What Is The Donut Hole Gap In 2020

In 2011, the government took several actions that started to close the donut hole. These included:

- 2011: The Affordable Care Act required pharmaceutical manufacturers to introduce discounts of up to 50% for brand name drugs and up to 14% for generic drugs, making it easier for people to buy medications once in the donut hole.

- 20122018: The discounts continued to increase.

- 2018: The Bipartisan Budget Act sped up changes to prescription drug discounts when a person was in the donut hole. Examples included manufacturer discounts and decreasing a persons costs on brand name drugs once they enter the donut gap.

The aim of these changes was to make drugs more affordable once a person reached the donut hole, which would encourage people to continue taking their medications and reduce the risk of a break in treatment. As of 2020, prescription drug coverage takes the following shape:

Ideally, these changes will allow a person to have long-term access to the medications their doctor prescribes.

How You Can End Up In Medicares Donut Hole And How You Get Out

Medicare prescription drug plans can have a coverage gapcalled the “donut hole”–which limits how much Medicare will pay for your drugs until you pay a certain amount out of pocket. Although the gap has gotten much smaller since Medicare Part D was introduced in 2006, there still may be a difference in what you pay during your initial coverage compared to what you might pay while caught in the coverage gap.

When you first sign up for a Medicare prescription drug plan, you will have to pay a deductible, which cant be more than $445 . Once youve paid the deductible, you still need to cover your co-insurance amount , but Medicare will pay the rest. Co-insurance is usually a percentage of the cost of the drug. If you pay co-insurance, these amounts may vary throughout the year due to changes in the drugs total cost.

Local Elder Law Attorneys in Your City

City, State

Once you and your plan pay a total of $4,130 in a year, you enter the coverage gap, aka the notorious donut hole. Previously coverage stopped completely at this point until total out-of-pocket spending reached a certain amount. However, the Affordable Care Act has mostly eliminated the donut hole. In 2021, until your total out-of-pocket spending reaches $6,550, youll pay 25 percent for brand-name and generic drugs. Once total spending for your covered drugs exceeds $6,550 , you are out of the coverage gap and you will pay only a small co-insurance amount. For more from Medicare on coinsurance drug payments, .

Do Medicare Advantage Plans Cover The Donut Hole

Private insurance companies manage Part C plans, which often include prescription drug benefits. These plans work similarly to standard Part D plans. Thus, they still involve coverage gaps. An Advantage plan might cover some generic medications in the donut hole, but these dont serve to close the gap faster due to their lower prices.

Don’t Miss: What Is The Maximum Income For Medicare

Do Medicare Advantage Plans Have A Donut Hole

Medicare Advantage plans are privately offered plans that bundle Medicare Part A , Part B , and usually Part D . If youre familiar with Medicare Part D, then you know about the Part D coverage gapalso known as the donut hole. So if your Medicare Advantage plan includes Part D, does the donut hole still apply?

Does The Medicare Donut Hole Affect Everyone With Medicare Prescription Drug Coverage

No. Not everyone will enter the Medicare donut hole stage. The Part D donut hole begins after you and your Medicare prescription drug plan have spent a certain amount for covered prescription drugs during the calendar year. If your prescription drug costs during the year are less than the pre-defined amount, you wont enter the Medicare donut hole stage. Your Part D expenses might not reach this limit in situations such as the following:

- If you dont take many prescription drugs, or those you take are lower-cost generic medications

- If you have other prescription drug coverage from an employer or union that pays a portion of your prescription drug costs

If you receive Extra Help paying Part D costs, you wont enter the Medicare Part D donut hole.

Recommended Reading: How To Sign Up For Medicare Part D

What Costs Count Toward The Medicare Part D Donut Hole

The expenses that count toward the Medicare donut hole can include:

- Copayments

- Brand-name prescription drug discounts you receive while in the Medicare Part D donut hole

- The amount you pay in the Medicare Part D donut hole

The expenses that dont count toward the Medicare Part D donut hole can include:

- Your plans monthly premium

- The pharmacy dispensing fee

- The cost of prescription drugs that arent covered under your drug plans formulary

Need More Help Check Out These Resources:

The State Health Insurance Assistance Program offers free, independent counseling services and local workshops to help with your health care benefit decisions.

Visit medicare.gov or talk to a Medicare expert, like an agent, broker or health plan sales rep.

Our monthly Medicare newsletter delivers helpful tips straight to your inbox.

Connect with experts

You May Like: Do I Need To Sign Up For Medicare Part B

How Does The Medicare Donut Hole Work

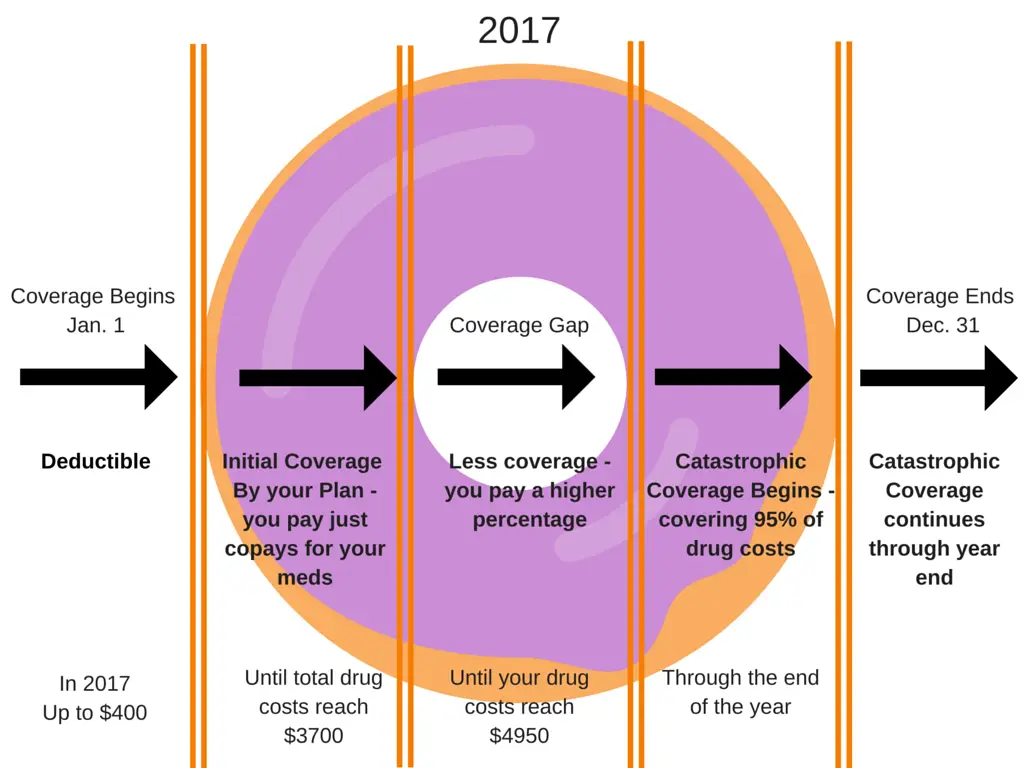

Prescription drug coverage consists of multiple stages. The first stage starts when the year begins and involves reaching your deductible, which can be up to $445. You are responsible for paying 100% of this cost. Then, you reach the initial coverage stage, when youre only responsible for copayments. After the cost of drugs reaches $4,130, you fall into the donut hole.

While youre in the coverage gap, youll need to pay 25% of the cost of generic and brand-name drugs, until what you pay reaches $6,550. Catastrophic coverage kicks in when youre out of the gap, leaving you responsible for just 5% of your drug costs. This lasts until the end of the year when your coverage ends and your plan restarts. The monthly statements you obtain from your plan provider should show your current status regarding the donut hole.

- Consider Applying for Extra Help

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Don’t Miss: How Do I Lookup My Medicare Provider Number

What Counts Toward Exiting The Coverage Gap

When you are in the gap and paying 25% of covered drugs, your spending counts toward exiting the gap. The manufacturers drug discount of 70% also counts and will help you exit the gap faster.

There are two things, though, that dont count toward closing the gap. These are:

- The amount that your drug plan pays toward the cost of the drug, which is 5% in the gap

- The amount that the drug plan pays toward the pharmacys dispensing fee, which is 75% of the fee in 2022

Keep in mind that there are other things that dont count toward reaching the catastrophic limit, which are your plan premium and also what you spend on any drugs that arent covered by your Part D plan.

Order Your Medications By Mail And In Advance

Many Medicare Part D prescription drug plans offer medications at a discount if you order a three-month supply by mail instead of picking up a 30-day supply at the pharmacy. Sometimes, a local pharmacy can even offer a 90-day supply of your prescription at the same price as the mail-order plan. Its worth looking into the different options and comparing the per-pill cost of the bulk options. Some drugs cant be prescribed in larger supplies, but for those that can, you may find valuable cost savings.

Read Also: Does Social Security Disability Include Medicare

How Do I Get Out Of The Coverage Gap

Once your total spending on covered drugs exceeds the threshold, youll enter the catastrophic coverage phase and no longer be subjected to the high costs of the coverage gap.

In 2022, to get out of the donut hole, the total cost of spending must reach $7,050 thats when catastrophic coverage automatically starts.

Exemptions From The Coverage Gap

Sometimes people ask us if their Medigap plan will cover the coverage gap in their drug plan. The answer is no. Medigap plans help to pay for inpatient and outpatient services only. Drugs fall separately under Part D.

Every year we have clients ask us to help them find a Part D drug plan with no coverage gap. Such a plan does not currently exist in most states. The are no Medicare Part D plans without the donut hole. There is no separate insurance plan that you can buy to cover you in the Medicare donut hole either. Read more on why that is here.

However, certain people with low incomes and limited assets may qualify for the low-income subsidy, called Extra Help for Part D. If you qualify, then Medicare will waive the gap for you. Also, your ordinary copays on your prescriptions will decrease quite a bit. You can apply for the subsidy at your local Social Security office or online at their website.

Don’t Miss: Can You Have More Than One Medicare Supplement Plan

Thanks To The Affordable Care Act The Donut Hole Closed Completely In 2020 Leaving You Paying The Same 25% Of Prescription Drug Costs As You Paid Before You Entered The Coverage Gap

The donut hole is the coverage gap that occurs when you and your Medicare drug plan have reached a pre-determined spending limit for covered drugs. For example, in 2022, once you have spent $4,430 on covered drugs, you enter the coverage gap.

While in this coverage gap, you will pay no more than 25 percent out-of-pocket for the cost of both brand-name drugs and generic drugs until you reach the catastrophic coverage phase. This amount changes every year. In 2022, once your out-of-pocket spending reaches $7,050, you leave the donut hole and enter catastrophic coverage. Once you reach this point, you pay only a small coinsurance or copayment for each covered prescription until the end of the year.

How To Get Out Of The Donut Hole

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement.

However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements. These include:

- Extra Help:Extra Help is a Medicare program that helps people pay for medications and other aspects of medical care. A person can qualify for Extra Help if their income is $18,735 or less when single or $25,365 or less as a couple. They must also have less than $14,390 as a single person or $28,720 as a married couple in resources. Resources include savings, stocks, or bonds.

- Medicaid: Medicaid is a federal program that helps low income individuals pay for healthcare. People who qualify for Medicaid are automatically enrolled in the program.

- State Health Insurance Assistance Program : These state-specific programs can provide additional assistance for people in funding healthcare costs, including medications.

Many pharmaceutical manufacturers also offer prescription assistance programs that can reduce costs. A doctor or pharmacist can often make suggestions for contacting the drug company.

You May Like: Does Medicare Medicaid Cover Dentures

Can You Avoid The Medicare Coverage Gap

Not everyone will enter the Medicare coverage gap, or donut hole, each year. For example, Medicare beneficiaries who get Extra Help paying for Part D costs wont enter this coverage gap.

Here are some ways you may be able to save money on prescription drugs:

- Ask local pharmacies if they offer drugs you take at a reduced cost.

- Check with your plan to see if using a mail-order pharmacy for a three-month supply of drugs may lower your copayments.

- Ask your doctor if your medications have lower-cost generic options.

- Always use a preferred pharmacy if your prescription drug plan has one.

- Ask your plan if you can get your prescription filled at GoodRX, Sams Club, Walmart, or other discount pharmacies.

- Get assistance from private, state, or federal programs that help with drug costs.

- Some drug manufacturers also offer assistance programs for their own drugs.

Dont let the Part D coverage gap alarm you too much a Medicare prescription drug plan can still save you money on your medications.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Medicare Donut Hole 2022

The Medicare Part D donut hole is just a term coined by ordinary people for the stage of Medicare Part D that is officially called the coverage gap. The reason they call it the Medicare donut hole is because it used to be a hole in the middle of your drug coverage during a calendar year.

All Medicare Part D plans have four stages, and the third stage is the donut hole. However, you may have heard about the Medicare donut hole ending. The reason people used to say that the donut hole was ending is because the percentage that you pay for brand name drugs in the gap lowered.

Confusing, right? Keep reading and well break it down for you.

Don’t Miss: Do Medicare Advantage Plans Cover Chemotherapy

What Happens After I Exit The Donut Hole

After you exit the donut hole, youll receive whats called catastrophic coverage. This means that youll have to pay whatever is greater for the rest of the year: Five percent of a drugs cost or a small copay.

The minimum copay for 2022 has increased a little from 2021:

- Generic drugs: minimum copay is $3.95, which is up from $3.70 in 2021

- Brand-name drugs: minimum copay is $9.85, which is up from $9.20 in 2021

Choosing Medicare prescription drug coverage

Are you planning on enrolling in a Medicare prescription drug plan? Consider the following before choosing a plan:

- Use the Medicare website to search for a plan thats right for you.

- Compare a Medicare Part D with a Medicare Advantage plan. Medicare Advantage plans include health care and drug coverage on one plan and sometimes other benefits like dental and vision.

- Check that the plan covers your medications.

- If you take generic drugs, look for a plan that charges a low copayment.

- If youre concerned about expenses while in the donut hole, find a plan that provides additional coverage during this time.

- Make sure that additional coverage includes medications you take.

Why Does Medicare Part D Even Have Different Phases

When Part D began in 2006, lawmakers established these phases as a way to encourage people on Medicare to make more cost-conscious decisions about their medications. As part of that plan, Phase 3 forced Medicare recipients to pay 100% of their medication costs. That steep dropoff in coverage seems to have inspired the donut hole nickname.

A 2018 analysis revealed that in recent years, as the donut hole has closed, Medicare recipients have increased their prescription use.

Read Also: How To Sign Up For Medicare Advantage

What Changed In 2020

When Medicare Part D was rolled out in 2007, users paid 100% of drug costs during the coverage gap until their out-of-pocket costs qualified them for catastrophic coverage.

The Affordable Care Act included a provision to require drug manufacturers to provide a 50% discount on the cost of brand-name drugs in the coverage gap and to require plans to pay a gradually increasing share of drug costs. The final phase of the plan was implemented in 2020, and users are now responsible for 25% of the cost of both brand-name and generic drugs.

What Is The Initial Coverage Period

During theinitial coverage period, you will pay the stated copayment or coinsurance fees for either brand-name or generic drugs. The exact amounts of these costs are based on your specific plan details and vary depending on your unique plan coverage.

Many Medicare recipients will stay in this period for the entire plan year it all depends on the cost of your prescriptions and the types of medications you take.

You May Like: Are Podiatrists Covered By Medicare

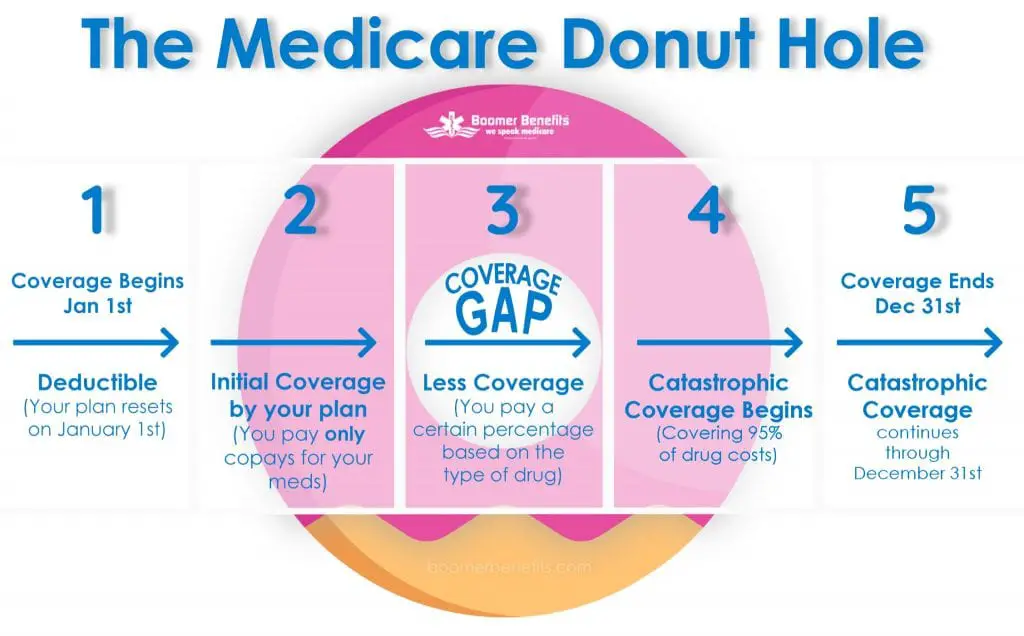

What Are The 4 Phases Of Medicare Part D

The four phases of Medicare Part D are:

- Deductible Phase

- Coverage Gap Phase

- Catastrophic Coverage Phase

During the deductible phase, you are responsible for 100 percent of your prescription drug costs until you meet your Part D plan’s annual deductible. The insurance companies that provide Part D plans set their own costs, including deductibles and premiums. However, they must work within guidelines established by the Centers for Medicare & Medicaid Services . In 2022, the maximum Part D deductible is $480.

Is The Medicare Donut Hole Ending

So, when does the donut hole end? Although it has shrunk, it hasnt ended quite yet.

Since the Affordable Care Act passed back in 2010, the donut hole has been slowly closing. It used to be that when you hit that point, you would pay 100% of the costs of your prescription drugs while you were in the gap.

However, the government has been reducing that percentage steadily, and as of 2021, the percentage of the cost that you pay for prescriptions during the Medicare donut hole is no more than 25%.

Get more Medicare help on our Facebook community page.

Don’t Miss: Does Medicare Advantage Cover Chiropractic Care