I Am Turning 65 In A Few Months And Want To Go On Medicare Will I Be Automatically Enrolled In Parts A And B Or Do I Need To Sign Up

It depends. If youre receiving benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65, you do NOT need to sign up youll automatically get Part A and Part B starting the first day of the month that you turn 65. You should receive your Medicare card in the mail three months before your 65th birthday. If you are NOT receiving benefits from Social Security or the RRB at least four months before you turn 65, you will need to sign up with Social Security to get Parts A and B. To sign up to receive Parts A and B, you can enroll online with Social Security, call Social Security at 1-800-772-1213, or visit your local Social Security office.

How Can I Get Assistance Paying My Health Care Costs

If you have a limited income, you may be able to get assistance with your health care costs through certain programs:

- Medicaid: If you have a low monthly income and minimal assets, you may be eligible for coverage through Medicaid to pay Medicare costs, like copays and deductibles, and for health care not covered by Medicare, such as dental care and transportation to medical appointments.

- Medicare Savings Programs : If you do not qualify for Medicaid but still have problems paying for health care, you may qualify for an MSP, a government-run program that helps cover Medicare costs. There are three types of MSP, and all of them pay the monthly Medicare Part B premium. The Qualified Medicare Beneficiary program covers deductibles and coinsurances as well.

- Extra Help: Also known as the Part D Low-Income Subsidy , this is a federal program that helps pay for some to most of the costs of Medicare Part D prescription drug coverage. You may be eligible for Extra Help if you meet the income and asset limits. Also, in many cases, enrollment in an MSP automatically leads to enrollment in Extra Help.

- State Pharmaceutical Assistance Programs: SPAPs are offered in some states to help eligible individuals pay for prescriptions. Most SPAPs have income guidelines. Many also require you to enroll in a Medicare Part D plan and to apply for Extra Help.

Is There A Penalty For Not Enrolling In Medicare Part A

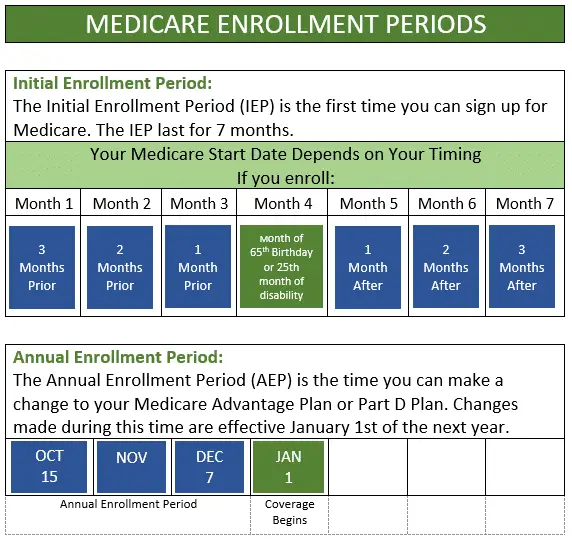

Letâs say youâre not automatically enrolled in Original Medicare, Part A and Part B. In that case, you should generally enroll in Medicare Part A as soon as you qualify. Your Medicare Initial Enrollment Period usually starts 3 months before the month you turn 65, includes that month, and continues for 3 months after that. Itâs a seven-month period altogether.

You could face a late enrollment penalty for Medicare Part A if both of these are true for you:

- You didnât sign up for Part A during your IEP.

- You have to pay a Part A monthly premium. If youâve worked at least 10 years while paying Medicare taxes, you typically donât pay the Part A premium.

If you donât have to pay a Part A premium, you generally donât have to pay a Part A late enrollment penalty.

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.For example, suppose that:

- You were eligible for Medicare in 2021, but you didnât sign up until 2023.

- You worked for eight years while paying Medicare taxes â so you do have to pay a Part A premium.

In this example, your Part A premium in 2023 would be $278 per month plus 10% of $278 every month. In this example, youâd pay the penalty for 4 years . Be aware that the Part A premium can change from year to year, so your penalty amount might also change.

Read Also: Does Medicare Cover Home Health Care For Elderly

Automatic Enrollment In Medicare

If youâre already receiving Social Security benefits when you turn 65, youâre typically enrolled in Medicare automatically. That is â youâre enrolled in Original Medicare, Part A and Part B. If this is the case for you, you donât have to worry about a late enrollment penalty for Part A and Part B.

Some people keep working past age 65 and delay receiving Social Security benefits. In that case, youâre not generally automatically enrolled in Medicare.

If you qualify for Medicare by disability, in most cases youâre automatically enrolled in Part A and Part B after 24 months of receiving Social Security disability benefits. See this article on qualifying for Medicare under age 65 for more information.

Why Did I Get An Extra Payment From Social Security This Month

The extra payment compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments will be made. Who was affected by the mistake? The mistake affected people who were eligible for Social Security before January 2000.

Recommended Reading: How Old For Medicare Part B

Do You Have To Sign Up

If you receive Social Security benefits at least 3 months before you turn 65, in most cases you will automatically receive Medicare Part A and Part B on the first day of the month when you turn 65. If your birthday falls on the first day of the month, your Medicare Part A and Part B coverage will begin on the first day of the previous month.

You will automatically receive Medicare Part A and Part B if you have received Social Security disability benefits for at least 2 years. If you reside in Puerto Rico, you will automatically be enrolled in Medicare Part A, but will have to sign up for Medicare Part B in order to receive it.

If you are not receiving Social Security benefits at least four months before you turn 65, you will have to sign up with Social Security in order to receive Medicare Part A and Part B coverage. To sign up you can apply online at SSA.gov. Additionally, when you receive coverage, you can decide to receive Part C or Part D for additional coverage.

You will receive coverage at different times depending on the exact situation. If you enroll one to three months before you reach 65 years of age, you will receive Medicare benefits the month that you hit 65. If you enroll the month you reach 65, you will receive Medicare one month after. If you enroll one month after you reach 65, you will receive Medicare two months after. If you wait two to three months after you reach 65, then you will have Medicare three months after the month you enrolled.

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

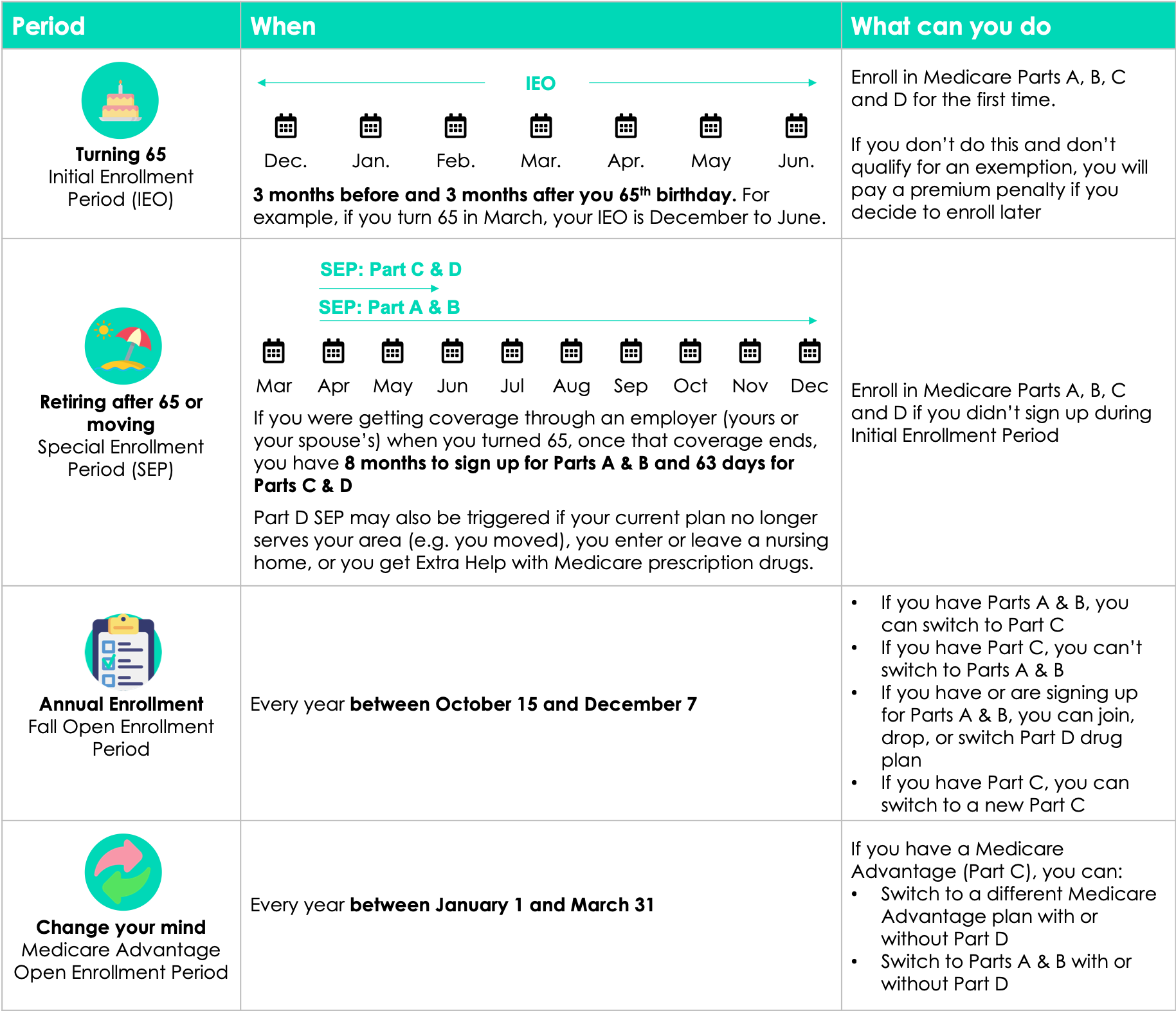

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

You May Like: Does Medicare Part B Cover Specialists

Do You Need To Renew Medicare Every Year

A short answer to this question is no. If youre enrolled in Original Medicare or a Medicare Advantage plan, your plan will renew automatically.

However, there are some exceptions and enrollment information you may not be aware of. Lets explore some of the renewal and enrollment details of common Medicare plans.

Medicare Eligibility At 65 And Older

You can apply for Medicare the year you turn 65, but you generally must meet three eligibility requirements to qualify for full Medicare benefits at this age.

The chief requirement is that you must be a U.S. citizen or permanent legal resident who has lived in the U.S. for at least five years.

In addition, you must meet one of the following other requirements:

- You or your spouse must have worked long enough to also be eligible for Social Security benefits or for railroad retirement benefits. This usually means you have worked for at least 10 years. You must be eligible for these Social Security benefits even if you are not yet receiving them.

- You or your spouse is either a government employee or retiree who did not pay into Social Security but did pay Medicare payroll taxes while working.

If you pay Medicare payroll taxes for 10 full years, you wont have to pay premiums for Medicare Part A, which covers hospital care.

You dont need the work credits to qualify for Medicare Part B, which covers doctor visits or outpatient services, and Medicare Part D, which covers prescription drugs. Everyone pays premiums for both regardless of work history.

If you are still working at 65, you dont have to sign up for Medicare but there are benefits to signing up while still employed. Similarly, if you have never worked, you can still get Medicare. It may be more expensive depending on your spouses work history.

Dont Miss: Will Medicare Cover Life Alert

Recommended Reading: Does Medicare Cover Lung Cancer Treatment

The Initial Enrollment Period

The Initial Enrollment Period is the time when most people enroll in Medicare. This period lasts for seven months. It consists of your birthday month, along with three months prior and three months after. During this period, you can make decisions about your enrollment in Medicare Part A hospital insurance, as well as Medicare Part B, Part C, and Part D prescription drug insurance.

If you already receive Social Security benefits, you wont have to do anything to enroll during the IEP. You will receive some materials about Medicare in the mail a few months before your 65th birthday notifying you that you are now eligible, and you will automatically enroll and then receive your Medicare card. If you want to defer your coverage until later, or purchase a Medicare Advantage plan, you will have to specifically contact Medicare to do so.

If you are receiving disability benefits, you will be able to begin Medicare coverage on the 25th month of disability. Your IEP will begin three months prior.

When you turn 65, you will also be able to purchase a Medicare Supplement plan, also known as a Medigap plan.

Automatic Enrollment For Original Medicare

You are automatically enrolled in Original Medicare if you are actively receiving Social Security benefits when you become eligible.

This occurs when you turn 65 years old or have a qualifying disability and have been on Social Security disability insurance for 24 months. In these cases, your premiums will be deducted from your Social Security check.

Pros:

- Whether you are on Original Medicare or a Medicare Advantage plan, everyone has to pay Part B premiums . Medicare Advantage plans, with some exceptions, charge their own monthly premiums. From this vantage point, Original Medicare is the cheapest option, at least when it comes to having access to Medicare.

- Automatic enrollment means you will be enrolled on time. You will be able to avoid late penalties for Part A or Part B, some that could last as long as you have Medicare.

Cons:

- Enrollment in a Part D prescription drug plan is not automatic, and you still need to take steps to sign up for a plan if you want one. Part D late penalties could apply if you sign up too late.

- If you want a Medicare Advantage plan instead, you need to be proactive. Pay attention to the Medicare calendar. If you do not change to a Medicare Advantage plan during your initial enrollment period, you will have to wait until the annual open enrollment period .

You May Like: Does Medicare Pay For Mobility Scooters

Signing Up For Medicare

Follow the steps below if you need to actively enroll in Medicare.

If you decide to enroll in Medicare during your Initial Enrollment Period, you can sign up for Parts A and/or B by:

- Visiting your local Social Security office

- Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare

- Or, by applying online at www.ssa.gov

If you are eligible for Railroad Retirement benefits, enroll in Medicare by calling the Railroad Retirement Board or contacting your local RRB field office.

Keep proof of when you tried to enroll in Medicare, to protect yourself from incurring a Part B premium penalty if your application is lost.

- Take down the names of any representatives you speak to, along with the time and date of the conversation.

- If you enroll through the mail, use certified mail and request a return receipt.

- If you enroll at your local Social Security office, ask for a written receipt.

- If you apply online, print out and save your confirmation page.

Related Answers

Dont Miss: What Does Medicare Advantage Cover

How Often Do Medicare Part B Premiums Increase

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. This represents a 14.5% increase. The annual deductible for all Medicare Part B beneficiaries will be $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

You May Like: Why Aren T Hearing Aids Covered By Medicare

Medicare Late Enrollment Penalties

If youre not automatically enrolled in Medicare and you dont apply on time, you may face late enrollment fees:

-

Medicare Part A: If you must buy Part A and you dont purchase it during your initial enrollment period, you may owe 10% more than the monthly premium for twice the time period you didnt sign up.

-

Medicare Part B: If you dont sign up for Part B during your initial enrollment period, your monthly premium increases 10% for each 12-month period that you went without Part B coverage. This is a permanent penalty as long as you have Part B.

-

Medicare Part D: If you go without Medicare drug coverage or other creditable prescription drug coverage for 63 or more days once your initial enrollment period ends, you’ll be assessed a permanent penalty for as long as you have Medicare drug coverage. The penalty is calculated as 1% of the national base beneficiary premium multiplied by the number of full months you werent covered. Your exact penalty amount is recalculated each year.

Disability & Medicare Eligibility And Enrollment What You Need To Know In 2022

Some people can qualify for Medicare due to disability. In this case, if you have a qualifying disability, you are eligible for Medicare even if you are not yet age 65. To find out if your disability qualifies for disability benefits or for Medicare, youll need to speak with Social Security directly, but in general, you become eligible the 25th month of receiving Social Security Disability Insurance benefits .

If you have a qualifying disability, you must first file for disability benefits through Social Security before you can even be considered eligible for Medicare due to disability. Approval of the request by Social Security is an important first step. It is also important to note that these benefits are different from Supplemental Security Income benefits, and that SSI benefits do not qualify you for Medicare.

Recommended Reading: Do You Pay Medicare After Retirement

Why You Should Review Your Medicare Plan Each Year

Although most Medicare plans renew automatically, your needs may change from year to year. Each fall, make time to sit down and review all of your Medicare plans. This will give you a chance to make changes if necessary and be confident that all of your needs will be met in the coming year.

Explore Medicare

When Does Medicare Not Automatically Start

Medicare will NOT automatically start when you turn 65 if youre not receiving Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. Youll need to apply for Medicare coverage.

Theres no such thing as a Medicare office enrollment in the program is handled by the Social Security Administration . If you have to enroll in Medicare Part A and/or B on your own, you can visit your local Social Security office.

You can also online by following the instructions at the Social Security Administration Medicare Benefits web page. In most cases, signing up online will take ten minutes.

Read Also: What Are The Pros And Cons Of Medicare For All

Do I Have To Take Part B

You are not required to take Part B, and some people choose to delay. Deciding to opt out of Part B at this time is a personal choice and depends on your unique situation. about whether or not you should take Part B when you qualify for Medicare with a disability. Some people who qualify for Medicare under age 65 due to disability but are covered under an employers plan or a spouses employer plan, may opt to delay.2