice manager who specializes in practice transformation with 10 years of experience working exclusively with athenaNet clients. Erin is certified by the American Academy of Professional Coders in Practice Management.

For additional support on this topic, contact Erin at for a complimentary needs assessment and explanation of services available through Epion Advisory Services.

Medicare Supplement Plan Eligibility

Medicare supplemental insurance, often called Medigap because it fills in the out-of-pocket coverage gaps in Medicare Parts A and B, is purchased from private insurers.

Medigap helps cover copayments, coinsurance and deductibles from Medicare Part A and Part B.

To be eligible for Medigap coverage, you must meet one of these qualifications:

- You must be 65 or older.

- You have been diagnosed with Lou Gehrigs disease.

- You have been receiving Social Security or Railroad Board disability payments for 24 months.

- You must have been diagnosed with end-stage renal disease, requiring regular dialysis or a kidney transplant.

You cannot enroll in a Medicare Advantage plan and a Medigap plan at the same time. You have to choose one or the other.

Read Also: Does Medicare Cover Biologics For Ra

Medicare Has Four Parts

Medicare is split into parts, each identified by a letter: A, B, C, and D.

When a person has both Parts A and B, this is called having Original Medicare.Part D covers prescription drugs only.

Part C is slightly different it combines the coverage of Parts A, B, and D under a type of plan called Medicare Advantage.

We explore all of these parts of Medicare below.

Medicare Part A: Hospital Insurance covers for inpatient services when admitted to the hospital, as well as home health care, skilled nursing care and Hospice. Part A may require a premium depending on work history while paying taxes, but typically beneficiaries are entitled to it at no cost. Individuals receiving at least four months of Railroad Retirement Board Benefits or Social Security benefits before they turned 65 will be automatically enrolled. Others must contact Social Security to enroll in Part A of Medicare.

Medicare Part B: Medical Insurance is outpatient physician care that includes doctors visits and other medical services as well as durable medical equipment for home use. Part B requires a premium in most cases. In 2021, this monthly premium is $148.50.

You can start here and now Medicare costs and insurance options at no cost!

State Expanded Medicaid Eligibility

As of August 2021, 38 states had expanded Medicaid to cover all low-income adults whose household incomes are below a specified threshold. If your state has expanded Medicaid, you are eligible for coverage based on your income alone. Typically, your household income shouldnt exceed 138% of the federal poverty level.

In Idaho, for instance, the monthly income limits for expanded Medicaid range from $1,482 for one member to $5,136 for a household with eight members. The income limit is $523 for each additional member beyond eight. Check this page to understand your states Medicaid profile.

You should still fill out a marketplace application if your state hasnt expanded Medicaid and your income level doesnt qualify you for financial assistance with a . States have other coverage options if youre pregnant, have children, or live with a disability.

Recommended Reading: Will Medicare Part B Pay For Shingrix

Medicaid Eligibility For Persons With Disabilities

Individuals that are unable to work due to a disability may receive cash assistance through the Supplemental Security Income program. Qualifying for SSI automatically qualifies you for Medicaid in most states, but not all. The federal government requires all states to offer Medicaid to low-income disabled individuals. However, states are still allowed to set their own income eligibility requirements. Ten states, referred to as the 209 states have set income requirements that are more restrictive than SSI requirements. This means that individuals receiving SSI are not guaranteed Medicaid. They have to apply separately and be approved. These ten states are Connecticut, Hawaii, Illinois, Minnesota, Missouri, New Hampshire, North Dakota, Ohio, Oklahoma, and Virginia.

For individuals with a disability that have not been qualified for SSI, there are still options to qualify for Medicaid. Most states allow individuals with an impairment to prove that their impairment has prevented them from being able to work for at least one year. Once this is proven, the individual will be able to apply under the income and asset requirements for people with disabilities.

Should I Enroll In Another Plan Or Take Additional Prescription Coverage

In most circumstances, the coverage provided by Medicare and whatever supplemental or secondary plan you select will provide sufficient coverage to meet your needs. Typically, the benefits payable with a third medical plan are not sufficient to justify the premiums paid. The savings realized by not paying premiums for the third coverage will usually cover any deductible and co-insurance you may owe for Medicare Part A and B and your supplemental or secondary plan.

You May Like: Who Do You Call To Sign Up For Medicare

When Can I Start Receiving Medicare Part A Benefits

You can start receiving Medicare Part A benefits with no premium once you are 65 or older if you or your spouse worked and paid Medicare taxes for at least 10 years. You can know you are eligible for premium-free Medicare A if one of the following applies to you:

- You currently receive or are eligible for Social Security.

- You currently receive or are eligible for Railroad Retirement Board benefits.

- You or your spouse served in a Medicare-covered government job.

If you received Social Security or RRB benefits at least four months prior to turning 65, you will receive Medicare Part A automatically. If not, you need to file an application with the Social Security Administration.

Important Information Regarding The Group Indemnity Plan:

For individuals eligible for Medicare coverage, medical claims under the Group Indemnity Plan are processed based on the assumption that you are enrolled in both Medicare Part A and B coverage. If you fail to enroll in either Medicare Part A or B coverage, you will be held responsible for the portion of the claim that Medicare part A or B would have normally paid.

Read Also: What Information Do I Need To Sign Up For Medicare

Medicare Other Insurance And How We Can Help

Did you know you can enroll in Medicare even if you have other kinds of insurance such as Medicaid, VA benefits, and employer-sponsored health insurance? That said, some of these types of insurance work better with Medicare than others. In some cases, they may affect your ability to enroll in Medicare.

To find out how to choose the right Medicare coverage and understand how it will interact with health insurance you may already have, call the number below. A licensed Medicare expert can answer your Medicare eligibility questionsand help you enroll.

Medicare Part B Premiums

Your Part B premium is based on your income. Most people pay the standard monthly premium. For more information about Part B premiums, call Social Security at 1-800-772-1213 .

If you’re getting Social Security Retirement or Disability, or Railroad Retirement Board benefits, your Part B premiums are taken from your monthly payment. If not, you’ll be billed quarterly for your Part B premiums.

Recommended Reading: Will Medicare Help Pay For Hearing Aids