What Does Medicare Part B Cover

Medicare Part B covers 80 percent of the Medicare-approved costs of certain services. Most, though not all, of these services are administered on an outpatient basis. This means you dont receive them as a patient in a hospital.

There are some exceptions to this, such as emergency room visits and the services you receive there, even if youre later admitted to a hospital.

In order to get coverage, your care must be administered by a Medicare-approved supplier, such as an MD, DO, NP, or other medical professionals.

Services that Medicare Part B covers include:

- most doctors visits that are medically necessary or preventive, provided that theyre from a Medicare-approved supplier

- medically necessary outpatient hospital care, such as emergency room services and some same-day surgical procedures

Will Original Medicare Alone Cover My Medical Costs

Unfortunately, Original Medicare only covers part of your health care expenses the rest is your responsibility. If youre hospitalized for a single day, you would owe $1,556. With a serious illness requiring multiple admissions, you run the risk of spending thousands more! More copays/coinsurance and deductibles can quickly add up, too. A Medicare Supplement can help you cover the costs, but the monthly premiums are often expensive. Fortunately, a Medicare Advantage plan like Johns Hopkins Advantage MD offers you an affordable, quality option.

What Is Medicare Advantage

Medicare Advantage is a Medicare plan offered by private insurers who contract with the program. Medicare Advantage plans, also known as Medicare Part C, provide hospital, outpatient, and, usually, prescription drug coverage, supplanting benefits under Medicare parts A, B, and D.

Anyone who joins an MA plan still has Medicare, and must continue paying Medicare Part B premiums in addition to any charged by the plan. Medicare Advantage plans typically have lower out-of-pocket choice than traditional Medicare and may offer additional benefits, while requiring members to receive care from providers in their network, and to obtain referrals to see specialists.

Read Also: Do Walk In Clinics Take Medicare

When Do I Enroll In A Medicare Plan

You can enroll in Medicare three months before your 65th birthday month and up to three months after that. But, if you decide to keep working, there are different enrollment rules to follow to avoid paying a Medicare penalty. Johns Hopkins is here to help you whenever you decide to enroll whether its at age 65 or later.

We have a long-standing commitment to the health and well-being of our Maryland neighbors. So, whether you want one-on-one assistance from Medicare Specialists or practical, easy-to-use resources like a personalized Medicare Timeline, well provide the help you need to put the right plan in place.

Independent Insurance Agency Benefits

What are the advantages of working with an independent agent for Medicare health insurance? We are able to access more than 50 plans through more than 30 carriers throughout the region. We are not tied to any one carrier, meaning we can find the most affordable plans that cover your needs.

The best part? You dont pay us anything for our services, so there are no additional fees for you to worry about. VibrantUSA is paid by the insurance carrier, not our client, allowing us to concentrate solely on you. Have questions about qualifying for Medicare, upcoming enrollment periods, or what to do if youre turning 65? Contact VibrantUSA today.

Recommended Reading: What Is A Hmo Medicare Plan

Can I Choose My Healthcare Provider

With Original Medicare, a primary care provider is not required. You can healthcare provider who accepts Medicare.

With a Medicare Advantage plan, your choice of doctor depends on whether you select a health maintenance organization or preferred provider organization plan.

With an HMO plan, you can choose your primary care doctor from any doctor in the plans network. If you opt for a PPO plan, generally, choosing a primary care doctor is optional. With both types of plans, youll usually save money by visiting an in-network provider.

Its important to note that Medicare Advantage plans must offer emergency coverage outside the plans service area, anywhere in the U.S.

Does Medigap Require Referrals

Medigap plans, also known as Medicare Supplement Insurance, are private insurance plans that help cover your out-of-pocket costs. Due to the nature of these plans, specialists wont apply in any way, and you dont need a referral for any part of Medigap.

Because these plans are private, their costs will vary even though each plan’s benefits are standardized. Our Ultimate Guide to Medicare Supplement Insurance explains everything you need to know about Medigap.

Recommended Reading: Does Everyone Qualify For Medicare

When Does Medicare Coverage Start

Medicare coverage is dependent on when you have signed up and your sign-up period. Coverage always starts on the first of the month.

If you meet the criteria for Premium-free Part A, your coverage starts the month you turn 65-years old or the month before if your birthday is the first of the month.

Part B and Premium-Part A plans are dependent on sign-up:

You can also sign up for Premium-free Part A after your 65th birthday. Coverage starts 6 months back from sign-up or when you apply for benefits from Social Security or the Railroad Retirement Board.

After your IEP is over, you can only sign up for Part B and Premium-Part A during the other periods of General Enrollment or Special Enrollment.

For Original Medicare, the General Enrollment Period is Jan. 1 March 31, with coverage beginning on July 1. You may have to pay a monthly late enrollment penalty if you do not qualify for Special Situations.

Under Special Situations or the SEP, you can sign up for Part B and Premium-Part A without paying a late enrollment penalty. Your coverage will start next month. Access your situation and

How Much Does Medicare Pay For A Doctor Visit

Everyone with Medicare is entitled to a yearly wellness visit that has no charge and is not subject to a deductible.

Beyond that, Medicare Part B covers 80% of the Medicare-approved cost of medically necessary doctor visits. The individual must pay 20% to the doctor or service provider as coinsurance.

The Part B deductible also applies, which is $203 in 2021. The deductible is the amount of money that a person pays out of pocket before the insurance begins to cover the costs.

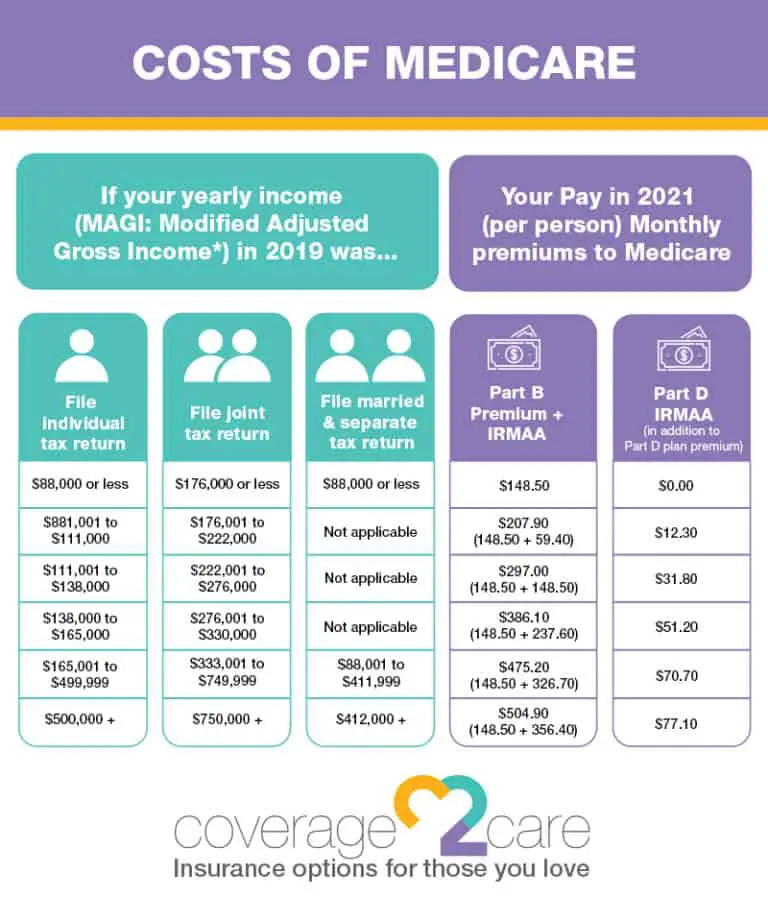

A person will also need to pay a premium to keep the policy. The standard monthly premium in 2021 is $148.50.

If a person did not sign up when they were eligible at the age of 65 years, they might also need to pay a late enrollment penalty. This penalty can increase the premiums by 10% for each year that someone qualified for Medicare but did not enroll.

The costs associated with Medicare Advantage Plans vary depending on several factors, including:

- whether the plan has a premium

- whether the plan pays the Medicare Part B premium

- the yearly deductible, copayment, or coinsurance

- the annual limit on out-of-pocket expenses

- the type of healthcare services a person needs

You May Like: Which One Is Better Medicare Or Medicaid

Pros Of Medicare Advantage Plans

With Medicare Advantage plans, you can get personalized, coordinated medical care at a lower cost, depending on your plan. There are many advantages of enrolling in a Medicare Advantage plan. You can get:

- All of your coverage bundled together in 1 convenient plan.

- Costs that may be lower than Original Medicare.

- Extra benefits such as coverage for vision, hearing, dental, wellness programs, and discounts on health-related items.

- Prescription drug coverage .

- All the rights and protections offered through the Medicare program.

- Help paying for premiums , if you qualify.

- All the benefits of Medicare Part A and Part B plans, without buying supplemental insurance.

How Much Does Medicare Advantage Cost

With Medicare Advantage options, instead of paying your healthcare bills directly, the federal government pays private insurance companieslike Humanato administer your coverage.

While there is a monthly premium for Medicare Advantage options, many private insurance companies choose to offer

As with Original Medicare members, Medicare Advantage members must continue to pay their Part B premium.

Recommended Reading: How To Get Your Medicare Number

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

When Does Medicare Not Cover Medical Visits

Medicare doesnt cover certain medical services that you may consider preventive or medically necessary. However, there are sometimes exceptions to this rule.

For questions about your Medicare coverage, contact Medicares customer service line at 800-633-4227, or visit the State health insurance assistance program website or call them at 800-677-1116.

If your doctor lets Medicare know that a treatment is medically necessary, it may be covered partially or fully. In some instances, you may incur additional, out-of-pocket medical costs. Always check before you assume that Medicare will or wont pay.

Other circumstances under which Medicare will not pay for a medical appointment include the following:

There may be other medical visits and services that Medicare wont cover. When in doubt, always check your policy or enrollment information.

Read Also: How Old Are You When You Sign Up For Medicare

Am I Eligible For Medicare Part B

You are eligible for Original Medicare, including Medicare Part B, if you meet one of three criteria:

- Youre aged 65 or older.

- Youre younger than 65 with eligible disabilities by the Social Security Administration.

- You have Amyotrophic Lateral Sclerosis or End-Stage Renal Disease .

Find the right Medicare plan for you

Does Original Medicare Cover Specialists

Original Medicare covers specialists as long as they are enrolled in Medicare. If a doctor is not enrolled in Medicare, your out-of-pocket costs will be higher.

Some healthcare providers accept Medicare but are non-participating, which means they do not agree to accept the Medicare-approved rate in all situations. This may result in you having to pay excess charges. Finally, some healthcare providers fully opt out of the Medicare program. In this case, Medicare wont cover any amount of the cost.

You can find a Medicare-approved doctor using Medicares Care Compare search tool, or ask your current doctor whether they accept Medicare assignment.

Recommended Reading: Is Medicare Supplement Plan F Being Discontinued

How Medicare Advantage Works

Medicare is generally available for people age 65 or older, younger people with disabilities, and people with end-stage renal diseasepermanent kidney failure requiring dialysis or transplantor amyotrophic lateral sclerosi .

Medicare Advantage plans are Medicare-approved policies offered by private companies as an alternative to traditional Medicare coverage. MA plans provide hospital and outpatient coverage that replaces that under parts A and B of Medicare, with the exception of hospice care. Most MA plans also include Part D prescription drug coverage.

More than 28 million people, about 48% of those receiving Medicare benefits, were enrolled in a Medicare Advantage plan in 2022. Medicare Advantage plan providers receive a fixed fee from the program for each enrolled health plan participant. The plan providers also collect out-of-pocket costs from policyholders, and may limit coverage to providers in a network while requiring referrals to see specialists.

Some Medicare Advantage plans cover additional costs not covered by traditional Medicare, including vision, dental, and hearing-related expenses. Medicare Advantage plans don’t work with Medigap, which is also called Medicare Supplement Insurance.

The average Medicare Advantage monthly premium was expected to decline to $18 in 2023, from $19.52 in 2022. Medicare Advantage participants pay any MA plan premium in addition to the monthly Medicare Part B premium, which is set at $164.90 for 2023, down from $170.10 in 2022.

Medicines Prescribed By Your Doctor

For many Medicare beneficiaries, the majority of office visits are to follow up on labs and make sure prescription levels are correct and working properly. There are many times your provider will send a prescription to your pharmacy.

Unless the medication is administered in the doctors office, medications may be covered by your Medicare Part Dprescription drug coverage or Medicare Advantage plan. In most cases, your healthcare provider will check with your plan to make sure the drug they are prescribing is on your plans formulary. However, there are times when something may not be covered by your plan, or the cost of your plan is more than you can afford.

If the drug is expensive but is covered by your plan you can check to see if you qualify for the Medicare Extra Help program. This program is designed to help Medicare beneficiaries that have low-income and limited resources pay for their prescription drugs.

Your eligibility for Extra Help is determined by your household income. You can apply with the Social Security Administration either online, in person, or over the phone. If your income is too high to qualify for this program, you can use a SingleCare free discount card to help lower your prescription drug costs. Using a SingleCare drug coupon in place of your coverage may greatly reduce the cost of your prescription. You can email, text, or download your SingleCare card and start saving in minutes.

Don’t Miss: When Can I Get My Medicare Card

Do I Have To Enroll In Medicare Part B

What if you have other medical coverage, like an employers plan? Do you still have to sign up for Part B?

You can choose to delay Part B enrollment, as some people do when theyre covered under an employers or union-based health insurance plan. However, when that coverage ends, be aware that if you dont sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty.

Heres one reason you might want to sign up for Medicare Part B. Suppose you decide youd like to buy a Medicare Supplement insurance plan. Or, you want to enroll in a Medicare Advantage plan. Both of these types of coverage require you to be enrolled in both Medicare Part A and Part B.

If you stay with Original Medicare and decide to sign up for a stand-alone Medicare Part D prescription drug plan, you need to be enrolled in Medicare Part A and/or Part B.

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, youll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

Do you want to learn more about those Medicare coverage options we mentioned? Start comparing plans right away by typing your zip code where indicated on this page and clicking the button.

New To Medicare?

Who Is Eligible For Medicare

depends on factors such as:

- Age: You must be 65 years or older to enroll in a Medicare plan. You can receive Part A without a premium if you are receiving or eligible to receive benefits from Social Security or the Railroad Retirement Board. In addition, you can qualify for a premium-free Part A, if you or your spouse had Medicare-covered government employment.

- Disability: If you are under 65 years old and have a disability, you qualify for Medicare.

- End Stage Renal Disease: With this disease, you are experiencing permanent kidney failure and require dialysis or a transplant. You qualify for Medicare.

If you have not been paying for Medicare taxes while you worked, are older than 65 and are a citizen or permanent resident of the U.S., you may have to purchase Part A.

If you are younger than 65, you can receive Part A without a premium if:

- You have been granted Social Security or Railroad Retirement Board disability benefits for at least 24 months.

- You are a patient that requires a kidney transplant or dialysis.

Most people do not have to pay for Part A. However, if you desire Part B, you must pay for it. The premium is deducted monthly from your Social Security, Railroad Retirement or Civil Service Retirement check. If you do not receive these types of payments, you will receive a bill every 3 months from Medicare.

Also Check: What Is Bernie Sanders Plan For Medicare For All

How Much Are Premiums Deductibles Doctor Visits And Hospital Stays

Rely on Original Medicare alone and your costs will typically look like this: the Part B monthly premium , Part A annual deductible and Part B annual deductible , plus you pay 20% of all the Medicare-approved costs for doctors and hospitals.

With Advantage MD, your wallet looks a whole lot better with plan options to fit your needs and budget starting at $25 a month, 100% coverage for Medicare deductibles and copays as low as $5 for doctor visits.** Plus, youll have an annual maximum for out-of-pocket costs with Original Medicare, theres no limit to what you could owe!