Why Do I Need To Buy A Private Health Plan

Private Medicare health plans like Medicare Advantage or Medicare Cost plans cover everything Original Medicare does, and usually include more coverage for services you might need. Plus, they can include extra perks and benefits.

Find out more in the article, 4 reasons to buy a private health plan.

Why Is Medicare Part B Cheaper In 2023

The Centers for Medicare and Medicaid Services recommended in May that any excess Supplementary Medical Insurance Trust Fund money be passed along to those with Medicare Part B coverage. This is to help decrease the costs of the premium and deductibles. While most Medicare recipients get Part A for free, everyone has to pay for Part B.

This year’s Part B premium was projected to cover spending for a new drug called Aduhelm, which is intended to treat Alzheimer’s disease. Since less money was spent on that drug and other Part B items, there were more reserves left over in the Part B account of the SMI fund, which will now be used to limit future Part B premium increases.

Medicare Part A premiums will rise a little in 2023.

Medicare Part B Premium Based On Income 2023

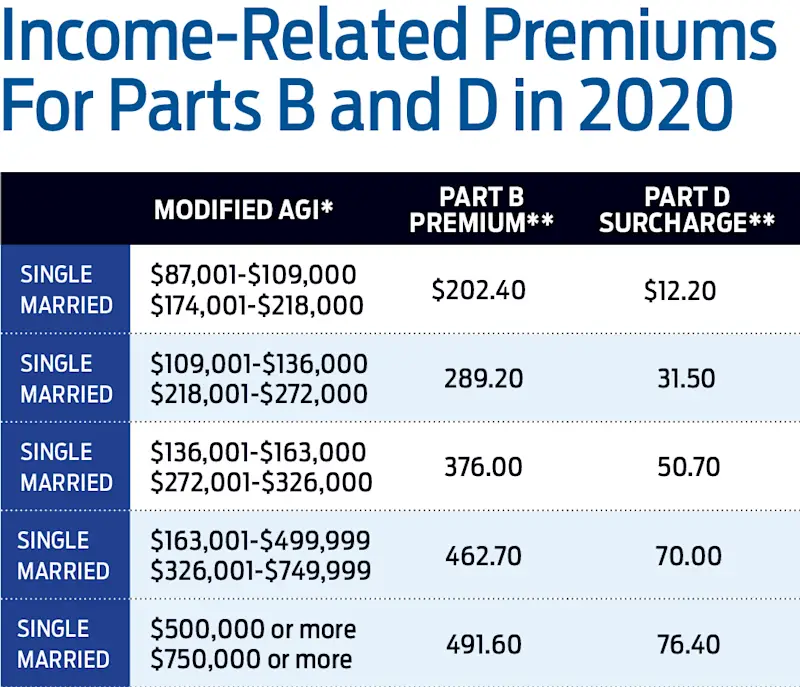

The standard Part B premium amount in 2023 is $164.90. Most people will pay the standard Part B premium amount. If your Modified Adjusted Gross Income as reported on your IRS tax return from 2 years ago is above a certain amount, youll pay the standard premium amount and an Income Related Monthly Adjustment Amount . IRMAA is an extra charge added to your premium.

The chart below shows the 2023 Part B premiums.

| If your filing status and yearly income in 2021 was |

| File individual tax return |

For more information, visit Medicare Part B Costs.

Also Check: What Is A Medicare Coverage Gap

C: Medicare Advantage Plans

| Learn how and when to remove this template message) |

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

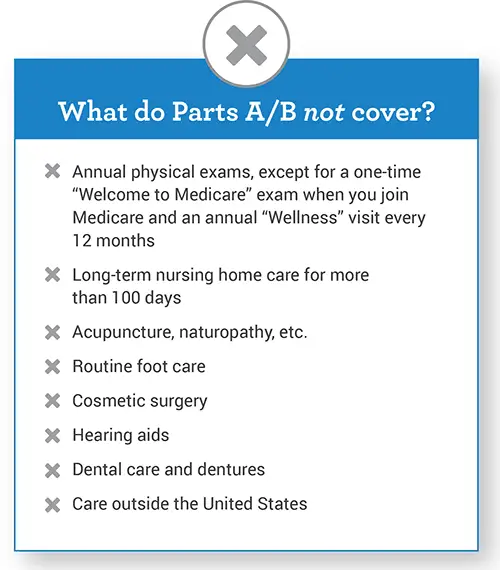

What Is Not Covered By Medicare

Several key healthcare costs still arent covered by Medicare. The biggest of these is long-term care, also known as custodial care.Medicaid, the federal health program for those on low incomes, pays these custodial costs, but Medicare doesnt.

Common expenses that Medicare does not cover include:

- Eye exams and eyeglasses

- Massage therapy

Recommended Reading: Do You Have To Get Medicare At 65

Do You Automatically Get A Medicare Card When You Turn 65

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If youre not getting disability benefits and Medicare when you turn 65, youll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Dont Miss: When Can You Collect Medicare Benefits

Can I Switch From Part B To A Medicare Advantage Plan

Yes, you can enroll in a Medicare Advantage plan during certain enrollment periods.

- Initial Enrollment Period Your Initial Enrollment Period starts 3 months before your turn 65, includes your birth month and continues for another 3 months after that.During this 7-month period, you can enroll in Original Medicare and a Medicare Advantage plan.

- Annual Enrollment Period This enrollment period lasts from every year.During Medicare AEP, you can enroll in a Medicare Advantage plan or switch from one Medicare Advantage plan to another.

- Special Enrollment Period As mentioned above, you could potentially qualify for a Special Enrollment Period for a number of reasons. Depending on your situation, you may be able to enroll in a Medicare Advantage plan during a Medicare SEP.

You should note that Medicare Advantage plans require you to be enrolled in Part B.

You may need to pay the Part B premium in addition to the Medicare Advantage plan premium, though some Medicare Advantage plans feature $0 premiums.

Don’t Miss: What Is Medicare Part B Id

The Cares Act Of 2020

On March 27, 2020, then-President Donald Trump signed a $2 trillion coronavirus emergency stimulus package, called the Coronavirus Aid, Relief, and Economic Security Act, into law. It expanded Medicares ability to cover treatment and services for those affected by COVID-19, the novel coronavirus. The CARES Act also:

- Increased flexibility for Medicare to cover telehealth services.

- Increased Medicare payments for COVID-19-related hospital stays and durable medical equipment.

For Medicaid, the Families First Coronavirus Response Act clarified that non-expansion states can use the Medicaid program to cover COVID-19related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

What Is The Medicare Part B Premium

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

- Medicare Part A is hospital insurance. It is available primarily to U.S. citizens and permanent residents age 65 and older. Most pay no premium for it.

- Medicare Part B covers other medically necessary services and preventative care like doctors services, lab tests, and outpatient care. Most pay a flat monthly premium for it, which is adjusted annually.

There is also a Medicare Part D, which covers prescription costs. It is available from insurance companies that are approved to offer it.

Don’t Miss: What Is Cms Centers For Medicare And Medicaid Services

What Is Medicare Part D

Medicare Part D is prescription drug coverage. You can get Medicare Part D either through a stand-alone plan or through a Medicare Advantage plan. If your Medicare Advantage plan includes prescription drug coverage, you cannot be enrolled in a stand-alone Medicare Part D Prescription Drug Plan at the same time. Stand-alone Part D prescription drug plans generally go together with Original Medicare coverage.

All Medicare Part D coverage is offered by private insurance companies and not by the federal government. The governments Medicare program, Original Medicare, does not include coverage for most prescription drugs you take at home. You will generally only get Original Medicare coverage for prescription drugs if you receive them as a hospital inpatient or as injection as a doctor office outpatient. There may only be other limited situations where Original Medicare will pay for prescription drugs. Without Medicare Part D coverage, you may have to pay for most of your prescription drugs out of pocket.

What Is The Medicare Part B Deductible For 2021

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

You May Like: How Much Money Will Medicaid Pay For Assisted Living

You May Like: Who Is Automatically Enrolled In Medicare

What The Part B Late Enrollment Penalty

If you do not have creditable coverage after you first become eligible for Medicare Part B, you incur a penalty that you will pay when you eventually do enroll in Part B.

The late enrollment penalty fee amount is a 10 percent increase in your Part B premium for each 12-month period you could have enrolled in Part B but did not.

- For example, if you did not enroll in Part B when first eligible and delayed your enrollment for 14 months , your standard Part B premium amount including your late enrollment penalty would be $187.11 per month.

- This total includes the standard Part B premium of $170.10 per month, plus your late enrollment penalty of $17.01 per month .

If you qualify for a Medicare Special Enrollment Period, you may not be required to pay the late enrollment penalty.

What Does Part B Cost

With Medicare Part B, you pay a standard monthly premium thats based on your income. In some cases, your monthly premium may be higher if you didnt sign up for Part B when you became eligible.

You may also need to meet an annual deductible before Medicare kicks in and starts paying. Once youve met your deductible, you will pay a 20 percent copay for approved Medicare Part B services.

You can always buy a Medicare Supplement Plan that pays your Part B deductible, as well as other out-of-pocket costs such as copays and coinsurance.

Read Also: How Do I Find Out My Medicare Card Number

Getting Started With Medicare

Do your current medical providers accept Medicare? If not, shop for new ones.

- Medicare Part B has a monthly premium based on income level, determined by the last reported tax filing two years before from the IRS.

- Original Medicare works like TRICARE Select or preferred provider organizations : You can choose any providers, specialists included, if they accept Medicare.

Does Part B Cover Prescription Drugs

Short answer: No, Part B doesnt typically cover prescription drugs.

Longer answer: Part B may cover some drugs in a specific situations, typically only those that are administered by a doctor in their offices or in a clinic.

To get Medicare coverage for most retail prescription drugs, you need a Medicare Part D prescription drug plan or a Medicare Advantage plan that includes prescription drug coverage.

Read Also: Do Any Medicare Advantage Plans Cover Dental Implants

Whats Medicare Part D

Medicare Part D is the Medicare prescription drug coverage program. Medicare Part D is optional coverage and you can get it from private, Medicare-approved insurance companies in a couple of different ways.

- If youre enrolled in Original Medicare, Part A and/or Part B, you can sign up for a stand-alone Medicare Part D prescription drug plan.

- If youd rather enroll in a Medicare Advantage plan , chances are you can get Medicare Part D coverage through your Medicare Advantage plan.

What If I Have Specific Questions About A Tricare For Life Claim

Contact a TRICARE for Life contractor. In the U.S. and U.S. Territories, visit the Wisconsin Physicians Service website. For all other overseas areas, visit the International SOS website.

Lisa Eramo is an independent health care writer whose work appears in the Journal of the American Health Information Management Association, Healthcare Financial Management Association, For The Record Magazine, Medical Economics, Medscape and more.

Lisa studied creative writing at Hamilton College and obtained a masters degree in journalism from Northeastern University. She is a member of the American Health Information Management Association, American Academy of Professional Coders, Society of Professional Journalists, Association of Health Care Journalists and the American Society of Journalists and Authors.

Lisa currently resides in Cranston, Rhode Island with her wife and two-year-old twin boys.

Also Check: How Much Are Medicare Supplement Premiums

What Are My Tricare For Life Costs

You are using an outdated browser. Please upgrade your browser to improve your experience.

When you use TRICARE For Life, you dont pay any enrollment fees, but you must pay Medicare Part B monthly premiums. Your Part B premium is based on your income. For more information visit or call Social Security at 800-772-1213 or 800-325-0778 .

What you pay out of pocket for care depends on how its covered. Your out-of-pocket costs are determined by the service you receive and whether or not its covered by Medicare and TFL. View your Health Care Plan Costs.

| How the service is covered | What you pay |

|

* TRICARE For Life pays nothing * You pay the entire bill |

What is covered?

TRICARE For Life and Medicare cover proven, medically necessary, and appropriate care. TRICARE has special rules and limitations for certain types of care, and some types of care are not covered at all. Tricare policies are very specific about which services are covered and which are not. It is in your best interest to take an active role in verifying coverage.

Exclusions

Also Check: Do I Need Medicare Part C

Whats The Difference Between Medicare Part A And Medicare Part B

Part A is the hospital services part of Medicare. This benefit covers inpatient care, hospital stays, skilled nursing facility care, hospice care, and medically needed home health care services.

Part B is the medical services part of Medicare. It covers many of the medically necessary services not covered in Part A, such as outpatient and preventive services. This involves things like x-rays, bloodwork, doctors visits, and outpatient care. It will also cover other medical items such as diabetic test strips, nebulizers, and wheelchairs.

Don’t Miss: What Parts Of Medicare Should I Sign Up For

What Is Covered By Medicare Part B

Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive.

The medically necessary coverage encompasses a variety of tests, procedures, and care options. A medical service or supply must be a requirement for treating or diagnosing a medical condition for Medicare to consider them medically necessary. Each situation is different, so a medical supply or service that is medically necessary for one person may not be for another.

It is easy to keep up with your general health needs through Medicares outpatient insurance by utilizing annual wellness visits.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Part B covers the following preventive care services:

- Mental Health Counseling

You can receive many preventive services and more at your annual wellness visit.

Alongside preventive care services, Medicare Part B covers certain outpatient services you receive in the hospital. These include:

If you are administered drugs while at the hospital, Medicare Part B will also provide coverage for these services.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

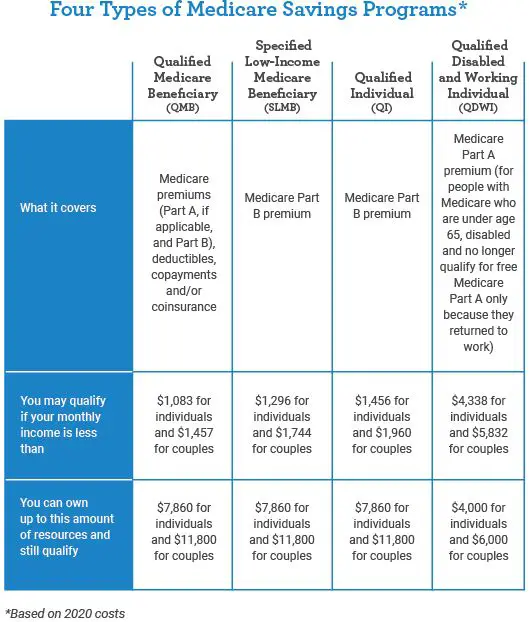

Is There Help For Me If I Cant Afford Medicares Premiums

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

Reviewed by our health policy panel.

Q: Is there help for me if I cant afford Medicares premiums?

A: Yes. Medicare Savings Programs can help with premiums and out-of-pocket costs.

Read Also: Does Medicare Pay For Dental Cleaning

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

I Have Cobra Coverage

COBRA lets you keep your employer health coverage for a limited time after your employment ends. There are two situations that can happen with COBRA and Medicare, and it depends on which you get first.

Situation 1: If you get COBRA first.

Usually you cant keep COBRA once you become eligible for Medicare. Youll want to sign up for Medicare Part A and Part B when you turn 65, unless you have access to other creditable coverage. However, you may be able to keep parts of COBRA that cover services Medicare doesnt, such as dental care.

Your spouse and dependents may be able to continue COBRA coverage after you enroll in Medicare. Talk with your plan benefits administrator about your needs and options.

Situation 2: If you get Medicare first.

In this case, you are allowed to enroll in COBRA as well. Its not required, and COBRA would act as your secondary insurance.

I am receiving Social Security disability benefits

You will be enrolled in Original Medicare automatically when you become eligible for Medicare due to disability. Youll get your Medicare card in the mail. Coverage usually starts the first day of the 25th month you receive disability benefits.

You may delay Part B and postpone paying the premium if you have other creditable coverage. Youll be able to sign up for Part B later without penalty, as long as you do it within eight months after your other coverage ends.

Read Also: How Much Does Medicare Pay For Urgent Care Visit