Medicare Part B: Doctors And Tests

Medicare Part B covers a long list of medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatment.

You’re not required to enroll in Part B if you have “” from another source, such as an employer or spouse’s employer. If you don’t enroll and you don’t have creditable coverage from another source, you may have to pay a penalty if you enroll later.

You pay a monthly premium for Part B. In 2022, the standard cost is $170.10, up from $148.50 in 2021. If you’re on Social Security, this may be deducted from your monthly payment.

The annual deductible for Part B is $233 in 2022. Once you meet the deductible, you pay 20% of the Medicare-approved cost of the service, provided your healthcare provider accepts Medicare assignment. But beware: There is no cap on your 20% out-of-pocket expense.

For example, if your medical bills for a certain year were $100,000, you could be responsible for up to $20,000 of those charges, plus the charges incurred under Part A and D umbrellas. There is no lifetime maximum.

Kathryn B. Hauer, MBA, CFP®, EA, a financial advisor with Wilson David Investment Advisors in Aiken, S.C., and author of Financial Advice for Blue Collar America, explains:

On the other hand, you pay nothing for most preventive services, such as diabetes screenings and flu shots, if you receive those services from a provider who accepts Medicare assignment.

Forms Necessary For Enrolling In Medicare Part B

There are two forms you need to submit for Medicare Part B.

First is Form CMS-40B, Application for Enrollment in Medicare Part B.

Next is Form CMS-L564, Request for Employment Information.

When you complete these forms you must state I want Part B coverage to begin in the remarks section for CMS-40B.

Complete Section B if your employer is unable to the best you can.

Can I Drop Other Coverage To Enroll In Part B

Once youre eligible for Part B, youre eligible.

If one of the exceptions applies that qualifies you for a Special Enrollment Period, you can drop other coverage and enroll in Part B at any time, assuming you have enrolled for Part A.

You may be automatically enrolled in Medicare Part A.

Your retiree health plan may require you to enroll in Medicare. Whether or not this is the case, many health plans coordinate benefits with Medicare.

Medicare is the usually the primary payer. You may find that adding part B coverage can help lower your overall out-of-pocket health care expenses. In any case, having other coverage doesnt typically block you from enrolling in Part B if you are eligible.

You should consult your human resources office or benefits administrator to see how your employee or retiree plan coordinates with Medicare.

Read Also: Does Medicare Offer Dental And Vision

What Factors Can Affect My Medicare Part B Premium

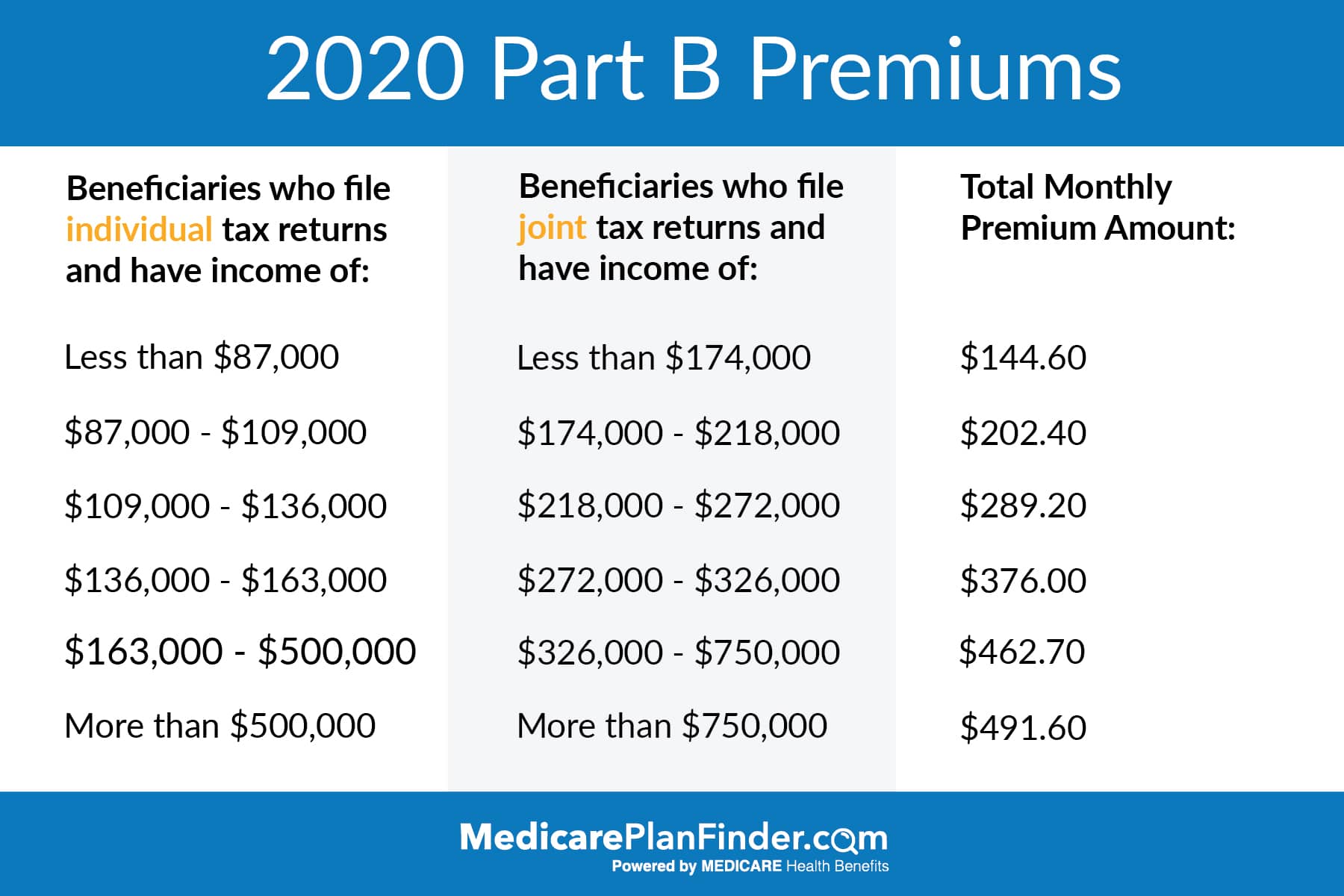

Most people actually pay less than the standard Medicare Part B premium amount, which is determined by the federal government each year. In 2021, the standard Medicare Part B premium is $148.50. You might pay more if you have a high income. See details below.

The standard premium also may apply to you if get both Medicare and Medicaid benefits, but your state may pay the standard Medicare Part B premium if you qualify.

If you delayed enrollment in Part B, you might have to pay a late-enrollment penalty along with your monthly premium- see below.

If your income is above a certain amount, you may be subject to the Income Related Monthly Adjustment Amount . See the table below.

What Are The Different Types Of Medicare

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments. Part C, also known as Medicare Advantage, seeks to cover any coverage gaps. Part D covers prescription drug benefits.

Also Check: Do You Need Medicare Part B To Get Part D

Medicare Part B Enrollment & Eligibility

If you already receive Social Security when you turn 65, you are automatically enrolled in Original Medicare .

If not, you need to sign up with Social Security when you first become eligible. Otherwise, you may face a late enrollment penalty.

You can sign up for Medicare in about 10 minutes on the Social Security website.

Once enrolled, you dont need to sign up again for coverage each year. However, you have an annual opportunity to review your coverage and change plans.

Open enrollment, also known as the annual election period, runs from Oct. 15 through Dec. 7.

Medicare Part A: Hospital Insurance

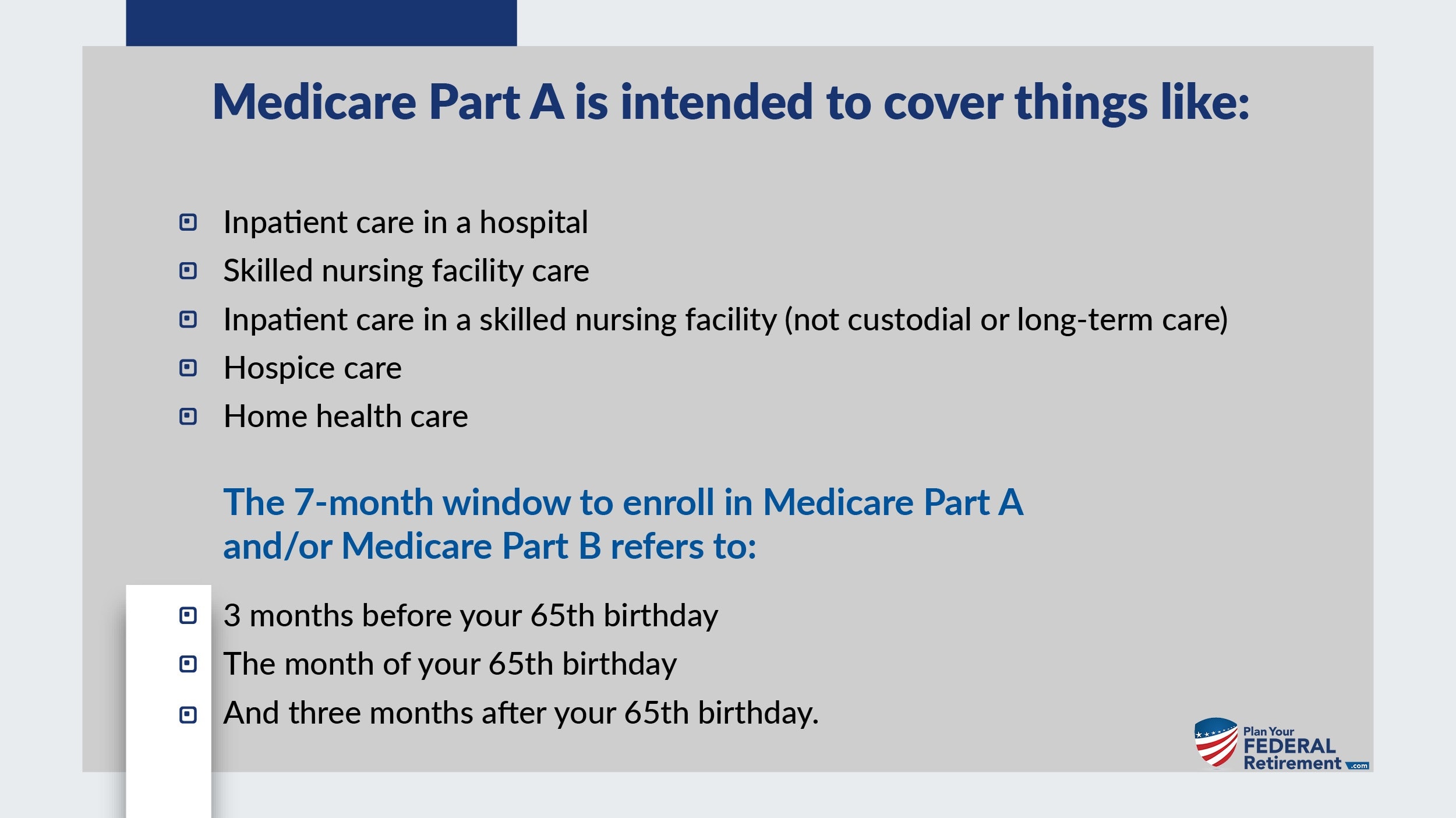

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,556 deductible in 2022.

Services covered under Part A may include surgeries, inpatient care in hospitals, skilled nursing facilities, hospice care, home healthcare services, and inpatient care in a religious non-medical healthcare institution.

This sounds straightforward, but itâs not. For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility.

Additionally, if youâre hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each dayâs expenses. If youâre admitted to the hospital multiple times during the year, you may need to pay a deductible each time.

Read Also: How Long Does It Take For Medicare To Become Effective

Recommended Reading: Does Medicare Pay For Eyeglasses For Diabetics

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

What Is Medicare Supplement

A Medicare Supplement insurance plan, sold by private companies, can help pay some of the out-of-pocket health-care costs that Medicare Part A and Part B dont pay, such as coinsurance, copayments, and deductibles. Some Medicare Supplement insurance plans may also help with costs of emergency medical care outside of the U.S. However, a Medicare Supplement insurance plan cannot be used to pay another plans premium, or to pay your Medicare Part A or Part B premium.

Similarly, Medicare doesnt pay for a Medicare Supplement insurance plan. If you have a Medicare Supplement insurance plan, you will need to pay the private insurance company for your Medicare Supplement premium as well as pay Medicare for your monthly Part B premium. If you receive Social Security benefits, in most cases your Part B premium is automatically deducted from your benefit payment.

Read Also: What Is Medicare Advantage Part C

Medicare Faqs And Information To Consider

Automatic Enrollment:

If you are already receiving Social Security benefits, Railroad Retirement benefits, or Federal Retiree benefits, your enrollment in Medicare is automatic. Your Medicare card should arrive in the mail shortly before your 65th birthday. Check the card when you receive it to verify that you are entitled to both Medicare Parts A and B.

Initial Enrollment Period:

If you are not eligible for Automatic Enrollment, contact the Social Security Administration at 800-772-1213 or enroll online at www.socialsecurity.gov, or visit the nearest Social Security office to enroll in Medicare Part A and Medicare Part B. You have a seven month window in which to enroll in Medicare without incurring a penalty. If youre not automatically enrolled in premium-free Part A, you can sign up for it once your Initial Enrollment Period starts. Your Part A coverage will start six months back from the date you apply for Medicare, but no earlier than the first month you were eligible for Medicare. However, you can only sign up for Part B during the times listed below.

General Enrollment Period:

- General Enrollment Period for Medicare Parts A & B

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

Also Check: Does Medicare Pay For Mobility Scooters

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2022 Part-B premium is $170.10 per month

Don’t Miss: What Is The Coinsurance For Medicare Part B

Medicare Part B Costs

While some people may be eligible for premium-free Medicare Part A if theyve worked at least 10 years and paid Medicare taxes during that time, most beneficiaries must pay a monthly premium for Medicare Part B insurance unless they qualify for low-income assistance. This premium amount may change from year to year. Learn how much you may have to pay for your Medicare Part B premium here.

If your income falls above a certain threshold, you may have to pay a higher amount for Medicare Part B coverage. This is known as an Income Related Monthly Adjustment Amount , which is an extra amount youll pay on top of your monthly Part B premium. Social Security will contact you if this applies to you.

In addition, you may owe certain out-of-pocket expenses for Medicare Part B-covered services, including copayments, coinsurance, and the Part B annual deductible. Once youve met your yearly deductible, youll usually pay 20% of the Medicare-approved amount for most medical services and supplies. However, this may vary, depending on the specific service or equipment.

Do you have questions about what Medicare Part B covers? Or perhaps youre interested in finding additional benefits beyond Original Medicare, such as through a Medicare Advantage plan. If youd like to discuss your Medicare coverage options with a licensed insurance agent, call eHealth today to learn about Medicare plan options that may work for your situation.

New To Medicare?

How Do You Sign Up For Medicare Part B

Signing up for Medicare Part B depends on your situation. In some cases, enrollment is automatic, and in others you must apply. If youre already receiving benefits from Social Security or the Railroad Retirement Board for at least four months before you turn 65, youll be automatically enrolled. If thats not the case, you can apply online at ssa.gov/medicare.6

That said, while most people should enroll in Medicare Part A, some people may choose to delay signing up for Part B. This typically depends on the kind of health coverage you have. For instance, if youre working and you still have health coverage through a job, or you have coverage through your spouse whos still working, you may be able to delay coverage without paying a late enrollment penalty.7 There are a lot of nuances find out about those and other situations here.

If you have Lou Gehrigs disease , end-stage renal disease , or youre under 65 and you are receiving Social Security Disability Insurance benefits, find out about enrollment here.

Recommended Reading: How Early Can You Get Medicare

What Do I Do After I Enroll In Medicare

Once youve started the application process, you should contact a licensed insurance agent to discuss your options for supplemental coverage. Individuals choose to enroll in either a Medicare Advantage plan or a Medicare supplement plan. You will also need to choose a Part D prescription drug plan, even if you arent taking any medications. As with Part B, you will be penalized for not enrolling in a Part D plan as soon as you are eligible.

Working with an independent Medicare advisor makes choosing additional Medicare coverage easy. They will educate you on your options and then help you choose the plans that make sense for you. If you have questions about your Part B enrollment or are ready to discuss supplemental coverage, give our office a call today.

When You Must Enroll In Medicare Part B

You may be required to get Medicare Part B even when youre still working. There are two situations in which youmust get Part B when you turn 65.

In each of the above cases, you wont qualify for a Special Enrollment Period and cannot delay enrolling without incurring late enrollment penalties.

Additionally, some employer plans will automatically become secondary to Medicare when you become eligible. In this case, Medicare becomes your primary insurance and would pay first. If you do not have Medicare and need health care, you would essentially have almost no coverage from your employer plan. One such plan that operates like this is the militarys TriCare for Life.

Also Check: Does Medicare Call To Verify Information

Im Under 65 And Have A Disability

Do I need to sign up?

You automatically get Part A and Part B after you get one of these:

- Disability benefits from Social Security for 24 months

- Certain disability benefits from the RRB for 24 months

Should I get Part B?

Certain people may choose to delay Part B. Find out more about whether you should take Part B.

How do I sign up?

You dont need to sign up if you automatically get Part A and Part B. Youll get your red, white, and blue Medicare card in the mail 3 months before your 25th month of disability.

Can I get a health or drug plan?

When you decide how to get your Medicare coverage, you might choose:

- A Medicare Advantage Plan

- Medicare prescription drug coverage

Medicaid Recipients And The $50000 Pip Option

Under the new auto no-fault law, recipients of Medicaid can select a $50,000 PIP medical expense option. This option is only available if:

Does Medicaid Cover Auto Accident Injuries Under the New Law?

If you are considering opting for this level of PIP coverage, it is absolutely crucial you first understand which services are not available through Medicaid but may be needed in the event of an auto accident. Again, CPAN has created a remarkable brochure for consumers to compare coverages.

Please visit .

Read Also: What Are The Medicare Open Enrollment Dates For 2020

Medicare Part B Enrollment: How Do I Get Medicare Part B

To be eligible for Medicare, you must be a United States citizen or legal permanent resident of at least five continuous years and 65 years or older. You can also be eligible for Medicare before 65 if youve been receiving disability benefits from Social Security or the Railroad Retirement Board for at least two years, or if you have end-stage renal disease or amyotrophic lateral sclerosis .

Like other parts of Medicare, there are rules concerning when youre eligible and when you can sign up for coverage. If youre already receiving retirement benefits before you turn 65, you may be automatically enrolled in Medicare Part A and/or Part B the month that you turn 65. Youre also automatically enrolled in Medicare if youve been receiving Social Security or Railroad Retirement Board disability benefits for at least two years youll be automatically enrolled in the 25th month of disability benefits. Those who qualify for Medicare because of end-stage renal disease must manually sign up for Part B.

You can also sign up for Medicare Part B during the following periods:

You can enroll in Medicare Part B through Social Security in the following ways:

- Online at SSA.gov. If youre not yet ready to apply for retirement benefits, you can apply for Medicare only.

- In-person at a local Social Security office.

Most Common Mistakes Regarding Part B

The most common mistake we see is from people who confuse Part B and Medigap. Just this week, a reader on our Facebook page commented that she was skipping Part B because she was enrolling in a Medigap plan instead.

She didnt realize that Part B and Medigap are not the same. She cannot purchase Medigap without first enrolling in Part B. I fault our federal government for making this all so confusing.

So just to recap what we covered earlier in this article: Part B is your base outpatient coverage. It pays for 80% of your outpatient services. A Medigap plan is what people with no other coverage buy to pay the other 20%. You need both Parts of Medicare in force before you are eligible to apply for a Medigap plan.

Another common question is: Do I have to apply for Medicare Part B? The answer is yes unless you signed up for Social Security income benefits before you turned 65. These people are automatically enrolled into Medicare.

Also Check: Should I Apply For Medicare If Still Working

Do I Need Medicare Part B If I Have Other Insurance

Many people ask if they should sign up for Medicare Part B when they have other insurance or private insurance. At a large employer with 20 or more employees, your employer plan is primary. Medicare is secondary, so you can delay Part B until you retired if you want to.

Keep in mind that both parts of Medicare can coordinate with large employer coverage to reduce your spending. Youll need to decide whether you want to enroll in Part B or delay it until later.

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $170.10/month for new enrollees in 2022. You can avoid that cost by simply delaying your Part B enrollment until you retire.