When Medicare Coverage Ends

1. If the beneficiary has Medicare only because of ESRD, Medicare coverage will end when one of the following conditions is met:

- 12 months after the month the beneficiary stops dialysis treatments, or

- 36 months after the month the beneficiary had a kidney transplant.

There is a separate 30-month coordination period each time the beneficiary enrolls in Medicare based on kidney failure. For example, if the beneficiary gets a kidney transplant that continues to work for 36 months, Medicare coverage will end. If after 36 months the beneficiary enrolls in Medicare again because they start dialysis or get another transplant, the Medicare coverage will start right away. There will be no 3-month waiting period before Medicare begins to pay.

Do I Need To Notify Anyone If Im Delaying Medicare

You don’t need to provide notice that you’d like to delay enrolling unless you’re receiving Social Security or Railroad Retirement Board benefits. If you are receiving either, you’ll be automatically enrolled in Medicare Parts A & B when you turn 65, and you’ll need to let Social Security know you wish to delay Part B. By law though, if you receive Social Security benefits and are eligible for Medicare, you must also have Medicare Part A.

Get Your Medicare When Working Past 65 Guide and Webinar AccessYou’ll get timely emails with important information to help you navigate your Medicare enrollment journey when working past 65. In this email series, you’ll receive a helpful PDF guide, exclusive access to six webinars and learn about Medicare basics, enrollment, plan options and more.

*Required fields

Thank you for signing up! Your Medicare When Working Past 65 guide and webinar access link will arrive in your inbox soon. Enjoy!

Having Creditable Drug Coverage

Before you officially delay Medicare, make sure you have creditable drug coverage. This means your employer drug coverage is at least as good as the standard Medicare Part D plan coverage. If your employer’s drug coverage isn’t creditable, you will need to enroll in a Part D plan during your Initial Enrollment Period to avoid the Part D late enrollment penalty . Consequently, you’ll also need to get either Part A or Part B in order to get a Part D plan.

Read Also: Does Medicare Pay For Eye Exams

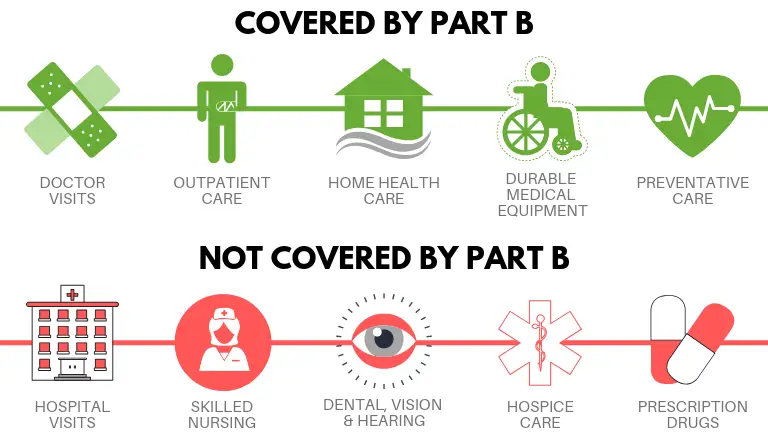

What Medicare Part B Covers

First, lets take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications: medically necessary services and preventive services. What qualifies something as medically necessary? In general, medically necessary services must be medical treatments that are required to treat a recognized medical condition or illness. Necessary services and items might include the following:

- Diagnostic equipment

- Supplies, such as walkers or wheelchairs

- Surgeries

For example, diabetics need regular doctor visits to ensure appropriate blood levels, as well as appropriate diagnostic coverage to ensure accurate readings.

Medicare Part B beneficiaries also gain access to preventive services, like yearly screenings for the flu or certain cancers. In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

As of the 2019 plan year, the Centers for Medicare and Medicaid Services has lifted coverage caps on critical services covered under Medicare Part B. These include physical therapy, speech language pathology and occupational therapy.

But original Medicare doesnt cover everything. You may need to obtain supplemental insurance, such as Medigap, if you need coverage for the following:

Enrolling Into Part B On A Delayed Basis

If you have delayed Part B while you were still working at a large employer, youll still need to enroll in Part B eventually. When you retire and lose your employer coverage, youll be given an 8-month Special Enrollment Period to enroll in Part B without any late penalty.

You should set up Part B to start the very next day after you lose your employer coverage. For example, if you know you will be retiring on June 30th, you should enroll in Medicare Parts A and/or B to begin on July 1st.

When you activate your Part B, you will activate your 6-month Medicare supplement open enrollment window. This is your one opportunity to enroll in any Medigap plan without health questions. Once the 6-month window expires, its gone forever. If Medigap is too expensive and you prefer a Medicare Advantage plan, you have a short window to also enroll in a Medicare Advantage plan using a Special Election Period. These are tricky, so always work with an agent who specializes in Medicare to set that up properly.

You May Like: Is Ibrance Covered By Medicare

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Read Also: How To Replace Lost Medicare Card

When To Enroll In Part D Your Drug Plan

You should sign up for Medicare Part D at the same time that you enroll in Part B. It’s important to be prompt. There is a permanent premium penalty for enrolling late.

There’s one situation that will exempt you from this late enrollment penalty. That is if you have other drug coverage, such as an employer or retiree plan, that is as good as Part D coverage.

Tricky Part B Situations

Look down this list to see if any of these situations apply to you. It will tell you what you should do about signing up for Part B.

You receive financial help to buy an individual health plan through your state’s Health Insurance Marketplace. Once you become eligible for Medicare, you can no longer get a subsidy. If you keep the plan anyway you will get that late Part B enrollment penalty. Enroll in all parts of Medicare and cancel your Marketplace plan.

You have an individual health plan but don’t receive a subsidy to help pay for it. If you keep this plan instead of enrolling in Medicare when you turn 65, you’ll be hit with the late enrollment penalty. It doesn’t matter where you got it or how long you’ve had it. Cancel it and enroll in Medicare.

You are still working at an employer with 20 or more employees. You can delay Part B enrollment without a penalty if you have health insurance through your own or a spouse’s current job. Once the last working spouse leaves his or her job, even if they’re getting COBRA or retiree insurance, it’s time for both of you to sign up for Part B. You have eight months, starting the month after the job ends, to get this done without penalty.

Don’t Miss: How To Change My Name On My Medicare Card

When To Enroll In Part B

This is trickier. If you get it wrong, it can cost you money.

If you are already retired or will retire right at 65, the answer is simple: sign up for Part B the same time you enroll in Part A. If you are still working, you’re going to have to figure out the right time to enroll on your own.

It’s really important not to mess this up. If you don’t sign up for Part B when you should, you will be hit with a harsh late enrollment penalty. The penalty is a permanent increase in your Part B premium of 10 percent for every year that you should have been enrolled but weren’t.

So for instance, if you sign up for Part B two years after you should have, your premium will be 20 percent higher.

Reaching Age 62 Can Affect Your Spouse’s Medicare Premiums

Although reaching age 62 does not qualify you for Medicare, it can carry some significance for your spouse if they receive Medicare benefits.

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they havent yet qualified based on their own work history.

- For example, Gerald is 65 years old, but he doesnt qualify for premium-free Part A because he did not work the minimum number of years required for eligibility. He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

- Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

In the above example, Jessica has not become eligible for Medicare by turning 62. Her husband Gerald, however, is now eligible to receive his Medicare Part A benefits without paying a monthly premium any longer.

You May Like: Is Medicare Advantage Part C

Do I Have To Apply For Medicare Part B

If youre under age 65 and already receiving Social Security or Railroad Retirement Board disability benefits, youll be automatically enrolled in Medicare parts A and B when you turn 65. If you dont wish to have Medicare Part B, you can defer it at that time.

If youre not currently receiving these benefits, youll have to actively enroll in Medicare.

Important Medicare Deadlines

Its extremely important not to miss any Medicare deadlines, as this can cause you to face late penalties and gaps in your coverage. Here are the Medicare deadlines to pay close attention to:

- Original enrollment. You can enroll in Medicare Part B 3 months before, the month of, and 3 months after your 65th birthday.

- Medigap enrollment. You can enroll in a supplemental Medigap policy for up to 6 months after you turn 65 years old.

- Late enrollment. You can enroll in a Medicare plan or Medicare Advantage plan from January 1March 31 if you didnt sign up when you were first eligible.

- Medicare Part D enrollment. You can enroll in a Part D plan from April 1June 30 if you didnt sign up when you were first eligible.

- Plan change enrollment. You can enroll in, drop out of, or change your part C or Part D plan from October 15December 7, during the open enrollment period.

- Special enrollment. Under special circumstances, you may qualify for a special enrollment period of 8 months.

Medicare Eligibility At Age 65

- You are at least 65 years old

- You are a U.S. citizen or a legal resident for at least five years

In order to receive premium-free Part A of Medicare, you must meet both of the above requirements and qualify for full Social Security or Railroad Retirement Board benefits, which requires working and paying Social Security taxes for at least 10 full years .

Learn more about Medicare eligibility at and before age 65 by referring to this helpful chart and reading more information below.

Don’t Miss: Does Medicare Cover Eye Surgery

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Can I Apply For Medicare At Age 62 Or Do I Have To Be 65

Although you may be able to begin withdrawing Social Security benefits for retirement at age 62, Medicare isn’t available to most people until they turn 65. But if you are under the age of 65, you could be eligible for Medicare if you meet any of the following criteria.

- You have been receiving Social Security disability benefits for at least 24 months.

- You receive a disability pension from the Railroad Retirement Board and meet certain criteria.

- You have Lou Gehrigs disease .

- You have ESRD requiring regular dialysis or a kidney transplant, and you or your spouse has paid Social Security taxes for a length of time that depends on your age.

If none of these situations apply to you, you’ll have to wait until age 65 to begin receiving your Medicare benefits. However, you can begin the sign-up process three months before the month you turn 65 during your IEP .

You May Like: Will Medicare Pay For Lasik Eye Surgery

Medicare Part B Isn’t Free And It Doesn’t Cover Everything

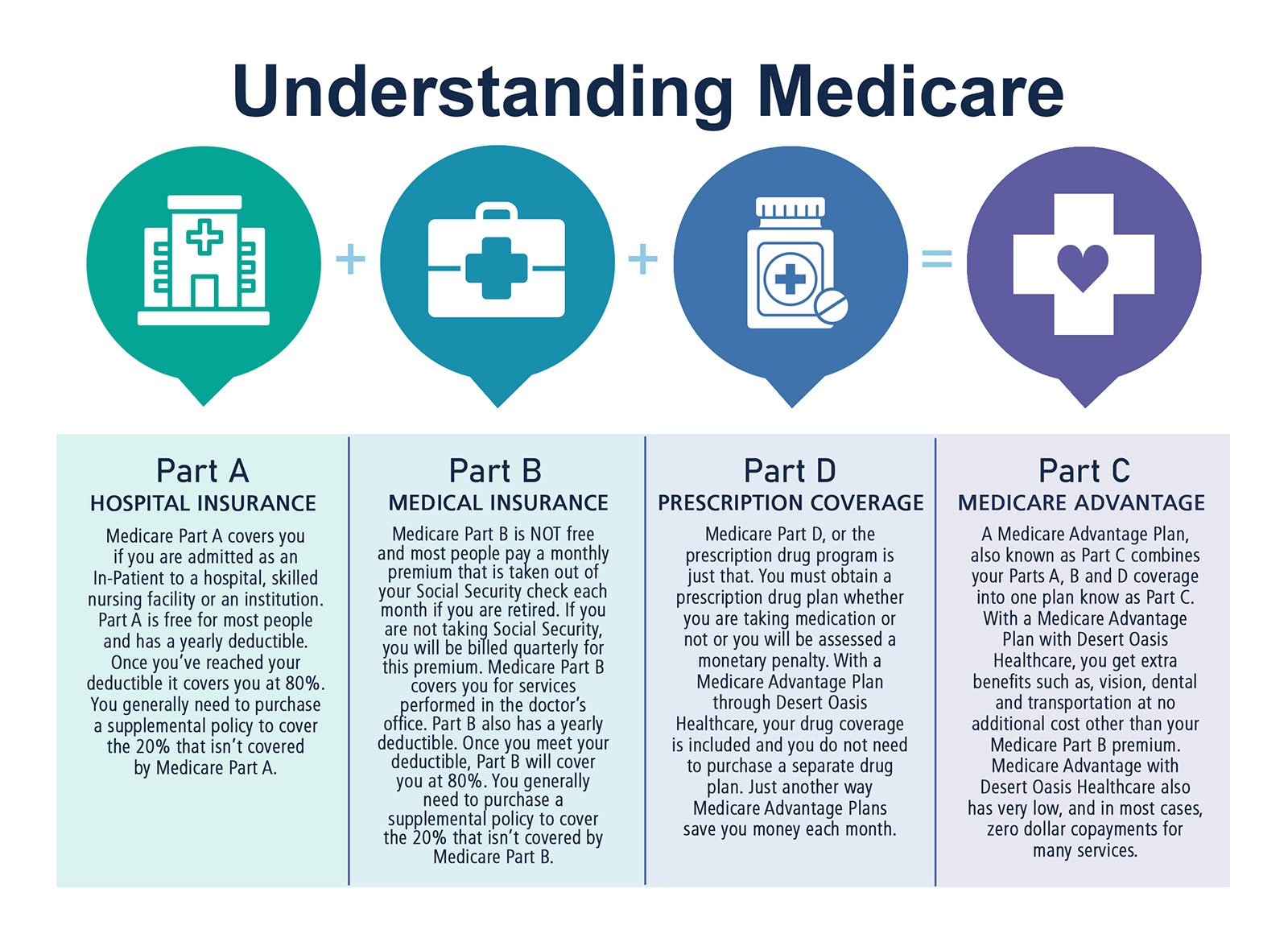

Medicare is a federal health insurance program for Americans who are at least 65 years old, disabled, or have end-stage renal disease or ALS . Its split into four parts Part A, B, C, and D.

Part B is referred to as medical insurance, and it’s the portion of Medicare that more closely resembles traditional health insurance. Lets take a look at what Medicare Part B covers.

Why Would I Be Disenrolled From Medicare Plan B

Medicare may disenroll a person for non-payment of premiums. A person may also disenroll themselves by leaving the plan voluntarily.

Because adequate healthcare coverage is important, the State Health Insurance Assistance program can help a person make informed decisions about Medicare coverage, including looking at different options to Part B.

You May Like: How Much Will Bernie Sanders Medicare For All Cost

Medicare Eligibility Due To Specific Illnesses

In addition to the above ways to qualify for Medicare health insurance, you may also be eligible if you have one of the following diseases:

- End-stage renal disease. To qualify, you must need regular dialysis or a kidney transplant, and your coverage can begin shortly after your first dialysis treatment. If you receive a transplant and no longer require dialysis, youll lose Medicare eligibility.

- Amyotrophic lateral sclerosis. Also known as Lou Gehrigs Disease, patients diagnosed with this terminal disease gain immediate Medicare eligibility.

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Recommended Reading: Do You Have To Pay A Premium For Medicare