What Happens If I Dont Pay My Premiums On Time

If you dont pay your Part B premiums on time, you could lose coverage. It wont happen immediately, however.

You have a 90-day grace period after the due date. Once the grace period passes, Medicare will send you a letter letting you know that you have 30 days to pay the bill or you will lose coverage. That makes a total of four months to pay your bill before Medicare will stop paying for covered services.

Private insurance plans may treat late payments differently. Check with your plan carrier if you have questions about the policies.

Ways To Find Out If Medicare Covers What You Need

Medicare Advantage Msa: A Special Type Of $0 Premium Plan

Another type of Medicare Advantage plan thats available is the Medical Savings Account plan. This plan is different because its designed to not include Medicare Advantage premiums at all. This $0 premium is not because the insurance company is passing on savings to plan members. As with all Medicare Advantage plans, you still pay your Part B premiums when you enroll in a MSA plan.

The trade off with not having a monthly premium is that MSA plans have a high deductible. The deductible is the amount of Medicare-covered services you must pay for out-of-pocket before the plan starts paying for covered services. The money that goes into your MSA can be used to pay your deductible and other healthcare costs.

Recommended Reading: What Age Does Medicare Eligibility Start

Can I Enroll In Medicare Part B At Any Time

To enroll in Medicare Part B you must have a valid enrollment period.When you first become eligible for Medicare, you are given an Initial Enrollment Period. If you do not enroll during this time, you must wait until the General Enrollment Period to enroll in coverage. The only exception to this is if you qualify for a Special Enrollment Period.

If you qualify for a Special Enrollment Period, this means that you receive an individualized time to enroll in Medicare Part B without penalty based on a special circumstance. It is essential to utilize these opportunities if you have the chance. If you do not have a Special Enrollment Period, you may be required to pay a Medicare Part D late enrollment penalty.

Signing Up For Medicare Part B

There are specific time periods that you can sign up for Part B. When you can or should sign up for Part B depends on your age and whether you or your spouse are still working. For more information, see Nolo’s article on Medicare enrollment periods and coverage start dates.

You could be eligible for up to $3,148 per month In SSDI Benefits

Also Check: How Much Does Social Security And Medicare Take Out

How To Make Premium Payments

Your Part B Medicare premiums are billed directly through Medicare, while your Part C premiums are billed through the private insurance company associated with your Medicare Advantage plan. Heres how you pay Medicare and your private insurance company.

- Premium Payments to Medicare: If you receive Social Security, Office of Personnel Management, or Railroad Retirement Board benefits, Medicare will automatically deduct your Part B premiums from your benefits check. If you dont receive these benefits, you will receive a bill called Notice of Medicare Premium Payment Due. You can then pay by mailing a check, using online banking services, or signing up for Medicares bill pay, which will automatically draft the premium from your bank account each month.

- Part C Premium Payments to Private Insurance Companies: If your insurance company charges a premium for your Medicare Part C plan, you can set your payments to come from your Social Security benefits. But this is not an automatic action. You must submit a request to Social Security, and they have to approve your request before your Part C premium payments will be deducted. If you dont get Social Security, you can mail in a check or have your premium automatically drafted from your bank account.

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

Recommended Reading: Do You Have To Start Medicare At 65

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Is Medicare Mandatory When Youre First Eligible

If youre still working when you turn 65, or you become eligible through disability, you may be covered under your employers group plan. Or maybe your spouse has an employment-based or union-based group health plan that covers you. You usually dont have to enroll in Medicare right away if you have a group health plan.

Traditional Medicare refers to Medicare Part A, which is hospital insurance, and Part B, which is medical insurance. Part A can be premium-free if youve worked and paid taxes long enough. If you qualify for premium-free Medicare Part A, theres little reason not to take it.

In fact, if you dont pay a premium for Part A, you cannot refuse or opt out of this coverage unless you also give up your Social Security or Railroad Retirement Board benefits. Youd also have to pay back your previous benefits to the government.

Donât Miss: Is Medicare Enrollment Required At Age 65

Read Also: How Do I Stop Medicare Calls

Medicare Part A: Hospital Insurance

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,556 deductible in 2022.

Services covered under Part A may include surgeries, inpatient care in hospitals, skilled nursing facilities, hospice care, home healthcare services, and inpatient care in a religious non-medical healthcare institution.

This sounds straightforward, but itâs not. For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility.

Additionally, if youâre hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each dayâs expenses. If youâre admitted to the hospital multiple times during the year, you may need to pay a deductible each time.

Read Also: How Long Does It Take For Medicare To Become Effective

What Is The Difference Between Medicare Part A And Medicare Part B

Medicare Part A and Medicare Part B are the two parts of Medicare that make up Original Medicare coverage. For most, Original Medicare is your primary healthcare coverage once you reach age 65 or receive disability income.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Medicare Part A handles inpatient services and benefits, whereas Medicare Part B covers outpatient, doctor, and medical supply benefits.

The two coverages work hand in hand but are not the same in terms of cost and benefits. Often, you will not need to pay a premium for Medicare Part A. However, you will need to pay a monthly premium for Medicare Part B. In terms of out-of-pocket costs, both parts of Medicare require you to pay deductibles, coinsurance, and copayments. However, those costs look very different between the two parts.

Read Also: Will Medicare Pay For Breast Implant Removal

Additional Options For Paying For Glasses

There are some options you can use to help offset the cost of glasses.

Additional insurance, such as private insurance, can provide vision benefits that can cover the cost of prescription eyewear, at least to an extent. You will need to talk to your insurance provider to find out what your coverage options are, what your out-of-pocket costs will be, and what provider and supplier you will need to use to get coverage for vision care and eyeglasses.

Other options, including nonprofits and organizations that offer services to reduce the costs of prescription eyewear, exist.

When Medicare does not offer the coverage you need for vision care and prescription eyewear, there are still options to get help with paying for glasses or even to get free glasses.

What Is Medicare Easy Pay

Medicare Easy Pay automatically deducts your Medicare premium from a designated checking or savings account. Youll still get a Medicare Premium Bill in the mail, but it will say, This is not a bill. It will serve as a statement letting you know that your premium has automatically been deducted from your bank account.

If you prefer to not have your Medicare premiums automatically deducted, there are a few other ways you can pay:

- You can sign onto MyMedicare.gov and pay your premiums online with your credit card or debit card.

- If you receive Social Security benefits, you can have your Medicare premiums deducted from your benefits.

- If you prefer to pay by check or credit card, you can return your Medicare bill with a check or credit card number by mail.

Using Medicare Easy Pay will save you time and prevent you from accidentally forgetting to pay your premiums.

Recommended Reading: Does Medicare Cover Air Evac

What Services Does Medicare Part B Cover

The following services are included:

- Doctor visits or appointments with other health care providers, including some doctor services when hospitalized

- Diabetes care, including education, certain equipment, prevention programs and screenings

- Diagnostic tests including CT scans, electrocardiograms, MRIs and X-rays

- Durable medical equipment, such as wheelchairs and walkers, that your doctor prescribes for use in your home

- Emergency department and outpatient surgery center services as well as other outpatient hospital services

- Some health programs, such as cardiac rehabilitation, obesity counseling and smoking cessation

- Laboratory services, such as blood and urine tests

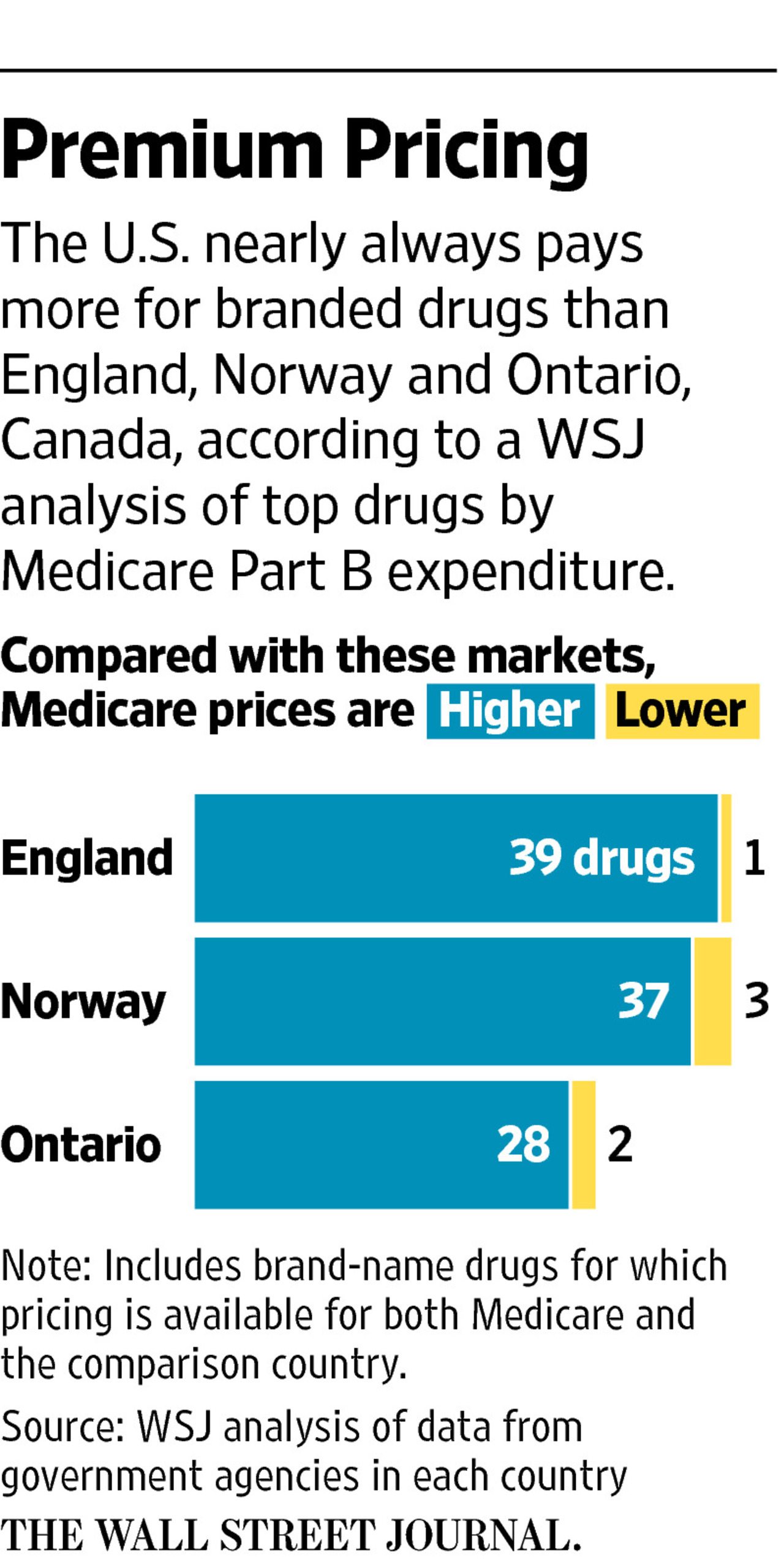

- A limited number of prescription drugs that you usually dont administer yourself

- Outpatient mental health services

- Outpatient physical therapy, occupational therapy, and speech and language pathology services

- Preventive care, such as flu shots and mammograms, to help avert illness or detect it at an early stage. Many preventive services are covered without deductibles or copayments.

- A Welcome to Medicare checkup and the annual wellness visit, which are covered in full without deductibles or copayments, unless additional tests are ordered.

When Is Medicare The Primary Payer

If you or your covered spouse are age 65 and have Medicare, it is the primary payer when you:

- Have FEHB coverage on your own as an annuitant, or through your spouse who is an annuitant

- Are a reemployed annuitant with the Federal government and your position is excluded from the FEHB, and you are not covered under FEHB through your spouse

- Are a Federal judge who retired under title 28, U.S.C., or a Tax Court judge who retired under Section 7447 of title 26, U.S.C.

- Are enrolled in Part B only, regardless of employment status

- Have Medicare because of end stage renal disease and are beyond the 30-month coordination period when you’re entitled to Medicare

- Are eligible for Medicare due to a disability and have FEHB coverage on your own as an annuitant

- Are covered under the FEHB Spouse Equity provision as a former spouse

After Medicare pays its share, your FEHB plan pays the remaining costs. This could help reduce your out-of-pocket costs since many FEHB plans waive cost sharing for enrollees who have Medicare. Cost sharing is the out-of-pocket costs you’d have such as deductibles, co-payments, and co-insurance.

Read Also: How Much Does Medicare Supplemental Health Insurance Cost

Will I Pay Less For Fehb Premiums If I Enroll In Medicare

FEHB premiums are not reduced if you enroll in Medicare, but having Medicare Part A and B can allow you to switch to a less expensive version of your current FEHB plan, because some FEHB insurers waive cost sharing when you have Medicare Parts A and B. Contact your FEHB insurer if youre wondering whether your plan waives cost sharing for people enrolled in Medicare.

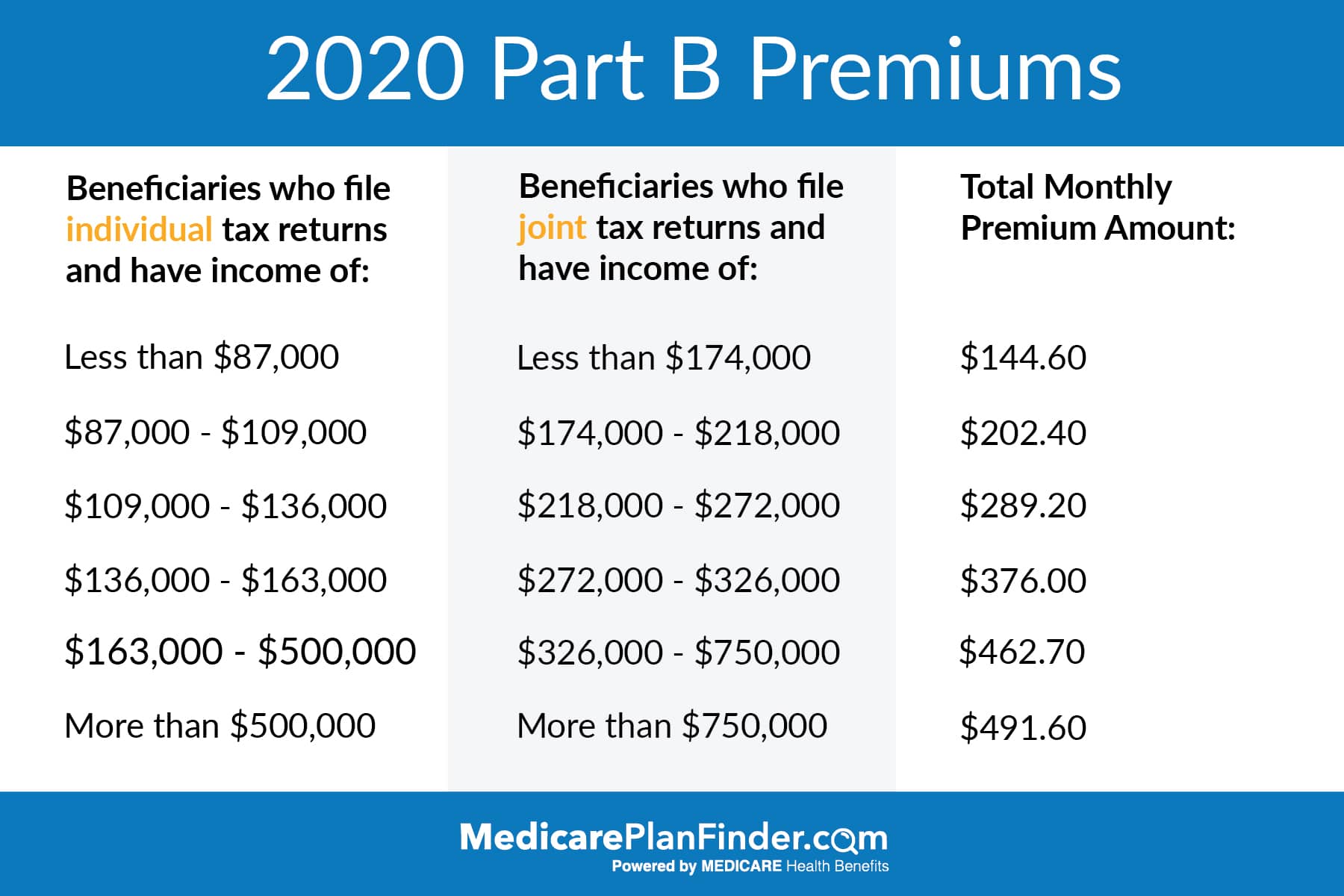

The decision whether to enroll in Part B often hinges on whether you have to pay more for it because of your income. You pay more for Part B in 2020 if you earn over $87,000 , according to your tax return from two years ago. These higher premiums can range from $202.40/month to $491.60/month. Youll have to gauge how much you are willing to pay in Part B premiums in exchange for lower cost sharing when you visit the doctor.

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youâre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youâre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a âguaranteed-issue rightâ to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition**. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.

Read Also: Can You Sign Up For Medicare Anytime

Defer Income To Avoid A Premium Surcharge

The standard premium for Medicare Part B is $170.10 per month in 2022 but that assumes youre not a higher earner. Those with higher income levels are subject to higher premium costs. For 2022 heres what youre looking at:

| 2022 Medicare Part B premium costs by income level | ||

|---|---|---|

| Income level: individual tax filer | Income level: joint tax filer | Total monthly premium |

| $750,000 and above | $578.30 |

If youre able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns. For example, your 2020 tax return will determine whether you pay a surcharge in 2022 .

Pay Your Premiums Directly From Your Social Security Benefits

Seniors who are enrolled in Medicare and Social Security simultaneously have their Part B premiums deducted directly from their Social Security benefits. Doing so isnt just a convenience, though in some cases, it can save you from rising premium costs thanks to Medicares hold-harmless provision.

This provision protects you from losing out on Social Security income when Part B premium increases surpass the cost-of-living adjustments that are applied to benefits each year. This means that if Part B increases by $30 a month in a given year, but your COLA only raises your monthly benefits by $24, you save yourself the extra $6 by not having to pay it.

In recent years, the COLA has been more than adequate to cover the full cost of the standard Part B increases, so the hold harmless provision hasnt been applicable. But its always there, just in case the Part B premium increase is more than a beneficiarys COLA for a given year.

Also Check: How Often Does Medicare Pay For A1c Blood Test