To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

Why Renew Your Public Services Card

The Public Services Card assists you in accessing a range of public services in an easy and safe manner. If you are a Free Travel customer, an in date Public Services Card is required for you to use this service.

To ensure no interruption in services you are advised to renew your Public Services Card before it expires.

Who Is Eligible For Medicare

Most people enroll in Medicare when they turn 65. You can enroll as early as three months before your 65th birthday or as late as three months after. Youll need to be a United States citizen or have been a permanent legal resident for at least five years. In order to get full coverage, you or your spouse need to meet a work requirement. Meeting the work requirement verifies that youve paid into the system.

Also Check: What Does Ship Stand For In Medicare

You May Like: Do Medicare Advantage Premiums Increase With Age

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the planâs denial for a service to be provided.

The Right to Information About All Treatment Options

Signing Up For Medicare Part D At 65 If Youre Still Working

To make sure you have prescription medication coverage, you need either from work, Medicare Part D, or a Medicare Advantage plan with drug coverage. Your employer can tell you if your workplace coverage is creditable, meaning its as good as or better than Part D.

Once you , you could lose your workplace prescription coverage and you may not be able to get it back.

If you dont have either and you dont enroll in Part D on time, youll pay higher Part D premiums.

Don’t Miss: How To Get A Lift Chair From Medicare

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

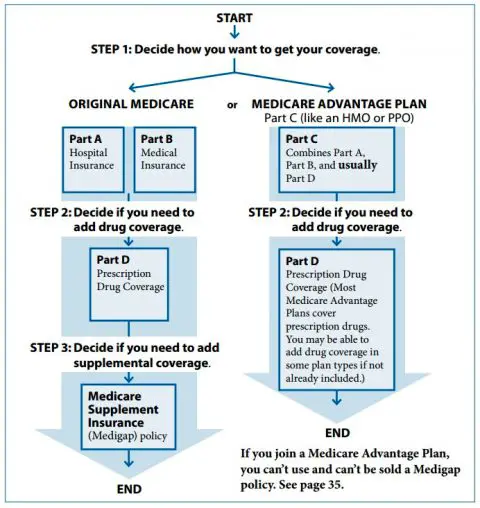

Medicare Part C And Part D

Medicare Part C and Medicare Part D plans are sold by private companies that contract with Medicare.

Medicare Advantage plans cover everything that Medicare parts A and B do and often include coverage for extra services. Medicare Part D plans cover prescription drugs.

Part C and Part D plans are optional. If you do want either part, youll also have multiple options at various price points. You can shop for Part C and Part D plans in your area on the Medicare website.

Some plans will have an additional premium but others will be premium-free.

You can have your Part C or Part D plan premiums deducted from Social Security. Youll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.

This means your first payment could end up being very large since itll cover multiple months at once. Your plan will walk you through the details and let you know how long it will take.

Your premiums will be deducted once per month after everything is set up.

Also Check: Who Is Entitled To Medicare Part A

What Is The Highest Income To Qualify For Medicaid

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.

Can I Get Medicare Early If I Retire Early

If you retire earlier than age 65, you will not be eligible for Medicare. Although Medicare is often thought of as insurance for retired people, the Medicare age requirement is still 65. Some people continue to work past age 65 and have insurance coverage through their employer. Many people retire before they turn 65 and must purchase health insurance or are covered on their spouses insurance plan. Although you may be eligible for social security retirement benefits if you retire early, it does not change your age requirement for Medicare health insurance coverage.

Also Check: How Can I Pay My Medicare Bill Online

Spouses And Social Security Retirement Benefits

Your spouse can also claim up to 50 percent of your benefit amount if they dont have enough work credits, or if youre the higher earner. This doesnt take away from your benefit amount. For example, say you have a retirement benefit amount of $1,500 and your spouse has never worked. You can receive your monthly $1,500 and your spouse can receive up to $750. This means your household will get $2,250 each month.

Read Also: Is A Sleep Study Covered By Medicare

Social Security Disability Insurance

When people discuss Social Security benefits, they are usually referring to retirement benefits. However, Social Security also administers disability benefits to qualified individuals.

A full discussion of this insurance program is outside of the scope of this article, but you can find some more details from the Social Security Administration page on disability insurance.

People who have received Social Security Disability Insurance benefits for 24 months are eligible for Medicare Part A and Part B, even if they arent yet 65 and dont receive Social Security retirement benefits.

Individuals who qualify for SSDI coverage and have Lou Gehrigs disease qualify to receive Medicare benefits sooner, starting on the first month of their SSDI coverage.

Don’t Miss: Does Medicare Part B Cover Prolia Shots

Disability & Medicare Eligibility And Enrollment What You Need To Know In 2022

Some people can qualify for Medicare due to disability. In this case, if you have a qualifying disability, you are eligible for Medicare even if you are not yet age 65. To find out if your disability qualifies for disability benefits or for Medicare, youll need to speak with Social Security directly, but in general, you become eligible the 25th month of receiving Social Security Disability Insurance benefits .

If you have a qualifying disability, you must first file for disability benefits through Social Security before you can even be considered eligible for Medicare due to disability. Approval of the request by Social Security is an important first step. It is also important to note that these benefits are different from Supplemental Security Income benefits, and that SSI benefits do not qualify you for Medicare.

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

Read Also: Is Medicare Plus Blue A Medicare Advantage Plan

Do I Have To Take Medicare When I Take Social Security

Since the full retirement age is after the age of Medicare eligibility, many Medicare beneficiaries start Medicare before Social Security. This enrollment occurs online at www.ssa.gov, in person at your local Social Security office, and sometimes over the phone. Once enrolled, most will receive a quarterly bill for their Medicare Part B premiums.

Many beneficiaries who continue to work past their 65th birthday can delay their Medicare Part B without a penalty since they have a creditable group plan through their employer. These beneficiaries can still take their Medicare Part A hospital insurance.

If youre not drawing Social Security benefits, its recommended that you start the process three months before your 65th birthday. This extra time allows for additional information to be requested and provided and ensures you have a painless transition to Medicare.

Can You Apply For Medicare Without Social Security

December 21, 2021 By Danielle Kunkle Roberts

Many people think you must enroll in Social Security before applying for Medicare fortunately, thats not the case. Social Security and Medicare are tied together in some ways, but in others, they are separate. In this post, well go over what you need to know about how the two go together.

You May Like: Is The Urolift Procedure Covered By Medicare

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Can You Get Medicare If Youve Never Worked

Even if youve never worked, you will still be eligible for Medicare. The only requirements are to be a United States citizen or legal resident of at least five years and qualify due to disability or age. However, you must pay the full Medicare Part A premium if you do not pay taxes for enough quarters.

However, your spouses work history counts toward your credit for premium-free Medicare Part A. If your spouse meets the requirements, you may be eligible for a reduced or zero Medicare Part A premium.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

You May Like: How Do I Find Out My Medicare Number

When Do You Have To Pay For Medicare

If you dont qualify for premium-free Part A coverage, youll need to pay a monthly premium. Youll also have to pay a premium if you sign up for Part B, which is optional.

If you receive Social Security benefits, youll have these premiums automatically deducted from your checks. Medicare will bill you directly if you arent collecting Social Security.

If you sign up for Parts C and D, youll also need to pay premiums for those plans. If you receive Social Security benefits, you can request that the premiums be deducted from your checks, but this wont happen automatically. If you dont receive benefits, youll get a bill from Medicare for Part D and from the insurer for Part C.

How Do I Enroll In Medicare If I Am Receiving Social Security

If you are getting Social Security benefits at least four months before you turn 65, you generally do not need to enroll in Medicare. You will automatically get Medicare Part A and Part B starting the first day of the month you turn 65. If your birthday is the first of the month, your Medicare benefits will start the first day of the prior month. If you decided you want Medicare Advantage, Medicare Supplement, or Medicare Part D prescription drug coverage, you must enroll separately.

If you are getting Social Security because you have a disability, you will automatically get Medicare Part A and Part B after you have been getting disability benefits from Social Security for 24 months. However, owever, Medicare treats some conditions differently from others. If you have ALS you automatically get Medicare Part A and Part B the month your Social Security disability benefits begin. If you enroll in Medicare because you have ESRD and youâre on dialysis, Medicare coverage generally starts on the first day of the fourth month of your dialysis treatments. Like with ALS, there is no two-year waiting period to enroll in Medicare.

You also can apply for Social Security and Medicare at the same time through the Social Security Official Website.

Also Check: Do You Automatically Get Medicare When You Turn 65

Medicare Part B Premiums

Your Part B premium is based on your income. Most people pay the standard monthly premium. For more information about Part B premiums, call Social Security at 1-800-772-1213 .

Your Part B premiums are taken from your monthly payment if youre getting:

- Social Security Retirement,

- Social Security Disability, or

- Railroad Retirement Board benefits.

If you’re getting Social Security Retirement or Disability, or Railroad Retirement Board benefits, your Part B premiums are taken from your monthly payment. If not, you’ll be billed quarterly for your Part B premiums.

Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

Don’t Miss: Does Medicare Cover Dermatologist Check Ups

Understanding Social Security And Medicare

Home / FAQs / General Medicare / Understanding Social Security and Medicare

Social Security and Medicare are both federal programs that help retired and disabled Americans. Together, these programs allow those no longer in the workforce to reap similar benefits to when they were employed. These benefits include a monthly income and healthcare coverage.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

There are similarities and differences between the two programs. Social Security provides income, whereas Medicare is health insurance. While they are two different programs, Medicare and Social Security work together. In this article, we answer your biggest questions, including who qualifies for each of these benefits.

Plan First Withdraw Later

Healthcare coverage can be a major retirement expense, and Medicare is not all-inclusive. Before you choose to take Social Security, make sure you’ve reviewed your budget, being careful to factor in healthcare costs, inflation and unexpected events.

Don’t underestimate those expenses. A fixed income may not allow for much fluctuation. Also people are living longer, so retirement may be longer than you plan for. According to the SSA, more than 1 in 3 of today’s 65-year-olds will live to age 90. More than 1 in 7 will live to age 95.7

The decision of when to take Social Security is important and personal. It will likely factor in to how you meet current and future healthcare needs.

Plan before you make your next move, and be better prepared for what lies ahead. For added peace of mind, consult a financial advisor before making any major decisions about your Social Security and retirement date.

Explore Medicare

Also Check: When Do You Receive Medicare Card

Examine Atentamente Su Factura

El tipo de factura de Medicare que recibe muestra si está en riesgo de perder su cobertura Medicare por pagos atrasados:

Si el cuadro de la esquina superior derecha dice |

Significa |

Haga esto |

|---|---|---|

| Esto no es una factura | Usted se inscribió en el Pago Fácil de Medicare. El pago de su prima se debitará automáticamente de su cuenta bancaria alrededor del dÃa 20 de cada mes. | No necesita hacer nada. |

| Primera factura | Esta es su primera factura o ya ha pagado el monto completo de su última factura. | EnvÃe un pago por el monto total adeudado. Medicare debe recibir su pago antes de la fecha de vencimiento de la factura o se considerará vencida. |

| Segunda factura | Medicare no recibió el pago antes de la fecha de vencimiento que se mostraba en la Primera factura. . | EnvÃe el pago por el total de la cantidad adeudada antes de la fecha de vencimiento de la factura. |

| Factura en mora | Medicare no recibió el pago antes de la fecha de vencimiento que se mostraba en la Segunda factura. . Si usted no paga la cantidad total adeudada, perderá su cobertura de Medicare. | EnvÃe un pago por el monto total adeudado antes de la fecha de vencimiento para no perder su cobertura de Medicare. Esta es la última factura que recibirá. |

Todas las facturas de Medicare vencen el dÃa 25 del mes. En la mayorÃa de los casos, la prima se debe pagar el mismo mes en que se recibe la factura. Por ejemplo, Medicare ejecuta la factura de abril el 27 marzo. Recibirá la factura a principios de abril y vence el 25 abril.