Three Approaches To Reform

The NASI study bit.ly/2K4Aya7 offers a fascinating in-depth look at three approaches to expanding Medicare eligibility: lowering the eligibility age, establishing Medicare for All, and creating a Medicare buy-in. The report was created by a study panel made up of 27 experts from a broad range of perspectives, such as economics, health policy, political science, sociology, medicine and law.

The report draws some surprising conclusions about the practicality of actually executing these approaches. Yes, Medicare for All might be the toughest putt from a political standpoint – but the optional buy-in – which sounded great rolling off the tongues of moderate candidates like Pete Buttigieg – actually is the most difficult to execute.

A lot of people think that Medicare for All sounds nice, but that it is aspirational and very difficult, if not impossible to do in practice, said Moon. And the buy-in just sounds like its not a big change. But we quickly realized that the buy-in was very complicated, because you take a complicated program like Medicare, which has a lot of moving parts, and then the even more complex Affordable Care Act structure and you try to marry the two in some way. Its very difficult to do.

Medicare Part A: Hospital Coverage

Medicare Part A is also called hospital coverage because it primarily covers costs like inpatient hospital care, nursing facility care, and hospice care. Part A can also cover some home health care costs, though these are mostly covered by Part B.

Premiums

Most people have no monthly premium for Part A due to paying Medicare taxes for a long enough time . If you dont qualify for premium-free Part A can buy the coverage instead. The premium costs as of 2021 are either $259 or $471, depending on how long someone worked and paid Medicare taxes.

Deductibles

Medicare Part A has a deductible of $1484 per benefit period, defined as the time between when you are first admitted to the hospital and the time that you have not received services for 60 consecutive days.

Copays and Coinsurance

There is no coinsurance required for the first 60 days of a stay in a hospital or skilled nursing facility, but there are coinsurance amounts that kick in after the initial sixty days have passed.

Medicare Before The Medicare Eligibility Age

There are also ways an individual under the age of 65 can be eligible for Medicare. For one, you may qualify if you have been eligible for Social Security benefits for at least 24 months. If you have a Railroad Retirement board disability pension you can also qualify. Or, if you have end-stage renal disease or Lou Gehrigs disease, you may qualify for Medicare benefits below the eligibility age.

You can also still get full Medicare benefits even if you dont qualify based on your work record or your spouses. However, you still must be at least 65 and a U.S. citizen or a legal resident of the U.S. for at least five years. To qualify, you must pay premiums for hospital insurance and pay the same monthly premiums that other enrollees pay for doctor visits and prescription drug coverage .

Don’t Miss: Are Legal Residents Eligible For Medicare

What Are The Differences Between Medicare And Medicaid

Medicare is a federal health insurance program open to Americans aged 65 and older, and those with specific disabilities who are under the age of 65. Medicaid, a combined state and federal program, is a state-specific health insurance program for low-income individuals with limited financial means, regardless of their age.

Medicare, generally speaking, offers the same benefits to all eligible participants. However, coverage is divided into Medicare Part A, Part B, and Part D. Medicare Part A is for hospice care, skilled nursing facility care, and inpatient hospital care. Medicare Part B is for outpatient care, durable medical equipment, and home health care. Part D is for prescription coverage. Not all persons will elect to have coverage in all three areas. In addition, some persons choose to get their Medicare benefits via Medicare Advantage plans, also called Medicare Part C. These plans are available via private insurance companies and include the same benefits as Medicare Part A and Part B, as well as some additional ones, such as dental, vision, and hearing. Many Medicare Advantage plans also include Medicare Part D.

Medicaid is more comprehensive in its coverage, but the benefits are specific to the age group. Children have different eligibility requirements and receive different benefits from low-income adults and from elderly or disabled persons.

Helpful Resources

Preparing As The Eligibility Age Nears

If a person already receives benefits from the Social Security Administration, the Administration will automatically enroll them in Medicare parts A and B.

The person will receive a âWelcome to Medicareâ packet 3 months before their 65th birthday, with instructions on how to sign up.

A person does not have to be retired to receive Medicare. If a person is not currently receiving Social Security benefits, they can apply for Medicare benefits as early as 3 months before their 65th birthday.

For example, if a person turns 65 years of age in April, they can apply for Medicare benefits in January of the same year.

Applying for Medicare benefits as early as possible may help the Social Security office process the paperwork in time for the personâs 65th birthday.

People who apply too late may face a premium 10% higher than that of those who apply on time. This premium would apply for double the time a person has been eligible but did not apply.

A person can apply for Medicare during their birth month or up to 3 months after their birth month without having to pay penalties for Medicare coverage.

However, their benefits will not begin until the Centers for Medicare and Medicaid Services process their request.

Recommended Reading: Are Resident Aliens Eligible For Medicare

New Proposal To Lower Medicare Age To 50 Could Be A Lifeline To Millions

A group of 21 Democratic senators have reintroduced legislation in Congress to lower the qualifying age for Medicare from 65 to 50.

When it comes to providing affordable health care for every American, there is more we must do right now to change the status quo, improve our health care system and lower costs, said Sen. Tammy Baldwin, a Democrat from Wisconsin and one of the cosponsors of the bill.

Baldwin added that this legislation would give millions of Americans an option to get the health care coverage they need at a price they can afford.

Heres what you need to know about the proposed reform and how to find affordable health coverage even if youre nowhere close to age 50.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

Another type of Medicaid program is Early and Periodic Screening, Diagnostic, and Treatment . This program is available to individuals under the age of 21 who live in households that meet certain financial criteria. This type of Medicaid also has an age restriction and could therefore also be considered age-based.

ABD and EPSDT are required by federal law to be included in all state Medicaid programs. But as long as certain federal requirements are met, state Medicaid programs are free to offer their own Medicaid benefits and eligibility guidelines to people who might not otherwise be eligible for these two programs. Age may or may not play a role, depending on where you live.

For example, Medicaid in North Carolina is only available to those age 65 and over or 21 and under unless you are pregnant, are responsible for a child age 18 and under, disabled or require long-term care.

But in North Dakota, Medicaid is available to all low-income adults, regardless of age.

It could be said that Medicaid is age-based in some states and for some programs, but it is not universally age-based.

You May Like: How Do I Get Dental And Vision Coverage With Medicare

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Quality Of Beneficiary Services

A 2001 study by the Government Accountability Office evaluated the quality of responses given by Medicare contractor customer service representatives to provider questions. The evaluators assembled a list of questions, which they asked during a random sampling of calls to Medicare contractors. The rate of complete, accurate information provided by Medicare customer service representatives was 15%. Since then, steps have been taken to improve the quality of customer service given by Medicare contractors, specifically the 1-800-MEDICARE contractor. As a result, 1-800-MEDICARE customer service representatives have seen an increase in training, quality assurance monitoring has significantly increased, and a customer satisfaction survey is offered to random callers.

Recommended Reading: Does Medicare Pay For Insulin Pumps

Medicare Vs Medicaid Compare Benefits

In the context of long term care for the elderly, Medicares benefits are very limited. Medicare does not pay for personal care . Medicare will pay for a very limited number of days of skilled nursing . Medicare will also pay for some home health care, provided it is medical in nature. Starting in 2019, some Medicare Advantage plans started offering long term care benefits. These services and supports are plan specific. But they may include:

- Adult day care

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

You May Like: What Does Part A Of Medicare Pay For

Progressives Wont Give Up On Medicare At 60 In Budget Package

Theres urgency for those pushing Medicare at 60 after Senate Democrats July 13, 2021 revealed a … $3.5 trillion budget blueprint backed by the White House that includes expanded dental, hearing and other benefits but doesnt change eligibility. In this photo, the American flag waves with the Capitol Hill in the background.

getty

Progressives and advocates for Medicare expansion arent about to give up on expanding eligibility to Americans between the ages of 60 and 64.

Theres urgency for those pushing Medicare at 60 after Senate Democrats revealed a $3.5 trillion budget blueprint with apparent backing from the White House that includes expanded dental, vision and other benefits but doesnt change eligibility.

A coalition of progressive members of Congress including U.S. Rep. Pramila Jayapal and other supporters of Medicare expansion like Families USA, several labor unions including National Nurses United will be part of a virtual town hall Wednesday night urging the president and Congress to also include Medicare eligibility changes and drug pricing reforms in the package.

In recent years, and particularly after Joe Biden was elected President last year, the option of buying into Medicare has gained more attention as people lost employer-sponsored health coverage during the pandemic and the spread of Covid-19.

Medicare Prescription Drug Coverage

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage .

Learn more about how to get Medicare drug coverage.

Each plan can vary in cost and specific drugs covered, but must give at least a standard level of coverage set by Medicare. Medicare drug coverage includes generic and brand-name drugs. Plans can vary the list of prescription drugs they cover and how they place drugs into different “tiers” on their formularies.

You May Like: Does Medicare Pay For Tdap Vaccine

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Will I Get Medicare At 62 If I Retire Then

If you retire before the age of 65, you may be able to continue to get medical insurance coverage through your employer, or you can purchase coverage from a private insurance company until you turn 65. While waiting for Medicare enrollment eligibility, you may contact your State Health Insurance Assistance Program to discuss your options.

Here are some ways you may be eligible for Medicare at age 62:

- You may qualify for Medicare due to a disability if you have been receiving SSDI checks for more than 24 months.

- You have been diagnosed with End-Stage Renal Disease .

- You are getting dialysis treatments or have had a kidney transplant.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

Recommended Reading: Should I Sign Up For Medicare While Still Employed

How Could Lowering The Medicare Age Affect People Eligible For Full Medicaid Benefits

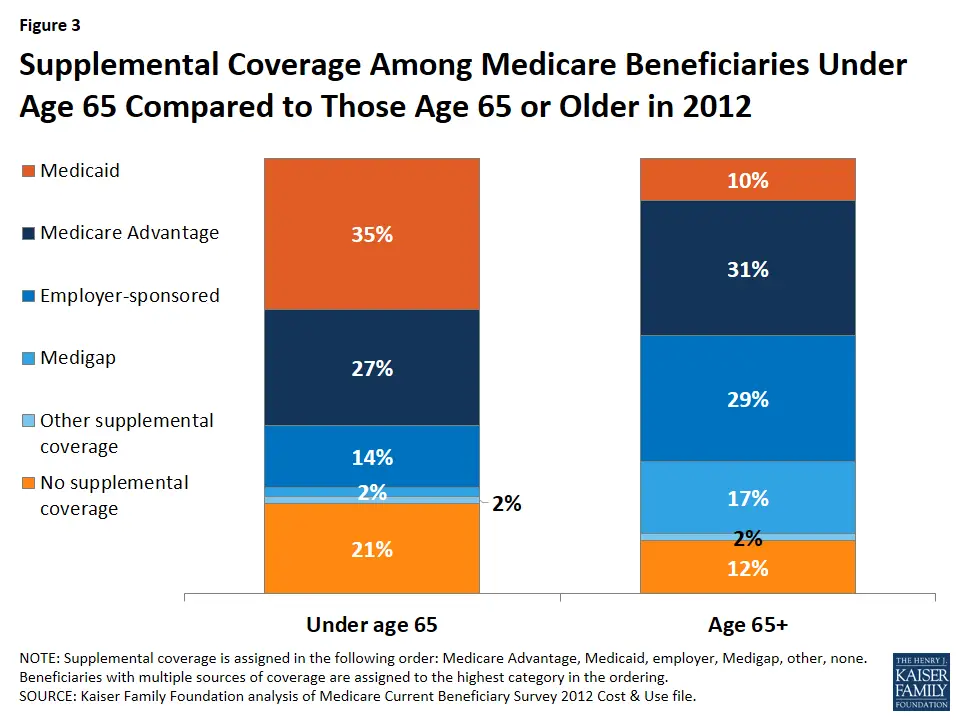

What is current policy? Today, some people are eligible for both Medicare and full Medicaid benefits, while others may lose Medicaid eligibility once they become eligible for Medicare. A persons status as a Medicare beneficiary does not qualify them for full Medicaid benefits. Instead, a person must independently qualify for Medicaid through an eligibility pathway based on low income or disability. Individuals in the 60-64 age range may qualify for Medicaid through various pathways that may have different eligibility criteria and benefit packages. For example:

What are the key policy choices and implications? Lowering the age for Medicare would require policy choices about whether to allow individuals in the new age range to continue to receive full Medicaid benefits, if eligible under the ACA expansion or other poverty- or disability-related pathways, or whether these individuals would move from Medicaid to Medicare as their sole or primary source of coverage. How these eligibility issues are resolved has important implications for enrollee benefits and cost-sharing as well as state and federal costs . Additionally, Medicare enrollment is limited to specific periods, while Medicaid enrollment is open year-round. However, Medicaid eligibility must be periodically renewed, while Medicare eligibility currently continues without the need to renew eligibility once a person turns 65.

Biden Plan To Lower Medicare Eligibility Age To 60 Faces Hostility From Hospitals

Of his many plans to expand insurance coverage, President-elect Joe Bidens simplest strategy is lowering the eligibility age for Medicare from 65 to 60.

But the plan is sure to face long odds, even if the Democrats can snag control of the Senate in January by winning two runoff elections in Georgia.

Republicans, who fought the creation of Medicare in the 1960s and typically oppose expanding government entitlement programs, are not the biggest obstacle. Instead, the nations hospitals, a powerful political force, are poised to derail any effort. Hospitals fear adding millions of people to Medicare will cost them billions of dollars in revenue.

Hospitals certainly are not going to be happy with it, said Jonathan Oberlander, professor of health policy and management at the University of North Carolina at Chapel Hill.

Medicare reimbursement rates for patients admitted to hospitals average half what commercial or employer-sponsored insurance plans pay.

It will be a huge lift as the realities of lower Medicare reimbursement rates will activate some powerful interests against this, said Josh Archambault, a senior fellow with the conservative Foundation for Government Accountability.

Biden, who turns 78 this month, said his plan will help Americans who retire early and those who are unemployed or cant find jobs with health benefits.

Avalere says 3.2 million people in that age group buy coverage on the individual market.

Read Also: When Is Open Enrollment For Medicare Supplement Plans