How To Choose The Top Medicare Supplement Company In Your Area

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2022, and when you use our agents, you get your cake and eat it too!When you enroll in a policy through us, you get the benefits of a low-cost plan with elite customer service.Our agents can access the most popular Medigap plans for you! So, instead of calling each company for a quote, you dial one agent, and they quote you on all the top carriers. Getting all your quotes in one phone call is going to save you time and money.Are you considering buying a Medicare Supplement plan? Call our agents at the number above to get the best coverage in your area.Don’t have time to call today? Fill out an online rate comparison form, and an agent will call you to discuss the top Medicare Supplement companies in your area.

How Much Do Blue Cross Blue Shield Medicare Supplement Plans Cost

There are some costs associated with Medigap plans, including BCBS plans. These costs may vary by the specific plan and your location. These costs can include:

- Monthly premium. Every Medigap plan has a monthly premium. Companies can have a standard monthly premium or set their premiums based on your current age or the age at which you purchased your plan.

- Deductible. Some Medigap plans dont cover deductibles for Part A, Part B, or both. Additionally, high-deductible Plan F and Plan G have their own deductible of $2,370 that must be met before they start covering costs.

- Copays and coinsurance. Some Medigap plans dont cover every type of copay or coinsurance associated with Medicare parts A and B.

- Out-of-pocket costs. Youll be responsible for paying any costs for services that arent covered by original Medicare or your Medigap plan. Plan K and Plan L have out-of-pocket limits of $6,220 and $3,110, respectively. After you meet these limits, your plan pays for 100 percent of covered costs.

Now, lets compare the monthly premium cost ranges of different Medigap plans offered by BCBS in a few different cities across the country.

| Atlanta, GA |

|---|

25 percent of people with original Medicare also have a Medigap plan.

There are 10 different Medigap plans. However, these plans are standardized. This means that each plan must offer the same basic level of coverage, regardless of which company is offering it.

Best Pricing: Aarp By Unitedhealthcare

AARP by UnitedHealthcare

-

Best discounts for people new to Medicare

-

User-friendly website

-

Rates do not increase based on age

-

Offers Part D drug plans

-

Does not offer high-deductible Plan G

-

Requires dues for AARP membership

Unlike many other Medicare Supplement companies, AARP UnitedHealthcare uses community-rated pricing in most states. Under this model, everyone in the community is charged at the same rate, regardless of age or gender. This can be beneficial because your premiums will not increase as you age, though, like any plan, they could still increase as a result of inflation.

Founded in 1977, UnitedHealthcare is the insurance arm of UnitedHealth Group. In 1997, it partnered with AARP, one of Americas largest advocacy groups for people over 50 years old. Together, they offer Medicare Supplement Plan Gwhich is available in all states except for Massachusetts, Minnesota, and Wisconsin. High-deductible plans are not available at this time.

Their website is chock full of helpful information and is easy to use. When enrolling in a plan, you can visit their website for an online chat, or call them 7 days a week. To be eligible for an AARP UnitedHealthcare Medicare Supplement Plan G, you must be an AARP member. Membership starts at $12 per year and comes with many perks such as financial advisory tools, health and wellness programs, shopping discounts, and more.

You May Like: How Much Does Medicare Pay For Hospice

Standardized Medicare Supplement Plans

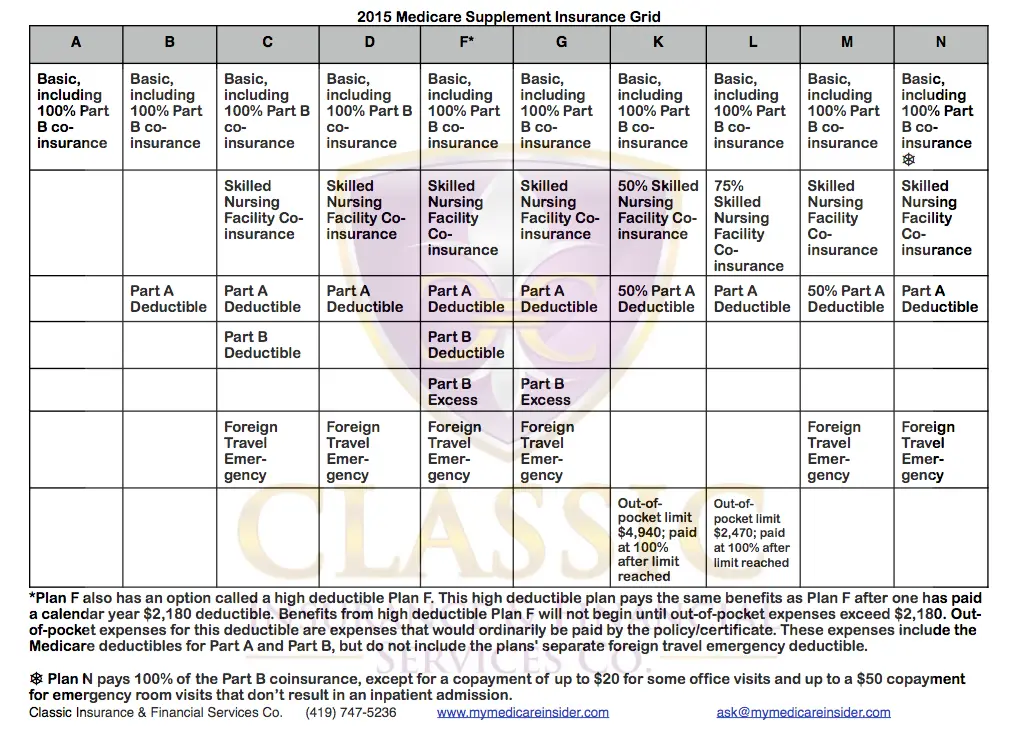

Screenshot from “Choosing a Medigap Policy,” July 8, 2019.

As you can see in the table above, Medicare Supplement insurance plans can cover the following costs:

-

Part A – coinsurances and hospital costs, hospice care coinsurance or copayment, and the Part A deductible

-

Part B – coinsurances or copayments, the Part B deductible, and any Part B excess charges

-

Skilled nursing facility coinsurance

-

The first three pints of blood for transfusions

-

Emergency medical costs during foreign travel

No Medicare Supplement plan covers prescription drugs. Youll have to enroll in Medicare Part D for drug coverage.

Plan A

Plan A is the standard Medicare Supplement plan. All other plans build upon the benefits offered by Plan A, adding other benefits or modifying the coverage amounts.

Like all Medigap plans, Plan A covers Medicare Part A coinsurances and hospital costs 100%. That means you wont pay anything for Part A costs.

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

Best for: People who are looking for the lowest cost and the lowest level of coverage, especially those who dont pay the Medicare Part A deductible and can comfortably afford the Part B deductible.

Plan B

Plan B covers everything Plan A covers. It also covers 100% of the Medicare Part A deductible.

Plan C

Plan D

What Are The Benefits Of Buying A Medicare Supplement Plan

The benefit of a Medicare Supplement plan is that it pays for the costs that are not paid for by Original Medicare. These include coverage for prescription medications, hospital stays, hospice care, bloodwork, and emergency room visits. It can drastically limit the out-of-pocket expenses that you may be hit with.

Also Check: What Is Blue Cross Blue Shield Medicare Advantage

Mutual Of Omaha Medicare Supplements

Mutual of Omaha was one of the very first companies to offer Medicare supplement plans. When Medicare was signed into law in 1965, Mutual was stepped up to help seniors get more coverage. They have been covering seniors ever since, and have several subsidiary companies, including United World Life Insurance Co. and United of Omaha Life Insurance Co.

Mutual offers Medicare supplement plans in all states, except Massachusetts, and is rated A+ by A.M. Best. Plans vary a bit by state, but the three most popular Plans F, G, and N are available in all states where Mutual and its subsidiaries sell Medicare supplement plans.

Here are the pros and cons:

What Is Covered Under Medicare Supplement Insurance Plan A

Plan A is the most basic of the 10 Medicare Supplement insurance plans, covering the fewest benefits.

Medicare Supplement insurance Plan A covers 100% of four things:

- Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up

- Medicare Part B copayment or coinsurance expenses

- The first 3 pints of blood used in a medical procedure

- Part A hospice care coinsurance expense or copayment

All 10 standardized Medicare Supplement insurance plans cover hospital care coinsurance at 100%. All 10 plans cover the other three categories as well , although Plan L covers these benefits at 75% and Plan K covers them at 50%. The nine plans other than Part A cover at least one benefit that Plan A does not cover some plans cover up to five additional benefits.

Recommended Reading: Should I Enroll In Medicare If I Have Employer Insurance

Medicare Supplement Plan Reviews

After our evaluation, we selected nine best Medicare supplemental insurance providers: United Medicare Advisors, Cigna, Mutual of Omaha, Medicare.net, Humana, Blue Cross Blue Shield, SelectQuote Senior, Aetna and AARP by United Healthcare. Each of these companies met our criteria and stood out uniquely.

Accendo Medicare Supplement Plans

A new company had arrived in 2020 called Accendo Insurance company.

This company is owned by CVS/Aetna and offers incredibly competitive rates for Seniors age 65 and Above.

Accendo Medicare supplement plans are offered in the same letters as found with other companies.

Accendo Medicare supplement plan G will likely be the most popular, as well as Plan N.

This plan is currently being offered in 16 states with many more scheduled to come.

Accendo offers a very generous 14% household discount to those living with someone else.

That person does not need to be applying for coverage at the same time.

Accendo Medicare Supplement Plan G

Plan G is now the most popular plan since Plan F is no longer being offered to people eligible for Medicare on January 1st. of 2020 and beyond.

Accendo Medicare supplement Plan G is no different than any other companies Plan G.

You must pay the annual Part B deductible first, then Accendo Plan G will pay any other deductibles and co-pays, as well as coinsurance after Medicare pays.

To get the very lowest rates on Accendo Medicare supplement Plan G call us today at 1-888-891-0229!

Accendo Medicare Supplement Plan N

Another great option for coverage is an Accendo Medicare supplement Plan N.

Now that Plan F is gone Medicare Plan N is quickly becoming a very popular plan among Seniors today.

With lower premiums than Plan G, call us today to see if an Accendo Medicare Plan N is right for you!

Also Check: Will Medicare Pay For Handicap Bathroom

Best For Educational Tools: Mutual Of Omaha

Mutual of Omaha

-

Price quote was on the higher estimate side

-

Doesnt offer high-deductible plan

Mutual of Omaha has provided insurance policies in the United States since 1909. Today, it serves 50 states, making it one of the most comprehensive companies we reviewed in terms of coverage.

The company’s website features a primer on Medicare Supplement insurance to help you establish basics like comparing different plans and how the company works with Medicare to supply your benefits. The site also offers a side-by-side comparison of different Plans . You can also choose from two views for your quote: monthly or annually.

You can quickly obtain a quote through Mutual of Omaha’s quote finder, which offers you a 7%-12% household discount. It also offers an e-application that you can start online and return to later. When you do apply, there are highlighted vocabulary areas throughout the application that define potentially unfamiliar terms.

The price we were quoted was on the higher side of the average Medicare estimate. For one zip code we searched, the Medicare plan finder provided a premium range estimate of $98 to $221, and we were quoted a $220.98 premium .

Medicare Supplement Insurance Writers

Information that follows is as of . The same informaton is also available in the following formats.

- Customer Service Phone Number: 264-4000

- Customer Service Email:

- 65 Over Individual Policy Plans: A, F, G, and N

- 65 Over Group Policy Plans: Not Available

- Under 65 Individual Policy Plans: A, F, G, and N

- Under 65 Group Policy Plans: Not Available

- Company Explanation: Accendo Insurance Company is an affiliate of Aetna. Household discount of 14% available.

** “Special” Policy Type denotes that the individual or group policy holder must be a member of an association, etc.

Read Also: Where Do I Apply For Medicare Benefits

United Healthcare Medicare Supplement Insurance Company

With over 4 million Americans choosing UHC as their Supplemental insurance provider, the company has built a reputation for being a champion for senior citizens. Customers will find that the most competitive states for the companys Supplemental insurance plans include Michigan, Pennsylvania, New Jersey, Ohio, Arizona, Texas, California, and New York. If you live in one of these states, you should definitely consider looking at United Healthcare when looking for a Medigap policy. Furthermore, some of the companys Supplemental plans offer extra perks such as a free Silver Sneakers membership when you sign up.

Determine Which Medicare Supplement Plan Gs Are Available

Medicare offers a Find a Plan database to help you search for Medigap plans by ZIP code. For more accurate pricing, enter your age, gender, and whether or not you use tobacco. Scroll to Medicare Plan G or Medicare Plan G High-Deductible to get a quick overview of costs and coverage. Finally, select View Policies for the list of specific insurance companies offering that plan in your area. You will need to reach out to those companies individually to get official quotes.

Don’t Miss: Are Medicare Advantage Premiums Deducted From Social Security

Best Medicare Supplement Coverage: Humana

Humana is licensed to sell Medigap policies in a whopping 45 states, plus Washington, D.C.

Also, it sells eight different Medicare supplement plans: A, B, C, F, G, K, L and N. It sells the high-deductible Plan F, too.

Other reasons to look to Humana for a Medigap plan:

- It has been in operation for nearly 60 years.

- It offers enrollees a variety of discounts and perks.

- It has an A- rating from A.M. Best.

Best For Discounts: Humana

-

High-deductible Plan G not offered in all locations

-

Plan G not offered in all states

Medicare doesnt require Medicare Supplement companies to offer Plan G. In 2018, an estimated 66 percent of all insurance companies that sold Medigap sold Plan G.

Humana was founded in 1961 and has become the third-largest health insurance provider in the U.S. It offers Medicare Supplement plans in all states and Washington, D.C. However, it does not offer Plan G in all states, so its important to search by your zip code to ensure you can obtain Plan G from Humana.

In terms of premium pricing, Humana was on the lower side based on our research. The quote estimates we received from the Medicare plan finder were $135 to $491 for Plan G and $47 to $110 for the high-deductible plan. Humana offered us $169.58 per month for Plan G with an online discount, and a high-deductible Plan G was $63.14.

If you are in a guaranteed-issue period, you may also qualify for Humanas Preferred rates, which are calculated by age and gender. The Standard rate is subject to medical underwriting for those outside a guaranteed-issue period and was usually $25 to $30 more per month compared to the Preferred rate.

Education and plan information was easy to find on the Humana website. The navigation is clean and user-friendlyanother reason it made our list.

Also Check: How To Apply For Medicare By Phone

Comparing Medigap Insurance Companies By Rate Increases

Look, we can tell you who we think the best Medigap insurance companies are, but until you actually compare rates and rate increase, youll never know for sure. As you are probably aware, all lettered Medigap plans offer the exact same benefits, regardless of the insurance company standing behind the policy. Thats because Medicare supplement plans are standardized

Heres a fact. An Aetna Medicare Supplement Plan FMedicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services…. may cost less in San Diego, California than the same plan from Mutual of Omaha, but in Tampa, Florida Mutual of Omahas rates could be better. You simply wont know until you get a free Medicare Supplement Rate Analysis.

Getting the rate increase history is important because it will show you, in back and white, what you can expect from each insurance carrier. The last thing you want is to jump into an insurance pool with a low initial rate and rapid rate increases down the road. Stable rates are best, even if the initial rate is slightly more.

See Which Medicare Supplement Plans Are Available In Your State

Compare the difference in cost between the plans as insurance plan costs differ from state to state. Narrow down the insurance companies you are considering and contact each one for an individualized rate quote to compare prices. Be sure you are comparing the same type of Medicare Supplement plan. For example, compare the price of plan A from one company with other companies plan A costs.

Don’t Miss: Does Medicare Require A Referral For A Colonoscopy

The 6 Best Medicare Supplement Plan G Providers Of 2021

- Best Overall Plan: Humana

- Best Access for High-Deductible Plan G: Mutual of Omaha

-

High-deductible plans in most states

-

Multiple discount programs

-

Offers dental, vision, and Part D plans for extra coverage

-

Rates increase based on age

We chose Humana for its intuitive website, mobile app, household discounts, and many other perks, as well as its coverage in 47 states. Humana was founded in 1961 as a nursing home company, and it began selling health insurance in the 1980s. It offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan G is available in all of those states except Missouri.

The Humana website discusses many Medicare topics, including eligibility, coverage, and costs for each part of Medicare. It is instinctive to navigate and can be a great resource for common questions about the program. You can turn to its mobile app, MyHumana, to access your benefits on the go.

There are many perks to enrolling in a Humana Medicare Supplement Plan G. A 5% household discount off your premiums is available if you live with another policyholder and you can take off even more if you arrange for automatic bank payments. Its 24/7 nursing line is especially helpful if you have medical questions, and it also offers a basic SilverSneakers gym membership available at over 15,000 locations in the U.S., plus discounts on hearing aids, non-prescription medications, and vision exams.

How To Shop & Compare Medicare Supplement Plans

Researching the plan thats right for you is key to getting the coverage you need. Each plan offers specific benefits depending on your state, which benefits you desire, and the costs.

Step 1: Determine if You Are Eligible to Enroll

In general, if you’re approaching your 65th birthday, but you haven’t started taking Social Security benefits yet, you are eligible for Medicare. For more information, please visit Medicare.gov.

Step 2: Find a List of Medicare Supplement Plans Available in Your State or ZIP Code

Using the tool available on Medicares website, you can search for coverage plans based on your location.

If you live in Massachusetts, Minnesota, or Wisconsin, Medicare Supplement policies have different rules. You have guaranteed issue rights to buy a Medicare Supplement policy, but the policies are different.

Step 3: Determine Which Aspects of Coverage Are Most Important to You

Perhaps you are concerned about out-of-pocket copays or high deductibles or you have a preexisting condition and want to know if there is a waiting period for coverage for it. Be sure to check each plan for the details that matter most to you.

Step 4: Compare the Difference in Cost Among Medicare Supplement Plans

Step 5: Consider Talking to a Broker or Consultant

Step 6: Sign Up

Once youve found a plan that works for you, contact that insurance company directly to enroll.

Read Also: Does Medicare Cover Dexa Scan