Medicaid For Children And Adults

Eligibility for Medicaid and Dr. Dynasaur are based on the current year Federal Poverty Level guidelines.

- The monthly income limit for adults ages 19 through 64, who are not blind or disabled, is 138% FPL.

- The monthly income limit for children under age 19 is 317% FPL. . There is a monthly premium for some households based on your income. For families up to 195% FPL, there is no premium. There are no prescription co-payments.

- The monthly income limit for Vermonters who are pregnant is 213% FPL. Dr. Dynasaur for pregnant women provides the same coverage as Medicaid, plus full dental coverage. There are no premium or prescription co-pays with this type of Dr. Dynasaur.

When Assets Exceed The Limit

When assets exceed the limit, it may be possible to spend down those assets until the individual becomes eligible for Medicaid coverage. However, use caution when using this approach. Almost every state has a five-year lookback period in which officials can examine a Medicaid applicants asset transfers. If you violate the rules, the state can impose a period of Medicaid ineligibility. Nevertheless, some transactions are permitted, such as modifying a home to make it more accessible or purchasing medical items that arent covered by insurance.

How Do I Qualify For Medicare Financial Assistance

Income limits change every year, so if you arenât sure about your qualification, donât count yourself out yet!

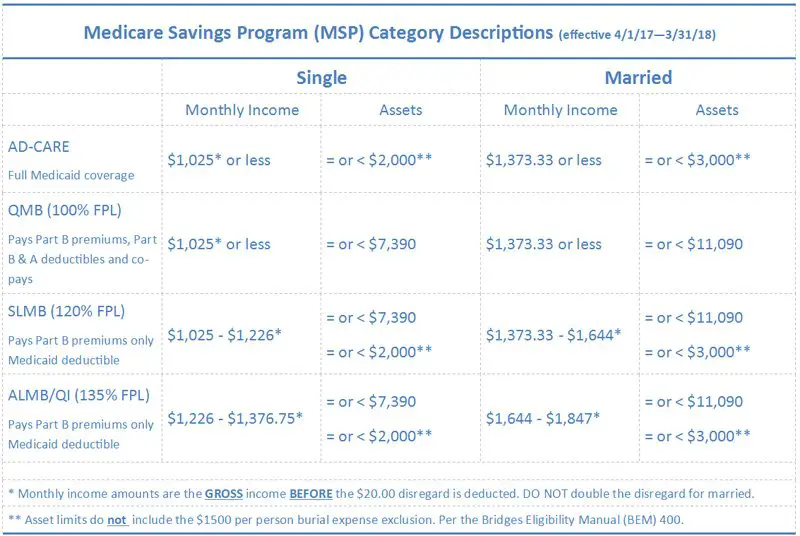

Each type of Medicare Savings Program has a different monthly income limit that varies based on marital status. Here are this yearâs limits to qualify for all the different programs*:

- QMB program: $1,094/month and $1,472/month

- SLMB program: $1,308/month and $1,762/month â

- QI program: $1,469/month and $1,980/month â

- QDWI program: $4,379/month and $5,892/month

*Income limits can be slightly higher in Alaska and Hawaii, so be sure to talk to a trusted agent to learn more about your specific qualifications.

Aside from income, there are also resource limits to qualify for Medicare Savings Programs. Countable resources include:

- Money in checking or savings accounts

- Stocks

However, the following resources are exempt:

- One home

- Up to $1,500 in set-aside burial expenses

- Furniture

- Any other household and personal items

All of these programs have personal qualifications, from age to disability status, so be sure to check with your agent or our team here at Medicare Allies to learn more about the best program for you.

Read Also: What Is The Average Cost Of Medicare Supplement Plan F

What If My Income Changes And I No Longer Qualify For Medicare Extra Help

Your eligibility for Medicare Extra Help lasts for an entire year. But Social Security will review your eligibility periodically.

To do this, the SSA will contact you with a form. These forms typically get sent out in the fall. If you dont receive one, you can count on your Extra Help staying the same in the coming year.

If you do get a form, youll need to fill it out within 30 days and send it back. If you dont, your coverage will end in January of the upcoming year. For example, if you receive an eligibility review form from Social Security on September 14, 2021, and dont send it back by October 14, your Extra Help will end in January 2022.

When you return the form, a few things might happen. Depending on changes to your income, your Extra Help could:

- stay the same

- end

The SSA will notify you of this decision. If you no longer qualify or qualify with higher out-of-pocket costs, youll get a letter explaining the changes. You might need to start paying premiums to keep your Part D plan.

Even if you no longer qualify for Extra Help, you might still be able to get help paying your Part D costs. You can contact your states Medicaid office or State Health Insurance Assistance Program for information on programs that can help you pay for your prescriptions.

Medicare Part A Lifetime Limits

Medicare Part A covers hospital stays for any single illness or injury up to a benefit period of 90 days. If you need to stay in the hospital more than 90 days, you have the option of using your lifetime reserve days, of which the Medicare lifetime limit is 60 days.

Each lifetime reserve comes with a Part A hospital coinsurance payment of $778 in 2022. Once theyre gone, you may be responsible for 100% of your hospital costs.

Also Check: How To Verify Medicare Eligibility Online

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual’s Medicare wages that exceed a threshold amount based on the taxpayer’s filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual’s wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There’s no employer match for Additional Medicare Tax. For more information, see the Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax.

How Does Medicare Determine Your Income

Original Medicare is two-fold, comprised of Part A and Part B . They differ not only in the Medicare benefits covered but also in how the premiums are determined.

Part A premium based on credits earned

Most people eligible for Part A have premium-free coverage. The premium is based on credits earned by working and paying taxes. When you work in the U.S., a portion of the taxes automatically deducted are earmarked for the Medicare program. Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium. A sliding scale is used to determine premiums for those who work less than 40 quarters. In 2020, this equates to $252 per month for 30 to 39 quarters and $458 per month for less than 30 quarters.

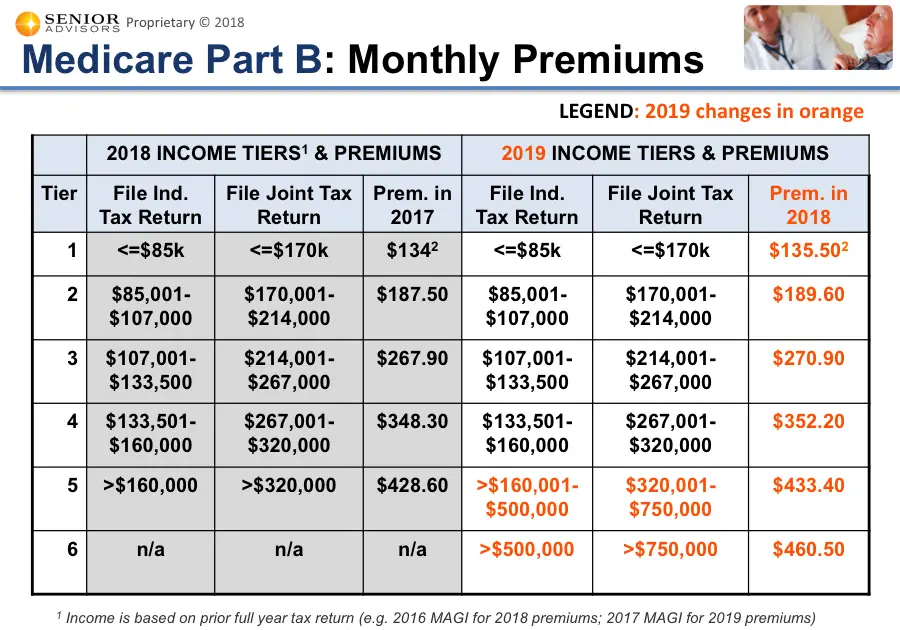

Part B premium based on annual income

The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium. Once you exceed $87,000 yearly income if you file an individual tax return, or $174,000 if you file a joint tax return, the cost goes up to $202.40. As your income rises, so too does the premium amount until a certain level of income is exceeded based on tax return filing status. At that level, the monthly premium is set at $491.60. The amounts are reevaluated by Medicare annually and may change from year to year. Any amount charged above the standard premium is known as an income-related monthly adjustment amount .

Related articles:

Recommended Reading: What Is The Requirement For Medicare

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or you may contact your local Social Security office to file your appeal. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services at 1-800-MEDICARE to make a correction. Social Security receives the information about your prescription drug coverage from CMS.

Is There A Limit On Medicare Tax

Unlike Social Security taxes, there is no limit on how much of your income is subject to Medicare taxes. The Medicare tax rate applies to all earned income and taxable wages, and there is no minimum income required to be subject to Medicare taxes.

In fact, higher earners pay an Additional Medicare Tax of 0.9% on all earned income above $125,000 , $200,000 or $250,000 . So if you make $150,000 per year and are married and filing separately, you will pay the standard 1.45% on the first $125,000 of your income and 2.35% on the remaining $25,000.

Only employees pay the additional 0.9%. The Additional Medicare Tax does not apply to employers.

Higher income earners will also pay an additional surtax for their Medicare Part B and Part D premiums.

Read Also: Does Medicare Cover Rides To The Doctor

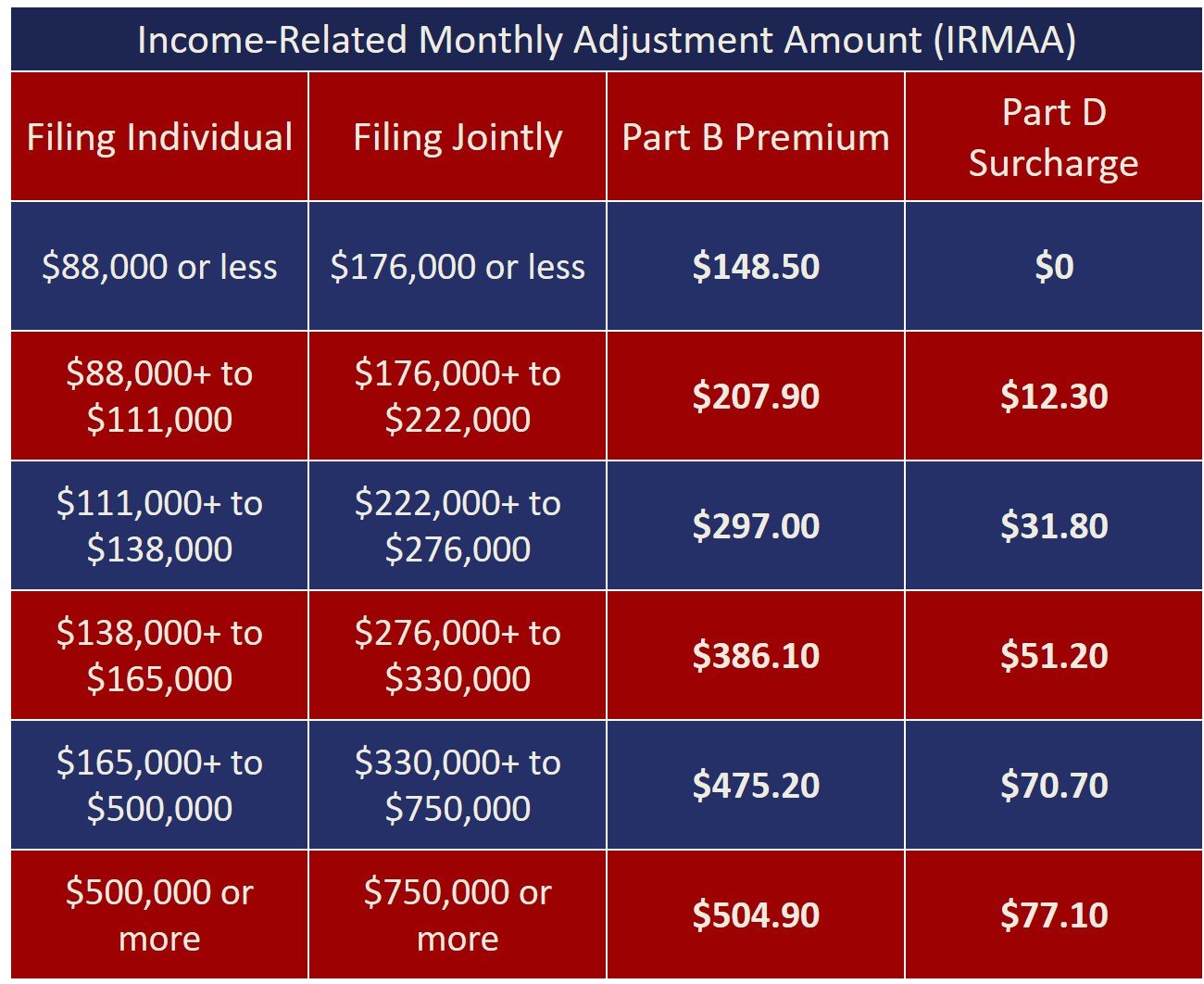

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

Caution: What Is Counted As Income May Not Be What You Think

For the NON-MAGI Disabled/Aged 65+/Blind, income will still be determined by the same rules as before, explained in this outline and these charts on income disregards. However, for the MAGI population – which is virtually everyone under age 65 who is not on Medicare – their income will now be determined under new rules, based on federal income tax concepts – called “Modifed Adjusted Gross Income” . There are good changes and bad changes.

GOOD: Veteran’s benefits, Workers compensation, and gifts from family or others no longer count as income.

BAD: There is no more “spousal” or parental refusal for this population and some other rules. For all of the rules see:

Read Also: Is Allergy Testing Covered By Medicare

Is There Any Way I Can Get Help Paying For Part D

You might be eligible for financial assistance with your Part D premiums. This program is known as Extra Help. Through the Extra Help program, prescriptions can be obtained at a significantly reduced cost. In 2021, generic drugs will cost no more than $3.70, while brand-name prescriptions will cost no more than $9.20.

Work With The Medicare Experts At Vibrantusa

Although Original Medicare costs are determined by income brackets, prescriptions, advantage plans, and supplemental insurance can vary wildly. Thats why its so important to get as much information as you can from people you can trust. Doubling up on insurance unnecessarily or being caught without the right Medicare benefits can be costly.

Since 2003, VibrantUSA has been dedicated to providing our clients with the information they need to make the right decisions. As an independent agency, we have access to more than 30 insurance carriers and more than 50 different plans. Depending on where you live, we can find out what plans are available, the best prices, and which doctors are available.

If youre turning 65, or recently went through a life-changing event while on Medicare, contact VibrantUSA for help. We take the time to learn about what you need and find the plans that fit your finances. We look forward to working with you!

You May Like: Are Pre Existing Conditions Covered Under Medicare

Is Medicare Part B Based On Income

Yes,Medicare Part B pricing is based on income. However, coverage is federally regulated, which means that Medicare Part A is usually a $0 premium, but Part B requires a monthly premium that is based on your tax filings.

âThe most common monthly Part B premium is $148.50. If you have a high income, you’ll pay more.

In 2021, the Medicare Part B deductible is $203. After you reach this deductible, you pay 20% of the Medicare-approved amount for most care.

Who Is Affected By The Irmaa Surcharges And How Does This Change Over Time

There have been a few recent changes that affect high-income Medicare beneficiaries:

- In 2019, a new income bracket was added at the high end of the scale, for people earning $500,000 or more . Prior to 2019, the highest income bracket was $160,000+ . But in 2019, the new income bracket meant that a beneficiary earning $500,000+ would be paying a larger premium than someone earning $160,000.

- 2020 was the first year that the income thresholds for IRMAA surcharges were adjusted for inflation. Prior to that, it started at $85,000 and that number had been unchanged since the program began. But starting in 2020, the thresholds were adjusted for inflation, with the low-end threshold increasing to $87,000 for a single person.

- In 2021, the IRMAA thresholds were indexed again, with the low-end threshold increasing to $88,000 for a single person. So a Medicare beneficiary whose 2019 tax return showed an income above $88,000 would be paying the IRMAA surcharge for Part B and Part D in 2021.

- For 2022, the projection is that the IRMAA thresholds will start at $91,000 for a single person and $182,000 for a married couple.

Recommended Reading: Does Medicare Pay For Ct Scans

What Medicaid Covers For Medicare Enrollees

Medicare has four basic forms of coverage:

- Part A: Pays for hospitalization costs

- Part B: Pays for physician services, lab and x-ray services, durable medical equipment, and outpatient and other services

- Part C: Medicare Advantage Plan offered by private companies approved by Medicare

- Part D: Assists with the cost of prescription drugs

Medicare enrollees who have limited income and resources may get help paying for their premiums and out-of-pocket medical expenses from Medicaid . Medicaid also covers additional services beyond those provided under Medicare, including nursing facility care beyond the 100-day limit or skilled nursing facility care that Medicare covers, prescription drugs, eyeglasses, and hearing aids. Services covered by both programs are first paid by Medicare with Medicaid filling in the difference up to the state’s payment limit.

What Are The Coverage Limits During The Medicare Part D Donut Hole

Medicare Part D prescription drug plans feature a temporary coverage gap, or donut hole. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs.

- Once you and your plan combine to spend $4,430 on covered drugs in 2022, you will enter the donut hole.

- Once you enter the donut hole in 2022, you will pay no more than 25 percent of the costs for brand name drugs and generic drugs until you reach the catastrophic coverage phase.

- After you spend $7,050 out-of-pocket on covered drugs in 2022, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

Also Check: How Does Medicare Work With Other Insurance

Who’s Eligible For Medicaid For The Aged Blind And Disabled In Tennessee

Medicare covers a great number services including hospitalization, physician services, and prescription drugs but Original Medicare doesnt cover important services like vision and dental benefits, and can leave enrollees with significant cost sharing obligations. Some beneficiaries those whose incomes make them eligible for Medicaid can receive coverage for Medicare cost sharing and Medicaid-covered services if theyre enrolled in Medicaid benefits for the aged, blind and disabled .

In Tennessee, Medicaid ABD does not cover any adult dental care. Here is a list of free or low cost dental clinics in Tennessee.

Medicaid ABD also does not cover routine vision care in Tennessee.

Medicaid ABD benefits dont ordinarily include Long Term Services and Supports . In most states, applicants who need those services must submit a separate application, undergo an assessment, and meet different resource and income limits.

The Medicaid program is called TennCare in Tennessee.

Income eligibility: The income limit is $783 a month if single and $1,175 a month if married.

Asset limits: The asset limit is $2,000 if single and $3,000 if married.

Assistance with prescription drug expenses in Tennessee

What Are The Medicare Income Limits For 2021

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000 for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

Recommended Reading: What Age Can You Get Medicare Part B

How Is The Income Limit Calculated

According to Social Secuity, the IRMA payments are calculated based on how much most beneficiaries pay for the true cost of Medicare Part B.

Most beneficiaries pay about 25% of the true cost for their Part B coverage. For those who meet the first threshold for IRMA payments, they will pay around 35%. For those who make 2nd threshold they pay 50%, for the 3rd they pay 65%, for the fourth they pay 80%, and for the fifth they pay 85%.

What Is The Difference Between Extra Help And The Medicare Savings Program

When investigating affordable Medicare options, you’ve likely come across the names Extra Help and Medicare Savings Progam.

Though Extra Help is a great resource, it is only going to help with Medicare Part D prescription drug costs.

If you’re looking for help with your Original Medicare-related costs, look for a Medicare Savings Program. There are four kinds:

- Qualified Medicare Beneficiary program

- Specified Low-income Medicare Beneficiary program

- Qualifying Individual program

- Qualified Disabled and Working Individuals program

Bonus Tip: If you qualify for the QMB program, SLMB program, or QI program, you automatically qualify for Extra Help to assist with your Medicare prescription drug coverage costs.

Don’t Miss: Does Medicare Cover Cataract Exams