Do You Need Medicare Part B

Ever wonder if you really need Medicare Part B? For most people over 65 the answer is: Yes, you need to enroll in Part B and you should do so when first eligible. If you miss your Part B deadline, you could be subject to penalties. Check out our Medicare deadline Calculator here

When to enroll in Medicare Part B largely depends on whether you has qualifying job-based or retirement insurance that can act in place of Part B. If so you may be able to waive Part B due since you have credible coverage through work. If you dont have access to credible coverage from a work or spouse, it is usually recommended that you enroll in Medicare Part B when first eligible .

Even if you have retirement insurance, you may still have to enroll in Part B. Most retirement programs require it. Check with your HR team and confirm your situation. Make sure that if you waive Medicare Part B due to retirement insurance, that you are not subject to Part B penalties if you enroll later.

For those who have retirement coverage, You have 8 months to enroll in Medicare once you stop working OR your employer coverage ends . If you do not enroll in Part B within 8 months of losing your coverage based on current employment, you may have to pay a lifetime late enrollment penalty and have a gap in coverage.

Does Part B Cover Prescription Drugs

Short answer: No, Part B doesnt typically cover prescription drugs.

Longer answer: Part B may cover some drugs in a specific situations, typically only those that are administered by a doctor in their offices or in a clinic.

To get Medicare coverage for most retail prescription drugs, you need a Medicare Part D prescription drug plan or a Medicare Advantage plan that includes prescription drug coverage.

When Can I Sign Up For Medicare Part C Or Part D Or Change Plans

- If youre new to Medicare, you can enroll in Medicare Part C or Part D during your Initial Enrollment Period.

- The fall may be a good time to compare plans and see if youre getting the best possible Medicare health or prescription drug plan for your needs. You can change plans during the Annual Election Period.

Is it time to compare plans to see if theres any plan in your area that may be better for you? Just click the button on this page to get started with no obligation. You can also contact eHealth to reach our licensed insurance agent.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

Don’t Miss: Who Do You Call To Sign Up For Medicare

Should I Enroll In Part B If I Have Fehb Coverage

Deciding whether to enroll in Part B is complicated. And unlike Medicare Part A, all enrollees pay a premium for Medicare Part B . While FEHB plans cover most of the same types of expenses that Medicare covers, FEHB plans coverage may be more limited than Medicare Part B when it comes to orthopedic and prosthetic devices, durable medical equipment, home healthcare, medical supplies, and chiropractic care. Conversely, FEHB plans cover emergency care received outside the United States, and this isnt covered by Original Medicare at all and is rarely covered by Medicare Advantage. FEHB plans may also pay for vision and dental care thats not covered by Original Medicare and is limited in Medicare Advantage.

If you are covered by an FEHB HMO plan, youre normally limited to seeing providers who are part of your plan. Having Part B means you can go outside the HMOs network and see other providers, as long as theyre part of Medicare.

Basics Of Medicare Part D

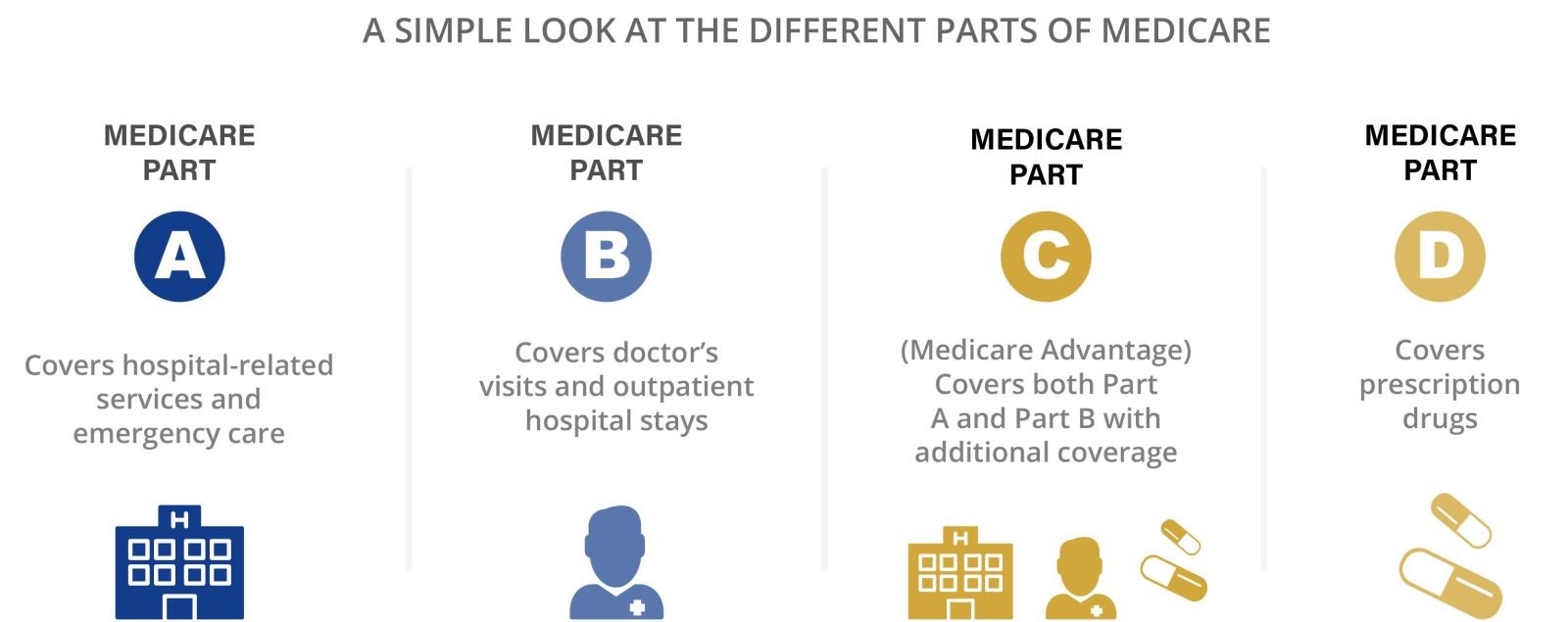

There are two ways to get prescription drug coverage through Medicare Part D.

- Enroll in a stand-alone Medicare prescription drug plan . If you enroll in a stand-alone prescription drug plan, it works alongside your Original Medicare benefits.

- Or, enroll in a Medicare Advantage plan with prescription drug coverage, or an MA-PD. A Medicare Advantage plan is an alternative way to get your Original Medicare benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications.

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance. The amounts can vary from plan to plan.

Prescription Drug plans include formularies, which are a list of the medications that are covered under the plan. Some formularies have tiers. Medications in lower tiers may have lower costs. Generic medications are often included in the lower tiers. When you are preparing for Medicare Part D enrollment, it is important to make sure the medications you take are included in the plans formulary.

You May Like: How Do I Check On My Medicare Part B Application

Medicare Part B And Va Benefits

Medicare Part B can provide you with medical coverage and services outside of the VA health system. Therefore, it is recommended that you enroll in Medicare Part B in addition to your VA benefits. If you wait to enroll in Part B when you are first eligible, you will likely experience gaps in coverage and incur a penalty for each 12-month period you were without Medicare Part B coverage. Learn more about Medicare Part B.

Should I Suspend My Fehb Cover To Enroll In Other Coverage

You can suspend your enrollment in FEHB to enroll in Medicare Advantage or other eligible coverage by contacting your agencys retirement system, and providing them documentation that you enrolled. If you do this, youll be allowed to leave your Medicare Advantage plan and return to FEHB. You usually have to wait until Medicares fall open enrollment and FEHBs Open Season to re-enroll in FEHB. You wont have to wait until an enrollment period if your Medicare Advantage plan ends through no fault of your own. In that case, you could re-enroll between 31 days before and 60 days after your Medicare Advantage plan ends. The FEHB coverage would begin the day after the Advantage plan terminates.

FEHB also allows you to suspend your enrollment if you want to use health coverage through Medicaid, Peace Corps, CHAMPVA, TRICARE, or TRICARE-for-Life. You can re-enroll in FEHB if this other coverage ends through no fault of your own. If you cancel your FEHB coverage instead of suspending it, youll never be able to re-enroll.

Although FEHB coverage can be more generous overall than Medicare Advantage or Original Medicare, having additional coverage may not be helpful if you cant afford its premiums. If you qualify for the Medicare Savings Program or Medicaid, you may find your healthcare costs are lower overall if you dont use FEHB.

Don’t Miss: Which Medicare Plans Cover Silver Sneakers

Whats Medicare Part D

Medicare Part D is the Medicare prescription drug coverage program. Medicare Part D is optional coverage and you can get it from private, Medicare-approved insurance companies in a couple of different ways.

- If youre enrolled in Original Medicare, Part A and/or Part B, you can sign up for a stand-alone Medicare Part D prescription drug plan.

- If youd rather enroll in a Medicare Advantage plan , chances are you can get Medicare Part D coverage through your Medicare Advantage plan.

I Have Va Benefits Do I Need Medicare

If you have VA benefits and Medicare, donât go canceling your Medicare coverage!

Just so weâre all on the same page, you can only be eligible for VA benefits if you meet a slew of eligibility requirements including financial status and how long you were enlisted. If you donât meet these requirements , youâll definitely need to enroll in Medicare.

In this article, weâll help you determine whether or not you need Medicare Part B, Medicare Part D, how Medicare coordinates with VA benefits, if you need a Medicare Supplement when you have VA benefits, and more.

Also Check: Can You Apply For Medicare At 64

Do I Need Medicare Part B If Im A Veteran

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of Medicare are one group. The most common situation though is with Veterans.

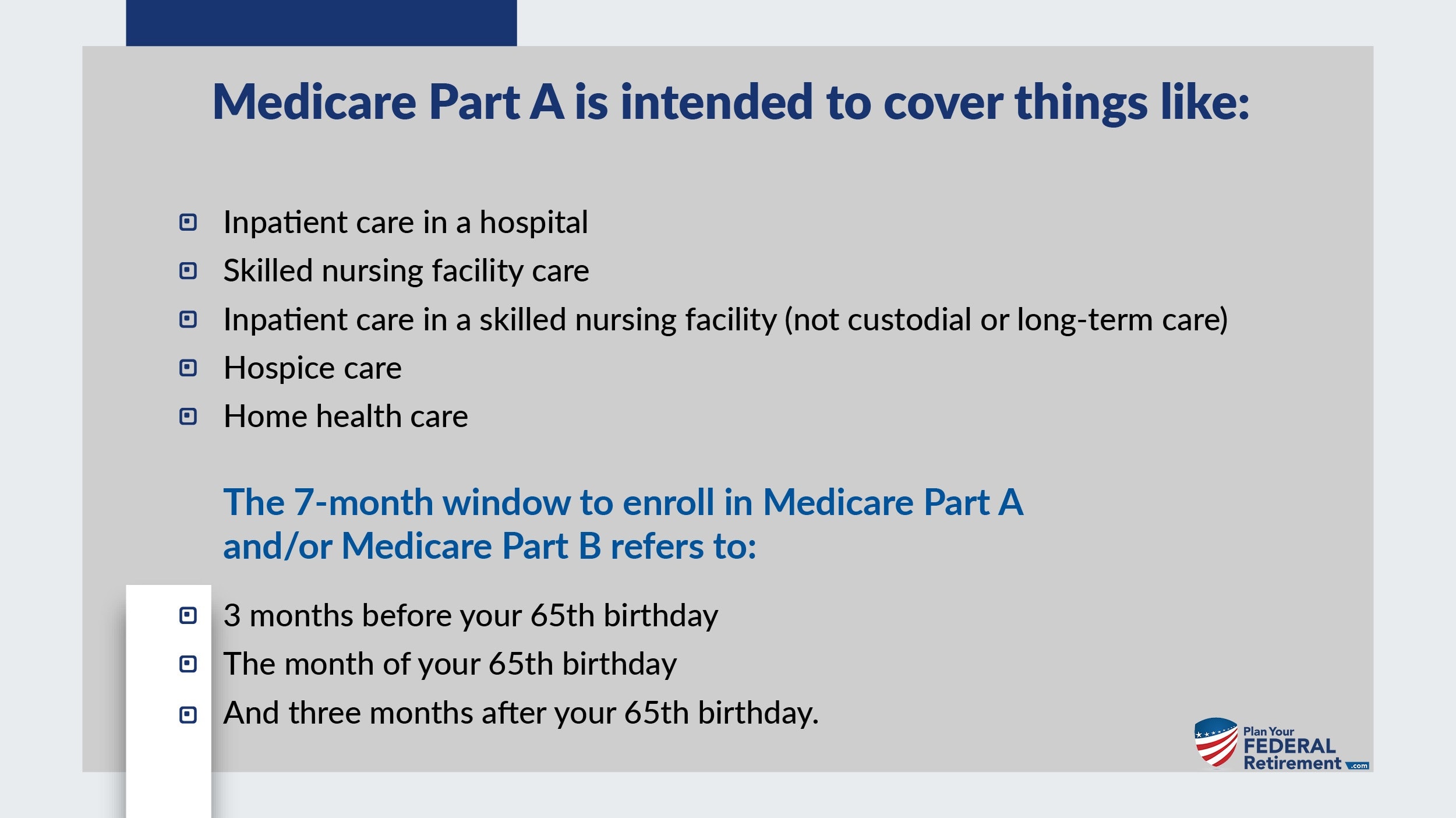

Not all veterans qualify for VA coverage. Your length of military service and your discharge characterization affect your eligibility. If you plan to use VA healthcare coverage as your only coverage, be sure that you apply for VA coverage before your initial enrollment window for Medicare expires. That window runs 3 months before and after your birth month.

Once enrolled in VA coverage, you can choose to skip Medicare and get all of your care at VA clinics and hospitals only. However, I do not advise this. The VA system has been the subject of considerably negative press for years over long waiting times. I have seen many people personally experience this.

Enrolling in Medicare Parts A and B gives you a civilian option. Medicare will pay for Medicare-covered services or items, and Veterans Affairs will pay for VA-authorized services or items.

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. Youll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active.

In my opinion, most Veterans should sign up for Part B. You can read more about VA coverage and Medicare here.

General Enrollment/medicare Advantage Open Enrollment

From January 1 to March 31, you can change or drop Medicare Advantage plans with Part D coverage or join original Medicare during this time.

You cant join a Part D plan during this time if you have original Medicare.

If you have questions about your Medicare part D coverage or enrollment periods, reach out to the insurance company from whom you purchase your coverage, contact the State Health Insurance Assistance Programs National Network or call 800-MEDICARE.

Read Also: What Is The Deadline For Medicare Supplemental Insurance

What Is Medicare Part D

Medicare Part D is prescription drug coverage. You can get Medicare Part D either through a stand-alone plan or through a Medicare Advantage plan. If your Medicare Advantage plan includes prescription drug coverage, you cannot be enrolled in a stand-alone Medicare Part D Prescription Drug Plan at the same time. Stand-alone Part D prescription drug plans generally go together with Original Medicare coverage.

All Medicare Part D coverage is offered by private insurance companies and not by the federal government. The governments Medicare program, Original Medicare, does not include coverage for most prescription drugs you take at home. You will generally only get Original Medicare coverage for prescription drugs if you receive them as a hospital inpatient or as injection as a doctor office outpatient. There may only be other limited situations where Original Medicare will pay for prescription drugs. Without Medicare Part D coverage, you may have to pay for most of your prescription drugs out of pocket.

Do I Have To Enroll Or Renew Medicare Part B Every Year

Medicare Part B will continue as long as you are paying your insurance premiums. For most people, these fees are subtracted for your Social Security payments. If you do not receive Social Security, Medicare sends a bill.

If you miss three payments in a row, you will receive a cancellation notice. If you do not pay what is due at that time, your plan will get cancelled, and you will have to wait until the next general enrollment period to get your Part B reinstated. Just be aware that you will likely have a penalty fee at that time.

Don’t Miss: When Does My Medicare Coverage Start

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

Medicare Part C And Va Benefits

If you need additional services or coverage not offered to you through your VA benefits, you may consider a Medicare Advantage plan. Most Medicare Advantage plans offer additional coverage, like vision, hearing, dental, prescription drug coverage, and/or health and wellness programs. These services are usually offered through your VA benefits too, however, a Medicare Advantage plan might be a better choice depending on the facility locations and your travel needs. Learn more about Medicare Part C.

Also Check: How Much Is Medicare B

Are You Automatically Reenrolled In Medicare

In most circumstances, you will be automatically reenrolled in your Medicare plan. The only reason why that might not be the case is if your plan is ending, the company your plan goes through is no longer in business, or if you have missed more than three months of payments in a row.

Even though it is automatic, you should still review your plan information annually. In September every year, you will receive an Annual Notice of Change that will cover all the changes your plan will have in the next calendar year.

How Does A Medicare Advantage Plan With Medicare Part D Included Cover My Prescription Drugs

The prescription drugs covered by your Medicare Advantage plan will be listed in the plans formulary, or list of covered medications. If a prescription drug you need is not covered by your Medicare Advantage plans formulary you can appeal that it be covered or switch plans during the Open Enrollment Period October 15-December 7 each year. Medicare Advantage plans generally put covered prescription drugs on tiers, which is a way to charge for different prescriptions. Tier 2 prescription drugs typically cost more than tier 1 prescriptions, and so forth.

For example, for a 30-day supply of your medication you may pay:

Tier 1 $10.00 copay

Tier 2 : $17.50 copay

Tier 3 : $45.00 copay

Tier 4 : $95.00 copay

Tier 5 33% coinsurance

Tier 6 $10.00 copay

Do you want to find a Medicare Advantage plan in your area that includes Medicare Part D coverage for prescription drugs? Just enter your zip code on this page to begin searching.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Don’t Miss: Are Resident Aliens Eligible For Medicare

Tips For Choosing A Medicare Part D Plan

Remember, the plan you choose isnt set in stone. If your needs change year to year, you can switch to another plan in the next open enrollment period. Youll have to stay in the plan an entire year, so choose carefully.

When using the Medicare plan finder to choose a Part D plan, enter your medications and doses, then select your pharmacy options. Of the available drug plans, youll see the lowest monthly premium plan displayed first. Keep in mind, the lowest premium plan may not fit your needs.

Theres a drop-down selection to the right of the screen listing three options: lowest monthly premium, lowest yearly drug deductible, and lowest drug plus premium cost. Click through all the options and look at your choices before making a final decision.

Can I Drop Other Coverage To Enroll In Part B

Once youre eligible for Part B, youre eligible.

If one of the exceptions applies that qualifies you for a Special Enrollment Period, you can drop other coverage and enroll in Part B at any time, assuming you have enrolled for Part A.

You may be automatically enrolled in Medicare Part A.

Your retiree health plan may require you to enroll in Medicare. Whether or not this is the case, many health plans coordinate benefits with Medicare.

Medicare is the usually the primary payer. You may find that adding part B coverage can help lower your overall out-of-pocket health care expenses. In any case, having other coverage doesnt typically block you from enrolling in Part B if you are eligible.

You should consult your human resources office or benefits administrator to see how your employee or retiree plan coordinates with Medicare.

Recommended Reading: Does Medicare Cover Prolia Injections

Will Fehb Be My Primary Coverage Or Medicare

If you have FEHB and do enroll in Medicare, then Medicare will be your primary coverage and your FEHB plan will pay after Medicare does. Having Medicare could reduce your out-of-pocket costs, because many FEHB plans waive cost sharing for enrollees who have Medicare. Even if this isnt the case, as long as your provider takes both your FEHB plan and Medicare, the most youd have to pay for care is the difference between what Medicare and your FEHB plan pay and Medicares limiting charge.

. Some states dont allow excess Medicare charges. If you live in one of these states or you see a doctor in any state that accepts Medicares rate as full payment youd only have to pay the difference between what Medicare and your FEHB plan pay and Medicares rate. Part Bs limits on what you can be charged dont apply to some services, and Part A doesnt have these limits.)

If you enroll in Part A but decline Part B, your FEHB coverage will pay after Medicare does for Part A services, but will be your primary insurer for other medical care. Medicare would no longer be your primary insurer if you return to work for the federal government, however, and in that case your FEHB plan would pay first, with Medicare paying at least some of your remaining costs.