What Is A Medicare Advantage Plan

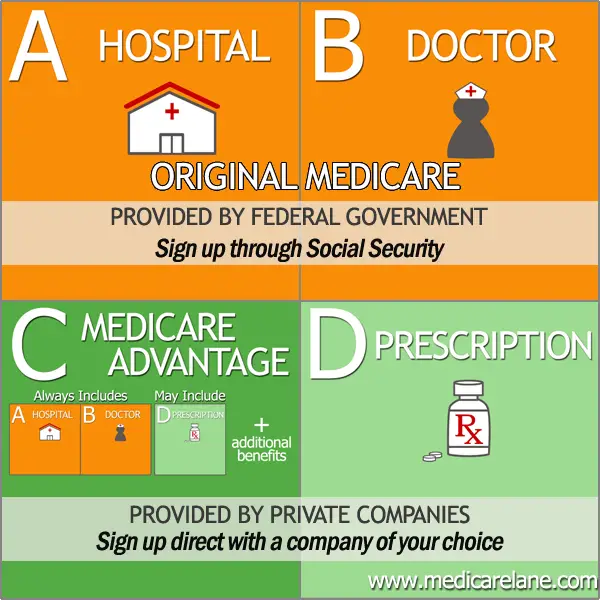

Medicare Advantage, also called Part C, is offered by private health insurance companies as an alternative to Original Medicare.

When you become eligible for Medicare, you can decide between either Original Medicare or Medicare Advantage. You can also change between the two types of Medicare later during an open enrollment period.

Medicare Advantage costs are on top of Part A and Part B premiums. Medicare Advantage plans often have supplemental coverage not found in Original Medicare, such as prescription drug, dental, and vision insurance.

What Are Lifetime Medicare Reserve Days

Medicare lifetime reserve days refers to the 60 days a Medicare beneficiary may use once they exhaust the first 60 days of Part A and the additional 30 days with the $371 co-insurance.

The patient dips into the lifetime reserve days Medicare provides. These days, however, are not free. The coinsurance is $742 per day. Once these 60 lifetime reserve days are exhausted, the patient assumes all costs in the hospital, assuming there is no other insurance.

How To Appeal A Denial Of Coverage

Medicare Advantage Plans must pay for the same medically necessary equipment and services as Medicare Part A and B. If your Medicare plan wont pay for a wheelchair you believe you need, you may appeal the denial of coverage and get an independent review of your request.

The appeal process for wheelchairs and other DMEs is the same as for other Medicare-covered services. In Original Medicare, the appeal starts with the Medicare Administrative Contractora private health insurer with the geographic jurisdiction to process Original Medicare medical claims or Durable Medical Equipment claims. In Medicare Advantage, the appeal process starts with the plan administrator.

If youre denied coverage, you should receive a denial letter that provides information on deadlines to appeal and the process to follow.

Also Check: When Can I Start Collecting Medicare Benefits

Medicare Prescription Drug Coverage

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage .

Learn more about how to get Medicare drug coverage.

Each plan can vary in cost and specific drugs covered, but must give at least a standard level of coverage set by Medicare. Medicare drug coverage includes generic and brand-name drugs. Plans can vary the list of prescription drugs they cover and how they place drugs into different “tiers” on their formularies.

Enrollment Period For Medicare Part A

Youre eligible to enroll in Medicare Part A during your Initial Enrollment Period , which is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes your birth month, and lasts up to three months after your birthday month.

When you apply for Social Security benefits, youre automatically enrolled in Medicare Part A.

Recommended Reading: Why Have I Not Received My Medicare Card

Medicare In A Nutshell

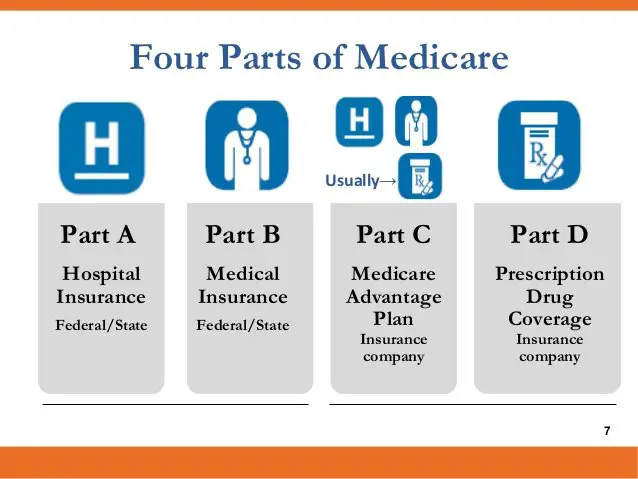

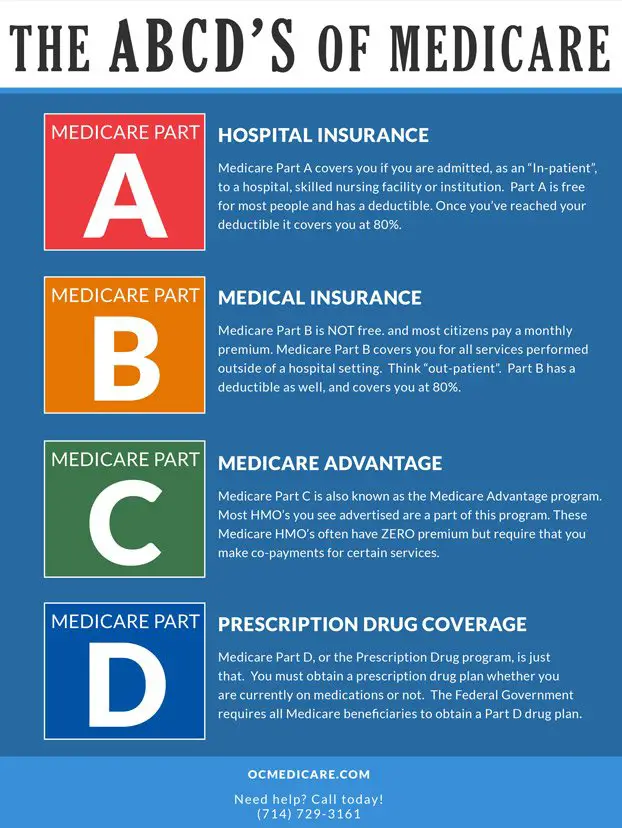

In its current iteration, Medicare provides health insurance for Americans age 65 and up, and for individuals of any age with a permanent disability or end-stage renal disease . Medicare is made up of four parts:

-

Part A provides hospital insurance

-

Part B provides medical insurance

-

Part C comprises Medicare Advantage Plans and

-

Part D provides prescription drug coverage.

Since its signing into law in 1965 by President Lyndon B. Johnson, Medicare has undergone numerous revisions. The Centers for Medicare and Medicaid Services offers a timeline of key legislative milestones affecting Medicare and other health programs from 1965 to 2003.

Medicare Part A Deductible In 2021

Medicare Part A comes with some costs to you. Most people dont have to pay a Part A monthly premium. You may pay coinsurance and/or copayments. You can read more about Part A costs.

The Part A deductible is not an annual amount. Instead, its per benefit period. A benefit period starts the day youre admitted as a hospital or skilled nursing facility inpatient. It ends when you havent had inpatient care for 60 days in a row. So, you might pay multiple Part A deductibles in one year if you spend a lot of time in a hospital.

The Medicare Part A deductible is $1,484 in 2021.

Would you like to take a look at some of the Medicare plans available in your area? Just enter your zip code in the box on this page to display a list and start comparing plans.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Don’t Miss: What Is The Extra Help Program For Medicare

Medicare Part A: Hospital Care And Services

Medicare Part A generally covers inpatient medical services. This includes stays in a hospital or nursing facility. It also pays for some home care and hospice.

Medicare Parts A and B are sometimes called “Original Medicare.” Original Medicare allows you to go to any doctor or hospital that accepts Medicare.

The Social Security Administration handles Medicare enrollment. You are automatically enrolled in Medicare Part A and Part B if you’re 65 and receive Social Security checks. Typically, you’ll get your Medicare card three months before your 65th birthday. Even if you have private health insurance through your employer, it likely makes sense to sign up for Medicare Part A because it will provide you with additional coverage at no extra cost. However, you may wish to delay signing up for Part B coverage — for which there is a monthly premium — if your employer insurance provides adequate coverage for outpatient medical services. If you do not have employer health insurance and you delay signing up for Medicare, you will have to pay a lifetime late enrollment penalty when you do enroll. If your employer coverage ends, you have 8 months to sign up for Part B to avoid paying a higher premium.

Medicare Part A pays some of the charges for:

For more information about Medicare Part A, see the Medicare web site or call 800-MEDICARE.

Medicare.gov: ”Medicare & You 2013” handbook, pp. 27-31.

Medicare Part A B C And D: What You Need To Know

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Medicare Parts A, B, C, and D are the four distinct types of coverage available to eligible individuals. Each Medicare part covers different healthcare-related costs. While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services , Medicare Part C and Medicare Part D are managed by private insurance companies.

Medicare is similar to the health insurance coverage youve probably had with an employer or an individual policy. It can cover doctor visits, inpatient and outpatient hospital care, prescription drugs, and lab tests. Depending on the plan you choose, your Medicare plan can also cover dental and vision, if you like.

Heres a brief overview of each of the parts of Medicare.

Also Check: How To Choose Best Medicare Part D Plan

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

Medicare Deductibles Affect Insurance Costs

It is important to note for those on Medigap policies or even Medicare Advantage that Medicare deductibles impact insurance costs. This extended coverage is the obligation of your Medigap policy or MA plan. Consequently, the insurance company actuaries must factor in the probability of occurrence and cost.

The cost is transferred to the price of the Medigap plan or co-pays on the MA plan. Many clients wonder why their Medigap plan premium is going up? There are many factors, but when Medicare lowers the amount it will cover, the insurance companies pass on the cost to the consumer.

Don’t Miss: What Does Part B Cover Under Medicare

The Solvency Of The Medicare Hi Trust Fund

This measure involves only Part A. The trust fund is considered insolvent when available revenue plus any existing balances will not cover 100 percent of annual projected costs. According to the latest estimate by the Medicare trustees , the trust fund is expected to become insolvent in 8 years , at which time available revenue will cover around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years. This and other projections in Medicare Trustees reports are based on what its actuaries call intermediate scenario but the reports also include worst-case and best-case projections that are quite different .

When Can You Sign Up For Medicare Part A

Medicare Part A enrollment comes with a seven-month Initial Enrollment Period for signup. This includes the three months before and after the month you turn 65, plus the month of your birthday. For instance, if you turn 65 in April, your Initial Enrollment Period stretches from January through July.13

If you arent automatically enrolled, you can sign up for Part A any time during or after your Initial Enrollment Period starts, and your coverage start date will depend on when you enroll.14

If you must buy Medicare Part A, you miss your initial enrollment and arent eligible for a Special Enrollment Period , you can sign up for Part A during the General Enrollment Period , which is January 1 and March 31 each year. There are a variety of reasons you might get a SEP, including losing employer health coverage.15

There is no late enrollment penalty if you sign up during a SEP. However, if you must buy Part A, and you didnt buy it when you were first eligible, you may pay higher premiums for a period of time when you do sign up.16

Read Also: Can You Apply For Medicare After 65

Medicare Part A Vs Part B

Part A and Part B are both components of Original Medicare, but they cover different health care services.

As stated earlier, Part A provides coverage for inpatient care in a hospital, skilled nursing facility care, nursing home care , hospice care, and home health care.

Part B provides Medicare coverage for outpatient care, doctor visits, outpatient surgical procedures, durable medical equipment, ambulance services, lab work, inpatient and outpatient mental health services, home health care, certain preventive services, and particular medications administered in a clinical setting.

Unlike Part A, Medicare Part B charges premiums based on your annual income earned two years prior, as reported on your IRS tax return. In other words, the 2021 cost for Part B is based on your earnings from 2019. Today, a monthly Part B premium varies from $148.50 to $504.90 monthly per person. Most people pay $148.50, but you may pay more for Part B if you have a higher household income.

In addition to paying premiums for Part B, you also pay approximately 20% of the costs of medical services after you meet your Part B deductible. Thats called coinsurance. Medicare covers the first 80% of eligible expenses and you cover the remaining costs.

Medicare Part A Coinsurance Payments Are Covered By

Once you exceed the first 60 days, you have a co-insurance of $371 per day from day 61-90. Medicare coinsurance is different from Medicare deductible in 2021. Again, this is assuming you have no Medigap policy or other health insurance.

Paying the Part A co-insurance amount is rare because most hospital stays end well before the 61st day.

Read Also: How Long Do You Have To Enroll In Medicare

How Much Does Medicare Part B Coverage Cost

Medicare Part B generally pays 80% of approved costs of covered services, and you pay the other 20%. Some services, like flu shots, may cost you nothing.

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount.

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021.

After you pay your deductible, you generally pay a 20% coinsurance for most covered services.

What Medicare Part D Plans Cover

Medicare drug plans cover both generic and brand-name drugs. All plans cover certain categories of drugs to treat specific conditions. Each plan decides which specific drugs to insure per category.

Each Medicare Part D plan lists the drugs it covers in a formulary, which typically includes both brand-name and generic drugs. Formularies change, so its very important to check regularly that your medicines are included.

You should also check each plan for restrictions on drug coverage, such as requirements that certain drugs be approved in advance by the insurer.

If you or your provider believe none of the covered drugs will treat your condition adequately, you can apply for an exception.

Recommended Reading: Does Medicare Cover Companion Care

Costs And Funding Challenges

Over the long-term, Medicare faces significant financial challenges because of rising overall health care costs, increasing enrollment as the population ages, and a decreasing ratio of workers to enrollees. Total Medicare spending is projected to increase from $523 billion in 2010 to around $900 billion by 2020. From 2010 to 2030, Medicare enrollment is projected to increase dramatically, from 47 million to 79 million, and the ratio of workers to enrollees is expected to decrease from 3.7 to 2.4. However, the ratio of workers to retirees has declined steadily for decades, and social insurance systems have remained sustainable due to rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office wrote in 2008 that “future growth in spending per beneficiary for Medicare and Medicaidthe federal government’s major health care programswill be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costswhich will be difficult, in part because of the complexity of health policy choicesis ultimately the nation’s central long-term challenge in setting federal fiscal policy.”

Medicare Part A Enrollment

Medicare Part A enrollment is sometimes automatic, meaning that the individual does not have to take any action to confirm the cover.

If a person is already getting social security, their enrollment in Medicare Part A will take place automatically 3 months before their 65th birthday.

Similarly, people who receive social security disability also receive automatic enrollment at the start of their 25th month of benefits.

People do not receive automatic Medicare enrollment if they are either over 65 years of age or 3 months from reaching 65 years and are not already getting social security. These individuals will need to sign up.

Individuals may apply for Medicare online through the Social Security Administration website or in person at a Social Security office.

The enrollment period for Medicare starts 3 months before a persons 65th birthday and ends 3 months afterward. There is also an open enrollment period in the fall.

When coverage for Medicare begins will depend on when the person signed up in relation to their 65th birthday.

For example, if a person signs up 3 months before their 65th birthday during the initial enrollment period, coverage will start on the first day of the month during which they reach 65 years of age.

You May Like: What Age Do You Apply For Medicare

Await Submission Of A Standard Written Order

The practitioner who performs your examination should prepare a standard written order , which documents that the wheelchair is a medical necessity. This is sent to a Medicare-approved supplier before it can deliver the equipment.

Only the practitioner who performs the in-person examination can write the SWO, which they must submit within six months after the examination.

Why Are Some Of Medigaps Plan Names Identical To Medicares Parts

The other Medicare program name that aptly describes its function is Medigap, also known as Medicare supplement insurance. It fills in the gaps, taking care of deductibles and copayments for enrollees who have original Medicare .

Medigap plans arent the same as Medicares four major parts . But the 10 federally standardized Medigap plans, first introduced in 1992, make up an alphabet soup of redundancy and potential confusion: A, B, C, D, F, G, K, L, M, and N.

That means, in most states, you can buy Medigap Plan A or B to protect you from out-of-pocket costs from Medicare Parts A and B. Of course, you can also buy a Medigap Plan G in many states to shield you from Medicare Parts A and B costs and so on.

But you can no longer buy Medigap Plans E, H, I, or J. If you already have any of those four plans, you can keep them, but they have been closed to new buyers since 2010. As some Medigap plans are restricted, typically by new laws, insurance agents may encourage existing enrollees to switch to newly created plans. These new plans may be more affordable and often come with letter names from further down the alphabet.

Government programs rarely take their cues from flashy tech or car companies. But imagine if the naming culture of private enterprise had influenced Medicare supplement insurance so youd now have a choice of a Medigap Tiger or Jaguar plan instead.

-

Platinum

-

Bronze

Also Check: Does Medicare Cover Mental Health Visits